Reviewing the 2024 Memecoin Super Cycle

TechFlow Selected TechFlow Selected

Reviewing the 2024 Memecoin Super Cycle

Memecoins have shown unusually strong activity in this cycle, becoming a barometer for on-chain liquidity, a harbinger of new narratives, and a thermometer for market sentiment.

Author: shaofaye123

Memecoins have been an inescapable theme in 2024. Classic memecoins such as Dogecoin and Shiba Inu achieved average gains exceeding fivefold, while emerging ones like MooDeng and PNUT delivered returns as high as hundreds of times their initial value. Token oversupply and highly liquid, overvalued VC coins have turned this bull market into one where participants no longer pass the hot potato among themselves. As a result, memecoins have demonstrated exceptional activity during this cycle, serving as indicators of on-chain liquidity, early signals for new narratives, and thermometers measuring market sentiment.

This year witnessed memecoins evolve from frenzied speculation toward mainstream cultural penetration and consensus-building. A great wealth transfer has thus occurred. Throughout this process, issuance methods have continuously innovated, asset types rapidly renewed, and growing mainstream acceptance has propelled explosive growth. Each transformation concealed opportunities for hundred- or thousand-fold returns. Looking back at the 2024 memecoin supercycle, let’s explore together the transformations and opportunities of this remarkable year.

Infrastructure Continuously Improving

The flourishing of the current memecoin supercycle would not have been possible without increasingly robust infrastructure. Both innovations in B2B-level token issuance and optimizations in C2C user experience have created favorable conditions for rapid capital inflow and user expansion within the memecoin ecosystem.

Innovation in Issuance Models

Traditional memecoin issuance resembles that of standard tokens. However, as products of attention economics, memecoins face rapidly shifting market trends. Current issuance processes remain lengthy and complex, while user preferences and hype cycles vary across blockchains—making it difficult to concentrate market attention and liquidity, and nearly impossible to quickly pump up asset prices in the short term.

PUMP.FUN: The Core Engine of the Supercycle

The fundraising frenzy sparked by BOME and SLERF earlier this year introduced a presale model that altered issuance to some extent and captured market attention. Yet, scam-ridden "pump-and-dump" schemes continued to proliferate, leaving core issues unresolved. It was only with the emergence of PUMP.FUN that these problems began to be effectively addressed. The memecoin issuance cycle shortened dramatically, capital started circulating more fluidly, users became increasingly centralized, laying the foundation for the memecoin supercycle.

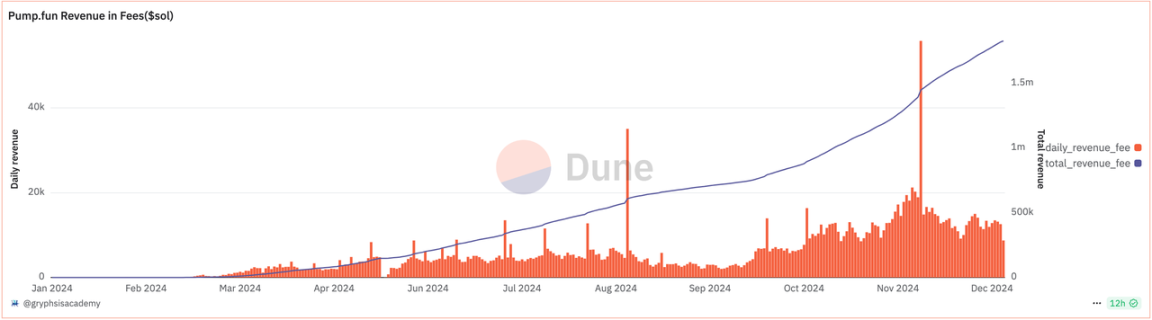

Founded by Alon in January 2024, PUMP.FUN initially attracted little attention until gradually entering public view around April. To date, it has launched nearly 5 million memecoins, accounting for nearly 70% of daily token issuance on Solana and becoming the highest-revenue protocol on the network. As the engine powering the memecoin supercycle, its key advantage lies in optimizing token issuance. It allows users to create tokens without any technical knowledge (since August, even the previous $2 creation fee has been waived). Its fair internal funding mechanism combined with a well-designed bonding curve significantly lowers issuance costs and accelerates launch speed—effectively addressing the challenge of fast-moving market trends and scattered capital concentration in today's memecoin landscape.

