FTX payouts begin, SOL ETF accepted—has the turning point for altcoins arrived?

TechFlow Selected TechFlow Selected

FTX payouts begin, SOL ETF accepted—has the turning point for altcoins arrived?

History shows that extreme market sentiment is often a precursor to major turning points.

Author: Axel Bitblaze

Compiled by: TechFlow

Retail markets are sluggish, sentiment has hit rock bottom, and altcoins have been declining for months—yet this could be the prelude to a new wave of opportunities.

Despite the seemingly bleak market conditions, I believe this is more of a setup phase rather than an endgame.

As key catalysts begin to emerge, I expect the next market upswing to be led by utility coins rather than memecoins.

Below are my views and when this shift might occur.

Since December 2024, investor patience waiting for an "alt season" has been completely worn out.

Starting in Q4 2024, the market actually saw many positive developments, yet the altcoin market failed to respond positively.

Currently, market sentiment appears to be in a "depression phase," with both retail investors and large holders (whales) selling off and exiting the market.

Does this mean the "alt season" is just a myth?

Could this market cycle end without ETH reaching a new all-time high?

Are there any remaining catalysts that could drive capital back into altcoins?

Let’s analyze from the perspective of upcoming catalysts and the timeline for an "alt season."

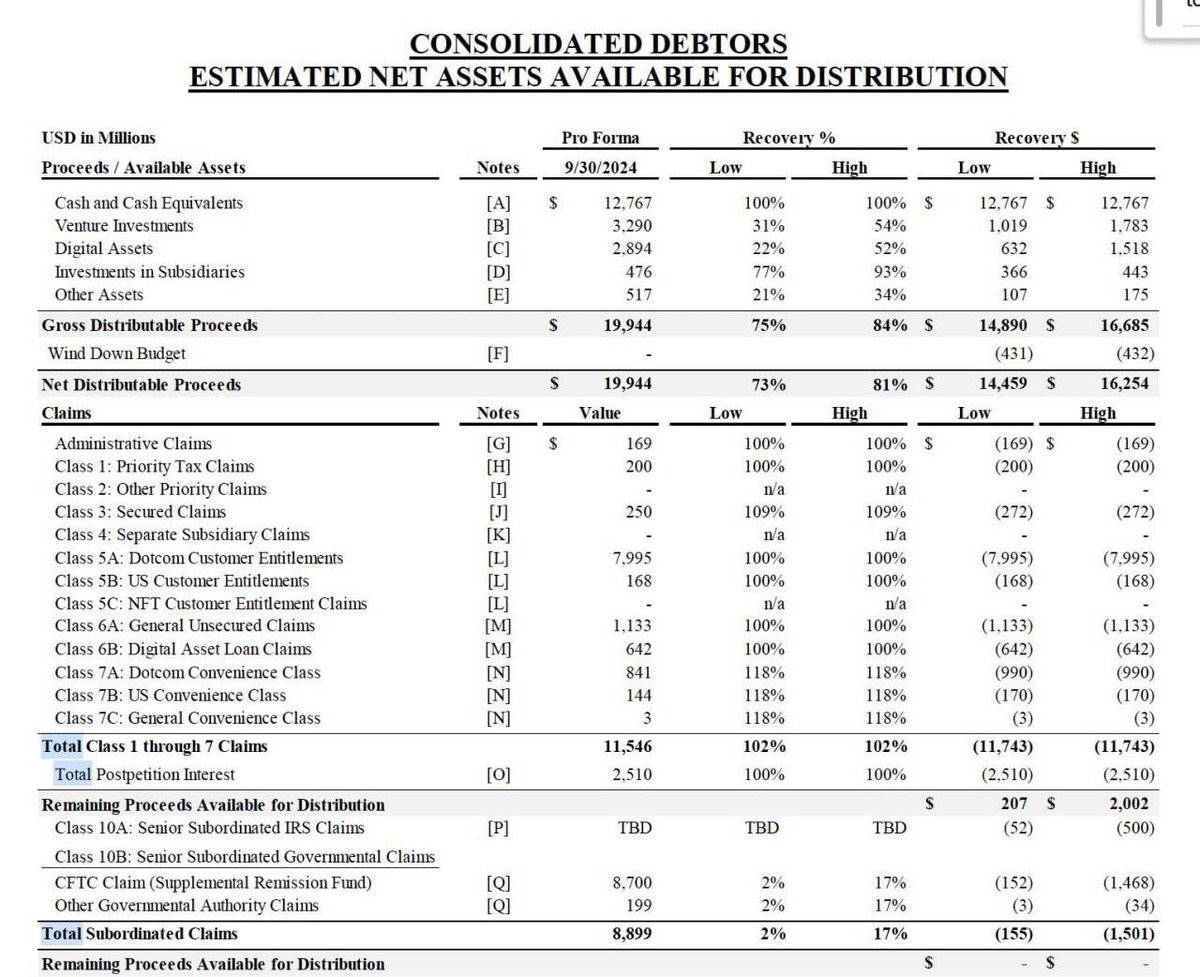

1. FTX Repayments: A New Market Variable

Previously, I thought FTX repayments would be dragged out for years like the Mt. Gox incident. But in fact, the process is accelerating.

