Deep Dive into the Underlying Causes of Current Crypto Market Volatility: Value Growth Anxiety After BTC Reaches New High

TechFlow Selected TechFlow Selected

Deep Dive into the Underlying Causes of Current Crypto Market Volatility: Value Growth Anxiety After BTC Reaches New High

The key is to observe whether BTC can take over from AI as the core driver of economic growth in the new political and economic cycle under Trump's administration.

Author: @Web3_Mario

Summary: First, I apologize for last week's delayed update. After briefly studying AI agents like Clanker and finding them fascinating, I spent some time building a few Frame-based tools. After evaluating development and potential cold-start costs, I realized that quickly chasing market trends might be the norm for most small-to-medium Web3 entrepreneurs. I hope readers understand and continue supporting me. Now, let’s dive into a perspective I've been pondering recently—one that may also explain the recent market volatility: after BTC breaks new price highs, how can we continue capturing incremental value? My view is that the key lies in observing whether BTC can take over from AI as the core driver of U.S. economic growth during the new political-economic cycle under Trump’s administration. This博弈 (struggle) has already begun thanks to MicroStrategy’s wealth effect, but it will inevitably face many challenges.

As MicroStrategy's wealth effect unfolds, the market has already started speculating on whether more public companies will follow by allocating BTC to drive growth

We saw significant volatility in the crypto market last week, with BTC prices fluctuating widely between $94,000 and $101,000. There were two main reasons for this, which I’ll briefly outline.

The first traces back to December 10, when Microsoft officially rejected a Bitcoin treasury proposal submitted by the National Center for Public Policy Research (NCPPR) during its annual shareholder meeting. The think tank had proposed that Microsoft allocate 1% of its total assets to Bitcoin as a potential hedge against inflation. Prior to the vote, MicroStrategy founder Michael Saylor publicly announced via X that he represented NCPPR as an FEP representative and delivered a three-minute online presentation. Despite the board having clearly recommended rejection beforehand, the market still held some hope for the proposal’s approval.

A brief aside on NCPPR: Think tanks are typically composed of industry experts and funded by governments, political parties, or corporations. Most operate as non-profits and enjoy tax-exempt status in countries like the U.S. and Canada. Their output often serves the interests of their sponsors. Founded in 1982 and based in Washington, D.C., NCPPR holds a certain standing among conservative think tanks—particularly those advocating free markets, opposing excessive government intervention, and pushing corporate accountability issues—though its overall influence remains limited compared to larger institutions like the Heritage Foundation or Cato Institute.

NCPPR has drawn criticism over its positions on climate change and corporate social responsibility, particularly due to suspected funding links to fossil fuel industries, which constrains its policy advocacy reach. Progressive critics often label it a "proxy for special interests," weakening its credibility across broader political spectrums. In recent years, through its Free Enterprise Project (FEP), NCPPR has frequently filed shareholder proposals at major public companies, challenging corporate policies on racial diversity, gender equality, and social justice—issues seen as left-leaning. For example, they’ve opposed mandatory race and gender quotas at firms like JPMorgan Chase, arguing such policies lead to "reverse discrimination" and harm business performance. At Disney and Amazon, they’ve questioned whether businesses should focus on profit rather than "appeasing minority groups." With Trump’s return and his supportive stance toward cryptocurrency policy, NCPPR has now extended these FEP campaigns to promote Bitcoin adoption among large corporations—including not only Microsoft but also Amazon and others.

Following the formal rejection of the proposal, BTC briefly dropped to $94,000 before rebounding sharply. The degree of price reaction reveals that the market is currently in a state of anxiety—specifically, uncertainty about where BTC’s next wave of value growth will come from after surpassing all-time highs. However, recent signals suggest that key figures in the crypto space are leveraging MicroStrategy’s success story to advocate for broader adoption of BTC on corporate balance sheets as a financial strategy to combat inflation and boost earnings. This could further expand BTC’s institutional adoption. Let’s now assess whether this strategy can succeed.

BTC as a substitute for gold faces a long road to becoming a globally recognized store of value; short-term success is unlikely

Let’s begin by analyzing the first appeal of this strategy: does holding BTC effectively hedge against inflation in the short term? Typically, when people think of inflation hedging, gold comes to mind first. Indeed, Powell mentioned during a press conference earlier this month that Bitcoin competes with gold. So, can Bitcoin truly replace gold as a global store of value?

This question has long been central to debates about Bitcoin’s intrinsic value, and many arguments have been made based on similarities in asset properties—so I won’t rehash them here. What I want to emphasize is the timeline: how long would it take for this vision to materialize? Does it justify BTC’s current valuation? My answer is no—at least not within the foreseeable four-year horizon, meaning this narrative lacks short-term attractiveness as a promotional strategy.

