Aptos: In-Depth Analysis of the Next-Generation High-Performance Public Blockchain

TechFlow Selected TechFlow Selected

Aptos: In-Depth Analysis of the Next-Generation High-Performance Public Blockchain

Aptos has demonstrated its efficiency and reliability through concrete actions, establishing its leading position among新一代公链.

Authors: Mark丨Stewart丨Mavis丨Jason丨Ryan丨Luiz, First.VIP

Translation: TechFlow

Investment Summary

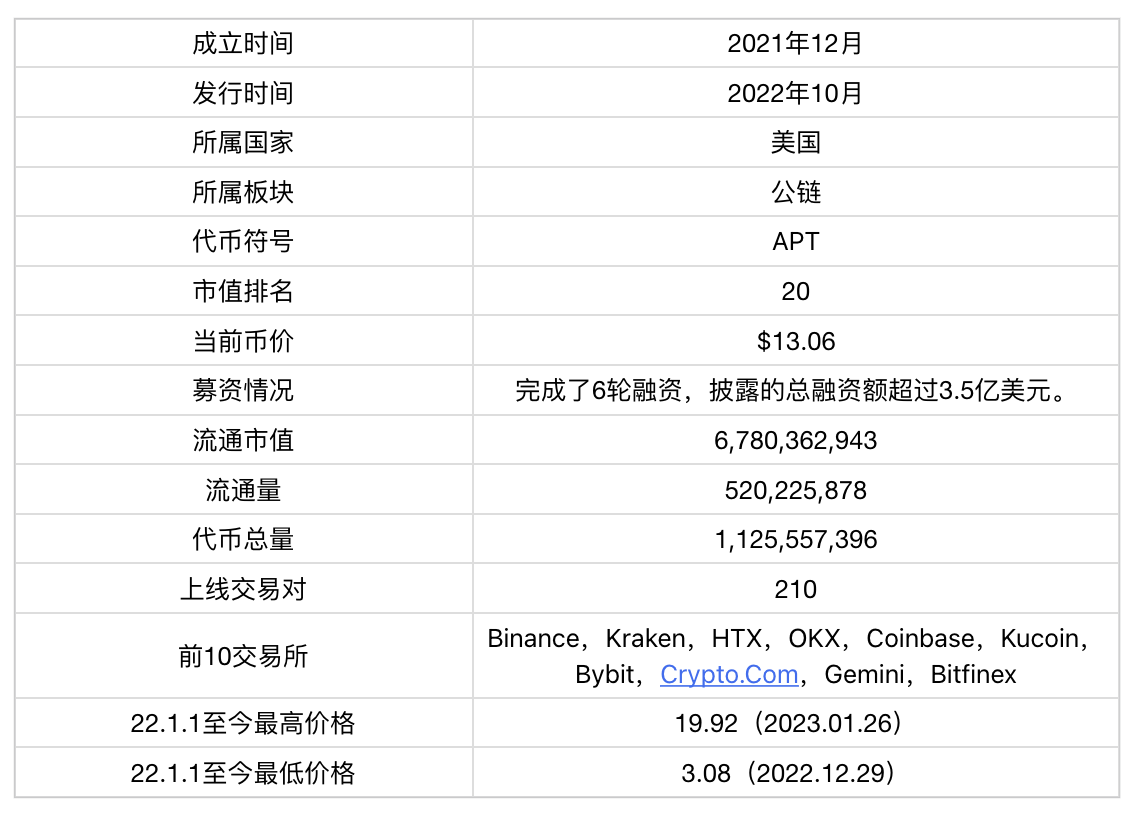

Aptos is a public blockchain project initiated at the end of 2021.

From a team perspective, Aptos’ core team has deep roots in Meta’s former blockchain initiatives Diem (formerly known as the Libra stablecoin project) and Novi. After Meta was forced to abandon its blockchain ambitions due to regulatory pressure, several key members from that original development team went on to found Aptos. In this sense, Aptos can be viewed as one of Meta’s legacy successors in the blockchain space. As a top-tier software engineering company, Meta cultivated a talent pool with strong academic backgrounds and proven technical capabilities—assets now inherited by Aptos. As the project scales, it continues to benefit from this solid foundational team.

Regarding funding, as of November 7, 2024, Aptos has completed six rounds of financing. According to disclosed information, prior to its mainnet launch in 2022, Aptos raised $350 million at a valuation of $2.75 billion. It subsequently conducted four additional strategic funding rounds with undisclosed amounts. Aptos’ investors include leading industry funds such as Binance Labs, Dragonfly Capital, A16z, Multicoin Capital, Circle, and Coinbase Ventures. The most recent round closed on September 19, 2024, suggesting the project remains well-capitalized.

From a product and technology standpoint, Aptos aims to build a scalable, secure, reliable, and upgradable smart contract platform. This goal is supported by key innovations including the Move programming language, the Diem BFT consensus algorithm, the Block-STM parallel execution engine, and an efficient node synchronization mechanism. While prioritizing scalability and security, Aptos makes certain trade-offs in decentralization—its number of nodes is limited and entry barriers are high, posing some centralization risks. However, the resulting performance gains are immediately evident. Since mainnet launch, Aptos has achieved peak TPS exceeding 12,000, processed over 300 million transactions in a single day, and reduced transaction latency to under one second—all without experiencing network delays or outages—demonstrating both high performance and reliability. Additionally, Aptos has significantly lowered user gas costs through an optimized fee mechanism, creating more room for DeFi and other application ecosystems to grow.

In terms of project development, Aptos has shown strong momentum, particularly since Q3 2024. Active addresses have steadily increased with notable retention, and transaction volume has grown substantially. On August 15, it set a record with over 300 million daily transactions and a peak TPS nearing 13,000—further validating its superior chain performance. The ecosystem is expanding in both breadth and depth, with DeFi, gaming, and social sectors potentially serving as cornerstones for future growth. Aptos also maintains active relationships with traditional enterprises and regulators, collaborating technically and commercially with companies like Microsoft, Google, Alibaba, Amazon, South Korea’s Lotte, and SKT. Furthermore, in late October 2024, native USDT officially launched on Aptos, which could bring significant new liquidity and unlock further ecosystem potential.

From a token economics perspective, APT serves primarily as the utility token for the Aptos network, used for consensus participation, governance, gas payments, and ecosystem incentives. Currently, a large portion of issued APT tokens are held by the Aptos Foundation for future operations and ecosystem development, highlighting the project’s long-term focus on nurturing its ecosystem and increasing opportunities for future growth.

Within the broader blockchain landscape, the public chain sector has evolved through multiple market cycles and technological advancements. Demand is now clearer than ever, and projects have developed deeper understandings of what constitutes a successful chain. We observe that a public chain’s underlying consensus and performance form the root enabling healthy ecosystem growth, while ecosystem prosperity represents the fruit borne from that foundation. An outstanding chain must possess robust foundational technology to yield strong results, and those results must be compelling enough to earn market recognition—three elements that are all essential. Aptos has already laid strong architectural foundations for ecosystem vitality and nurtured early-stage ecosystem growth through thoughtful tokenomics and incentive programs. Now, it awaits the emergence of breakout applications to bear impressive fruit. In terms of competition, Ethereum and Solana remain first-tier leaders. Compared to them, Aptos and Sui lag significantly across most dimensions beyond raw performance, requiring time to catch up. Aptos and Sui share origins at Meta, use the same programming language, and offer comparable performance. However, differing ecosystem strategies have led to divergent market perceptions. We believe that as Aptos continues refining its ecosystem and launches more market-visible projects, it holds substantial untapped potential and a high ceiling.

1. Overview

1.1 Project Introduction

Aptos is a public blockchain project initiated at the end of 2021, inheriting part of Meta’s exploratory work in blockchain. With a strong founding team and elite investor backing, Aptos has demonstrated real-world efficiency and reliability since its mainnet launch. Going forward, its long-planned ecosystem may drive even greater achievements.