Starting February 18, 2025, FTX will initiate its first round of repayments, totaling between $7 billion and $8 billion, primarily distributed in stablecoins.

What does this mean for the alt market?

First, most FTX traders were high-risk-tolerance investors whose portfolios were heavily weighted toward altcoins.

Second, current market data shows that many altcoins, including ETH, are significantly undervalued relative to BTC.

Looking back at the market during the FTX collapse, BTC was around $16,000, SOL around $20, and ETH around $2,500.

Now, as funds return to the market, many investors will reassess the current environment and recognize ETH's undervaluation.

Besides ETH, numerous altcoins have significantly underperformed BTC since the cycle low.

Combined with increasingly favorable U.S. regulatory policies toward crypto, I believe much of this capital will flow into the altcoin market—especially into tokens with real utility, not just hype-driven memecoins.

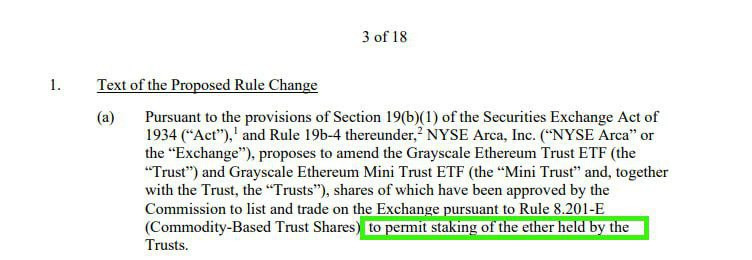

2. ETH ETF Staking: A New Draw for Institutional Capital

ETH holders have long awaited applications related to staking-enabled ETH ETFs. Now, that process has finally begun.

In the past three days, Grayscale and 21Shares have filed applications with the SEC to allow staking of ETH held within their Ethereum ETFs.

Although BlackRock has not yet submitted a similar application, I expect it to happen within the next 2–3 weeks.

Currently, institutional investors have little incentive to choose ETH ETFs over BTC ETFs. However, once staking approval comes through, ETH ETFs could offer 3%–4% annual yields. For traditional financial institutions (TradFi), such returns are highly attractive and would likely draw significant institutional capital into ETH.

