Podcast Notes: Why Does VanEck Predict ETH Could Reach $50,000 by 2030?

TechFlow Selected TechFlow Selected

Podcast Notes: Why Does VanEck Predict ETH Could Reach $50,000 by 2030?

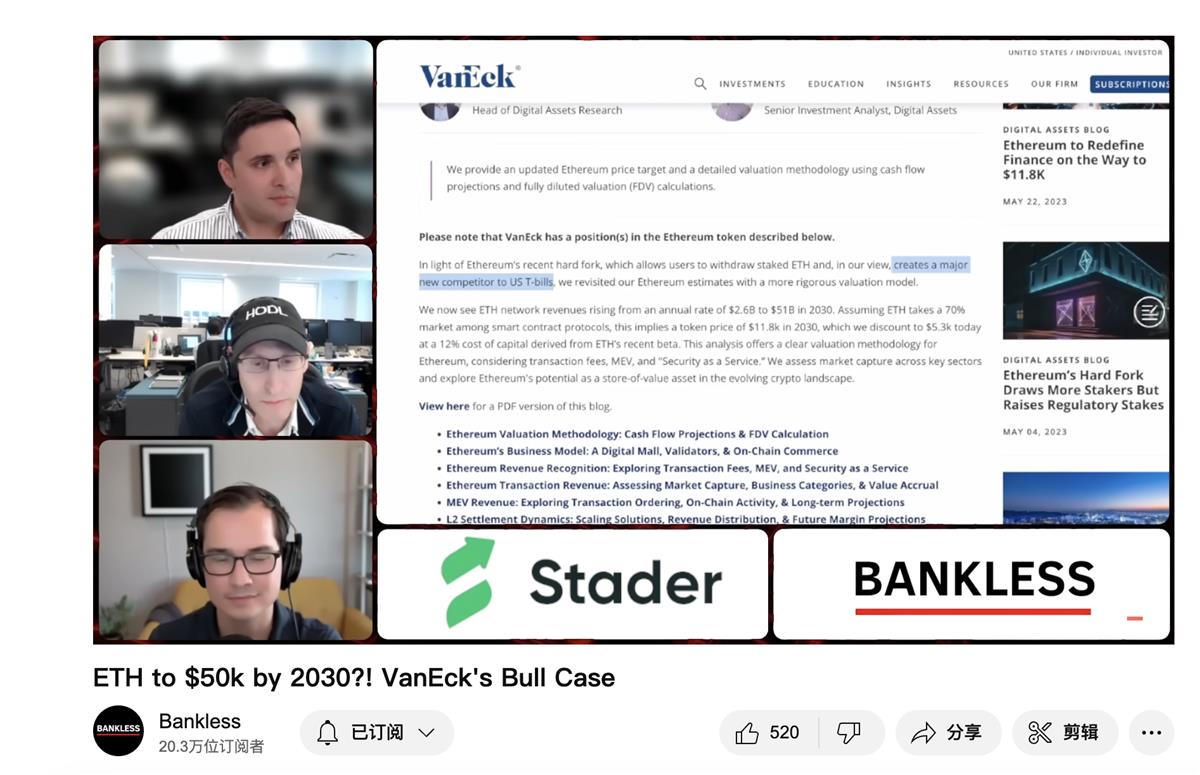

VanEck analysts believe that in a bull market scenario by 2030, ETH's price could surpass $50,000 and become a major competitor to U.S. Treasury bills (T-bills). What theoretical basis supports this forecast?

