VanEck Solana Valuation Report Full Text: SOL Could Reach $3,211 by 2030

TechFlow Selected TechFlow Selected

VanEck Solana Valuation Report Full Text: SOL Could Reach $3,211 by 2030

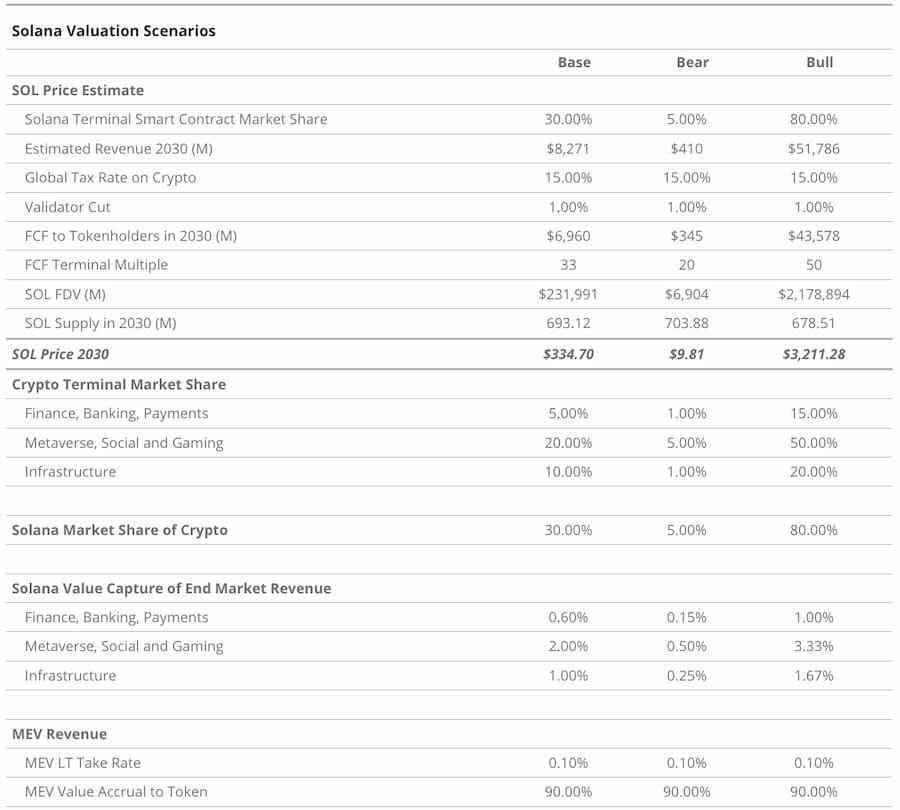

Three valuation scenarios for Solana by 2030 according to asset manager VanEck.

Authored by: Patrick Bush, Senior Digital Assets Investment Analyst & Matthew Sigel, Head of Digital Asset Research, VanEck

Translated by: Karen, Foresight News

By 2030, VanEck’s Solana valuation framework projects a price range for SOL from a bear case of $9.81 to a base case of $335 and a bull case of $3,211.28, depending on varying market share and revenue forecasts across key industries.

-

In this research, we model a scenario where Solana becomes the first blockchain to host a single application with over 100 million users.

-

We assume SOL’s take rate is only 20% of ETH’s, and due to fundamental philosophical differences, its market share remains less than half of Ethereum’s.

-

We see a credible path toward $8 billion in annual income for SOL token holders by 2030.

Table of Contents

-

Solana's Approach: Usability;

-

Solana vs. Ethereum: Philosophical Contrast;

-

Solana’s Cost vs. Revenue Challenges;

-

2023 Solana Valuation Scenario Overview;

-

Projected Transaction Landscape for Solana by 2030;

-

Solana’s Potential: Risks and Returns.

Smart contract platforms (SCPs) aim to host applications that enable users to participate in efficient, censorship-resistant economic activity while minimizing third-party rent extraction from these activities.

