2024 Crypto Investment Landscape Shift: Primary and Secondary Markets Decouple, VC-Backed Projects Lose Dominance

TechFlow Selected TechFlow Selected

2024 Crypto Investment Landscape Shift: Primary and Secondary Markets Decouple, VC-Backed Projects Lose Dominance

The AI sector shows strong momentum, with a sharp increase in funding deals in Q4 2024.

Author: Fu Ruheshi, Odaily Planet Daily

In 2024, the热度 of fundraising in the crypto sector decoupled from overall market performance, with VC coins no longer driving market trends.

On a macro level, the cryptocurrency market witnessed numerous historic moments in 2024: the launch of spot Bitcoin ETFs, the approval of spot Ethereum ETFs, clearer regulatory policies across countries, the Federal Reserve's announcement of rate cuts, and Donald Trump’s anticipated return to the White House—all contributing positively to market sentiment. As a result, Bitcoin successfully broke through the critical $100,000 threshold.

From within the crypto ecosystem, Memes became central to market attention, with different types of Meme coins acting as catalysts for price surges across various periods. In contrast, VC-backed projects underperformed, as linear token release schedules turned into a chronic "poison" undermining their long-term viability.

Under these combined influences, while the number of first-stage financings increased significantly in 2024, total funding amounts remained cautious.

Reviewing 2024's primary market investment activities, Odaily Planet Daily observed:

-

There were 1,295 funding rounds in the primary market in 2024, with disclosed total funding amounting to $9.346 billion;

-

The AI sector emerged strongly, with a sharp increase in funding events in Q4 2024;

-

The largest single round went to Praxis, raising $525 million.

Note: Based on business type, target users, and business models, Odaily Planet Daily categorized all disclosed funding projects in Q1 (with actual closing times typically earlier than public announcements) into five major sectors: Infrastructure, Applications, Technology Service Providers, Financial Service Providers, and Other Service Providers. Each sector includes subcategories such as GameFi, DeFi, NFTs, Payments, Wallets, DAOs, Layer 1, Cross-chain, and others.

2024 Belonged to BTC and Meme Coins

A comprehensive review of primary market fundraising over the past three years reveals a key conclusion: in 2024, primary market investment activity gradually decoupled from broader crypto market trends. Market momentum was primarily driven by Bitcoin and Meme coins, while traditional VC-backed projects underperformed and failed to serve as core market drivers.

Data analysis shows that 2022, the peak of the previous crypto cycle, saw highly active primary market fundraising, with both volume and value closely tracking overall market movements. In Q1 2022 alone, there were 562 funding rounds totaling $12.677 billion. However, as the market entered a downturn, fundraising quickly contracted, dropping to just 330 deals worth $3.375 billion by Q4.

2023 continued the bear market trend, with both primary market activity and the broader market remaining sluggish. Funding volume and value declined throughout the year, reaching a three-year low of 232 deals and $1.725 billion in Q3. During this period, the primary market was clearly influenced by overall market conditions, with suppressed investor sentiment and capital activity.

2024 marked a turning point for primary market investment. Data shows a significant rebound in deal count—for example, Q1 saw 411 deals, an increase of nearly 69% compared to Q4 2023. Yet, in contrast to the rising number of deals, funding amounts remained conservative, with quarterly totals hovering between $1.8 billion and $2.8 billion. This indicates that while capital activity has recovered somewhat, investors are exercising greater caution—further evidence of the decoupling between the primary market and broader market trends.

In terms of market focus, 2024’s crypto market dynamics were dominated by Bitcoin and Meme coins, a stark contrast to the previous cycle. Previously, VC-backed projects were often at the center of market hype, but in 2024 they largely underperformed and struggled to exert meaningful influence. This shift has diminished the primary market’s role as a leading indicator for broader market performance.

The primary market in 2024 demonstrated a trend toward rationality and independence. After the frenzy of 2022 and the freeze of 2023, investors have clearly become more cautious, placing greater emphasis on a project’s fundamentals and long-term value rather than blindly chasing trends. This evolution may signal that the primary market is gradually脱离 traditional crypto cycles and entering a new phase of development.

The rise in deal count alongside conservative funding sizes reflects VCs’ preference for diversified investments and more restrained capital allocation. This mindset suggests that renewed market interest hasn’t led to a flood of capital, but instead prompts investors to focus on truly promising ventures. In other words, the primary market is no longer merely a follower of market cycles—it is beginning to shape the future landscape.

