A new generation's financial rebellion: Why are young people betting on meme markets?

TechFlow Selected TechFlow Selected

A new generation's financial rebellion: Why are young people betting on meme markets?

This is not just a game; it's a vote of no confidence in traditional wealth accumulation methods.

Author: Cumberland Labs

Translation: TechFlow

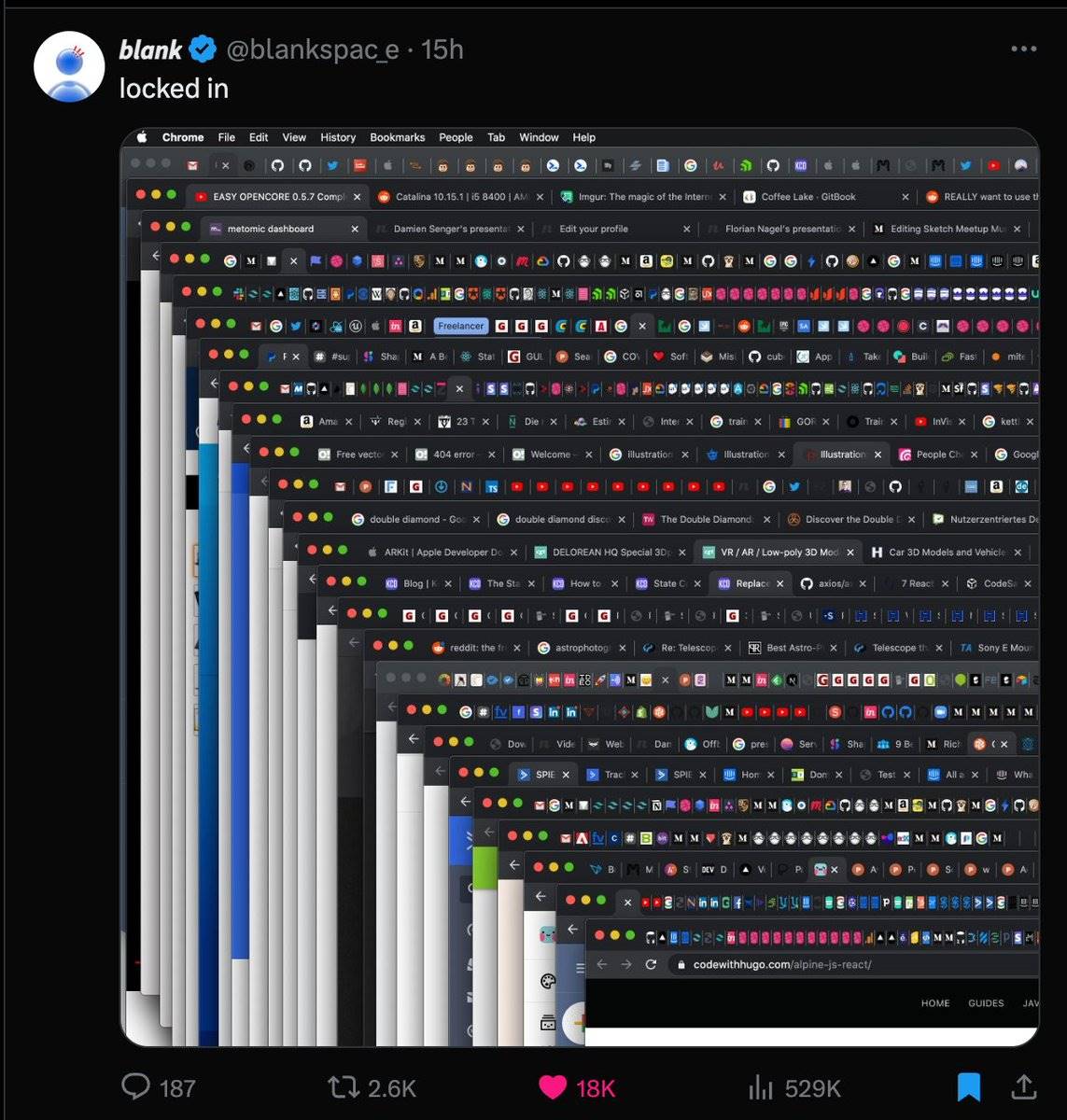

After weeks of observing Discord, diving into Telegram groups, browsing Twitter, and speaking with multiple research analysts and traders, I’ve gained a comprehensive understanding of how everyone—from sophisticated algorithmic traders to my wife’s younger brother—views meme coins. My investigation ranged from improving the UI/UX of limit orders and complex order execution, to asking friends whether they find Moo Deng cute or have heard of the peanut squirrel.

Content in the image:

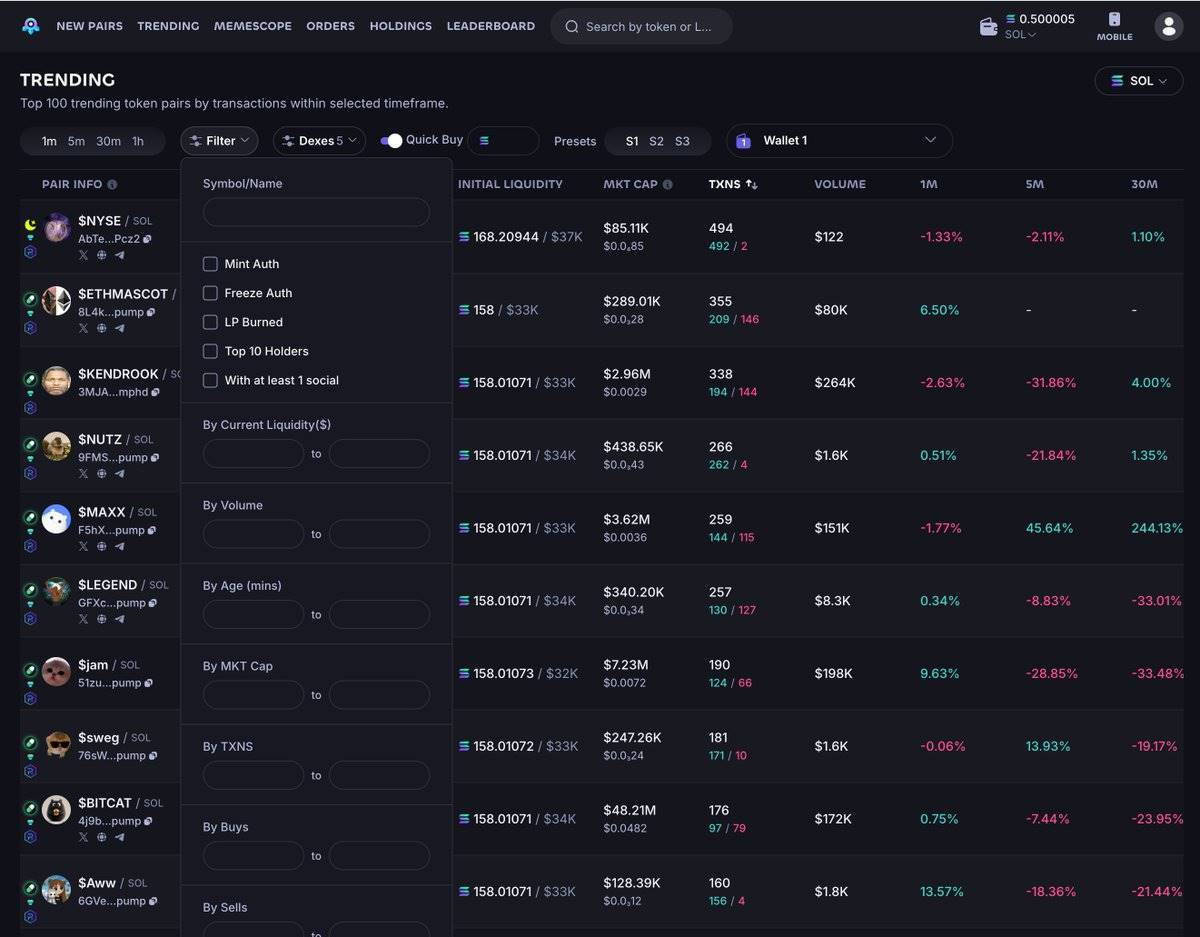

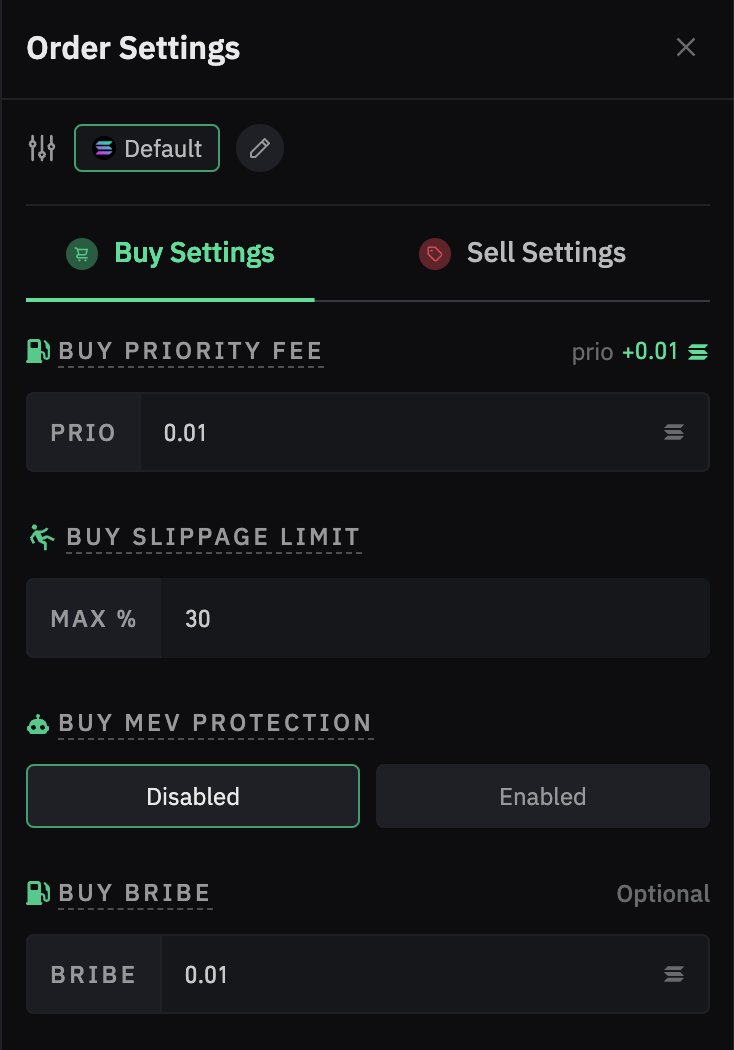

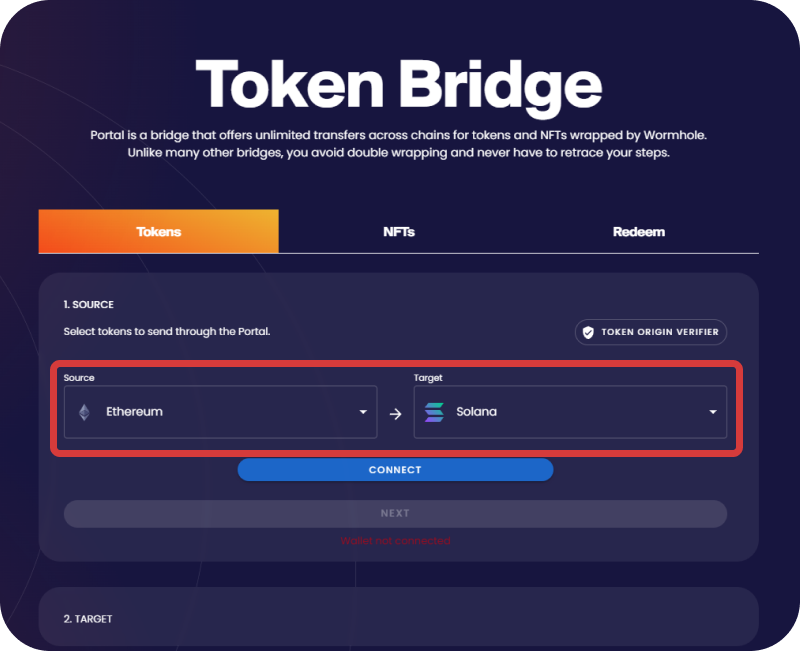

I use Solana daily, from legacy Telegram bots to trading interfaces like Photon or Bullx—I've tried nearly all of them. There are essentially four or five major players in this space, and other blockchains should take note. The key difference lies in device usage (trading interfaces are typically used on PCs, while Telegram bots are faster on mobile, enabling quick reactions when someone mentions a token in a group). In cross-chain trading, user experience remains a significant pain point (Azura is working on it but is still early), and certain settings need further abstraction. For example, you can manually configure parameters like bribes and priority fees—but I want these handled automatically (with manual override only when necessary), which is especially critical during periods of network congestion and fee volatility.

Survey from Discord

What follows is a synthesis of field research, combining public data from the ecosystem and anonymous feedback on this topic. At Cumberland Labs, we believe this narrative is compelling and will continue shaping markets for years to come. While it may appear simple—or even childish on the surface—it actually represents a shift in user behavior that will channel billions of dollars in idle capital into blockchains, whether traders realize it or not.

Survey from my wife

What Are Meme Coins?

The evolution of meme coins began with DOGE as a satirical take on Bitcoin, capturing Elon Musk’s attention, followed by SHIB and PEPE capturing public imagination, and now evolving into fair-launch phenomena on Solana—the market continuously reinvents itself.

