YouTuber interviews the creator of LIBRA: I was also a victim myself

TechFlow Selected TechFlow Selected

YouTuber interviews the creator of LIBRA: I was also a victim myself

Not "reaping the韭菜", but a failed plan to drive away other snipers.

Original interview: Coffeezilla, YouTuber and cryptocurrency journalist;

Guest: Hayden Davis, one of the main creators of LIBRA;

Translation: ChatGPT

Editor's note: Hayden Davis, a member of Kelsier Ventures, is one of the four primary creators of LIBRA, along with Julian Peh from the Kip Protocol, and Mauricio Novelli and Manuel Godoy from the Argentine tech forum. The project received support from Javier Milei on February 14, 2025. Video creator Coffeezilla interviewed Hayden to uncover what exactly happened with LIBRA. During the interview, Hayden admitted that the LIBRA team conducted a launch sniper attack on LIBRA’s token release, and the MELANIA team similarly sniped their own token launch.

Below is the original content (slightly edited for clarity):

TL;DR

Coffeezilla: Over the past 48 hours, I’ve been investigating an Argentine meme coin called LIBRA. If you didn’t know, Argentina’s president publicly endorsed this meme coin, after which it crashed, leading people to question where $100 million in funds went—seemingly vanished. I’ve contacted key figures involved to find answers. Next, you’ll hear a one-hour interview with Hayden Davis, one of the main organizers behind this launch and deeply involved in token decisions. He currently holds $100 million and is deciding what to do with it. You’ll notice we’re not speaking for the first time—I’ve tried contacting him over the past 24 to 48 hours.

This interview isn’t me pushing my views—I just want information. What we lack most are answers. So I mostly listened, though some important admissions emerged. I want to clarify this isn’t my usual “scammer” style—it was deliberately designed. From the start, he seemed very nervous, so aggressive tactics felt inappropriate. People will form their own opinions based on what they hear.

I believe a more neutral approach is letting him speak for himself. This is his first public statement since his one-minute Twitter post, which poorly received. I wanted to give him space to fully explain. The interview began abruptly—he said off-record things I had to cut. But hopefully, it sheds light on what truly happened.

Not a "rug pull," but a failed plan to fend off other snipers

Coffeezilla: Can this part be considered official? I don’t want private details made public. Thanks for the background info—the LIBRA part is what matters.

Hayden Davis: Yes, the LIBRA part is fine. Okay, let’s go. One issue with LIBRA is when launching on Meteora, you try to avoid all these snipers, but the problem is… there were no real safeguards. There wasn’t any insider-controlled situation like that.

Hayden Davis: The real issue is, during large launches, massive volume floods in, and then you see this guy—with a big wallet—unexpectedly doesn’t sell much. I don’t understand why, but he held $57 million. LIBRA’s market cap was $4.5 or $5 billion—that’s where the problem lies.

Hayden Davis: It wasn’t actually $5 billion. So you have to make a real-time decision: “Should I pull some liquidity out, protect the floor price, knowing more marketing plans are coming?” Or “should I just let the chart crash?” This happens every launch—3 to 10 guys get big allocations.

Hayden Davis: They’re just bad snipers trying to dump. You can’t track them—they either take forever or are impossible to trace. This happens every single time.

Hayden Davis: Regarding LIBRA specifically, I’m happy to share, though Javier and his team told me there’ll be a major TV interview tomorrow that’ll clarify me and the LIBRA project, as he’s clearly under public pressure. Basically, at launch, our goal was: “Can we gather enough liquidity?” Some might say this is partial or incomplete, but the goal was gathering enough liquidity because Milei was preparing a second video, and other unnamed high-level figures would participate, tweet, promote videos.

So our aim was: could we pull enough liquidity at this stage to push out the snipers, at least control them, so when the chart drops, it doesn’t destroy the whole project? Then let Milei release his next video and reinject most capital—or at least most liquidity—to create a massive launch. As for why he deleted his post, I still don’t have a clear answer. I suspect he faced intense political pressure. As someone outside crypto, he might’ve panicked. I get it. I’d react the same way.

Now we’re figuring out what to do next. Some call it a “rug pull.” That’s clearly wrong—$60 million remains locked in liquidity, right? Market cap is $300 million. It’s not a rug pull—it’s a failed plan. I hold $100 million as custodian, but I don’t know what to do. I don’t want to be the public enemy. I didn’t benefit—I’m in danger.

Coffeezilla: Yes, several points here. Thanks for explaining. About the $100 million, the public sees terms like “rug pull” used widely, now meaning unfair value extraction. My understanding is, unfair extraction means taking money without clear explanation of where it went—so people assume it was profit. Clearly something must be done to return funds to the market and people. This process is complex—must avoid others exploiting it.