1.2 Basic Information

2. Detailed Project Analysis

2.1 Team

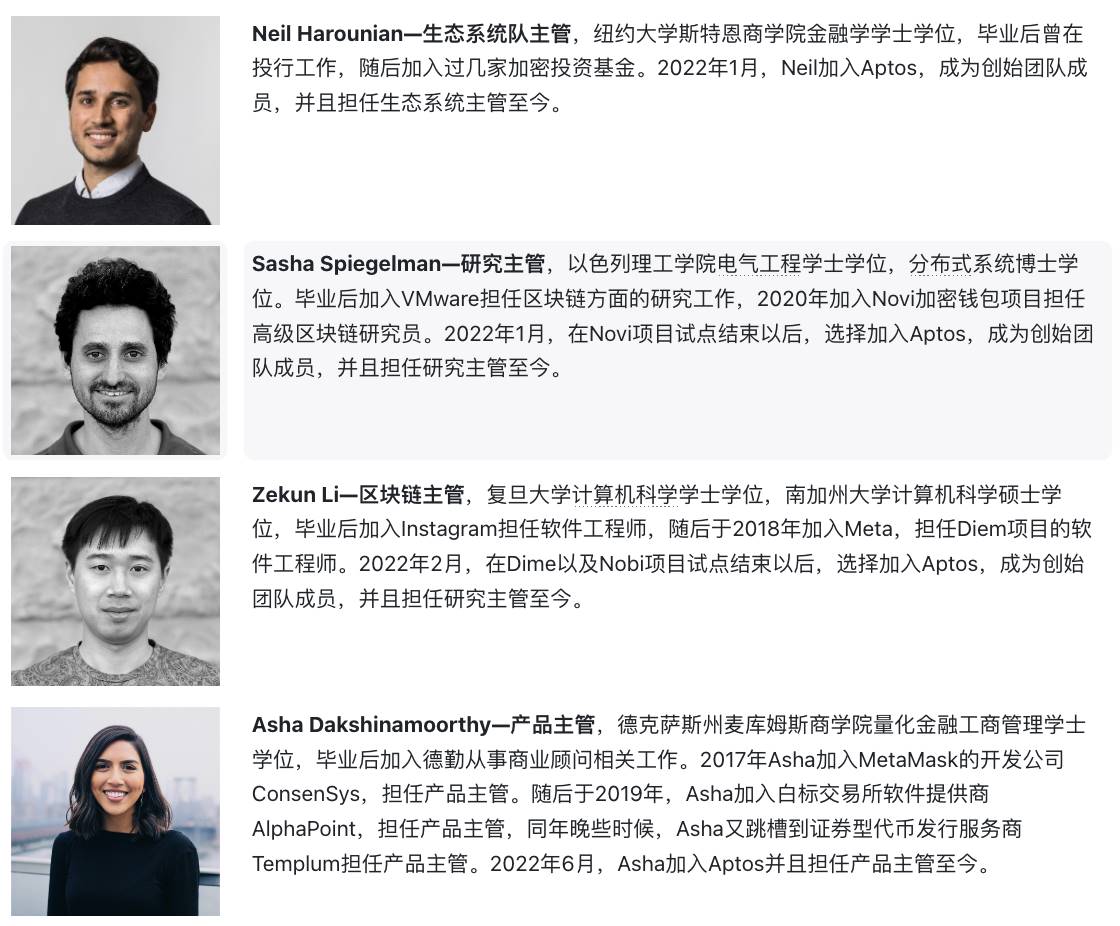

Based on available information, Aptos’ core development team, Aptos Labs, is primarily based in California, North America, with employees distributed globally. The team size is estimated to exceed 100 people. LinkedIn shows 225 individuals affiliated with Aptos, and according to the whitepaper, over 350 developers had contributed to Aptos before mainnet launch in 2022. The official website lists 16 founding members and 12 department heads. Key personnel profiles are listed below:

Reviewing the backgrounds of Aptos’ core team reveals their deep ties to Meta’s former blockchain projects Diem (originally Libra) and Novi. After Meta abandoned its blockchain efforts under regulatory pressure, several key engineers from that team founded Aptos. In this way, Aptos can be seen as one of Meta’s blockchain legacy successors. Given Meta’s status as a top-tier software company, the talent pool it cultivated brings strong academic credentials and proven technical expertise. As Aptos grows in scale, it benefits from this exceptional team foundation.

2.2 Funding

Table 2-1: Aptos Funding History

As of November 7, 2024, Aptos has completed six funding rounds. According to disclosed data, prior to its 2022 mainnet launch, Aptos raised $350 million at a $2.75 billion valuation. It later conducted four additional strategic funding rounds with undisclosed amounts. All investors are leading industry funds, including Binance Labs, Dragonfly Capital, A16z, Multicoin Capital, Circle, and Coinbase Ventures. The latest round closed on September 19, 2024, indicating the project remains well-funded.

2.3 Codebase

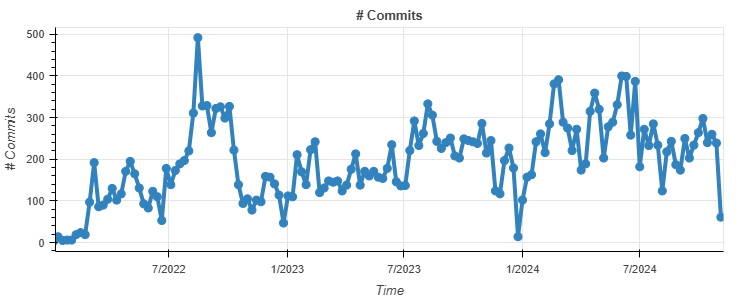

Figure 2-1: Aptos Code Commit Activity

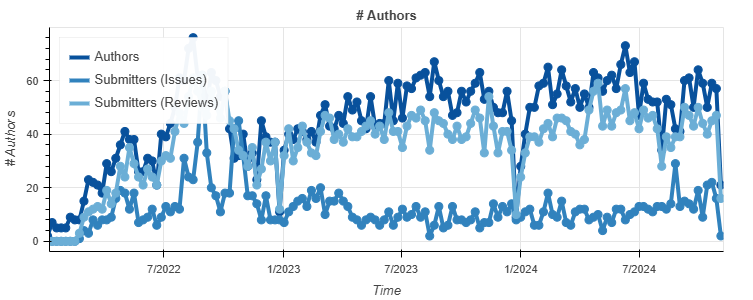

Figure 2-2: Aptos Code Contributors

Aptos’ source code is open-sourced on GitHub. As of November 7, 2024, the repository shows consistent updates, with a total of 40,223 commits. Developer count peaked above 70 and currently stands around 50. Development has seen three major peaks: the first in Q3 2022, corresponding to incentive testnet and pre-mainnet preparations; the second in Q3 2023, related to Move language and new on-chain identity solutions; and the third in Q2 2024, focused on new asset standards and consensus protocol upgrades. Overall, development progress is steady with no signs of stagnation, suggesting strong ongoing technical potential.

2.4 Product & Technology

Aptos is a public blockchain designed around principles of scalability, security, reliability, and upgradability, aiming to bring mainstream Web3 applications to solve real-world user pain points in a decentralized manner. To achieve these goals, Aptos has implemented unique designs in consensus, smart contract architecture, system security, performance, and decentralization.

2.4.1 Vision and Technical Framework

Aptos aims to build a scalable, secure, reliable, and upgradable smart contract platform—a vision reflecting its approach to the blockchain “impossible triangle.” Coined by Ethereum founder Vitalik Buterin, the impossible triangle posits that a blockchain cannot simultaneously achieve scalability, decentralization, and security—only two at most.

In short, Ethereum and Bitcoin prioritize decentralization and security at the expense of scalability. Newer chains like Solana emphasize extreme scalability but compromise on decentralization and security. Notably, Aptos’ whitepaper and Medium posts describe their goals using “scalability, security, reliability, and upgradability,” omitting explicit mention of decentralization—indicating deliberate architectural trade-offs.