@elonmusk's first tweet about Doge

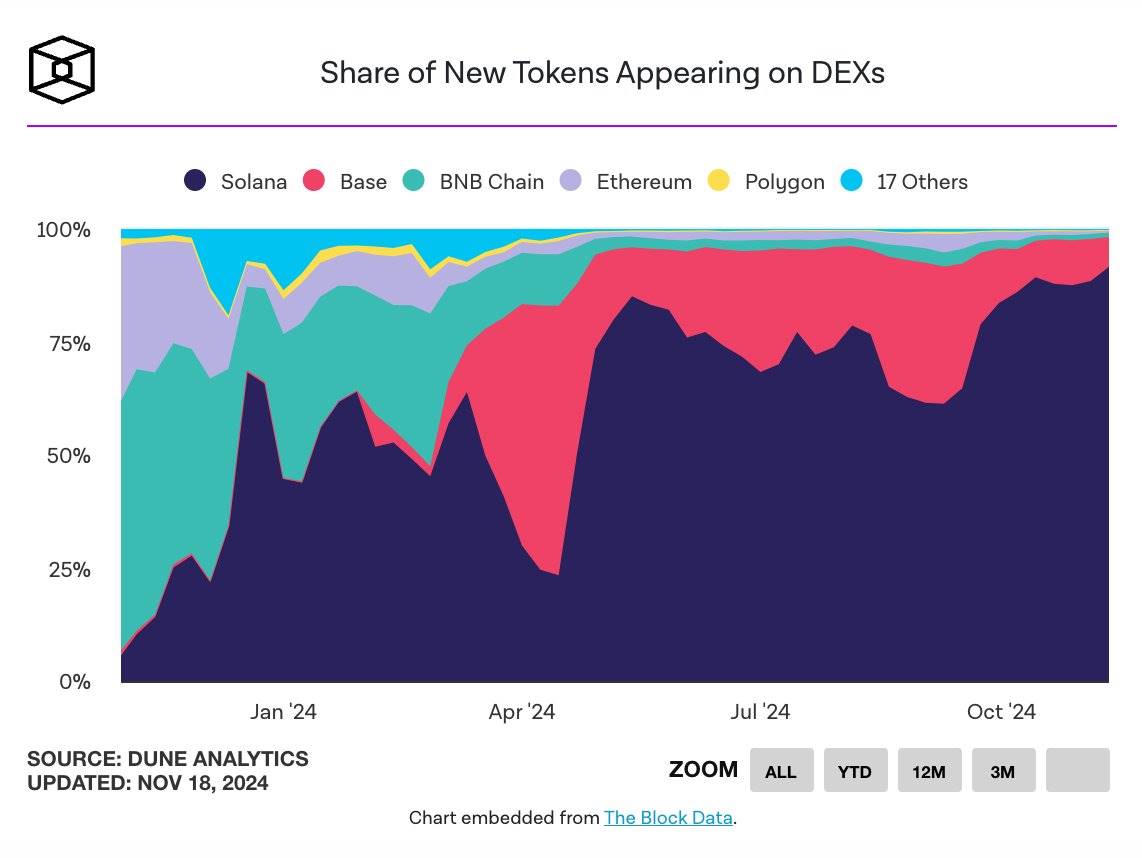

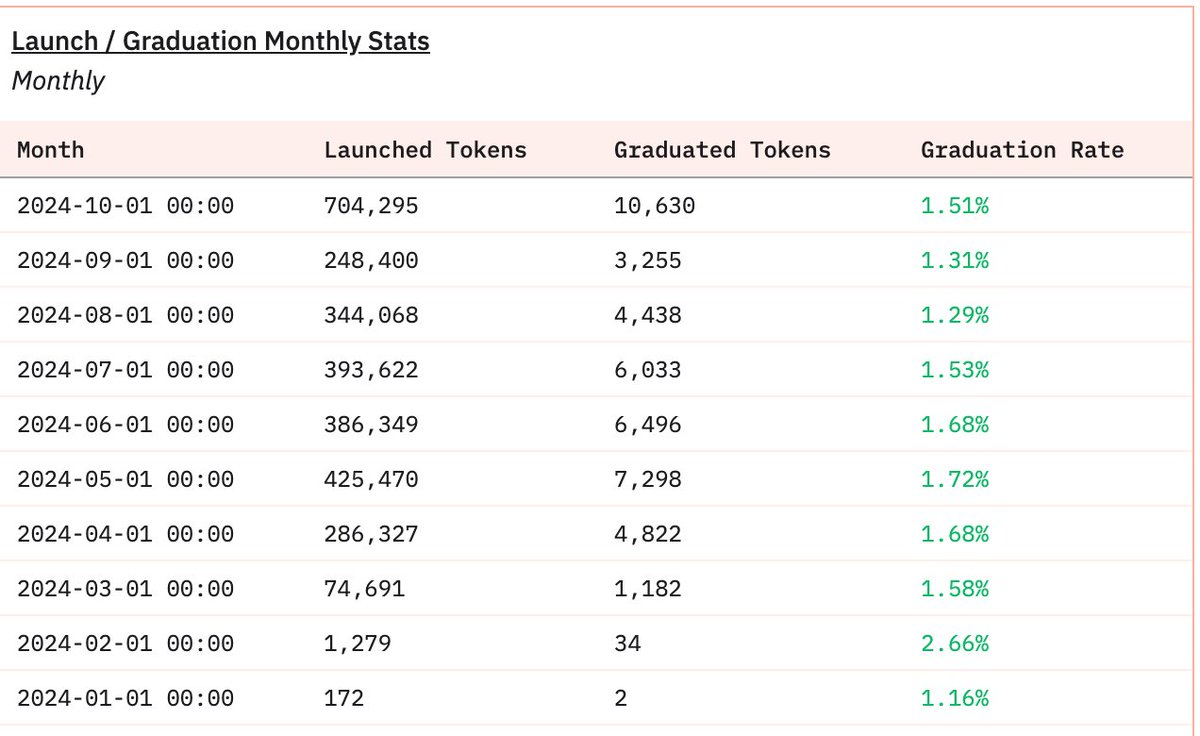

Today, Solana leads this space, powering 89% of new token launches. Just last week, 181,000 new tokens appeared on decentralized exchanges (DEXs). This isn't just about volume—it's about accessibility. Platforms like pump.fun allow anyone to launch a token, yet success rates reveal a harsh reality: fewer than 2% of tokens make it to Raydium, and only 0.0045% maintain a market cap above $1 million.

Source: @TheBlock__

So, what differentiates meme coins from "shitcoins"? Success hinges on specific traits:

From DOGE to Moo Deng, the most successful tokens share common characteristics: strong meme potential, attention-grabbing catalysts, and active community engagement. DOGE leveraged Elon Musk’s endorsement and first-mover advantage, while Moo Deng captured imaginations through viral social media momentum. But crucially, both built communities capable of turning casual observers into passionate advocates.

