UDC Conference: Upbit Listing Speculation Guide

TechFlow Selected TechFlow Selected

UDC Conference: Upbit Listing Speculation Guide

70% listing hit rate: UDC conference project overview.

Written by: Shaofaye123, Foresight News

As the market strengthens, the wealth effect from new listings on Upbit has become increasingly evident. Recently listed tokens such as AGLD surged up to 150% on their first day, DRIFT rose 190%, while SAFE, CARV, PEPE and others achieved 100% gains. Trading based on news, the algorithmic teams have made hundreds of millions this round. If we can't outpace algorithms, how can we still capture the wave of wealth brought by Upbit listings?

The UDC Conference serves as a key indicator for upcoming listings on Upbit. According to statistics, from 2018 to 2023, it achieved a listing success rate of 76%. The UDC 2024 conference was held as scheduled on November 14—this article provides a quick overview of the projects attending UDC.

About the UDC Conference

UDC is a flagship blockchain conference in South Korea hosted annually since 2018 by Dunamu, aimed at promoting blockchain industry development, ecosystem growth, and widespread adoption. This year marks its seventh edition. Themed "Blockchain: Driving Real-World Transformation," UDC 2024 explores how blockchain expands across industries and transforms reality under topics including trends, finance, policy, technology, and culture.

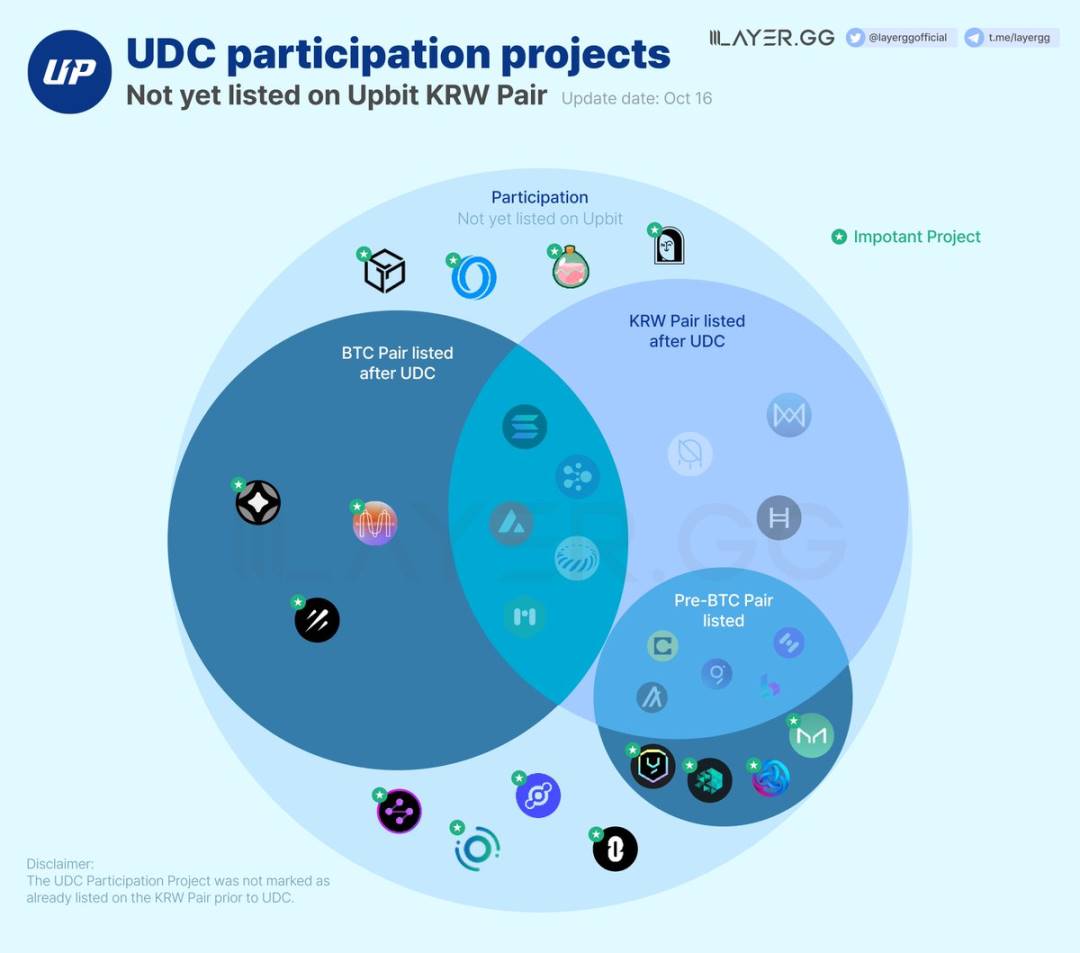

According to data from Layerggofficial, between 2018 and 2023, around 66 projects participated in UDC. Of these, 37 had already been listed on KRW pairs prior to participation. Among the remaining 29 projects, 13 were later listed on Upbit with KRW trading pairs—representing a 44.8% post-conference listing rate.

Why does the UDC Conference hold such significance? And where does Upbit's wealth effect originate?

