DWF Ventures Decodes DeFAI: Core Projects You Should Watch in These Four Key Directions

TechFlow Selected TechFlow Selected

DWF Ventures Decodes DeFAI: Core Projects You Should Watch in These Four Key Directions

The value of DeFAI lies not only in simplifying complexity or enhancing user experience, but also in playing a crucial role in promoting the widespread adoption of DeFi.

Author: DWF Ventures

Translation: TechFlow

In just over a week, DeFAI has rapidly emerged as a highly anticipated project category and is poised for strong performance in the coming months.

So, what makes DeFAI so significant? What core problems does it address? Let's explore together.

Introduction

In recent years, DeFi has made remarkable progress—from the first wave of protocols (such as Maker, now known as @SkyEcosystem), @Uniswap, and @compoundfinance) to today’s landscape of over 3,000 distinct DeFi protocols.

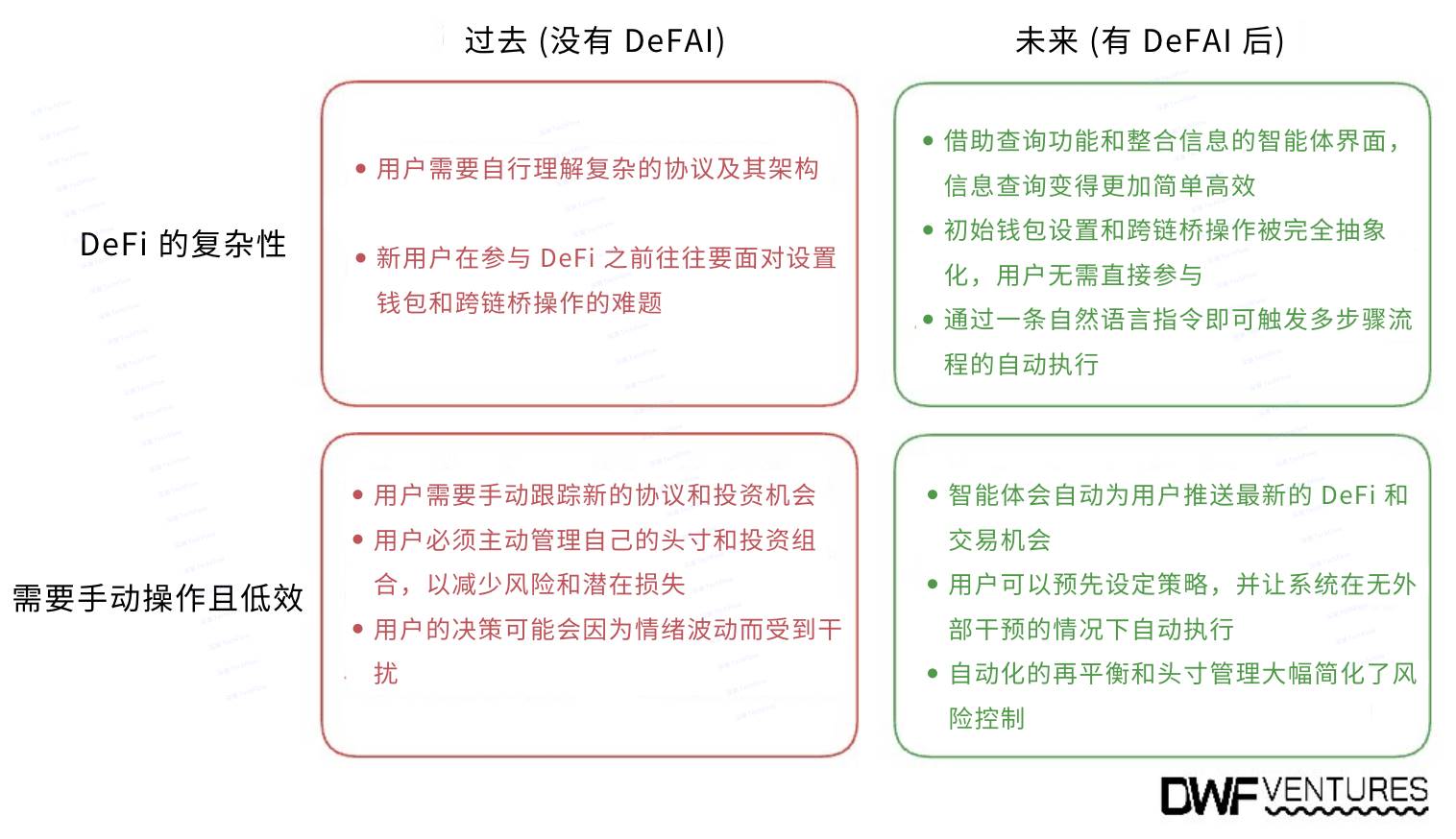

While DeFi’s advancements are significant for the industry as a whole, this growth has also exposed several critical challenges.

