VanEck's Top 10 Crypto Predictions for 2025: Bull Market to Reach New Highs by End of Next Year, U.S. to Further Support Bitcoin via Strategic Reserve Policy

TechFlow Selected TechFlow Selected

VanEck's Top 10 Crypto Predictions for 2025: Bull Market to Reach New Highs by End of Next Year, U.S. to Further Support Bitcoin via Strategic Reserve Policy

The cryptocurrency bull market reached its mid-term peak in the first quarter and hit a new high in the fourth quarter.

Author: Matthew Sigel & Patrick Bush

Translation: TechFlow

Please note that VanEck may hold the digital assets mentioned below.

Before diving into our outlook for 2025, let’s first review how our 2024 predictions performed. Out of the 15 forecasts we made at the end of 2023, we score ourselves 8.5 out of 15. While a 56.6% accuracy rate isn’t perfect, it’s good enough to keep us “in the game.” With Bitcoin (BTC) surpassing $100,000 and Ethereum (ETH) breaking $4,000, 2024 remains a historic year for crypto—even if some predictions missed the mark.

Review of 2024 Predictions

We successfully called several key trends in our 2024 forecast, including:

-

The launch of spot Bitcoin ETPs

-

A successful Bitcoin halving

-

Ethereum remaining second only to Bitcoin

-

Bitcoin reaching new all-time highs in Q4 2024

-

Layer-2s dominating Ethereum activity (though L2 TVL still below Ethereum's)

-

Stablecoin market cap hitting a new record high

-

Dex trading volume share reaching a new record

-

Solana (SOL) outperforming Ethereum (ETH)

-

Growth in DePIN network adoption

While not every prediction fully materialized, the overall trends validate the direction of our analysis.

Top 10 Crypto Predictions for 2025

-

The crypto bull market will peak mid-year in Q1 and reach new highs by year-end

-

The U.S. further embraces Bitcoin through strategic reserves and policy support

-

Total value of tokenized securities exceeds $50 billion

-

Daily settlement volume of stablecoins reaches $300 billion

-

On-chain activity from AI agents exceeds 1 million agents

-

Total value locked (TVL) in Bitcoin Layer-2 networks reaches 100,000 BTC

-

Ethereum blob space fee revenue hits $1 billion

-

DeFi trading volume sets a new record at $4 trillion, with TVL reaching $200 billion

-

NFT market rebounds, with annual trading volume reaching $30 billion

-

Performance of decentralized application (dApp) tokens gradually closes the gap with major L1 tokens

Next, we’ll dive deeper into the rationale behind some of these key predictions.

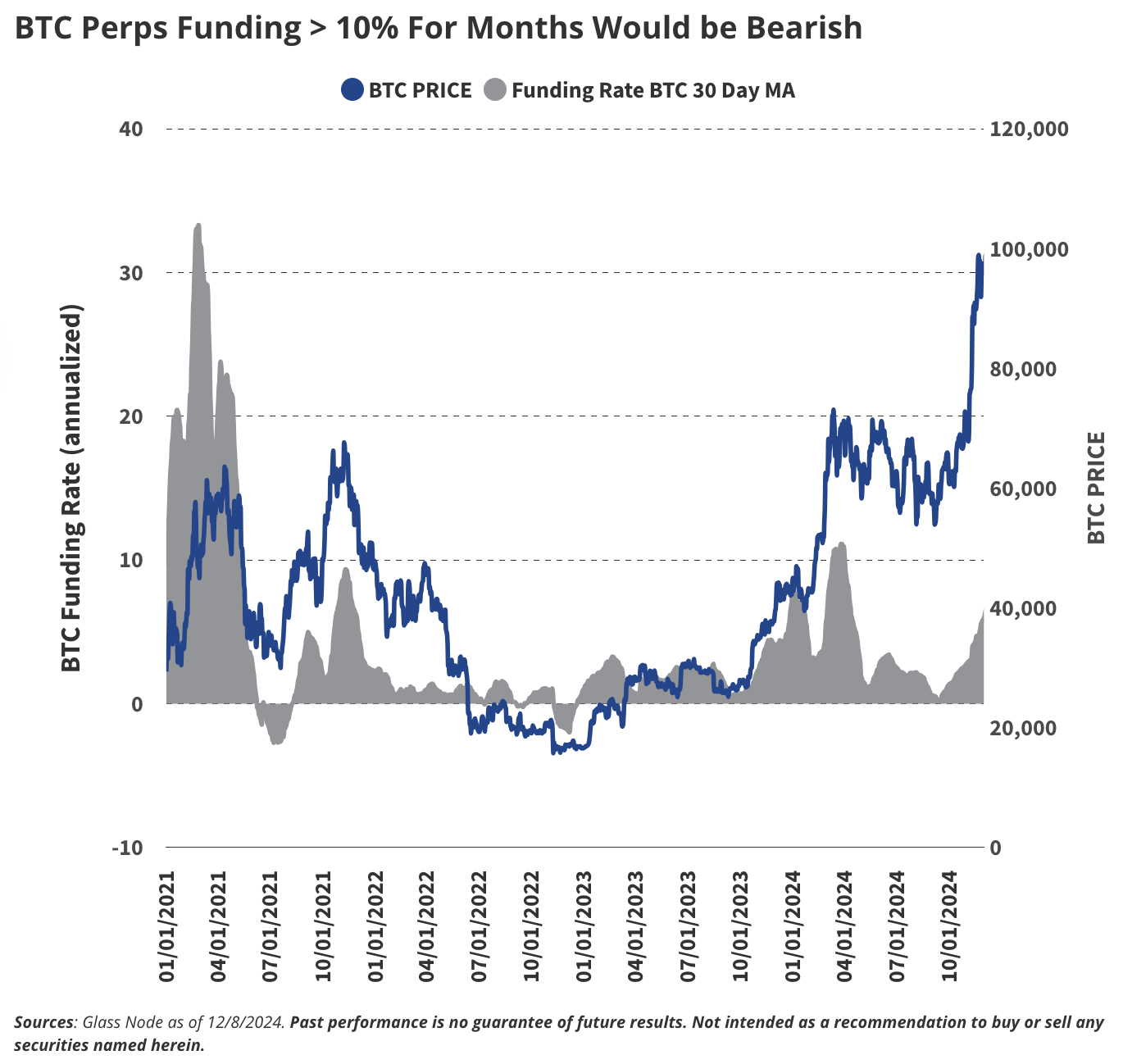

1. Crypto Bull Market Peaks Mid-Year in Q1 and Reaches New Highs by Year-End

We believe the 2025 crypto bull market will continue to unfold, peaking in the first quarter. At this cycle peak, we expect Bitcoin (BTC) to reach approximately $180,000 and Ethereum (ETH) to break above $6,000. Other prominent projects such as Solana (SOL) and Sui (SUI) could exceed $500 and $10, respectively.

After this initial peak, we anticipate BTC will retrace by 30%, while altcoins may fall more sharply—up to 60%—reflecting summer consolidation. However, a recovery may emerge in the fall, with major tokens regaining momentum and surpassing previous highs again before year-end. To identify when the market is approaching its top, we will monitor the following key signals:

-

Persistently high funding rates: When traders borrowing to bet on rising BTC prices are willing to pay funding rates above 10% for three months or longer, it indicates speculative overheating.

-

Excessive unrealized profit: If a large proportion of BTC holders are sitting on significant paper gains (profit-to-cost ratio reaching 70% or higher), it suggests market euphoria.

-

Market cap overvaluation relative to realized value: When the MVRV (Market Value to Realized Value) ratio exceeds 5, BTC’s price is far above the average acquisition cost, typically signaling market overheating.

-

Declining Bitcoin dominance: If Bitcoin’s share of the total crypto market drops below 40%, it means speculative capital is rotating into higher-risk altcoins—a classic late-cycle behavior.

-

Mainstream speculation: When a surge of non-crypto friends starts asking about questionable projects, it’s often a reliable sign the market is nearing its top.

Historically, these indicators have been reliable signs of market mania, and they will guide our outlook across the 2025 market cycle.