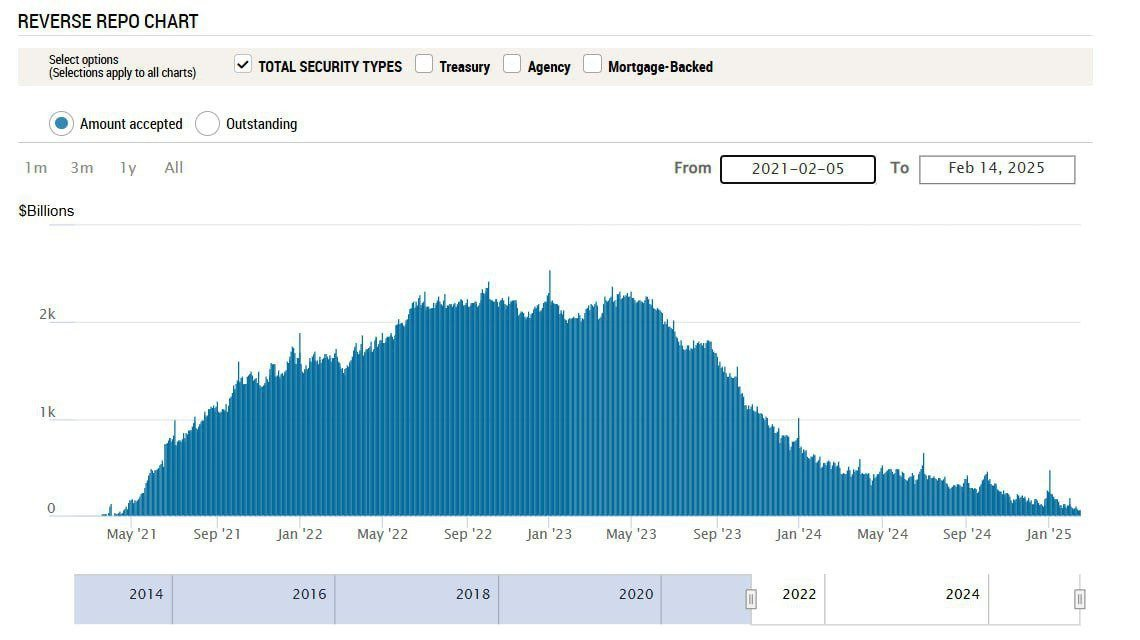

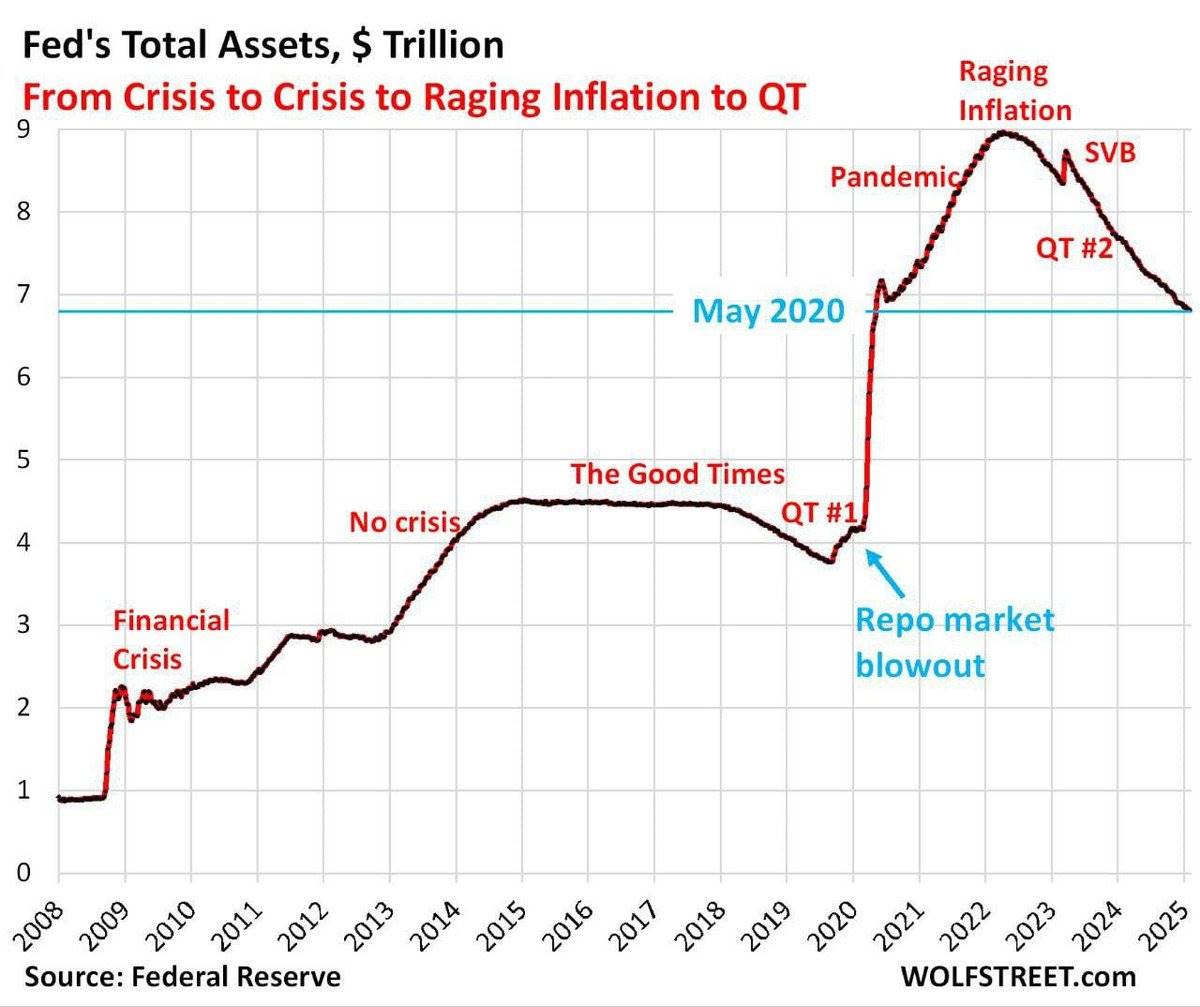

3. Decline in Fed's Reverse Repo (RRP): A Liquidity Turning Point?

The Federal Reserve's Reverse Repo (RRP) facility is a key tool for managing liquidity in the financial system. A declining RRP balance typically signals shrinking excess liquidity.

This usually occurs during quantitative tightening (QT), as the Fed shrinks its balance sheet—a process currently underway.

To date, the Fed’s RRP balance has dropped $2.5 trillion from its peak, returning to April 2021 levels.

What does this mean for the market?

The end of QT appears to be in sight.

Notably, no "alt season" has ever occurred during active QT phases.

