How to stay rational during the explosive rally of a bull market?

TechFlow Selected TechFlow Selected

How to stay rational during the explosive rally of a bull market?

Good luck, and I hope everything goes smoothly.

Author: Stephen | DeFi Dojo

Translation: TechFlow

Yes, the bull market is finally here—something many of us have been waiting for. But don't assume that means everything will go smoothly. Bull markets bring their own unique pressures and anxieties.

Here are some emotional traps to watch out for:

FOMO (Fear of Missing Out)

This one is obvious. During a bull market, high-risk investments can deliver double- or even triple-digit gains. When your ETH or BTC goes up 10% in a month, you feel good about your strategy—until you see someone on social media flaunting 10x, 50x, or even 100x returns, and suddenly start questioning your choices.

Here are some coping strategies:

-

Remember: those scoring 10x–100x returns are usually taking far bigger risks. They’re often investing in memecoins like lottery tickets—maybe putting money into 40 tokens and hitting it big on just one. If you keep investing rationally, their annualized returns might not differ much from yours in the long run.

-

Practice measured diversification. Allocate a small portion of your portfolio to researching and making small bets on memecoins. This helps you determine whether high-risk investing suits you. If you find it doesn’t, it’s easier to resist FOMO.

-

This point is especially important: respect the market’s upside.

Another helpful tactic is what’s known as "fake it till you make it." When you feel FOMO seeing others succeed, try leaving them a congratulatory comment. Receiving a “thanks” in return gradually trains your brain to associate success with positive emotions rather than negative envy.

Stagnation in a Bull Market

Even during a bull market, most of the time the market moves sideways. Both accumulation and distribution phases can be exhausting. Why? Because once we get used to constant upward momentum, we begin expecting it to continue indefinitely. But that’s not how it works. Even during the most optimistic phases of the last bull cycle, markets spent most of their time consolidating. In fact, during the rally from July to November 2021, two-thirds of the time the market was flat or down.

Solutions:

-

Avoid over-leveraging. This helps achieve "risk-adjusted returns." Imagine opening a highly leveraged long position just before an accumulation phase—every day without upward movement would feel frustrating. Overexposure increases the risk of poor decisions or losses.

-

Keep capital deployable. A common mistake in bull markets is dumping all your funds at once and then passively waiting. If you're an active yield farmer who enjoys the process, great. But for most people, the best way to stay engaged during sideways or down periods is dollar-cost averaging or buying the dip. Allocating funds weekly ensures you always have a small amount ready to deploy, rather than waiting until month-end paychecks.

-

Maintain stablecoin or neutral positions. This keeps you active and earning while waiting for the next major move. During bull markets, stablecoin or neutral strategies often yield over 30% APY with relatively low risk.

Downturns—Daily or Weekly

Similar to stagnation, but more painful: bull markets still include frequent down days and weeks.

In fact, since Bitcoin hit $27,000, 23 out of 58 weeks (about 40%) have been down!

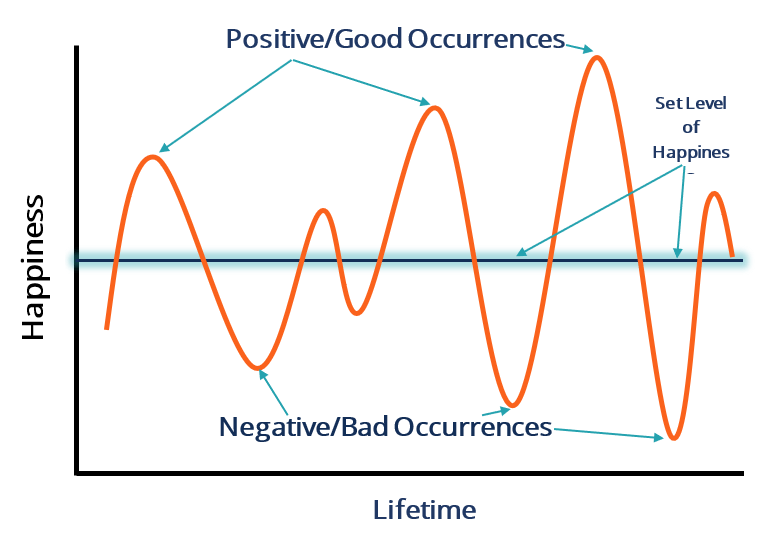

So even if your portfolio has grown 50% or 100% since last month, you may have become accustomed to gains—making any loss feel particularly painful. This is known as the hedonic treadmill effect.

Once you adapt to a new higher value, seeing losses hurts.

The solutions are the same as before:

-

Avoid excessive leverage

-

Keep capital liquid

-

Engage in some stablecoin investing (also a great way to maintain liquidity)

Another solution is implementing long-short hedges. Also known as pairs trading—though not detailed here—the benefit of such a strategy (even if not perfectly balanced) is that you can profit from closing short positions during downturns to reinforce your long exposure.

Anticipation Anxiety

A very common issue. Elections, rate cut dates, presidential transitions, geopolitical escalations, major token launches, or airdrop events—all generate intense anticipation. As one sage put it, “Living in the future is anxiety.” Constantly worrying about or anticipating events that could impact your investments is mentally draining and stressful.

Solution:

Join a community. When you speculate alone about future events, you're essentially torturing yourself, likely amplifying fear. Trying to map every possible outcome is a neurotic and isolating exercise, and news outlets often deliberately sensationalize—making them poor sources for rational speculation.

Instead, join a community of intelligent individuals with similar investment goals. Discussing and speculating together makes the process far lighter—and sometimes even humorously relieving. It helps you gain new perspectives and assess whether your reactions are overblown or undercooked.

Additional Tips:

-

Avoid emotional trading. Learn from the bull market, keep investing rationally, and you’ll do just fine.

-

When your investment doubles or triples, withdraw your initial capital. No one ever went broke taking profits.

-

Don’t allocate large portions of your capital to new, small, or unaudited projects.

I expect certain yields to look extremely attractive at times. Scam seasons do exist. Small protocols are essentially binary bets (either you win or lose everything), so they typically shouldn’t represent more than a single-digit percentage of your portfolio.

-

Try new chains. This cycle offers massive incentives. These are free opportunities with relatively favorable risk-adjusted profiles.

For example, chain-level or institutional/foundation incentives (like ARB STIP or Optimism Superchain Foundation events) are among the safest plays, as these rewards tend to flow toward top-tier protocols.

Don’t hesitate to explore a new chain with strong foundational incentives.

Investing in Aave at 75% APY on SillyChain is better than investing in NewPonzuFork at 100% APY on Ethereum mainnet.

Finally

Remember: life is like a hedonic treadmill.

Constant euphoria is never the norm. You can't sustain peak excitement indefinitely. Our nervous systems simply aren't built for it.

Accept that euphoria is fleeting. Don't chase it. Even in a bull market, fear and FOMO will inevitably surface.

The real key is minimizing deviations from your baseline state.

Good luck, and may fortune favor you.

@WordJizz said:

"This is our moment at the summit."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News