Hayden Davis: True. Let me add—it’s multi-faceted because it’s a meme coin. If you bet your entire portfolio on one meme coin… while not financial advice, that’s just stupid.

Hayden Davis: I get it, but if you consider this, I discussed today how to assess a token’s value, especially when it’s not “dead.” The president may continue supporting it, so it likely has rebound potential. You must control the narrative: “People lost money because they chose to sell, but the token isn’t dead.” But the issue is, no one gives me clear answers.

Coffeezilla: Understood. I’d be shocked if Milei came back. I think he’ll disown it, wash his hands. Though I could be wrong. I don’t fully grasp the situation. One direct question: does Milei profit from this? No, right? Second: were Manuel and Mauricio involved in the launch? Yes, from Argentina’s Tech team. Correct. Kip Protocol handles operations via a nonprofit, like a foundation.

Hayden Davis: Yes, exactly.

Coffeezilla: They weren’t involved much, and you handled the launch but not fund distribution.

Hayden Davis: Yes, I can elaborate. This was meant to be an experiment, right? Milei really wants everything on-chain, transparent—all national financial transactions tokenized. So I’ve talked with many people, funds, about what this might look like in coming years. Original idea: since he supports it, let’s test it. Honestly, though he backed it, it wasn’t his official meme coin—let’s clarify that. Anyway, that’s enough.

Coffeezilla: Right, so a key point everyone’s trying to figure out: funds were withdrawn, and accusations surfaced that insiders knew contract details before launch. All these KOLs—basically industry insiders—knew about the coin pre-launch, possibly sharing info unfairly, giving some an edge, or profiting themselves.