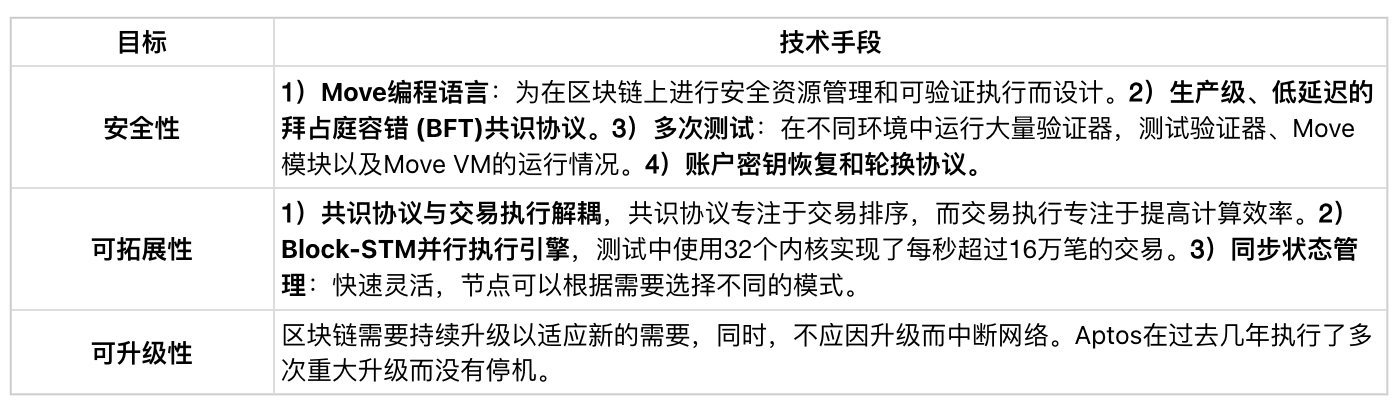

Table 2-2: Aptos Goals and Corresponding Technical Approaches

According to the Aptos whitepaper, core technical framework principles include:

1) Fast and secure transaction execution via the new Move smart contract programming language.

2) High throughput and low latency through pipelining and parallelized applications.

3) Support for arbitrarily complex transactions via the Block-STM parallel execution engine.

4) Optimized performance and decentralization through rapid validator rotation weighted by stake, with reputation tracking.

5) Upgradability and configurability as first-class design principles, embracing new technologies and use cases.

6) Modular design enabling component-level testing, improving security and operability.

The following sections explain these core technologies in detail.

2.4.2 Move Programming Language

In a 2021 article titled “Why Build Move,” Meta’s Diem engineering team described how programming languages enable accurate representation of state and transitions in blockchains. Here, “state” refers to asset value, storage location, and ownership, while “transitions” refer to who can create/destroy/move assets, allowed state changes, and rules governing asset transfers.

Due to blockchain’s unique nature, programming languages must not only accurately represent state and transitions but also satisfy requirements for determinism, encapsulation, and metering:

Determinism: Blockchains rely on state machine replication for consensus, so the language must be highly deterministic to ensure validators maintain consistent states. General-purpose languages like C (lacking memory safety) or Java (allowing undefined semantics) fail this requirement and thus cannot be safely used.

Encapsulation: To ensure message authenticity, transaction inputs must be strictly limited. Programs can only accept inputs from global state or the current transaction. References to external sources could lead different validators to receive different inputs, disrupting consensus.

Metering: To sustain continuous transaction processing, each state transition must have a bounded resource cost—i.e., gas. Most general-purpose languages lack built-in metering, necessitating a specialized blockchain language.

To meet blockchain-specific needs for determinism, encapsulation, and metering, Move draws inspiration from languages like Rust and introduces the concepts of “resources” and “modules.”

Move is a resource-oriented language, where resources represent certain types of values, and any asset on Move can be represented or stored as a resource. Resources are scarce, each defined with a lifecycle, storage method, and access pattern, ensuring assets like tokens cannot be forged, destroyed, or double-spent—enhancing asset security.

Modules contain data types and Move code, identified by the account address that declares them and the module name. They are used to create, store, or transfer assets. Move emphasizes “access control”: modules are either private or public. Private modules cannot be accessed externally and can only be modified within their defining module; public modules can be accessed by others and via public accessors—increasing overall security. Modules under the same account are grouped into a package, which the owner can deploy as a whole on-chain. The owner can choose whether the package supports upgrades, allowing new functions and resources to be added without altering existing ones—improving programmability and upgradability. Another type of program in Move is transaction scripts—functions that accept arbitrary parameters but return nothing, mainly used to call public modules and effect specific state changes.

Through resource and module design, Move satisfies blockchain requirements for determinism, encapsulation, and metering, enabling efficient, secure transaction execution and smooth code iteration on Aptos.

2.4.3 Diem BFT Consensus Algorithm

Consensus mechanisms (or protocols/algorithms) are systems that keep distributed networks synchronized and securely record transactions. More specifically, they govern how blocks (transactions) are ordered and confirmed among validators.

Different blockchains adopt different methods based on their goals. Bitcoin uses Proof-of-Work (PoW), where nodes perform massive computations to win block rewards. PoW offers the highest decentralization but consumes the most resources and has low efficiency. Early Proof-of-Stake (PoS) adjusts mining difficulty based on staked token amount and duration, speeding up validation. PoS reduces decentralization slightly but improves efficiency and lowers energy use.

Aptos uses a BFT-based mechanism. Diem BFT is a production-grade, low-latency Byzantine Fault Tolerance (BFT) engine developed by Aptos, derived from HotStuff—the original consensus protocol used by Diem. For higher efficiency, BFT requires only a threshold number of nodes to participate in consensus. With ≥ 3f + 1 total validators (up to f faulty ones), confirmation occurs once ≥ 2f + 1 nodes validate.

Over recent years, Diem BFT has undergone four major iterations, including:

1) Faster block finality—requiring only two network round trips, achieving sub-second finality.

2) Introduction of a node reputation system to analyze on-chain data and automatically rotate leaders, identifying unresponsive validators without manual intervention.

Traditional BFT systems use leader rotation, but often ignore leader health—faulty nodes may still be selected, slowing down the chain if too many fail.

Diem BFT improves this with a State-Machine Replication (SMR)-based reputation system that tracks node liveness and effectiveness. Liveness is monitored via on-chain data, and leaders are elected accordingly. If a leader fails due to attack or outage, the reputation system quickly identifies a suitable replacement, minimizing network disruption.

Additionally, Aptos clearly separates network liveness from security. Even if parts of the network become unreachable or non-core components are compromised, the chain does not need to fork as long as BFT’s honest guarantees hold. The consensus protocol has been audited and formally verified.

Aptos is currently developing its next-generation consensus protocol. In September 2024, Aptos Labs research lead Alexander Spiegelman announced Raptr, a new BFT protocol integrating DAG (Directed Acyclic Graph) technology to boost TPS while maintaining optimal theoretical latency. This upgrade will be deployed in two phases on the Aptos network.

2.4.4 Block-STM Parallel Execution Engine

When evaluating blockchain system performance, two common metrics are throughput and finality. Throughput (TPS) measures transactions processed per second; finality refers to the time between transaction submission and confirmation.

As of November 12, 2024, since mainnet launch, Aptos has achieved peak TPS near 13,000, processed over 300 million transactions in a single day, and maintained sub-second finality—with no network delays or outages. Its theoretical maximum TPS is projected to reach 160,000.

These records stem from Aptos’ advanced transaction processing architecture:

1) Complete separation of consensus and execution: Consensus agrees on transaction order. Validators execute transactions separately in off-critical-path protocols and agree on final execution results. Decoupling eliminates shared dependencies, enabling higher throughput and lower latency. Aptos Labs is advancing this decoupling in the next protocol version, expected to integrate with testnet later this year.

2) Block-STM Parallel Engine: Aptos Labs developed Block-STM, an in-memory parallel smart contract execution engine. STM stands for Software Transactional Memory—a novel engineering method supporting flexible concurrent programming.

Ethereum Virtual Machine (EVM) is single-threaded, processing transactions one at a time. During traffic spikes, this causes congestion and delays. To address this, newer chains like Solana employ multi-threaded concurrency. Aptos follows suit, currently testing up to 32 threads.

