Bitcoin's $2 Trillion Overt Strategy: Expanding the Boundaries of Time and Space

TechFlow Selected TechFlow Selected

Bitcoin's $2 Trillion Overt Strategy: Expanding the Boundaries of Time and Space

With the development of BTCFi, Bitcoin will transform from a passive asset to an active asset; from a non-yielding asset to a yield-generating asset.

Authors: @BMANLead, @Wuhuoqiu, @Loki_Zeng, @Kristian_cy

The major event in crypto in 2024 has materialized as Bitcoin's price approaches the $100,000 mark. With Bitcoin halving and ETF approval now behind us, and Trump reportedly considering Bitcoin as a strategic reserve asset, Bitcoin’s deeper integration into traditional finance prompts a fundamental question:

What is finance?

At its core, finance is the spatial and temporal allocation of assets.

Typical spatial allocation: lending, payments, trading.

Typical temporal allocation: staking, interest, options.

Historically, Bitcoin remained static—stored passively in wallets, inactive across both space and time. Over 65% of Bitcoin hasn’t moved in more than a year. The idea that “BTC should only be held in wallets” acted like a mental imprint.

Hence, BTCFi was long dismissed.

Although Bitcoin was originally conceived as a hedge against traditional financial systems—and Satoshi Nakamoto himself mentioned in a 2010 forum post that Bitcoin could support various DeFi-like use cases—the narrative gradually shifted toward “digital gold,” causing exploration of Bitcoin-based financial applications to stall.

In parallel, Rune Christensen announced MakerDAO’s vision in March 2013. In 2016, OasisDEX, the first DEX on Ethereum, launched. In 2017, Stani Kulechov founded Aave as a student in Switzerland. By August 2018, Bancor and Uniswap—now household names—went live, sparking the explosive DeFi Summer. At that moment, the future of DeFi was effectively entrusted to Ethereum.

But by 2024, Bitcoin has reclaimed center stage in the crypto world. With BTC priced at $99,759—nearly $100,000—and a market cap exceeding $2 trillion, BTCFi has emerged as a $2 trillion open secret. Interest and innovation around BTCFi are quietly resurging…

I. Bitcoin’s $2 Trillion Open Secret: BTCFi

While Ethereum pioneered the DeFi era, BTCFi may arrive late—but it will not be absent. Ethereum’s role as a DeFi testbed offers valuable lessons. Today’s Bitcoin resembles 15th-century Europe on the brink of discovering a new world.

1.1 From Passive to Active Asset

Rising FOMO and active management incentives among Bitcoin holders are transforming BTC from a passive store of value into an active yield-generating asset, laying fertile ground for BTCFi.

Institutional holdings continue to grow. According to Feixiaohao, 47 companies currently hold $141.34 billion worth of BTC, representing 7.7% of total circulating supply. The approval of spot BTC ETFs has accelerated this trend. Since年初, spot BTC ETFs have brought nearly 17,000 BTC into the market. Compared to early miners and HODLers, institutions are far more sensitive to capital efficiency and ROI, making them not just likely participants but potential drivers of BTCFi.

The rise of inscriptions and the broader BTC ecosystem has diversified the community. Traditional BTC holders prioritize security above all, while newer entrants are more eager for new narratives and assets.

Ethereum DeFi has matured into a sustainable model. Projects like Uniswap, Curve, Aave, MakerDAO, and Ethena have found ways to sustain economic models without relying solely on token emissions, instead generating internal or external revenue streams.

These factors have significantly boosted interest in scalability and BTCFi within the Bitcoin community. Forum discussions are increasingly positive. Notably, Luke Dashjr’s proposal to ban inscriptions—which sparked debate last year—was ultimately rejected and officially closed in January.

1.2 Infrastructure Maturation Paves the Way

Technical constraints historically limited Bitcoin to a store of value, but this is changing. The 2010–2017 scaling debate ended with the BTC/BCH fork, yet scalability improvements didn’t stop. SegWit and Taproot upgrades laid the foundation for asset issuance, enabling the emergence of Ordinals. The proliferation of new assets created demand for trading and financialization. Now, with technologies like Ordinal, sidechains, L2s, OP_CAT, and BitVM, building BTCFi applications has become genuinely feasible.