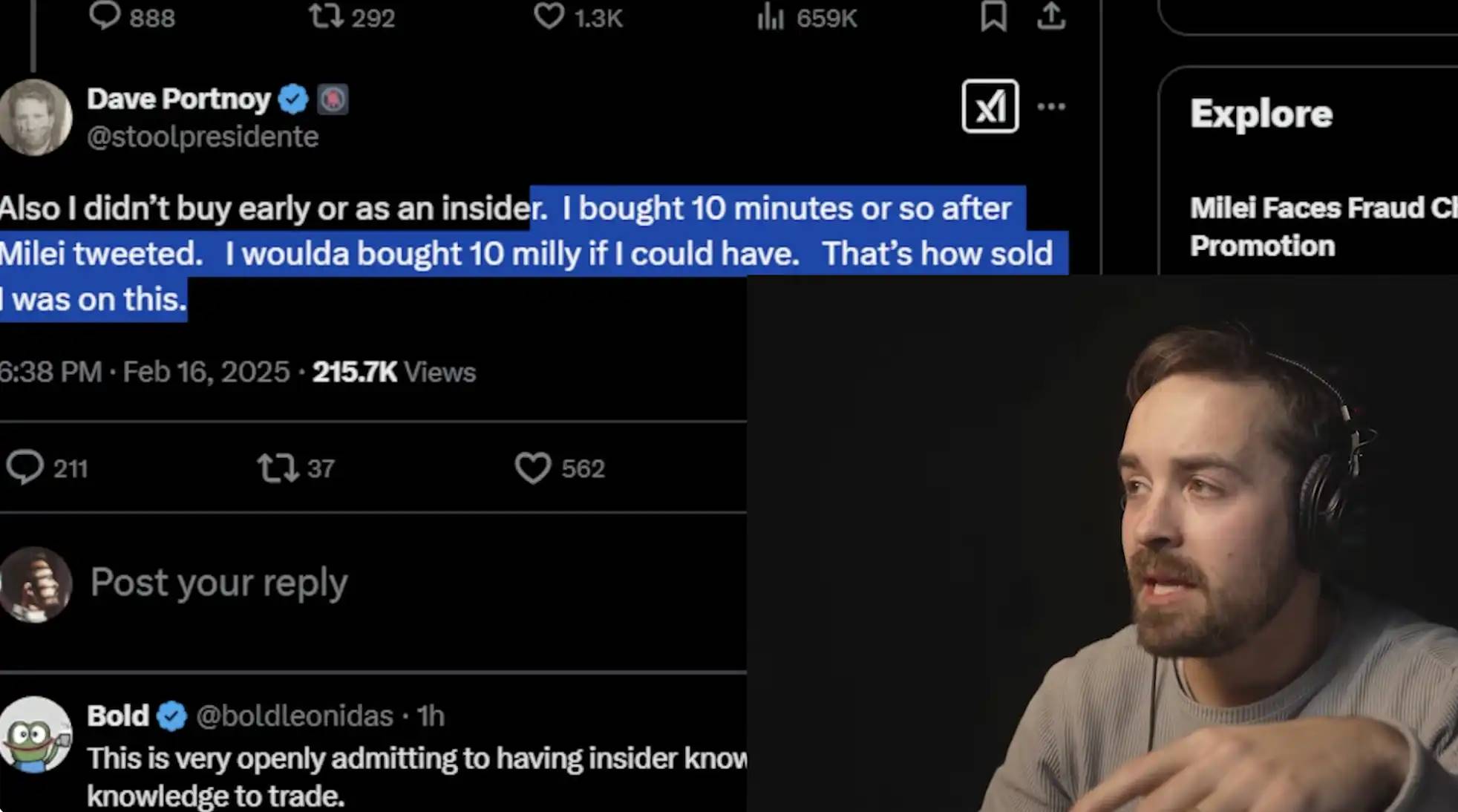

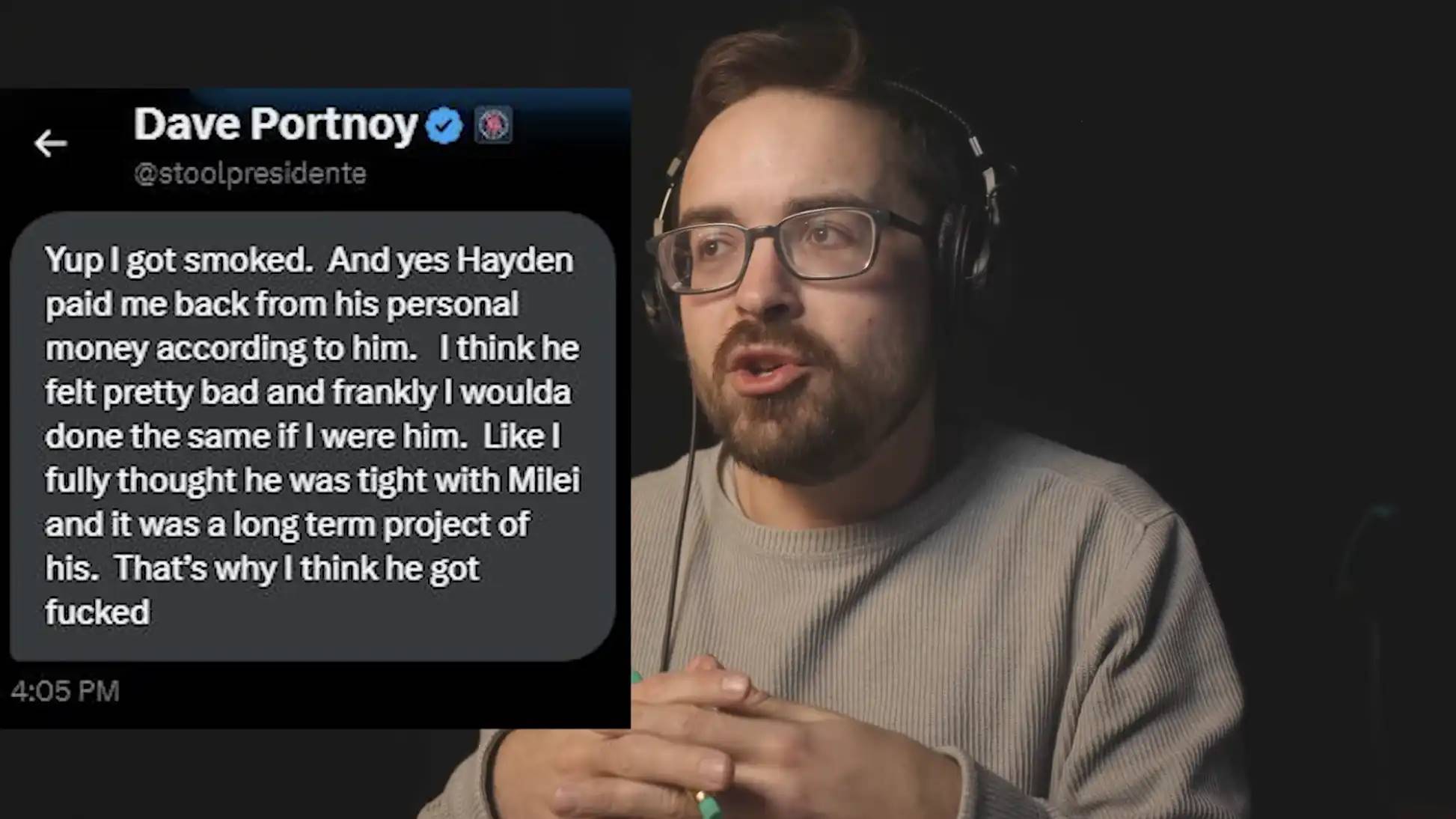

A clear example is Dave Portnoy—he knew about the coin two weeks prior, right? So he knew. To clarify: though Dave claims he knew a launch might happen, he says he didn’t buy early or as an insider. He bought ~10 minutes after Milei’s tweet. He says he’d have bought $10 million if possible. So to clarify: while he knew the coin existed, he states he didn’t trade early. Just ensuring this is in the story. He had time to raise $5 million, traded the coin, lost money ironically, then you refunded him. That’s what many see as insider advantage and unfairness—how manipulated it seems. He trades $5 million, loses, gets refunded. Right?

Hayden Davis: A few points. First, that was my mistake—honestly, I don’t recall the timing, it was late night, messaging back and forth. I thought, “Milei will publicly support it, no big deal,” and I didn’t want Dave to lose money. I wasn’t thinking people would question it. So maybe I need to talk to him—I’m sure we’ll discuss different terms for those who knew. I can’t say whether I or anyone else—Manuel or Mauricio—told others.

What I can say: very few people knew. The term “insider” puzzles me because in every meme coin I’ve known or invested in, or projects I’ve joined, those who benefit most are usually structured traders—like any business, closest ones earn or lose most. So I don’t see it as insider info. I think it’s angry crypto people always feeling unfair advantages exist. If you’re a chain genius who knows how to game Meteora, 30 people worldwide excel at it. So some feel this is...

Coffeezilla: No, there are genuinely unfair rules. Many know stock markets well. You can be Warren Buffett, but Buffett differs from someone with Pfizer insider info trading on it. Public frustration isn’t about trading skill, but knowing non-public info and using it for trades—which is illegal on public markets: insider trading.

Hayden Davis: But with meme coins, A, it’s not illegal, B, it’s standard practice. Every KOL, globally, earns this way—knowing a project, making deals, profiting. Like that. If you accuse this, you must accuse all similar cases. It’s just... I think really...

Coffeezilla: I think it’s terrible—I truly believe it’s terrible. For everyone except insiders, that’s my view on meme coins: they benefit insiders.

Hayden Davis: Frankly, I don’t oppose that, but I think most betting on meme coins, especially early ones, is a separate topic—retail players are playing the game. Those angry are those not insiders. That’s what happens. All social media complaints come from those excluded. You never hear from those who got in. So what do you do? Do nothing? Don’t launch? Then what? That becomes the issue.

