The Fed Says No! Can It Stop America's Bitcoin Strategic Reserve?

TechFlow Selected TechFlow Selected

The Fed Says No! Can It Stop America's Bitcoin Strategic Reserve?

One person takes on global financial markets: Does the Federal Reserve have the power to stop the Bitcoin Strategic Reserve plan?

Producer|OKG Research

Authors|Jason Jiang, Hedy Bi

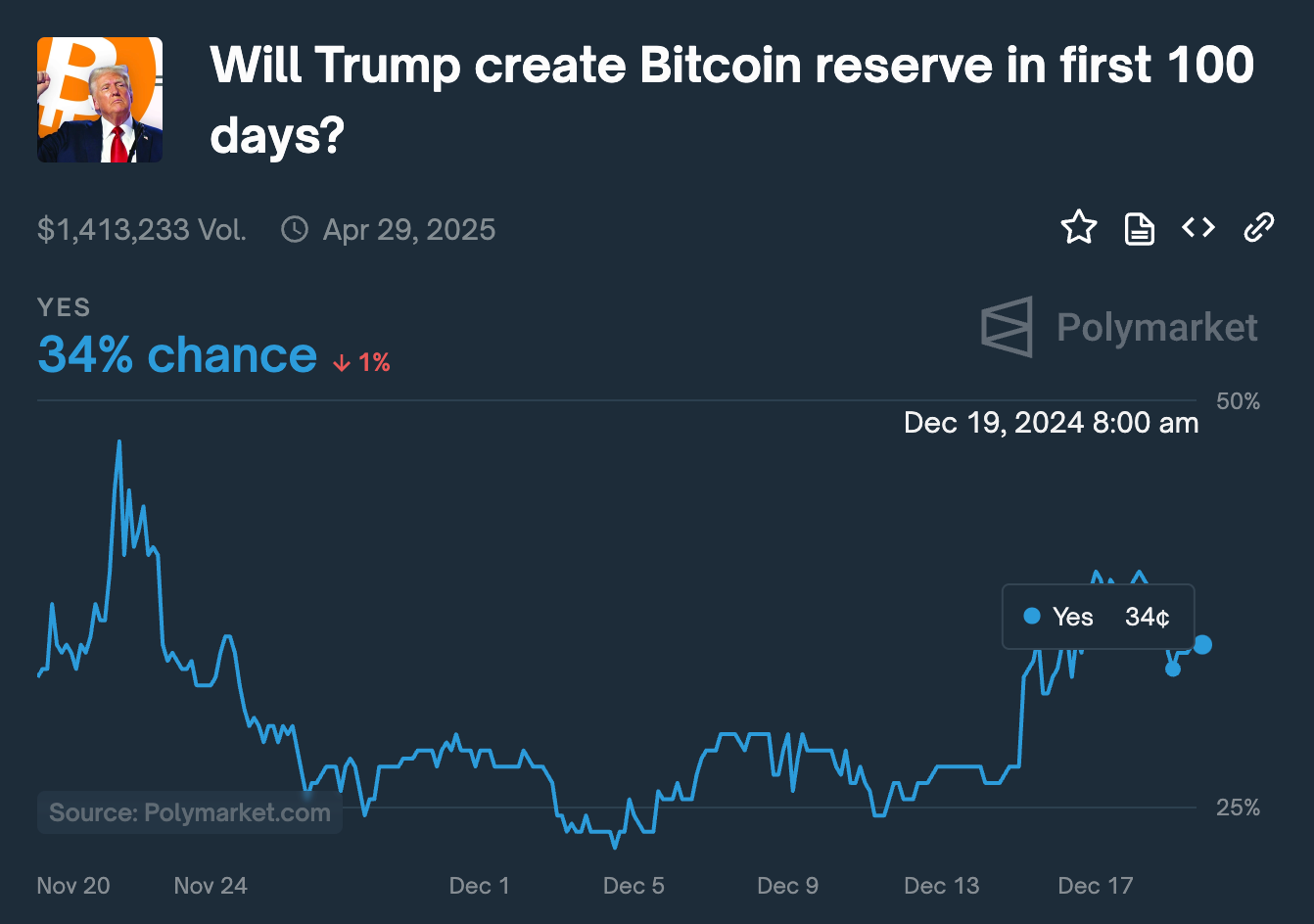

In the early hours of today, Federal Reserve Chair Jerome Powell clearly stated during a press conference following the monetary policy meeting that the Fed has no intention of participating in any government plans to accumulate bitcoin. He emphasized that such matters fall within Congress’s jurisdiction and that the Fed has not sought to change existing laws to allow holding bitcoin. Powell's remarks immediately triggered market volatility, with bitcoin prices rapidly pulling back from their weekly highs. According to prediction market Polymarket, the probability of a Bitcoin Strategic Reserve (BSR) dropped from a peak of 40% on the 18th to 34% following Powell’s speech. The total crypto market capitalization also sharply declined, losing approximately 7.5% in value.

Image source: Polymarket

This statement not only cast doubt on the prospects of a “Bitcoin Strategic Reserve (BSR),” but also refocused attention on a deeper question: Does the Federal Reserve actually have the authority to block a BSR plan?

First, it is important to clarify the Federal Reserve’s position within the U.S. financial system. The Fed’s overseeing body is the U.S. Congress: Congress serves as the highest authority for all financial regulatory institutions, establishing financial regulations and policies