Z-generation's new favorite in crypto: How much more room does Robinhood have to grow?

TechFlow Selected TechFlow Selected

Z-generation's new favorite in crypto: How much more room does Robinhood have to grow?

Robinhood's core user base is primarily concentrated among millennials and Gen Z, the very groups that are the most active participants in cryptocurrency.

Author: RockFlow

Key Takeaways

-

Robinhood's rise in crypto stems from three key advantages built over years: a large young user base established through its zero-commission model, technical infrastructure and capabilities enabling product innovation, and investment habits cultivated during the meme stock craze.

-

Recent quarterly earnings show Robinhood’s significant 2024 stock surge was driven by stronger-than-expected recovery in its crypto business. Crypto revenue jumped 165% year-on-year to $61 million in Q3 2024, forming a dual growth engine with options trading.

-

Looking ahead, Robinhood’s expansion into EU and UK markets, its core user base (Millennials and Gen Z) being the most active crypto participants, and potential regulatory easing under Trump’s new administration create substantial growth potential for its crypto operations.

In the 24/7 frenzy of the crypto market, one name is increasingly on investors’ lips—Robinhood. Founded by two Stanford graduates, this fintech platform not only disrupted traditional Wall Street with its zero-commission model but also carved out a new frontier in digital assets.

When Baiju Bhatt and Vlad Tenev persisted through 75 failed funding attempts, they likely never imagined Robinhood would become a crucial bridge connecting traditional finance and digital assets.

RockFlow has previously covered Robinhood’s development history, the GME event, and payment for order flow (PFOF) in detail—Robinhood: There’s No Free Lunch, Only Eternal Suckers (click to view).