In 2024, There Were 1,295 Primary Market Funding Rounds, With Disclosed Total Amounting to $9.346 Billion

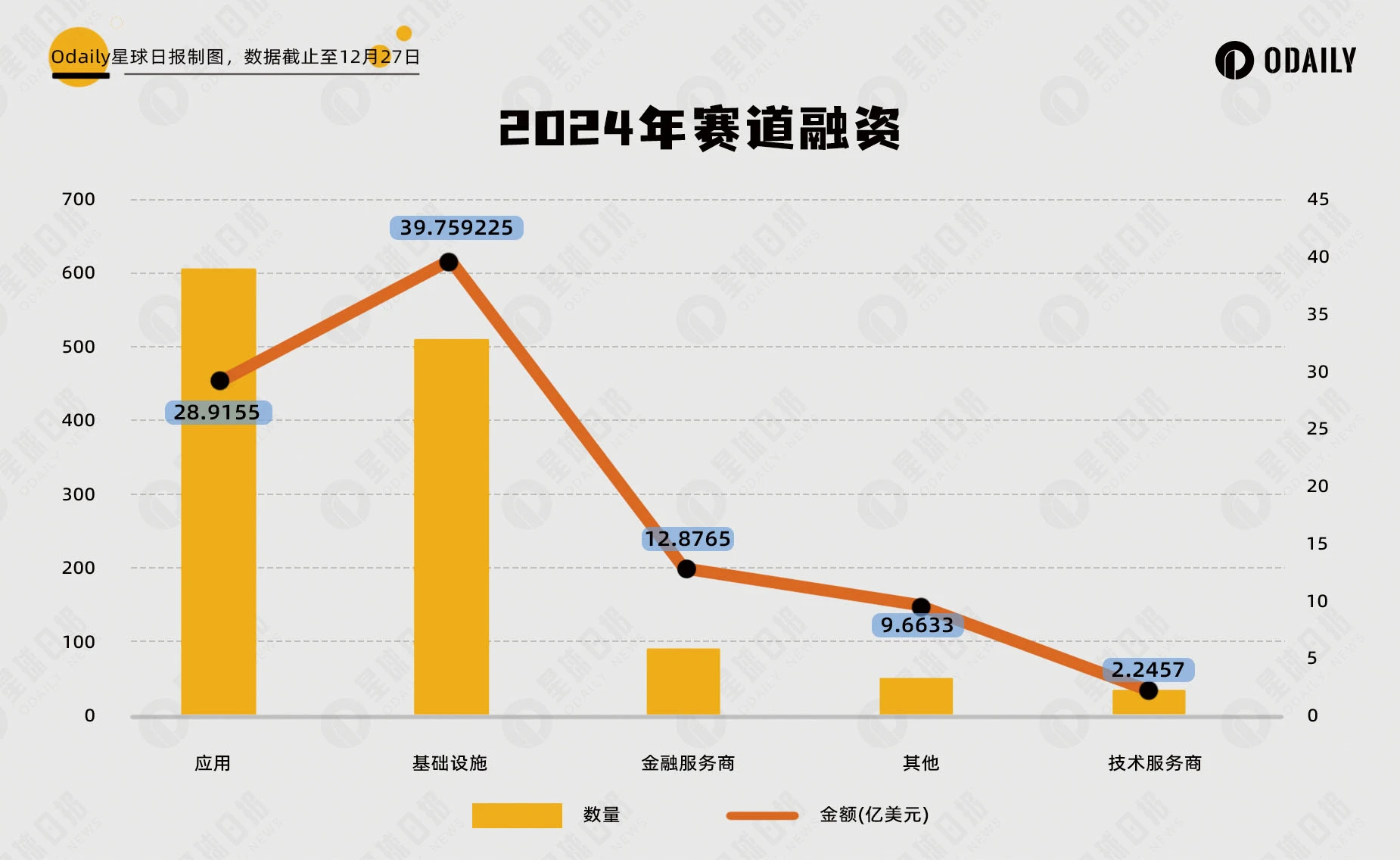

According to incomplete statistics from Odaily Planet Daily, the global crypto market saw 1,295投融资 events in 2024 (excluding fund raises and mergers & acquisitions), with a disclosed total of $9.346 billion. These funds were distributed across five sectors: Infrastructure, Technology Service Providers, Financial Service Providers, Applications, and Other Service Providers. The Applications sector received the highest number of investments, totaling 606 deals, while the Infrastructure sector attracted the most capital—$3.976 billion—leading in both volume and value.

As shown in the chart above, the Applications sector—being closest to end-users—has consistently been a focal point for primary market investors. In 2024, it achieved dual growth in both deal count and funding amount, increasing by approximately 20% year-on-year.

The Infrastructure sector also performed exceptionally well in 2024, with both deal volume and funding amount rising over 50% compared to 2023. This surge stems not only from ongoing demand for technological upgrades in foundational layers but also from the emergence of new fields like AI (Artificial Intelligence) and DePIN (Decentralized Physical Infrastructure Networks), which have opened fresh opportunities for infrastructure development.