Beyond mechanism innovation, PUMP.FUN also excels in user positioning and product design. From the user perspective, it solves real pain points for most Web3 participants: “users want easier, faster, lower-cost ways to achieve higher returns.” From the product side, it is one of the few projects with a complete commercial loop and transparent revenue streams (earning 1% of platform trading fees before listing on Raydium, and charging 6 SOL as a listing fee during the Raydium integration).

According to Dune analytics, as of December 23, PUMP.FUN has deployed close to 5 million memecoins since launch, with daily active users reaching 300,000 and daily new addresses hitting 170,000. Data from DefiLlama shows that PUMP.FUN generated $94 million in protocol revenue over the past 30 days, with cumulative revenue nearing $300 million.

Rise of PUMP.FUN Clones and Continuous Micro-Innovations

PUMP.FUN ignited the current memecoin supercycle, and the subsequent wave of clones further fueled its expansion.

Sun.pump: Memecoin Launchpad Becomes the Fifth Standard Component of Blockchains

Massive capital inflows and intense market attention prompted major blockchains to launch PUMP.FUN-inspired platforms, making memecoin launchpads the de facto fifth essential component of blockchain ecosystems.

Major blockchain ecosystems have begun supporting memecoins throughout their value chains. On BSC, platforms like Four.meme and Flap attract attention through continuous campaigns and collaborations; on Base, Ape.Store, Rug.fun, and Trugly.meme engage users via diverse gamified experiences; on Bitcoin Layer 2s, clones such as LnPUMP.FUN, SatsPUMP.FUN, and CPUMP.FUN have emerged. Sun.pump on Tron single-handedly drove a resurgence across the entire Tron chain. Hot money flooded in, TRON rapidly gained external visibility, gas fees surged, and TRX, long dormant, reached a three-year high in price. However, after peaking, TRX entered a sustained downtrend and now trades around 0.24 USDT.

First we see the rise of the tower, then we watch it crumble. While memecoins can serve as traffic gateways bringing temporary windfalls to blockchains, how to sustainably build out the broader ecosystem remains a critical question.