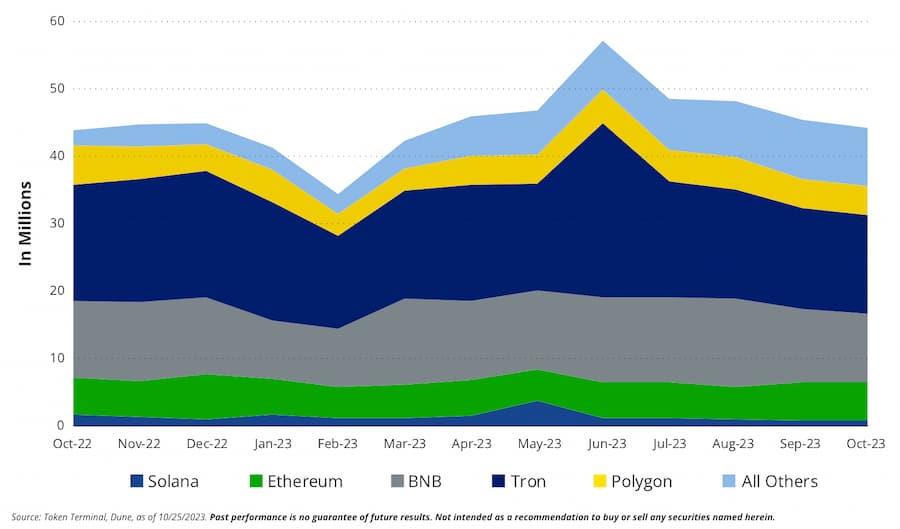

Despite the proliferation of blockchains today, all have relatively small user bases compared to off-chain transaction volumes. There are approximately 5.5 million daily active unique addresses and about 44 million monthly active unique addresses across smart contract platforms.

However, these figures likely overstate actual user counts, as many users control multiple addresses. Even accepting these numbers at face value, they remain low relative to 2 billion daily Facebook interactions or 431 million monthly PayPal users.

Blockchain adoption has been slow because using blockchains still involves friction, and there are few meaningful use cases beyond value transfer and speculation.

For crypto to achieve broad adoption and scale its current $1.3 trillion market cap, it needs practical appeal for individuals and businesses who are neither decentralization extremists nor libertarian ideologues — in short, it needs a killer application.

The blockchain hosting such a killer app would benefit enormously from the associated activity. In this report, we model a scenario where Solana becomes the first blockchain to host a single application attracting over 100 million users.

SCP Monthly Active Users

Solana’s potential begins with its founding team combining radical experimentation with applied science to dramatically improve blockchain scalability.

While other blockchains have chosen scaling paths that cleverly sidestep the limitations of distributed ledgers, Solana pushes the boundaries of technical feasibility and works backward from there.

The Ethereum ecosystem and many others pursue a modular vision, where different blockchains specialize in core Layer 1 functions.

In contrast, Solana continuously optimizes every component of its blockchain to achieve higher transaction throughput and extreme efficiency.

As a result, Solana holds a significant advantage over traditional competitors in processing capability. More importantly, Solana translates its pioneering spirit into an ecosystem philosophy centered on risk-taking and technological optimism.

Solana has fostered fascinating experiments, including blockchain phones, NFTs containing apps, and consumer-facing products like decentralized maps and vehicle data collection.

Compared to other ecosystems, builders on Solana are creating things more likely to meaningfully impact daily life.

Solana’s Path: Usability

A blockchain’s probability of hosting the next “killer app” depends on how quickly, easily, and accessibly it enables application usage. The better it performs here, the stronger the environment for users.

The key challenge lies in measuring blockchain capacity and translating it into usability. A commonly used metric—transactions per second (TPS)—is inadequate and easily manipulated.

In reality, blockchain teams can manipulate TPS through various tricks: altering data size per transaction, abandoning transaction ordering, or limiting which parts of the ledger transactions can modify.