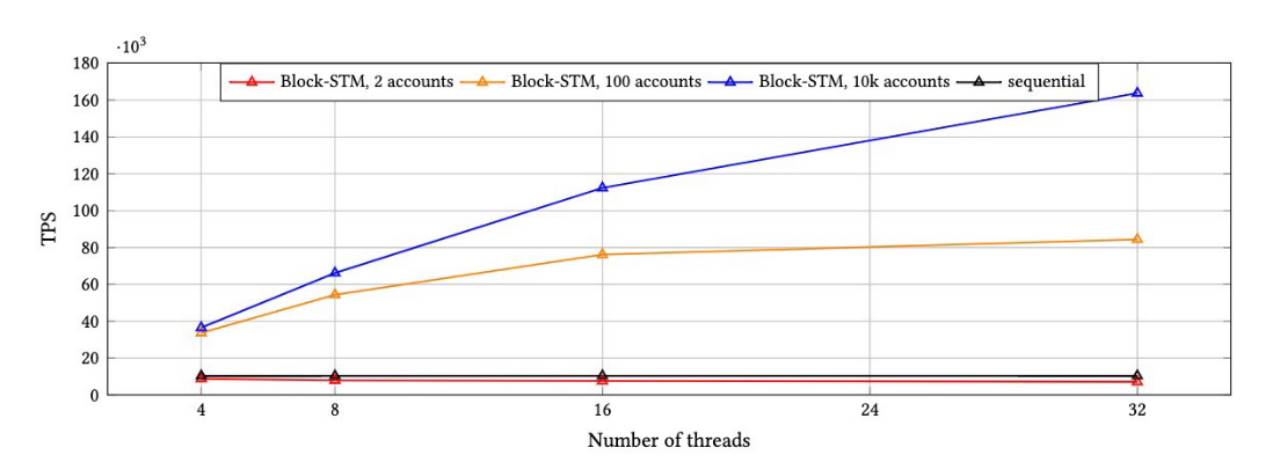

Aptos has open-sourced Block-STM, leveraging Rayon, Dashmap, and ArcSwap crates for concurrency, with performance benchmarks shown below. Each block contains 10,000 transactions. Account count determines system contention levels. Red line: 2 accounts; yellow: 100; blue: 10,000; black: sequential execution. X-axis: thread count; Y-axis: TPS. System performance varies across thread and account counts.

Figure 2-3: Block-STM Performance Across Thread Counts

The graph shows sequential execution yields constant 10,000 TPS regardless of thread count. With 4 threads, Block-STM reaches up to 40,000 TPS. With 16 threads, up to 110,000 TPS. With 32 threads, up to 160,000 TPS. Clearly, parallelization boosts speed, and advantages grow with higher user loads, delivering much higher TPS.

3) Optimized authentication data structures: To address scalability issues with Merkle tree persistence, Aptos is developing authenticated data structures designed to be scalable and database-friendly. This involves optimizing branching factors, caching access patterns, and careful version control.

2.4.5 Node State Synchronization

State synchronization is the protocol allowing non-validator nodes to distribute, verify, and persist blockchain data, keeping all network nodes aligned. Most blockchains follow a layered structure, with a core group of active validators. Validators advance the chain by executing transactions, producing blocks, and reaching consensus. Other peers (e.g., full nodes, clients) replicate data generated by validators.

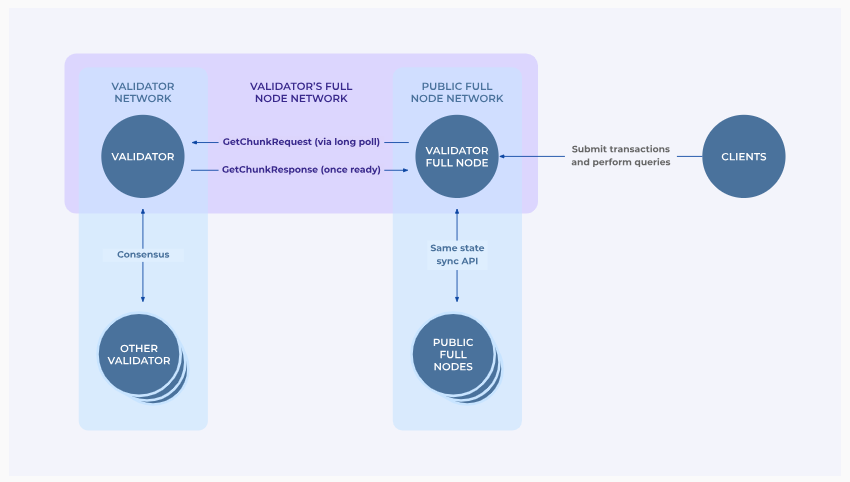

Figure 2-4: Aptos Node Architecture

The diagram shows Aptos’ node system: validators interconnect, while full nodes and clients serve auxiliary roles. Efficient synchronization among nodes is critical for the entire blockchain, for the following reasons:

1) Data correctness: State sync ensures all data is correctly validated during synchronization, preventing malicious peers from modifying, censoring, or forging transactions.

2) User experience: When validators process new transactions, state sync propagates data to peers and clients. Slow or unreliable sync leads to perceived delays, artificially inflating finality times.

3) Consensus integrity: Crashed or lagging validators rely on state sync to catch up. If sync cannot keep pace with consensus, crashed validators cannot recover. New validators cannot join, and full nodes cannot reach the latest state.

4) Decentralization: Fast, efficient, and scalable state sync enables:

A. Faster validator set rotation, as validators can freely enter/exit consensus;

B. A larger pool of potential validators;

C. Faster onboarding of full nodes without long wait times;

D. Lower resource demands, increasing node heterogeneity. These factors enhance decentralization and support geographic and scale expansion.

To achieve more efficient state synchronization, Aptos implements:

1) A range of synchronization protocols tailored to different CPU capacities and bandwidths, letting nodes choose appropriately and encouraging broader participation.

2) Low-cost full nodes that sync transactions and execution results. With signatures from a quorum of validators, nodes can skip computation and directly apply ledger updates.

3) Clients can use a top-level transaction accumulator to fetch the latest committed transactions without downloading the entire ledger, as required by most blockchains. Previous transactions and ledger history can also be cheaply pruned if needed.

Thanks to this efficient state sync design, Aptos achieves 10x higher throughput, 3x lower latency, and enables peers to verify and sync over 10,000 transactions per second.

2.4.6 Security Design

Aptos aims to bring Web3 to mainstream users, emphasizing transaction security. Given frequent fraud incidents in blockchain, enhanced safeguards are essential:

1) Transaction Validity Protection

Users sign transactions to authorize them. Sometimes, users inadvertently sign unwanted transactions or fail to anticipate manipulation risks. To mitigate this, Aptos limits transaction validity to protect signers from indefinite exposure. The blockchain provides three protections: sender sequence number, transaction expiration time, and designated chain identifier.

Each sender account allows only one transaction per sequence number. If a sender observes their account’s sequence number is greater than or equal to a transaction’s, then either the transaction was already submitted or will never be (as the sequence number is already used).

Blockchain time is recorded with sub-second precision. If current time exceeds a transaction’s expiry, then either it was already confirmed or will never be.

Every transaction includes a designated chain ID to prevent replay attacks across different blockchain environments.

2) Key Rotation and Hybrid Custody Mechanism

Aptos accounts support key rotation, reducing risks from private key leaks, remote attacks, or future cryptographic breaks. Users can delegate key rotation rights to one or more custodians or trusted entities, then define policies via Move modules for these entities to rotate keys under specific conditions. For example, entities could be k-out-of-n multisig keys held by trusted parties, providing key recovery to prevent loss. Compared to cloud backups or social recovery, Aptos’ on-chain, transparent key management offers greater clarity and trust.

3) Improved Pre-Signing Transparency

Current wallets lack signing transparency—many signatures aren’t plain text, leaving users unaware of consequences. This enables phishing attacks and fund theft.

To address this, Aptos provides preventive measures describing possible outcomes before signing, reducing fraud. Wallets can also enforce constraints during execution; violating transactions are rejected, offering further protection against malicious apps.

Together, these security features create a safer user environment on Aptos.

