Ethereum in a Bull Market: An Undervalued Blue-Chip or a Slowing Giant?

TechFlow Selected TechFlow Selected

Ethereum in a Bull Market: An Undervalued Blue-Chip or a Slowing Giant?

Is Lian Po old yet, and can he still eat?

By Frank, PANews

As the bull market enters the "altseason," time may be running out for ETH. Since the beginning of this rally at the end of 2023, ETH's performance has drawn continuous attention. However, over the past year, ETH seems to have underperformed expectations. Most directly, in terms of price appreciation, ETH has seen a maximum gain of only 170% since October 2023, repeatedly testing the $4,000 level without achieving a significant breakout. In contrast, BTC has gained over 300% during the same period, while SOL has surged more than 1,300%. Many believed that ETH would lead the altseason, but recently, as numerous established altcoins surge sharply in the short term, ETH’s momentum clearly appears insufficient.

Ethereum, the leading smart contract platform—objectively speaking—is it undervalued by the market or performing normally? Is it still capable despite its age?

On-Chain Data Stagnant for a Year

From an on-chain data perspective, PANews can clearly observe that Ethereum, over the past year, hasn't declined per se, but certainly hasn't shown any notable growth either.

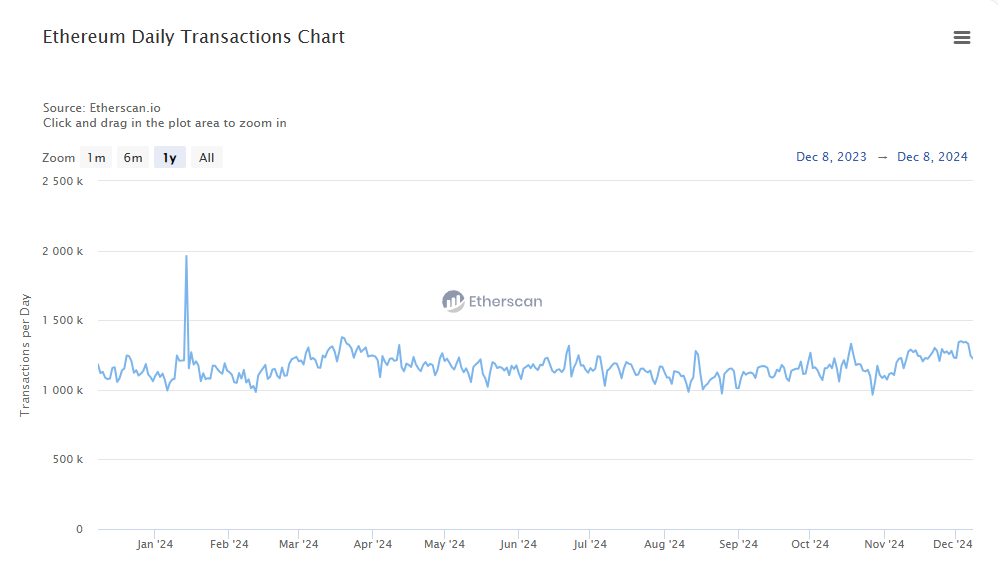

Daily transaction count is a key metric of network activity. Looking at the chart of Ethereum’s average daily transactions over the past year, one sees a relatively flat, slightly fluctuating line resembling an ECG. On December 8, 2023, Ethereum’s mainnet recorded 1.18 million transactions; a year later, on December 8, 2024, the figure stood at 1.22 million—essentially unchanged. During this period, transactions briefly peaked at 1.96 million in January 2024, but otherwise remained mostly between 1 million and 1.3 million.

Gas fee trends provide an even clearer picture of on-chain activity. From late 2023 to early 2024, Ethereum gas fees were relatively high, averaging above 40 Gwei and peaking around 100 Gwei. As newer layer-1 chains like Solana rose in popularity, Ethereum’s gas fees dropped noticeably—especially from July to September, when they fell as low as 0.3 Gwei. Even with a recent rebound, fees generally remain below 20 Gwei. Layer-2 solutions initially gained traction largely because Ethereum’s mainnet gas fees were too expensive. Now, Ethereum’s gas fees have finally come down—but it seems users have already left. Or perhaps it’s precisely because users migrated away that Ethereum’s fees were able to drop so significantly.

Active addresses follow a similar pattern to daily transaction counts. According to blockchain explorer data, the number of daily active Ethereum addresses and ERC20 token addresses has shown little growth, remaining roughly at pre-bull-market levels.