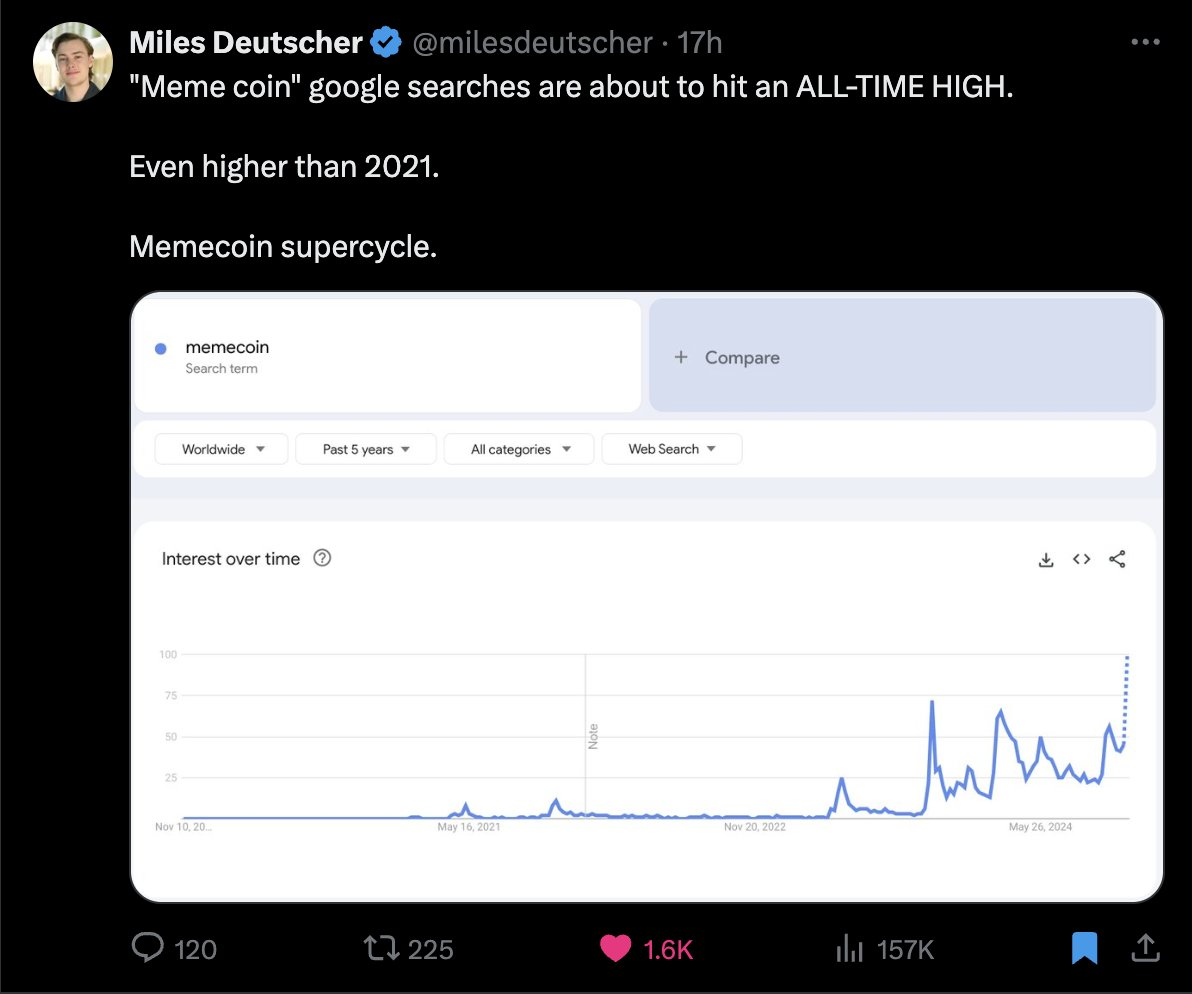

Data Doesn’t Lie

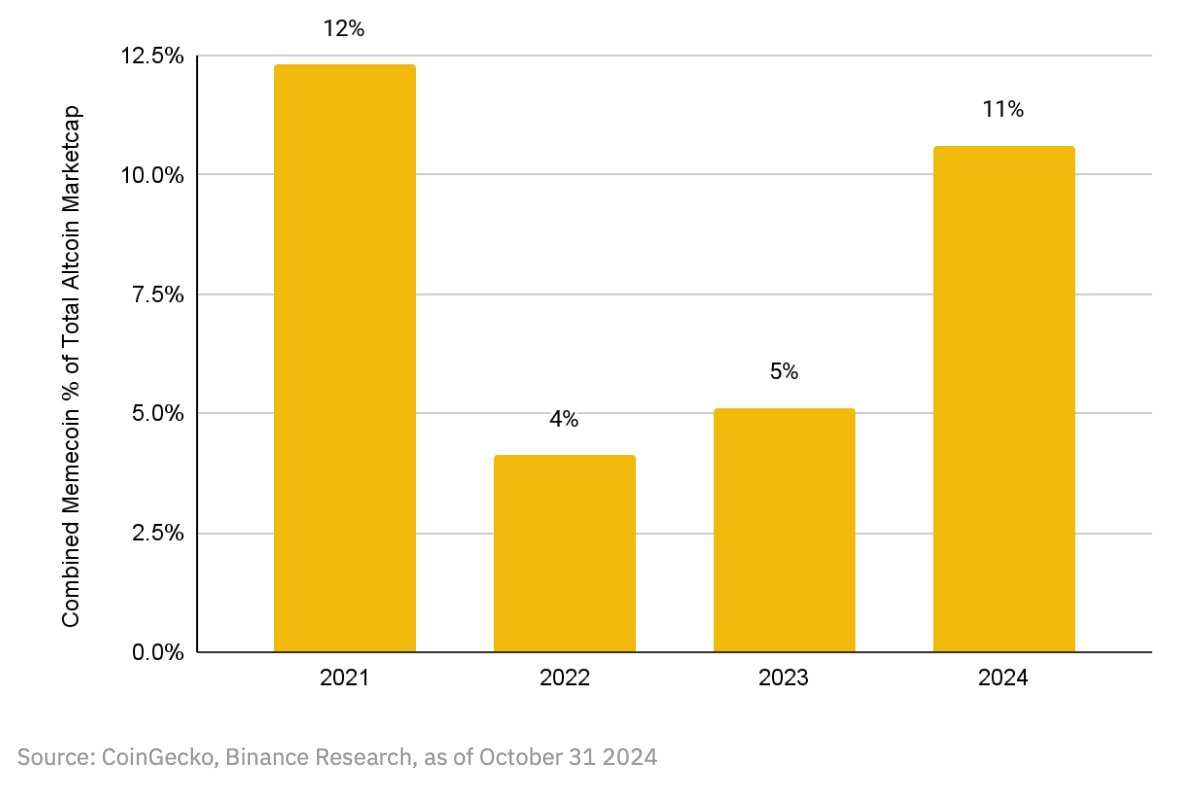

Recent growth in meme coins is no flash in the pan. According to Binance Research, since 2022, meme coins’ share of market cap (excluding BTC/ETH/stablecoins) has grown from 4% to 11%, nearly tripling amid fierce competition.

Source: @BinanceResearch

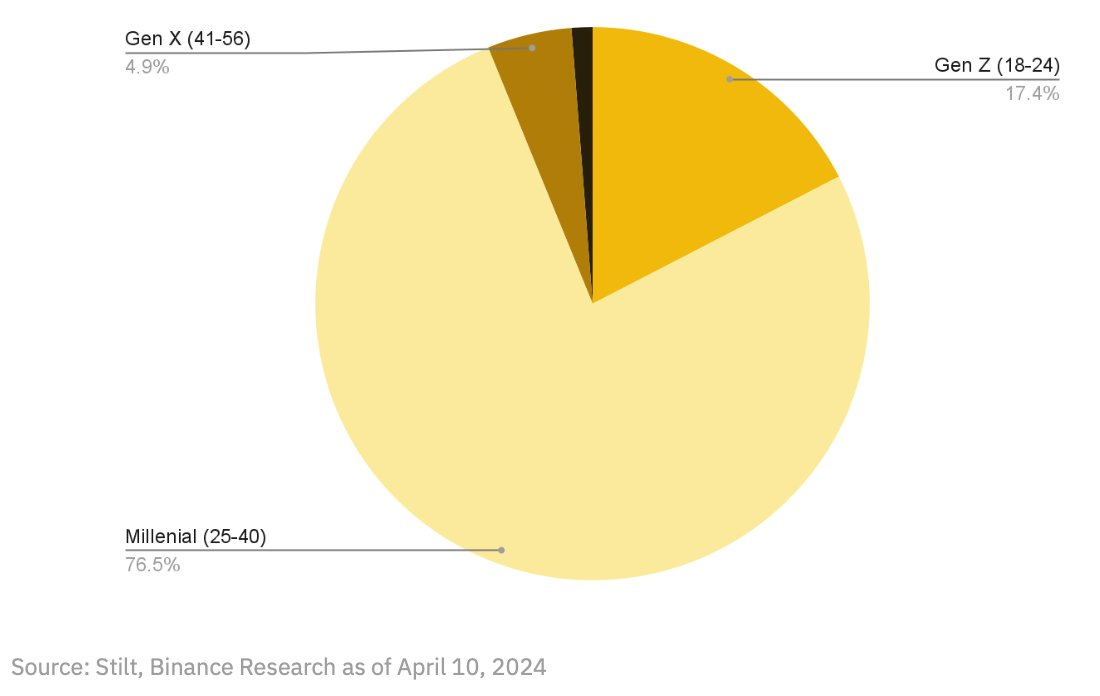

Millennials and Gen Z now represent 94% of digital asset buyers. This isn’t a demographic coincidence—it’s an entire generation responding to their economic environment. They’re not just buying tokens; they’re rejecting the traditional financial security path taken by their parents. While meme coins may seem like jokes on the surface, for these traders, they represent real opportunities to earn outside the traditional system.

