Why should you learn to sell coins and improve your life during a bull market?

TechFlow Selected TechFlow Selected

Why should you learn to sell coins and improve your life during a bull market?

You'll gain a benefit that cannot be measured in money when you sell at a point sufficient to change your life.

Author: Route 2 FI

Translation: Luffy, Foresight News

If you have unrealized gains that could change your life, listen to me: you need to sell. This isn’t just advice—it’s a lesson I learned the hard way. Early in my trading career, I hesitated repeatedly about taking profits, and I regretted every single moment of indecision. Nominal wealth may fluctuate throughout our trading journey, but one principle remains constant.

One thing I’ve come to realize is that selling when it can change your life brings an immeasurable benefit: permanently improving your life and the lives of those around you. Imagine being able to instantly elevate your living situation with just one click of "sell." That’s powerful! If you have such an opportunity, I strongly urge you to take it.

I know how tempting it is to wait for the perfect exit—believing that if you just hold on a bit longer, you’ll make even more. But the truth is: the perfect timing is an illusion. The most successful traders I know didn’t get there by perfectly timing every peak. They succeeded through consistent profit-taking and maintaining liquidity. They understood early on that converting holdings into cash is essential for survival in this game.

One of my most liberating realizations is that opportunities will always exist. This mindset helps ease the fear of missing out (FOMO) that traders often feel when considering a sale. Yes, letting go of a well-performing position might feel uncomfortable, but remember: holding onto it out of FOMO will cost you far more in the long run.

I often think about what it means to reach “escape velocity”—a financial state where you can take calculated risks without jeopardizing your stability. Once you reach that level, only then can you truly start playing the game and going all-in.

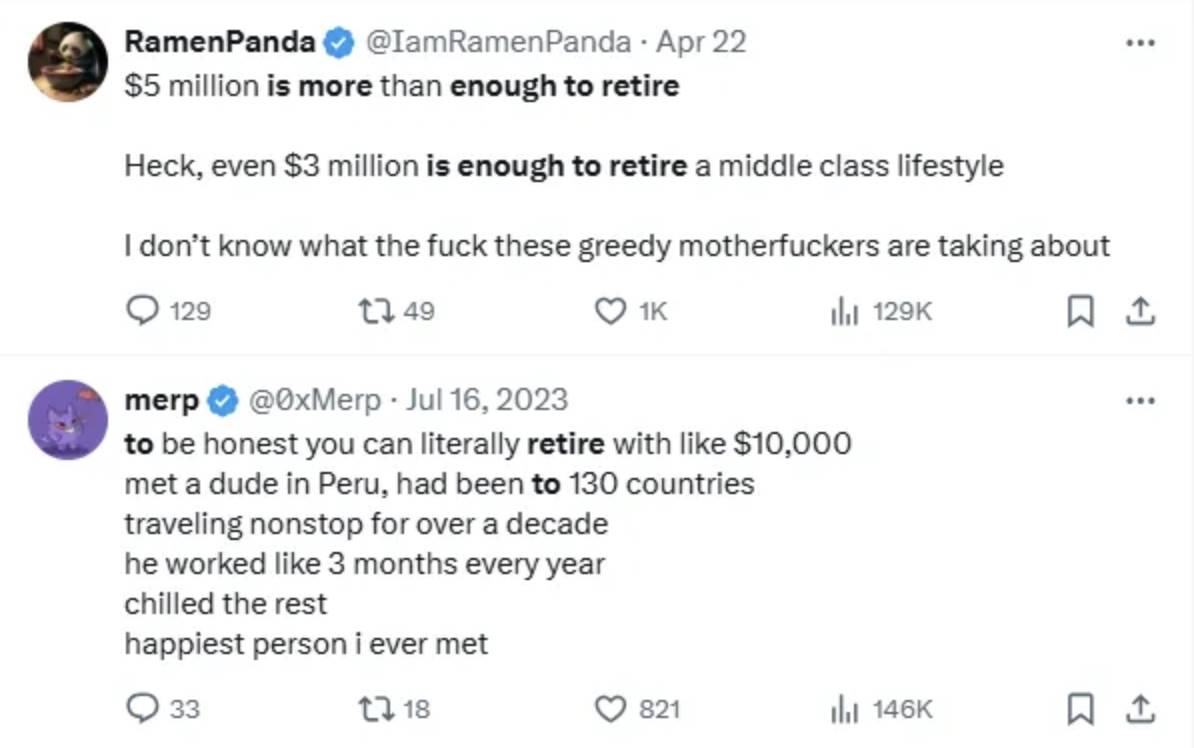

How Much Is Enough to Retire?

As someone who’s constantly thinking about retirement, I often ask: How much is enough? While the media often portrays it as needing an astronomical sum, I believe for many of us, $1–2 million is actually the sweet spot. Here’s why—let’s first look at it from a traditional finance (TradFi) perspective.

In 2022, the average retirement account balance for individuals aged 65 or older was just $232,710. So suddenly having $1–2 million isn’t trivial, is it? In fact, only about 3.2% of retirees have savings exceeding $1 million.

Alright, I know—you reading this are unlikely to be over 65, and you probably want to retire before 65. When I first heard that Americans believe they need $1.46 million to retire comfortably, I was shocked. But then I realized something crucial: that number is an average. Individual needs can vary dramatically.

Let’s consider the 4% rule, a common guideline in retirement planning. With $2 million saved, you can withdraw $80,000 annually. For many people, that’s more than enough for a comfortable lifestyle. Your retirement needs largely depend on the lifestyle you want. Do you plan to travel the world, or are you content with simpler pleasures? According to the Bureau of Labor Statistics, average annual expenditures for those aged 65+ were $52,141 in 2021. A $1–2 million nest egg can easily cover that.

Your choice of where to live in retirement greatly affects how far your wealth goes. A $1 million retirement fund might feel tight in New York City, but it could afford you a luxurious life in a small town or abroad.

Psychological Factors

Knowing you have $1–2 million saved can relieve immense financial stress, allowing you to truly enjoy retirement.

Ultimately, whether $1–2 million is enough to retire depends on your personal circumstances. For many of us, it’s not just sufficient—it’s more than we ever dreamed of. The key is to start saving early, live within your means, and focus on what truly brings joy to your life. Remember, retirement isn’t just about money—it’s about creating the life you love, regardless of whether your bank account has millions.

I understand what Fiskantes said above. Once you’ve secured life-changing money in the bank or invested in assets like real estate, you can participate in the markets with true freedom.

What do I mean by “freedom”? Well, I don’t mean it becomes easier to make money—I mean your mindset becomes relaxed. You can calmly make better decisions and let trades come to you. And even if you lose, you won’t lose everything, because you already have a safety net.

As Fiskantes put it: “That’s where the real fun begins.” In that sense, this cycle becomes more interesting to me. Even if everything goes to zero, at least I still have a secure fallback. That said, some people perform better under pressure—but I think that’s true for only a minority.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News