MakeNow.Meme: Optimization of Market-Making Models

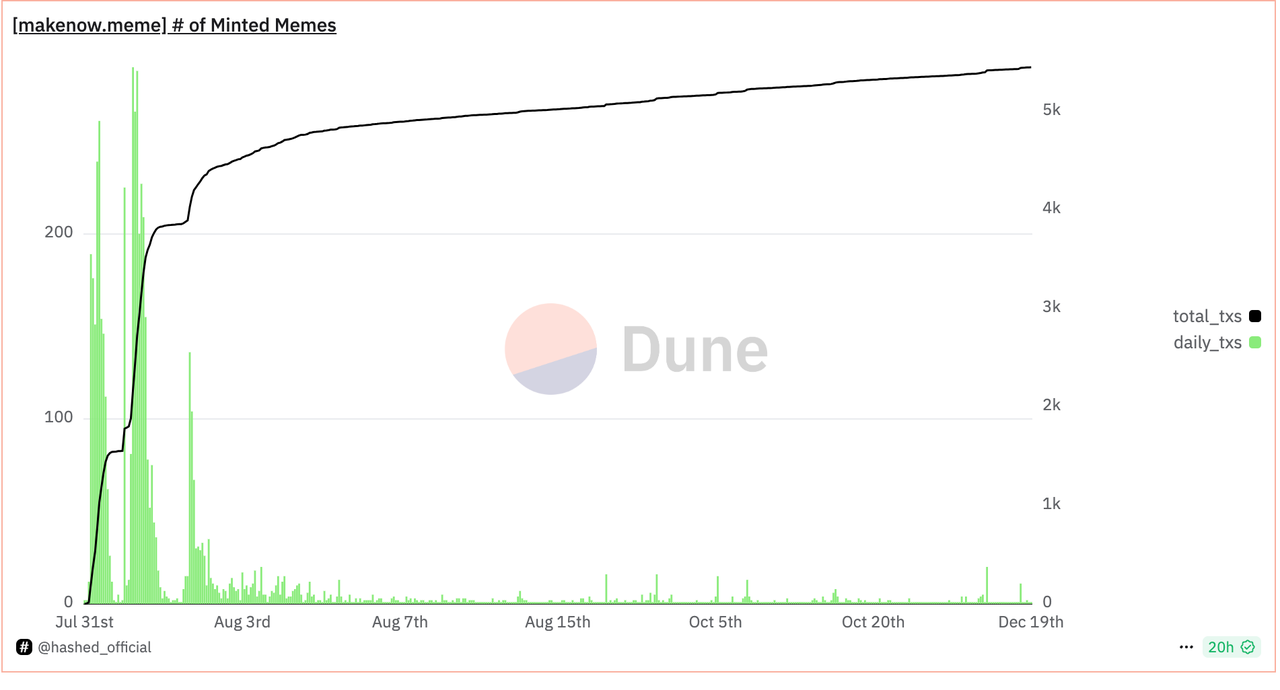

Though no longer trending, MakeNow.Meme once attracted widespread attention—launching over 2,600 memecoins in a single day and earning over 230+ SOL. Compared to PUMP.FUN, its model not only simplified issuance further but also introduced novel directions for market-making mechanisms.

-

Further Simplified Issuance — Users simply post a tweet starting with $ followed by a ticker symbol and include a description/image/video, then tag the official account. The team responds with the contract address in the comments.

-

Market-Making Model Innovation — While fair launch mechanics appear to give everyone equal access via blockchain scanning, in reality, KOLs or project teams may privately coordinate with the platform to front-run and acquire low-cost positions early.

Dune data reveals that MakeNow.Meme declined shortly after its first week and eventually faded into obscurity. This may underscore that the core narrative and logic behind memecoins still revolve fundamentally around fairness.

Moonshot: Leveraging Natural Traffic from DEX Screener

Launched by DEX Screener around June 2024, Moonshot benefits from native integration and direct exposure within a high-traffic platform. Despite this inherent advantage, its performance pales in comparison to PUMP.FUN. Metadata isn’t shown pre-launch, launch history lacks transparency, and overall functionality suffers from poor visibility—indicating inadequate user conversion despite abundant traffic.

Its lackluster post-launch metrics suggest that while traffic sources exist, effective user conversion remains the true challenge.

Recommended Read: Mapping All Chain Versions of "PUMP.FUN": Where Should You Play to Earn?

User Experience Enhancements

Beyond innovative issuance models and capital redirection, improvements in user experience have also contributed significantly to the large-scale breakout of memecoins.

