From the "Lemon Problem" to Zero-Knowledge Proofs: Exploring Self-Regulation in the Web3 Ecosystem

TechFlow Selected TechFlow Selected

From the "Lemon Problem" to Zero-Knowledge Proofs: Exploring Self-Regulation in the Web3 Ecosystem

One way to make cryptocurrency a necessity and integrate it into the fabric of our economic lives is to ensure it is reliable, secure, and supportive of our users.

Compiled by: Loxia

The Lemon Problem and the Crisis of Trust

Today I don't want to talk much about technology. I want to discuss a social issue we're facing in crypto. The title of this talk is "Social Consensus and Self-Regulation." Let me first ask, has anyone heard of the "lemon problem"? Does that term ring a bell?

Well, not really. Not much.

In American slang, a "lemon" refers to an unreliable car—one you didn’t know in advance would be unreliable. I'm not entirely sure about the origin of the term, but that's what it means.

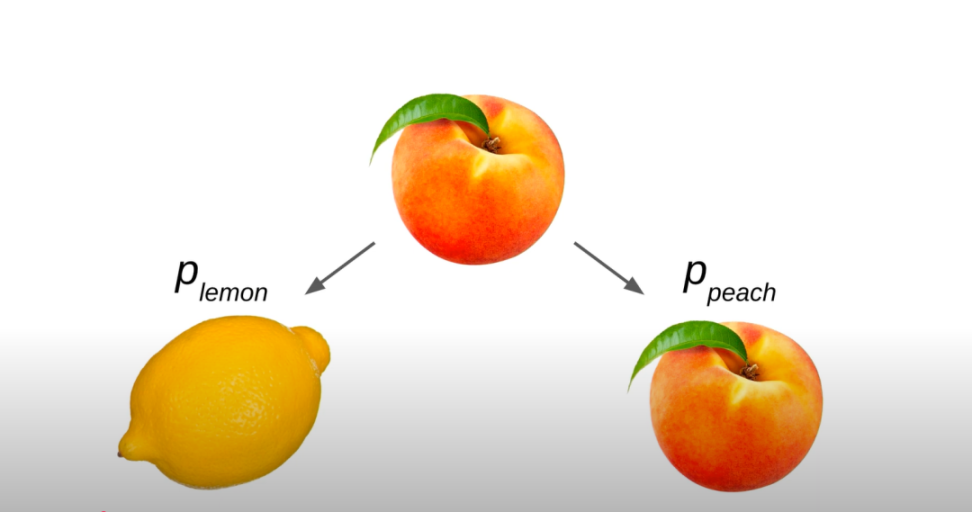

Good, reliable cars are called "peaches." I didn’t know that either until I looked it up. Kind of cute.

