99% of meme trades are destined to lose money—whales are the real big winners

TechFlow Selected TechFlow Selected

99% of meme trades are destined to lose money—whales are the real big winners

And you won't know who the house is until it's too late.

Author: Foxi (DeFi / AI)

Translated by: TechFlow

My Meme trading account is currently down -60%. Am I a terrible trader? Yes, I truly am. But it's not just due to poor decisions—I'd like to believe I'm no worse than the average gambler. So where exactly did things go wrong? Inspired by data from @0xngmi (who pointed out that playing Memecoins yields worse returns than casinos), I decided to dig deeper into the root of the problem.

First, I admit: I'm a terrible Meme trader

Like many beginners, I've been swept along by market hype and emotions—chasing pumps, panic selling, buying high and selling low, frequent trades causing slippage, and unknowingly handing money over to insider traders in the market.

Although this isn't my first time participating in the crypto market, this experience has made me feel like I'm playing an unfair game. Worse yet, the rules of this game seem to change every moment—and always favor those with more information.

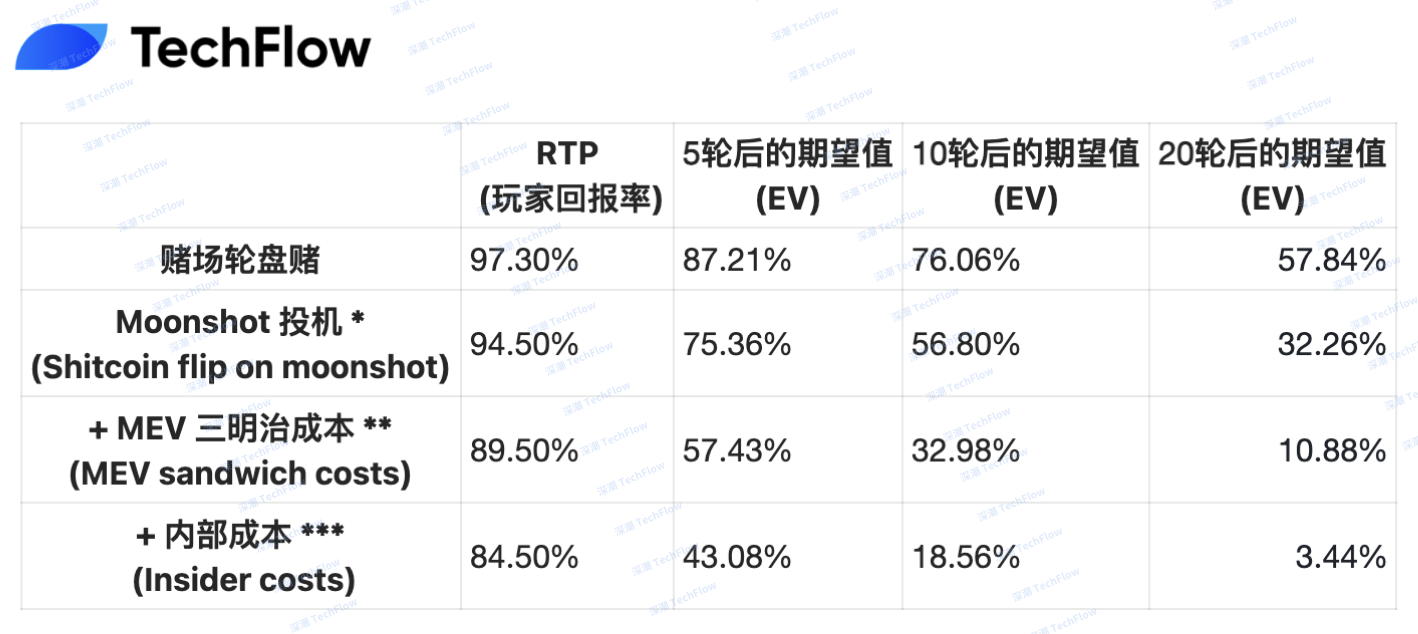

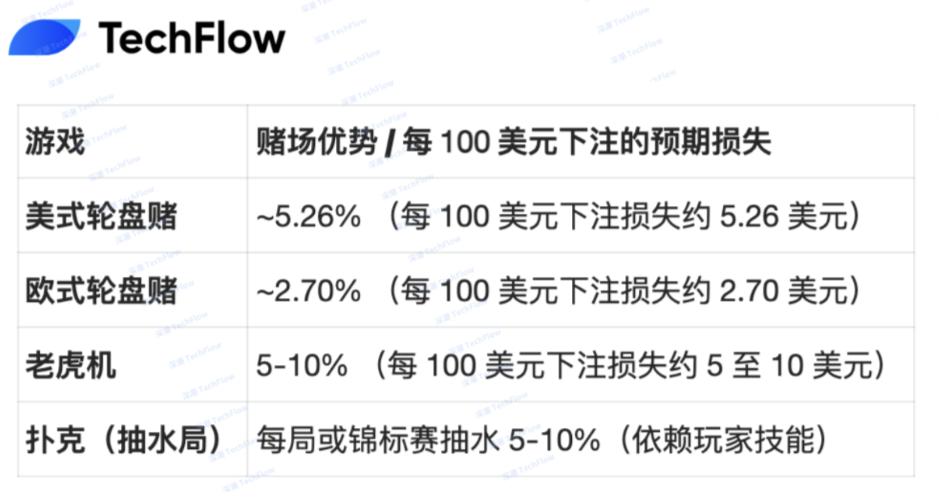

@0xngmi calculated a comparison between the expected value (EV) of playing roulette in a casino and speculating on Memecoins (based solely on paid transaction fees).