2. The U.S. Further Embraces Bitcoin Through Strategic Reserves and Adoption

Donald Trump’s election has already provided a significant boost to the crypto market, appointing multiple pro-crypto leaders to key roles—including Vice President JD Vance, National Security Advisor Michael Waltz, Commerce Secretary Howard Lutnick, Treasury Secretary Mary Bessent, SEC Chair Paul Atkins, FDIC Chair Jelena McWilliams, and HHS Secretary RFK Jr. These appointments not only signal an end to anti-crypto policies (such as systemic de-banking of crypto firms), but also herald the beginning of a policy framework positioning Bitcoin as a strategic asset.

Crypto ETPs: Physical Creation, Staking, and New Spot Approvals

The new SEC leadership (or potentially the CFTC) will approve multiple new spot crypto exchange-traded products (ETPs) in the U.S., including VanEck’s Solana product. Ethereum ETPs will expand to include staking functionality, enhancing utility for holders, while both ETH and BTC ETPs will support physical creation/redemption. The repeal of SEC Rule SAB 121—whether by the SEC or Congress—will pave the way for banks and brokers to custody spot crypto, further integrating digital assets into traditional financial infrastructure.

Sovereign Bitcoin Adoption: Federal, State, and Mining Expansion

We predict that by 2025, either the U.S. federal government or at least one state (possibly Pennsylvania, Florida, or Texas) will establish a Bitcoin reserve. At the federal level, this would most likely be done via executive order using the Treasury’s Exchange Stabilization Fund (ESF), though bipartisan legislation remains uncertain. Meanwhile, states may act independently, viewing Bitcoin as a hedge against fiscal uncertainty or a tool to attract crypto investment and innovation.

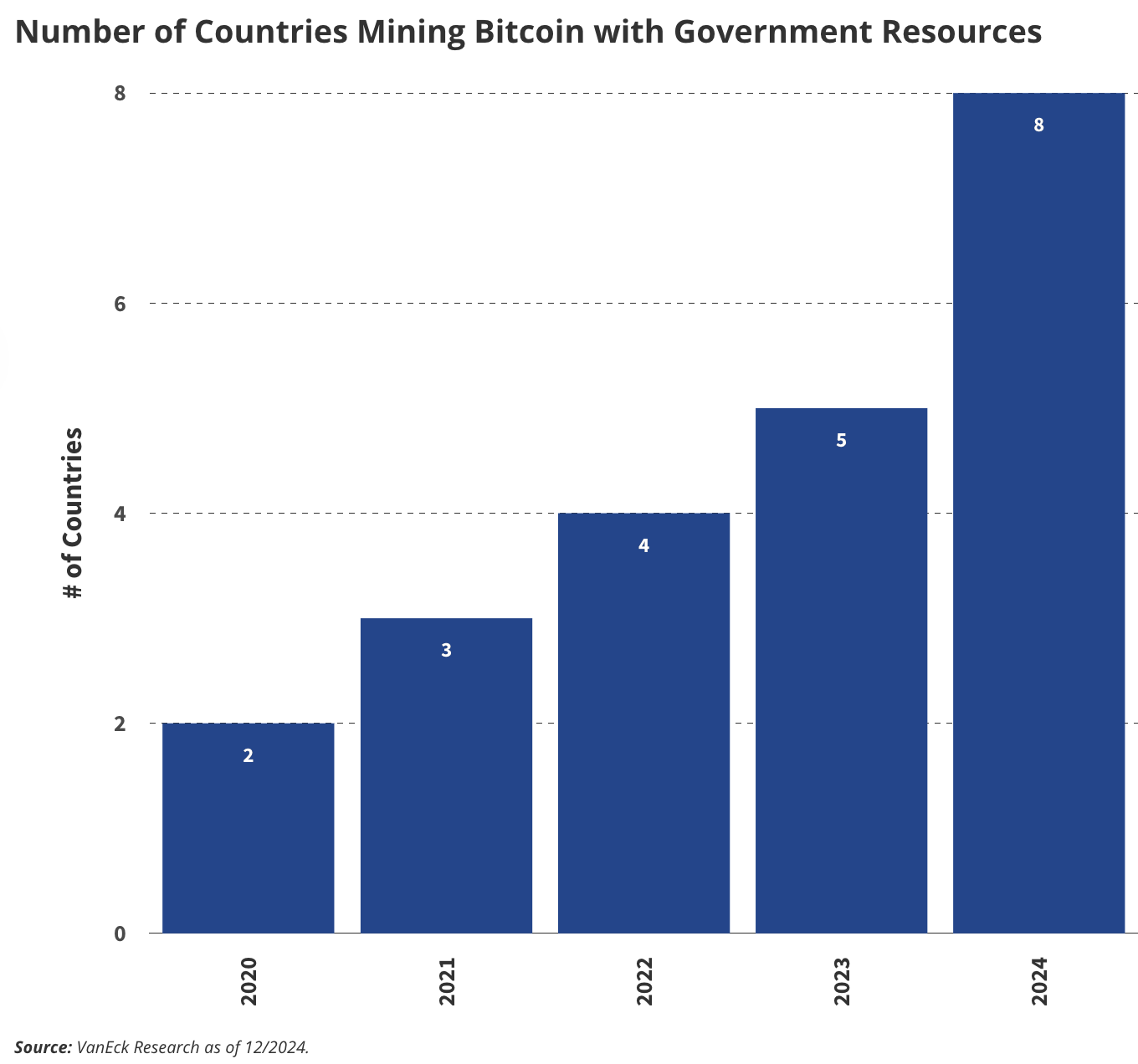

In Bitcoin mining, the number of countries mining using government resources is expected to reach double digits (currently seven), driven by increasing BRICS adoption of cryptocurrencies. This trend is amplified by Russia’s announcement of plans to use crypto for international trade settlements, further highlighting Bitcoin’s global influence.