Summary

From the team perspective, Aptos’ core members originated from Meta’s Diem (formerly Libra) and Novi projects. After Meta exited blockchain under regulatory pressure, key engineers founded Aptos. Thus, Aptos inherits Meta’s blockchain legacy. As a top software firm, Meta cultivated a talented, academically strong, and technically capable team—now forming a solid foundation for Aptos’ continued growth.

On funding, as of November 7, 2024, Aptos has raised $350 million at a $2.75 billion valuation before mainnet launch in 2022, followed by four undisclosed strategic rounds. Backed by top-tier VCs like Binance Labs, Dragonfly, A16z, Multicoin, Circle, and Coinbase Ventures, and with its latest round closing September 19, 2024, the project remains well-funded.

Technologically, Aptos targets a scalable, secure, reliable, and upgradable smart contract platform, enabled by Move, Diem BFT, Block-STM, and efficient node sync. Since mainnet launch, it has achieved over 12,000 peak TPS, processed more than 300 million daily transactions, and reduced latency to under one second—without outages—proving high performance and reliability. Gas costs are minimized via efficient fee design, benefiting DeFi and dApps. However, pursuing scalability and security comes with trade-offs: fewer nodes and high entry barriers pose centralization risks.

3. Development

3.1 History

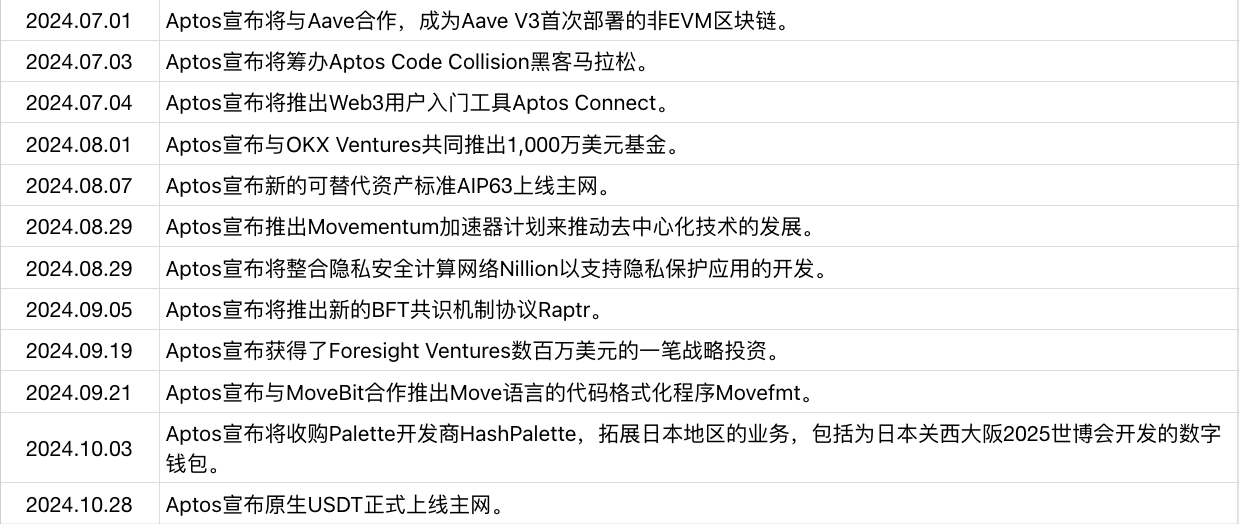

Table 3-1: Major Events in Aptos History

3.2 Current Status

3.2.1 Operational Data

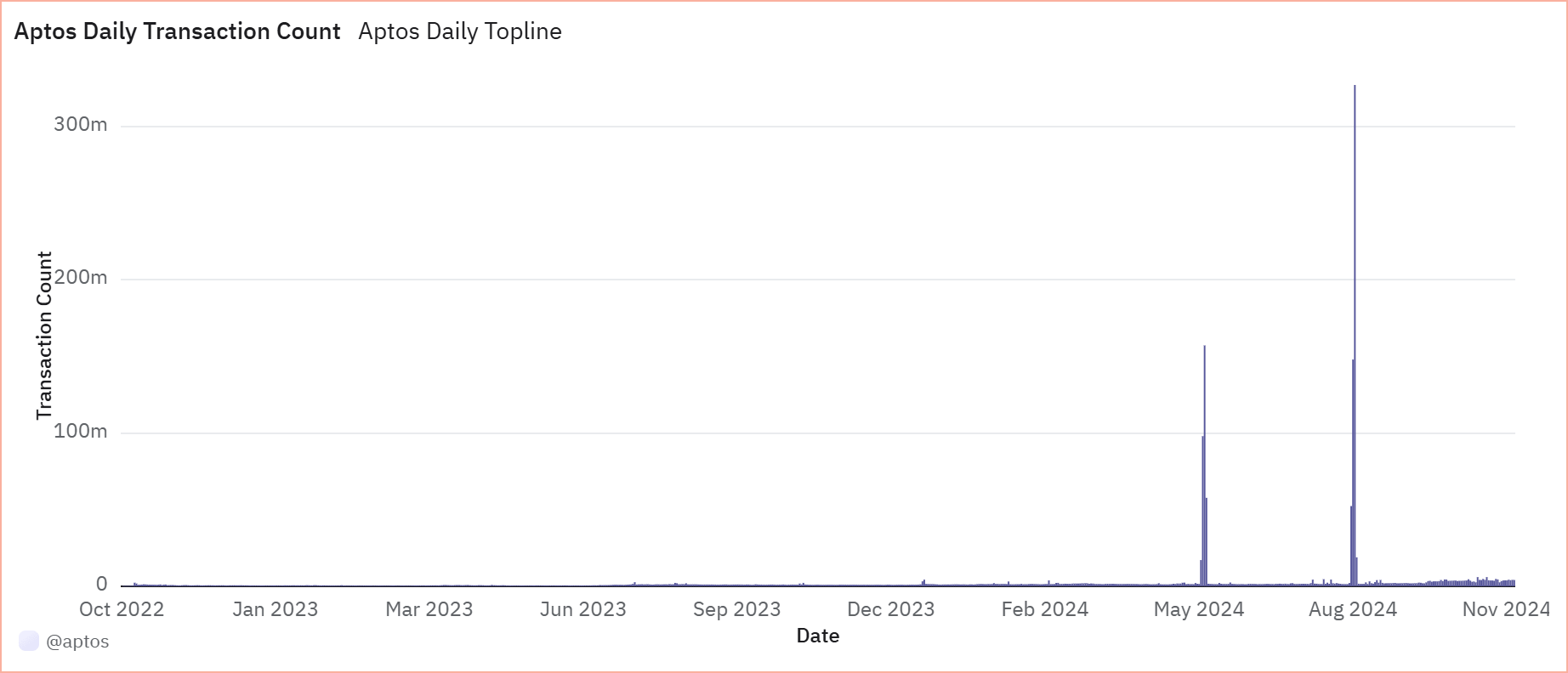

Figure 3-1: Aptos Daily Cumulative Transaction Volume

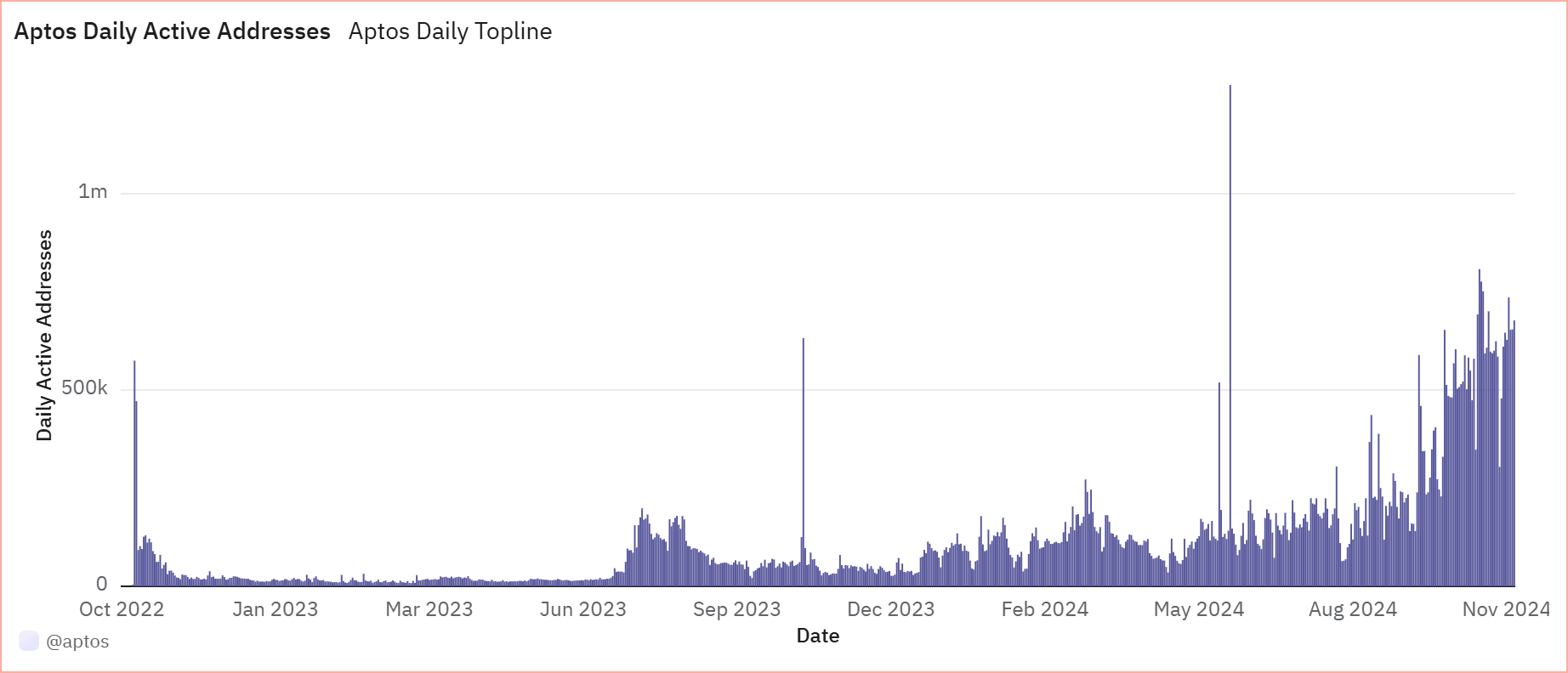

Figure 3-2: Aptos Daily Active Addresses

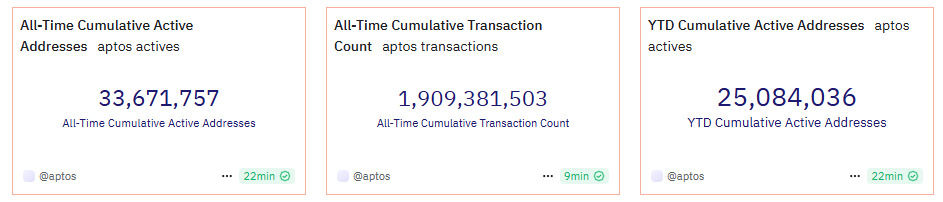

Figure 3-3: Aptos Basic Metrics 1

Figure 3-4: Aptos Basic Metrics 2

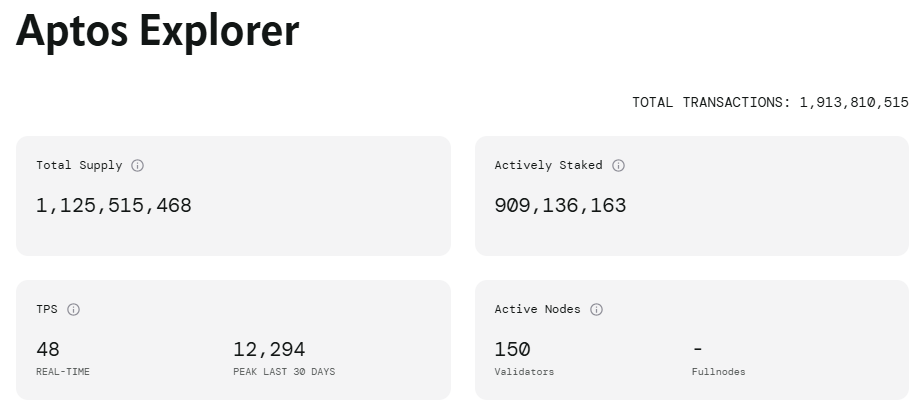

According to Aptos’ official Dune dashboard, as of 10:00 AM on November 11, 2024, Aptos has accumulated 33,671,757 active addresses and 1,909,381,503 total transactions. Over the past 30 days, 8,184,230 active addresses (24.3% of total) were recorded. Year-to-date, 25,084,036 active addresses (74.5%) participated—indicating strong user retention.

Daily active addresses and transaction volume have consistently grown since mainnet launch in October 2022. Growth accelerated notably in Q4 2024, with similar trends visible in transaction volume.