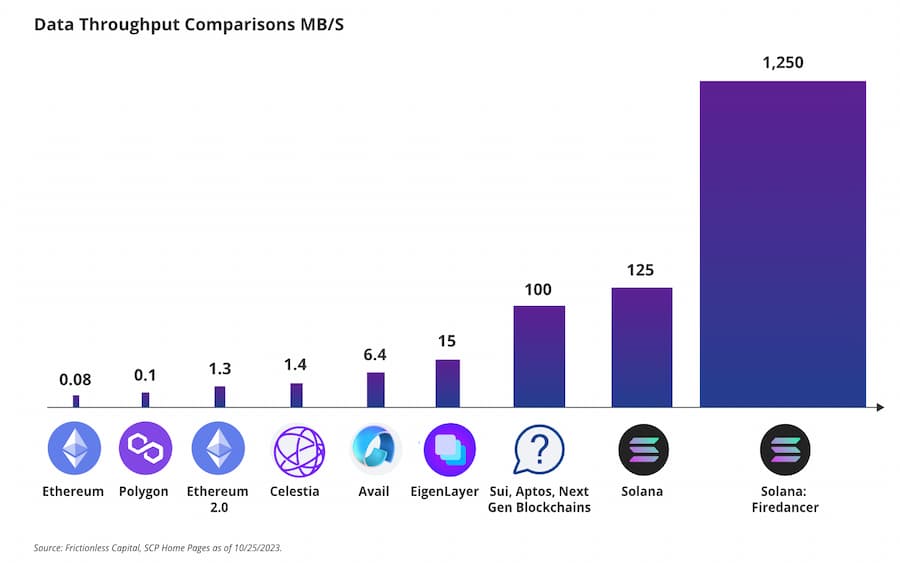

In fact, the best measure of blockchain capacity is not TPS but data throughput.

Data throughput refers to a blockchain receiving, processing, and ordering data, then reaching consensus on its effect on the ledger.

It is measured by the volume of data a blockchain can receive and apply within a given time frame.

Currently, Solana’s data throughput exceeds any other existing blockchain. Indeed, Solana’s data capacity surpasses most planned blockchains, and its upcoming major software upgrade—Firedancer—is expected to increase Solana’s current capacity tenfold. While we don’t know exactly how much data the next killer app will require, we can imagine that over 100 million users will push scalability to the limit.

Data Throughput Comparison MB/S

Solana leverages this data throughput to address user concerns. Compared to most other chains, Solana provides faster feedback due to continuous transaction processing.

Take Ethereum: it batches user-submitted transactions into a waiting area called the mempool. Validators (or block builders under the new paradigm) then select and order transactions based on offered fees. Every 12 seconds, transactions are executed and the resulting block is transmitted to other nodes. Thus, Ethereum processes transactions in discrete intervals.

This method is significantly slower than Solana’s, leading to longer wait times. On Ethereum, users must wait for the entire process to complete before knowing if their transaction succeeded—often taking several minutes.

In contrast, Solana begins processing immediately, with finality in about 2 seconds.

Applications on Solana

To further enhance user experience, Solana introduced a novel feature called“local fee markets.”

If a blockchain is likened to a data pipeline from users to the ledger, Solana’s local fee markets act as internal sub-pipelines, allowing information from different users to flow simultaneously to different parts of the ledger.

This solves a core issue on Ethereum and similar chains: heavy usage of one app slows down all others.

For example, on Ethereum, if many users mint an NFT, the resulting congestion may prevent others from borrowing on AAVE. For a killer app, users need consistent interaction with the blockchain.

In contrast, Solana uses “local fee markets” to segment these pipelines and charge different prices based on demand. Even during high load for one app, many others can still access Solana.

This is especially important because a killer app might rely on simultaneous interaction with many different applications.

Additionally, the ability to adjust “local fee markets” to price different transaction types could be key to Solana dynamically adjusting prices based on usage. This might allow Solana to differentiate pricing based on each transaction’s economic value.

Local fee markets could help killer app developers more accurately assess their costs.

Solana vs. Ethereum: Philosophical Contrast

Solana was built by engineers fromQualcomm, applying their expertise in enhancing mobile network capacity to create a high-performance blockchain.

The Solana team’s guiding principle is building a network assuming consumer-grade computing power grows with Moore’s Law and network bandwidth expands accordingly. Thus, Solana is designed to leverage hardware advancements more directly than competitors.

We view this as an optimistic belief in continuous future progress. The core conviction is that blockspace—the amount of data that fits on-chain over time—should be extremely cheap. This enables software engineers and entrepreneurs to cheaply test new blockchain use cases. This contrasts sharply with Ethereum’s paradigm, where success depends on ETH serving as the primary (and only) collateral securing all chains.

Solana was initially conceived as a “decentralized Nasdaq.” While that vision remains viable, the emergence of compelling non-financial consumer apps like Hivemapper, Render, and Helium has expanded perceptions of Solana’s capabilities.

The Solana team deserves credit for embracing innovative applications of its technology. They’ve explored bringing blockchain to phones via SMS or the Solana Mobile Stack, enabling developers to build mobile blockchain apps. Their experiments even led to creating phones optimized for blockchain use.

Though criticized as a distraction from Solana’s core mission, the phone demonstrates Solana’s commitment to solving fundamental user problems. This consumer focus helped Solana form partnerships with Shopify, Visa, and Google to explore new use cases and grow its ecosystem.