TG Bots: Optimized for Web3 Users

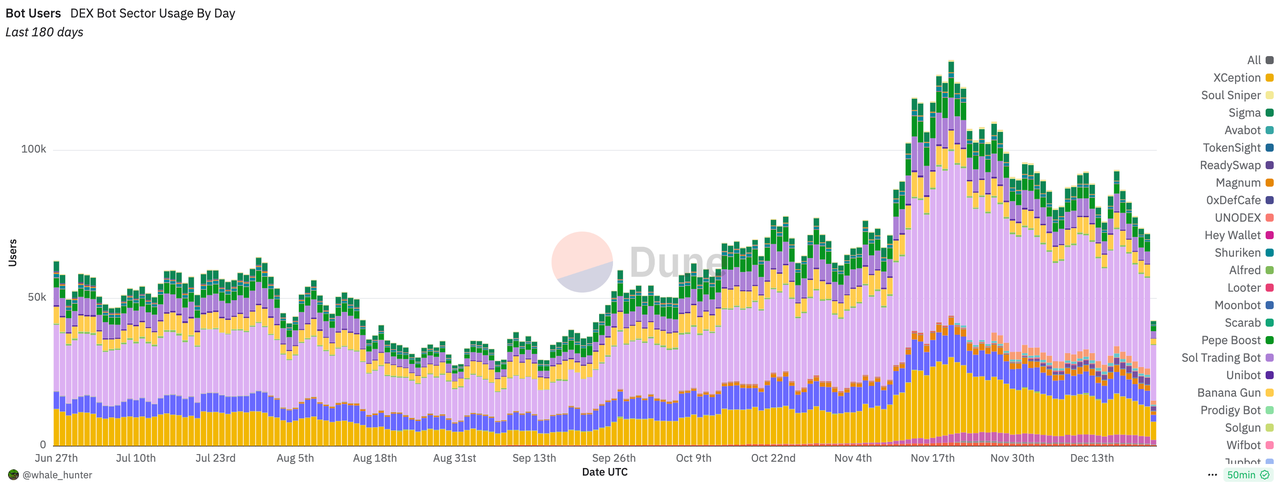

The current memecoin supercycle has been supported by rapid advancements in tools and on-chain bots, whose functionalities are constantly evolving—from sniping and dollar-cost averaging to security checks and relationship analysis. Powerful tools and bots safeguard users’ on-chain treasure hunts, driving memecoins into the mainstream from the demand side.

During this period, memecoin trading tools expanded from mobile apps to web platforms. Specialized multi-chain trading sites like gmgn.ai, Bullx, and Photon cater to niche demands, while convenient Telegram bots such as Banana Gun, Tojan, and Bonkbot offer quick execution. These dedicated memecoin trading tools have evolved from broad accessibility to deeper functionality, with wallet analytics, Twitter monitoring, and safety detection features maturing rapidly, validating their business models. TG bot user counts have grown steadily, reaching over 140,000 daily active users at peak, with daily trading volume approaching $500 million. Though still far behind major DEX volumes, this niche remains a blue ocean under the influence of the memecoin supercycle.