Source: @BinanceResearch

Andrew Edgecliffe-Johnson summed it up best: “If people lose faith in getting rich slowly, it’s hard to blame them for wanting to get rich quickly.” That faith has been eroding for years. In 1963, buying a home required only 4.4 years of average wages; today, it takes 8.1 years. Add soaring inflation in recent years—with 2021 seeing a 7% rate—and it’s clear why younger generations seek financial opportunities elsewhere.

This movement isn’t solely about fast profits (though that element exists). It’s about using capital as protest against a system they no longer trust. The meme coin phenomenon offers high risk and high reward—the very appeal that resonates deeply with today’s traders. This isn’t just a game; it’s a vote of no confidence in traditional wealth accumulation.

Exploring the Meme Coin Phenomenon

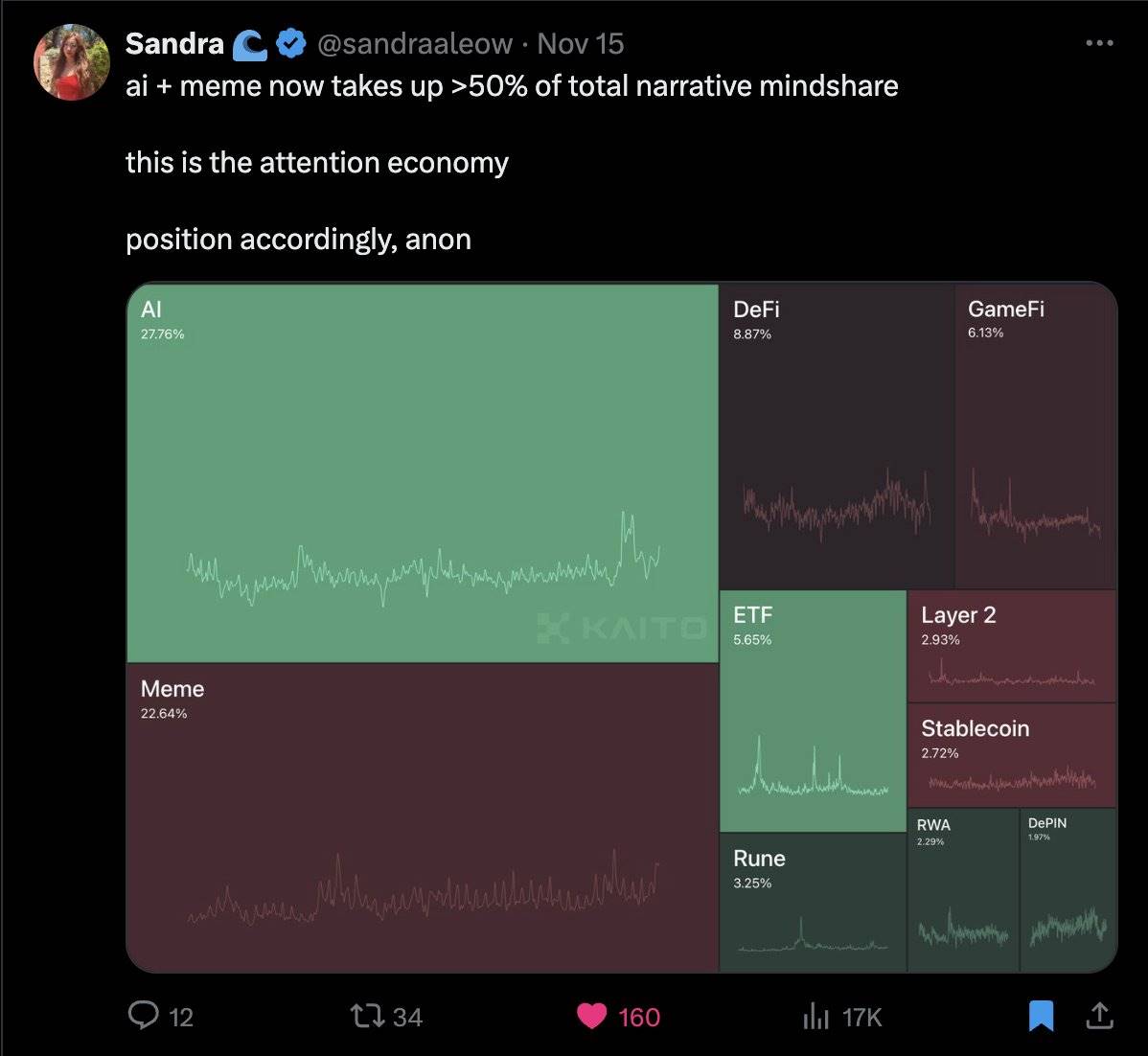

The speed of this market’s evolution is astonishing. Research shows $BOME reached a $1 billion market cap in just two days, $PNUT in 14 days, $WIF in 104 days, $SHIB in 279 days, and $DOGE took a full eight years. Capturing—and retaining—trader attention is key to success.