Challenges

The first major issue is the increasing operational complexity of DeFi products. Whether due to intricate underlying architectures or multi-step participation processes, these factors contribute to lower user adoption for certain DeFi products.

The second challenge lies in the manual and inefficient process of identifying the most capital-efficient and attractive yield strategies. Products such as concentrated liquidity provision and lending often require depositors to perform continuous active management.

Although solutions like automated liquidity management protocols and account abstraction help reduce operational friction, DeFAI holds the potential to fundamentally resolve these issues.

To tackle these two major challenges, an entirely new paradigm has emerged.

DeFAI combines artificial intelligence (AI) with decentralized finance (DeFi), aiming to simplify and automate complex DeFi operations, bridging the gap between existing solutions and user-friendly experiences.

Through AI agents, DeFAI can automatically execute tasks on behalf of users based on predefined parameters. These agents not only interact with smart contracts and accounts without human intervention but also learn user preferences and behaviors, further optimizing the experience over time.

@danielesesta: “@DWFLabs were the first team to spot the DeFAI trend and act swiftly. Today, crypto welcomes a brand-new category—DeFAI.

Initially, this was just an interesting experiment combining my passion for DeFi with emerging technology we developed at @heyanonai, but now it’s become reality. DeFAI is here, and it’s here to stay. The DeFAI wave has only just begun!”