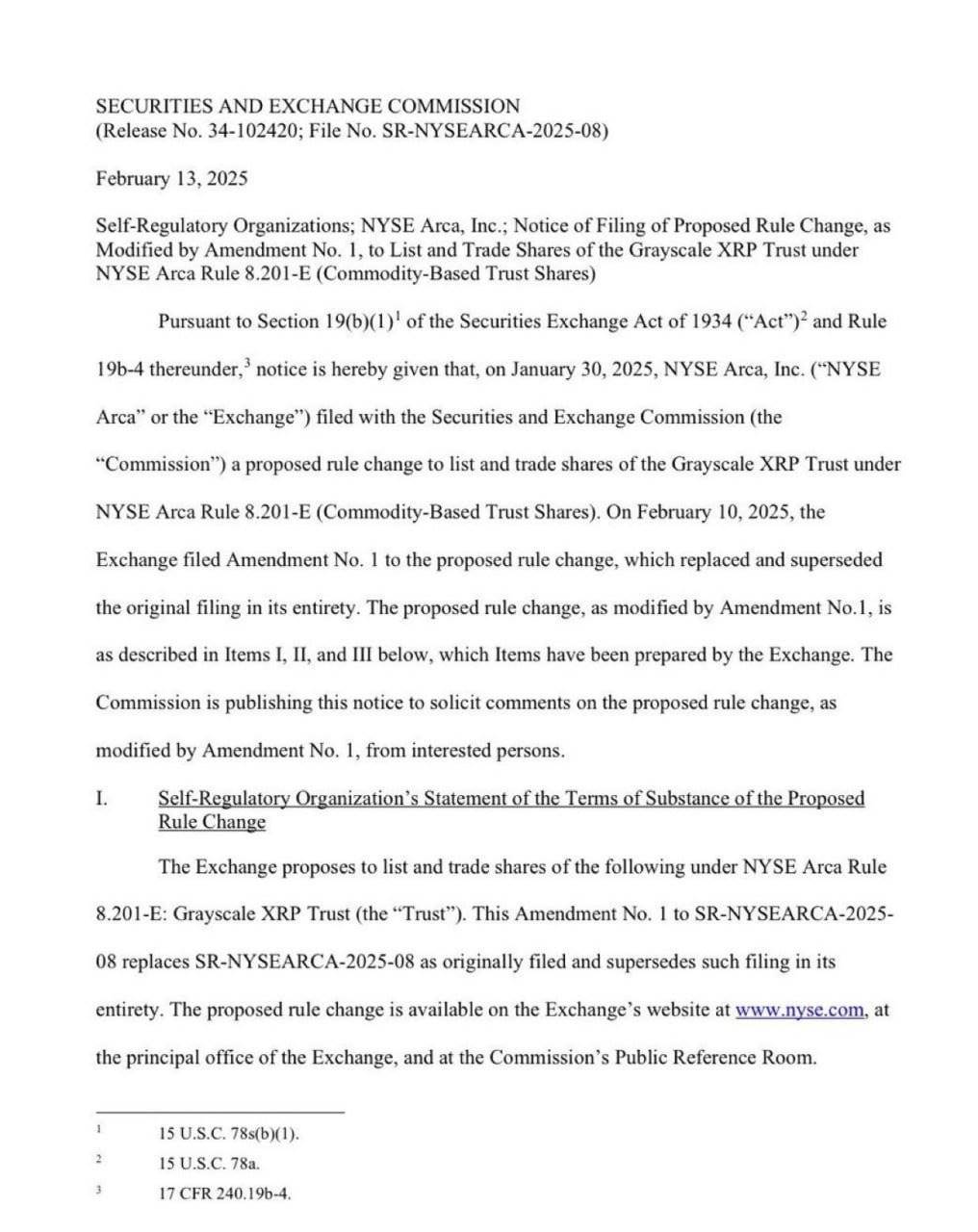

4. Regulatory Breakthrough on Altcoin ETFs: A New Dawn?

Since January 20, 2025, the SEC has begun cooperating with issuers of altcoin ETFs.

In recent days, the SEC has officially accepted spot ETF applications for XRP, DOGE, and SOL.

While this doesn’t guarantee approval, it signals that the U.S. altcoin market may be moving toward clearer regulations—boosting market confidence.

5. Deteriorating Market Sentiment: Crisis or Opportunity?

Current market sentiment is at a low:

-

Competition among developers and project founders is intensifying.

-

ETH supporters are even removing their .eth identifiers to express dissatisfaction.

-

Bitcoin supporters are selling spot BTC to buy ETFs.

