Decoding the Bitcoin Lending Business: A New Paradigm for Trillion-Dollar Liquidity

TechFlow Selected TechFlow Selected

Decoding the Bitcoin Lending Business: A New Paradigm for Trillion-Dollar Liquidity

The trillion-dollar scale of dormant Bitcoin needs an answer to "become more liquid from idle assets."

Author: JiaYi

I've mentioned many times before that Bitcoin, with a market cap in the trillions of dollars, is actually the largest and highest-quality "funding pool" within the crypto ecosystem.

Last month, Avalon Labs—the largest on-chain lending protocol in the Bitcoin ecosystem—just completed a $10 million Series A funding round led by Framework Ventures. My venture capital firm, GeekCartel, also participated, hoping to work alongside Avalon and more innovative projects in the Bitcoin ecosystem to transform BTC from a digital store of value into a more active financial instrument.

In fact, for the Bitcoin ecosystem, starting with Babylon and Solv, BTC as a liquid and niche asset is visibly expanding into increasingly diverse on-chain structured yield scenarios, gradually giving rise to uniquely characterized yet self-contained BTCFi ecosystems.

From a sustainable perspective, unlocking dormant BTC and building an efficient, secure liquidity network could fully open up the global imagination of BTC—a trillion-dollar asset—as a DeFi niche asset.

Industry Practices Unlocking Bitcoin Liquidity

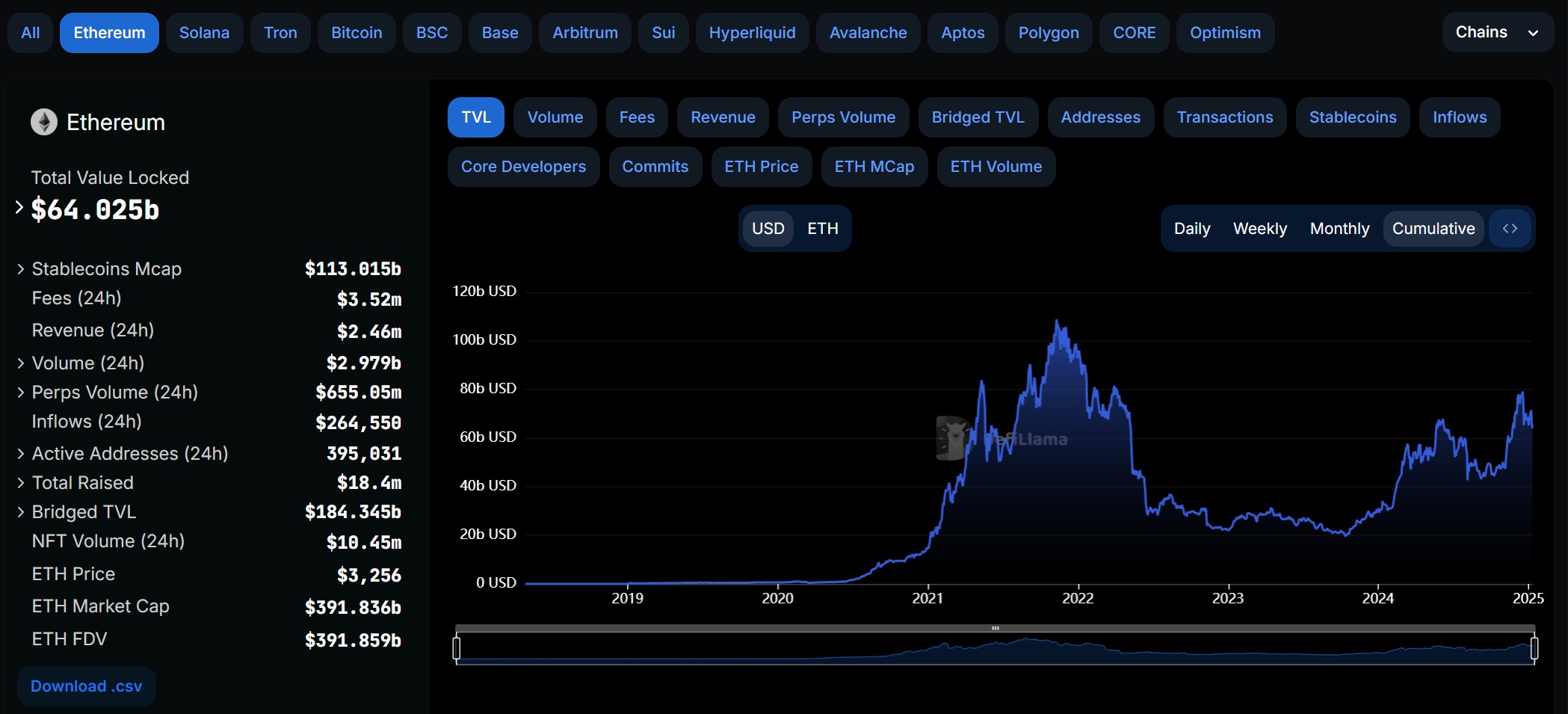

According to DeFiLlama data, as of January 9, 2025, Ethereum’s total value locked (TVL) exceeded $64 billion, nearly tripling from $23 billion in January 2023. Meanwhile, despite Bitcoin’s market cap and price growth significantly outperforming ETH since the rise of the Ordinal movement, the expansion speed of its on-chain ecosystem has consistently lagged behind Ethereum’s.