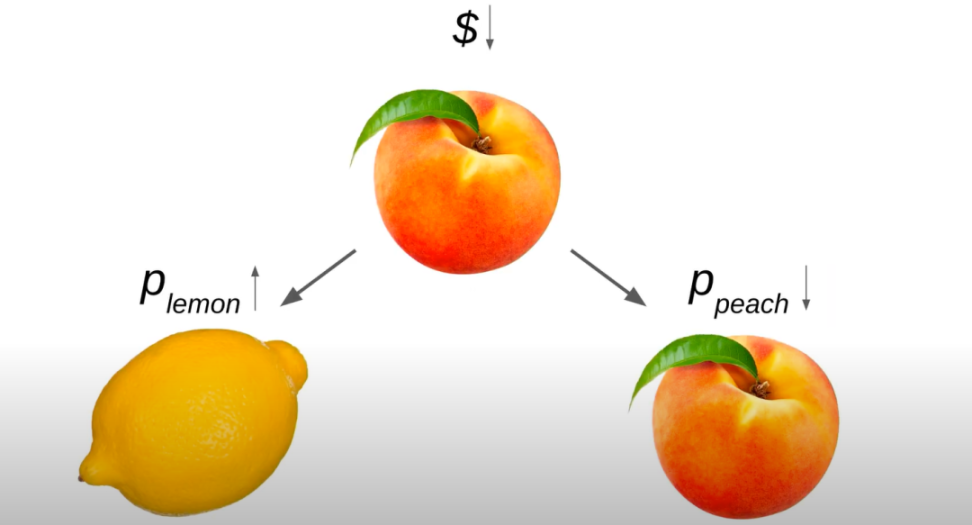

The "lemon problem" is essentially a used car dealer problem. You go to a used car market—it feels a bit shady, because you don’t know whether the car you’re buying will be a "peach" or a "lemon." This is also a major issue in crypto today—everything looks like it could be a "peach," but in reality, many protocols are "lemons."

So when you buy a car or use a protocol, there’s some probability it’s a "peach" and some probability it’s a "lemon." How much are you willing to pay for it? What’s your weighted average expected price for something that might be a "peach" or a "lemon"?

How much are you willing to pay? It’s like a kind of weighted average—we can all internalize this concept: probability of lemon times value of lemon, plus probability of peach times value of peach.

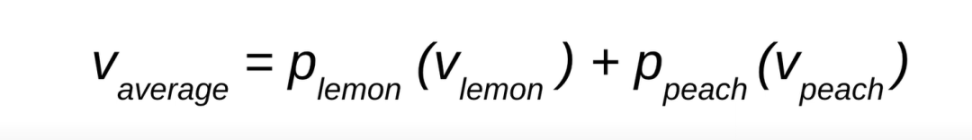

You might intuitively think the price you’re willing to pay lies somewhere between what you’d pay if you knew it was a "peach" and what you’d pay if you knew it was a "lemon." So why is this a strange dynamic, and why are we talking about fruit?

What incentives does this create for used car dealers? If you know everyone will pay a price somewhere between "peach" and "lemon," what’s your incentive?

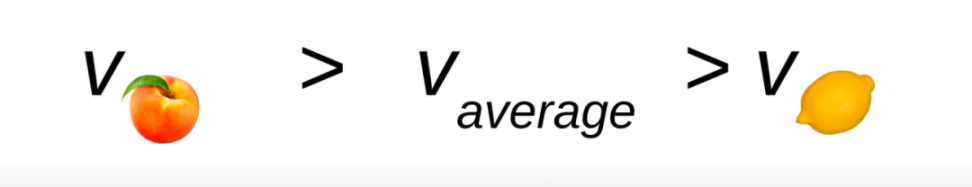

Your incentive should be to only sell "lemons," right? If people are willing to pay more than a "lemon" is worth, you have no reason to sell a "peach"—you can just sell them the "lemon."

This is usually called a scam.

Okay, I want to pause here—this is a big problem in crypto today: the lemon problem.

The current dynamic in crypto is that due to this lemon problem, the probability of "peaches" is actually decreasing. Fewer people are willing to grow "peaches" because they’re expensive, while "lemon" dealers flood the market thinking, wow, I can sell my "lemon" to people who’ll pay more than it’s worth because they’re misled into thinking it’s a "peach." Overall, users’ willingness to engage with the ecosystem declines—and that makes sense.

Now I can already hear some of you—or your imagined interlocutor—saying: "That’s the cost of permissionlessness; we have to accept the good with the bad, like a 30% discount in crypto—you know, that’s just reality."