-

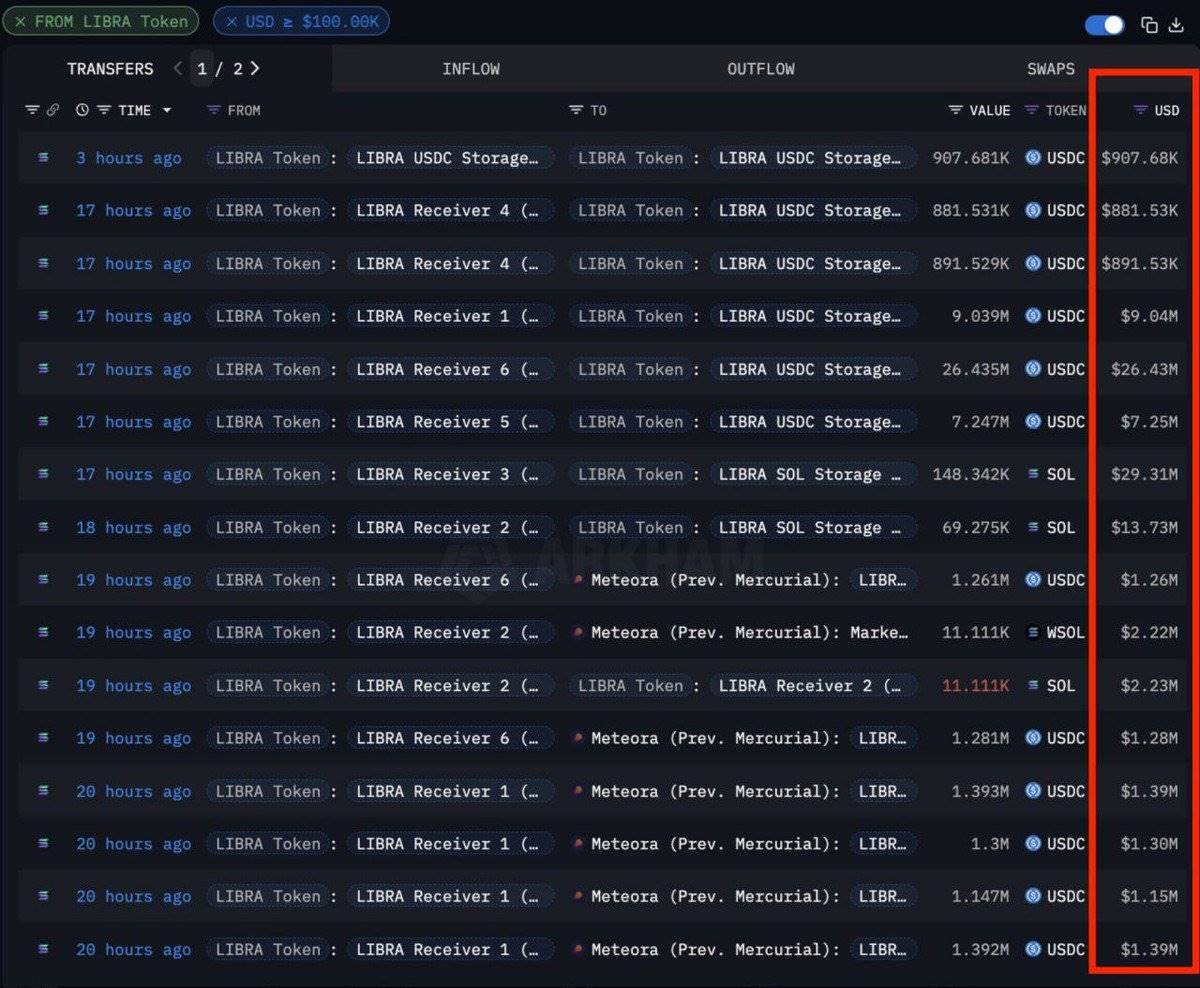

Some countries are even launching memes to extract hundreds of millions from retail investors.

In this context, altcoin trading performance remains weak, as if the market is experiencing a major crisis of trust.

Yet history shows that extreme market sentiment often precedes major turning points.

After the crashes of Luna and FTX, market sentiment is now even lower.

As someone who lived through both the Luna and FTX collapses, I can say that current market sentiment is worse than back then.

Right now, 99% of retail investors’ portfolios are either wiped out or down 90%–95% from their peaks.

This is a classic sign of market capitulation.

Selling at price levels is largely complete; now the market is undergoing “time-based capitulation”—investors losing patience due to prolonged losses.

Nevertheless, many overlook the series of positive developments happening behind the scenes, including:

-

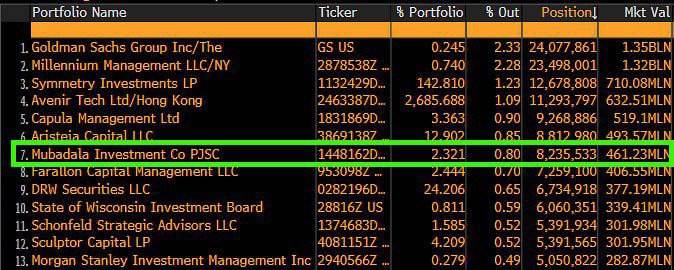

Abu Dhabi's sovereign wealth fund is buying Bitcoin (BTC) at scale.

-

Multiple U.S. banks are preparing to launch crypto custody services.

-

Goldman Sachs has allocated billions into BTC purchases.