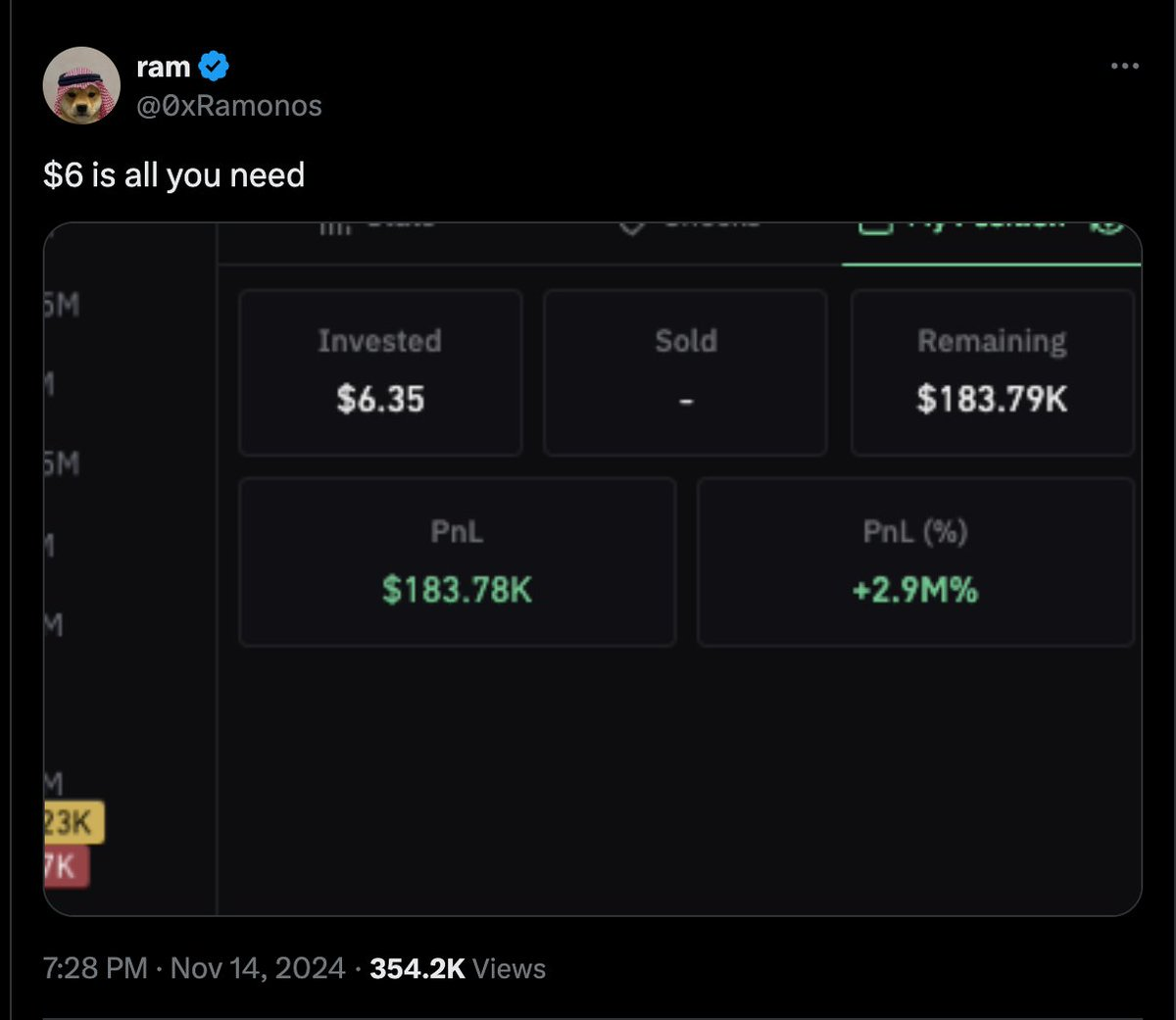

On X, screenshots of Phantom wallets showing returns of 633x and +10,520% highlight a broader theme: accessibility and fairness have become central. During the 2017 ICO boom, broad participation was essential—no private rounds, no VC allocations, no complex vesting schedules.

Today’s meme coin traders are rebelling against what some call the “VC exit liquidity simulator” in modern token launches. Some new meme coins have no team allocations, are priced purely by the market, and harken back to the early days of crypto’s level playing field—where community and network effects were the keys to success.

Viewing the meme coin craze as a chance to compete on a level playing field makes more sense—no worries about VC vesting or token unlocks. People are tired of being used as exit liquidity, and fair-launch platforms like pump.fun let anyone easily launch and participate in a coin.

Breaking Gravity—The Secret to 100x Gains

What separates winners from the sea of failed projects? The data is stark—fewer than 2% of tokens graduate from pump.fun to Raydium, and only a tiny 0.0045% sustain a market cap over $1 million. Yet some tokens do achieve “escape velocity,” breaking free from obscurity.

Successful meme coins often follow observable patterns. The most successful usually excel in at least one of seven key areas: meme potential, attention catalyst, novelty, humor, community, distribution, and development. Look at any successful meme coin, and these factors are at play—with attention catalyst, meme potential, community, and distribution being the most critical.

Source: dune

Take Moo Deng as an example—its success wasn’t accidental. The project gained traction via social media platforms like Twitter, Telegram, and TikTok. Its cute, easy-to-understand character constantly appeared in feeds, creating a viral loop of recognition and sharing. While not particularly humorous, its strong attention catalyst and distribution strategy generated momentum.

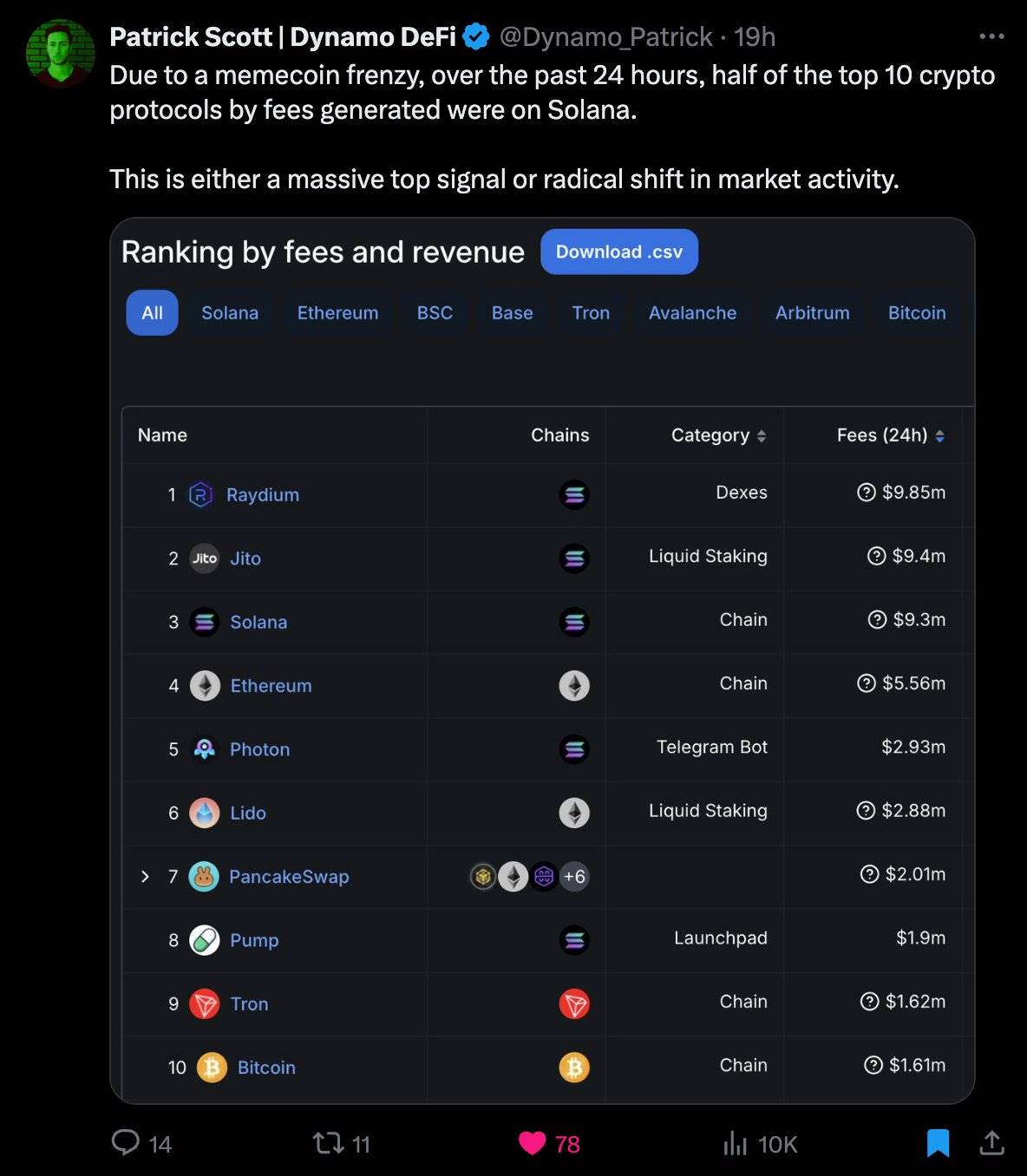

Solana plays a crucial role here. The network currently supports 89% of new token launches, processing around 41 million non-voting transactions. Solana’s dominance isn’t coincidental—its low fees and fast transaction speeds enable rapid experimentation, even if most attempts fail.