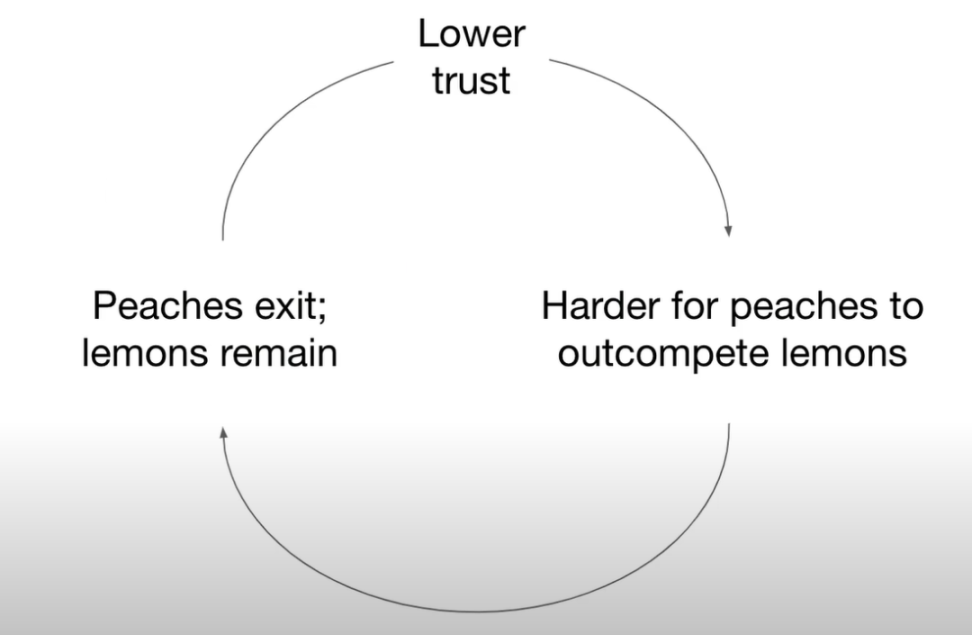

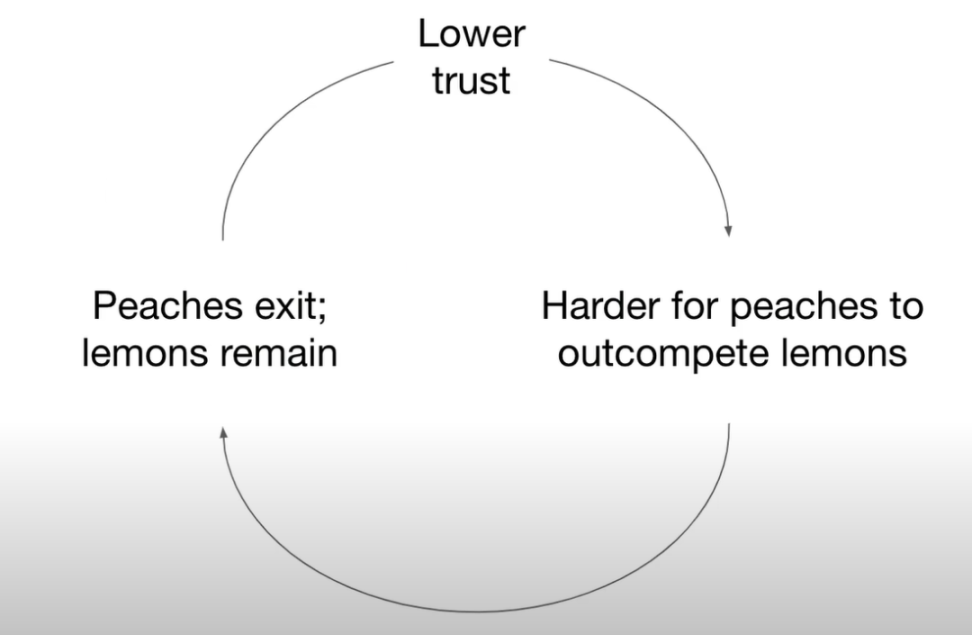

But this isn’t a one-time cost. The lemon problem isn’t a one-off—it’s actually a death spiral.

Because as trust erodes, "peaches" find it harder to outcompete "lemons," so "peaches" exit the market, leaving only "lemons." That’s not a good place to be.

So we need to help consumers identify "lemons" in some way. And I’d say, if we don’t do this, Gary will—and he’s already trying very hard. That’s why I advocate that if we want to preserve the spirit of what we’re building in crypto and solve the lemon problem, we need some form of self-regulation.