-

The U.S. is expected to roll out crypto regulatory policy within the next 60–90 days.

In addition:

-

Trump-affiliated companies have announced plans to purchase BTC and other crypto assets.

-

World Liberty Financial is continuously buying altcoins using a TWAP (time-weighted average price) strategy.

-

Over 22 U.S. states have introduced bills to include Bitcoin in state reserves.

-

Companies like GameStop plan to add BTC to their balance sheets.

These positive factors could become key drivers for the next crypto rally.

Predicting the Altcoin Market Recovery Timeline

Most FUD related to tariffs has already faded or been delayed by 1–2 months.

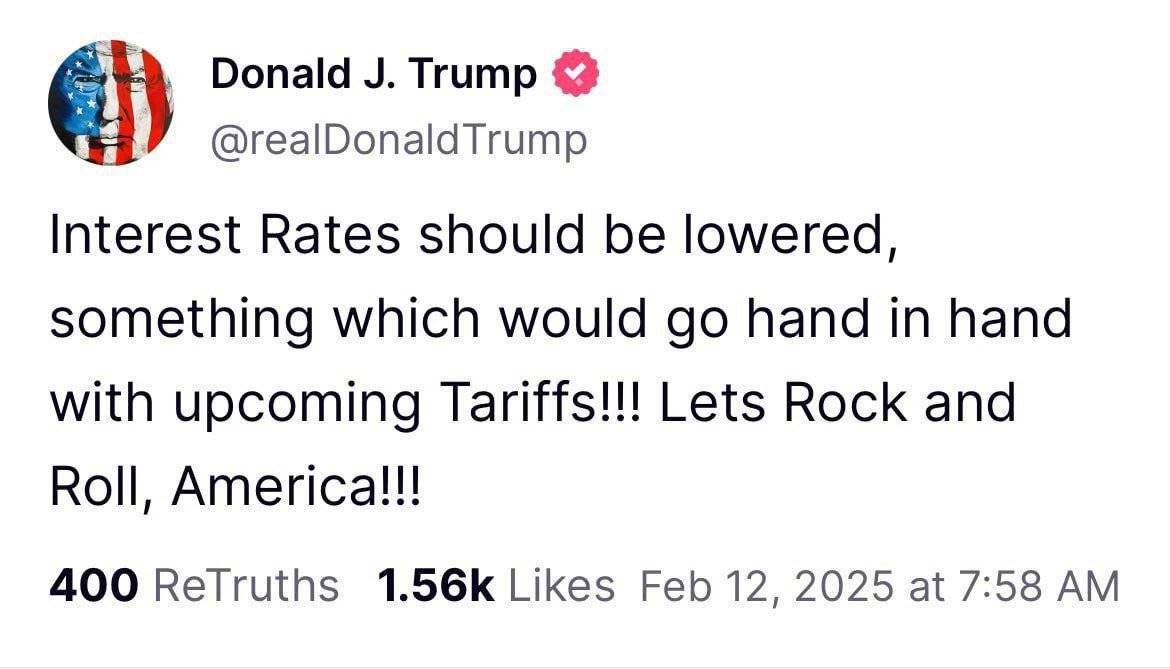

The main current concern is rising inflation potentially forcing the Fed into more aggressive rate hikes. However, I believe this is unlikely, as the Trump administration continues pushing for rate cuts.

The next FOMC meeting is in March, but I expect the altcoin market rally to begin before then.

Another reason supporting a late-February altcoin rebound is that investor patience with meme scams has run out—they’re likely to redirect capital toward utility-driven altcoins.

While this alt season may not reach the scale of 2017 or 2021 peaks, it could last 6–8 weeks, forming a local high similar to Q1 2024.

My Summary and Advice

The excessive hype around memecoins has indeed delayed the alt season, but as the meme bubble bursts, the next altcoin rally could outperform Q4 2024.

Since the February market crash, I’ve been actively accumulating utility-focused altcoins, as I believe a market reversal is imminent.

If I had one piece of advice for investors, it would be: Don’t chase flashy new memes—focus on accumulating altcoins with real-world use cases and strong network effects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News