South Korea's Crypto Chronicles: A Feast in Search of Exit Liquidity

TechFlow Selected TechFlow Selected

South Korea's Crypto Chronicles: A Feast in Search of Exit Liquidity

To get listed on Upbit, you must first be listed on Binance/OKX, or at least Bybit.

By: TechFlow

Soju mixed with beer turns into "honey water," partygoers dance gracefully to the DJ’s beats on the dance floor, Hanwoo beef sizzles on the grill nearing medium-rare, and over 300 side events unfold... South Korea Blockchain Week is bustling with energy.

Yet beneath the music and alcohol-fueled noise lies deep anxiety.

Project teams are anxious: market liquidity is insufficient, there's a lack of new narratives, retail investors aren't buying in, listing on top-tier exchanges is becoming increasingly difficult, and investors keep pressing, “WHEN LISTING?”

VCs are anxious: many of their portfolio projects are in a semi-dormant state; even those that have launched tokens remain locked up, with daily market caps continuously declining; fund lifecycles are short, and fundraising is getting harder;

Founders are anxious: the primary market has cooled down, many VCs are just chatting but not investing—after months of talks, no new funding round has closed. Even if a VC shows interest, they often say they can only co-invest after a strong lead investor is confirmed;

Media and communities are anxious: positioned mid-to-lower down the industry food chain, they depend on others having surplus funds to survive;

Exchanges are also anxious: trading volumes keep shrinking, competition intensifies, and they can only comfort themselves by thinking they're still better off than project teams.

What can relieve this worry? Only a bull market.

Everyone is waiting for a roaring altcoin bull run. Many projects pin their hopes on Q4, planning to launch tokens and list during that period.

However, “waiting for a bull market” equals passive surrender. Thus, everyone is turning their attention to the South Korean market as a path to liquidity exit.

Whether project teams or VCs, most coming to Korea share the same mission: get listed on Korean exchanges; collaborate with Korean KOLs and communities for promotion.

At multiple event venues, the most frequently heard questions were, "Do you know someone at Upbit or Bithumb? Can you introduce us?" or curiously asking, "How did XXXX and XXXXXX get listed on Upbit?"

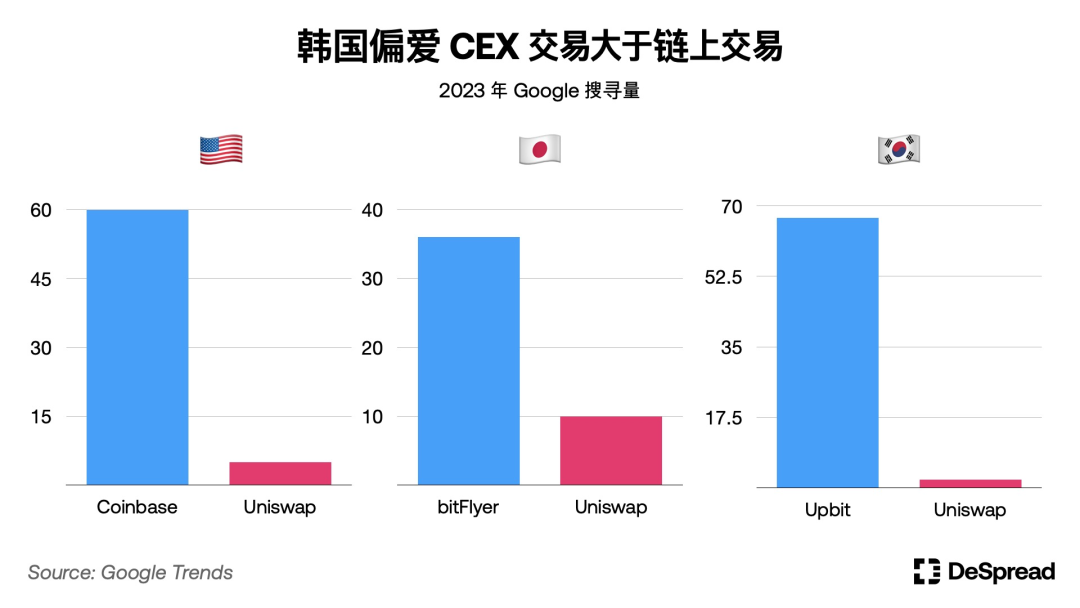

It’s increasingly clear that Korean exchanges, especially Upbit, are world-class markets for altcoin liquidity (exit venues). Compared to on-chain trading, Korean investors strongly prefer centralized exchanges.