Coffeezilla: Clear. Doing a deal vs. using internal project info for trades are different. If I’m paid for a tweet, disclosing it, I see no issue. But if I use insider info to buy $1 million in tokens, I think that’s wrong and should be eradicated. If people treat these markets like capital markets, that’s exactly...

Hayden Davis: I don’t think so, nor should people treat them as capital markets—they aren’t capital markets. That’s not their nature.

Coffeezilla: But you’re a trader—you’d naturally think that, right?

Hayden Davis: Even then, even with trades, I’m just placing bets. If I invest, I think it might go to zero—I genuinely don’t know. So I don’t treat it like regular stocks—I treat it like a casino, because that’s its essence.

Coffeezilla: Oddly, those saying “oh, no regulation needed” are often those tilting the casino table. I hear Dave or others say, “Oh, you babies in the trenches are crying.” Well, doc, how’s the taste? First, most “babies in the trenches” didn’t get $5 million refunds. Second, Dave says, “Oh, you’re mad I dumped your coins before you?” You’re just...

Hayden Davis: You’re mad because you didn’t dump.

Coffeezilla: I’m not mad. Of course, those controlling the most leverage in the casino are the ones saying, “We don’t think our words or actions should follow any rules, as long as we declare openly, ‘Hey, I’m doing this to you, you’re aware.’” Right?

Hayden Davis: But let me say, first, Dave’s a good guy. Second, Dave doesn’t actually understand how meme coins work. He doesn’t—he just weeks ago realized, “Oh, if I bet on this coin and talk about it, the price goes up. Crazy, how? What do I do? How do I handle this?”

Admits LIBRA team launched sniper attack on its own token

Coffeezilla: Wait, I don’t want to focus on him—he has transparency I appreciate. It reveals unseen backstage dynamics. But my broader point: those saying “yes, loosen regulations, don’t treat these like other projects” are often those manipulating the game or benefiting from it. That’s an unfair advantage. As you said, complainers lack unfair advantages; non-complainers have them. I think that’s accurate. I want to shift focus—those wallets seem linked to you and your launched coin, right? With LIBRA, one wallet refunded Dave—he says it’s your personal fund—and it’s linked to an Avalanche wallet that sniped LIBRA. So if you launched the coin, did you unfairly participate in the snipe?

