Why is South Korea's Upbit losing its listing premium effect?

TechFlow Selected TechFlow Selected

Why is South Korea's Upbit losing its listing premium effect?

"Never ignore the疯狂 Korean buying" is an old saying.

Author: MORBID-19

Translation: TechFlow

I hope everyone can make life-changing money on-chain. Haven't you? Maybe you got dumped by the Korean market. I've seen dozens of PnL screenshots showing profits in the tens or even hundreds of thousands of dollars. Even in real life, I’ve heard that some people I know—not too distantly—have made serious money. Yes, if you're not trading meme coins, you’re not making money.

Until now, the general perception was that Koreans only trade on centralized exchanges, primarily Upbit. That’s only partially true. When there are 1000x opportunities on-chain, what use is a centralized exchange?

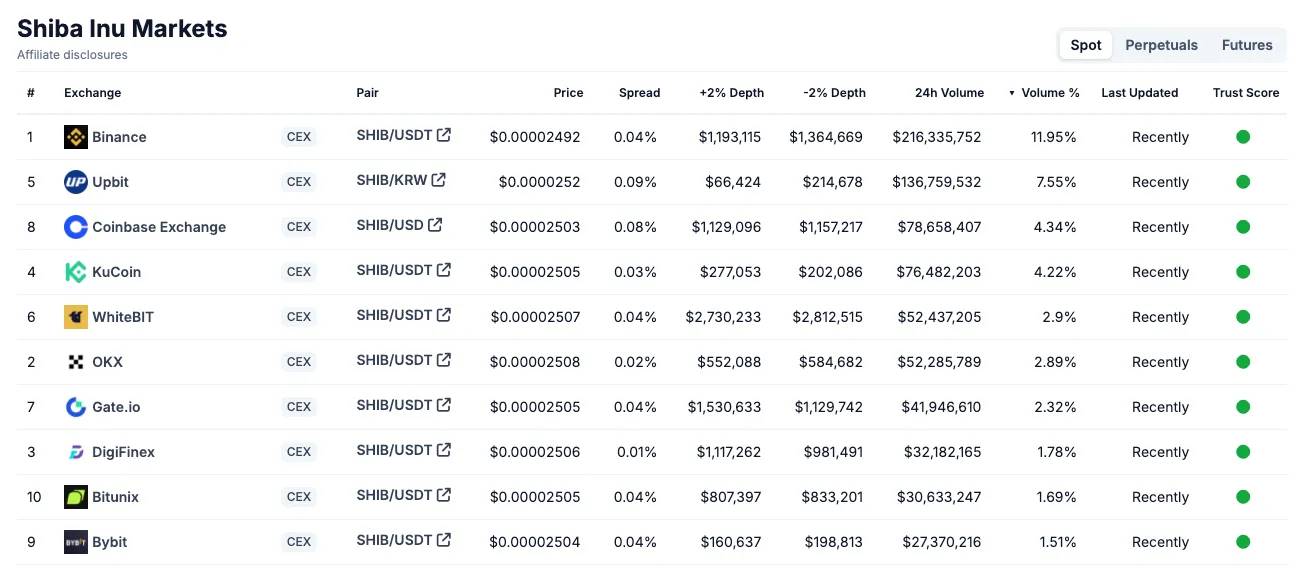

Yet, when you look at $DOGE and $SHIB, Upbit remains the second-largest spot market.

"Don’t underestimate the疯狂 Korean bid" has long been a saying.