Current Market Landscape: Data Analysis

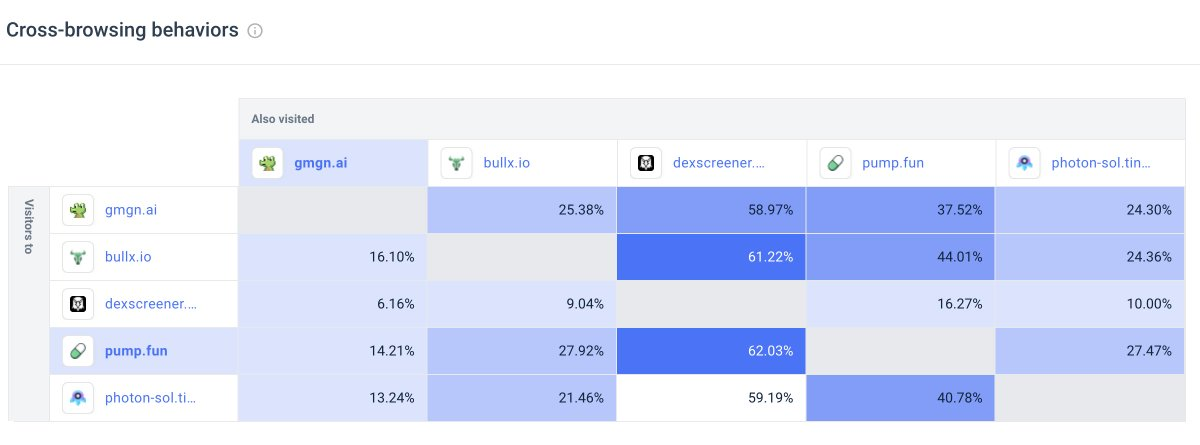

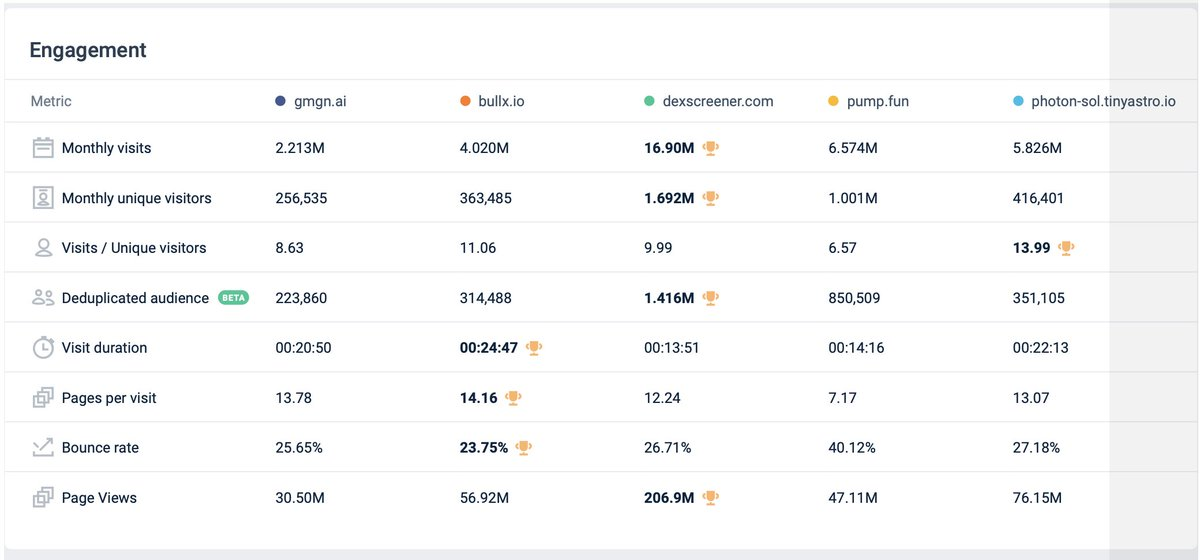

Data provides valuable insights into how traders interact with different meme coin platforms and reveals critical gaps in the market.

First, notably, about 60% of users who have a preferred trading terminal still visit DexScreener. They use DexScreener for insights, advanced filters, and analytics, indicating existing platforms don’t fully meet their needs. However, only 10–12% of DexScreener users go on to use trading and execution terminals—even though those terminals offer better customization and parameter control than DexScreener’s interface. This reflects a gap in user satisfaction—despite superior functionality, trading terminals remain underutilized.

Source: SimilarWeb

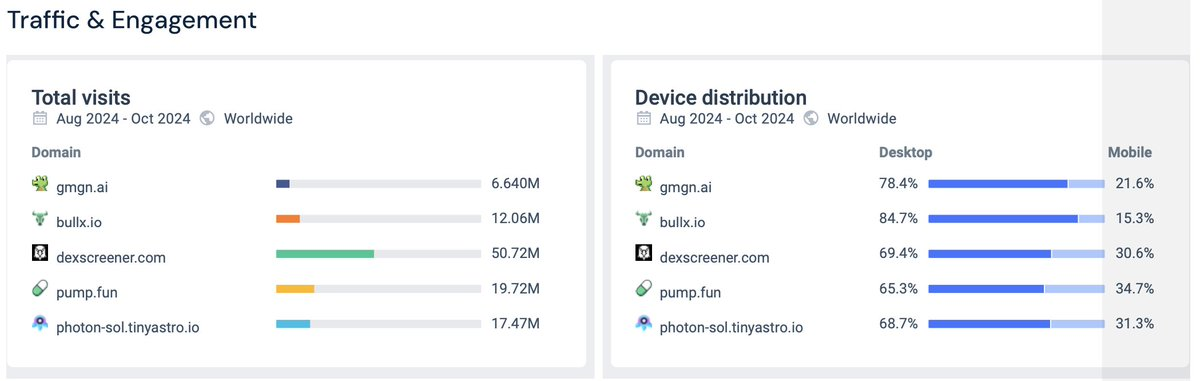

In comparing mobile versus desktop usage, Photon stands out. Among the three main trading terminals—gmgn.ai, BullX, and Photon—Photon has the highest mobile usage, while BullX has the most desktop users. Despite BullX’s large desktop user base, much of its traffic comes from Telegram links. This suggests that even when distributed via mobile-first platforms like Telegram, users ultimately operate BullX on desktop. This reflects the complexity of these terminals and indicates users prefer environments where they can fully manage functions.

Source: SimilarWeb

This trend reveals a broader issue: existing trading terminals are too complex. Their dominance on desktop highlights poor usability on mobile, leaving a massive gap—a seamless trading terminal across devices. Traders want powerful tools that are easy to use on mobile, with simplified interfaces available when needed. The market urgently needs an integrated solution—an intuitive platform that combines advanced features with ease of use, regardless of device.

The current fragmented experience is inefficient and inconvenient. Traders must switch between multiple platforms to get insights and execute trades effectively. A unified solution offering depth and functionality, with adaptive mobile interfaces, would dramatically improve the trading experience.

Diving Deeper: Trader Perspectives

Conversations with traders reveal a consistent desire for simple yet powerful tools. “When network load is high, I still have to set priority and extra fees,” said one trader. “I want smart defaults that run automatically, but let me adjust when needed.”