Let’s compare this to something that works well—this might be controversial.

The Casino Model: Building Trust through Security and Fairness

Okay, what am I talking about?

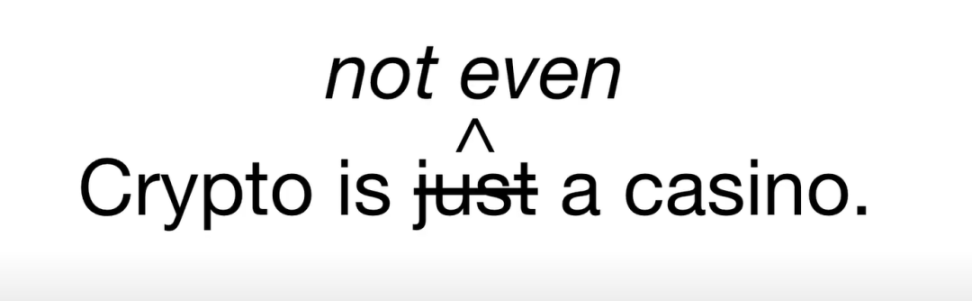

Am I saying crypto is a casino?

No, I’m saying crypto isn’t even as good as a casino.

We need to at least perform as well as casinos. If crypto is going to work,

We need to at least do what casinos do well,

And I think it’s worth taking a look—that’s what I’ll talk about next.

Casinos are known for fairness and security—they heavily advertise this. Why do they go to such lengths to prove the casino isn’t rigged, except in the obvious ways it clearly is?

Let me give you a few examples. This is an automatic card-shuffling machine.

Why do they use this instead of letting dealers shuffle manually?

They want to prove to you that you’re not being cheated—at least not in terms of randomness. They want to show verifiable randomness.

They ban cheaters and share information about them across casinos. Why would they cooperate against cheaters? If I’m Flamingo Casino (a Las Vegas casino) and I catch a cheater, why would I share that info with competitors?

They use dice calipers to ensure dice are evenly weighted—all these measures exist to convince consumers: you’re not being scammed, you’re playing fairly, even if the odds are against you, you won’t be deceived.

Governments and casinos actually co-invest in making casinos safe. We forget that casinos are highly legal and rapidly growing. Ethereum is projected to generate $2 billion in fees this year, while the global casino industry will generate $300 billion.

Marketing safety is a highly successful collaboration between casinos and governments—a way to convince authorities that making this system safe benefits everyone.

Okay, how does this work? It’s a virtuous cycle: higher trust leads to more users, which leads to investment and greater fairness and security.

We need to achieve this in a decentralized way. There’s one three-letter acronym I haven’t heard mentioned in any conversation this week—FTX. No one talks about it. We like to pretend it was just a nightmare. Bad actors really eroded trust across the entire ecosystem—not just their direct victims, but everyone.