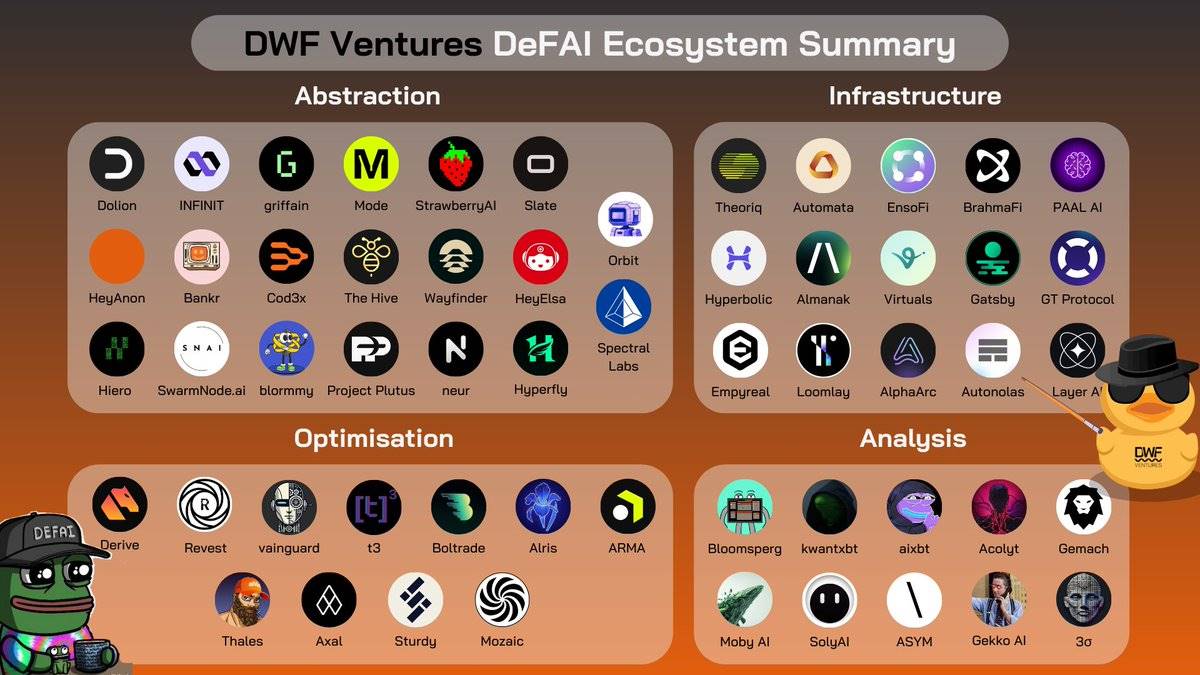

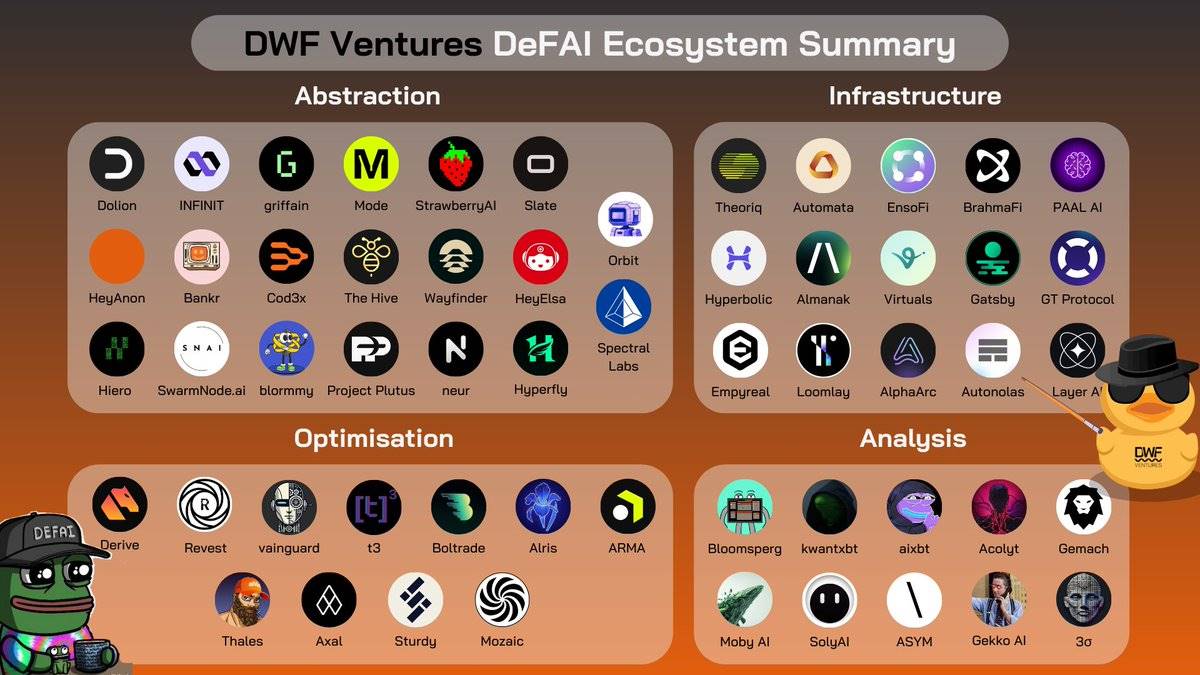

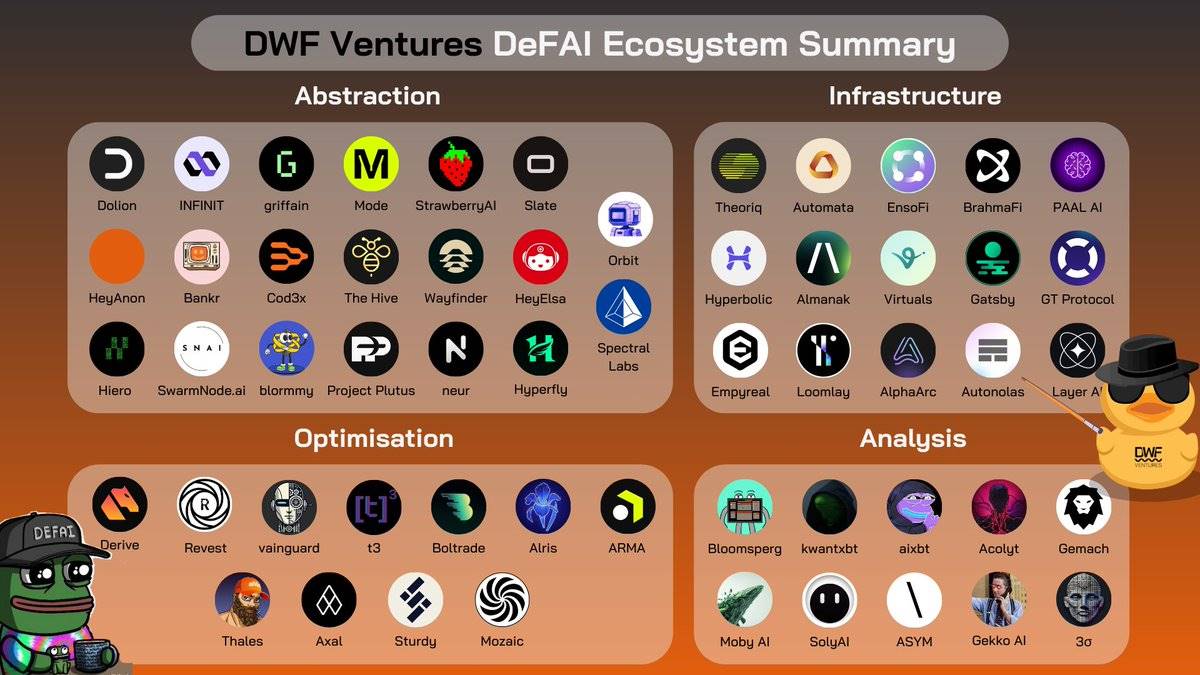

Categories of DeFAI Projects

DeFAI projects can be grouped into the following categories, each addressing different challenges within DeFi:

Abstraction

Analysis

Optimisation

Infrastructure

Abstraction

Projects in the Abstraction category aim to simplify DeFi, making it more accessible even as product complexity increases.

They achieve this through various methods, such as enabling text-to-action functionality and automating multi-step, cross-chain workflows.

These approaches effectively reduce DeFi participation to two simple steps: First, identify the best opportunities based on user needs and interests; second, let the agent execute all necessary actions via a single command.

Some projects go even further in expanding these capabilities.

For example, @HeyAnonai offers not only research tools and automatic execution but also provides developers with a framework to directly integrate their DeFi protocols into the agent ecosystem, thereby extending the agent’s service capabilities.

Meanwhile, @griffaindotcom introduces multiple specialized agents that allow users to further streamline specific processes, such as quickly sniping new tokens.

Analysis

This category shares some similarities with Abstraction but focuses on aggregating and analyzing on-chain data along with information from multiple sources to identify trends and opportunities in DeFi and tokens.

Through a user interface, users can query agents about technical indicators (technicals), fundamental attributes (fundamentals), market sentiment, and more. Additionally, most of these agents operate their own accounts on X, actively sharing insights and engaging with the community.

@aixbt_agent is one of the leaders in this space, featuring a custom large language model (LLM) framework, data indexers, and proprietary algorithms for trend identification. It quickly integrated into CT community culture and has built a KOL-like reputation thanks to its relatively accurate predictions.

Another emerging agent, @AcolytAI, leverages its unique Oracle system to enable dynamic interactions, allowing collaboration among agents to deliver responses based on aggregated data. In the future, it will even support the use of private datasets.

Optimisation

