Time Magazine: Has Trump's cryptocurrency opened a "Pandora's box"?

TechFlow Selected TechFlow Selected

Time Magazine: Has Trump's cryptocurrency opened a "Pandora's box"?

Some people see these coins as symbolizing Trump's commitment to cryptocurrency, but many in the crypto community have expressed反感 toward them.

Source: TIME

Translation and compilation: Bitpush News

When Donald Trump won the presidential election in November, many cryptocurrency enthusiasts celebrated, as he had promised to prioritize deregulation and legitimize crypto businesses.

Just days before his inauguration, heavyweights from the industry gathered in Washington for a "crypto ball," celebrating their new status as members of the capital's elite circles.

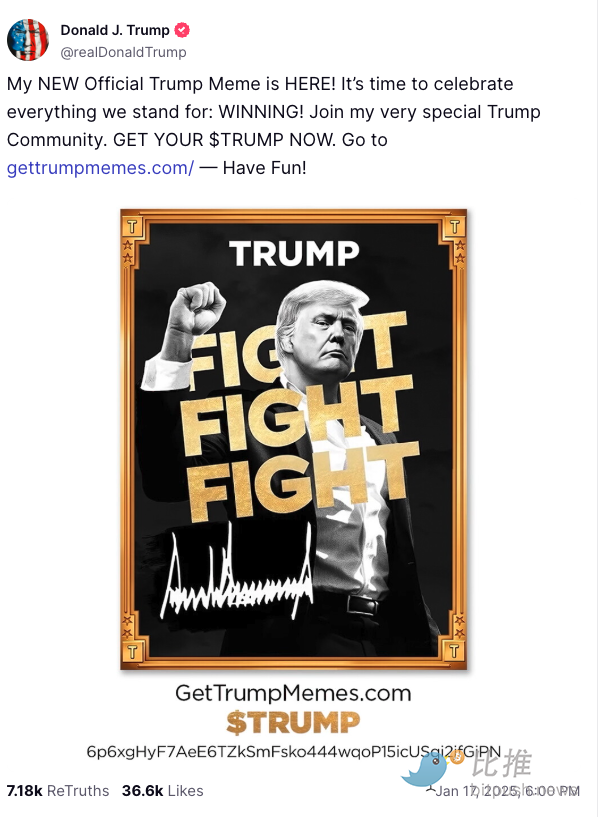

Yet during the event, one move by Trump shocked nearly everyone: he announced a new token called TRUMP. This "meme coin" is widely considered to have no intrinsic value, with its price entirely dependent on market supply and demand.

Trump supporters and some opportunistic day traders generated billions of dollars in trading volume, driven by loyalty, hype, and the chance for quick profits. All this activity gave the coin’s creators—affiliates of the Trump Organization—paper gains worth billions. The day after the launch, Melania Trump announced her own meme coin, which also experienced wild price swings. By Wednesday, TRUMP had become the 25th largest cryptocurrency by market cap, according to CoinMarketCap, priced around $43, well off its previous high of $75.

Trump’s meme coins have brought massive attention to the crypto space and attracted many newcomers.

To some, these tokens symbolize Trump’s commitment to crypto and his willingness to advance the industry. But many insiders are disgusted, viewing them as nothing more than cash grabs—an avenue for Trump to directly profit from his supporters. The Trump team controls at least 80% of the coin’s supply, giving them enormous influence over its price. Although they’re currently barred from selling their holdings, once sales begin, it could trigger a market crash, causing devastating losses for ordinary users.

Industry insiders worry these coins may further erode public trust in an already fraud-ridden sector.

"The crypto industry empowered someone whose first act was to highlight and exploit its get-rich-quick opportunities," said Angela Walch, a cryptocurrency researcher and writer. "It’s just embarrassing."

Trump downplayed his role in launching the coin, saying at a January 21 press conference: "I know almost nothing about the coin other than I launched it." The Trump Organization did not immediately respond to requests for comment. A White House spokesperson also declined to comment.

Still, elected officials and legal experts have raised ethical and geopolitical concerns. They argue these tokens could serve as tools for bribery and conflicts of interest. "These tokens provide Trump a channel to gain economic benefits from foreign adversaries and may lead him to place personal interests above the collective good of the American people," said Puja Ohlhaver, a lawyer at Harvard University's Democratic Innovation Lab.

What Are Meme Coins?

Both TRUMP and MELANIA fall under the category of meme coins. These cryptocurrencies are essentially created out of thin air by entrepreneurs writing blockchain code. Their value depends entirely on belief and willingness to buy. To generate excitement, teams often use popular internet memes on social media for marketing. The logic is simple: if memes can drive culture, creativity, and even ideology, why can’t they also hold financial value?