VanEck’s Bold Claim: ETH Will Compete With U.S. Treasury Bills

Ryan first introduced Matthew Siegel and Patrick Bush from VanEck, a leading global investment firm. Matthew joined VanEck in 2021 and currently serves as Head of Digital Asset Research, leading a team dedicated to cryptocurrency research. Patrick was his first hire—an analyst focused on identifying profitable crypto tokens and building financial models around crypto assets. Ryan brought up the report authored by Matthew and Patrick titled "Ethereum Price Forecast: $11,800 by 2030." He expressed particular interest in their bold assertion that ETH could become a primary competitor to U.S. Treasury bills, and asked Matthew to elaborate on this claim. Matthew began by reviewing VanEck’s history. Founded in 1955, VanEck is a macro-investment firm known for innovative products that capture emerging investment trends. Notably, during the gold boom of the 1970s—when gold re-emerged legally after being banned for three decades—VanEck achieved significant success. Matthew explained that the same forward-thinking spirit led Jan VanEck, the founder’s son and current leader, to recognize Bitcoin as a potential competitor to gold in 2017. This insight prompted VanEck to reinvest profits earned from gold directly into Bitcoin, Ethereum, and cryptocurrency startups. Regarding Ethereum, Matthew said: “VanEck revisited its Ethereum outlook in 2021 following ETH’s hard fork to proof-of-stake (PoS) and the ‘Shapella upgrade,’ which enabled staked ETH to be withdrawn. This upgrade gave VanEck confidence to significantly increase its investment in ETH. Ethereum and other cryptocurrencies represent a major shift in the future of finance—and we view them as the Gordian knot of finance (a legendary knot whose solver was prophesied to become ruler of Asia).” VanEck’s valuation approach is based on Ethereum’s utility, not merely treating it as a high-beta Nasdaq stock. The monetary premium associated with Ethereum changes its valuation multiples, distinct from value accumulated through use cases alone.Uncertainty in Ethereum’s Revenue Model, Price Forecast, and Value Accrual

Ryan shared VanEck’s revenue and price target model for Ethereum from the report, including projections for 2030. Currently, ETH trades around $1,900. By 2030, VanEck forecasts three potential price scenarios: a base case of $11,849, a bear case of $343, and a bull case of $51,000. Ryan asked how these models—based on revenue and cash flow—forecast income. Matthew explained they divided the total addressable market into three segments and studied existing business models and their revenue within each. Based on this, they made assumptions about what percentage of revenue opportunity open-source blockchains could capture: 5% for finance, 20% for the metaverse, and a moderate 10% for infrastructure. To estimate Ethereum’s potential market share across these penetration levels, Matthew said they conducted line-by-line assessments. The idea is that these end markets (finance, metaverse, infrastructure) will view crypto as an opportunity to reduce costs and discover new revenue streams. Currently, large-scale fees paid for blockchain-based payments are proportional to their revenues. Patrick noted this could be a reasonable way to determine fee rates (the fees charged by service providers per transaction). One challenge their model faces is that massive application execution on Ethereum could lead to substantial ETH burning. In some years, widespread adoption might result in 20–30% of ETH supply being burned, creating uncertainty around value accrual on the blockchain. Nevertheless, transactions appear to be Ethereum’s strongest value accumulation mechanism.Ethereum’s Revenue: Transaction Fees, MEV, and SaaS Potential

Ryan raised awareness about Ethereum’s current revenue, noting many people underestimate its revenue potential. Patrick explained they used Ethereum’s gas usage data from the past year and Artemis data to break down different use cases. By analyzing financial transactions and payments, they estimated the percentage breakdown of Ethereum’s current usage. By examining burn rates, base fees (base transaction cost), and TIF fees (effective tip fees), they were able to model transaction revenue. However, estimating MEV (Maximal Extractable Value) revenue remains difficult—they used methods similar to traditional finance, assuming long-term asset utilization rates. Ryan questioned Ethereum’s current annual revenue, given the report projects it could surge to $51 billion by 2030. Matthew stated that Ethereum’s generated revenue can be treated like traditional equity cash flows—subject to taxation and discounted back to present value using a 12% weighted average cost of capital (WACC). Patrick highlighted Ethereum’s high cash flow and profit margins. He believes this makes Ethereum an exciting asset class, free from the high management overhead typical of traditional companies. Matthew expects that by 2030, the market may assign Ethereum a ~30x free cash flow multiple, equivalent to a 3% yield, which appears reasonable. When asked how Ethereum compares to stocks, Matthew replied it resembles growth stocks like Netflix or Amazon, possibly slightly higher. He added that in a leveraged, speculative bull market, the 30x free cash flow multiple could rise to 300x. He compared this to gold, which has almost no free cash flow. He emphasized their model does not assume leveraged bubble conditions but focuses more on cash flow fundamentals. Ryan pointed out that Ethereum’s current annualized total revenue stands at $2.5 billion, primarily composed of transaction fees ($1.9 billion), with additional contributions from MEV revenue and Ethereum Security-as-a-Service (SaaS). Patrick commented on the difficulty of estimating MEV revenue, suggesting $500 million as a reasonable rough estimate. Ethereum sells blocks, experiences congestion, and competitive bidding—all reflected in transaction and MEV modeling. Regarding Ethereum SaaS, he suggested Ethereum could secure new blockchains, oracle networks, or contract protocols, meaning this new value should also be factored in.Ethereum’s Potential: Valuation, Investment, and Regulation