Overall, 2024’s global crypto investment landscape showed clear characteristics: the dominance of Applications and Infrastructure in both deal count and funding value highlights strong market demand for improved user experience and underlying technical innovation. Meanwhile, Technology Service Providers, Financial Service Providers, and Other Service Providers continue evolving steadily, with the Financial Services sector particularly poised for breakthroughs in 2025 as traditional finance increasingly enters the space.

The AI Sector Emerged Strongly, With a Surge in Funding Events in Q4 2024

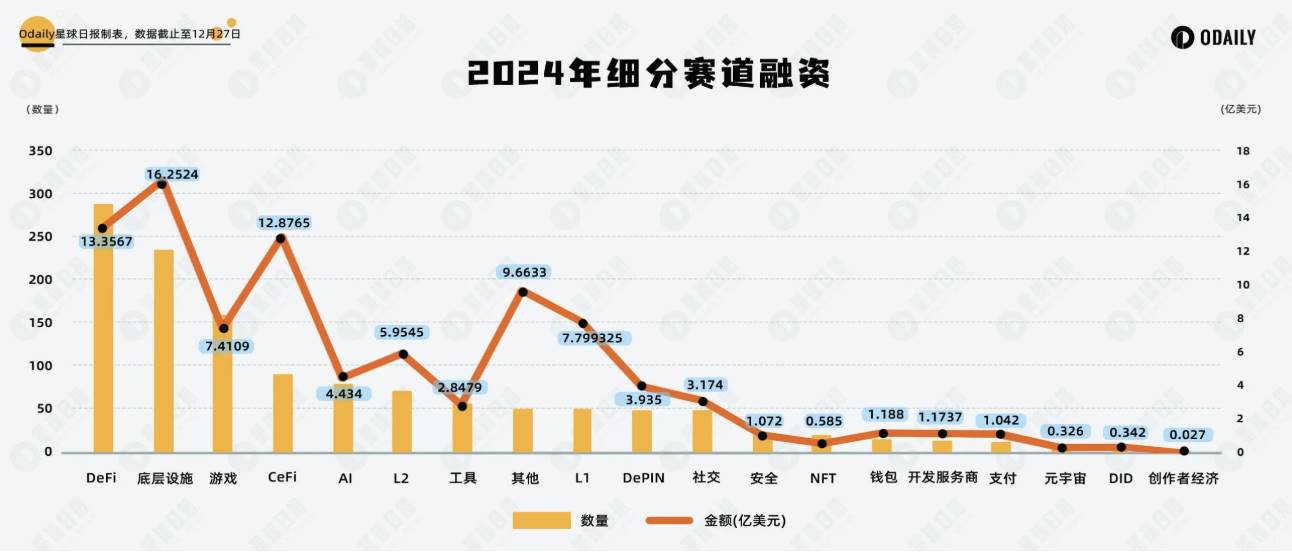

According to incomplete data from Odaily Planet Daily, the most concentrated funding activity in 2024 occurred in DeFi, underlying infrastructure, and gaming. Specifically, DeFi recorded 289 deals, infrastructure 236, and GameFi 160.

Analyzing sub-sector distributions:

Throughout 2024, DeFi and infrastructure maintained steady growth, topping both deal volume and funding amount. This reflects sustained strong demand for decentralized finance and foundational technologies—whether it's innovation in new DeFi protocols or continuous improvements in multi-chain interoperability and blockchain security—which remain key areas of investor interest.

In contrast, the gaming sector performed strongly in the first three quarters, consistently ranking among the top three in funding volume, but experienced a notable decline in Q4, with only 29 projects announcing funding. This trend indicates a temporary cooling of GameFi enthusiasm, as the market adopts a more cautious stance toward its short-term profitability and user growth prospects.

Meanwhile, the AI sector rapidly gained momentum, becoming one of 2024’s standout narratives. Initially developing alongside other domains like DeFi and infrastructure—and thus not separately classified—AI began to stand out starting in Q3. By Q4, both funding volume and amount had doubled. Investor interest in AI + blockchain use cases surged, further fueled by the rising popularity of AI Agents.

The Largest Single Investment Was Praxis’s $525 Million

Looking at the Top 10 funded projects of 2024, despite market volatility, investor confidence in infrastructure-focused projects remains robust. Nearly all top-funded projects center on foundational technology and innovation, reflecting strong institutional expectations for the sector’s future.

Layer 1 blockchains continue to attract large-scale investments. Besides established chains like Avalanche securing a $250 million private placement, emerging projects such as Monad, Berachain, and Babylon also demonstrated strong growth potential. Through technological innovation and ecosystem expansion, they captured investor attention.

Praxis topped the list with a massive $525 million raise. However, the project’s specific direction remains relatively opaque, partly because it operates via a DAO governance model where membership requires application, limiting public disclosure.

Notably, Paradigm’s dominance in the rankings is evident. As a top-tier venture capital firm, Paradigm led investments in three of the top ten projects—Monad, Farcaster, and Babylon.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News