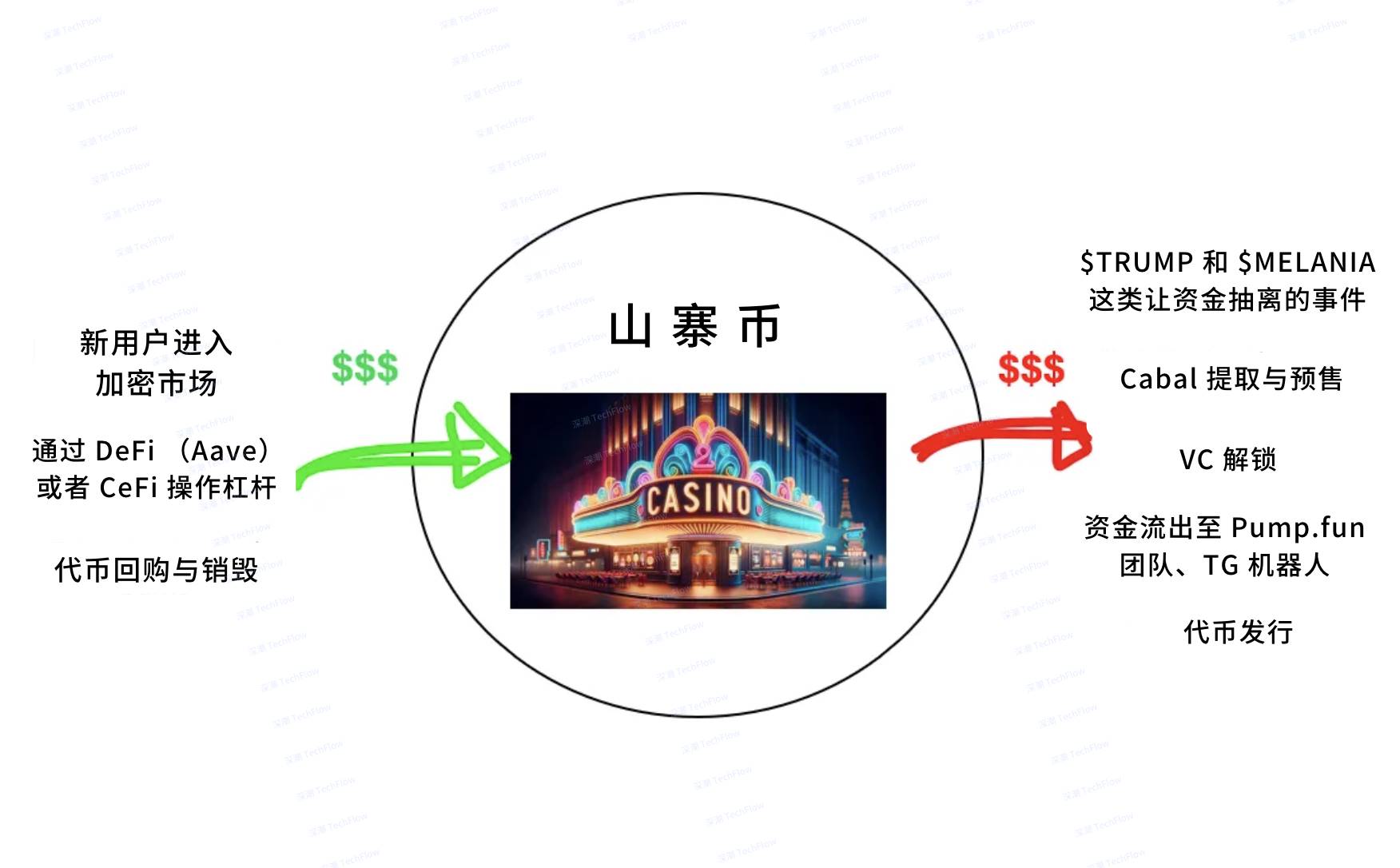

If the meme season is a giant casino, which table is right for you?