Recommended Read: Stop Bag-Holding! An Advanced Guide to Memecoin Tools

MoonShot: Bridging the Gap for Web2 Users

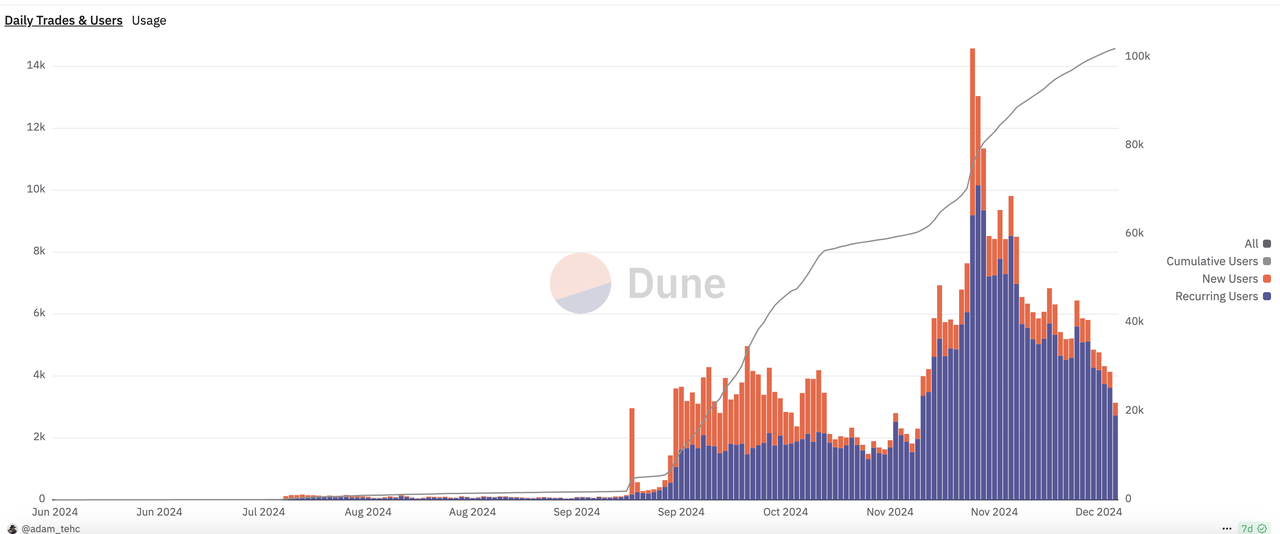

Beyond Web3 audiences, memecoins also serve as the most direct gateway for Web2 users to enter and understand Web3. However, current challenges—including high security risks, fragmented platforms, and difficulty obtaining gas—remain significant barriers. MoonShot, backed by Alliance DAO—the incubation team behind PUMP.FUN—has made progress in solving these issues.

It is a Solana-based mobile app focused on meme trading, allowing users to directly purchase memecoins using fiat payment methods such as Apple Pay, credit cards, and PayPal. By simplifying social logins and fiat onboarding, MoonShot brings fresh users and capital into the Solana ecosystem, bridging the gap between off-chain funds and on-chain memecoin markets. However, as the wealth effect wanes, MoonShot’s user activity has gradually declined. Effectively converting Web2 users remains a persistent challenge across the crypto space.

Rapid Evolution of Narratives

As the purest expression of attention economics in crypto, memecoins exhibited increasingly diverse narrative themes amid the 2024 market frenzy. Reviewing past standout performers, memecoin themes varied widely. Each type reflects distinct market trends, community dynamics, and capital strategies. Based on historical patterns, we can broadly categorize them into four types: Event-Driven Derivative Memecoins, Community-Powered IP Memecoins, Celebrity-Centric Concept Memecoins, and Cross-Domain Emerging Memecoins. These categories often overlap rather than existing in isolation.

Event-Driven Derivative Memecoins

Memecoins triggered by sudden events often gain massive attention immediately, with traffic and capital quickly driving up prices. Their emergence and surge tend to be abrupt and hard to replicate. Their defining traits include rapid explosions, high short-term multiples, but limited staying power—once attention fades, they require new catalysts to sustain momentum. Examples include BOME, SLERF, FIGHT, and BAN—all driven by event-based hype.