1.3 Massive Demand Fuels Development

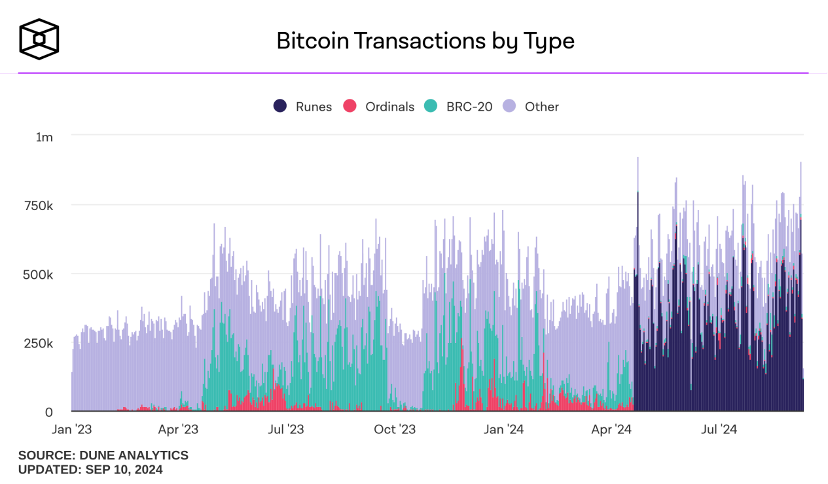

Transaction volume reflects growing asset diversity and higher transaction frequency. Data from The Block shows that over the past year, daily BTC transfers have exceeded 500k/day, with RUNES and BRC-20 transactions dominating. It follows naturally that demand for trading, lending, credit derivatives, and yield generation will follow. BTCFi enables Bitcoin to become a productive asset, allowing holders to earn returns directly from their BTC holdings.

Source: The Block

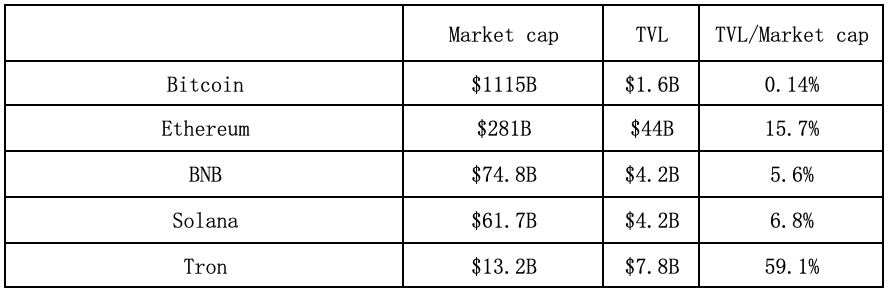

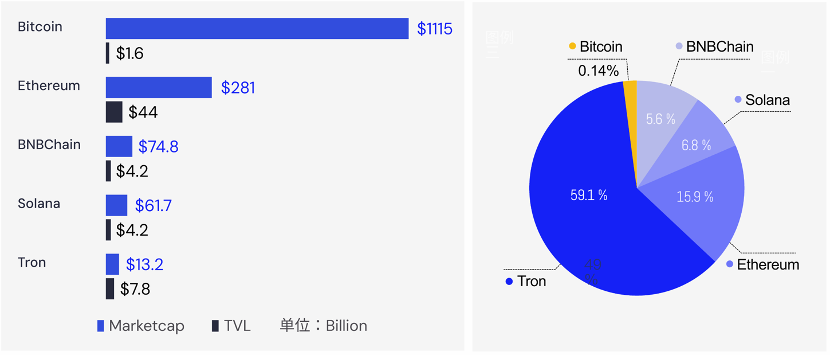

In terms of TVL, Bitcoin—with its dominant market cap—has immense untapped potential. Currently, the total value locked (TVL) on the BTC network (including L2s and sidechains) is about $1.6 billion, just 0.14% of Bitcoin’s total market cap. In contrast, other major blockchains show much higher ratios: ETH at 15.7%, Solana at 5.6%, and BNB Chain at 6.8%. Using the average of these three, BTCFi still has ~65x room to grow.

Mainstream smart contract platforms have significantly higher TVL-to-market-cap ratios: Ethereum at 14%, Solana at 6%, Ton at ~3%. Even at a conservative 1%, BTCFi would have 10x growth potential.

Source: Defillama, Coinmarketcap

II. The Year of BTCFi

Thus, in 2024, as Bitcoin surges toward a $2 trillion valuation, we also enter the Year of BTCFi.

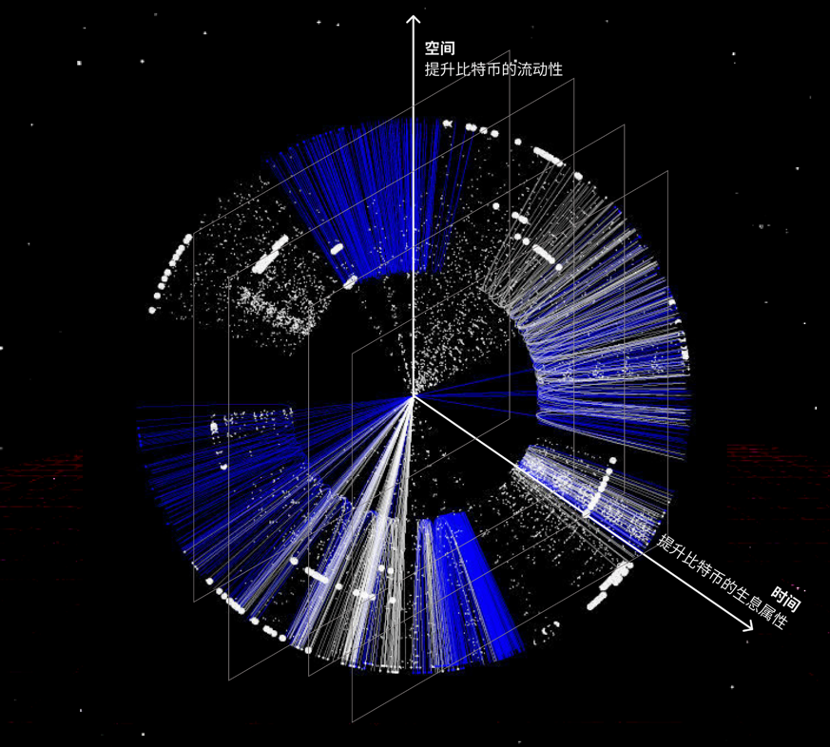

Adding “finance” to Bitcoin instantly unlocks $2 trillion in potential, expanding Bitcoin’s boundaries across time and space.