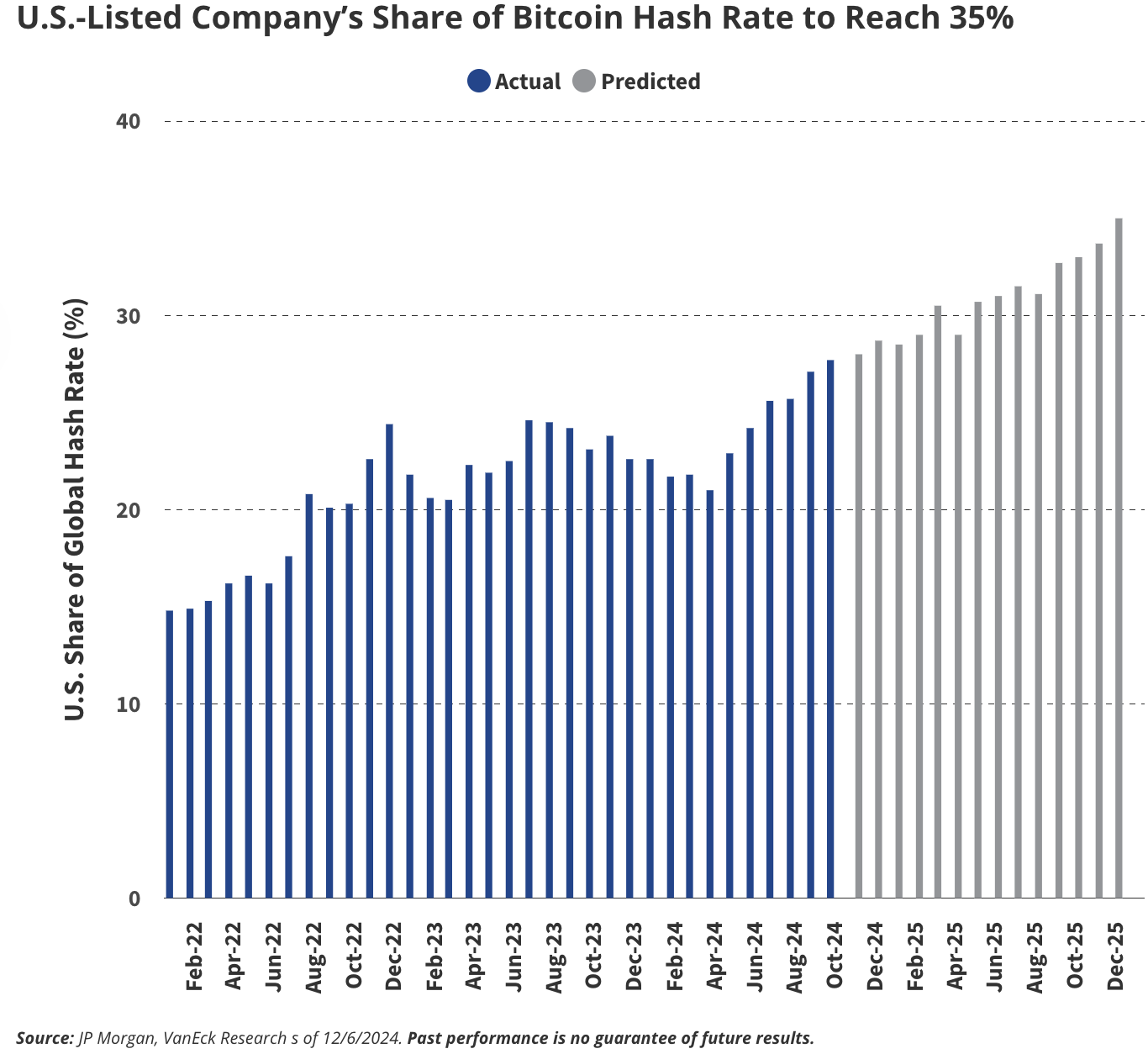

We expect this pro-Bitcoin stance to ripple across the broader U.S. crypto ecosystem. With regulatory clarity and incentives attracting talent and companies back, the U.S. share of global crypto developers will rise from 19% to 25%. Meanwhile, U.S. Bitcoin mining will flourish, with the country’s share of global mining hash rate increasing from 28% in 2024 to 35% by end-2025—fueled by cheap energy and potential tax incentives. Together, these trends will solidify America’s leadership in the global Bitcoin economy.

U.S. Listed Companies Will Account for 35% of Global Bitcoin Hash Rate

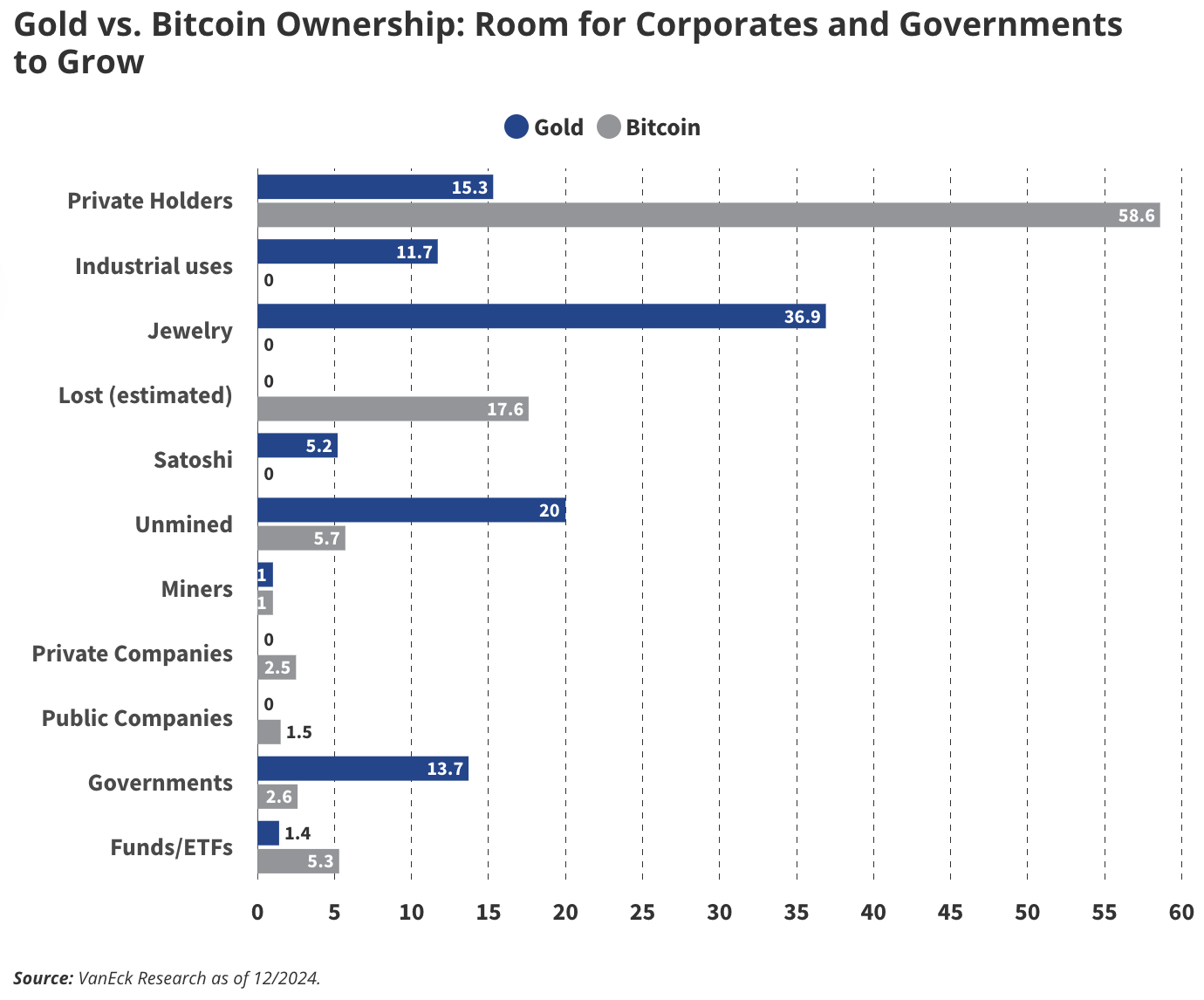

Corporate Bitcoin Holdings: Set for 43% Growth

On corporate adoption, we expect companies to continue accumulating Bitcoin from retail hands. Currently, 68 publicly traded companies hold Bitcoin on their balance sheets—we project this number will reach 100 by 2025. Notably, we boldly predict that the total BTC held by private and public companies (currently 765,000 BTC) will surpass Satoshi Nakamoto’s estimated 1.1 million BTC holdings next year. This implies a significant 43% growth in corporate Bitcoin holdings over the coming year.