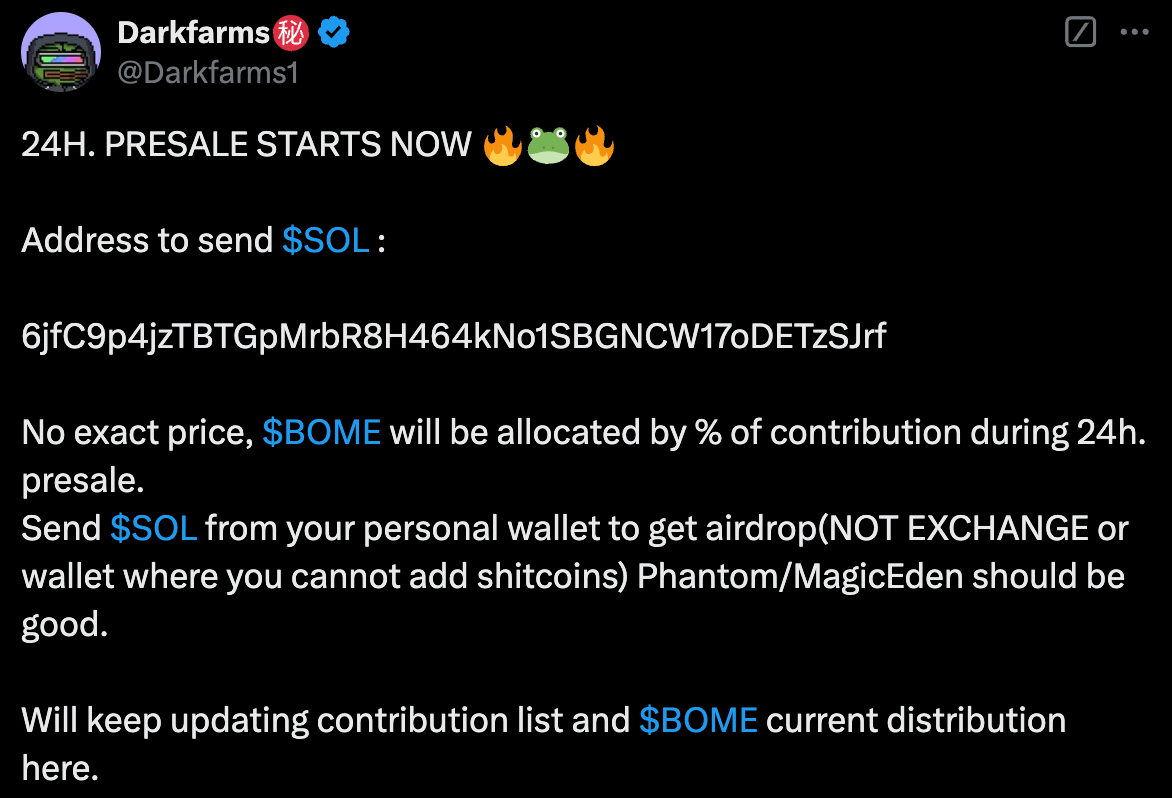

BOME (BOOK OF MEME), a presale project initiated by Pepe artist Darkfarm, raised over 10,000 SOL during fundraising. Widely anticipated, it saw over $200 million in trading volume upon launch and reached a market cap above $1 billion just three days after listing on Binance. SLERF, which followed a similar presale model, experienced a spiraling price surge after the developer accidentally burned LP tokens and airdrop allocations—an unexpected incident amplified by viral discourse.

However, if event-driven memes fail to maintain ongoing attention, their prices inevitably decay. FIGHT, inspired by slogans following Trump’s assassination attempt, briefly surpassed an $80 million market cap but later lost over 90% of its value due to fading interest. Similarly, BAN, an art-themed memecoin launched on PUMP.FUN by Sotheby’s VP Michael Bouhanna, dropped 85% from its all-time high after Binance listing.

Community-Powered IP Memecoins

IP-based memecoins typically enjoy strong consensus, develop slowly over time, and eventually form tight-knit communities. These community-driven IP memecoins demonstrated remarkable resilience throughout 2024’s volatility. They may take extended periods to reach peaks, characterized by deep community alignment, cult-like devotion, or exceptional durability through repeated price swings. Notable examples include POPCAT, SPX, APU from the Cult series, and other established IPs like MEW, NEIRO, and MANEKI.

MEW (“cat in a dog’s world”) represents a brave cat standing against dogs. Launched in March, it became a pioneer in the “cat niche,” reaching a peak market cap of $1 billion. Another IP, Maneki (the Japanese lucky cat), adopted its model of allocating 90% of liquidity and 10% to the community, sparking brief FOMO. Neiro, named after a rescue dog recently adopted by Kabosu—the late internet-famous Shiba Inu who inspired Dogecoin—reached nearly $50 million in market cap within two days of launch. Its price fluctuated repeatedly around chain-related debates and uppercase/lowercase naming disputes, extending the speculation from on-chain to exchanges. Ultimately, the lowercase Ethereum version Neiro prevailed within the community, peaking at a $1.2 billion market cap. Additionally, Murad, a rising star in the supercycle, specifically selected tokens that had existed for at least six months and survived at least two drawdowns exceeding 70%. While SPX’s short-term rally benefited from his influence, the strength of its community IP was key to its revival amid repeated crashes.

Celebrity-Centric Concept Memecoins

Memecoin performance is often closely tied to influential figures. Celebrities can use specific memecoins to promote ideas, and those tokens gain broader exposure through celebrity association. Their hallmark is that price movements correlate strongly with the magnitude of celebrity influence and the depth of their connection to the project. Examples include DOGE, PNUT, TERMINUS led by Elon Musk, and others like JENNER and MOTHER.