Additionally, driven by the popularity of tap-to-earn game Tapos, Aptos saw transaction peaks in May and August 2024. On August 15, daily volume hit 326,972,362 transactions—a new Layer 1 record—and peak TPS neared 13,000. Despite this load, the network experienced no block production issues, demonstrating exceptional concurrency handling and readiness for future ecosystem growth.

3.2.2 Ecosystem

As a Layer 1 platform, Aptos’ ecosystem combines breadth and depth thanks to strong network performance.

Breadth is reflected in diverse sector coverage. As of November 11, 2024, Aptos hosts 192 projects across 16 major sectors, including 49 DeFi, 48 infrastructure, 28 wallet, 25 gaming, 18 social, and 16 NFT projects—featuring several high-profile names. The ecosystem remains in early to mid-stages, dominated by functional and liquidity infrastructure. Once foundational layers mature, more applications and use cases will emerge, unlocking greater ecosystem potential.

Table 3-2: Aptos Ecosystem Sector Breakdown

In exploring ecosystem depth, Aptos actively collaborates with projects on technical and application fronts, providing new Move versions, compilers, formatters, game SDKs, token/NFT/wallet standards—helping ecosystem teams maximize their strengths on Aptos.

Beyond these, the Aptos Foundation promotes hackathons and ecosystem grants, offering four funding categories: “Ecosystem Grants,” “Registration Fee Grants,” “Gas Fee Grants,” and “Security Audit Grants”—supporting developers from idea to deployment. As of November 2024, over 200 projects received funding, including Thala Labs, Pontem Wallet, Merkle Trade, Mercato, Wapal, and Aptos Arena.

While building on-chain ecosystems, Aptos leverages Meta-era goodwill to maintain strong ties with global tech and traditional firms—including Amazon, Alibaba, Google, NBCUniversal, Microsoft, Brevan Howard, SK Telecom, Boston Consulting Group, and South Korea’s Lotte—spanning technical and commercial cooperation. Aptos also maintains positive relations with U.S. regulators; co-founder Mo Shaikh was appointed to the CFTC’s Digital Assets Subcommittee in June 2024.

3.2.3 Social Media Presence

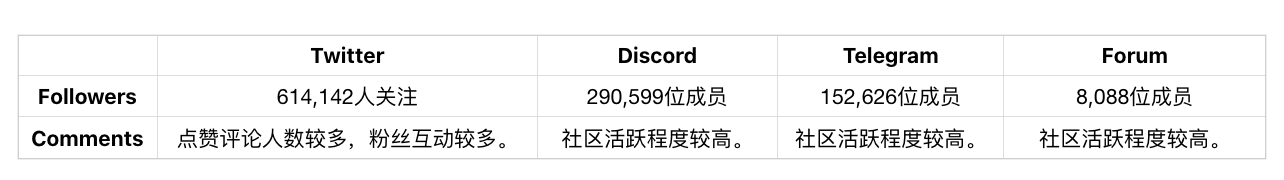

Table 3-2: Aptos Social Media Metrics

As of November 11, 2024, Aptos maintains a large, active social media presence with high engagement. The community is sizable and vibrant, focusing discussions on token developments and ecosystem growth. Governance forums are active, covering project status, upcoming upgrades, and strategic direction.

