The Diamond Hand Manual: How to Achieve 100x Returns in the Memecoin Market?

TechFlow Selected TechFlow Selected

The Diamond Hand Manual: How to Achieve 100x Returns in the Memecoin Market?

Statistics show that only 0.001% of memecoins can "laugh last," with market capitalizations exceeding $100 million.

Author: 0xLeoDeng, LK Venture Partner & Investment Lead

How to Find the Most Promising Memecoins Among Millions?

In the world of crypto, memecoins are an endless drama. They perfectly blend internet culture with cryptocurrency—from early tokens like $Doge and $Shiba Inu to rising stars such as $GOAT and $PNUT. These seemingly "unserious" projects have created market caps worth billions of dollars. Yet behind this carnival lies a sea of "shitcoins" and scams.

The value of memecoins stems not only from community consensus and viral spread but also from holders' belief—the so-called "Diamond Hands" investment mentality. Amid extreme market volatility, Diamond Hands symbolize unwavering confidence and long-term optimism toward an asset. It's more than just a label for investors; it's a manifestation of faith. Only steadfast holders can seize the next wave of explosive growth when markets swing.

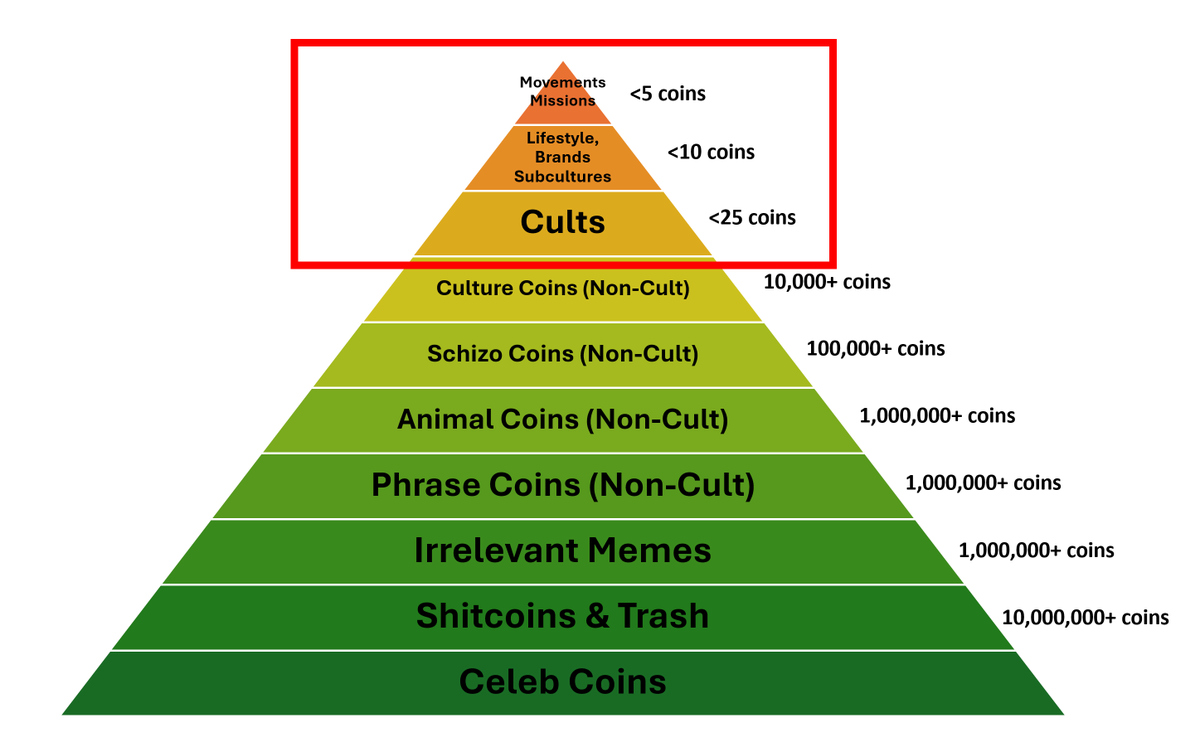

So how do we define the value of memecoins? How do Diamond Hands identify promising assets among millions of options? Let’s start with a “pyramid diagram” to unravel this mystery.