Room to Grow: Corporate and Government Ownership of Gold vs. Bitcoin

3. Tokenized Securities Exceed $50 Billion in Value

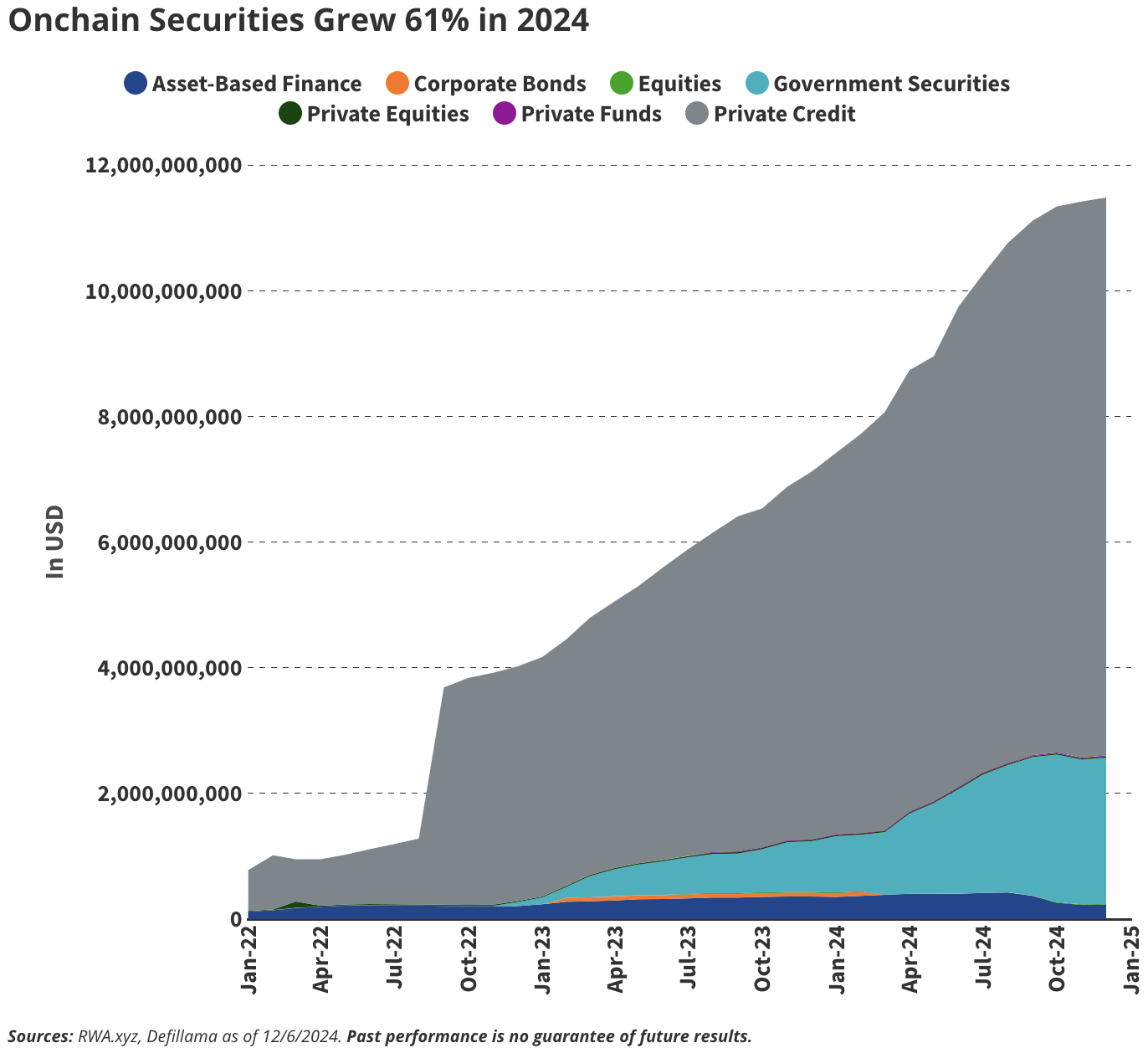

On-Chain Securities Grew 61% in 2024

On-Chain Securities Increased by 61% in 2024

The crypto infrastructure promises to improve financial systems through greater efficiency, decentralization, and transparency. We believe 2025 will be the breakout year for tokenized securities. Currently, around $12 billion in tokenized securities exist on blockchains, with the majority ($9.5 billion) being tokenized private credit securities on Figure’s semi-permissioned blockchain, Provenance.

Looking ahead, we see massive potential for tokenized securities launching on public blockchains. Investors have strong incentives to issue tokenized stocks or debt securities fully on-chain. We predict entities like DTCC will support seamless transitions of tokenized assets between public blockchains and private closed infrastructures within the next year. This dynamic will help establish AML/KYC (anti-money laundering / know-your-customer) standards tailored for on-chain investors. As a bold prediction, we expect Coinbase to take an unprecedented step: tokenizing its COIN stock and deploying it onto its BASE blockchain.

4. Stablecoin Daily Settlement Volume Reaches $300 Billion

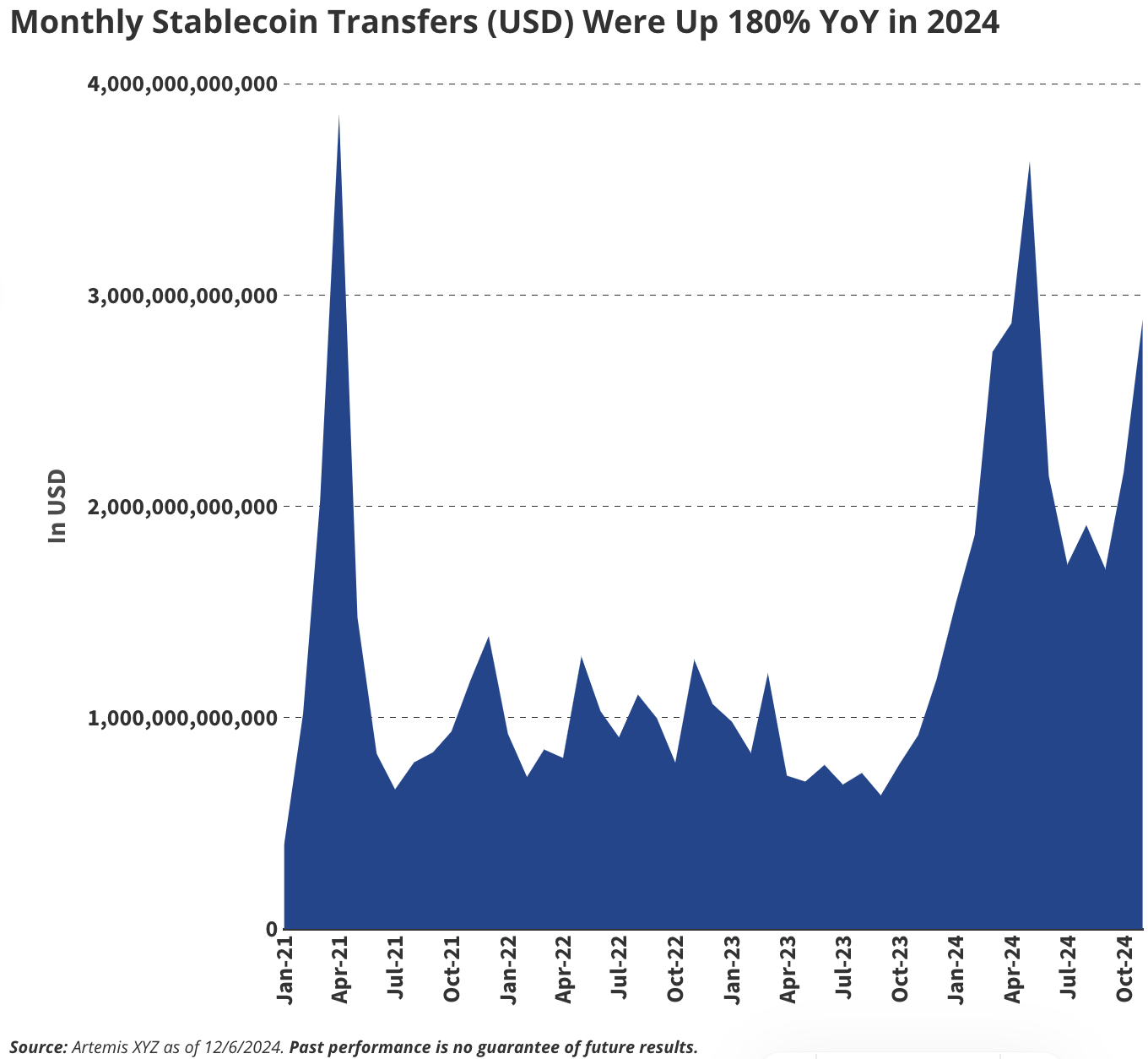

Monthly Stablecoin Transfer Volume (USD) Up 180% YoY in 2024

Source: Artemis XYZ, data as of December 6, 2024.

Past performance is not indicative of future results.

Stablecoins will evolve from a niche role in crypto trading to a core component of global commerce. By the end of 2025, we expect daily stablecoin settlement volume to reach $300 billion—equivalent to 5% of current DTCC volumes, compared to roughly $100 billion per day in November 2024. With adoption by major tech firms (like Apple and Google) and payment networks (Visa and Mastercard), stablecoins will redefine the economics of payments.

Beyond transactions, remittances will experience explosive growth. For example, stablecoin transfers between the U.S. and Mexico could grow from $80 million monthly to $400 million—a fivefold increase—driven by speed, cost savings, and growing perception of stablecoins as practical tools rather than experimental technology. While blockchain adoption is still debated, stablecoins are effectively the “Trojan horse” of blockchain technology.