Keep in mind, even releasing just 10% of BTC's liquidity would create an $180 billion market; if it reached a similar TVL ratio to ETH (TVL / market cap, currently around 16%), it would unleash approximately $300 billion in liquidity.

This alone could drive explosive growth in the BTCFi ecosystem, potentially surpassing the broader EVM networks and becoming the largest super on-chain financial ecosystem.

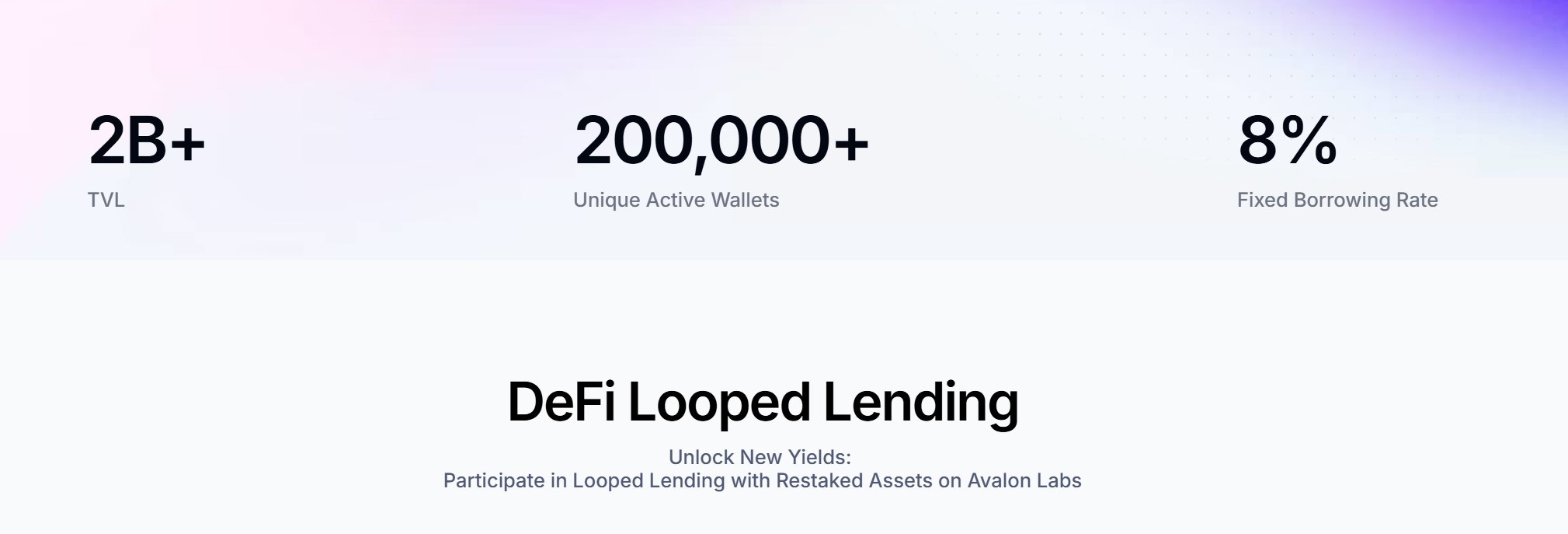

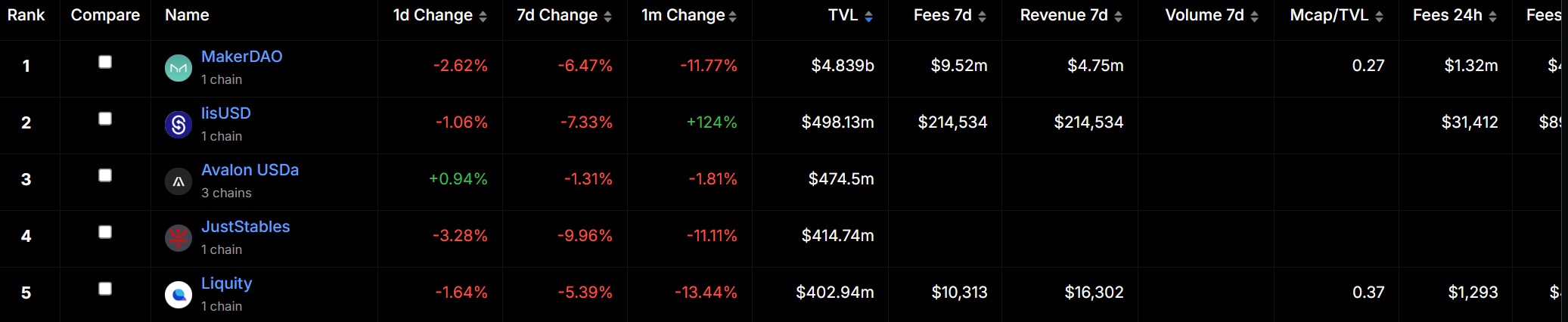

From this perspective, platforms like Avalon—which enable anyone to benefit from BTC lending—have immense potential. Avalon has already become the largest lending protocol in the entire BTC ecosystem, second only to DAI and lisUSD.