As previously stated: Finance is the spatial and temporal allocation of assets.

Therefore, Bitcoin Finance (BTCFi) is the allocation of Bitcoin across space and time.

Temporal allocation: Enhancing Bitcoin’s yield-bearing properties, such as staking, time-locking, interest, and options. Examples include:

-

@babylonlabs_io – Unlocking time dimension for Bitcoin

-

@SolvProtocol – Bitcoin yield gateway

-

@Lombard_Finance – “Semi-centralization might be optimal”

-

@LorenzoProtocol – “Comes with Pendle built-in”

-

@use_corn – A chain born for BTCFi

Spatial allocation: Enhancing Bitcoin’s liquidity through lending, custody, synthetic assets, etc., e.g.:

-

Custody platforms: @AntalphaGlobal, @Cobo_Global, @SinohopeGroup

-

Lending newcomer: @avalonfinance_

-

CeDeFi pioneer: @bounce_bit

-

Blooming Wrapped BTC ecosystem

-

Stablecoin rising star: @yalaorg

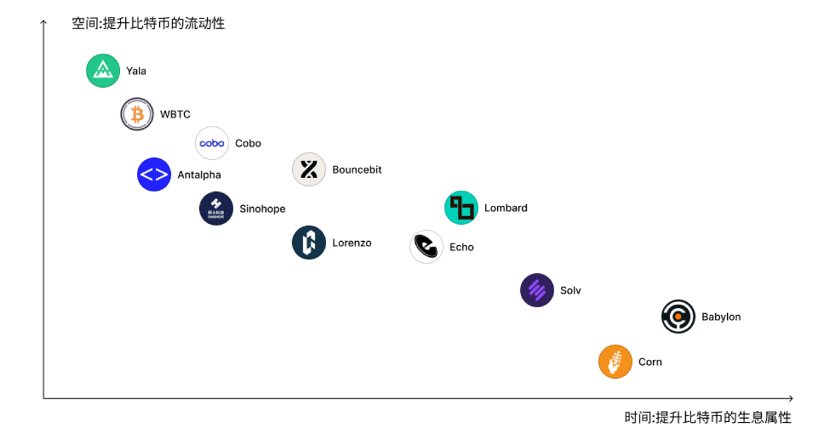

Financial applications are not only returning to the Bitcoin ecosystem but also spawning entirely new possibilities. BTCFi projects are emerging en masse, forming a comprehensive Bitcoin finance landscape:

Source: ABCDE Capital

Whether it's adding yield to "digital gold" or enhancing liquidity, these two core functions of BTCFi align perfectly with Bitcoin’s prevailing narrative. Regardless of bull or bear markets, as long as Bitcoin remains unchanged and continues to be recognized as the premier digital gold, BTCFi as a sector is unlikely—or perhaps “need not”—be falsified.

Take gold as an analogy. Gold’s value typically rests on three pillars:

-

Jewelry and industrial use

-

Investment

-

Strategic reserves by central banks

From an investment perspective, the approval of gold ETFs two decades ago led to a 7x surge in gold prices. Before ETFs, investing in gold required physical ownership, which involved high barriers due to insurance, transportation, and storage costs. Gold ETFs—essentially “paper gold” tradable like stocks without custody concerns—were transformative, dramatically improving liquidity and accessibility.

In contrast, BTC ETFs lack the same revolutionary impact because trading this “digital gold” was already accessible. BTC ETFs mainly improve compliance, regulation, and ideological acceptance. Their price impact is likely smaller than that of gold ETFs. However, BTCFi, by adding temporal and spatial financial functionality, makes BTC more “useful”—akin to gold’s jewelry and industrial applications. Therefore, in the long run, BTCFi may contribute more to Bitcoin’s value and price appreciation than BTC ETFs.

2.1 Time: Enhancing Bitcoin’s Yield-Bearing Properties

2.1.1 Babylon: Unlocking Time for Bitcoin

Babylon is arguably the most pivotal project in BTCFi, as it introduced the concept of truly “on-chain yield-bearing BTC.”

As widely known, Bitcoin uses PoW, which lacks inflation or yield mechanisms. Unlike Ethereum’s PoS, which offers a relatively predictable annual yield of 3–4% (adjusted based on staking ratio), Bitcoin holders couldn’t earn native yield. However, EigenLayer’s introduction of restaking sparked realization: while restaking is a bonus for ETH, it’s a necessity for BTC.