Users Migrate to L2s, Capital Remains on L1

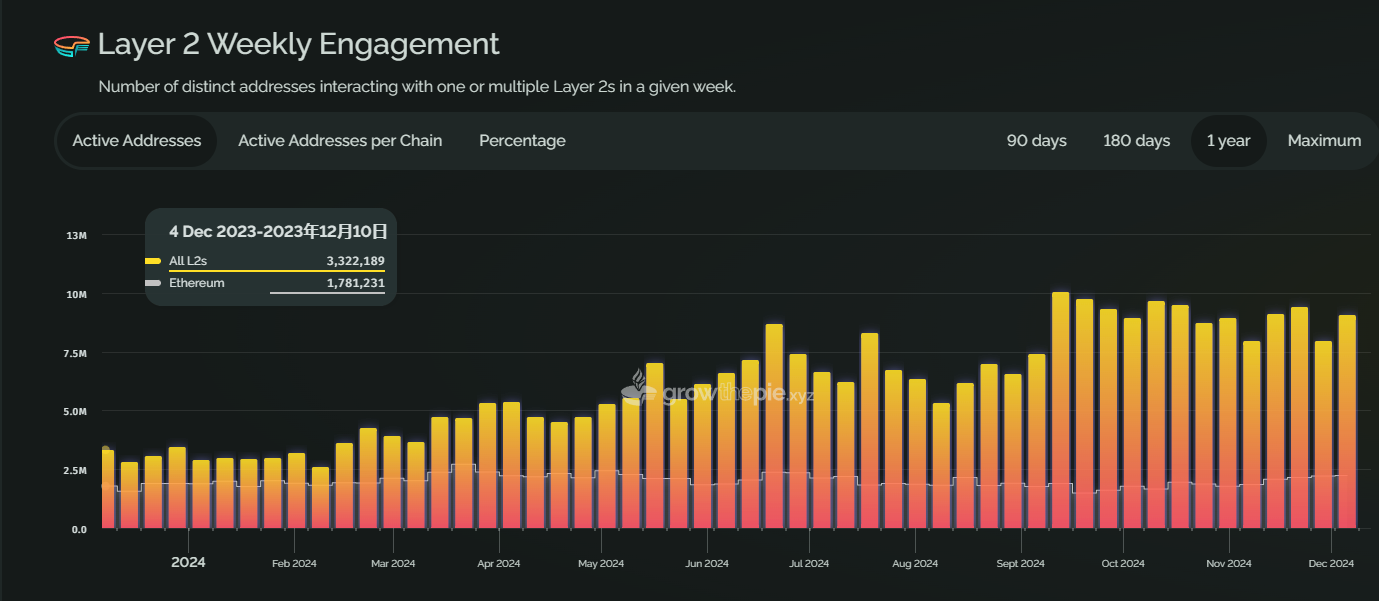

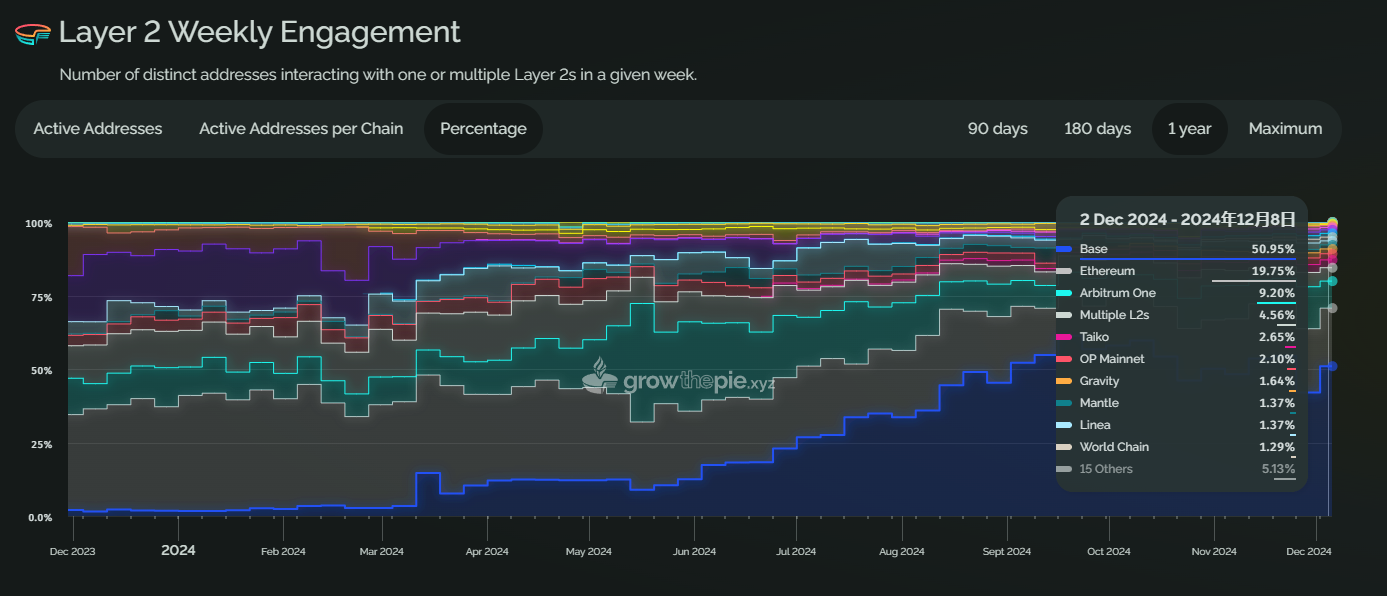

Where exactly have Ethereum’s users gone? Weekly on-chain activity data shows that a year ago, Ethereum mainnet accounted for about 50% of all active addresses across the Ethereum ecosystem (including L2s). Today, however, L2 networks collectively show rising active address counts, while Ethereum mainnet now accounts for only about 24% of total L2 activity.

Looking at individual chains, in December 2023, Ethereum mainnet was the most active chain, representing about 32.48% of activity. By December 2024, Base had become the most active chain, with its share rising to 50%, followed by Ethereum mainnet in second place at 19%, and Arbitrum third at 9.2%.

However, when it comes to TVL (Total Value Locked), Ethereum mainnet remains the top choice for large investors. In terms of stablecoin deposits, Ethereum mainnet accounted for approximately 95% last December and currently holds around 91%. Moreover, TVL is almost the only metric for Ethereum mainnet that has seen clear growth over the past year. In December 2023, Ethereum’s TVL was about $28.8 billion; by December 2024, it had risen