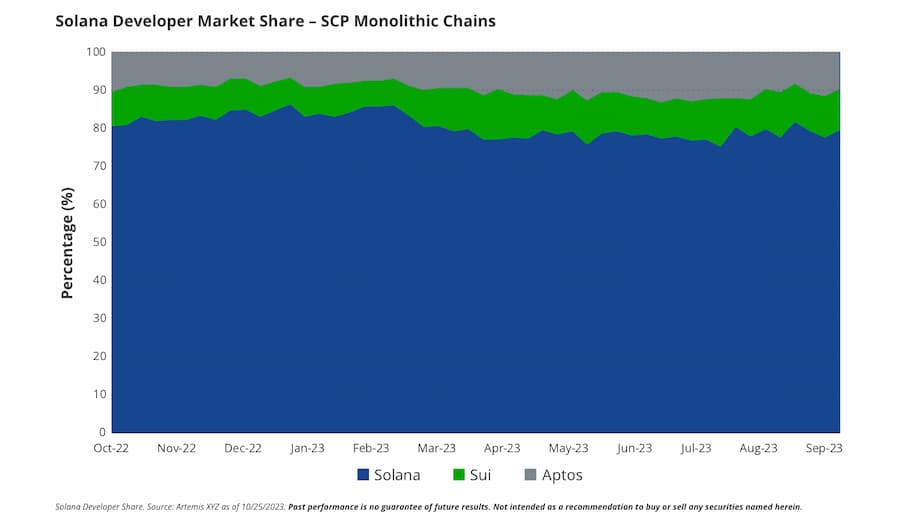

Solana Developer Market Share

Solana’s Cost vs. Revenue Challenge

Solana’s focus on cheap blockspace, experimentation, and cutting-edge tech isn’t without drawbacks. While cheap blockspace fosters ecosystem growth by providing nearly cost-free sandbox environments, we must remember that providing it still incurs costs.

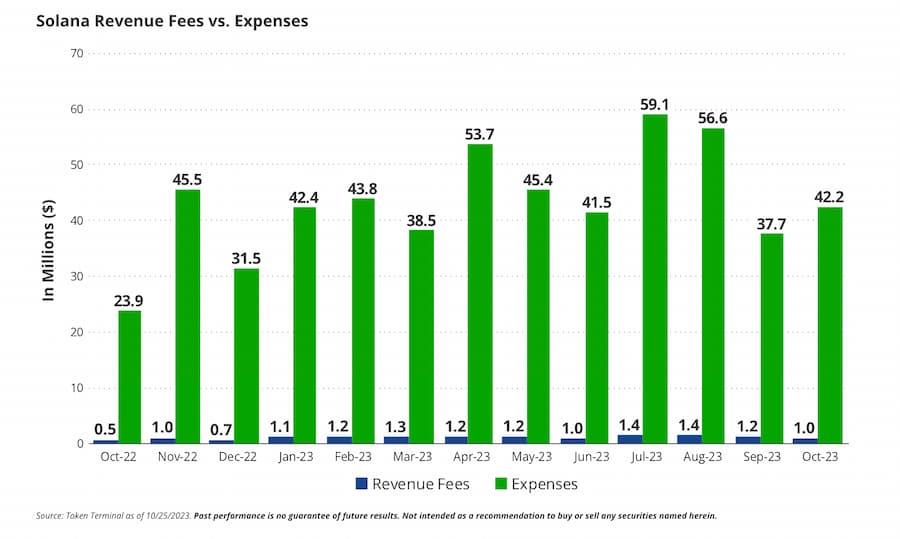

Over the past 30 days, Solana generated $1.26 million in fee revenue, but同期 spent $52.78 million protecting its blockchain by paying validators with SOL inflation.

Although Solana won’t collapse in the short term due to lack of “profitability,” long-term security costs must eventually be covered by organic SOL demand from the ecosystem.

This is because Solana validators sell part of their inflationary rewards to cover operational expenses like hardware, labor, and connectivity (we exclude voting costs here).

Solana Revenue Fees vs. Costs

We estimate total non-blockchain operating costs for Solana’s 1,977 validator nodes at $11.8 million annually, excluding labor. We thus treat this as a minimum estimate of annual SOL sell pressure.

On the revenue side, half of fee income ($630k) is burned, representing buy-side pressure on SOL (the other half goes to validators and stakers and may be offset by sales).

Based on this simplified buy/sell dynamic, there is a net imbalance of -$11.17 million, representing buy pressure needed to offset collective validator selling.