5. On-Chain Activity from AI Agents Surpasses 1 Million Agents

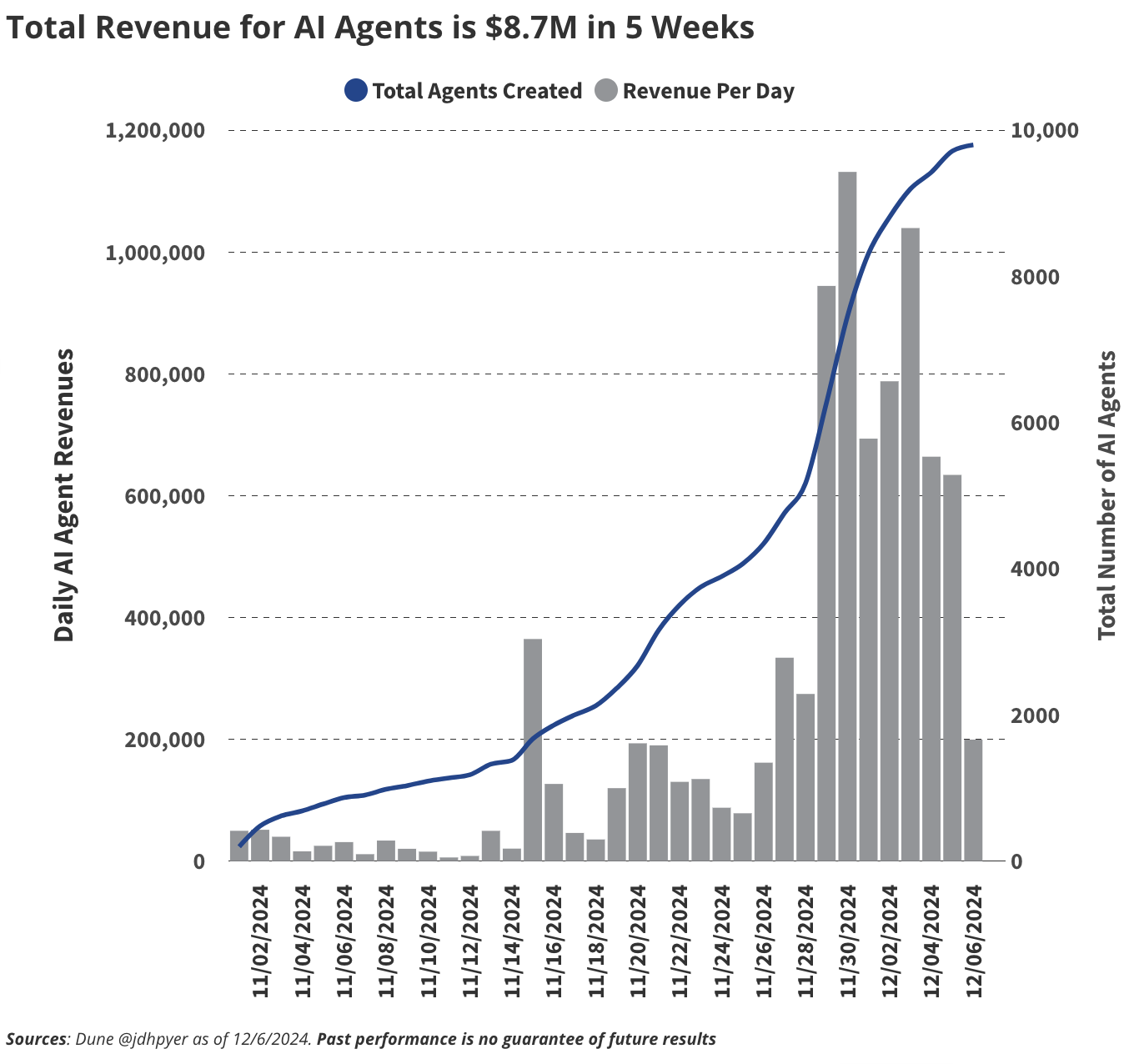

AI Agents Generate $8.7 Million in Revenue Within 5 Weeks

Source: Dune @jdhpyer, data as of December 6, 2024.

Past performance is not indicative of future results.

We believe AI agents represent one of the most compelling trends set to gain massive traction in 2025. AI agents are specialized AI bots designed to help users achieve goals—such as “maximize yield” or “boost engagement on X/Twitter”—by autonomously adjusting strategies to optimize outcomes. These agents are trained on data within specific domains. Protocols like Virtuals now offer anyone the tools to create on-chain AI agents. Virtuals enables non-technical users to access decentralized AI contributors (fine-tuners, dataset providers, model developers), allowing ordinary users to build and even rent out their own agents for income.

Currently, agent development focuses heavily on DeFi, but we believe AI agents will extend beyond finance. They can serve as social media influencers, in-game avatars, or interactive assistants in consumer apps. Agents like Bixby and Terminal of Truths have already become influential figures on X/Twitter, with 92,000 and 197,000 followers respectively. Therefore, we expect over 1 million new agents to emerge in 2025.

6. Bitcoin Layer-2 (L2) Total Value Locked (TVL) Reaches 100,000 BTC

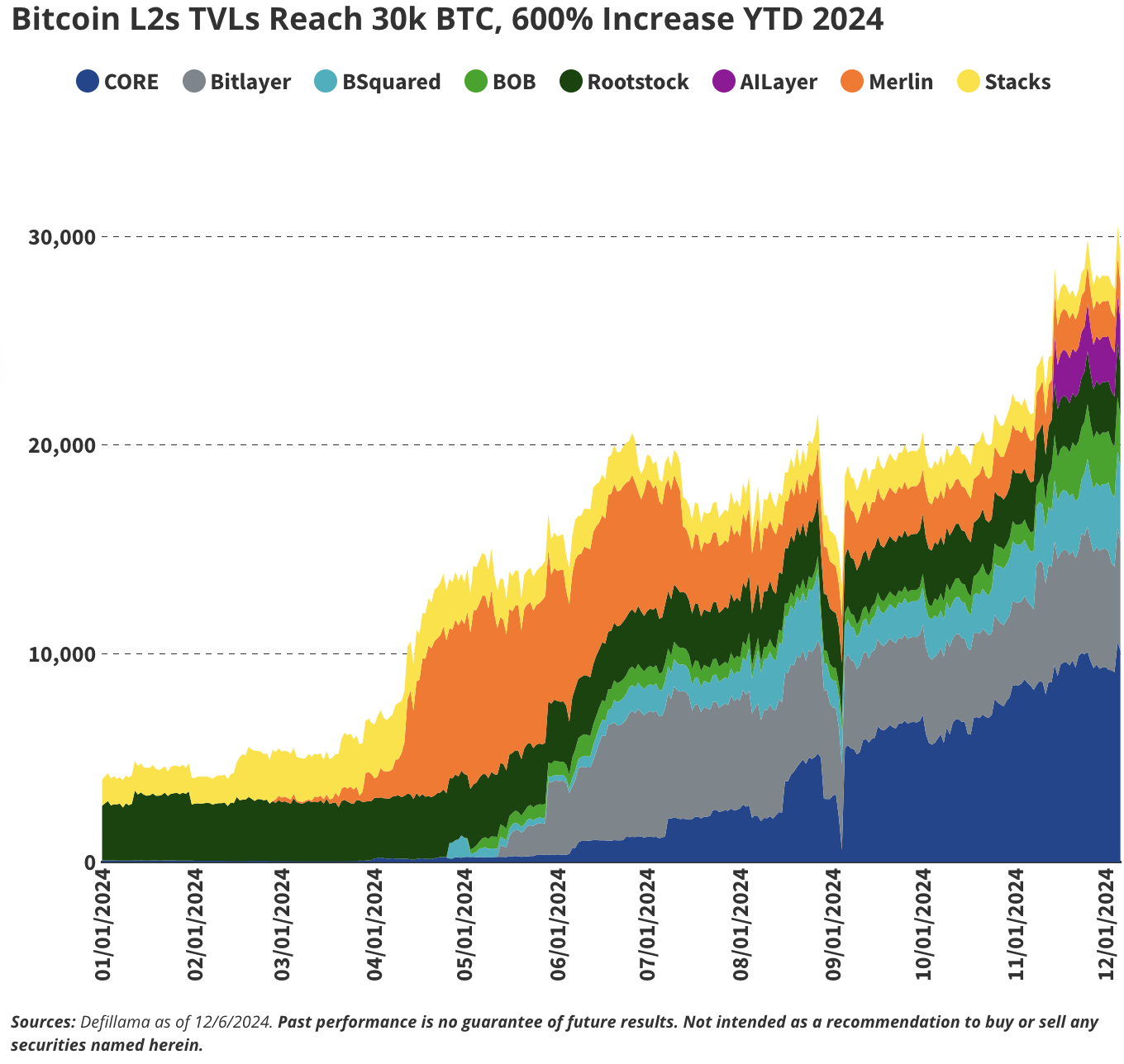

Bitcoin L2 TVL Hits 30,000 BTC, Up 600% YoY in 2024

Source: Defillama, data as of December 6, 2024.