Dogecoin and Shiba Inu are classic examples—especially Dogecoin, whose price has surged multiple times due to tweets by Elon Musk. However, meme coins lack intrinsic value, making them highly volatile and speculative. For some, that’s precisely the appeal: investors who buy at the right time could earn huge returns. Conversely, buying at a peak could result in total loss. Moreover, meme coins have been used in scams where investors lost significant amounts.

Trump and Meme Culture

Trump supporters frequently use memes as a marketing tool. During his presidential campaign, a content creation team flooded social media with pro-Trump meme content. Last summer, unofficial Trump-themed meme coins like Pepe (TRUMP) and Maga People Token (PEOPLE) saw price fluctuations, with some investors treating them as proxies for Trump’s chances of winning.

Trump has also previously profited from cryptocurrency. He began selling NFT trading cards in 2022, earning millions according to financial disclosures. In September 2023, he launched World Liberty Financial, a yet-to-launch crypto platform. By 2025, meme coins may have become the fastest way for aspiring crypto entrepreneurs to make money.

The TRUMP Trading Frenzy

On January 18, two days before the inauguration, Trump launched his token through CIC Digital LLC, an affiliate of the Trump Organization. The move caught the entire industry off guard. It happened during the "crypto ball," attended by guests including Snoop Dogg and House Speaker Mike Johnson. Crypto entrepreneur Nick O’Neill posted a video from the event stating that almost no one there knew about the token.

The next day, markets went into a frenzy, triggering a chain reaction. Solana, the blockchain supporting the token, and Coinbase, the crypto exchange, both suffered hours-long transaction delays. Coinbase CEO Brian Armstrong wrote on X: "We didn’t anticipate this level of trading surge."

Within just one day, the team controlling the token—led by CIC Digital—saw their holdings reach a paper valuation of about $51 billion. But this figure is illusory; attempting to convert those tokens into dollars would cause prices to plummet instantly. Later that same day, Melania Trump launched her own meme coin, MELANIA, effectively cutting TRUMP’s market cap by billions as traders appeared to sell TRUMP to buy the new coin. Within an hour of MELANIA going live, TRUMP dropped from over $70 to around $45. A fake coin unrelated to Trump’s son, BARRON, briefly reached a $460 million market cap before crashing 95%.

A Crisis of Conscience for the Industry

Some of Trump’s crypto backers accuse him of predatory behavior. Cryptocurrency advocates decentralization, yet the president’s team controls at least 80% of the TRUMP supply. Blockchain analytics firm Bubblemaps found that 89% of MELANIA tokens were concentrated in a single wallet. Coinbase executive Conor Gregor wrote Saturday that the Trump team earned $58 million in transaction fees alone.

"Trump’s credibility is completely ruined," wrote investment manager Michael A. Gayed. Anthony Scaramucci, Trump’s former White House communications director and a crypto advocate, said: "No one thinks this kind of conduct benefits society."

Angela Walch summed it up: "The entire industry is now undergoing deep reflection. We gained power—but does this align with our original goals?"

Concerns About Ethics and National Security

Critics outside the crypto world have raised ethical concerns. Trump is now directly involved in an industry he is supposed to regulate. (The controlling company, affiliated with Trump’s business, claims the Trump token is “not an investment or security, but a form of ‘support expression.’”) Critics argue that the president’s windfall from crypto reduces his incentive to crack down on the industry, as doing so might devalue his holdings by billions. Ro Khanna, a California Democratic congressman and one of Congress’s leading crypto supporters, wrote on X: "The law must prohibit elected officials from holding meme coins."

Some fear these tokens pose national security threats, as they allow foreign agents to purchase large quantities as leverage over Trump’s policy decisions. Such actors could buy tokens to curry favor—or threaten to dump them, potentially crashing the price. Ohlhaver from Allen Lab noted they could also use encryption to hide their identities from everyone except Trump himself.

The Founding Fathers sought to prevent such conflicts of interest through the Constitution’s Emoluments Clause, which prohibits presidents from profiting personally from their office. (At the time, gift-giving was a common form of corruption among European rulers and diplomats.) Some argue that because Trump issued the tokens before taking office, he acted as a private citizen. Crypto journalist Zack Guzmán wrote on X: "Issuing these tokens before Trump officially became president makes it less complicated for them. Otherwise, it would be much easier to claim Trump profited from the presidency and violated the Emoluments Clause."

But Ohlhaver believes significant conflicts remain as long as Trump retains any stake in the tokens. "He still owns them, and if foreign adversaries heavily promote them, the price will rise," she said.

Ohlhaver added that Trump’s meme coins fundamentally threaten public understanding of money. "With the rise of social media and global networks, it’s now easy to leverage your status and influence to create and legitimize a new form of currency," she said. "What matters for us is preserving our national public goods, ensuring they serve our collective interests—not the narrow interests of an elite class that stands to gain enormously at everyone else’s expense."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News