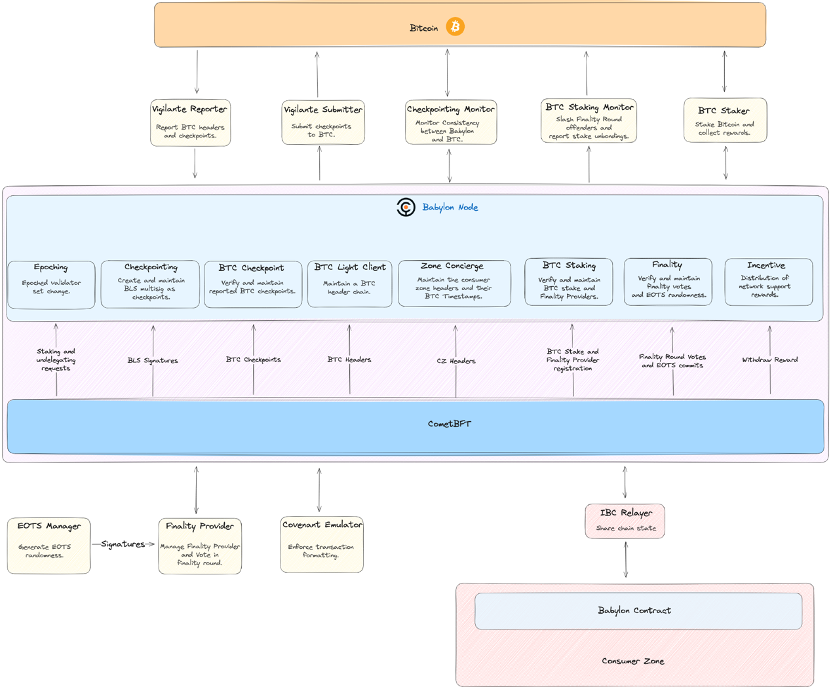

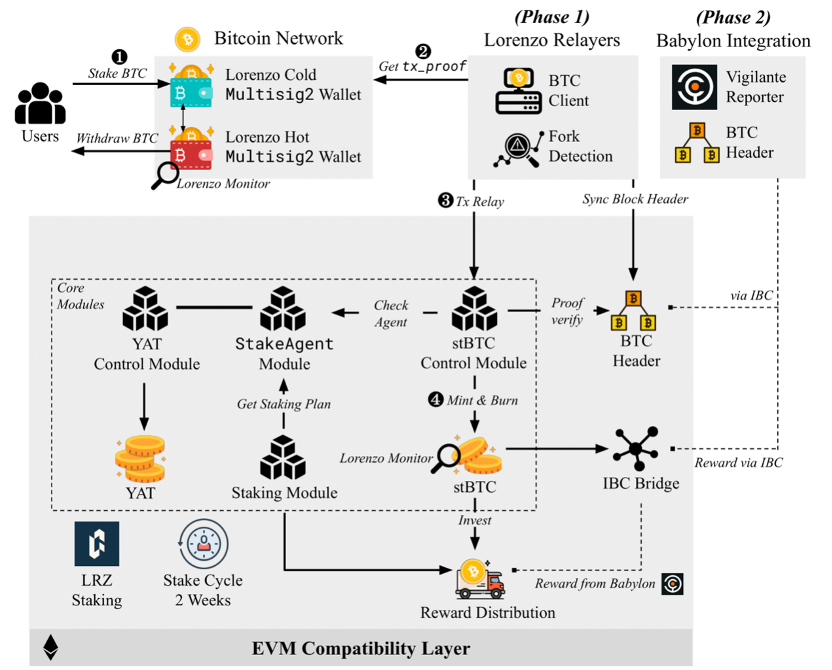

Naturally, you can’t directly restake BTC on EigenLayer—it’s a different chain. Replicating EigenLayer entirely on Bitcoin is technically impossible due to Bitcoin’s lack of Turing-complete smart contracts. But could EigenLayer’s core concept—restaking for PoS security—be ported to Bitcoin? This is exactly what Babylon achieves.

Briefly, Babylon leverages existing Bitcoin scripts and advanced cryptography to simulate staking and slashing functionalities on Bitcoin, without bridges or third-party wrapped tokens that compromise decentralization and security. Since Bitcoin scripts support “time locks”—allowing users to lock UTXOs for a set period—this mimics staking on PoS chains. Babylon uses this feature so that staked BTC never leaves the Bitcoin chain, simply being locked via time-lock scripts into a designated “staking address.”

Source: Babylon

But how does slashing work without smart contracts? This is where Babylon employs advanced cryptography—EOTS (Extractable One-Time Signatures). If a signer signs two different messages with the same private key, the private key is automatically revealed. This mirrors the standard PoS security violation: “a validator signing two different blocks at the same height.” By exposing the private key upon misbehavior, Babylon effectively implements “automatic slashing.”

Through restaking, Babylon primarily enhances PoS chain security. However, to achieve full EigenLayer-like functionality (e.g., EigenDA) or more complex slashing logic, collaboration with other projects in the Babylon ecosystem is required.

Babylon introduces an innovative model: self-custodied BTC locking combined with on-chain staking and slashing, offering BTC holders a trustless way to earn yield. Previously, earning yield on BTC required either centralized exchanges (CEXs) or wrapping BTC into WBTC to participate in Ethereum DeFi—both requiring trust assumptions.

While Babylon is often compared to Ethereum’s EigenLayer restaking ecosystem, due to Bitcoin’s lack of native staking, we see Babylon as a foundational pillar for building a true BTC staking economy.