Zero-Knowledge Proofs, Self-Regulation, and Social Consensus

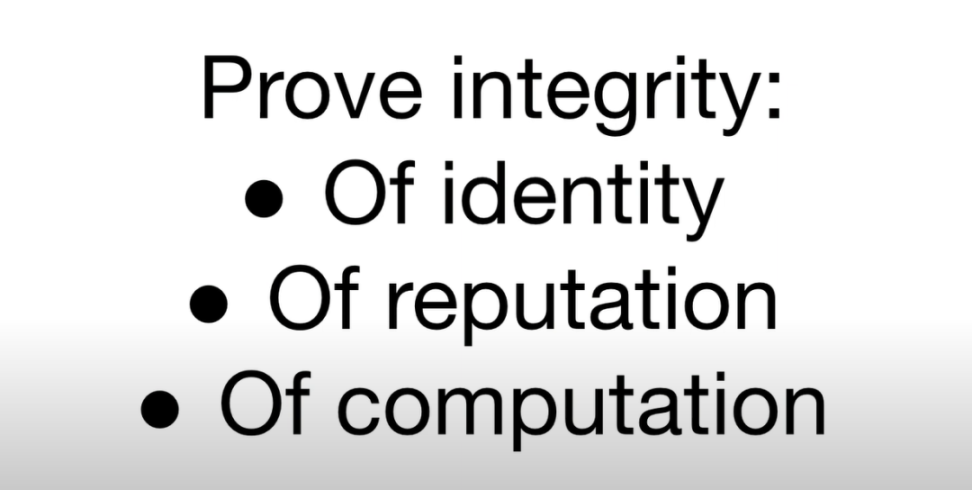

But we have the technology to prove security and legitimacy. We just need to adopt it at the social level. So the obligatory nod this week: zero-knowledge, right? It’s a term we all know.

We have the ability to prove integrity—to prove identity, reputation, and computational correctness.

The issue isn’t technical. We keep attending these conferences and talking about technology. Part of the problem is actually social consensus and ideology.

We know we can create new forms of social consensus around protecting applications and users. We need to accept that this is something we must do. We need to self-regulate before we get regulated by others.

I think ideologically, we’re extremely polarized—either fully permissionless or fully permissioned, black or white, all or nothing.

But in reality, there’s a broad spectrum of social consensus between these extremes.

Let me give you an example. What ZK and ASIC-resistant designs ultimately enable could break ideological taboos—you know, only third-party-verified token holders who can prove the legitimacy of their funds can enter a pool. This can be both permissionless and permissioned. I can create a pool with these rules, and you choose whether to join. So we get this concept of libertarian paternalism.

Social consensus—say, within this room or community—decides this is how we operate securely, then users decide what they want to do. Instead of insisting on a strict black-and-white stance where any permission—even social, even democratic—is unacceptable.

Another example is the idea of decentralized clean providers that Vitalik and our co-founder Zach Williamson have been working on—a social graph where individuals verify the legitimacy of your funds and transactions. They observe behavior and say, "This isn’t something we want associated with us." This is very different from centralization, very different from censorship—it’s a democratic form of social consensus where we collectively say we won’t tolerate certain behaviors in our ecosystem.

The goal here is still to allow users to express their preferences across various protocol designs. This isn’t about restricting freedom—it’s about giving users more choice than we currently offer.

ZK enables permissionlessness at the base layer while enabling permissioned social consensus at the application layer.

There are many other examples: reserve proofs, anti-phishing, opt-in compliance pools, proof of legitimate funds.

But the point is this: we need to turn zachXBT into ZK. We need to use math and social consensus instead of trust or centralized compliance.

To sum up, we need ZK to unlock three key improvements.

First, we need to preserve user choice while enabling self-regulation and compliance. As a community and ecosystem, we haven’t truly discussed self-regulation—we just hope and pray others won’t notice.

We won’t succeed unless we address this. Web3 won’t work. We need to prove to someone that we’re taking care of each other and our users. We need to show users that as a community, we support them.

Instead of imposing ideology on users, let’s give them choices about where they want to go. That’s ultimately what this space is about—freedom, autonomy.

Finally, we need to improve security. We need to make it reliable. We need to make crypto essential, not optional. We forget that governments—at least supposedly—are made up of voters. Why were Uber and Airbnb once illegal, but now legal? Because someone went up to Capitol Hill and said, "You can’t take my Uber unless I’m dead." Someone did that. Individuals did that. I don’t know if you remember that moment.

One way we make crypto essential and embedded in the structure of our economic lives is by ensuring it’s reliable, secure, and that we support our users.

This is how we turn "lemons" into "peaches."

This episode features a video from BlueYard Capital published on YouTube: {Jon Wu (Aztec) @ If Web3 is to Work... A BlueYard Conversation}

Original video link: https://www.youtube.com/watch?v=o17GnPJXxgU&t=244s

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News