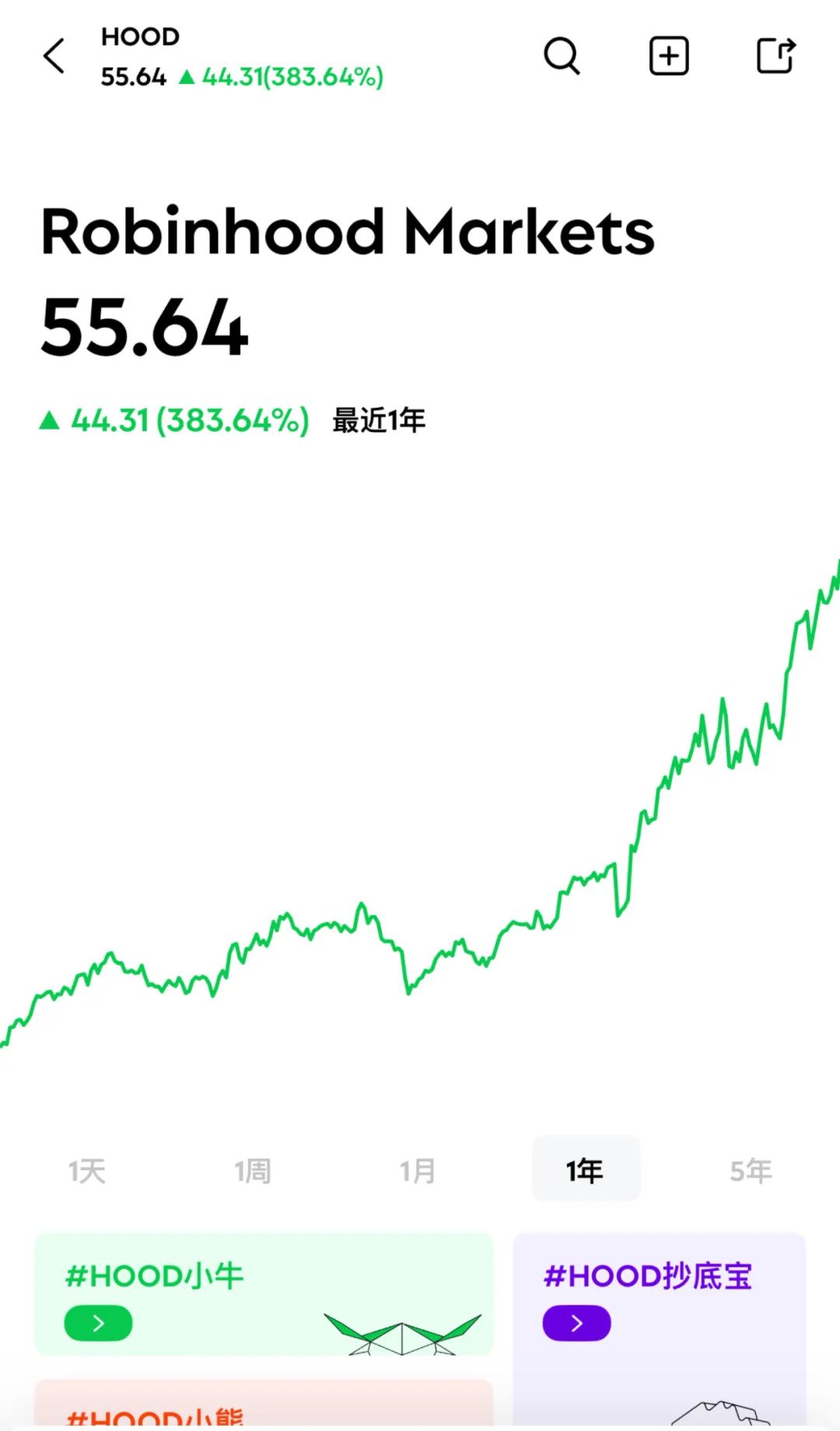

In this article, RockFlow’s research team dives into the core of Robinhood’s crypto business, exploring the reasons behind its 383% stock surge over the past year, and analyzing its current investment value and future bullish catalysts.

1. Three Waves of Growth Paved the Way for Crypto Success

Robinhood’s exceptional performance in crypto was no accident. Three revolutionary waves gradually built a robust user base and strong product innovation capabilities, laying a solid foundation for its later success in crypto.

Initially, Robinhood entered the market with a zero-commission model, breaking the traditional brokerage barrier of $8–$10 per trade. By eliminating minimum deposit requirements and supporting fractional shares, it successfully attracted a large number of young users and established initial trust. This laid the groundwork for expanding into innovative services like crypto.

During the second growth wave, Robinhood demonstrated outstanding product innovation. By incorporating gamification into the trading experience, creating a clean and intuitive interface, and offering attractive stock rewards, the platform achieved explosive growth. Trading volume reached nine times that of E-Trade, while options contracts traded were 88 times higher than Charles Schwab, proving its technological strength and operational excellence—capabilities later applied effectively to crypto trading products.

The third wave saw Robinhood play a central role in the meme stock and crypto boom. It became the primary battleground for stocks like GameStop and AMC, as well as cryptocurrencies like Dogecoin. In January 2021, it set a record by opening more new accounts than all other brokers combined. This period brought massive active users and, more importantly, cultivated user habits around investing in emerging asset classes.

These three revolutionary growth waves not only reshaped the brokerage industry but also transformed investment culture. Retail investors now account for 20% of total trading volume. Younger generations increasingly see investing as part of their lifestyle—a shift that created fertile ground for the adoption of innovative financial products like cryptocurrencies.

These accumulated strengths—massive user base, strong technical capabilities, mature operational experience, and profound cultural influence—collectively form the foundation of Robinhood’s success in crypto.

2. Soaring Crypto Revenue Fuels Robinhood Stock Surge

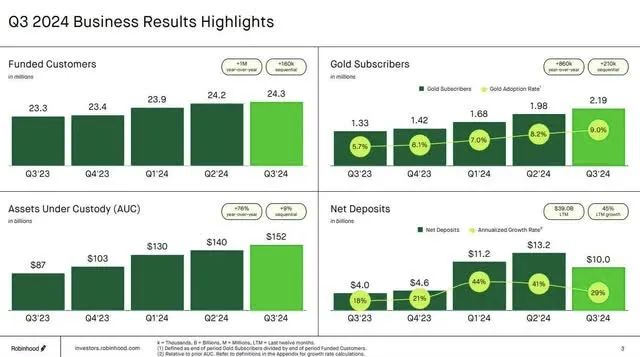

Since 2023, as the crypto market gradually recovered, Robinhood has benefited significantly. In recent quarterly reports, crypto revenue has steadily increased. The chart below shows Robinhood’s revenue over the past nine quarters, with particularly notable growth in options and crypto income:

For example, in its latest Q3 2024 earnings report, crypto revenue surged 165% year-on-year to $61 million, demonstrating remarkable momentum. This result not only validates Robinhood’s strategic foresight in crypto but also highlights its strong execution in business expansion.