3.3 Future Outlook

Aptos has not released a formal roadmap recently. Per community responses from officials, no roadmap will be published soon, though project updates will continue to be shared in real time.

Given current progress, core blockchain development is largely complete. Future efforts will focus on incremental tech updates, with primary emphasis shifting toward ecosystem expansion and business partnerships.

Summary

In terms of development, Aptos is progressing well. Since Q3 2024, active addresses have grown steadily with good retention, and transaction volume has risen sharply—peaking at over 300 million daily transactions on August 15, with TPS nearing 13,000—validating its excellent performance. The ecosystem continues to expand in scope and depth, with DeFi, gaming, and social likely forming future growth pillars. Aptos also maintains strong ties with traditional enterprises and regulators, partnering with Microsoft, Google, Alibaba, Amazon, Lotte, and SKT. Moreover, native USDT launched on Aptos in late October 2024, potentially bringing significant new liquidity and unlocking further ecosystem potential.

4. Economic Model

4.1 Supply

4.1.1 APT Token Distribution

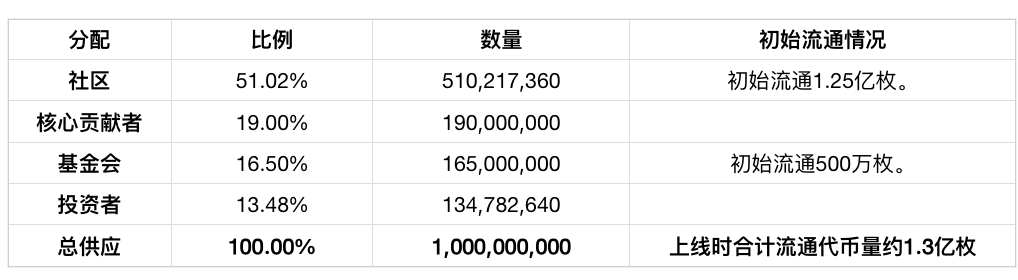

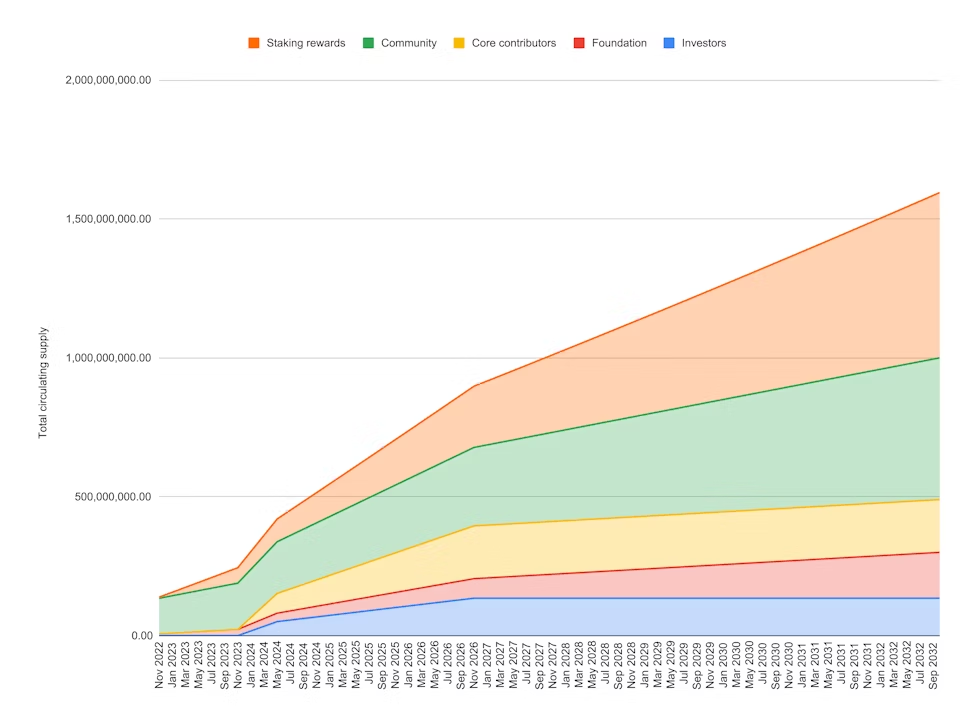

APT is Aptos’ native token, launched on mainnet in October 2022, with an initial supply of 1 billion. New tokens are minted via inflation: 7% annual inflation in Year 1, declining annually by 1.5% until stabilizing at a floor of 3.25% after ~50 years. These new tokens reward node operators and stakers to sustain network operations. As of November 11, 2024, total APT supply is 1,125,360,719, with 520,057,351 in circulation (46.2%).

Table 4-1: Initial APT Token Allocation

Community & Foundation Allocation

The Community (51.02%) and Foundation (16.5%) portions are designated for ecosystem-related initiatives such as grants, incentives, and growth programs. Some tokens are already allocated to projects building on Aptos, to be released upon milestone completion. Most (410,217,360 APT) are held by the Aptos Foundation, with a smaller portion (100,000,000 APT) held by Aptos Labs, expected to be distributed over ten years. Lock-up and release details:

1) Community: 125 million APT entered circulation at launch for ecosystem support, donations, and growth initiatives;

2) Foundation: 5 million APT entered circulation at launch to support Foundation-led programs;

3) Remaining Community and Foundation tokens unlock monthly at 1/120 per month over ten years.

Core Contributors & Investors

Core Contributors (19%) and Investors (13.48%) are fully locked for 1 year, then distributed over the next 3 years. Details:

1) No tokens from these groups enter circulation in the first 12 months post-launch;

2) From month 13 to 18 (inclusive), tokens unlock monthly at 1/16;

3) Starting month 19, remaining tokens unlock monthly at 1/48.

Note: Under Aptos’ token plan, all tokens—whether unlocked or still locked—can participate in staking. Thus, the vast majority of APT remains staked and not in free circulation.

Figure 4-1: APT Token Distribution Stack Chart

At launch, the community nominally held over half the tokens. However, most are still held by the Aptos Foundation for future ecosystem development. Because locked tokens can stake and earn newly issued rewards, the effective circulating share available to early community participants will decrease over time. Overall, APT distribution remains highly centralized, with the Foundation holding dominant control—potentially limiting small holders’ influence in ecosystem governance.

4.2 Demand

APT serves as the utility token for the Aptos network, fulfilling several key roles:

1) Basis for PoS consensus and validator block rewards.

2) Governance token for voting on proposals, including network parameters, marketing, ecosystem development, and tech upgrades.

3) Gas token for paying transaction fees on the network.

4) Reward mechanism for ecosystem participants and contributors.

4.2.1 Network Nodes

Aptos uses a Byzantine Fault Tolerant (BFT) consensus algorithm in a PoS model.