This time, the Korean market feels different

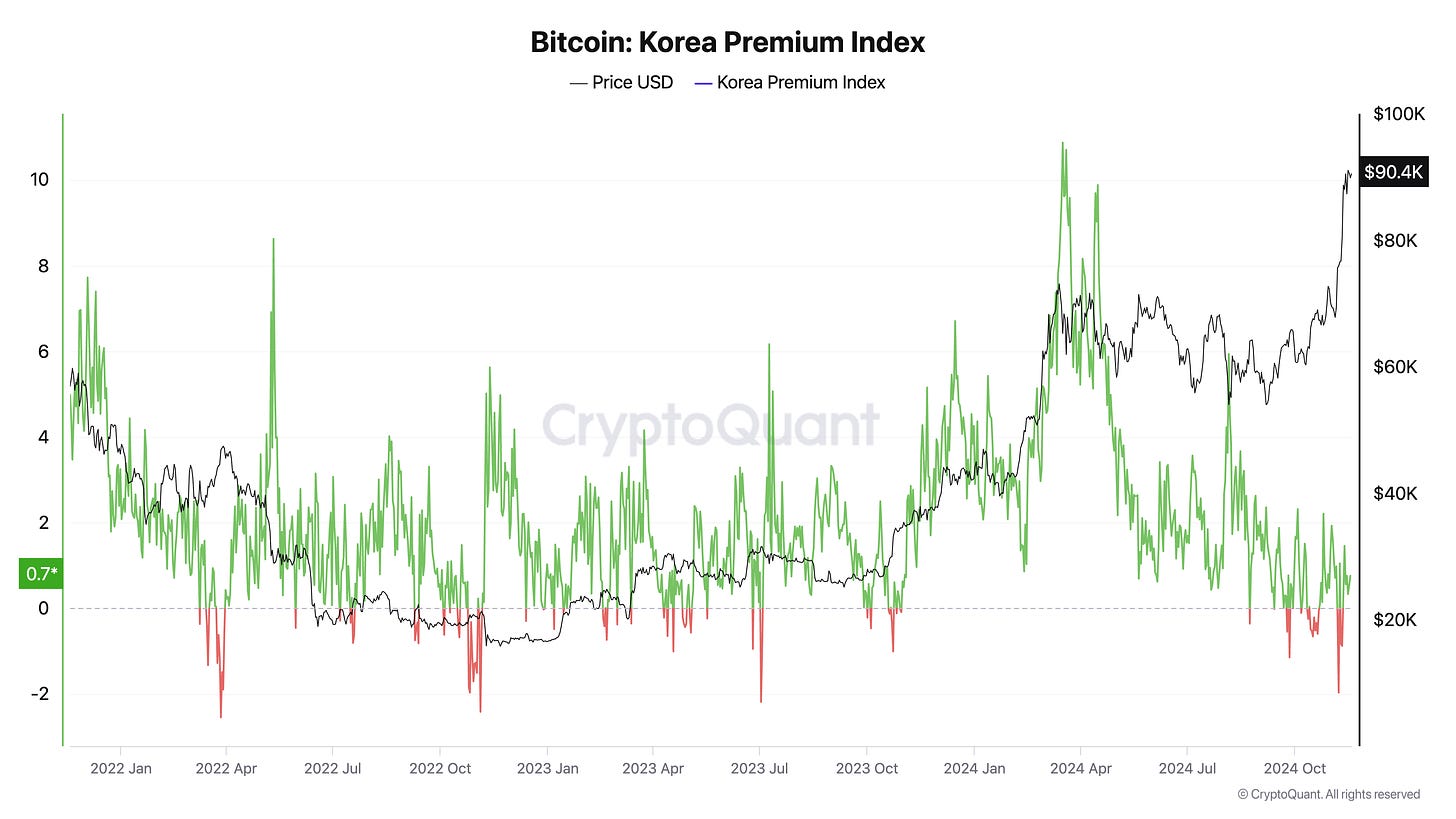

But where’s the premium? For weeks, I've discussed the Korean premium as a sentiment indicator. When the Korean premium hits +10%, it's time to start slowing down. But this time seems different. I see people checking their Binance portfolios on the subway; friends asking about DOGE.

Then why isn’t there a 10% Korean premium?

Bitcoin hit $90K—an unbelievable price. But this chart makes no sense. What’s going on?

Are Koreans not buying? No. Recently listed projects on Upbit have seen massive rallies.

Are new users not increasing? No. Crypto apps in Korea recently ranked high in app stores.

Have we just gotten better at arbitrage? Not really.

If so, why didn’t we perform better earlier this year?

Actually, we have found better ways to arbitrage the Korean premium. Teams like Presto Research have done excellent work here: while it might simply be because "we're still early," Upbit’s recent trading volume has exceeded $18B, significantly higher than the $14B in March 2024, when the Korean premium reached 10% and stayed above 5%. So why no premium now?