Robinhood’s revenue comes primarily from three areas: transaction revenue, net interest income, and other income. Transaction revenue rose 72% year-on-year to $319 million, with crypto business growing 165% year-on-year—one of the standout segments. Alongside options trading revenue ($202 million), these two now form the dual engines driving company growth.

Despite rapid growth, Robinhood has maintained business stability. Net interest income grew 9% to $274 million, providing steady cash flow. Innovative services like Gold subscriptions drove other income up 42% to $44 million, with 2.2 million premium users reflecting strong platform loyalty.

Additionally, the platform achieved over $10 billion in net deposits for the third consecutive quarter, underscoring high user trust. This trust supports both traditional and innovative businesses like crypto.

Notably, while pursuing high growth, Robinhood maintains disciplined cost control, keeping full-year 2024 operating expense guidance between $1.85–1.95 billion. This balanced approach ensures sustainable development for innovative ventures like crypto.

This earnings report clearly shows Robinhood evolving from a traditional zero-commission trading platform into a comprehensive fintech player with crypto as a key growth driver. Its strong crypto performance not only boosts revenue but also signals vast potential in the new era of digital assets.

3. Why Robinhood Still Matters in 2025

Although Robinhood’s stock rose 383% over the past year, RockFlow’s research team remains optimistic about its 2025 outlook, largely due to its proactive positioning in crypto.

Robinhood’s core user base—Millennials and Gen Z—is precisely the most active demographic in crypto. As wealth transfers from older to younger generations, assets are likely to flow toward platforms better aligned with new investment preferences. As a bridge between traditional finance and crypto innovation, Robinhood stands to gain significantly from this shift.

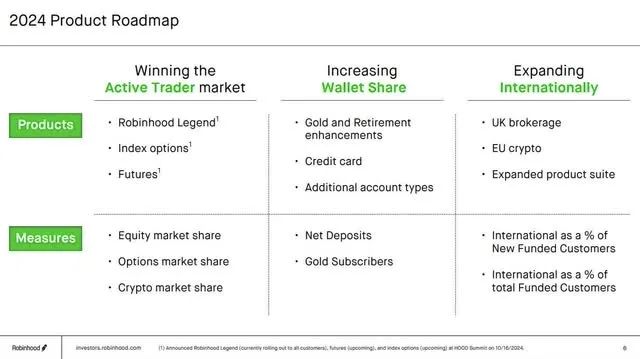

Moreover, Robinhood’s international strategy emphasizes crypto: EU Market – actively expanding crypto operations as a key pillar of globalization; UK Market – establishing presence in London’s financial district to lay the groundwork for future crypto service expansion.

Finally, Robinhood is enhancing its crypto competitiveness through multiple initiatives: developing futures trading infrastructure to support future crypto derivatives; expanding Gold membership benefits to include more crypto-related perks; and continuously improving trading interfaces and services to boost user engagement in crypto trading.

Overall, Robinhood’s crypto strategy reflects clear global vision and innovation focus. By integrating traditional finance with crypto services, it is building a more inclusive financial ecosystem. Its European expansion, especially in crypto, demonstrates long-term commitment to digital assets. As the global crypto market matures, Robinhood is well-positioned to play a larger role in this fast-evolving space.

On the policy front, Trump’s official inauguration and his impact on U.S. equities and the crypto sector could serve as a major catalyst for Robinhood’s stock.

It’s widely known that Trump’s administration traditionally favors reduced financial regulation, potentially lowering compliance costs and streamlining processes. Fintech firms like Robinhood, which rely on agile operations, may benefit from a more lenient regulatory environment. If crypto receives continued policy support—such as clearer regulations or relaxed restrictions—Robinhood’s crypto business could exceed expectations even further.

Secondly, although the new president has been in office for less than a month, market volatility has already risen sharply. Recent tariff policies—and their subsequent delays—have caused wild swings in U.S. stocks. Increased market volatility tends to boost retail trading activity, which could lead to higher trading volumes and commission income (especially in options) for Robinhood.

Conclusion

RockFlow’s research team believes Robinhood is showing impressive growth potential: its core user base (Millennials and Gen Z) are the most active crypto participants and will benefit from intergenerational wealth transfer; combined with improved trading infrastructure, innovative Gold membership offerings, and favorable regulatory trends under Trump’s new administration, these factors will collectively strengthen Robinhood’s position in the global crypto market.

While short-term regulatory pressures and market volatility may pose challenges, in the long run, Robinhood is poised to become a vital bridge between traditional finance and the future of crypto—an investment opportunity worthy of sustained attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News