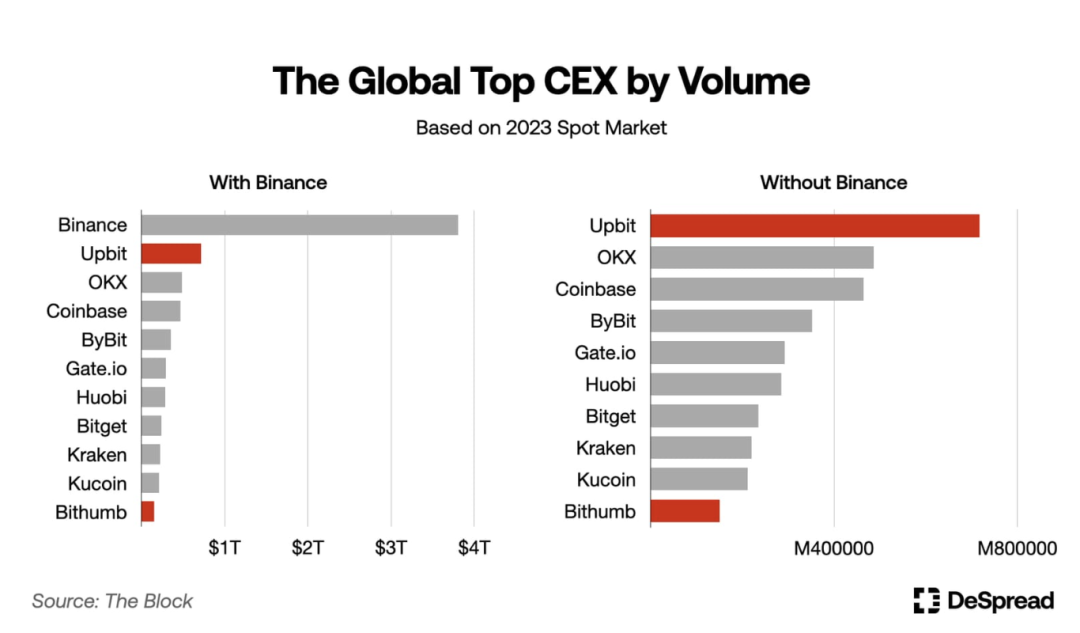

South Korea has four major exchanges: Upbit, Bithumb, Coinone, and Korbit. Upbit dominates the market with a 70%-80% share. In 2023, Upbit ranked as the world’s second-largest crypto spot market, behind only Binance.

Bithumb consistently holds second place, accounting for 15% to 20% of the combined trading volume of the big four. Coinone holds a market share between 3% and 5%, while Korbit’s share is less than 1%.

Therefore, getting listed on Upbit has become a long-term goal for many projects.

However, listing on Upbit isn’t easy. Korean exchanges don’t conduct initial token offerings, and Upbit’s listing criteria include two key requirements related to token liquidity and exchange listing:

Market Demand:

Assessing the proposed digital asset’s trading liquidity and commercial viability.

Reviewing its known market cap, concentration of holdings, number of wallets, or trading volume on other exchanges.

Listing Status:

Reviewing the current listing status of the proposed digital asset, including listings on other exchanges. Evaluating the reputation, jurisdiction, and AML/CFT practices of those exchanges.

A relatively open unwritten rule is: to list on Upbit, you must first be listed on Binance/OKX, or at least Bybit.

The relatively closed nature of South Korea’s crypto market has given rise to numerous intermediaries and brokers profiting from information asymmetry. Some help overseas projects execute GTM strategies in Korea—for example, SEI and SAGA were both deployed in the Korean market by individuals rather than institutions. Others manage KOL promotions, while some offer consulting services for Korean exchange listings...

With so many intermediaries of varying quality, a member of a local Korean institution told TechFlow: “The Upbit listing process is quite standardized. If anyone claims they can guarantee a listing on Upbit, they’re likely a scammer.” Achieving liquidity exit requires not just an exchange listing, but also retail investor participation. Engaging Korean communities and KOLs for promotion has thus become essential.