Ryan compared Ethereum’s valuation model to the discounted cash flow (DCF) model used for stocks. VanEck’s report predicts Ethereum’s annual revenue could reach $50 billion by 2030, potentially driving ETH’s price to $12,000. He then asked how VanEck’s Ethereum model could appeal to institutional investors, who traditionally evaluate non-cash-flow assets like commodities (e.g., gold). Matthew agreed with Ryan’s assessment of differing valuation models between commodities and crypto assets. He emphasized that Ethereum’s transition to proof-of-stake enabled analysis of underlying cash flows, which he attributes to Ethereum’s strong performance. Matthew noted that regulatory challenges have limited institutional investment in the U.S. crypto market, primarily due to obstacles from the SEC. Ryan asked whether lack of institutional participation is a global issue or specific to the U.S. Matthew responded that while most pronounced in the U.S., this trend is broadly global—for example, banks generally do not participate in crypto markets. Matthew discussed the potential for countries to adopt Ethereum and Bitcoin. Given Ethereum’s smart contract functionality, he believes intellectually advanced nations may favor Ethereum. However, national-level adoption of Ethereum may take longer than Bitcoin. Ryan observed that institutions hesitate to invest in crypto due to regulatory uncertainty—not due to lack of understanding. Clearer regulation, especially within global banking systems and particularly in the U.S., could encourage institutional interest. With comprehensive reporting and transparency, family offices and high-net-worth individuals may be more willing to engage with crypto.Bear and Bull Scenarios for Ethereum’s Future: Model Variables and Assumptions

Ryan reviewed the possible bear and bull scenarios by 2030. The bear case suggests Ethereum’s annual revenue grows only modestly to $2.5 billion, with ETH price falling to $343. Conversely, the bull case envisions annual revenue surging to $136 billion, targeting an ETH price of $50,000. He asked Patrick what variables and assumptions drive these divergent outcomes in the model. Patrick explained the model accounts for market adoption of crypto. The base case assumes 5% of bank revenue allocated to crypto and public blockchains, adjusted to 10% in the bull case and 1% in the bear case—reflecting shifts in regulation or adoption curves. The value Ethereum captures from Layer-2 settlements is crucial. They assume numerous undifferentiated L2s will emerge, making Ethereum a monopolistic settlement layer, while MEV correlates with underlying business adoption and on-chain activity. Given the winner-takes-all nature of digital platforms, Matthew assumed ETH would capture 70% of the open-source blockchain market share. Ryan summarized the key layers of the model: global crypto adoption rate, Ethereum’s market dominance, and L2 structure—where Ethereum’s position strengthens as more decentralized L2s emerge. Patrick clarified the third point in their model: Ethereum is estimated to capture 3% of foundational banking revenue. The fourth layer considers the split between L2s and Ethereum, with Ethereum serving as the settlement layer and L2s handling transactions—the revenue split depending on dynamics between L2s and Ethereum.Decoding Ethereum: Layer-2, Bitcoin, and Monetary Value

Ryan asked about potential risks to Ethereum, such as Layer-2 solutions becoming overly dominant. Matthew believed diverse Layer-2 solutions benefit Ethereum. His concern lies in potential value capture scenarios—such as Arbitrum acquiring Prysmatic Labs. Ryan asked if they had analyzed L2 tokens. Matthew said their focus leans more toward Layer-1 or application-specific projects, as there is greater uncertainty around L2s. Before making major bets on L2s, they are waiting to observe developments in on-chain farming and user activity. Patrick expressed interest in studying user migration from Ethereum to L2s, which is part of ongoing analysis at VanEck. Ryan asked whether their modeling approach for Bitcoin is similar to Ethereum’s. Matthew said they treat Bitcoin as a unique asset, comparable to gold. He noted that if cash flow dynamics change due to Bitcoin-based L2 development, they may need to reassess this view. Ryan proposed comparing Bitcoin to gold and Ethereum to bond markets. Matthew responded that ETH is more akin to high-growth equities. Ryan asked about Ethereum’s potential as a gold model—could there be a hybrid model combining Ethereum’s fundamentals with gold’s monetary premium? Matthew explained they’ve already incorporated certain monetary factors into their ETH valuation via staking revenue streams. However, he doubts any nation-state will buy $ETH in the short term, though doing so would significantly boost Ethereum’s monetary value. Ryan mentioned discussions within the market and VanEck team about how much monetary premium Ethereum should carry relative to Bitcoin. Patrick noted Bitcoin’s monetary advantage stems from its fixed supply and immutability. However, he views Ethereum’s value proposition as a transparent, alternative financial system. He believes Ethereum itself shouldn’t carry a monetary premium, though it could be reflected in $ETH’s valuation multiples if necessary.Revenue and Risks for Layer-1s