Hayden Davis: I’d say no, for several reasons. First, as I said earlier—this is a bigger topic, like I mentioned in texts. Usually, when we snipe, we aim to block other snipers. Anyway, I don’t snipe—I’m not that guy. I don’t know how to snipe. Put me at a computer to snipe, I wouldn’t know how. Never built bots, clueless.

Coffeezilla: But you don’t deny wallets linked to you participated in sniping LIBRA.

Hayden Davis: I wouldn’t say linked to me. I’d say linked to…

Coffeezilla: No, linked to the wallet that refunded Dave, and Dave says it’s your personal fund.

Hayden Davis: Coincidence—it happened under pressure of fund transfers. But it was a mistake. I mean, if anything, actually, when we reinjected funds, it flowed back through another wallet—same pool we considered.

Hayden Davis: The “snipe” was essentially project funds, right? That’s how we operate. Whenever we do this, it’s this way. Usually, sniping aims to stop other snipers. If the project has enough volume, we use it to ensure continuity. I think this is hard for many to grasp.

Coffeezilla: I agree—I agree. I think it’s indeed hard to understand.

Hayden Davis: See, for example, look at TRUMP’s snipes—massive volume, snipes barely mattered, negligible impact.

Coffeezilla: No, wait. That’s wrong. One person sniped early with $1 million. MELANIA’s crash—blamed on MELANIA—but actually, that sniper sold tens of millions.

Hayden Davis: Sure, the one with $84 million, right? We could debate all day. My point: when you’re on the team, sniping isn’t always necessary, but often protective. With enough volume, pulling some out lets others push prices up. Meme coins move too fast—projects can die in two days. Only hope is having funds to fight snipers. This is discussed by everyone on Solana, all familiar with launches.

Coffeezilla: Do you think the public knows project teams snipe their own launches? Assuming charitably the money isn’t for profit but project benefit—do you think the public knows about these secret ops via “side wallets”? It’s problematic. Teams control price—strange price manipulation. You might say: “If price gets too high, we’ll cut some from the chart.” It also makes “treasury wallets” meaningless—seems you have a sniper wallet as treasury. No public transparency. Honestly, do you think this happens often?

Hayden Davis: I think it happens in all meme coin projects, unless they fully collapse and are revoked—hope no one messes up. But I must say, I’m being very transparent—maybe oversharing—I don’t care. All this happens because some already figured out how to exploit blockchain systems.

Hayden Davis: When you’re responsible, trying to sustain these projects, almost everyone launching them—unless malicious—is struggling to keep them alive.

Hayden Davis: Like, my whole goal entering this space—if you want Dave’s story briefly—was Milei’s team wanted Dave involved for cross-platform promotion, maybe even interviews like Trump’s, and if Dave had a project, opportunities for holders to benefit, creating another social finance project.

Hayden Davis: We’ve constantly tried figuring this out. What always ruins it? Massive sniping. Main reason things go bad, with no solution—those guys leave with $80 million, $100 million, $200 million, unscathed, while others get screwed and projects blamed.

Hayden Davis: So, is sniping the most moral act? No. But I think no one’s figured out better containment, especially at launch—only snipers see it, only snipers see contract addresses. They manipulate Radium, Meteora—they’re certain they manipulate Orca too.

Coffeezilla: So, I think it’s insane you snipe your own projects. But I agree sniping is a huge problem for all meme coins. I also think insider info is a big problem. Both can coexist. Some sniping stems from leaks—like…

Hayden Davis: I disagree.

Coffeezilla: You can disagree, but Alpha groups exist—searching chains for info, hunting early contract leaks, paying for early addresses, then sniping.

Hayden Davis: True, but so what? So what? The question is, what’s the solution? Don’t launch, or try to protect it? Well, I ask you, what would you do?

Coffeezilla: Philosophically, I think meme coins are zero-sum games—extracting value from most participants through mechanisms where someone’s $1 gain requires another’s $1 loss—inherently unfair. So I think the industry’s overall direction is flawed from the start. But clearly, I’ll focus on unfair elements like fraud or insider trading—things widely seen as wrong. If people want to join meme coins, fine. But if they do, markets should at least be fair. I think meme coins are silly, but even if you join silly things, they should be fair.