(Original image from @0xngmi, translated by TechFlow)

* Small trade fee is 2.5%, Raydium fee is 0.25%. One speculation requires two trades, so fees are multiplied by 2.

** Moonshot's default slippage setting is 5%, half of which is used as an average sandwich attack estimate.

*** Hard to estimate precisely, as differences vary greatly between tokens; assuming a cost of 2.5% per trade.

This led me to wonder: How does Meme speculation compare to actual gambling? Are the odds similarly bad—or even worse? More importantly, are Meme traders just casino gamblers dressed up as "investors," or is there a more complex and hidden mechanism at play? According to @0xngmi's analysis, putting money into a casino appears smarter than playing Memes.

The real odds: Memecoin vs. Casino

We need to talk about Expected Value (EV), a core concept in both gambling and trading. It tells us how much money you can expect to win or lose per bet on average over time.

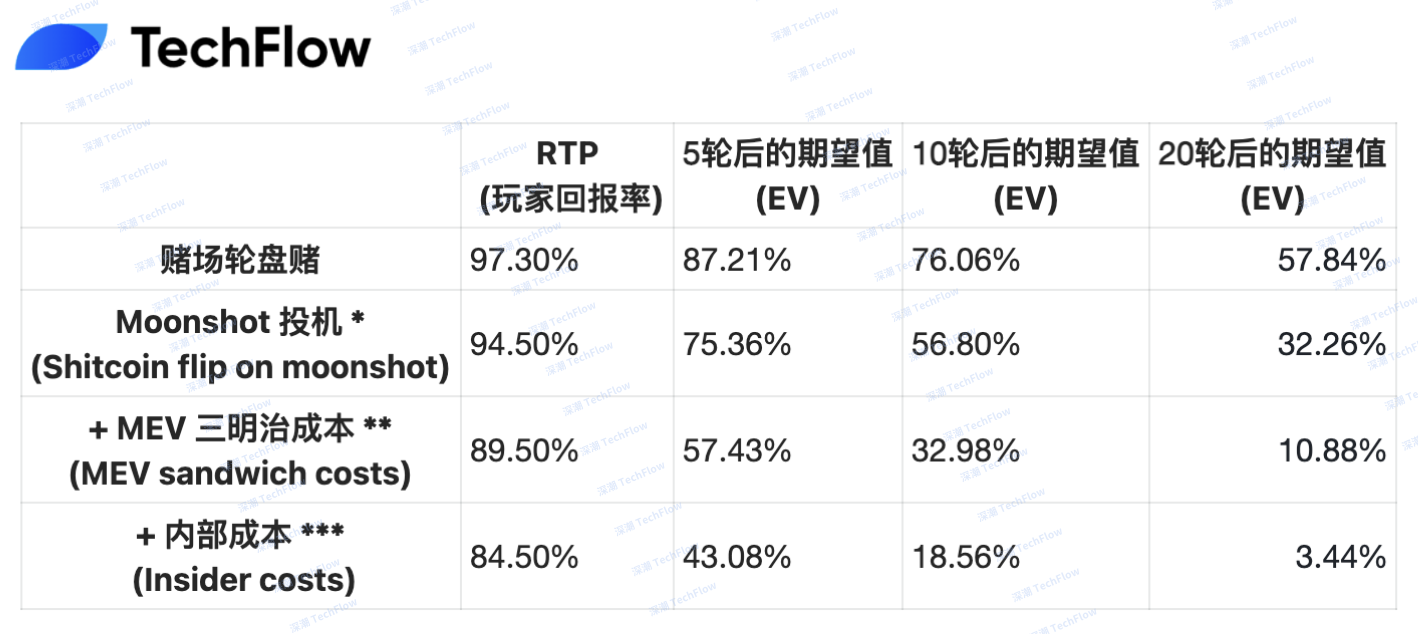

Casino games have a mathematically defined kind of "fair unfairness." In the long run, you can always predict how much you'll lose. Let’s take a closer look:

(Original image from Foxi (DeFi / AI), translated by TechFlow)

In traditional gambling, the house extracts profits in a slow and predictable way. Whether it's each spin of the roulette wheel or pull of the slot machine lever, everything follows a known probability model. For example, in American Roulette, if you bet on red, you have a 47.37% chance of winning and a 52.63% chance of losing. Over time, the house always wins—but it doesn’t cheat; it simply uses probability to maintain its edge. However, to protect gamblers, some jurisdictions mandate minimum payout ratios. For instance, in Ontario, slot machines must have an RTP (Return to Player) of at least 85%, meaning the house edge (the rake) cannot exceed 15%.