through legislation and delegating functions to other financial agencies—such as the SEC and the Federal Reserve. In the U.S. financial system, monetary policy and fiscal policy serve as two core tools of economic governance, managed separately by the Federal Reserve and the Treasury Department. These institutions operate with checks and balances while maintaining independence to ensure the stability of the U.S. economy and financial markets.

While the Federal Reserve enjoys significant autonomy in matters of monetary policy and national economic stability, it does not hold veto power over decisions regarding the establishment of a BSR.

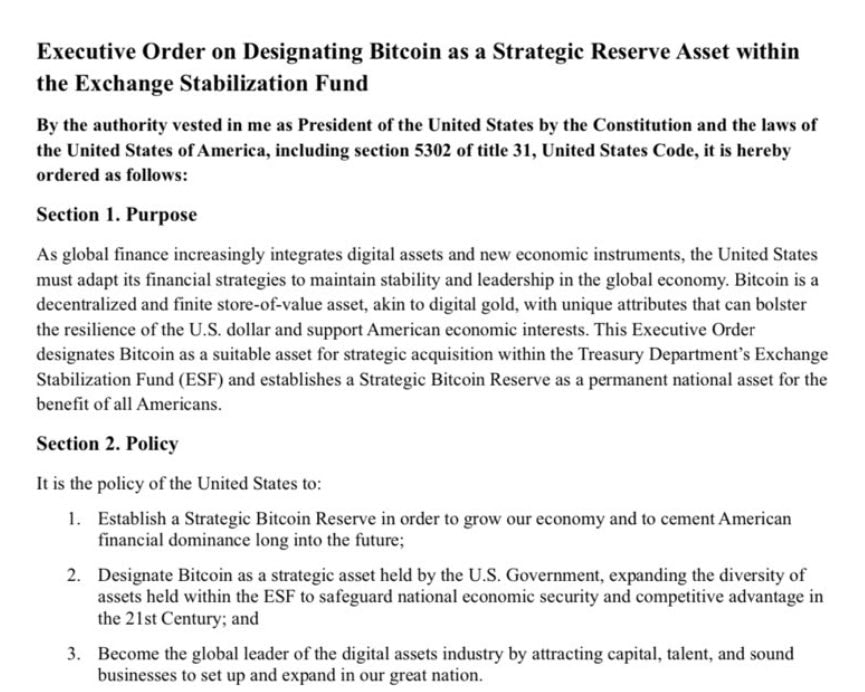

If the Trump administration wishes to quickly establish a BSR, the most direct path would be issuing an executive order upon taking office, instructing the U.S. Treasury to use the Exchange Stabilization Fund (ESF) to directly purchase bitcoin. The ESF is a special fund managed by the U.S. Treasury, primarily used for foreign exchange market interventions, supporting dollar stability, and responding to international financial crises. It currently holds assets including U.S. dollars, Special Drawing Rights (SDRs), and gold. The operation of this fund is not under congressional control, giving the President and Treasury broad discretion in its use. In theory, the President could issue an executive order directing the Treasury to reallocate ESF funds to purchase or hold specific assets—including bitcoin—bypassing the need for direct congressional appropriations and reducing political friction. The Bitcoin Policy Institute recently drafted such an executive order with this approach in mind.