1. The Memecoin Pyramid Ecosystem

Image link:

https://x.com/MustStopMurad/status/1851690032639148044

The above pyramid, provided by Murad, offers a clear view of the different layers and value logic within the memecoin ecosystem. From bottom-layer "shitcoins" to top-tier "faith coins," each level reflects varying degrees of narrative depth and market positioning:

1. Bottom Layer: Celeb Coins, Shitcoins & Trash

-

Characteristics: Driven purely by hype or celebrity endorsement, lacking technical foundation or real-world use cases—surviving only on short-term traffic.

-

Examples: Celeb Coins (riding on celebrity fame); Shitcoins & Trash (no innovation, quickly launched to cash grab).

-

Commentary: These are like "one-hit wonders"—once the spotlight fades, their value quickly drops to zero.

2. Irrelevant Memes (Meaningless Memecoins)

-

Characteristics: Absurd themes, random content, without clear narratives or strong community support.

-

Examples: GrumpyCatCoin (based on the angry cartoon cat meme); certain forks of Pepe (bandwagon tokens with no uniqueness).

-

Commentary: While they may attract fleeting interest due to humor, these lack long-term value and remain temporary phenomena.

3. Phrase Coins (Non-Cult)

-

Characteristics: Based on popular phrases in crypto circles, leveraging linguistic memes for attention—but stuck at the conceptual stage.

-

Examples: WenLamboCoin (named after the meme “When Lambo?”); HODLToken (playing off the classic term “Hold On for Dear Life”).

-

Commentary: Phrase coins are mostly about meme engagement. They might spark short-term excitement but offer limited long-term potential.

4. Animal Coins (Non-Cult)

-

Characteristics: Themed around animals, offering higher fun factor and virality, some community backing, but weak storytelling.

-

Examples: TigerKingCoin (inspired by Netflix’s *Tiger King*); BabyDogeCoin (claims to be Dogecoin’s “son”).

-

Commentary: Animal coins have moderate community momentum, but without further innovation or branding, they’re easily forgotten.

5. Schizo Coins (Chaotic Coins, Non-Cult)

-

Characteristics: Often feature surreal, absurd, or niche cultural elements that appeal to specific audiences, yet have limited broader reach.

-

Examples: FlokiCoin (named after Elon Musk’s dog “Floki”), briefly went viral; CultDAO (attempts to build a cult-like culture but lacks lasting impact).

-

Commentary: Though uniquely charming to subcultures, most fail to break beyond their echo chambers.

6. Culture Coins (Non-Cult)

-

Characteristics: Tied to internet subcultures or niche communities, with decent narrative and community support—but haven’t reached full “faith” status.

-

Examples: PEPE: rooted in the iconic Pepe frog meme; POPCAT: the first cat-themed memecoin based on the globally famous “Popcat” click-game meme.

-

Commentary: These leverage distinct cultures to draw relatively stable fanbases, but require deeper narratives to overcome growth bottlenecks.

7. Cults: Lifestyle, Brands, Subcultures (Faith Tier)

(1) Lifestyle, Brands, Subcultures

-

Characteristics: No longer just tokens—they represent lifestyles and brands, attracting highly loyal followers.

-

Example: Shiba Inu: evolved from an animal coin into a branded memecoin with a full DeFi and NFT ecosystem.

-

Commentary: These have moved beyond speculation into brand-building, creating sustainable long-term value.

(2) Movements, Missions

-

Characteristics: Their narratives transcend cryptocurrency, representing social goals or cultural movements.

-

Example: Dogecoin: evolved from a “joke coin” into a “decentralized people’s currency,” amplified by figures like Elon Musk who gave it a sense of mission.

-

Commentary: Top-tier memecoins aren’t merely investment vehicles—they become vessels of cultural belief. Only those aligned with societal missions or cultural shifts can achieve multibillion-dollar consensus value.

Pyramid Summary: The Success Pattern of Memecoins

-

Bottom-tier coins: Shitcoins and meaningless memecoins rely solely on trends or short-lived traffic—extremely short lifespans.

-

Middle-tier coins: Cultural and animal-themed coins have some community and narrative support but lack sufficient innovation.

-

Top-tier coins: Faith-based coins possess powerful narratives, devoted communities, and branding potential—becoming cultural symbols.

Core Logic Behind the Pyramid: Narrative + Community + Innovation

-

Narrative is foundational: Top memecoins all tell compelling stories that resonate and invite participation—e.g., Dogecoin’s “people’s money” narrative.

-

Community is key: Without an active community, there’s no heat. The loyalty of the SHIBArmy is central to Shiba Inu’s success.