TechFlow Selected TechFlow Selected

If the meme season is a giant casino, which table is right for you?

Pump-and-dump investing is more like a poker game, but there are too many tables and too few players.

Author: tzedonn

Translation: TechFlow

After a wild fourth quarter, it's time to pause and reflect. In just three months, the market has undergone significant changes.

This time is different.

Everyone is waiting for the "alt season" (the moment when the blue line crosses above the orange line), just like in 2021–2022, when prices of all altcoins exploded. However, since the launch of Bitcoin ETFs in January 2024, the gap between Bitcoin (BTC) and the TOTAL2 index (representing the total market cap of alts) has been widening steadily.

In past alt seasons, investors typically rotated profits from Bitcoin into higher-risk assets, driving broad gains across the alt market. This created the classic capital flow pattern.

But now, Bitcoin’s capital flows have completely decoupled from other cryptocurrencies, forming an independent ecosystem.

Bitcoin inflows are primarily driven by three factors:

-

ETFs: Currently, ETF funds collectively hold 5.6% of global Bitcoin;

-

MicroStrategy: This company holds 2.25% of Bitcoin and remains a consistent institutional buyer;

-

Macroeconomic factors: Including interest rates and geopolitical developments (e.g., the U.S. sovereign wealth fund or other nations potentially buying Bitcoin).

On the other hand, Bitcoin outflows mainly include:

-

The U.S. government: Currently holds about 1.0% of Bitcoin and has indicated it may not sell;

-

Bitcoin miners: Miners regularly sell portions of Bitcoin to cover operational costs;

-

Bitcoin whales: These large holders have seen their holdings appreciate approximately fivefold since the 2023 market low.

Clearly, these capital flow drivers are entirely distinct from those affecting the alt market.

Alt Market: Are There Still Enough Players?

The alt market can be compared to a casino.

The best time to participate is when there is abundant capital flow in the casino (i.e., high net inflow). Equally important is choosing the right table (i.e., investment target).

Capital inflow sources for the alt market include:

-

New capital entering:

-

For example, in 2021, a surge of retail investors brought new funds into crypto. However, current inflows via Phantom/Moonshot or TRUMP token launches, as well as growth in USDT/C market cap, appear insufficient to sustain the market.

-

Additionally, certain specific assets may benefit from capital rotation. For instance, some investors who previously avoided Memes might now consider "AI Memes," as such investments are easier to rationalize.

-

Leveraged capital obtained through decentralized finance (DeFi) platforms (e.g., Aave, Maker/Sky) or centralized finance (CeFi) platforms (e.g., BlockFi, Celsius). From an institutional perspective, the CeFi market, after its 2021 collapse, is no longer active. In DeFi, the IPOR index (tracking USDT/C borrowing rates) shows rates have dropped from around 20% in December 2023 to about 8% today.

-

-

Token buybacks and burns: Making players’ chips more valuable

-

The "buyback and burn" mechanism in crypto projects is akin to a casino operator using revenue to enhance the value of players' chips.

-

A notable example is the HYPE insurance fund, which repurchased 14.6 million HYPE tokens at $24 each, totaling approximately $350 million.

-

However, most crypto projects lack sufficient product-market fit (PMF), making it difficult to conduct buybacks large enough to meaningfully impact token prices (e.g., JUP’s buyback case).

-

Outflows from the Casino: Who Is Cashing Out Chips?

-

Major withdrawal events

In January, two once-in-a-lifetime large-scale withdrawals occurred:

-

The Trump event: Capital surged from $0 to $75B, then rapidly fell to $16B;

-

The Melania event: Capital rose from $0 to $14B, then dropped to $1.5B.

These two events conservatively removed over $1B in liquidity from the crypto ecosystem. In other words, if someone made over $10M in a single trade, they likely moved more than 50% of those profits off-chain.