In practice, this sell pressure has been offset by speculative capital inflows.

Thus, until fee revenues improve, Solana’s current operation relies on continuous inflows of speculative capital.

Long-term pricing of Solana’s blockspace and usage costs presents another challenge. Monolithic chains like Solana struggle to extract value from users and return it to token holders.

This stems from Solana pricing transactions based on required computation, total computational demand, and regional congestion on the network.

While resource-based pricing makes economic sense for allocating network resources, it fails to effectively price diverse user operations.

For example, sending an order to CME is essentially free.

Yet CME and similar exchanges charge traders upon execution, sometimes varying fees based on whether the trade passively provided liquidity or actively took it. Similarly, posting on a Twitter-like platform is free, but promoting posts or targeting users incurs higher fees.

In isolation, such pricing may not be ideal for value extraction, but it's not critical.

However, in a world with thousands of blockchains, each tailored to specific use cases, specialized chains may capture value more efficiently for token holders.

If weak SOL prices cause Solana’s security budget to fall below requirements, it could threaten economic sustainability.

Likewise, blockchains will want to ensure limited resources are allocated to economically beneficial activities.

Mispriced resources may lead to networks being flooded with economically harmful activities—even with local fee markets. This has already occurred, disrupting legitimate use cases. During periods of hundreds of transactions per second, low-value arbitrage trades often congest the network. Local fee markets may alleviate this, but whether such improvements scale adaptively under significantly increased usage remains uncertain.

We greatly respect Solana and its team’s vision and experimental spirit, but its architecture has produced adverse outcomes affecting technical stability.

Although Solana achieved 100% uptime after key upgrades post-March 2023, prior to that it experienced several outages halting network functionality entirely.

Between January 2022 and February 2023, Solana had outages in 7 of 13 months. The most recent outage occurred on February 25, 2023, lasting nearly 19 hours.

The root cause of these outages lies in Solana running an experimental system.

Solana’s consensus mechanism hasn’t undergone formal verification, and due to the massive data volume processed, future failure modes cannot be predicted from design alone.

Despite numerous mitigations implemented, Solana’s design may harbor unforeseen complexities that only manifest during failures. Thus, the team still considers the chain in “beta,” as future faults could arise from unpredictable causes.

Given Solana’s complexity and data load, resolving such issues may take considerable time.

Clearly, this situation is unacceptable for financial and non-financial enterprises considering deployment on Solana. Unpredictable uptime contributes to Solana’s relatively low TVL (total value locked) in DeFi compared to peers.

Although the team has implemented key fixes, network fragility will remain a concern in the foreseeable future, and the new Firedancer design may even increase the risk of irreconcilable issues.

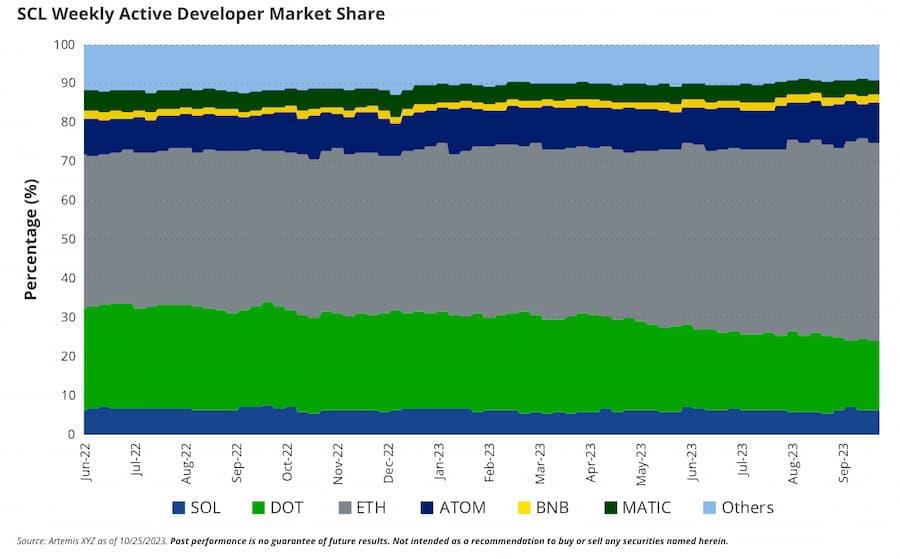

SCL Weekly Active Developer Market Share

Finally, we question Solana’s ability to attract developers. Due to the complexity of the Solana Virtual Machine (SVM) and overall design, building on Solana remains challenging.