Past performance is not indicative of future results. Securities mentioned are not recommendations to buy or sell.

We are closely watching the rise of Bitcoin Layer-2 blockchains—networks with transformative potential for the Bitcoin ecosystem. By extending Bitcoin’s functionality, these L2 solutions enable lower latency and higher transaction throughput, addressing limitations of Bitcoin’s base layer. Moreover, Bitcoin L2s enhance Bitcoin’s capabilities by introducing smart contract functionality, enabling a decentralized finance (DeFi) ecosystem built around Bitcoin.

Currently, Bitcoin can be transferred to smart contract platforms via bridges or wrapped BTC—but these rely on third-party systems vulnerable to hacks and security flaws. Bitcoin L2 solutions aim to mitigate these risks through frameworks directly integrated with Bitcoin’s main chain, reducing reliance on centralized intermediaries. Despite liquidity constraints and adoption hurdles, Bitcoin L2s promise improved security and decentralization, giving BTC holders greater confidence to actively participate in decentralized ecosystems.

As shown, Bitcoin L2 solutions experienced explosive growth in 2024, with TVL exceeding 30,000 BTC—up 600% year-over-year, equivalent to ~$3 billion. Over 75 Bitcoin L2 projects are currently in development, though only a few may achieve significant long-term adoption.

This rapid growth reflects strong demand from BTC holders for yield generation and broader utility. As chain abstraction and Bitcoin L2 technologies mature into user-ready products, Bitcoin will become a key player in DeFi. For instance, Ika platform on Sui or Infinex’s chain abstraction used by Near demonstrate how innovative multi-chain solutions can enhance interoperability between Bitcoin and other ecosystems.

By enabling secure and efficient on-chain lending, borrowing, and other permissionless DeFi solutions, Bitcoin L2s and abstraction technologies will transform Bitcoin from a passive store of value into an active participant in decentralized ecosystems. As adoption scales, these technologies will unlock massive potential for on-chain liquidity, cross-chain innovation, and a more unified financial future.

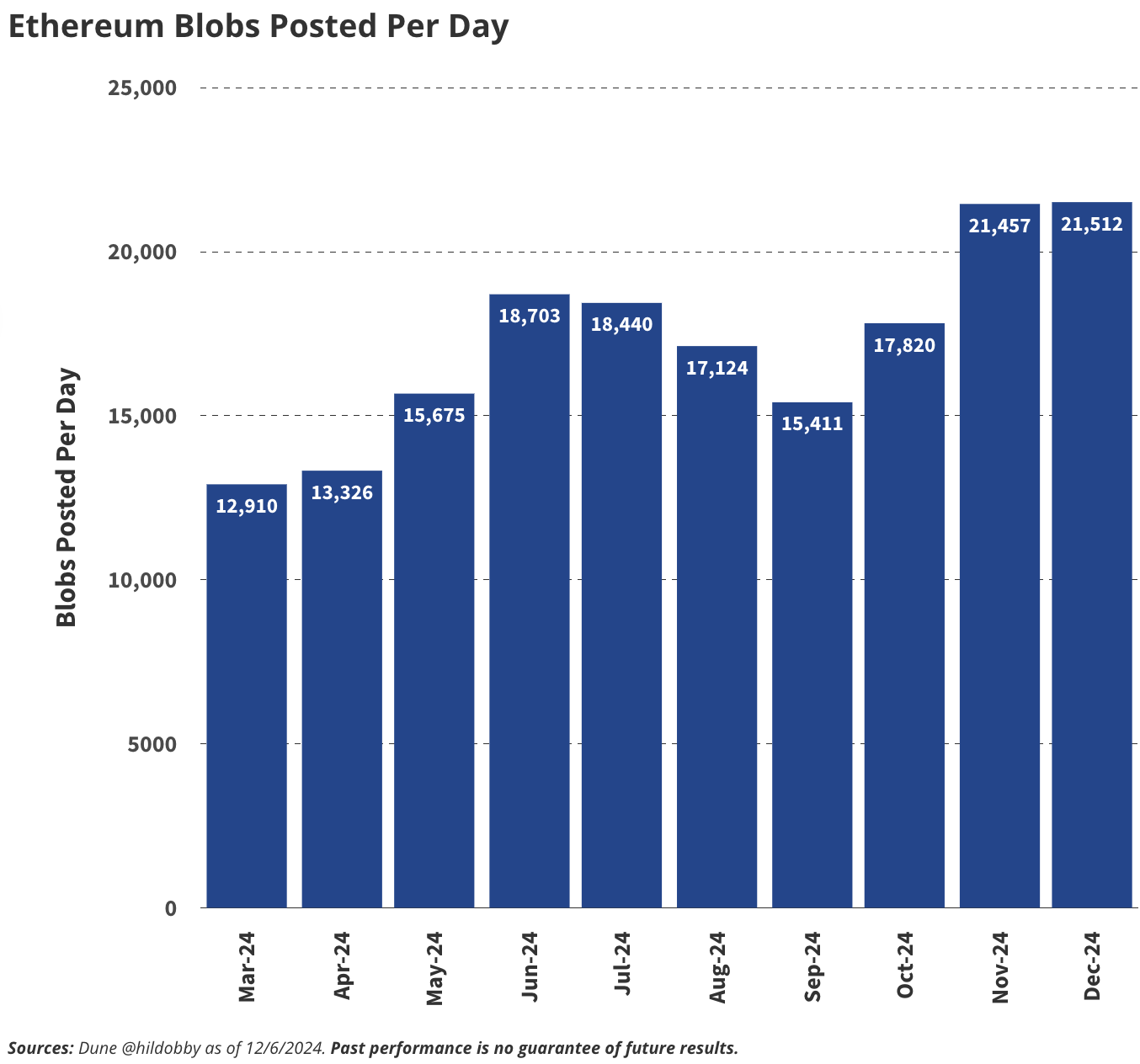

7. Ethereum Blob Space Fee Revenue Reaches $1 Billion

Daily Blob Space Generated on Ethereum

Source: Dune @hildobby, data as of December 6, 2024.

Past performance is not indicative of future results.

The Ethereum community is actively debating whether its Layer-2 (L2) networks can return sufficient value to the Ethereum mainnet via blob space. Blob space is a critical part of Ethereum’s scaling roadmap—a dedicated data layer where L2s submit compressed versions of their transaction history and pay ETH fees per blob. While this architecture supports scalability, currently L2s return little value to the mainnet, with gross margins around 90%. This raises concerns that Ethereum’s economic value may be overly shifted to L2s, potentially leading to underutilization of the main chain.

Despite recent slowdowns in blob space growth, we expect usage to surge significantly in 2025, driven by three key factors:

-

Explosive L2 adoption: Ethereum L2 transaction volume is growing at an annualized rate of over 300%, as users migrate to low-cost, high-throughput environments for DeFi, gaming, and social apps. As more consumer-facing dApps emerge on L2s, more transactions will flow back to Ethereum for final settlement, greatly increasing demand for blob space.

-

Rollup tech optimization: Advancements in rollup technology—such as improved data compression and reduced costs for submitting data to blob space—will encourage L2s to store more transaction data on Ethereum, unlocking higher throughput without sacrificing decentralization.