2.1.2 Solv Protocol: The Bitcoin Yield Gateway

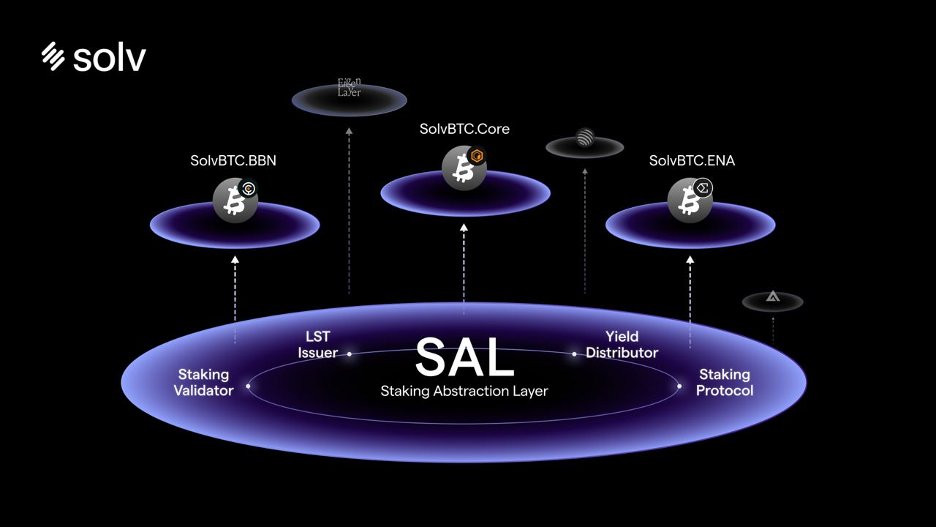

Another key player in the staking ecosystem is Solv Protocol. Solv isn’t a direct competitor to Babylon. Instead, by introducing a “staking abstraction layer,” it enables the creation of multiple LST (liquid staking token) products with diverse yield sources, such as:

-

Yield from staking protocols (e.g., Babylon);

-

Node operator rewards from PoS networks (e.g., CoreDAO, Stacks);

-

Trading strategy returns (e.g., Ethena).

Solv has already launched several successful LST products—SolvBTC.BBN (Babylon LST), SolvBTC.ENA (Ethena LST), and SolvBTC.CORE (CoreDAO LST)—all performing strongly. According to DeFiLlama, SolvBTC’s TVL on Bitcoin mainnet has surpassed the Lightning Network, ranking first.

Source: Solv

Its yield mechanisms include:

SolvBTC – Mintable on 6 chains, circulating on 10, integrated with 20+ DeFi protocols for yield generation

-

SolvBTC.BBN – BTC earns yield via Babylon through Solv

-

SolvBTC.ENA – BTC earns yield via Ethena through Solv

-

SolvBTC.CORE – BTC earns yield via Core through Solv

-

Future yield-bearing assets like SolvBTC.JUPITER with net value growth

Source: Solv

Rather than viewing Solv as just a BTC staking protocol, we describe it as a “Bitcoin余额宝 (Yu’e Bao).” It offers diversified yield sources—staking, node rewards, trading strategies—giving BTC holders flexible income options.

Notably, Solv stands out among all BTCFi protocols in key metrics:

-

Broad coverage: Circulating on 10 blockchains, integrated with 20+ DeFi protocols.

-

Innovative partnerships: For example, Solv’s collaboration with Pendle offers ~10% fixed APY and up to 40% LP farming yields.

-

Wide adoption: Over 200,000 SolvBTC holders, total market cap exceeding $1 billion.

-

Strong reserves: Holding over 20,000 BTC.

These achievements position Solv as a leader in BTCFi, continuously iterating its product suite. Its next focus is launching more LST variants. Reports suggest Solv plans to launch SolvBTC.JUP with Jupiter, bringing perpetual DEX market-making yields into BTC LSTs, further expanding the frontier of BTC staking.

Meanwhile, Babylon provides a trustless mechanism for BTC holders to earn staking-like yields, paving the way for projects to compete for the “Lido-like” ecosystem position—creating liquid staked tokens like stETH. While Babylon secures BTC and offers base yield, unlocking liquidity and boosting returns requires representing staked BTC as tokenized receipts usable in both EVM and non-EVM DeFi ecosystems. Leveraging blockchain composability is key to building the LST ecosystem—SolvBTC.BBN exemplifies this success.

Beyond Solv, heavyweight projects like Lombard and Lorenzo are also vying for LST dominance. These projects share similar technical directions: unlocking BTC liquidity and participating in DeFi yield.

Solv’s core advantage lies in offering Bitcoin users a wider range of yield types—re-staking, validator node, and trading strategy returns—providing greater flexibility and choice.

2.1.3 Move Ecosystem’s BTCHub: Echo Protocol

Echo is the BTCFi hub of the Move ecosystem, providing one-stop financial solutions for Bitcoin on Move, enabling seamless interoperability between BTC and Move-based apps.

Echo pioneers bringing BTC liquid staking, restaking, and yield infrastructure to the Move ecosystem, introducing new liquidity asset classes. By integrating all native BTC L2 solutions—including Babylon—and supporting various BTC LSTs, Echo becomes a critical entry point for attracting new capital into Move DeFi.