Image source: Bitcoin Policy Institute

This method is the easiest to implement—the use of ESF funds does not require prior congressional approval—but Congress retains the ability to investigate or legislatively restrict such actions. During the 2020 COVID-19 pandemic, Congress imposed strict limitations on certain Treasury fund operations. Additionally, the sustainability of a BSR established via executive order remains questionable, as executive orders are extensions of executive authority and can be revoked or modified by future administrations through new executive orders.

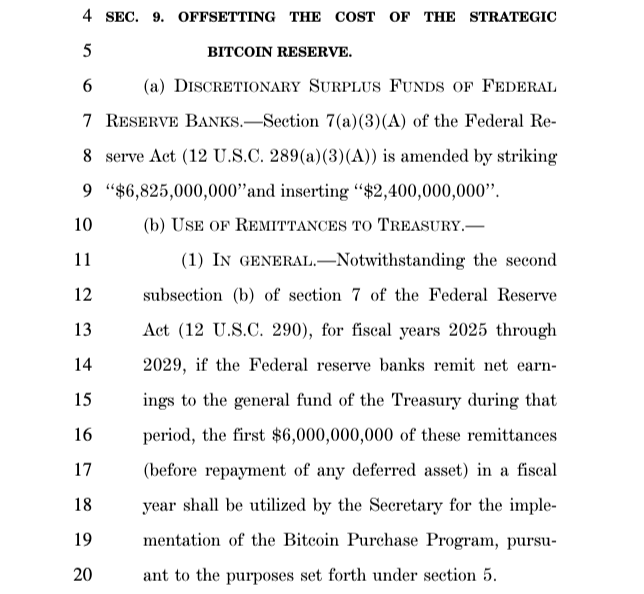

For a more durable and stable BSR, an alternative path would be required: passing legislation through Congress to formally include bitcoin in the Strategic Reserve Act or similar legislation, explicitly recognizing bitcoin as a national strategic reserve asset. This approach offers stronger legal legitimacy and establishes a long-term framework for bitcoin reserves. Republican Senator Cynthia Lummis’s previously introduced "United States Bitcoin Strategic Reserve Act" follows this route. The bill has already been formally submitted to Congress and referred to the Senate Banking Committee for review, and must still pass through Senate, House, and presidential approval before becoming law. Therefore, establishing a strategic bitcoin reserve through this path will take significantly longer and may face various political hurdles along the way.

Regardless of whether a BSR is established via presidential executive order or congressional legislation, based on current proposals, implementation would ultimately be led by the Treasury Department—not the Federal Reserve.

Image source: Congress.gov

Beyond these two main paths, the Federal Reserve and Treasury Department could theoretically pursue an intermediate approach to bitcoin allocation. The Fed could conduct open market operations to purchase bitcoin and include it on its balance sheet. Due to its relative independence, the Fed does not require congressional approval for such actions, but would need a clear policy framework justifying bitcoin purchases. Given the Fed’s recent statements, however, this scenario appears unlikely in the short term. Alternatively, the Treasury could establish a dedicated fund to invest in bitcoin as part of a broader fiscal investment strategy. While this would not alter existing legal frameworks, any related funding would still require congressional approval.

No matter which path is taken, the phrase “the Fed says no” cannot single-handedly kill the BSR proposal—and Trump, known for his pragmatic approach, has already signaled support through action. According to on-chain data, just two minutes after Powell began his speech, the Trump family’s crypto project, World Liberty Financial, quietly initiated purchases of altcoins. This moment vividly illustrates a deeper博弈: on one hand, the Fed’s lukewarm response reflects the government’s cautious stance toward emerging assets; on the other, the moves by the Trump-affiliated crypto project reveal the subtle tug-of-war between traditional power structures and market innovation. The intricate interplay among government, traditional finance, and the crypto market may well be setting the stage for the future of digital assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News