-

High-fee use cases emerging: Enterprise applications, zk-rollup-based financial solutions, and tokenized real-world assets will drive high-value transactions that prioritize security and immutability—and thus are willing to pay blob space fees.

By the end of 2025, we expect blob space fees to exceed $1 billion, up from negligible levels today. This growth will reinforce Ethereum’s role as the ultimate settlement layer for decentralized apps while enhancing its ability to capture value from its rapidly expanding L2 ecosystem. Blob space will not only scale the network but also become a major revenue stream for Ethereum, rebalancing the economic relationship between the mainnet and L2s.

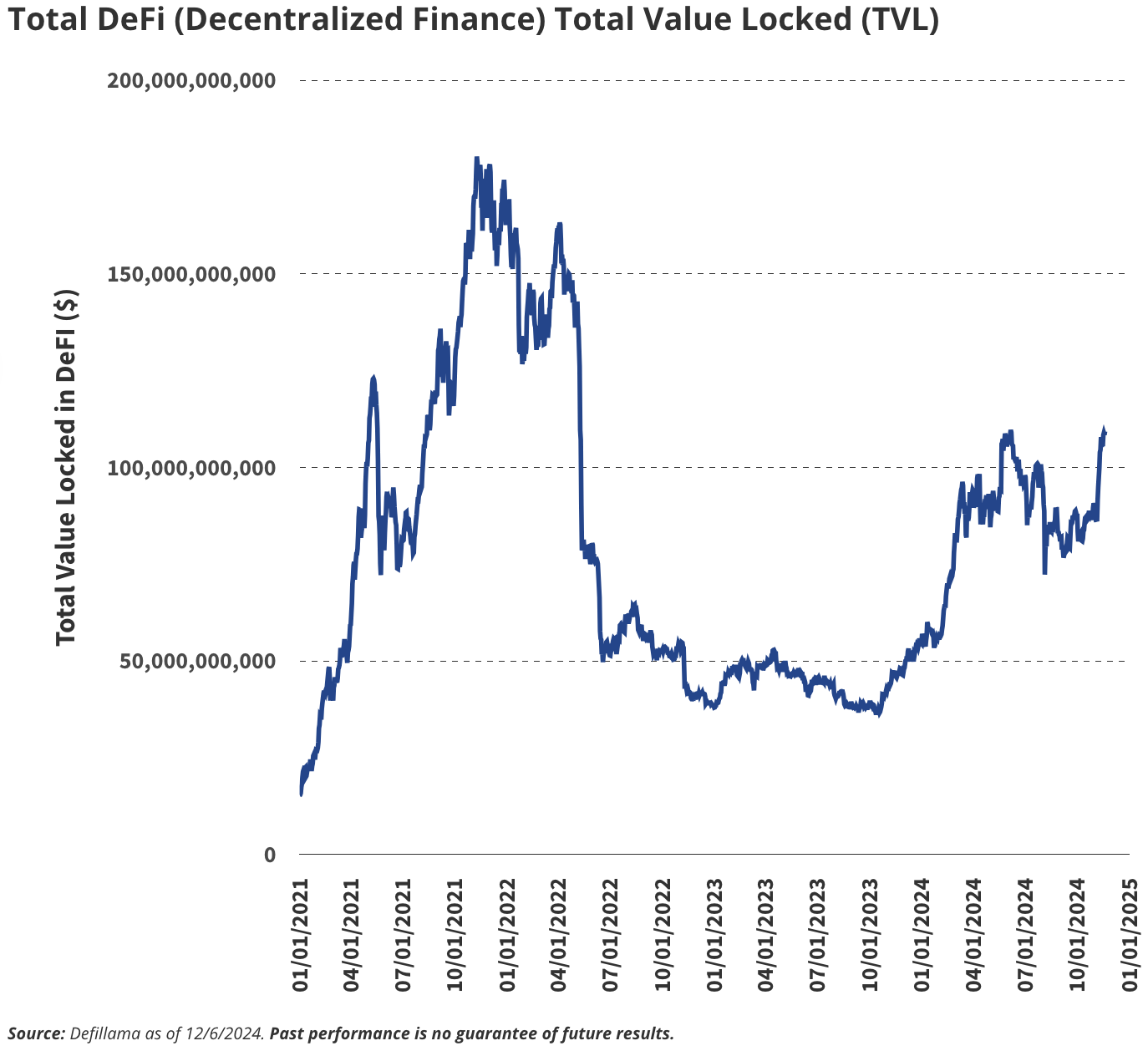

8. DeFi Sets New Records: DEX Volume Hits $4 Trillion, TVL Reaches $200 Billion

DeFi Total Value Locked (TVL)

Source: Defillama, data as of December 6, 2024.

Past performance is not indicative of future results.

Although decentralized exchange (DEX) trading volume has hit new highs both in absolute terms and as a share of centralized exchange (CEX) volume, DeFi’s total value locked (TVL) remains 24% below its all-time high. We expect DEX volume in 2025 to surpass $4 trillion—accounting for 20% of CEX spot volume—fueled by the rise of AI-related tokens and new consumer-facing dApps.

Additionally, the influx of tokenized securities and high-value assets will act as catalysts for DeFi growth, bringing new liquidity and broader utility to the ecosystem. As a result, we project DeFi TVL to rebound to over $200 billion by year-end.

This growth reflects not only a recovery in decentralized finance but also marks its rising status within the global financial system. With more user-friendly dApps and innovative financial instruments, DeFi will attract fresh capital inflows and solidify its position as a viable alternative to traditional finance.