This balance between simplicity and control comes up repeatedly. Current platforms are either oversimplified or dump all complexity onto users. There’s no middle ground—nothing that’s both plug-and-play and deep.

“An all-in-one interface—if swapping, charts, and recent trades were combined, reducing clicks, with all important info in one place—that’d be great,” said a large trader. Another mentioned spending excessive time teaching their team basics like optimizing gas fees—time that could be spent trading.

Limit orders are a recurring pain point. “Even when orders execute, all positive slippage gains are eaten by the platform,” one trader noted. Another observed that limit orders on one platform always seem to fill faster than others, creating an uneven playing field—and confusion among users.

Market Structure: Real Challenges

Current trading platforms are primarily designed for crypto-native users and on-chain traders familiar with terms like “slippage tolerance,” “priority fees,” and “bribes.” Yet most traders simply care about how much they’ll pay and whether their trade goes through. One trader managing over 100 wallets admitted they can no longer effectively track their own positions.

The mobile experience is even worse. While Telegram bots partially bridge the gap, they aren’t sustainable. They’re temporary fixes for systems that need complete redesign.

This fragmentation carries real costs. Traders switch between platforms, miss opportunities due to failed trades, and suffer losses from poor execution. The current ecosystem forces users to choose between expensive tools and subpar performance—with no middle ground.

Building Solutions: Beyond Band-Aids

The current meme coin trading environment feels like a patchwork of stopgap solutions—temporarily meeting demand but clearly far from optimal. When traders say, “I wish there were tools to customize LP strategies,” or complain, “I have to tweak priority and bribes when fees spike,” or hope for better stop-loss and take-profit execution, they’re pointing to a fundamental truth: these so-called solutions aren’t real solutions.

Most platforms seem designed for users already fluent in on-chain trading, bridging, and DeFi—hence their complexity. But conversations with traders show they want the ability to access advanced features within a simple interface. Existing “advanced” UIs lack the parametrization serious traders need, while default interfaces are too basic, omitting features that could significantly impact P&L. For example, traders want a feature that “automatically tells me how much this trade will cost (including gas and fees) to ensure it succeeds”—helping experts assess fee reasonability and helping newcomers understand what they’re paying.

Solutions aren’t just about simplifying interfaces—they’re about rethinking how traders interact with markets. Some liken meme coin trading to a “game,” and they’re seeking gamified value-adds: analytics showing win rates, meaningful performance tracking, and tools to understand trading patterns.

The Way Forward: Cumberland Labs’ Vision

We’re not building another trading terminal or launching a new Telegram bot. The opportunity we see is bigger: creating an interface that combines Moonshot’s simplicity with the power of advanced trading terminals. A platform that evolves with users—offering an easy entry point for beginners while meeting the depth and complexity needs of experienced traders. More retail participants mean higher volumes, deeper liquidity, and better opportunities for everyone—from sophisticated on-chain traders to complete newcomers.

This means:

-

Simplifying complexity without sacrificing functionality—offering smart defaults with full customization when needed

-

A unified trading experience, integrating charts, execution, and analytics in one window

-

Truly effective cross-chain portfolio management

-

Real-time performance tracking to help traders understand their strategies

-

Risk mitigation without limiting opportunity

Current platforms provide a solid foundation for today’s crypto-native and on-chain traders. But the next wave of retail users needs something different—a platform that starts simple and grows with them. They need intuitive interfaces that guide them through the process and gradually introduce more complex features as they’re ready. The current “advanced vs. default” UI paradigm can be refined to better serve diverse user needs. This isn’t about dumbing things down—it’s about creating layers of complexity that users can explore at their own pace.

The meme coin market is evolving faster than ever. While 75% of meme coins were created in the past year alone, we see an opportunity to build tools that attract newcomers while empowering seasoned traders.

Beyond Trading: A Vision for Community Building

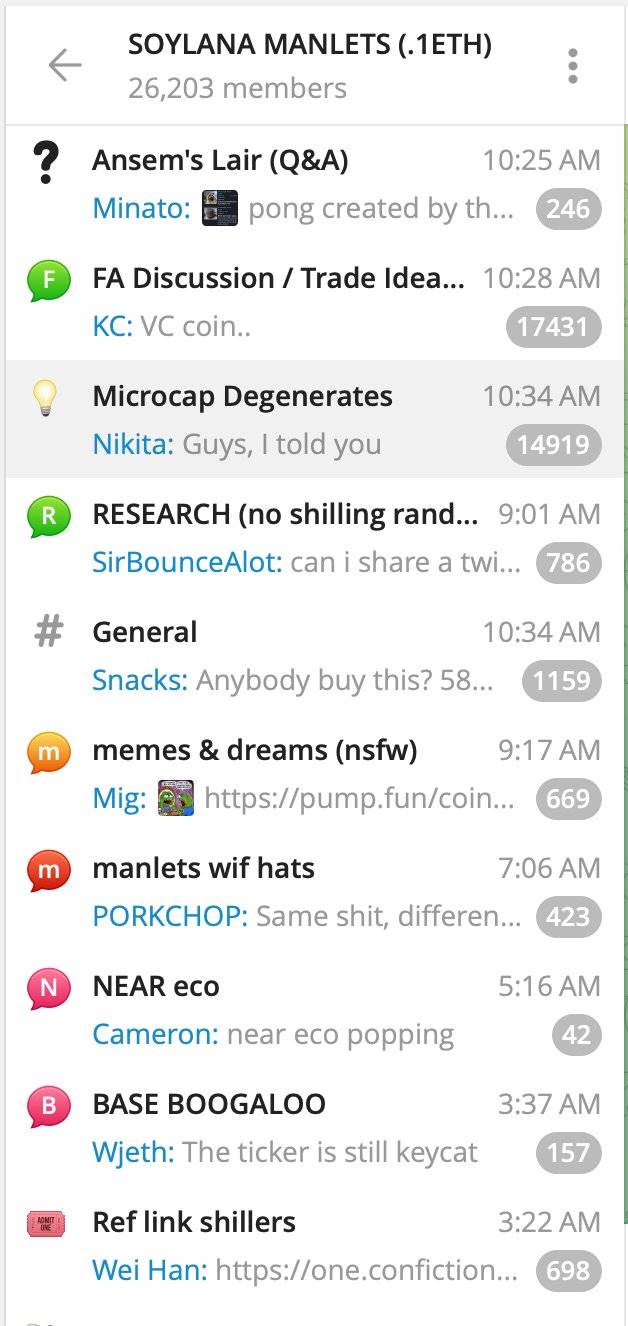

Trading is just one piece of the ecosystem. Community building, education, and shared experiences are key drivers of the meme coin economy. While existing platforms like Discord and Telegram offer some integration, embedding community directly into the trading platform is innovative. Currently, Telegram bots see higher engagement than traditional trading interfaces partly because users can quickly copy contract addresses from Telegram groups into bots for instant trades—much faster than navigating a trading UI.

@blknoiz06 Telegram group

We envision a more integrated approach. Imagine tracking your progress alongside other traders, sharing strategies in real time, and building reputation based on actual trading performance—not arbitrary metrics, but deep insights into what strategies work and which don’t.

This social layer isn’t about creating another crypto echo chamber—it’s about providing context and understanding to help traders make smarter decisions. Whether analyzing how different entry points affect returns, understanding pre- and post-migration performance patterns, or learning from successful strategies, every feature aims to improve trading outcomes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News