A local marketing consultancy said their business volume this year is several times higher than last year.

Previously, many believed Korean crypto investors primarily gathered on the local chat app Kakao. But in reality, most crypto investors today—especially younger ones—are now concentrated on Telegram.

Let’s examine the top 10 most frequently shared channels among the top 110 Telegram channels in the South Korean crypto market in 2023.

The most shared channel was “코인같이투자 (WeCryptoTogether)” with 168,765 shares, about 34% more than the second-place “취미생활방 (EnjoyMyHobby)” with 125,919 shares.

From third to tenth place: @kkeongsmemo, @emperorcoin, @centurywhale, @mujammin123, @masrshallog, @airdropAScenter, @seaotterbtc, @kookookoob.

What information do Korean investors care about most?

We can find clues in the view and share data from these 110 Telegram channels.

Looking at the most viewed content across the South Korean crypto community in 2023, three themes stand out clearly.

First, legal and regulatory issues within Korea’s crypto industry, and content related to negative developments such as privacy breaches, money laundering, and financial crimes topped the viewership charts;

Second, new token investment opportunities—information about the Sui token sale ranked fourth, indicating Korean investors are highly sensitive to new projects and profit potential;

Lastly, content related to macroeconomic indicators (like CPI) ranked third. Bitcoin’s price movements this year were largely driven by macro data.

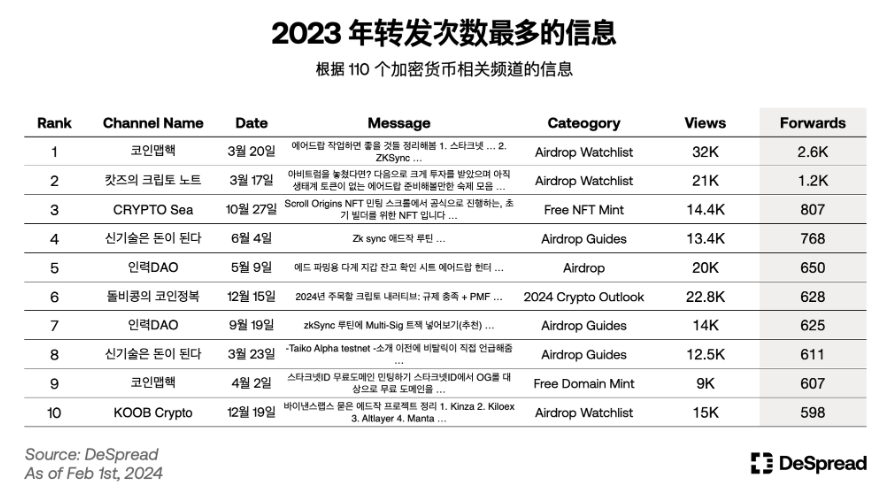

Now, looking at the most shared messages in South Korean crypto communities in 2023, we find everyone focused on one topic: Airdrop farming.

The most shared message was the “Airdrop Workflow Summary” posted on March 20 in the “Coinmap Hack” channel. It detailed how to participate in airdrops from major projects like Starknet, zkSync, and LayerZero, and was shared over 2,600 times, ranking first.

Most of the messages ranked second through tenth were also about zero-cost airdrop farming—such as how to claim airdrops or free NFTs from zkSync, Starknet, and other projects.

It seems airdrop farming is a universal consensus, transcending nationality and culture, familiar and accepted by all crypto investors.

As more and more projects flood into the Korean market, Korean KOLs and community managers have become increasingly cautious. A local community leader said they prefer collaborating with projects backed by well-known investment firms, especially those supported by Binance Labs.

Another hard-to-verify piece of information is that Korean investors currently don’t favor local Korean founders or investment institutions. If true, this situation bears a striking resemblance to the Chinese-speaking market. When leaving Seoul, the author asked several VCs and project team members, “How was your trip to Korea?” Most replied, “Not much gained—mostly leisure or medical tourism,” and some even felt guilty, thinking they were wasting company money.

This perhaps reflects the current state of the Korean market: it looks attractive from afar, but achieving a liquidity exit in Korea is far from easy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News