A veteran VC who has weathered three market cycles—does he feel anxious about this meme-driven surge?

TechFlow Selected TechFlow Selected

A veteran VC who has weathered three market cycles—does he feel anxious about this meme-driven surge?

Meme has become the most unavoidable and essential track-level opportunity in our industry.

Author: YettaS

"Yetta, are you guys anxious about the current market?" This was a serious question someone asked me at dinner. I was momentarily taken aback—why would they think we should be anxious? "Because a lot of people believe that with memes dominating, VC coins are dead, haha." Indeed, the biggest topic at this year's DeVCon has been memes. Colleagues joke that talking about primary markets slows down meme trading, and some even ask whether our asset allocation includes memes.

To be honest, we aren't particularly anxious—in fact, early this year we more or less anticipated this situation. Primitive is a permanent capital fund without external funding, which allows us to view this industry through a longer time horizon. We don’t face pressure to deploy capital quickly or justify our investment theses to LPs who don’t understand our space (often a major source of stress). Everything we do follows our own curiosity—learning where value and talent flow in this ecosystem.

In this crypto market, where primary and secondary markets have merged and the latter is increasingly speculative, the role of VC ironically aligns more closely with its original definition: betting on things with venture returns. Following ideologies or engaging in political battles is meaningless; learning from the market is what truly matters.