to approximately $77.5 billion—an increase of about 2.69x, outpacing ETH’s own price appreciation, which correlates with broader bull market asset inflation. Among L2s, Arbitrum and Base rank second and third in stablecoin TVL.

In revenue terms, Ethereum mainnet remains the most profitable chain within the Ethereum ecosystem. Over the past year, its share of total protocol revenue has consistently exceeded 80%; as of December 8, it reached 92%. Base has emerged this year as the second-highest revenue-generating chain in the Ethereum ecosystem.

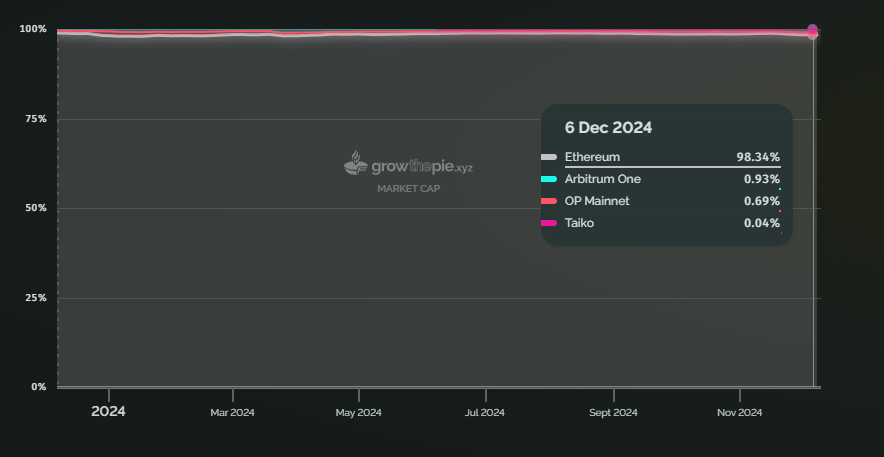

Ethereum’s market dominance within its own ecosystem has also remained around 98%. Despite declining on-chain activity, this figure closely tracks TVL share. However, looking at Ethereum’s share of the entire crypto market, it has steadily declined over the past year and now stands at only about 13.4%.

Yet, considering TVL growth, most large capital continues to reside on Ethereum mainnet. Comparing total TVL to active user count, Ethereum mainnet averages $178,700 per user, compared to about $3,315 for Base and $1,972 for Solana. By this measure, Ethereum maintains the highest per-user capital value across all networks.