It’s like casinos, right? Casinos aren’t just unfair gambling—they’re full of fraud. So they end up strictly regulated. Why regulate casinos? Because people get scammed. I think similar things should eventually happen to these projects, though strong forces push de-regulation.

Admits involvement in MELANIA launch sniper attack

Coffeezilla: Obviously, I know this is sensitive, but I must ask—it’s part of my story. Many link you to MELANIA’s launch, a huge issue, especially for me. Did you participate in MELANIA’s launch? Was it also sniped?

Hayden Davis: I think I’ve told you this, but I’ll say it. No, I’m happy to share truth, but you’re asking a factual question that could put me in great danger—but fine, I’ll answer. I was involved. I think the team wanted to snipe because TRUMP’s snipe volume was huge. But we weren’t big snipers—we definitely weren’t—we tried avoiding it. We didn’t earn from MELANIA team, didn’t pull any liquidity.

Coffeezilla: Okay, wow—that’s shocking. But let me expand. You said, “We didn’t pull any liquidity,” but we tracked a wallet receiving $1.5 million MELANIA tokens from an address, then selling them. So you say you didn’t sell liquidity, but…

Hayden Davis: I didn’t. No liquidity exchange, no single-asset exchange. I didn’t say no money was sold. Exchanging liquidity and selling liquidity are different.

Coffeezilla: Oh, so you exchanged but didn’t sell, or vice versa?

Hayden Davis: No, vice versa.

Coffeezilla: Vice versa? Sold but didn’t exchange? Hmm, interesting. Okay. So were these your two main launches? I’ve heard of Hood’s launch—was that you? I know it’s messy, but I think you’re fairly transparent—thanks for honesty. You seem at least honest about this.

Hayden Davis: I’m actually…

Coffeezilla: Sitting on $100 million?

Hayden Davis: Look, about the $100 million—I must say one thing. These things, all of them, aren’t special. Some try saying, “How is he connected to Dave and Milei?” I’m not special. I track this because I want two things. First, I thought meme coins were a step toward social finance. Now I realize that’s wrong—everyone wants to kill me for enabling this. Second, I think you and others should at least consider what people should do, how they should profit from these projects? Because there’s only one real way, right? Fees—launch fees are tiny. Then platforms—whether it’s a rug pull or success—they profit hugely, which I strongly oppose. I completely disagree. Platforms like Meteora, Jupiter, Bullex, Photon profit from trading fees regardless. If people lose, they still profit—that feels wrong to me. I’ve told many platform owners this is wrong—there should be refund policies.

Anyway, beyond that, the problem is fixing a broken system—organizing launches, mechanisms, starting from high market caps, deciding who’s involved, who’s not, how to keep contract addresses, how to market without telling people—what should you do?

If this conversation is recorded and published, I hope it sparks some thought—because even crypto’s best minds lack answers. They don’t. No one knows what to do. I keep wondering, “What should we do? Can we profit cleanly? Is it possible?” You know…

Coffeezilla: Fundamentally, I think crypto people lack good answers because the real answer—nobody wants to hear—is that things like tulip mania—how do you fairly profit? You can structure it many ways, but extracting value from most of the world isn’t inherently good. So I think…

Hayden Davis: Stop saying crypto extracts—every crypto project, VC-backed or meme coin, extracts value.

Coffeezilla: No? Wait, I think there’s a difference. Some things have utility—overused term, but actual tools providing services, then discussing value. Others have no intrinsic value, right? But…

Hayden Davis: Still value extraction. Utility or not, same thing.

Coffeezilla: Not necessarily. Not necessarily. Take Coca-Cola. You can say they make profits for shareholders, but they provide a service. Opinions vary, but they offer a product people pay for, pay dividends. Shareholders might buy for $1, exit for $1, but profit from dividends.

Coffeezilla: Not zero-sum. Coca-Cola isn’t zero-sum. Apple isn’t. Capital market companies aren’t—they create things. That’s their value. In crypto, initial vision—though speculative—was caring about underlying value, some fintech innovation. I think that’s the main point.

Hayden Davis: But look at any crypto asset—Bitcoin. Bitcoin’s value comes from many believing it’s valuable, “supposedly” uncontrollable. At the top, it’s essentially value extraction. All crypto, meme coins or large utility projects, has this extractive nature. All our efforts aim to avoid this—it’ll take huge progress.

Coffeezilla: But that progress won’t happen with meme coins, right?

Hayden Davis: Last thing—I’m not saying I’m right, just sharing my thoughts. I don’t claim certainty. But I think if meme coins collaborate, cross-promote, burn tokens, add utility, they might unlock social finance potential. But getting there involves much stupidity.