Echo’s flagship product, aBTC, is a cross-chain liquid Bitcoin token backed 1:1 by BTC. This innovation boosts DeFi interoperability, allowing users to earn real yield within ecosystems like Aptos, with full support across the Aptos DeFi network.

Echo also introduces restaking to the Move ecosystem via its innovative eAPT product, enabling restaking to secure MoveVM chains or any project building its own blockchain, allowing them to rely on Aptos for security and validation.

Thus, Echo becomes the BTCHub for the Move ecosystem, offering four Bitcoin-centric products:

-

Bridge: Enables bridging BTC L2 assets to Echo, enabling Move-BTC L2 interoperability;

-

Liquid staking: Stake BTC on Echo to earn Echo Points;

-

Restaking: Synthesize aBTC, a Move-native LRT, enabling cross-ecosystem operability and multi-layer yield stacking;

-

Lending: Deposit APT, uBTC, or aBTC to provide collateralized loans, sharing profits with users for near 10% APT yield.

2.1.4 Lombard: “Semi-Centralization Might Be Optimal”

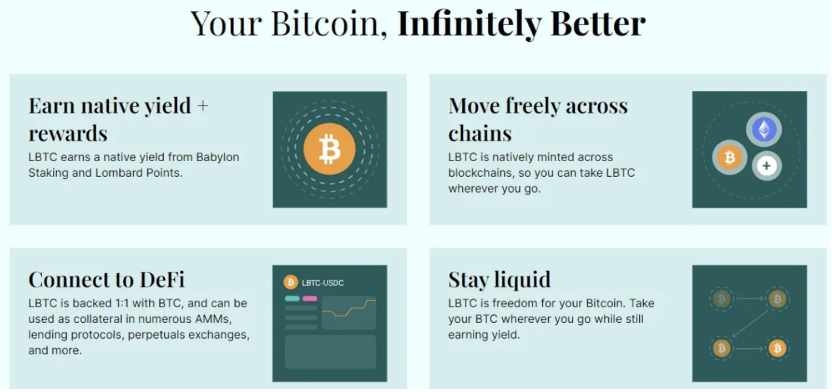

Lombard’s LBTC strikes a balance between security and flexibility. Absolute decentralization ensures high security but sacrifices flexibility—RenBTC and TBTC’s low market caps compared to WBTC illustrate this trade-off. Full centralization maximizes flexibility but faces trust and security risks, limiting upside. This partly explains WBTC’s relatively small share of total BTC supply.

Lombard finds a sweet spot: maintaining strong security while maximizing LBTC’s flexibility, opening new avenues for BTC liquidity assets.

Source: Lombard

Unlike traditional multisig mint/burn models, Lombard introduces a “Consortium Security Alliance.” Originally seen in consortium chains, unlike typical DeFi or bridge projects controlled by single teams, Lombard’s alliance comprises highly reputable nodes—project teams, top institutions, market makers, investors, and exchanges—reaching consensus via Raft algorithm.

This isn’t “100% decentralized,” but it’s far more secure than standard multisig, while retaining benefits like 2/3 notarization, full-chain circulation, and flexible minting/redeeming. Moreover, full decentralization doesn’t guarantee absolute security. Attack cost and security models of PoW/PoS chains can be calculated based on design and market cap. Beyond BTC, ETH, and Solana, most decentralized projects may not be as secure as Lombard’s “security alliance.” This design balances security and flexibility, offering users a credible and efficient BTC liquidity solution.

Beyond the alliance, Lombard uses CubeSigner—a hardware-backed, non-custodial key management platform—with strict policies against theft, breaches, insider threats, and key misuse, adding another layer of protection for LBTC.

A $16 million seed round led by Polychain signals strong industry backing, boosting credibility of its consortium nodes and facilitating integrations with DeFi and other blockchain projects. LBTC is poised to become WBTC’s strongest contender.

Source: Lombard

2.1.5 Lorenzo: “Comes with Pendle Built-In”

While Lombard excels in asset security, Lorenzo—backed by Binance as a Babylon LST gateway—offers compelling features.

In this wave of DeFi innovation, most DEXs and lending protocols still follow DeFi Summer patterns or “live off past glories.” After Terra’s collapse, stablecoin innovation has been stagnant—except for Ethena. The most promising areas are LSTs and LRTs, driven by Ethereum’s shift to PoS and EigenLayer’s restaking leverage.

In this space, Pendle is the biggest winner. It’s fair to say most yield-bearing assets in Ethereum eventually flow into Pendle. Principal-yield separation unlocks new DeFi玩法: risk-averse users gain hedging tools, while aggressive players boost returns via implicit leverage.

Lorenzo aims to consolidate these innovations. Once Babylon enables staking, its LST gains principal-yield separability akin to stETH, Renzo, or EtherFi. Lorenzo splits its LST into two tokens: Liquid Principal Token (LPT, i.e., stBTC) and Yield Accruing Token (YAT). Both are freely transferable and tradable, allowing separate yield extraction or BTC redemption. This boosts asset flexibility and offers richer investment choices.