Consider how gold achieved its current status as a store of value. As a precious metal, gold has been universally valued across civilizations due to several key attributes:

• Its distinctive luster and excellent malleability give it practical use as decorative items.

• Limited supply gives it scarcity, lending it financial characteristics and making it a natural symbol of class distinction once social hierarchies emerge.

• Widespread global distribution and relatively low extraction difficulty allow independent discovery across cultures regardless of technological advancement, enabling bottom-up cultural transmission.

These traits collectively established gold’s universal value, allowing it to serve as money throughout human history. This evolutionary process endowed gold with stable inherent value. Even after sovereign currencies abandoned the gold standard and modern financial instruments added layers of complexity, gold prices have generally followed a long-term upward trend, closely reflecting real purchasing power dynamics.

In contrast, Bitcoin replacing gold in the short to medium term is unrealistic. The core reason is that its value proposition—as a cultural idea—will contract rather than expand in the near future, for two primary reasons:

• Bitcoin’s value proposition spreads top-down: As a virtual digital commodity, Bitcoin mining relies on computational power competition, determined by two factors—electricity cost and computing efficiency. Electricity cost reflects a nation’s level of industrialization, while energy source cleanliness indicates future development potential. Computing efficiency depends on chip technology. In short, acquiring BTC is no longer feasible via personal computers. As technology advances, production becomes increasingly concentrated in a few regions. Developing nations—home to most of the world’s population but lacking competitive advantages—will find access difficult. This hinders efficient propagation of its value proposition: if you cannot control a resource, you become subject to exploitation. This explains why stablecoins challenge local currencies in countries with unstable exchange rates—and why, from a national interest perspective, such value systems struggle to gain acceptance. Thus, it’s unlikely we’ll see developing nations endorse Bitcoin’s value narrative.

• Globalization reversal and challenges to dollar hegemony: With Trump’s return, his isolationist policies are expected to significantly undermine globalization. The most direct impact will be on the U.S. dollar’s role in global trade settlement. This weakens dollar dominance—a trend known as “de-dollarization.” In the short term, this reduces global demand for dollars. Since Bitcoin is primarily priced in USD, de-dollarization increases the cost of acquiring Bitcoin, thereby raising barriers to spreading its value proposition.

The above points highlight macro-level challenges to Bitcoin’s short- to medium-term evolution as a gold alternative—though long-term prospects remain intact. These constraints most directly manifest in high price volatility. Short-term price surges are driven more by speculative appreciation than by expanding cultural influence, making BTC behave more like a speculative asset with high volatility. While its scarcity means it shares some inflation-resistance traits with other dollar-denominated assets (similar to luxury goods in previous years), especially amid aggressive dollar printing, this alone doesn’t make it a stronger store of value than gold.

Therefore, I believe promoting BTC as an inflation hedge is insufficient to attract “professional” institutional investors over gold, given the extreme volatility it introduces to balance sheets—a feature unlikely to change soon. Consequently, it’s improbable that large, stable public companies will aggressively adopt BTC holdings solely for inflation protection in the near future.

BTC takes over from AI as the core engine driving U.S. economic growth in the new political-economic cycle under Trump

Now let’s turn to the second argument: Can the financial strategy of struggling public companies boosting overall revenue—and thus market capitalization—by allocating BTC gain broader acceptance? I believe this is the key determinant of whether BTC can achieve new value growth in the short to medium term. And unlike the inflation-hedge narrative, I believe this path is achievable in the near term. In this scenario, BTC would succeed AI as the central force driving U.S. economic growth during the upcoming political-economic cycle under Trump’s leadership.

Earlier analysis clearly outlined MicroStrategy’s successful strategy: converting BTC appreciation into reported corporate revenue growth, thereby increasing market cap. This model holds strong appeal for companies facing stagnation—after all, riding a trend is easier than rebuilding from scratch. We’re already seeing declining firms with shrinking core revenues turning to this strategy, deploying residual capital to preserve options.