Uniswap’s Potential Exodus Poses Greater Risks

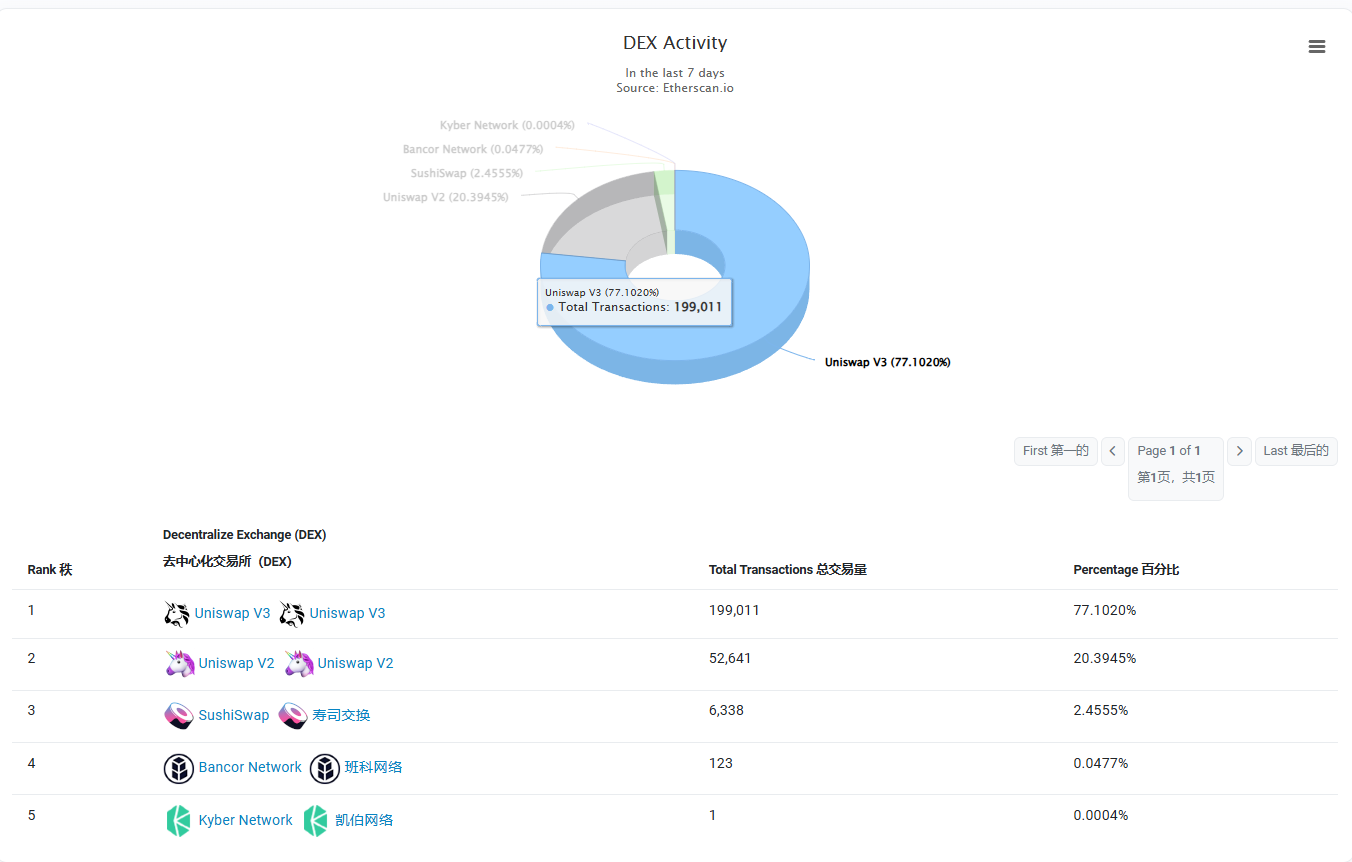

Across various metrics, Uniswap remains Ethereum’s undisputed largest application. As a DEX, Uniswap V2 and V3 combined account for over 97% of Ethereum mainnet’s trading volume. On Ethereum’s fee-burning leaderboard, Uniswap consistently ranks first: as of December 9, it burned 6,372 ETH in the past 30 days, compared to just 4,594 ETH burned via regular transfers.

If Uniswap shifts most of its trading activity to its own dedicated chain, Unichain, Ethereum mainnet’s activity and fee burn could decline further. According to Forbes, as Uniswap transitions to its own chain, Ethereum validators could lose $400–500 million annually in revenue. But beyond the financial loss, this move threatens Ethereum’s core narrative as a deflationary asset. Uniswap’s universal router is the single largest gas consumer on Ethereum, responsible for 14.5% of total gas usage—equivalent to burning $1.6 billion worth of ETH.

Summarizing these indicators, several patterns emerge. Ethereum mainnet’s on-chain activity has not grown over the past year and its relative share within the broader Ethereum ecosystem has gradually declined. This suggests that nearly all new users are choosing alternative L2s or other blockchains—after all, emerging chains like Solana, Sui, and Aptos are experiencing rapid growth in these metrics.

Returning to our original question: has Ethereum’s fundamental outlook changed significantly? Or is ETH simply undervalued? Based on the data above, Ethereum mainnet appears to be transforming into a capital reservoir for whales and institutional players. Even though gas fees have dropped substantially, it still cannot compete with L2s or other chains in terms of transaction speed and cost efficiency. Thus, Ethereum mainnet is clearly no longer the playground for retail traders. It no longer holds a community size advantage in trending sectors like MEME coins. Instead, it better serves users who prioritize security over frequency—those requiring high asset safety with lower interaction needs. From this perspective, we can say Ethereum mainnet’s ecosystem role is shifting, with liquidity and security becoming its final moats.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News