Indeed, building on Solana is difficult—so much so that founder Anatoly likened it to “chewing glass.” Partly because Solana developers must master Rust, a language with 2.2 million active developers, versus Ethereum’s ability to draw from 17.4 million JavaScript developers. Despite major progress in developer tooling, Solana’s high programming barrier keeps its share around 6–7% of weekly active crypto developers over the past 18 months.

Considering Solana lost its biggest backer, FTX/Alameda, in November 2022, maintaining stable developer share is commendable—but increasing both total developers and market share is essential to boost chances of hosting a breakout app.

2023 Solana Valuation Scenario Overview

Applying VanEck’s standard valuation framework to Solana, we arrive at a base case token valuation of $335 by 2030. This estimate is derived by forecasting a terminal valuation multiple based on projected real returns to SOL token holders.

This real return is calculated from projected cash flows returned to SOL holders. The multiple is then applied to the final year’s token FCF (free cash flow) and divided by the expected number of tokens in that year.

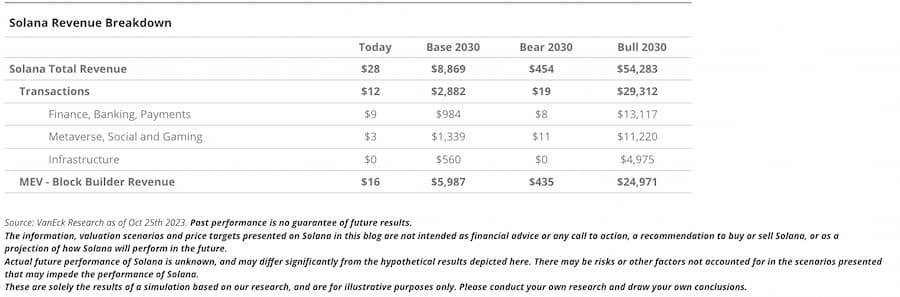

More specifically, our framework first examines Solana’s different revenue streams.

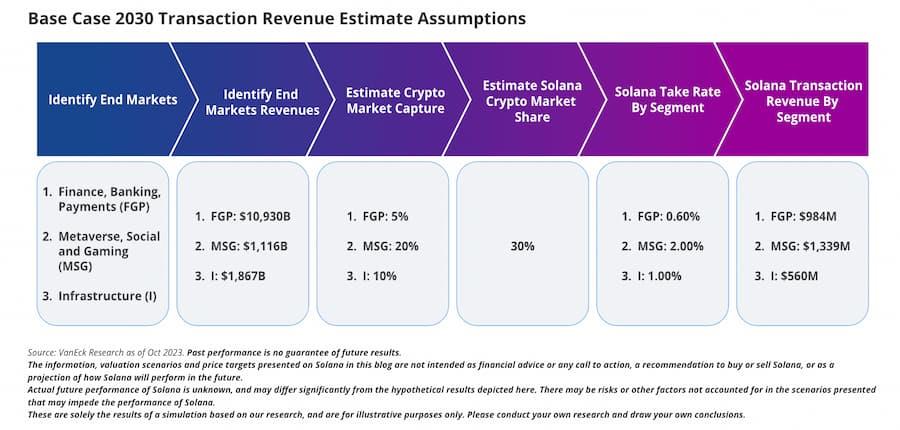

First isadoption rate in end-market activity. We identify end-markets likely to utilize public blockchains (e.g., Ethereum and Solana).

These fall into three main categories:

-

Financial, Banking, and Payments (FBP),

-

Metaverse and Gaming (MG),

-

Infrastructure (I).

Depending on context, we assume a portion of business activity—and its revenue—will stem from blockchain operations, leveraging blockchains to find customers, launch products, reduce costs, or streamline backend functions.

Since public blockchains resemble Web 2.0 platforms like Amazon, Apple App Store, and Uber, we assume they capture an effective take rate of total GMV (gross merchandise value) in their respective end markets (i.e., GMV-to-platform-revenue conversion).

In our base case, we assume blockchain adoption is 1/5 that of Ethereum equivalents. Thus, Solana’s total revenue from end-market transactions reaches $2.88 billion.

Additionally, we include MEV (Maximal Extractable Value) as a revenue stream, effectively flowing from traders to validators and ultimately to token holders. We estimate MEV by multiplying assets locked in Solana DeFi by an annual take rate.