What’s changed since March 2024? I believe the main reasons are: 1) Listing of USDT, 2) macro market conditions, 3) implementation of the “Virtual Asset User Protection Act.” While Bithumb listed $USDT back in December 2023, Upbit followed relatively late—in June 2024. Before that, most Korean investors used $TRX or $XRP to move crypto from Korean exchanges to global platforms like Binance, Bybit, and OKX. With USDT now available, arbitraging premiums and investing directly in USD has become much easier.

Especially with the weakening won and the Korean stock market clearly underperforming both crypto and U.S. equities, interest in dollar-denominated investments has surged. This has driven up USDT trading volume, which now holds around 9% market share, up from just 2.6% in December. Note that most trading pairs on Korean exchanges are denominated in KRW (e.g., BTC/KRW, ETH/KRW), not stablecoins. This means most USDT volume comes from USDT/KRW pairs.

Thus, one of the historically easiest ways for Koreans to make money was through the Korean premium trade. This involved buying USDT, transferring it to overseas exchanges, earning returns, and returning to the Korean market when the premium appeared (while also earning KRW gains + benefiting from Bithumb’s zero-fee campaign post-regulation)—or simply buying USDT when the premium was low and selling when high. These trades have become more active, and I believe they are now suppressing the Korean premium.

— Min Jung (Read full thread here)

Wow, I hadn’t considered this at all before. Therefore, my previous assumption—that the Korean premium would disappear as a bull market signal once institutional accounts were enabled—now appears completely outdated. The Korean premium may no longer mean anything!

But is this good or bad?

I'm not sure. For Koreans, a lower Korean premium means prices are fairer. For the broader market, however, it loses a key indicator for spotting market tops.

Still, I think Koreans are slowly losing something too. Just today, Korea’s Financial Supervisory Service (FSS) suggested allowing exchanges to freeze crypto trading accounts without notifying users.

Under the “Virtual Asset User Protection Act,” exchanges must disclose the reason for freezing an account before taking action. However, the FSS wants to allow exchanges to preemptively freeze accounts in certain “special circumstances” to respond swiftly during emergencies such as hacks, fraud, and—as we all know—money laundering attempts.

In principle, advance notice should be given, but they emphasize that the predictability of the freezing reason and the purpose/intent behind prior notification should be fully considered.

The same applies when the National Tax Service or investigative agencies request account freezes and ask for delayed notification to serve investigation purposes.

The FSS stresses that unless unavoidable circumstances prevent it after careful consideration, advance notice must be provided.

Wait, what does this mean? They’re not only allowing pre-freezing to protect consumers but also to protect national interests? Who could have imagined. This is yet another reason not to keep money on Korean exchanges. Imagine making a 5x on some random altcoin on Upbit, only to have your funds frozen by the tax office.

Needless to say:

-

Paju City in Gyeonggi Province announced plans to become Korea’s first local government to directly sell virtual assets seized from delinquent taxpayers to recover unpaid taxes.

-

To implement this, Paju issued notices on the 13th to 17 individuals who collectively owe 124 million KRW in local taxes, warning them of the impending transfer and sale of their virtual assets.

-

The city has already seized the virtual assets of these tax delinquents via cryptocurrency exchanges. If these individuals fail to pay their overdue taxes by the end of this month, the city plans to transfer approximately 50 million KRW worth of virtual assets into its own account to offset the unpaid taxes.

-

According to the city government, virtual assets have recently been used by tax delinquents to hide or transfer assets. A city official explained: “Collecting through virtual assets sends a clear message to delinquents that they cannot hide their assets, and we will continue tracking their property until tax measures are ultimately enforced.” — KBS News

Why would Koreans choose to leave funds on exchanges? Why would they want to convert crypto into won? As the market grows, this issue becomes increasingly apparent. If everyone knows crypto assets can be so easily confiscated, who would willingly deposit them into Korean exchanges?

If crypto is truly a trillion-dollar opportunity and governments are willing to support it, capital must be allowed to flow freely. There’s a reason people prefer using USD over CNY—because the latter could be seized.

It was precisely the risk of seizure that gave birth to the crypto industry. It’s irrational for an industry to be accepted, only to revert back to old mindsets.

These protectionist and highly controlling measures will only increase capital outflows—especially from high-risk on-chain activities. Assets will stay on-chain; what they aim to protect will instead be destroyed by fear of loss.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News