-

Traffic determines survival: Whether via Elon Musk’s tweets or Reddit virality, traffic is the lifeblood of any memecoin.

Yet even knowing these principles, picking truly promising memecoins from thousands remains like finding a needle in a haystack. That’s why we need a simple, effective filtering framework.

2. The M.E.M.E. Framework: How to Choose Higher-Value Memecoins

When selecting higher-value memecoins, I’ve developed a memorable “M.E.M.E.” framework to help cut through the noise:

1. M – Mission (Purpose & Storytelling)

- Is the story interesting and easy to share?

- Does it tap into culture or emotion, fostering a sense of belonging?

- Is there a clear value proposition?

Memecoins with strong purpose create emotional resonance, encouraging long-term holding.

2. E – Engagement (Community Participation)

- Does it inspire users to join fun activities?

- Is the community growing in size and activity?

- Do holders exhibit HODL behavior, showing abundant “Diamond Hands”?

The community is the heart of any memecoin. Without active engagement, there is no true memecoin. People should stop chasing the next 100x token and instead look for the next 100x community.

3. M – Momentum (Market Heat & Liquidity)

- Is it backed by celebrities or trending events?

- Are trading volume and liquidity strong?

- Does it sustain ongoing buzz rather than being a flash-in-the-pan?

Market momentum opens wallets. Without media attention and capital flow, nothing else matters.

4. E – Evolution (Innovation & Ecosystem Development)

- Does it integrate new industry trends (e.g., AI, DeSc)?

- Is it exploring real-world applications or offline expansion?

Only memecoins capable of continuous evolution can survive long-term competition.

Case Analysis

Based on the M.E.M.E. framework and differing risk-return profiles, promising memecoins can be categorized into three types: 1. Low-risk, steady-return; 2. Medium-risk, medium-return; 3. High-risk, high-return.

Below is a curated list of memecoins analyzed using the M.E.M.E. framework and summarized with assistance from ChatGPT (for model analysis reference only—not investment advice):

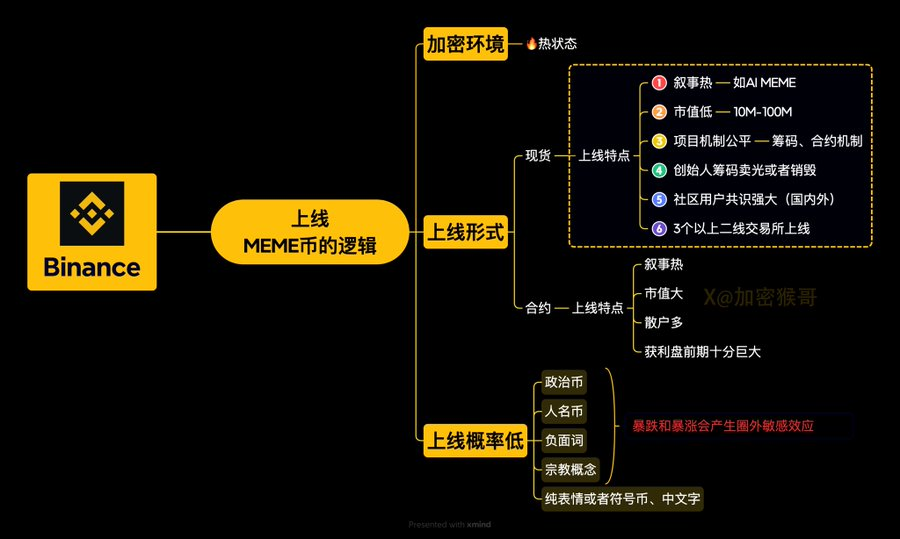

Finally, here’s a diagram compiled by Crypto Monkey Brother illustrating Binance’s logic for listing memecoins—worth comparing and reflecting upon:

Original link:

https://x.com/monkeyjiang/status/1856607604429963673

Finding Order in Chaos: Choosing Memecoins

The memecoin world is fascinating—a spectrum from trash to faith, reflecting both the diversity of crypto culture and humanity’s deep attraction to storytelling.

Murad describes the current bull run since 2024 as the “People’s Bull Market”—the most significant wealth creation opportunity for retail investors since Bitcoin’s early days. This cycle, we could see over ten memecoins surpass $10 billion in valuation.

By applying the pyramid analysis and the M.E.M.E. framework, I hope you’ll gain better insight into the value and risks behind memecoins—helping you discover your own wealth code and become a true “Diamond Hand” in the world of memes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News