Furthermore, we consider MEV as a revenue item flowing from trading entities to validators and finally to token holders. We calculate MEV by estimating total assets locked in Solana DeFi and multiplying by an annual take rate.

In the base case, we find MEV revenue reaches $5.99 billion by 2030. Once we have raw revenue, we subtract assumed tax rates and approximate costs for validator operations within the ecosystem.

2030 Transaction Revenue Estimate Assumptions

Base Case 2030 Transaction Revenue Estimate Assumptions

Despite its potential, we believe Solana’s likelihood of hosting most global crypto transactions by 2030 remains lower than Ethereum’s.

Solana’s network and execution engine enable higher throughput and greater potential, but it lacks momentum in user and developer adoption.

Currently, Solana holds only a small fraction of the $4.08 billion TVL within the broader $40.8 billion crypto ecosystem, and its share of daily active users is low—184,000 out of 5.5 million.

We also believe that as public blockchains gain wider adoption, new developers entering the space may not feel tied to existing ecosystems or ideological about decentralization.

Thus, future developers may gravitate toward next-generation blockchains offering novel development frameworks, features, and capabilities—just as in previous crypto cycles. Hence, in our base case, we project Solana’s adoption at ~30%, a significant increase from current levels but far below Ethereum’s base case of 70%.

This comparison is appropriate because Ethereum’s ecosystem growth exhibits a black-hole-like effect, absorbing ideas and increasing its share among blockchain developers.

Notably, our $11,800 price target for Ethereum assumes it captures 70% market share in value transmission across open-source blockchains.

If Solana avoids falling into Ethereum’s event horizon and achieves similar dominance, our bull case shows 2030 revenue of $51.8 billion and a price target of $3,211.

Regarding value capture from end-market blockchain revenues, we believe Solana’s potential lags behind Ethereum’s. In our base case, we assume Solana captures 20% of Ethereum’s GMV value. This assertion stems from Solana’s simpler value capture framework and founder Anatoly Yakovenko’s philosophical preference for abundance over scarcity.

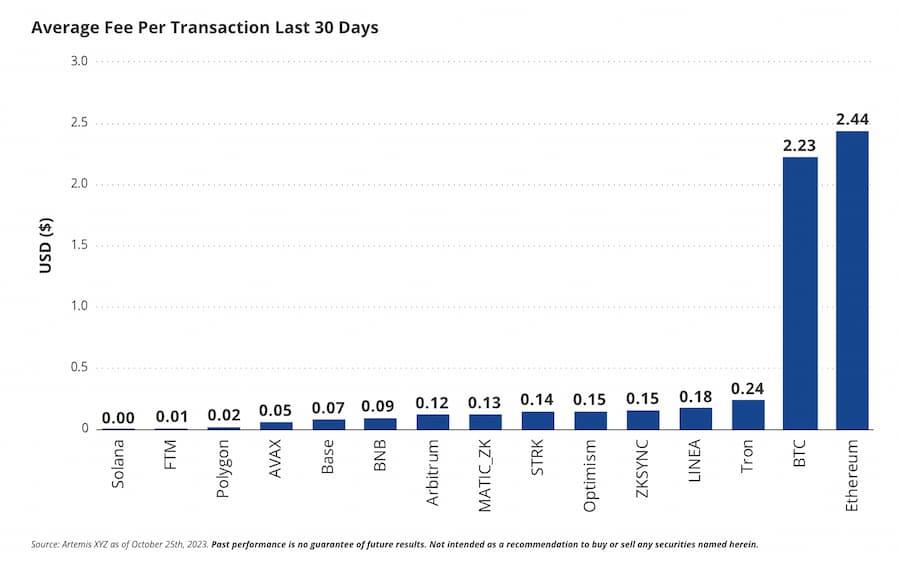

An abundance-over-scarcity outcome means blockspace stays cheap, keeping transaction costs very low. Mathematically, this implies Solana’s take rate on GMV would be ~0.60% for FBP, 2.00% for MSG, and 1.00% for I.

Average Fee Per Transaction Over Past 30 Days Across Networks

The key question is: “How can Solana profit long-term given its low transaction pricing?” Currently, fees are so small that massive transaction volume is needed to boost revenue.

In our base model, we project ~$600 billion in annual transaction volume by 2030, derived from assumptions about Solana’s end-market share and average transactions per user. Based on this, we estimate 534 million monthly active users.