The impact of celebrity-endorsed coin launches has evolved in this supercycle thanks to PUMP.FUN—faster-paced and capable of generating higher multiples, attracting numerous Web2 celebrities to join. Caitlyn Jenner, a U.S. influencer from the Kardashian family, launched the JENNER token, which surged 160x overnight. American rapper Iggy Azalea tweeted about the Meme coin MOTHER, causing its contract to spike thirtyfold within two minutes and briefly surpassing a $200 million market cap. Musk-linked concept coins remain top picks for memecoin traders—whenever he promotes topics like Mars colonization (TERMINUS), government efficiency departments (D.O.G.E.), or political themes (PNUT) on social media, related on-chain tokens experience sharp short-term rallies.

Cross-Domain, Multi-Dimensional Emerging Memecoins

The current memecoin supercycle has transcended native Web3 content, expanding into multiple domains with broader themes. Within various sectors, speculative assets have diversified rapidly, drawing cross-industry attention. From TikTok virality and AI breakthroughs to DeSci (decentralized science) and physics, memecoin mania has spread swiftly, reflecting an increasing trend of interdisciplinary convergence. Memecoins seem to have become testing grounds for emerging technologies and unproven赛道 (tracks). The defining feature of this category is fresh narratives with wide-reaching appeal beyond crypto circles. Examples include MOODENG, PESTO, CHILLGUY, GOAT, ACT, VIRTUAL, AIXBT, RIF, and URO.

