Aftermath of the LIBRA farce: How do Solana founder Toly and influencer Cobie view it?

TechFlow Selected TechFlow Selected

Aftermath of the LIBRA farce: How do Solana founder Toly and influencer Cobie view it?

Only after experiencing multiple painful losses will investors stay away from the game of buying at the top.

Author: 1912212.eth, Foresight News

A meme coin called LIBRA has stirred shockwaves across the crypto community. On February 15, Argentina's president announced the launch of the meme coin LIBRA and revealed its contract address. The token surged rapidly afterward, briefly reaching a market cap exceeding $4 billion. However, within hours, its price crashed dramatically. It now trades at $0.36, with a market cap under $400 million. Just hours after posting about it, the Argentine president deleted his earlier tweet promoting the meme coin, stating: "I initially thought it was just another casual endorsement of a private entrepreneurial project unrelated to me, as I’ve done before. I wasn’t aware of the project’s details. After learning more, I will absolutely not promote such things again (which is why I deleted the post)."

Early investors who rushed into this speculative trade suffered heavy losses. Chaofan Shou, developer at Solayer, along with Tonykebot, each lost over $2 million in this incident. They later exposed that the team behind LIBRA consisted of core members from kip protocol and vowed to pursue accountability. But they are far from alone. According to data from lmk.fun, transaction records show that 24 traders lost over $1 million each on LIBRA, while 61 lost over $500,000. The biggest loser incurred a loss of $5.17 million—having spent $5.6 million to buy 2.1 million tokens, he eventually sold them for only $430,000. In contrast, by February 15, eight wallets linked to the LIBRA team had withdrawn 57.6 million USDC and 249,671 SOL (worth approximately $49.7 million), cashing out around $107 million in total through liquidity additions, removals, and fee claims.

Insider trading in meme coins, celebrity influence promotion, and the game of finding greater fools once again become focal points of market attention.

Today, Paridigm researcher Samczsun, Solana co-founder Toly, and crypto KOL Cobie discussed their views in a Twitter exchange.

The Conspiracy and KOLs

Samczsun initiated the discussion with a question: Will anyone be held accountable for this event on a social level?

Toly responded pessimistically, noting that "group judgment at the social layer itself is problematic because it's a reactive response to outcomes rather than based on a predefined and widely accepted set of rules." Attackers can infinitely generate failed tokens, act as the sole bidders to acquire most of the supply, then hand the contract address over to a KOL. In Toly’s view, the only solution would be enforcing social credit scores for users and rejecting tokens associated with low scores.

Samczsun followed up: If insider-controlled meme coins are harmful, why not formally exclude all participants from the start? In the short term, the benefit of one-time profit wouldn't outweigh the cost of exclusion; in the long run, such behavior simply wouldn't pay off.

Toly gave a simple answer: Once a KOL promotes a contract address and faces backlash from followers, the conspiracy group simply moves on to the next KOL.

Cobie added that many KOLs don’t even know who they're dealing with or what they’re actually promoting. There's just an agent telling them: if you tweet about this pyramid scheme, you’ll get X coins.

If KOLs and their agents are informed something is clearly bad, will they take responsibility for their actions? We often see certain tokens proven to involve multiple insider deals and fraud, yet no one ever faces any form of punishment.

Some KOLs have indeed seen reputational damage, but part of the reason lies in: "How do we even define good and bad in meme coins? Even in completely organic, free-market token distributions, the top 20% of holders usually end up owning over 80% of the supply," offered Toly.