Figure 4-2: Aptos Validator Distribution

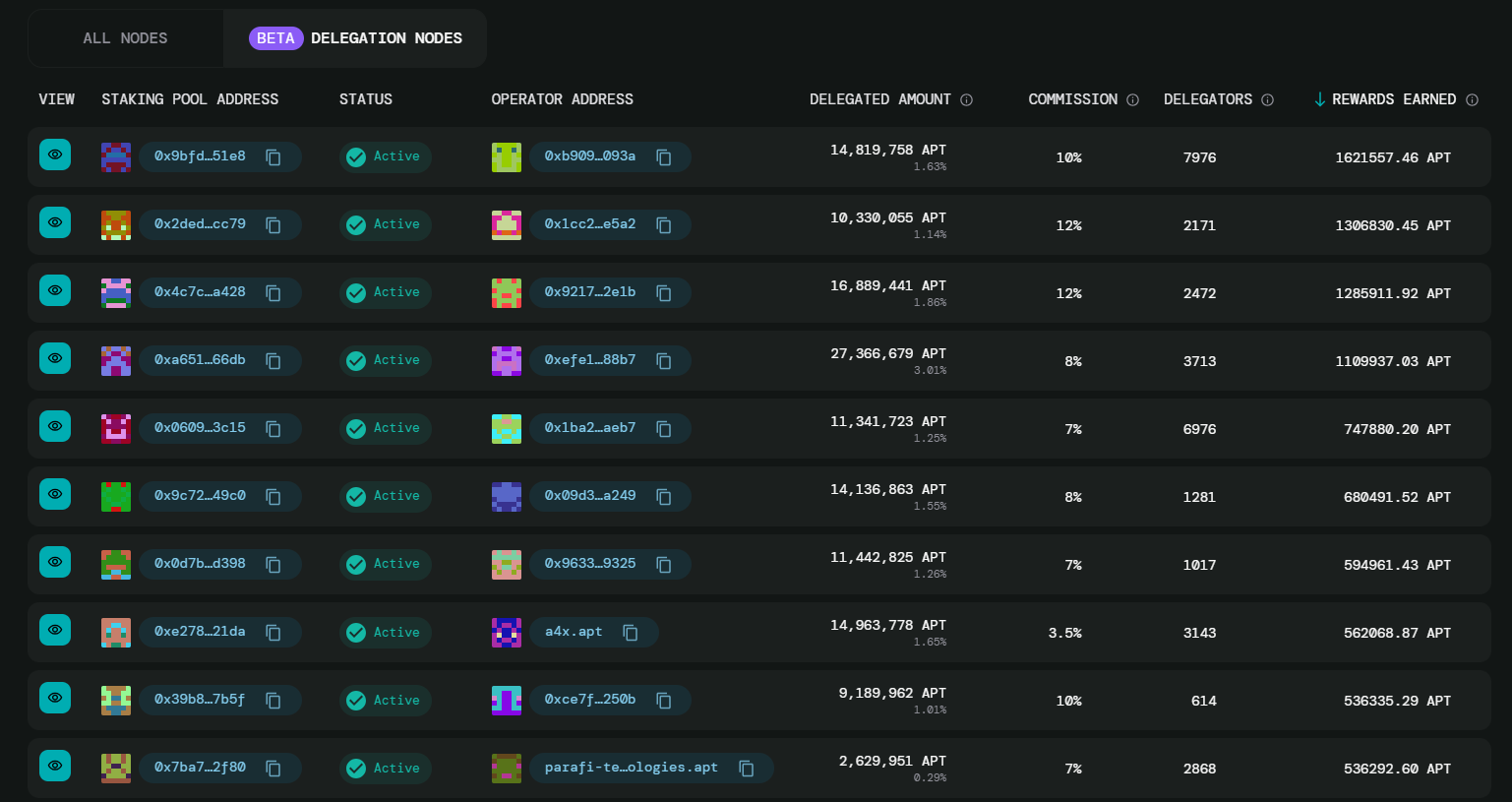

Two main node types exist: full nodes and validators. Though sharing the same codebase, they differ functionally. Full nodes maintain the latest blockchain state and provide scalability and DDoS mitigation. They do not participate in consensus. Any blockchain explorer, wallet, exchange, or dApp can run a local full node. Validators run the consensus protocol, execute transactions, and store data on-chain. Token holders can operate validators via staking or delegation (minimum 1 million APT, max 50 million APT), earning consensus rewards.

Figure 4-4: APT Staking Overview

As of November 12, 2024, Aptos has 150 validators across 47 cities in 23 countries, with 909,136,163 APT staked (~80.78% of total supply). While validator count indicates some centralization, geographic distribution enhances security.

4.2.2 Delegated Staking

In April 2023, Aptos launched official delegated staking, giving APT holders a direct path to participate in consensus and earn rewards—also enhancing decentralization and security.

Figure 4-5: Delegation Interface

APT holders can use Aptos Explorer to delegate. From the validator page, clicking “Delegate” reveals a table of active validators accepting delegations, showing staked amount, number of delegators, service fee, and earned rewards. Clicking a validator’s address displays detailed performance data and estimated annual yield—currently around 7% across all nodes. Users can freely select and delegate to preferred validators.

Beyond official delegation, users can also stake via liquid staking protocols in the ecosystem—such as Tortuga, Ditto, and Thala—to earn liquid staking tokens for further DeFi activities.

4.2.3 Governance

APT holders gain proposal and voting rights through staking.

Proposal rights require a minimum stake (currently 1 million APT) and a lock-up period lasting through the 14-day proposal window and 3-day voting period. Voting rights have no such restrictions. After staking, users receive a voter key representing their voting weight, usable for self-voting, held by custodians, or delegated to others. Voting power is proportional to staked APT relative to total staked supply.

As a public chain, Aptos governance is relatively narrow, focused on technical upgrades. On-chain proposals cover four areas:

1) Changing blockchain parameters (e.g., Epoch duration, min/max validator stake thresholds).

2) Modifying core blockchain code.

3) Upgrading Aptos framework modules to fix bugs or add functionality.

4) Deploying new framework modules.

As of November 12, 2024, 116 governance proposals have been submitted. One is pending vote, seven lacked final votes, one was rejected (AIP-52: auto-account creation for sponsored transactions, later resubmitted and passed), and 107 have been approved and executed on-chain.

Key proposals include lowering voting thresholds, upgrading gas models to reduce fees, enabling multisig, launching delegation and arbitration storage, enabling fee sponsorship, reducing block rewards, raising gas limits to increase concurrency, shortening voting periods, lowering proposal thresholds, and enabling Keyless accounts—mainly focused on improving performance, expanding use cases, and lowering governance barriers.

Summary

From a tokenomics perspective, APT primarily functions as Aptos’ utility token for consensus, governance, gas payments, and ecosystem incentives. Currently, most issued APT tokens are held by the Aptos Foundation for future operations and ecosystem development—highlighting Aptos’ long-term commitment to ecosystem growth and laying the groundwork for sustained expansion.

5. Sector Analysis

5.1 Sector Overview

Aptos belongs to the public blockchain sector.

Public chains form blockchain infrastructure, defining narrative ceilings and offering expansive market cap potential—drawing intense capital and talent competition. Blockchain evolution can be divided into three phases:

Phase 1 (2008–2013): After Satoshi Nakamoto published the Bitcoin whitepaper, Bitcoin gained popularity, inspiring many Bitcoin-improvement-focused “altcoins,” forming the first generation of public chains led by BTC.

Phase 2 (2014–2017): The introduction of Turing completeness made Ethereum a turning point—smart contracts emerged, enabling programmable blockchains capable of hosting applications. The rise of apps like CryptoKitties gave users tangible experiences of blockchain utility. Ethereum leveraged first-mover advantage to build strong ecosystem moats. Chains from this era include ETH, NEO, QTUM, and EOS.

Phase 3 (2018–present): Innovations in consensus and transaction layer tech spawned high-performance, low-cost chains like BSC, Solana, and Avalanche.

This phase shows three trends: 1) Ethereum as base layer with various Layer 2 solutions; 2) New monolithic chains using cutting-edge tech, such as Aptos and Sui; 3) Specialized chains, including modular and privacy-focused blockchains.

We assess public chains across three dimensions:

First, consensus mechanism: How the community perceives decentralization. This relates to psychological security—users prefer placing core assets on chains they deem safest, like BTC and Ethereum, rather than BCH or LTC. This is the hardest barrier to overcome and the most critical competitive edge. EOS once rivaled Ethereum in popularity but faded due to severe centralization.

Second, technical innovation: Whether the chain offers novel, advantageous mechanisms that optimize performance. This ties directly to the “impossible triangle.” As proposed by Vitalik Buterin, a blockchain cannot simultaneously achieve scalability, decentralization, and security—only two at most. Ethereum and Bitcoin prioritize decentralization and security, sacrificing scalability. Solana and others chase extreme scalability, compromising somewhat on decentralization and security.

Third, ecosystem strength: Ability to attract developers and projects, driving user adoption and creating virtuous cycles. A chain is just infrastructure—value accrues only when developers, apps, and users actively engage. More developers, stronger innovation, richer ecosystems, and higher user activity lead to exponential marginal gains.

By 2024, after multiple market cycles and tech advances, demand for public chains is clearer than ever, and understanding of what makes a successful chain has deepened. We now see that a chain’s foundational consensus and performance form the root enabling ecosystem growth, while ecosystem

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News