Coffeezilla: Yes, I’d love to keep discussing. You now hold $100 million, seeking solutions. We texted—my suggestion may be imperfect, but I think: first, take a snapshot, calculate P&L, identify losers, distribute losses proportionally. Knowing this, perhaps prioritize smaller losses—set max loss per person at $50k, assuming larger losses involve experienced traders. Focus on less sophisticated investors—maybe an Argentinian user seeing Milei’s tweet, investing blindly, or Americans investing ~$1k. Compensate them this way. Downside: needs much time, data firms—honestly, huge effort, but most reasonable given current chaos.

Hayden Davis: Yes, I’ve basically been given four options. Help welcome. Texting you wasn’t to tell a sob story—I genuinely need trustworthy help—I don’t know what to do. I don’t want blame for a situation I never intended.

Hayden Davis: Remember, the trouble is, this is Argentina’s government Milei project—not my team. I’ll repeat this a hundred times. I never wanted this position. Anyway, options. First: no refunds, donate all money to Argentine nonprofits, tell people “it’s fine.” But I think that’s a terrible idea. Second: refund. But refunds based on various metrics—people will still be angry, come after me. So no—I’ve been advised this is a bad idea. Though I do think people deserve refunds—even if meme coins are speculative, putting life savings in is absurd. Still, based on my analysis, refunds at certain prices are feasible. Third: reinject all money into the market. I calculated our funds, even under heavy sell pressure.

Coffeezilla: How much sell pressure?

Hayden Davis: How high can we push it?

Coffeezilla: No, how much cash is in the bank now?

Hayden Davis: Around $100 million. That’s roughly my number. Plus fees. So maybe $110 million—roughly that. About $110 million cash.

Hayden Davis: Because these tokens can be reinjected. I made a chart. If we inject all this money, market cap might reach ~$2.5–3 billion, near all-time highs. At least gives it a chance. And I’d have zero responsibility, right? Then people can say, “Well, money’s back in the market.” Someone might say, “He bought before,” etc. Actually, I’d never buy again. I want out. This is a nightmare for me.

Coffeezilla: Let me share my view—I strongly believe this is a mistake. Let me quickly explain why it’s disastrous, creates more problems.

First, it’s an unfair solution. Proportional distribution tries fairness. But you’re solving a launch already front-run by fastest actors exploiting it. Your solution—“Let’s do something”—lets those front-runners and bots exploit injected capital again. Once you announce considering this, if you’re a sharp speculator, you know, “Hey, this guy will push market cap to $2 billion.” You buy cheap LIBRA now. I’m not advising this. But even mentioning it creates insider opportunity. I could rush, raise funds, buy LIBRA, wait for reinjection. I could say, “Hayden, inject the money, do it.” You inject $2 billion, I 100x. That’s disaster. So immediate insider trading issues.

Hayden Davis: Why? Why disaster? Why disaster? If I announce intent, it gives everyone a chance—anyone can buy. Not insider trading—fully free market, everyone knows money returns—actually fully transparent.

Coffeezilla: But even so, smarter buyers profit more, right? But then…

Hayden Davis: Exactly. Whether launch or reinjection, same result. Either way, outcome’s identical. Like you said, whether I refund or reinject, people stay angry. Refunding sounds crazy, reinjecting—still anger. So why…

Coffeezilla: But if you just say, “Hey everyone, obviously they won’t get all money back,” why would they be angry?

Hayden Davis: Because some will tell me, “Give me $1.5 million or I’ll kill your family.” So whether I refund or not, I face them.

Coffeezilla: You seriously plan…

Hayden Davis: Of course not! But now I must protect my whole family.

Coffeezilla: No, first, you should remove money from your control. Find a trusted firm, set up legal structure, transfer funds out of your hands. So you, Hayden, have no control. Your fear now stems from holding $100 million. But…

Hayden Davis: Yes, exactly. But if I’m fully transparent and honest, this is also my leverage with certain groups. Having control makes me a target—but also protects me—because it’s an international incident. Not a random scam. It’s a presidential-level plan gone wrong.

Coffeezilla: Actually, I agree. It’s a plan. So if I…

Hayden Davis: Hand it to a custodian—yes, even a trusted third party, I lose my leverage. So until I get answers from Javier Milei, his team, a real game plan. Until then, I won’t act. I’ve set a 48-hour window—if someone proposes a solid plan beyond “we need six more months,” I’ll do it. Fine, I don’t care, I’ll fully surrender control. I absolutely don’t want to be involved anymore. Not at all. But now my situation: reputation ruined—fine—I’m a government target, possibly worse. My only leverage is holding this money. So it’s not a simple “hand it over.” Not that kind of story.