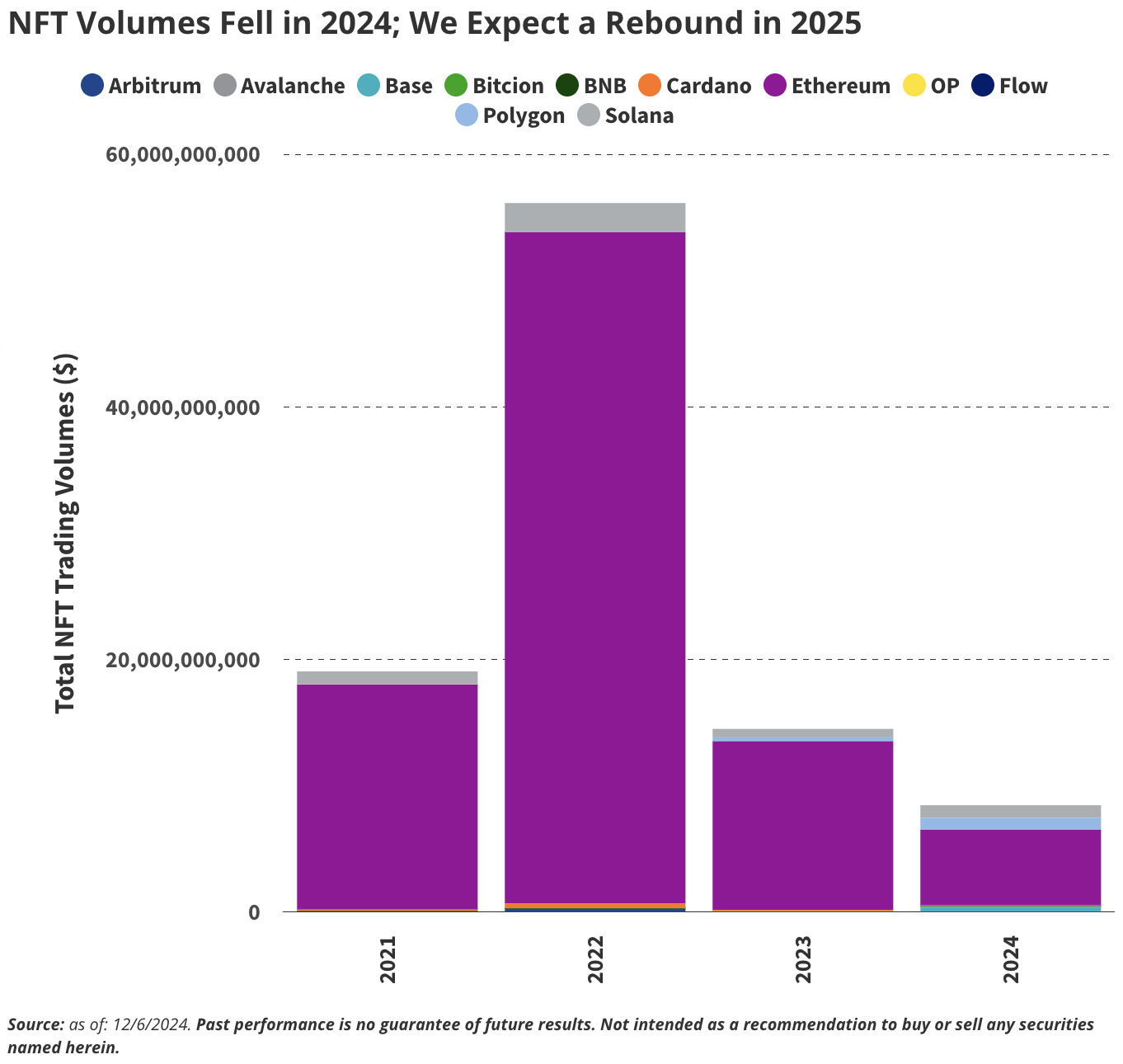

9. NFT Market Recovery: Trading Volume Reaches $30 Billion

NFT Trading Volume Declined in 2024; We Expect a Rebound in 2025

Source: Data as of December 6, 2024.

Past performance is not indicative of future results. Securities mentioned are not recommendations to buy or sell.

The 2022–2023 bear market severely impacted the NFT space, with trading volume down 39% since 2023 and a staggering 84% drop from 2022 levels. While fungible token prices began recovering in 2024, most NFTs lagged until a turning point in November, after prolonged weakness and low activity. Despite these challenges, certain projects with strong community ties have defied the odds by moving beyond pure speculation.

For example, Pudgy Penguins successfully transformed from collectible toys into a consumer brand, while Miladys gained cultural relevance through internet satire. Similarly, Bored Ape Yacht Club (BAYC) continues evolving as a dominant cultural force, attracting brands, celebrities, and mainstream media attention.

As crypto wealth rebounds, we expect newly wealthy users to diversify into NFTs—not just as speculative investments, but as assets with lasting cultural and historical significance. Established collections like CryptoPunks and Bored Ape Yacht Club (BAYC), due to their strong cultural impact and relevance, will benefit most from this shift. Although BAYC and CryptoPunks’ trading volumes remain 90% and 66% below their ATHs (in ETH terms), other projects like Pudgy Penguins and Miladys have already surpassed their prior peaks.

Ethereum continues to dominate the NFT space, hosting most major collections. In 2024, Ethereum accounted for 71% of NFT trading volume, and we expect this share to rise to 85% in 2025. This dominance is also evident in market cap rankings—Ethereum hosts all top 10 NFT collections and 16 of the top 20, underscoring its central role in the NFT ecosystem.

While NFT trading volume may not return to the frenzied highs of previous cycles, we believe an annual volume of $30 billion is achievable—about 55% of the 2021 peak. The market is shifting from speculative hype toward sustainability and cultural relevance.

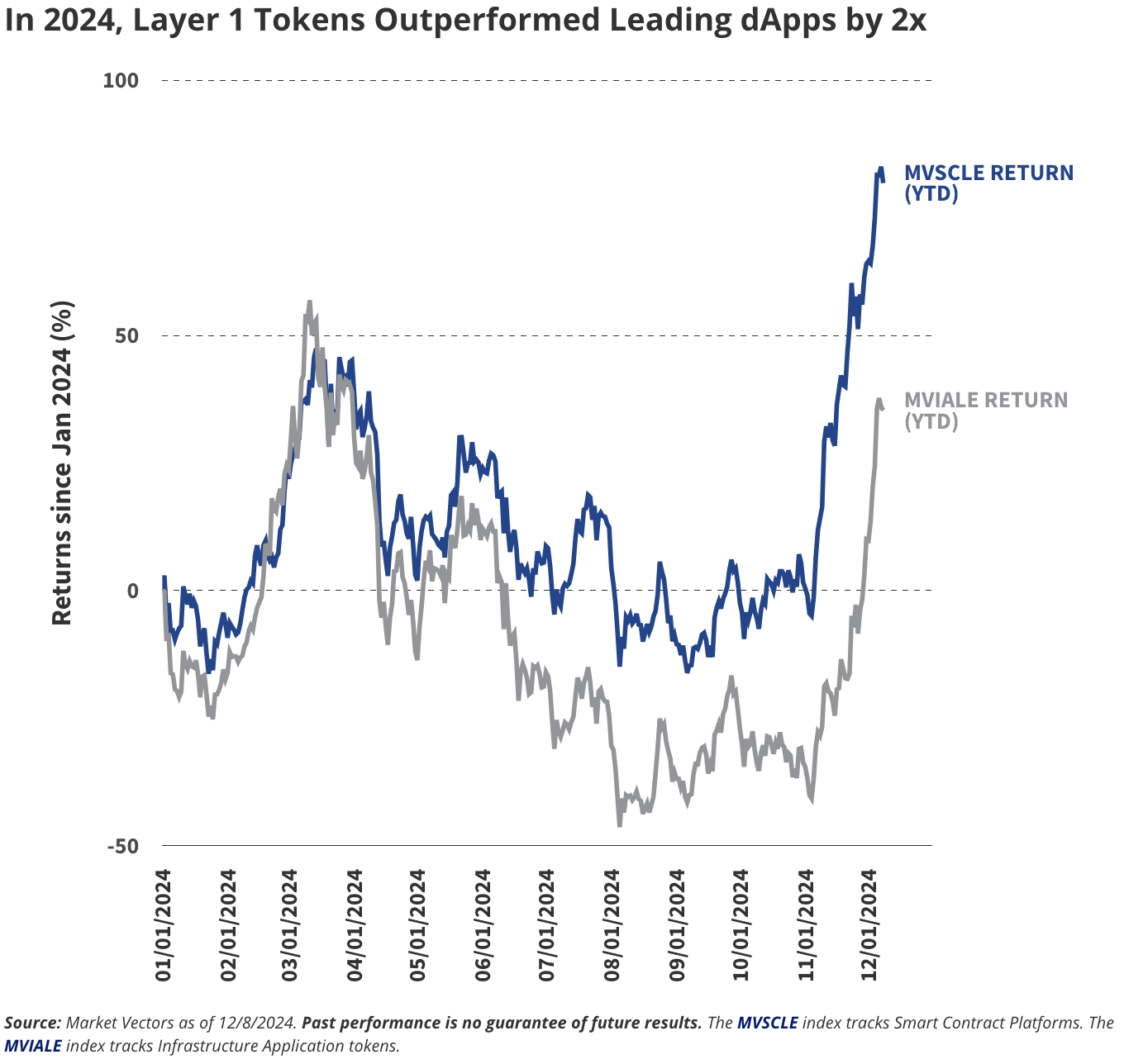

10. dApp Tokens Narrow Performance Gap With L1 Tokens

In 2024, Layer-1 Tokens Outperformed Major dApp Tokens by 2x

Source: Market Vectors, data as of December 8, 2024.

Past performance is not indicative of future results.MVSCLE Index tracks smart contract platforms; MVIALE Index tracks infrastructure application tokens.

A defining theme of the 2024 bull market was the significant outperformance of Layer-1 (L1) blockchain tokens relative to decentralized application (dApp) tokens. For example, the MVSCLE Index, which tracks smart contract platforms, rose 80% year-to-date, while the MVIALE Index tracking application tokens gained only 35% over the same period.

However, we expect this dynamic to shift later in 2024 and into 2025, as a wave of new dApps launches innovative, useful products that create value for their associated tokens. Among key thematic trends, we see artificial intelligence (AI) as a standout category for dApp innovation. Additionally, decentralized physical infrastructure networks (DePIN) projects hold significant potential to attract investor and user interest, helping rebalance performance more broadly between L1 and dApp tokens.

This shift highlights the growing importance of utility and product-market fit in determining the success of application tokens within the evolving crypto landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News