First, let me explain our understanding of structural changes in the industry

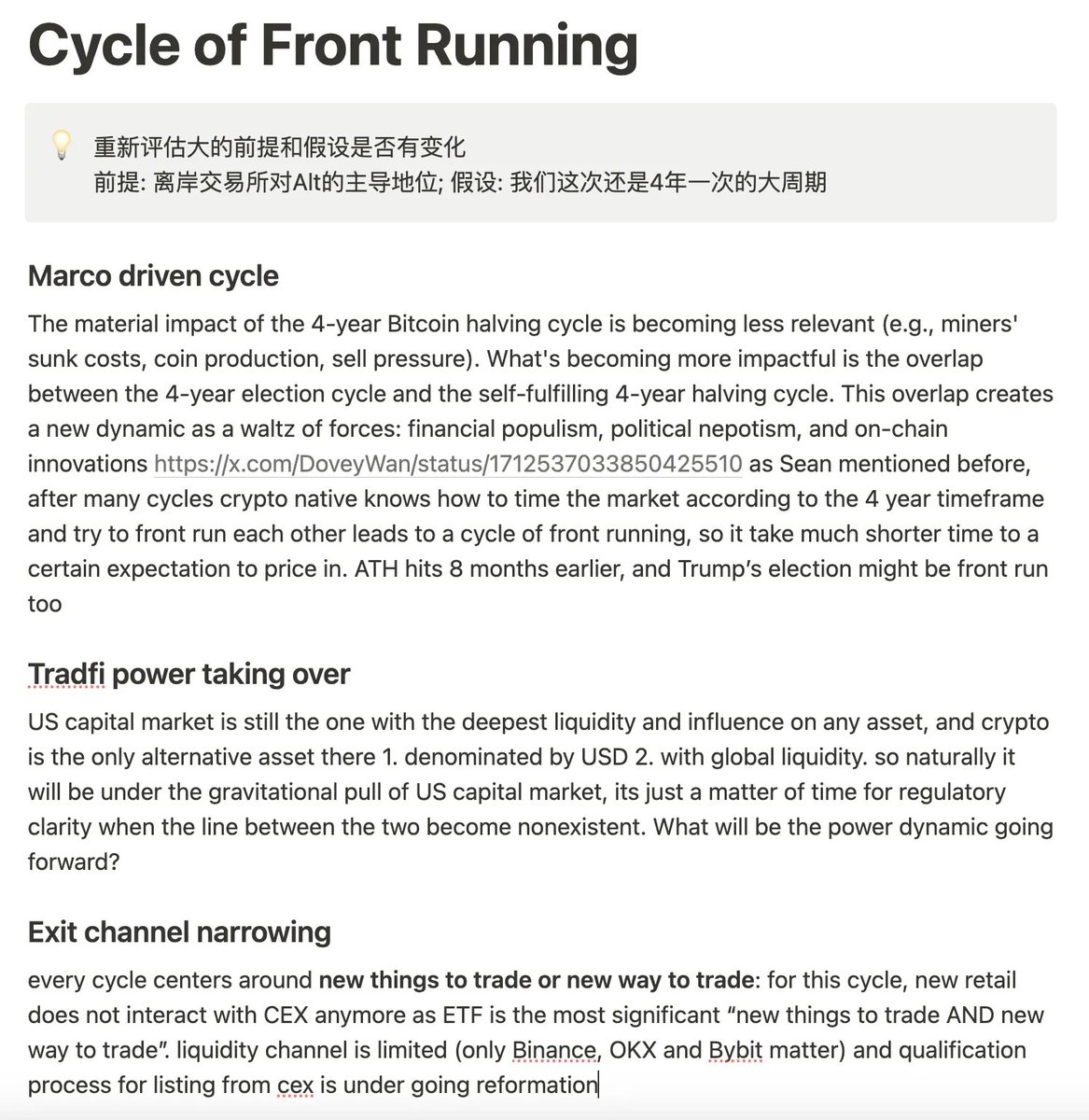

At the beginning of this year, we conducted an extensive post-mortem on industry dynamics and wrote an internal report titled “Cycle of Front Running.” TLDR: The polarization within our industry is intensifying. On one hand, the overall market size has grown, and TradFi institutions have integrated substantial crypto assets into Wall Street via compliant instruments like ETFs. This liquidity has been siphoned off and is unlikely to return to our on-chain ecosystems. On the other hand, populist capitalism is rapidly expanding, attention economies are tightening, and financialization has become increasingly simplistic and aggressive. The most crypto-native approach now is simply trading memes—an area completely out of reach for TradFi.

Under these macroeconomic and social conditions, in-market liquidity continues to shrink. In the past, Barbell Strategy implied that both ends could eventually converge. But the opposite has happened—the divide only widens. As a result, the middle ground in our industry is becoming harder and harder to sustain.

Who occupies this middle ground? All institutions that rose during the wild west era: Offshore CEXs, trading firms, crypto financial service providers, and VCs—no one is immune.

This structural shift makes offshore exchanges nervous—CME’s futures open interest has already surpassed Binance’s. If major coins are increasingly traded on regulated venues due to TradFi inflows, while memes can pump over $1B directly on-chain, isn’t Binance’s position being squeezed?

Beyond offshore CEXs, market makers who once thrived in crypto now face high-frequency quant teams from Wall Street entering with superior infrastructure and capital. How do they respond? As their influence wanes, third-party financial services built around them also fade—and it goes without saying that VCs, unable to actively trade, are even more vulnerable.

This polarization and liquidity squeeze represent the fundamental transformation in our industry. Only those who find a breakthrough will succeed.

Second, what exactly went wrong with VC tokens?

I fully understand the market sentiment toward VC tokens. Projects launch with sky-high FDVs, then continuously unlock and dump tokens for profit. If it's all just gambling anyway, why not go to a relatively fairer casino? Why take the bag for billion-dollar VC coins when you can play PVP meme games and only blame yourself if you're too slow?

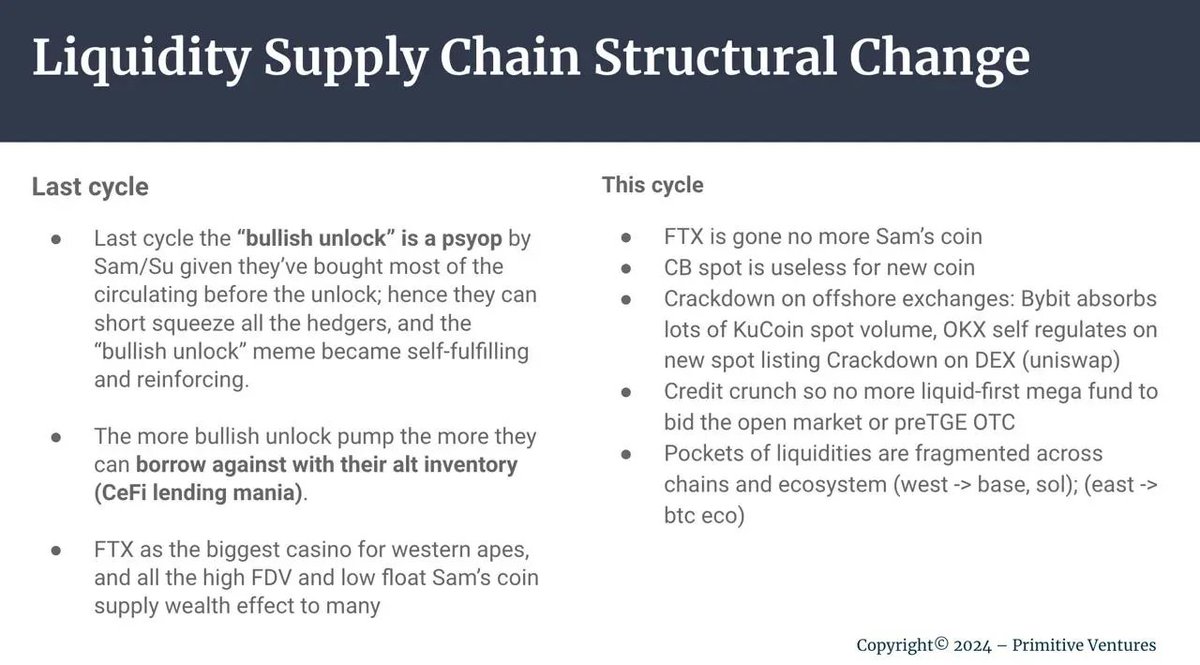

What lies beneath this issue? The problem stems from a broken Liquidity Supply Chain in our industry.

Why does Solana keep reaching new ATHs? Because it has real product adoption, and users can consistently earn SOL-denominated returns. Thus, the user community evolves into a trading community. The positive feedback loop between them becomes a self-fulfilling prophecy—this is key to generating buy-side pressure.