Although in our base case MEV will be Solana’s largest value capture mechanism—accounting for 67.5% of total revenue—we believe Solana could still enhance token value through other mechanisms even if usage falls short of projections.

As previously noted, a blockchain must be cheap enough to encourage widespread use while ensuring validators earn sufficient compensation.

Chains like Solana fund security budgets via inflation—payments to validators that dilute existing token holders.

Without sufficient economic activity or if on-chain activity is underpriced, relying solely on inflation for security is unsustainable. This cannot continue indefinitely.

While raising transaction prices would almost certainly reduce throughput, if economically valuable activity exists, Solana should reasonably capture some of that value.

Additionally, Solana could reduce effective SOL supply by increasing fees for deploying apps, wallets, NFTs, or storing data on-chain.

On Solana, any entity deploying code or operating a wallet must pay fees in SOL based on storage size. Users can opt out of ongoing fees by holding enough SOL to cover two years of rent.

With storage priced at 0.00000348 SOL per byte and wallet data at 372 bytes, each active wallet holder must lock up 0.0026 SOL. Similarly, apps and token smart contracts must maintain these balances.

A program like Serum (~340KB) must hold 2.4 SOL to avoid rent. Solana could significantly increase these balances, effectively reducing circulating SOL supply.

Of course, such changes to rents and transaction costs would violate current protocol principles controlled by Solana’s founding team. Moreover, Solana lacks governance mechanisms to make such decisions—though recently some validators proposed introducing token-based voting governance. By 2030, we believe Solana will adopt token voting for governance, strengthening SOL’s economics if the ecosystem thrives.

Solana’s Potential: Risks and Returns

Solana is indeed a compelling project dedicated to improving user experience by pushing the boundaries of blockchain possibilities, offering the right functionality for developing the next killer app.

Moreover, the Solana team are giants in the field, whose contrarian thinking has birthed one of today’s most powerful blockchains.

Through continuous innovation, their experimental and optimistic ethos has permeated a small yet creative, consumer-focused application ecosystem.

Above all, Solana’s community possesses strong identity and resilience, enduring major setbacks that might collapse many other blockchain ecosystems.

Unlike Ethereum and its proponents focused on modular blockchain components, Solana chose a different path—building an integrated blockchain that combines these components into a unified data throughput machine.

This is a daunting task, and the Solana team started from a position of relative weakness, with fewer developers, lower TVL, less VC funding, and smaller foundation capital compared to EVM-compatible chains. Likewise, they still face significant challenges regarding the long-term stability of their technical approach.

Nevertheless, even with end-market share and take rate assumptions far below those for Ethereum, our model yields greater upside potential for SOL in the base case.

Therefore, we believe it is reasonable to assign a significant weight to SOL tokens in investor portfolios.

Solana Valuation Scenarios

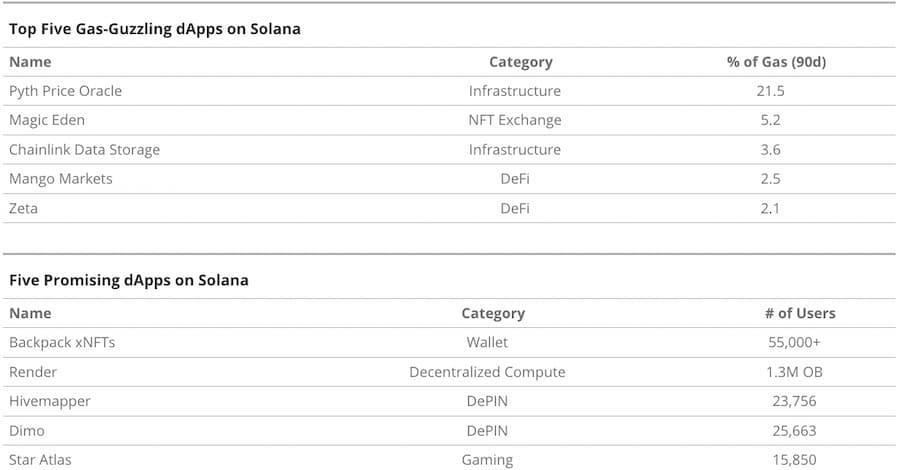

Top 5 Gas-Consuming dApps and Top 5 Most Promising dApps on Solana

Disclosure: The VanEck team holds SOL tokens and positions in other Solana-based applications (e.g., Hivemapper, Helium, and Render).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News