Opinion: The flywheel kicks in, Solana emerges as the winner of the Meme craze

TechFlow Selected TechFlow Selected

Opinion: The flywheel kicks in, Solana emerges as the winner of the Meme craze

Whenever people bet on memes and "profit" by buying SOL, the real winners are the VCs selling SOL.

Written by: Duo Nine, crypto analyst

Translated by: Felix, PANews

Solana captured the retail market in this cycle in a way no other chain could, because it did one thing right.

Competitors like Ethereum failed in this regard and paid a heavy price. BNB Chain failed. Tron tried but failed.

These competing L1s have failed while Solana succeeded—and for that, SOL deserves credit.

How did Solana do it?

Solana VC captured market greed in a way no other L1 could match.

Tron also has very low transaction costs, as does BNB Chain. Solana holds no advantage here. Yet both competing chains focused on the wrong things.

Binance focuses on its CEX, generating user airdrops from new tokens listed on Binance. Users must stake BNB for this. This method works well to keep BNB’s price high.

BNB also hit an all-time high in this cycle, but it didn’t rise 28x (compared to its 2022 low) like Solana did.

According to official Tether data, there are 60.2 billion USDT on the Tron network—nearly half of the total 130.7 billion USDT in circulation. Ethereum holds 66.3 billion USDT, while Solana has only 860 million USDT.

USDT on ETH is mainly used for DeFi, while USDT on Tron is used for transfers and payments. Tron and Justin Sun attempted to create memes and attract retail users to their chain, but failed. They entered too late, and TRX hasn’t risen 28x in this cycle.

As for Ethereum, it’s completely detached from market reality. Vitalik talks about 5-year roadmaps on forums.

But retail attention spans last 30 seconds—the same time it takes for a Solana meme to 10x on pump.fun.

What made Solana the winner?

Besides low transaction fees and a 28x rise since 2022 (which matters greatly to retail), Solana did one other crucial thing.

They built applications and an ecosystem that feeds greed through memes. Solana VCs poured in massive cash, subsidized network costs, and actively created FOMO via memes.

They also focused on creating apps and wallets that retail users can easily understand. Retail doesn’t care about infrastructure (unlike Ethereum developers)—they care about price increases.

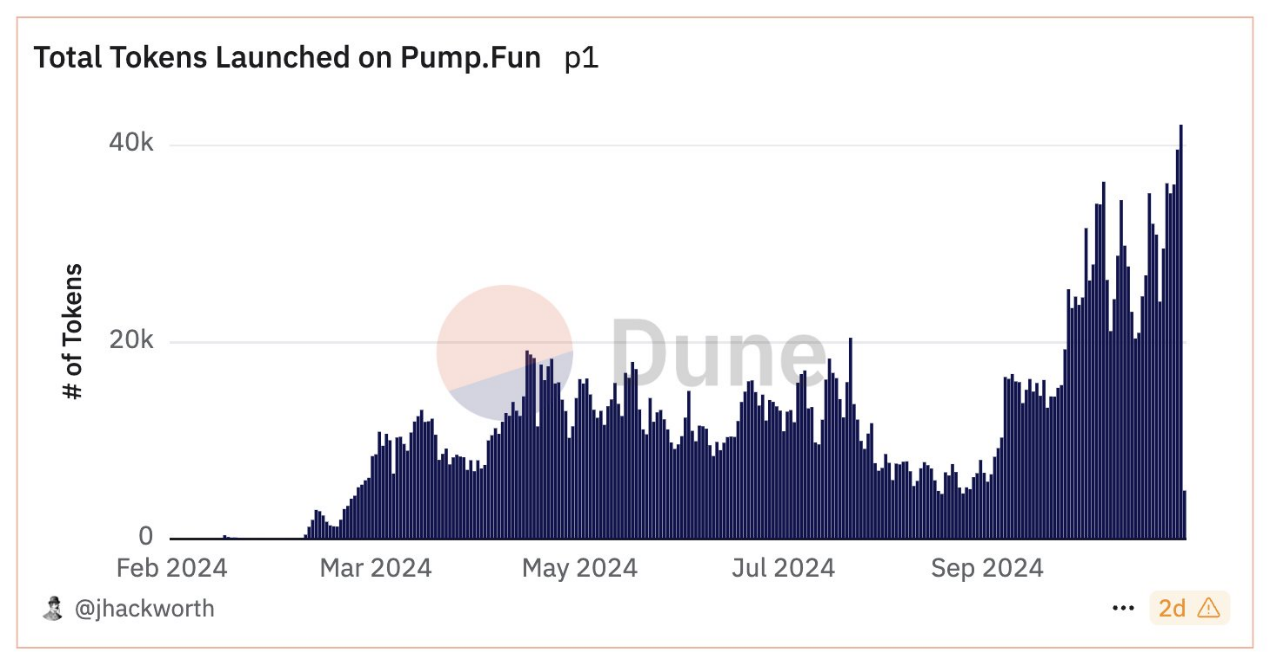

Solana delivered exactly that and allowed retail to gamble like degens. Literally, Solana is a meme machine—the king of memes. New memes constantly emerge from its ecosystem, just as Tron processes USDT transactions.

No other L1 holds this edge, and retail loves memes.

This has also produced unintended consequences.

If you talk about crypto with friends, Solana will be the first and most discussed altcoin. In this cycle, the question you get from newcomers is “How do I buy Solana?” not “How do I buy Ethereum/BNB/TRX?”

This should not be underestimated. New capital is flowing into Solana, and SOL’s price reflects that.

Even Solana’s VCs are surprised by this success. They executed well—and now plan massive sell-offs.

In early 2025, tens of millions of SOL tokens will unlock and flood the market. Retail may go wild buying SOL out of FOMO. A single meme token could cost hundreds of dollars.

In fact, the Solana token itself is the ultimate meme. Retailers might actually think, “I’ll sell this meme coin and put the profits into SOL.”

They don’t realize Solana is also a meme.

This belief currently drives SOL’s price higher. As long as retail sees Solana as “safe” or “blue-chip,” the game continues—until the music stops.

Every time people bet on a meme on SOL and “profit” by buying more SOL, the real winners are the VCs selling SOL.

Solana lacks real-world use cases like Tron’s payments or remittances, or Ethereum’s DeFi. It has memes. And Solana excels at this—performing exceptionally well in bull markets.

You can gamble on Solana, but eventually exit. Don’t leave your money in SOL or any token on the Solana network. It’s a centralized database, not a decentralized currency like Bitcoin.

Some may argue Solana is full of fake users—and that’s true.

But that doesn’t stop real retail investors from being lured into its ecosystem.

Once onboard, the bots created by Solana kick in. On pump.fun alone, hundreds of bots immediately snatch up any newly created meme token.

It’s a flywheel that incentivizes users to keep spending, hoping one of their tokens will explode.

Some will—but most won’t. It works well—until bear market liquidity dries up and retail exits.

By then, all plans are complete, and VCs have already cashed out hundreds of millions—or even billions.

You see, retail only needs to spend $100 on a meme token and become a millionaire. That story satisfies the FOMO of thousands of new users.

Then the cycle repeats. Over and over. Solana has perfectly captured this loop. And past crypto markets have seen similar cycles before.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News