DeFi in the last cycle worked similarly: products launched with fun micro-innovations, DEXs enabled continuous liquidity and price discovery. Once product communities and trader communities aligned, CEX listings unlocked further liquidity, creating a win-win-win scenario among projects, communities, and exchanges.

A healthy ecosystem means everyone playing on-chain wants to buy tokens—and evangelize them. That’s how the liquidity supply chain achieves a virtuous cycle.

But today? With VC tokens, these two communities are split. Mainnets launch TGE immediately, before any actual product exists. Communities show up solely to farm airdrops, bringing only sell-side pressure. Last cycle, figures like Sam or Su helped us leveraged long alts—but leverage has largely been cleared this cycle. Meanwhile, many VCs raised massive funds in the previous bull run and face deployment pressure. To show strong paper returns to LPs, they’re forced to push valuations higher round after round.

Hence the current state of VC tokens: high valuations at launch, zero organic demand—what else can they do but fall?

This naturally explains the logic behind memes: if VC-backed projects fail to deliver, and everything is just speculation anyway, why not speculate on something lower-valued and fairer?

Memes have become an unavoidable, sector-level opportunity in our industry

Given the polarization described earlier, memes have emerged as one of the most significant opportunities in crypto—one that cannot be ignored.

I used to think memes were purely speculative plays—until recently, when I realized I was wrong. Memes are vessels carrying cultural movements. Their value doesn’t lie in functionality or technology, but in their unique ability to embody collective consciousness, emotion, and identity—just like religion. Beneath their absurd surface lies deep sociopsychological needs and values. Memes tokenize, productize, and capitalize on ideas and emotions.

In other words, the core product of a meme is the narrative and ideology it carries. The scale of that narrative determines the meme’s ceiling. Whether it’s cutting-edge tech, idol worship, IP sentiment, or subcultural trends—we analyze their potential just as VCs assess a startup’s market size and positioning.

For memes, the token is the product. Therefore, the goal is to create a mutually reinforcing relationship between price and community. Price action, in a sense, represents product iteration. Through volatility, a solid community foundation is built—paper hands turn into diamond hands, who then spread the word, ultimately fulfilling a self-reinforcing prophecy.

Here, meme tokens hold a massive advantage over traditional VC tokens. Since the token is the product, the product community and the trading community become one and the same—creating unified momentum.

Due to extremely low issuance costs, meme investing suffers from terrible signal-to-noise ratio. You can’t analyze them using conventional product frameworks. It requires exceptional taste in reading cultural currents and market sentiment. I’m still trying to learn—is there a structured methodology to study this space and identify winners amid such noise? And if so, which opportunities fit our profile, and when should we engage?

But I firmly believe memes represent a cross-cycle opportunity—they are, at heart, a cultural phenomenon of the digital age. As long as ideas endure and emotions evolve, memes will never dry up.

More importantly, I’ve always believed that giving underdogs a shot at life-changing wealth is what gives our industry its vitality. Before this meme wave, people said building this cycle required ten times the effort of before, and that VCs had already captured all the value. Community and retail sentiment were deeply suppressed. But memes gave young people another chance to get 100x through early participation. Anti-authority is one of crypto’s core spirits—I believe it will always remain alive.

How much longer can memes go in this cycle?

When everyone is passionately ready to fight for their community and believes profits are endless, remember: profit-taking is inevitable. That’s finance 101. Recall the NFT community back in the day—everyone proudly used monkey avatars, connected brands, hosted global events and collaborations, NFT parties everywhere—then what?

When overconfidence and unrealistic expectations grow, when people think holding majors is worse than memes, when hacks and rugs start piling up—that’s when we should grow cautious. Once our industry lacks larger liquidity catalysts and BTC hits resistance, every amplified alpha will collapse faster.

By the way, isn’t DeSci essentially the same narrative as PeopleDAO and the movement to save Assange last cycle? Under the banner of “justice,” can we still distinguish faith from speculation?

In reality, the turning point for memes came when Binance listed little Neiro. At that moment, VC tokens were struggling. The breakthrough occurred when Binance embraced community-driven memes, allowing projects, communities, and CEX users all to profit—thus birthing ACT.

But doesn’t blind on-chain meme liquidity today resemble the race for TVL after Binance listed high-TVL projects? Or the competition following Binance’s listing of Ton, which brought huge user bases?

CEXs adjust their listing strategies based on market expectations, thereby shaping market direction. Given ultra-low issuance costs and liquidity premiums, our industry inevitably slides into chaotic, homogenized competition—eventually leading to numbness and exhaustion.

This is the power of cycles.

On a short-term basis, don’t blindly follow whatever CEX supports—genuine builders will always emerge.

On a long-term basis, bear markets will inevitably clear out the oversupply of idle projects and restore order.

The market constantly oscillates between long-term construction and short-term emotion—it’s a spectrum. Main characters and memes will form the two ends of the barbell, shifting dominance as sentiment ebbs and flows.

No need to panic. Just find your own rhythm.

Investing is a game: we place bets based on our understanding. When we win, we profit; when we lose, we review. Stay forever curious, forever humble.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News