-

Tool-driven continuous withdrawals

Beyond major events, certain tools continuously extract capital:

-

Pump.fun: Generated cumulative revenue of $520M in about one year;

-

Photon: Accumulated revenue of approximately $350M;

-

Bonkbot, BullX, and Trojan: Each tool has generated around $150M in cumulative revenue.

These tools gradually remove substantial capital from the market through dispersed, small-scale withdrawals.

-

Cabal exits and presale models

Cabal exits and presale models often signal the end of a market cycle. At this stage, a few individuals extract large amounts of capital and move them off-chain. As cycles near completion, these events become increasingly short-lived:

-

Pasternak: Lasted only about 10 hours;

-

Jellyjelly: Lasted about 4 hours;

-

Enron Pump: Lasted only 10 minutes.

This rapid capital outflow is vividly termed the "euthanasia rollercoaster", as it subjects the market to brief yet intense volatility.

-

Venture capital (VC) token unlocks

Venture capital firms convert unlocked crypto assets into USD to return distributed profits (DPI) to their limited partners (LPs). For example, in the TIA project, VCs extracted significant capital from the crypto market through this method.

-

Deleveraging

There is also deleveraging in the market, such as declining USDT (Tether) lending rates. This reduces leveraged capital in the market, further impacting liquidity.

(Original image by tzedonn, translated by TechFlow)

Choosing Alts: How to Find Your Table?

Selecting the right investment is key to success in crypto markets. This process can be likened to choosing the right poker table.

When the market is active (i.e., many participants), your potential returns increase—but only if you pick the right token.

This type of investment is called a "poker game" because it is essentially a zero-sum game.

In this game, projects either:

-

Generate no revenue or value;

-

Return generated value to the token.

The only possible exceptions are two types of projects:

-

Frequently used L1s, such as SOL and ETH;

-

Products that generate high revenue, such as HYPE.

Note that some investors bet on teams based on "fundamentals," expecting sustainable future revenue, but I remain more pessimistic about this in the short term.

2025 situation: Too many tables, too few players.

By 2025, competition in the crypto market has intensified, making it harder than ever to find suitable investments. This is because there are simply too many "poker tables" (i.e., token projects) coexisting in the market.

Here are some numbers:

-

About 50,000 new tokens are launched daily via Pump.fun;

-

Since Pump.fun’s launch, over 7 million tokens have been created, with around 100,000 eventually listed on Raydium.

Clearly, there aren’t enough investors to support all these token projects. As a result, altcoin returns are becoming highly polarized.

Selecting the right investment has become an art, typically requiring consideration of the following aspects:

-

Team and product strength;

-

Narrative behind the project;

-

Virality and marketing effectiveness.

Kel wrote an excellent article detailing how to choose altcoin investments.

What Does This Mean?

-

Alts are no longer “high-beta Bitcoin.” The old investment thesis that “holding alts instead of Bitcoin” yields higher returns may no longer hold true.

-

Asset selection matters more. With Pump.fun reducing the barrier to token issuance to nearly zero, picking the right altcoin has become more critical than ever. Market inflows no longer uniformly lift all tokens.

-

Alt investing is more like a poker game. While describing altcoin investing as a poker game may sound pessimistic, it accurately reflects the current market reality. Perhaps in the future, I’ll write an article exploring crypto’s true long-term use cases.

Has it peaked? Currently, the market may have reached a temporary peak, but future movements remain to be seen.

When will the next alt season arrive?

The traditional "four-year cycle" theory may no longer apply, as altcoins are increasingly decoupling from Bitcoin (BTC).

In the future, altcoin rallies may be triggered by unexpected events, such as phenomenon-level occurrences like "GOAT."

In the long run, the outlook for crypto markets remains highly promising, especially under the influence of a U.S. Sovereign Wealth Fund (US SWF), Bitcoin-supportive governments, and upcoming stablecoin legislation.

The future is uncertain, but full of opportunities. Good luck, and enjoy the ride!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News