Ryan asked how modeling another Layer-1 like Solana or Cosmos’ Atom might compare to ETH, and whether those chains’ total revenues might be significantly lower. Patrick said they apply the same principles when evaluating these Layer-1 solutions. Ethereum, Solana, and Cosmos may differ in ecosystem revenue capture ratios. In his view, Solana—as a single monolithic execution layer—might achieve higher ecosystem value capture, whereas Atom, due to its revenue-sharing model, may capture less, placing Ethereum somewhere in between. Matthew explained that under certain assumptions—such as Solana capturing 70% of all open-source blockchain activity—Solana could have greater upside potential, but also higher risk. He also noted that MEV constitutes a much larger portion of Solana’s revenue line, indicating centralization concerns. Patrick raised another potential issue with Solana: proprietary clients created by large proprietary trading firms like Jump Crypto, which could impact Solana’s value capture capability. Ryan questioned whether SOL token holders benefit from MEV, and what happens if those benefits are diverted through other channels. Patrick responded that execution on Ethereum and even Atom largely occurs on L2 chains, raising the question: how much value actually flows back to Ethereum? If multiple L2s compete for Ethereum’s block space, they may have to share significant revenue with Ethereum. Ryan discussed how non-Ethereum Layer-1s compete with Ethereum and Ethereum’s L2s, questioning whether lower-revenue chains like Solana can continue to grow. Matthew emphasized that this is still an asset class requiring capital inflows. He highlighted that Ethereum is an exception in an otherwise inflationary crypto ecosystem. Due to underinvestment in reliable energy and politics, Matthew issued a warning about the current market. Investors now prioritize cash flow and are reluctant to buy speculative assets without substantial cash generation. Alternative L1s without cash flow are therefore at a disadvantage. While Matthew prefers profitable blockchains, he remains cautious about macroeconomic shifts that could affect speculative chain investments.VanEck’s Cryptocurrency Investment Strategy

Ryan asked how these models influence VanEck’s investment strategies and how confident they are in the models’ reliability. Matthew outlined two strategies at VanEck. The Beta strategy aims to outperform a Layer-1 index, with approximately 50% of the portfolio allocated to ETH. VanEck’s Alpha strategy focuses on the top 20 tokens with clear value accrual and product-market fit, where ETH may hold a smaller allocation due to its relatively limited upside compared to more volatile tokens. This strategy also emphasizes themes like stablecoins, NFTs from traditional companies, and DeFi. Patrick agreed with Matthew, stressing the importance of understanding a system’s potential when sizing positions. He emphasized ETH as the benchmark in their token strategy, aiming to outperform Bitcoin. Ryan asked for their outlook on the future of the crypto market, particularly regarding the possibility of another bull run. Matthew explained they left traditional finance because they believe decentralized systems offer enormous upside. While acknowledging political and inflation-related challenges, he expects these to ease soon. He anticipates a shift in the U.S. political landscape next year, along with changing conditions for Bitcoin, potentially triggering an adoption cycle driven by non-U.S. nations. Patrick added that the current market phase tests investor conviction, exposing the emptiness behind some initial beliefs. Yet, he remains optimistic about the future, citing continuous innovation and vast potential within the crypto space. Despite expecting further challenges, he maintains strong optimism about cryptocurrency’s long-term future. Podcast source link: https://www.youtube.com/watch?v=iyCr0BEAuMg&t=603s Full text of VanEck’s Ethereum valuation report: https://www.techflowpost.com/article/detail_12077.htmlJoin TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News