Source: Lorenzo

This unlocks more DeFi possibilities for Babylon-staked BTC. For example, LPT and YAT can form trading pairs with ETH, BNB, or USD stablecoins, creating arbitrage and investment opportunities. Lorenzo can also support lending protocols and structured products (e.g., fixed-income BTC理财产品). In short, most innovative use cases on Pendle can be adapted by Lorenzo.

As one of the few Bitcoin ecosystem projects directly backed by Binance, and the only BTCFi LST project with native “Pendle-like” functionality, Lorenzo deserves close market attention. It expands BTC liquidity and introduces flexible yield management, enriching investor options.

2.1.6 Corn: A Chain Born for BTCFi

Corn is the first Ethereum L2 using Bitcoin as gas, designed to offer financial services including lending, liquidity mining, and asset management. Entirely built around Bitcoin’s financial needs, its uniqueness lies in mapping BTC to BTCN—the network’s native gas token—enabling broader Bitcoin usage in Ethereum’s ecosystem.

Key Features:

BTCN Token:

Corn introduces BTCN as gas for transactions on its network. BTCN acts like an ERC-20 version of Bitcoin—similar to wBTC but implemented differently. Benefits include lower fees, improved BTC utility, and new value capture opportunities.

“Crop Circle” Ecosystem:

Corn proposes a “Crop Circle” ecosystem to recycle Bitcoin’s value for additional yield. Users can stake BTCN for rewards, participate in liquidity mining, lend, or build BTCN-based derivatives.

Tokenomics:

Introduces $CORN and $popCORN. $CORN is earned by staking BTCN or providing liquidity. $popCORN is obtained by locking $CORN and serves as a governance token, granting voting rights and extra rewards. This model encourages long-term holding and strengthens community engagement via dynamic weights and lock-up mechanisms.

By bringing Bitcoin into Ethereum’s ecosystem, Corn offers an innovative L2 solution to create more yield opportunities for BTC holders.

2.2 Space: Enhancing Bitcoin’s Liquidity

2.2.1 Custody Platforms: Antalpha, Cobo, Sinohope

While decentralization is the ultimate “political correctness” in crypto, removing black swan events like FTX’s collapse, top-tier centralized custodians and financial platforms generally perform better in fund security than most decentralized platforms. Annual losses from non-custodial wallets and DeFi hacks exceed those from centralized custodians by an order of magnitude.

Thus, leading Bitcoin custody and financial service platforms play indispensable roles in unlocking BTC liquidity and enabling spatial/temporal asset allocation.

Consider these three:

Antalpha – Hosts one of crypto’s largest Bitcoin communities, strategic partner of Bitmain, and offers Antalpha Prime—an ecosystem product providing institutional services like miner financing, electricity financing, and MPC-based BTC custody.

Cobo – Co-founded by Shen Yu and Dr. Jiang Changhao, Cobo Wallet is trusted by millions. With over 100 million addresses and $200 billion in transaction volume, Cobo now offers MPC and smart contract wallets—making it a go-to one-stop wallet provider for institutions and users.

Sinohope – A publicly listed firm in Hong Kong, offering not just wallet solutions but full-stack blockchain services: L1/L2 explorers, faucets, basic DEXs, lending, NFT marketplaces, and more.

All three serve large B2B user bases with consistently strong security. Many DeFi protocols collaborate with them. Here, the line between centralization and decentralization blurs—prioritizing security and trust, finding a stable balance between technology and commercialization.

2.2.2 Lending Rising Star: Avalon

Avalon is a decentralized lending platform focused on providing liquidity to Bitcoin holders. Users can collateralize BTC to borrow funds. Avalon automates lending via smart contracts and offers fixed borrowing rates as low as 8%, making it competitive in the crowded DeFi space.

Bitcoin-focused: Avalon is live on BTC L2s including Bitlayer, Merlin, Core, and BoB, specifically serving Bitcoin users’ liquidity needs.

Collateral Management: Uses over-collateralization—users must deposit more BTC than the loan amount—to minimize platform risk.

Data Performance: Platform TVL exceeds $300M. Avalon actively partners with BTCFi projects like SolvBTC, Lorenzo, and SwellBTC to expand its user base.

2.2.3 CeDeFi Pioneer: BounceBit

BounceBit is an innovative blockchain platform empowering Bitcoin assets by merging centralized finance (CeFi) and decentralized finance (DeFi) with restaking strategies, transforming Bitcoin from a passive asset into an active participant in the crypto ecosystem.

Key Features:

BTC Restaking: Users deposit Bitcoin (native BTC, WBTC, renBTC, etc.) into BounceBit to earn additional yield via restaking, increasing asset liquidity and return opportunities.

Dual-Token PoS Consensus: Uses a hybrid BTC + BB (BounceBit’s native token) PoS mechanism. Validators stake both BBTC (BounceBit’s Bitcoin token) and BB, enhancing network resilience, security, and participation.

BounceClub: Enables even non-developers to create their own DeFi products.

Liquid Staking: Introduces liquid staking, keeping staked assets liquid and unlocking additional yield—unlike traditional locked staking, offering greater flexibility.