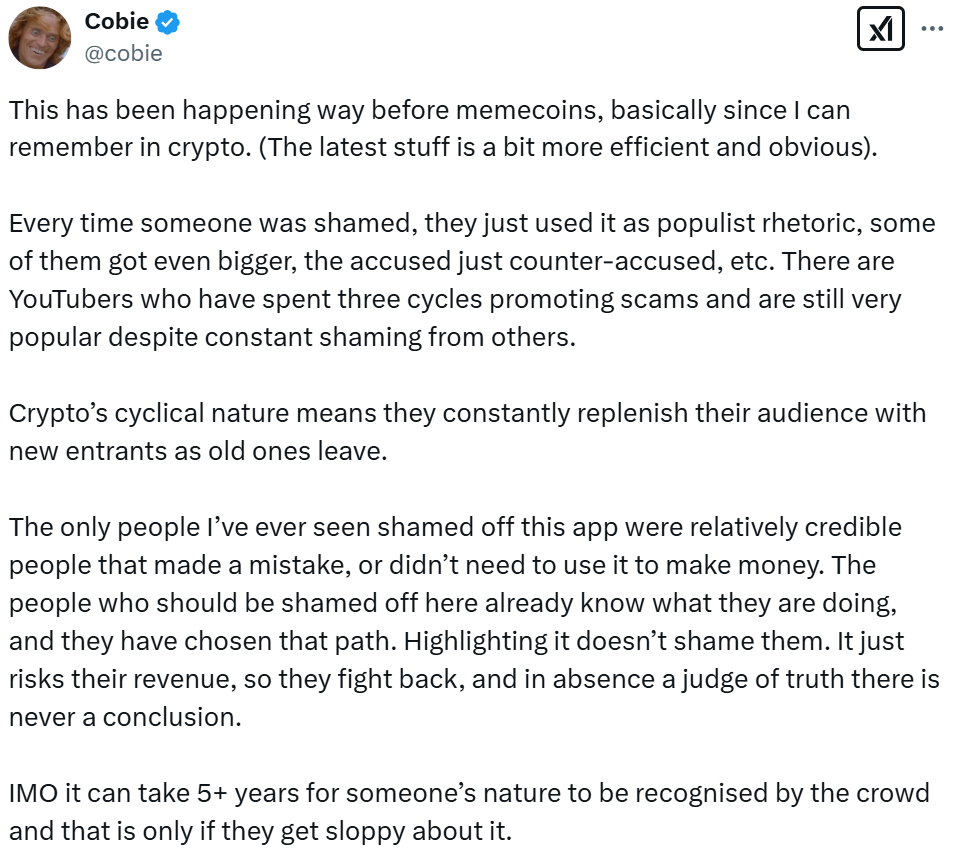

At this point, Cobie bluntly stated there is currently no effective way to shame the shameless. He then posted a long thread elaborating his perspective.

"This situation has existed long before meme coins emerged—it's basically been this way since I first entered crypto. (Recent tactics are just more efficient and obvious.) Every time someone gets called out, they use populist rhetoric to turn it into a narrative of persecution. Some even grow more popular as a result. The accused typically counter-accuse others, creating division. For example, some YouTubers have promoted scams across three consecutive cycles. Despite constant exposure, they remain popular. The cyclical nature of crypto means new entrants always replace those who leave, so these individuals always find fresh audiences."

Lack of Truth and Oversight Leaves No Consequences

In Cobie’s view, the only people he’s seen truly shamed into leaving the space were either relatively reputable individuals who made mistakes or those who didn’t depend on the industry for income. Those who should be expelled already know exactly what they’re doing and have made their choices. Exposing them doesn’t make them feel shame—it only threatens their income, so they fight back. Without a "truth arbiter," debates often lead nowhere.

Cobie also noted that it may take over five years for the public to truly recognize someone’s true character—and only if they make glaring mistakes along the way.

"If scammers face no threat of losing their freedom, preventing further fraud is nearly impossible."