It also set the record for the fastest-growing DeFi lending protocol in terms of TVL in DeFi history. Official data shows Avalon Labs’ TVL has surpassed $2 billion, and its Bitcoin-backed stablecoin USDa reached over $500 million in locked value just one week after launch.

For current BTC holders, making full use of their idle BTC assets is clearly a pressing need. At the same time, they don’t want to expose their BTC to significant principal risk, and ideally, they’d prefer to convert static holdings into flexible, liquid assets.

Hence, on-chain Bitcoin lending protocols are poised to enter a golden opportunity window—this is precisely where Avalon comes in. The platform offers a fixed borrowing rate of 8%, with professional institutions securely custodizing the collateralized Bitcoin, while the borrowed stablecoins are supplied without limit, giving BTC holders greater liquidity to participate in other ecosystem projects.

This model has already been validated by the market. Notably, unlike other TVL-focused projects, Avalon places emphasis on enabling healthy participation from retail users across the ecosystem—not just whales. Anyone can join and safely leverage their positions to maximize returns.

What Is the Value of a Bitcoin-Backed Stablecoin?

From a stablecoin perspective, decentralized on-chain stablecoins are still dominated by collateralized debt position (CDP) models—MakerDAO’s DAI being the largest, followed by liUSD, USDJ, and others.

At its core, a CDP doesn’t look like a traditional loan: a borrower creates a CDP, and the protocol’s oracle prices it at a 1:1 USD value. The CDP can then be sold on public markets, allowing the borrower to “borrow” another asset, while the lender receives the CDP.

In essence, this extends stablecoin usage through lending scenarios—creating an additional liquidity pool for otherwise dormant assets. Taking Avalon as an example, its ecosystem currently consists of four core business segments: USDa, a yield-generating stablecoin backed by Bitcoin; a lending protocol built on USDa; a hybrid lending platform bridging DeFi and CeFi; and a decentralized lending protocol supporting BTC staking.

This explains why stablecoin and lending protocols naturally converge—take Aave and MakerDAO, for instance, which have moved toward each other: one launched its native stablecoin GHO, while the other accelerates its expansion into lending use cases.

On this shared foundation, Avalon’s liquidity market enables the creation of the USDa stablecoin market through strategic liquidity design, while offering users fixed-yield products.

In short, Avalon truly allows everyone to benefit from BTC lending, transforming Bitcoin from idle holdings into a more liquid asset. This not only solves the long-standing stablecoin gap in the Bitcoin ecosystem but also leverages LayerZero technology to achieve cross-chain compatibility. Users can seamlessly operate USDa across multiple DeFi ecosystems without relying on third-party bridges—effectively extending Bitcoin’s liquidity to other chains.

Recall that most BTC remains idle. Due to its strong security margin compared to other alt-assets, many OGs and Maxis have neither incentive nor willingness to risk bridging their BTC to ecosystems like Ethereum—leading to the majority of BTC lying dormant and BTCFi’s scale stagnating for years.

Here, USDa plays a crucial role. On one hand, it fills a missing piece of DeFi infrastructure—the lending protocol—within the Bitcoin ecosystem. On the other, Avalon’s USDa leverages its CeDeFi lending platform advantage, allowing users to obtain USDT from CeFi liquidity providers via USDa, resolving pegging issues.

It provides the Bitcoin network with an efficient framework to utilize assets and activate dormant BTC, enabling more BTC holders to safely participate in on-chain liquidity activities and confidently deposit large amounts of idle BTC into DeFi liquidity pools for trading or yield generation.

Conclusion

It’s foreseeable that as Bitcoin assets gradually awaken from dormancy, BTCFi could emerge as a new DeFi asset class worth hundreds of billions—or even trillions—of dollars, becoming a key driver in building a thriving on-chain ecosystem.

As an investor in Avalon, witnessing it become the undisputed leader in BTCFi lending within just a few months has strengthened my conviction that both Avalon and BTCFi have a bright future ahead—building diverse financial products and DeFi scenarios around BTC, and redefining Bitcoin’s role across the entire DeFi landscape.

Whether Bitcoin’s deep integration into DeFi will reach a pivotal turning point remains to be seen—but certainly worth watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News