Why 99% of people lose money trading Memecoins

Unlike casinos, Memecoin trading may appear to be a "game of chance," but the issue is—you don’t even know who the real players are. While there's no explicit "house edge" in the Memecoin market, your funds are still gradually drained through transaction fees, slippage, insider trading, and market manipulation. And this erosion is often invisible and difficult to quantify.

Here are the three main reasons why most Memecoin investors lose money:

-

Fees

-

Slippage

-

Market manipulation

1. Transaction Fees: The Hidden "House Rake"

Every trade incurs costs. Whether you're using centralized exchanges (CEX, such as @bitgetglobal or @MEXC_Official), decentralized exchanges (DEX, such as @RaydiumProtocol), or trading bots (like @gmgnai, widely used by most people), these fees gradually eat into your profits.

-

CEX fees: ~0.1% per trade (buy + sell = 0.2% round-trip cost)

-

DEX fees: ~0.3% per trade, plus gas fees (possibly $5–$50+ per transaction)

-

Trading bot fees: ~1% per trade, plus priority fees (could be 4x normal DEX fees)

-

Meme coin tax: Some projects take 5%-10% from each transaction as part of redistribution or burn mechanisms. For example, @aipool_tee charges a 10% fee on sell transactions.

These trading bots are earning massive revenue from retail users. Even now (February 17), when fewer people are trading Memes, daily income still exceeds $700,000.

On the surface, a 0.2%-1% trading fee might not seem high, but when you trade frequently throughout the day, these fees quickly accumulate. Making 10 trades in one day could consume 2%-6% of your principal—even worse than losses in European Roulette.

2. Slippage (MEV Cost)

Slippage refers to the difference between the expected price of a trade and the actual executed price, often due to market volatility. In Memecoin trading, slippage is especially severe, particularly when liquidity is low or markets are highly volatile.

-

Example: You try to buy a Memecoin for $100, but due to insufficient liquidity, you only receive tokens worth $95—a 5% loss.

-

Similarly, when selling: You plan to sell for $200, but slippage means you only receive $190.

-

Total slippage loss: Approximately 10% round-trip trading cost.

@0xngmi mentioned that around 2.5% of trading fees are consumed by MEV (sandwich attack costs), and on BNB Chain, this cost can exceed 5% due to inferior infrastructure.

Better blockchain infrastructure can significantly reduce MEV costs. This is why many believe Solana is superior to BNB Chain (a view I fully agree with). If @cz_binance wants to promote Meme culture on BNB Chain, the top priority should be reducing MEV costs to improve traders' expected value (EV).

However, even on Solana, 2.5%-5% MEV costs are still worse than losses in casino games. If you found out the house took a 10% cut at a slot machine, you’d probably be furious. Yet in the Memecoin market, that’s not even the worst part.

3. Insider Trading & Market Manipulation

There’s almost no need to elaborate here. Unlike casinos, which have clear rules, the Meme market heavily favors insiders. No regulation prevents team wallets, developers, or influencers from running "pump and dump" schemes to exploit retail traders. Consider these examples:

-

$LIBRA: Rug-pulled over $107 million worth of tokens

-

$MELANIA: Any connection to Meteroa?

-

$CAR: African Rugged incident

-

$CUBA: Another country’s Rugged event

-

$GANG: @mrpunkdoteth cashed out $10 million via fanbase

-

$Broccoli: Controlled and profited from by scammers and insiders

These are just the tip of the iceberg. It’s fair to say that unless you’re an insider like @frankdegods, you have virtually no advantage in these Memecoin games. In a casino, at least you know what the house edge is; in the Memecoin market, you don’t even know who the house is—but they’re definitely taking your money.

Final Comparison: Memecoin Speculation vs. Gambling EV

Casino games slowly drain your funds over time, while Memecoin speculation is far more brutal. A single bad trade could wipe out weeks of gains instantly. The only thing keeping people engaged is the occasional 100x return. But in reality, the odds of achieving a 100x gain are roughly 1 in 25,000—lower than winning the lottery.

People often believe they are “special” or “skilled” (yes, I was that guy too), but ultimately, they still get rekt.

Memecoins aren’t like gambling because they create an illusion of control—a false belief that research, timing, and skill can lead to profits. True, some traders do profit, but they’re rare, just like professional poker players. Most traders, like most gamblers, end up losing.

Advice for Blockchain Platforms

If you want to attract users and increase on-chain trading volume, ensure traders’ MEV costs are low, and consider lowering transaction fees through partnerships or fund subsidies. Casinos survive because gamblers keep coming back.

Advice for Investors

If you're engaging in Memecoin speculation, remember: the house always wins. And you won’t know who the house is until it’s too late. If you realize you can’t stop, you might already be addicted to gambling.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News