Through innovative restaking and dual-token consensus, BounceBit creates new yield opportunities for Bitcoin holders and advances Bitcoin’s role in DeFi. Its liquid staking and BounceClub tools make DeFi development simpler and more accessible.

2.2.4 Stablecoin Rising Star: Yala

Yala is a stablecoin and liquidity protocol on Bitcoin. Through its modular infrastructure, Yala enables its stablecoin $YU to move freely and securely across ecosystems, unleashing BTC liquidity and injecting massive capital into the broader crypto space.

Core Products:

-

Overcollateralized Stablecoin $YU: Generated by overcollateralizing Bitcoin. Infrastructure runs natively on Bitcoin’s protocol and can be deployed securely across EVM and other ecosystems.

-

MetaMint: Core component of $YU, enabling users to easily mint $YU using native BTC across ecosystems, injecting BTC liquidity into them.

-

Insurance Derivatives: Offers comprehensive insurance solutions within DeFi, creating arbitrage opportunities.

Yala’s infrastructure serves its vision: bringing Bitcoin’s liquidity to every crypto ecosystem. With $YU, BTC holders earn extra yield across cross-chain DeFi protocols while preserving Bitcoin’s mainnet security. Governance token $YALA enables decentralized control across products and ecosystems.

2.2.5 The Blooming Wrapped BTC Landscape

WBTC

Wrapped Bitcoin (WBTC) is an ERC-20 token linking Bitcoin to Ethereum. Each WBTC is backed by 1 BTC, pegging its value to BTC. WBTC allows Bitcoin holders to use their assets in Ethereum’s DeFi ecosystem, greatly enhancing BTC’s liquidity and use cases in DeFi.

WBTC has long dominated the wrapped BTC space. But on August 9, BitGo—the custodian—announced a joint venture with BiT Global to migrate WBTC’s multi-sig management address. Though seemingly routine, controversy erupted when it emerged that BiT Global is controlled by Justin Sun. MakerDAO swiftly proposed reducing WBTC collateral in its vaults to zero. Market concerns over WBTC opened doors for new wrapped BTC alternatives.

BTCB

BTCB is Binance Smart Chain’s Bitcoin token, enabling BTC usage on BSC. Designed to boost BTC liquidity, BTCB leverages BSC’s low fees and fast finality.

Binance is actively expanding BTCB’s functionality, planning to launch more DeFi products on BSC—lending, derivatives, etc.—to enhance BTCB’s utility and liquidity. BTCB is already supported by multiple DeFi protocols: Venus, Radiant, Kinza, Solv, Karak, pStake, Avalon, and others. These allow users to use BTCB as collateral for lending, liquidity mining, and stablecoin minting.

Binance aims to strengthen BTCB’s market position and drive broader BTC adoption in BSC’s DeFi ecosystem. BTCB creates new use cases for BTC holders and injects significant liquidity into BSC.

dlcBTC (now iBTC) @ibtcnetwork

iBTC is a Bitcoin asset based on Discrete Log Contracts (DLC), enabling secure, privacy-preserving complex financial contracts. Its core feature is full decentralization—no third-party custody or multisig—ensuring complete user control and eliminating centralization risks. iBTC’s unique self-wrapping mechanism keeps BTC under user control; only the original depositor can withdraw, preventing theft or seizure.

iBTC also uses zero-knowledge proofs to enhance transaction privacy and security. Users execute complex financial transactions without revealing details, protecting personal information. This innovation enables BTC holders to participate in DeFi while retaining full ownership and control.

iBTC is the most decentralized wrapped BTC solution, solving transparency issues in centralized custody during commercialization.

Beyond these, other solutions like FBTC, M-BTC, and SolvBTC further diversify the BTC landscape.

IV. Conclusion

Bitcoin has existed for 15 years. It is no longer just digital gold—it’s a $2 trillion financial system. Builders continue pushing Bitcoin’s boundaries, giving rise to a new sector: BTCFi. Our key takeaways:

1. Finance is the temporal and spatial allocation of assets. Spatial examples: lending, payments, trading. Temporal: staking, interest, options. As Bitcoin’s market cap hits $2 trillion, demand for allocating BTC across time and space grows, forming the BTCFi landscape.

2. Bitcoin may soon become a national reserve asset in the U.S., driving institutional adoption and creating large-scale institutional-grade financial demand—such as lending and staking—spawning institutional BTCFi projects.

3. Mature infrastructure—asset issuance, Layer 2 networks, staking—has paved the way for BTCFi applications.

4. BTC network TVL is ~$2 billion (including L2s and sidechains), just 0.1% of total market cap. Ethereum: 15.7%, Solana: 5.6%. We believe BTCFi has at least 10x growth potential.

5. BTCFi unfolds along two axes: enhancing yield (projects: Babylon, Solv, Echo, Lombard, Lorenzo, Corn) and enhancing liquidity (projects: Wrapped BTC, Yala, Avalon).

6. As BTCFi evolves, Bitcoin will transform from passive to active, from non-yielding to yield-generating.

7. Looking at gold history: gold ETFs 20 years ago drove a 7x price surge by turning gold from a passive asset into a financial instrument. Today, BTCFi adds temporal and spatial financial attributes to Bitcoin, expanding its utility and value capture. Long-term, this could profoundly impact Bitcoin’s value and price.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News