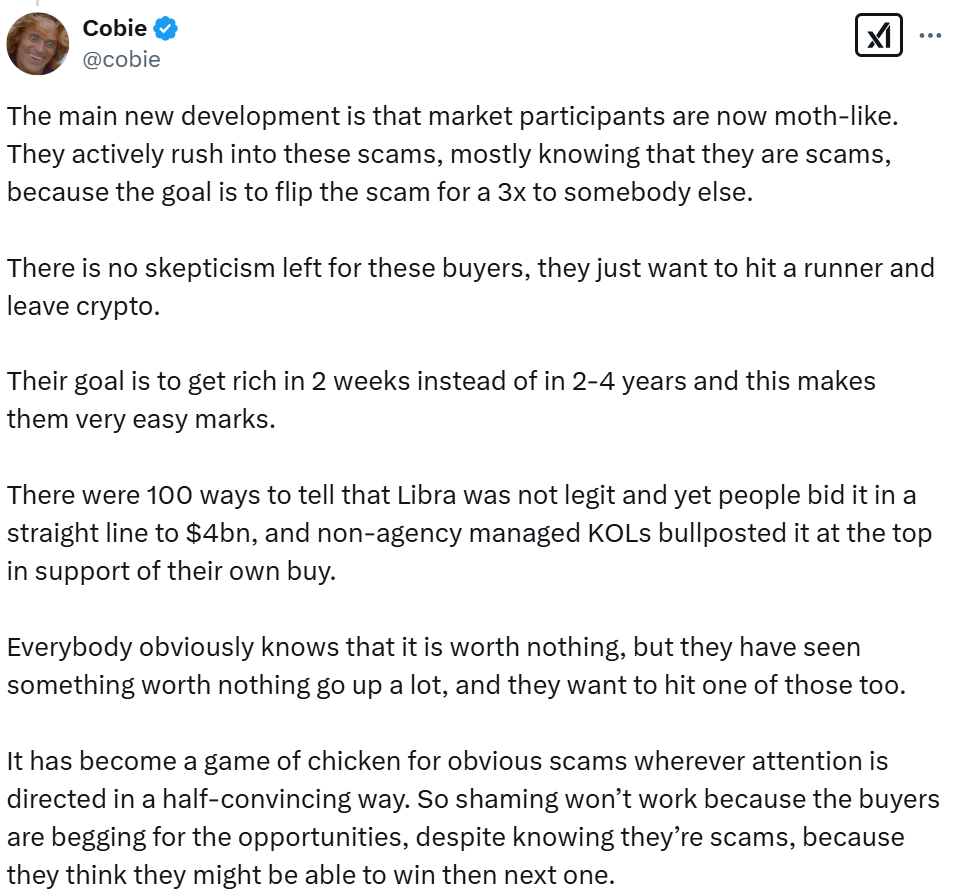

The Greater Fool Game Faces Unsolved Dilemmas

Regarding controversial high-FDV VC tokens and the fast-paced issues in meme coins, Cobie offered a sharp critique: Market participants rush into these scams like moths to flame. Most know they’re scams, but their goal is simply to sell at triple the price to the next buyer. They want to get rich in two weeks, not two to four years. Players hope they’ll be the lucky ones to win big in the next round.

If you can’t stop them, avoiding participation might be the best approach.

Cobie said investor/player behavior is easy to change. If you lose ten times, you stop playing. When no one buys VC tokens anymore, in fact some (very, very few) were mispriced. They stop buying because they’re tired of being drained.

Cobie previously wrote about high-FDV, low-circulation VC tokens, but expressed disappointment that it didn’t achieve its goal or stop people from buying these tokens. The only way to change investor behavior is when participants lose enough money. Only through real pain can they truly learn to avoid such involvement.

He wrote, "This in turn changes token issuers’ behavior—when the public stops buying these products, you can no longer easily issue this type of token."

Finally

If you were to launch a token called echo today and had to choose between two paths:

(1) Sell 25% to venture capital firms and insiders, reserve 35% for the team, launch a token that receives revenue distributions from Echo’s business to holders, issued with low circulating supply;

(2) Sell 0% to anyone, keep 50% for yourself, launch a memecoin called 'Echo the Racist Dolphin' that has no connection to Echo other than the name, deployed from my public wallet and promoted via a CA account;

Which one do you think would achieve a higher market cap? Cobie gave his answer: The meme coin’s value (at least currently) would exceed that of the VC token. But perform the same experiment five years later, and the result would be the opposite.

Interestingly, in Cobie’s comment section, someone cheekily posted an image asking which token he was referring to.

Cobie said he’d reveal the contract address in 25 minutes. Toly commented: Do you have any shame?

Cobie replied it was just a joke, teasing Toly using Buterin’s nickname ("God").

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News