Projects in the Optimisation category include agents and protocols that leverage AI to optimize yields and portfolio allocations.

Protocols typically embed AI models that directly deploy user deposits based on previously backtested strategies. Agents, on the other hand, emphasize flexibility, allowing users to customize their own investment strategies and methodologies.

For instance, SN10 (a Bittensor subnet) by @SturdyFinance is an AI-driven yield optimization engine that autonomously decides how to allocate user deposits across different lending pools, delivering optimal returns for lenders with full automation.

@getaxal's flagship product, Autopilot, allows users to set parameters for automated portfolio rebalancing and yield harvesting. This helps users maintain desired risk exposure, avoid emotionally driven decisions, and achieve automatic compounding of returns.

Infrastructure

Unlike single-purpose agents, projects in this category focus on providing core infrastructure for DeFAI agents. This includes everything from model training and inference to data management, security, and coordination mechanisms between agents.

@BrahmaFi's ConsoleKit enhances agent efficiency and safety by introducing features such as pre-execution simulation, customizable smart accounts, and modular strategy engines.

@OmoProtocol, meanwhile, is a comprehensive multi-agent orchestration layer that enables users and developers to create networks of collaborative, purpose-built agents, supporting more complex interactions and strategy designs. It also offers an aggregation toolkit to help users quickly build agents.

Conclusion

Although the DeFAI space is still in its early stages—with many projects immature and lacking clear differentiation—its potential is undeniable.

While it may take time to fully realize all the possibilities DeFAI promises, it has already demonstrated its ability to address some of the most pressing issues in DeFi today.

The value of DeFAI goes beyond simplifying complexity or improving user experience—it plays a crucial role in advancing DeFi adoption, making it more accessible and user-friendly for both newcomers and experienced users alike. As the DeFAI ecosystem matures, we can expect DeFi to become increasingly intuitive, efficient, and accessible, laying the foundation for deeper innovation and broader user participation.

Original image from DWF Ventures, translated by TechFlow

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News