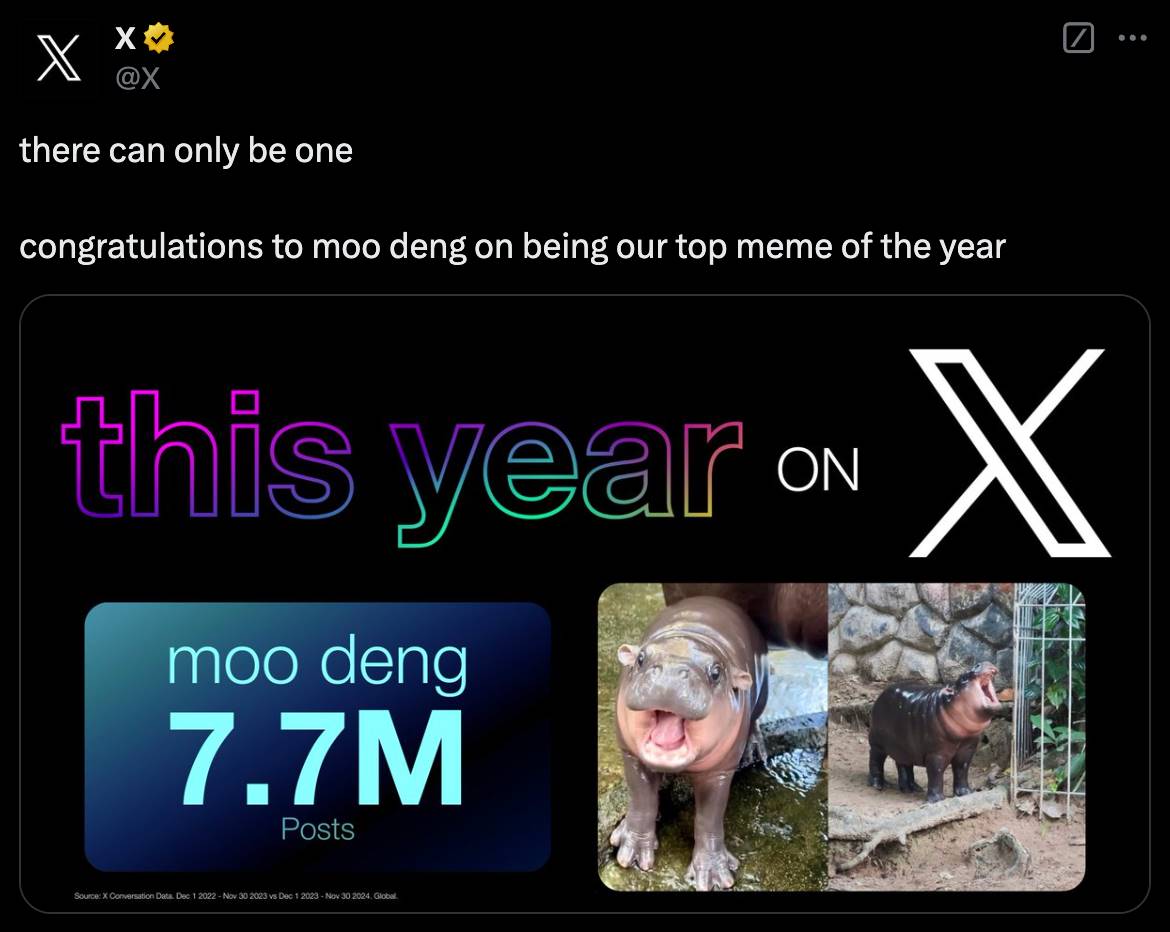

Moo Deng, a baby hippo born at a Thai zoo, gained meme status through expressive photos that went viral on TikTok and Instagram, ultimately being named Twitter’s Meme of the Year. The Solana-based Moo Deng token briefly reached a $700 million market cap and, despite its small size, successfully listed on Coinbase—sparking demand for Web2-originated meme speculation. Subsequently, PESTO and CHILLGUY also attracted widespread attention due to strong Web2 traffic, each briefly exceeding $500 million in market cap.

Hype soon extended to AI agents. GOAT originated from @truth_terminal, an AI bot launched in June, which saw its market cap explode past $1 billion. Soon after, AI-themed memecoins like ACT and ELIZA captured the imagination of on-chain players, while application tokens such as ai16z, zerebro, virtual, and aixbt began forming ecosystems around AI agents. Later, when Binance announced investment in BIO, DeSci (decentralized science) entered the mainstream spotlight. Tokens like RIF and URO on Pump.Science—a platform integrating real scientific experiments—sparked a new wave of speculation, briefly surpassing $200 million in market cap.

Recommended Read: Deconstructing Memes: Why Have MEMEs Performed So Exceptionally This Cycle?

Mainstream Acceptance and Adoption

From marginalized assets to gaining widespread institutional and investor attention, memecoins have seen continuous user growth and capital inflows, gradually earning recognition and adoption in mainstream markets.

In terms of capital flows, liquidity trends are clear. Institutions are beginning to allocate to memecoins; exchanges are actively listing them; market makers are accumulating positions. As of December 23, 2024, the total market cap of memecoins has climbed to $230 billion and continues to grow. According to a June report by Bybit, institutional investors added nearly $300 million in spot holdings during the first half of the year. Virtually every major crypto exchange now lists multiple memecoins. Since 2024, Binance alone has listed over 20 memecoins (including both futures and spot), with 80% experiencing significant market cap growth post-listing. Five major crypto market makers—Wintermute, GSR Markets, Auros Global, B2C2 Group, and Cumberland DRW—hold memecoins valued at hundreds of millions of dollars.

On the user growth front, attitudes have shifted markedly. A16Z, once debating the merits of value-based tokens in early 2024, unexpectedly participated in the hype, indirectly catalyzing the first AI memecoin GOAT. Vitalik Buterin expressed optimism about the future of memecoins and joined promotional and charitable efforts for MooDeng. Pantera Capital partners publicly endorsed memecoins, calling them the simplest way to introduce younger generations to cutting-edge DeFi applications and onboard them into Web3. More Web2 users are recognizing the utility of memecoins—whether it’s DeSci’s scientific aid initiatives, Dogecoin’s ocean cleanup program, or NOT serving as a social tipping and red packet tool—all creating fertile ground for broader acceptance. Statistics show that global memecoin user count surpassed 50 million from年初 to year-end 2024 and continues to grow.

Conclusion

BTC, arguably the largest memecoin in the eyes of Web2, has already broken $100,000 and proven itself in the market. For early memecoin participants, are they merely gambling speculators chasing riches—or visionary investors ahead of the curve? And where will memecoins ultimately go? Will they fade into irrelevance, or continue evolving and step firmly into the mainstream?

Cycles turn, time tests truth, and the answers lie in the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News