As South Korea’s largest cryptocurrency exchange, Upbit leads the domestic market in both trading volume and user base, holding approximately 73% of the market share. Korean investors can directly purchase cryptocurrencies using Korean won (KRW), and the convenience of deposits, combined with strong profit potential, has caused crypto trading volumes in Korea to surpass those of the domestic stock market. This ensures robust buying demand for any new token listed on Upbit. Although smaller in scale compared to events like KBW in terms of duration and attendance, the UDC Conference—organized by Dunamu, Upbit’s parent company—remains highly significant. Last year’s attendees included ZRO, MNT, and STG, all of which have since been listed on Upbit, confirming the event’s predictive power.

Data source: https://x.com/layerggofficial/status/1714145904943587774?s=46

UDC 2024 Participating Projects

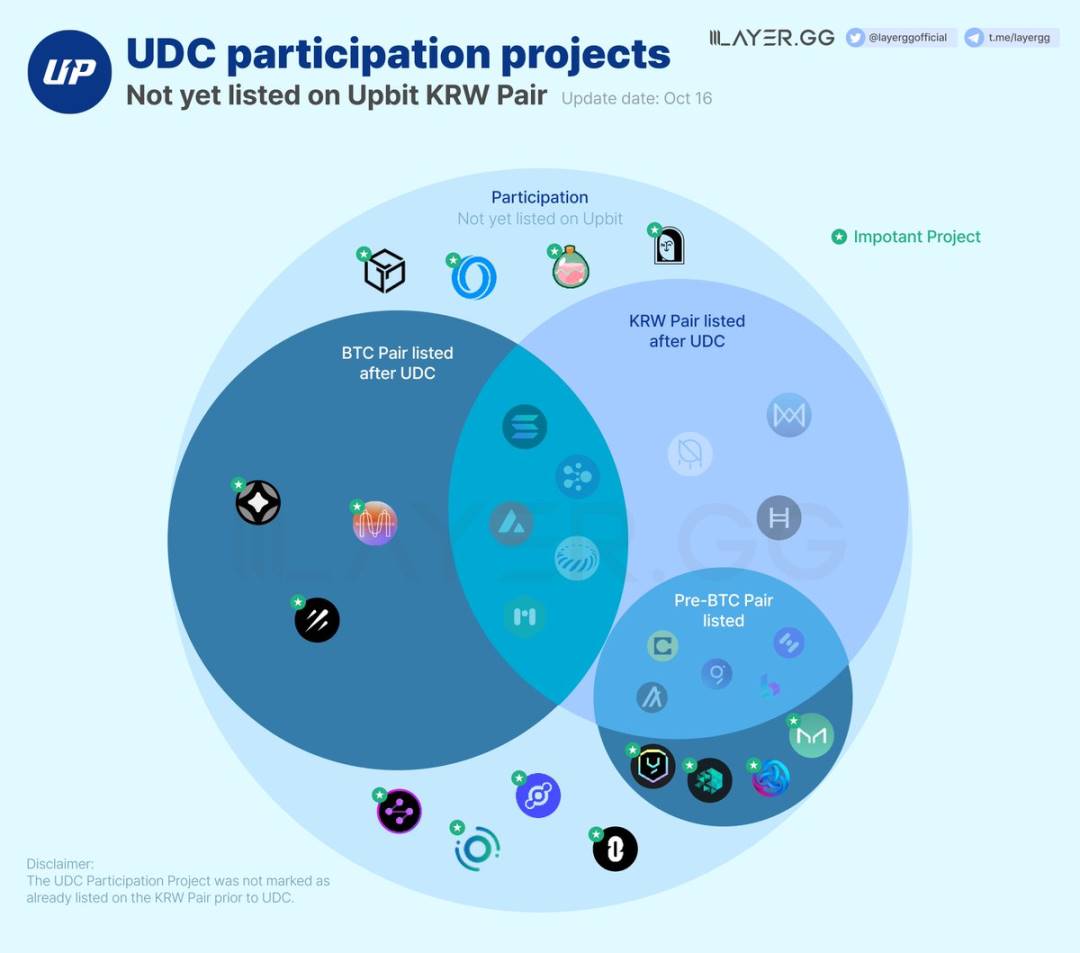

This year’s UDC conference took place yesterday. Among the participating projects, Axelar, Taiko, Zetachain, Mantle, and Cyber are already listed on Upbit. As of this year’s conference, there remain 11 projects that have not yet been listed on Upbit or lack KRW trading pairs.

-

Projects not yet listed: SLP, HNT, GALA, NFT, ROSE;

-

Already listed with BTC pairs but without KRW pairs: MKR, YGG, IOTX, Cyber;

-

Have not issued tokens yet but participated in UDC: Linea, Magic Eden

In line with this year’s UDC themes and trends, compliance and AI remain dominant narratives. Although Oasis Network did not participate in UDC this year, ROSE saw a notable price surge on November 5 driven by AI-related momentum. Additionally, given South Korea’s high interest in NFTs and gaming, Magic Eden’s potential token launch could make it a strong candidate for an Upbit listing.

Beyond UDC’s forward-looking implications, another South Korean exchange, Bithumb, also shows correlation with Upbit’s listing patterns. Influenced by prevailing market narratives, both exchanges tend to list similar types of tokens within the same period—for example, AI tokens early this year and currently, memecoins. To protect investors, Korean exchanges generally avoid newly launched tokens with small market caps. Instead, they prefer established coins that have undergone sufficient market consolidation, possess larger market capitalizations, and exhibit relatively stable prices.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News