Hayden Davis: Firmly believes in Milei’s integrity

Coffeezilla: No, I understand—I get what you mean. Indeed, not a simple story. When discussing my suggestion, my first point: this is a slow fix—whatever you do, go slowly. Don’t rush. That’s why injecting money directly won’t solve all problems. It’s like giving it away. I do think you should handle this carefully. But when you say “if we refund, people will come after me,” I mean, if you eventually find a trusted third party, that eases fears of family kidnapping, forced payouts. Because you’d have no money to give.

That’s another issue. But I get it—you’re using the $100 million as leverage to find answers. Because Javier Milei clearly tried distancing himself. Initially said he was part of it, later distanced. Nobody disputes that. I won’t say Javier Milei didn’t know or support it. I think he regrets supporting it, but that doesn’t change he did support it, endorse it.

But the question is, “What do you do with the money?” I just think you should truly consider fairness—no one disputes the injustice done. So when cleaning up, tempting to take easy routes. Easy route: reinject money, say “not my problem, gamble on, you gamblers.” But fairer, harder-to-criticize, more responsible way: find a way to share losses, return money to people—slowly. Given the sum, it must be done. But I admit, I’m not in your shoes—I don’t want to be. When you say I can help, it sounds like a nightmare—I don’t want to inherit your $100 million problem—but I do hope people get money back. So I offer what I think fairest advice—you decide, bear consequences. It’s your burden.

Hayden Davis: But clarify—I carry this burden because no one tells me what to do, right? I’m in extreme circumstances—something people can’t grasp. My decisions represented Argentina’s government, and they’ve disowned the project. I have no responsibility. If they want refunds, I’ll comply. If you get it, it’s an impossible situation.

Coffeezilla: They gave you no instructions? No guidance at all?

Hayden Davis: No one told me what to do. Zero. Nothing.

Coffeezilla: Well, I think Milei panicked over his own issues.

Hayden Davis: Yes, clearly because…

Coffeezilla: He might be impeached. Not sure, but procedures likely.

Hayden Davis: He might not be impeached, but it’ll be close.

Coffeezilla: It harms him.

Hayden Davis: Definitely harms him greatly. I’m a staunch Milei supporter—I believe he’s absolutely clean, not corrupt. I think many in Argentina want him gone, to restore their corrupt system.

Hayden Davis: Anyway, this situation is simply unworkable. I’m like a sacrificial lamb. I won’t profit—it destroyed my reputation, I’m exposed online, I don’t know what to do. I’m just a facilitator. Craziest part—I’m not even the issuer, not part of the team.

Coffeezilla: Hmm, when you say team—who are the members?

Hayden Davis: Kip is the team. The group meant to manage the project.

Coffeezilla: Oh, got it. But you handled the launch, while fund management should’ve been…

Hayden Davis: From my view, I’m the launch strategist—just making decisions for the team. Yes, executing their desired choices.

Hayden Davis: I’m not saying I’m a “mastermind” plotting profits. I’m here to integrate projects, cross-promote, build something useful. That’s my only reason. I’m stuck—many things I couldn’t influence—I was mostly an executor.

Coffeezilla: We must admit, you typically earn millions from these projects, right? Can’t deny that.

Hayden Davis: I’m certainly not doing it for free—I can’t claim that.

Coffeezilla: Okay, fine. Just confirming you’re not portraying yourself as a victim. I think your situation is tough, but financially…

Hayden Davis: I’m absolutely a victim here. I won’t profit from this, but of course, I won’t claim I don’t earn.

Coffeezilla: How do we know? This is my concern about “project sniping.” As I said, I can trace blockchain—I think I’m among the top 1%, most don’t know how. Even asking me to find all snipers—it’d take ages, impossible due to complexity. My point: when you say “I won’t benefit,” how prove you didn’t secretly pocket millions? Entirely possible. Not accusing you—don’t say you’re doing it. But with money moving fast, access to vast funds, side wallets sniping—oh, “to protect the project”—how ensure money doesn’t flow to your pockets?

Hayden Davis: I think you can cite other projects as proof. For this project, targeting my family, president involved—it’s a totally different game, honestly. I have zero interest in profiting—it risks my life, my family’s safety. So unlike threats from Argentine drug cartels or elsewhere, I want nothing to do with this project or profiting from it. You can interpret this as you wish, but it’s different.

Coffeezilla: Interesting. Look, I find you a fascinating figure in some ways. You know my views on meme coins—I won’t overly blame you, though I disagree. Disagree on sniping, many things. But you’re interesting—you represent the “behind-the-scenes” side. You’ve seen inner workings of some biggest projects.

MELAN

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News