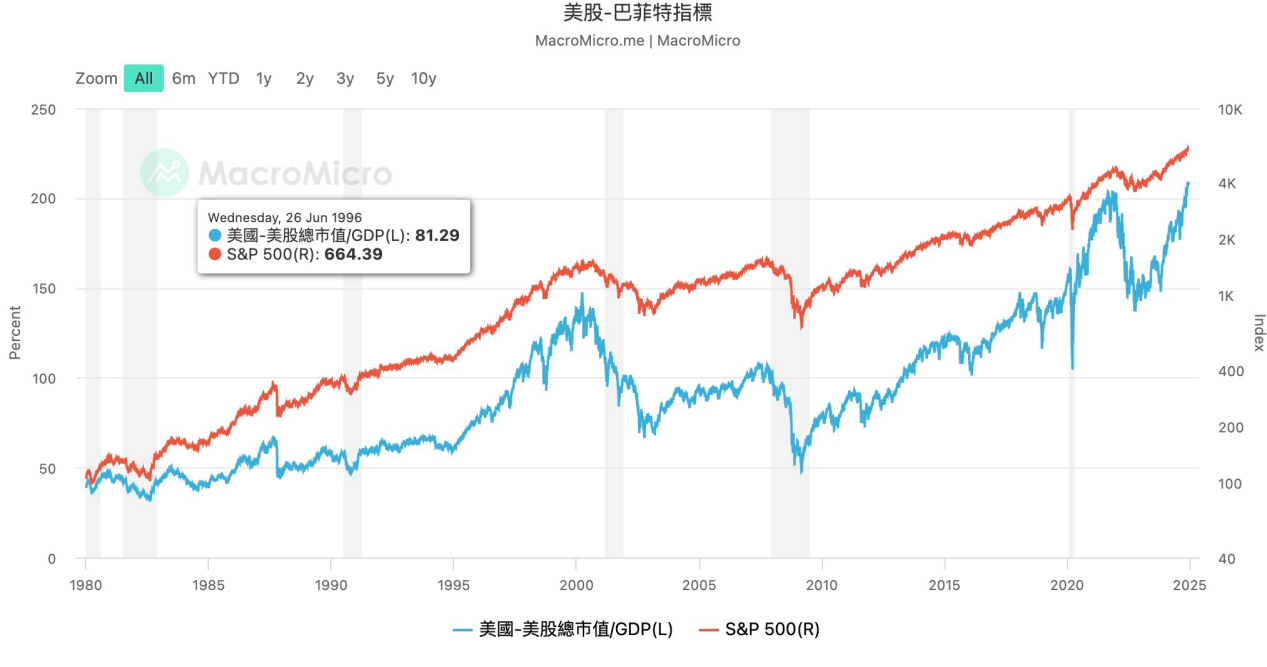

Trump’s return brings significant changes to U.S. economic structure through domestic policy cuts. Consider one key metric: the Buffett Indicator. Coined by Warren Buffett in a 2001 Forbes article, it measures total stock market capitalization relative to GDP. Buffett suggested 75%–90% represents a fair valuation range, while readings above 120% signal overvaluation. This indicator helps assess whether financial markets accurately reflect economic fundamentals.

Currently, the U.S. Buffett Indicator exceeds 200%, indicating extreme market overvaluation. Over the past two years, the primary force preventing a correction—despite tightening monetary policy—has been the AI sector, led by companies like NVIDIA. However, NVIDIA’s latest quarterly report showed slowing revenue growth, and guidance suggests further deceleration next quarter. Such slowdowns cannot sustain current sky-high valuations. Therefore, U.S. equities are likely to face significant downward pressure in the coming period.

Meanwhile, the specific impacts of Trump’s economic policies remain uncertain: Could tariff wars trigger domestic inflation? Will spending cuts hurt corporate profits and increase unemployment? Will tax reductions worsen an already severe fiscal deficit? Beyond economics, Trump appears determined to restore traditional American moral values. His push on culturally sensitive issues may spark strikes, protests, and labor shortages due to reduced illegal immigration—all casting shadows over economic growth.

If economic problems arise—and in today’s highly financialized America, that primarily means a stock market crash—his approval ratings would suffer, undermining his reform agenda. Hence, installing a controllable, growth-driving core within the economy becomes highly strategic. And in my view, Bitcoin is exceptionally well-suited for this role.

The so-called “Trump trade” recently unfolding in the crypto world already demonstrates his influence over the sector. Notably, Trump-supporting businesses tend to be traditional, domestically focused enterprises—not tech firms—meaning they didn’t directly benefit from the last AI-driven cycle. But imagine a different future: suppose SMEs across America start adding BTC to their balance sheets. Even if their core operations falter due to external shocks, Trump could stabilize markets simply by promoting pro-crypto policies to lift prices. This form of targeted stimulus would be highly efficient—even bypassing Federal Reserve monetary channels—and less vulnerable to establishment resistance. Therefore, in the emerging U.S. political-economic cycle, this strategy offers compelling benefits for both the Trump administration and countless American small and medium enterprises. Its evolution deserves close attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News