Bitcoin Market Report: Key Trends, Insights, and Bullish Price Predictions

TechFlow Selected TechFlow Selected

Bitcoin Market Report: Key Trends, Insights, and Bullish Price Predictions

By mid-2025, Bitcoin could reach between $102,000 and $140,000.

Written by: Bitcoin Magazine Pro

Translated by: Felix, PANews

Bitcoin Magazine Pro has published a review of Bitcoin in October and discussed several key topics, including declining Bitcoin exchange balances, ETF inflows exceeding $5 billion, and bullish forecasts that could redefine Bitcoin’s value in the coming quarter. Below are the details of the report.

Key Highlights:

-

On-chain analysis: Bitcoin exchange balances are at historic lows, indicating growing holder confidence and an increasing preference for self-custody.

-

Bitcoin ETF surge: ETF inflows exceeded $5.4 billion in October, with BlackRock's IBIT leading the market—reflecting rising adoption of Bitcoin in mainstream financial markets.

-

Mining dynamics: Russia and China are expanding their mining influence, while the U.S. maintains the largest share of global hash rate.

-

Bullish price prediction: Bitcoin analyst Tone Vays predicts a potential price range of $102,000 to $140,000 by mid-2025, supported by strong technical indicators.

Bitcoin On-Chain

Highlights

-

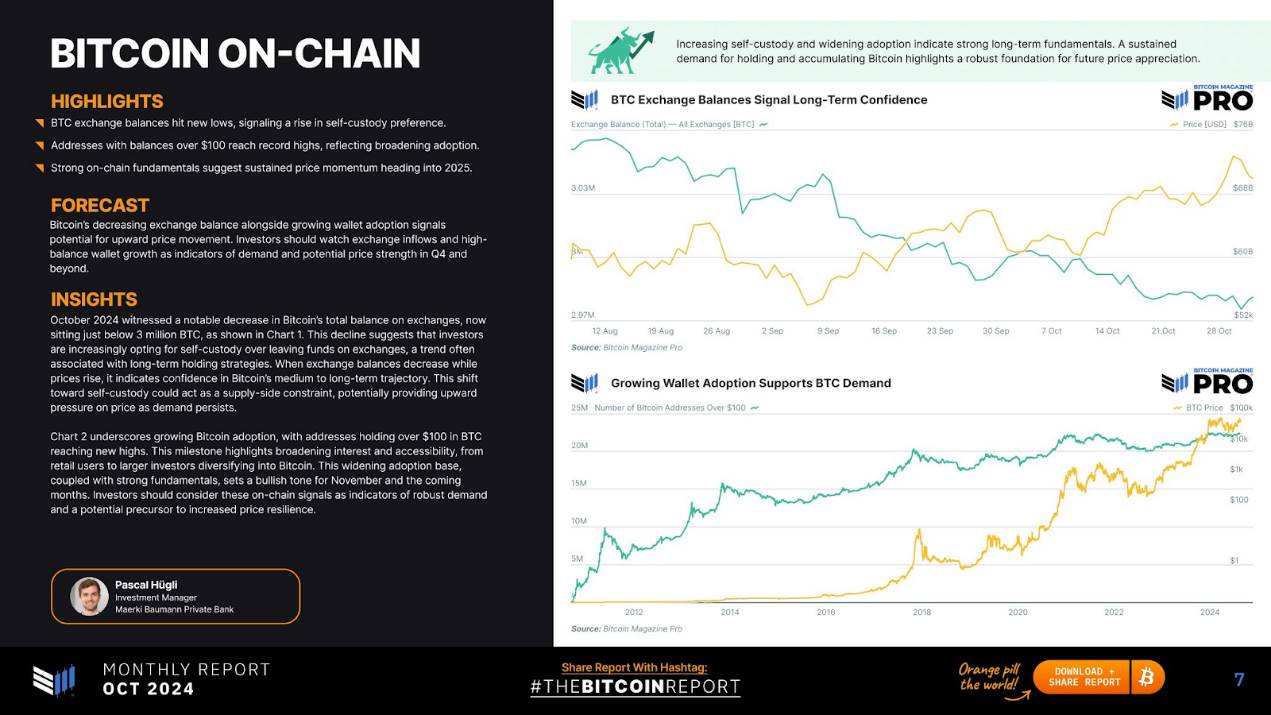

BTC exchange balances hit new lows, signaling increased preference for self-custody

-

Addresses holding over 100 BTC reached record highs, reflecting broader adoption

-

Strong on-chain fundamentals suggest sustained price momentum into 2025

Outlook

The decline in Bitcoin exchange balances and growing wallet adoption indicate potential for price appreciation. Investors should monitor exchange outflows and growth in high-balance wallets as indicators of demand and potential price strength in Q4 and beyond.

Insight

In October, total Bitcoin balances on exchanges declined significantly, now slightly below 3 million BTC, as shown in Figure 1. This downward trend suggests investors are increasingly moving toward self-custody rather than leaving funds on exchanges—a behavior often associated with long-term holding strategies. Declining exchange balances amid rising prices signal strong medium- to long-term confidence in Bitcoin. This shift toward self-custody may act as a supply constraint, potentially exerting upward pressure on prices if demand remains steady.

Mining

Highlights

-

Russia and China are currently making significant contributions to global Bitcoin hash rate.

-

The U.S. remains the leader in hash power, but Russia ranks second, and despite its mining ban, China continues to see a quiet resurgence in mining activity.

-

Emerging markets such as Ethiopia and Argentina are also seeing growth, which could influence future hash rate distribution.

Outlook

If hash rate growth in China and Russia continues, U.S. miners could face intensified global competition next year.

Insight

Russia and China have recently emerged as key players in global Bitcoin mining. Russia is now the second-largest contributor to global hash rate, leveraging its abundant natural resources to provide cost-effective energy for miners. This expansion is driven by regional support for mining as a profitable and strategic economic activity. Meanwhile, despite China’s official ban, underground mining persists and has grown notably in recent years. This dual development signals a shift in mining power that could reshape market dynamics, especially if the global hash rate becomes less dominated by the U.S.

While the U.S. still leads in Bitcoin hash rate, Russia’s rapid rise and China’s resilience pose challenges to American miners. Additionally, emerging markets like Ethiopia and Argentina are ramping up mining operations, contributing to a more decentralized global mining network. This diversification could enhance the security and operational stability of the Bitcoin network, making it less vulnerable to regional disruptions. As these trends continue, U.S. Bitcoin miners may face fiercer competition—not only in securing energy resources but also in maintaining profitability under volatile market conditions.

ETFs

Highlights

-

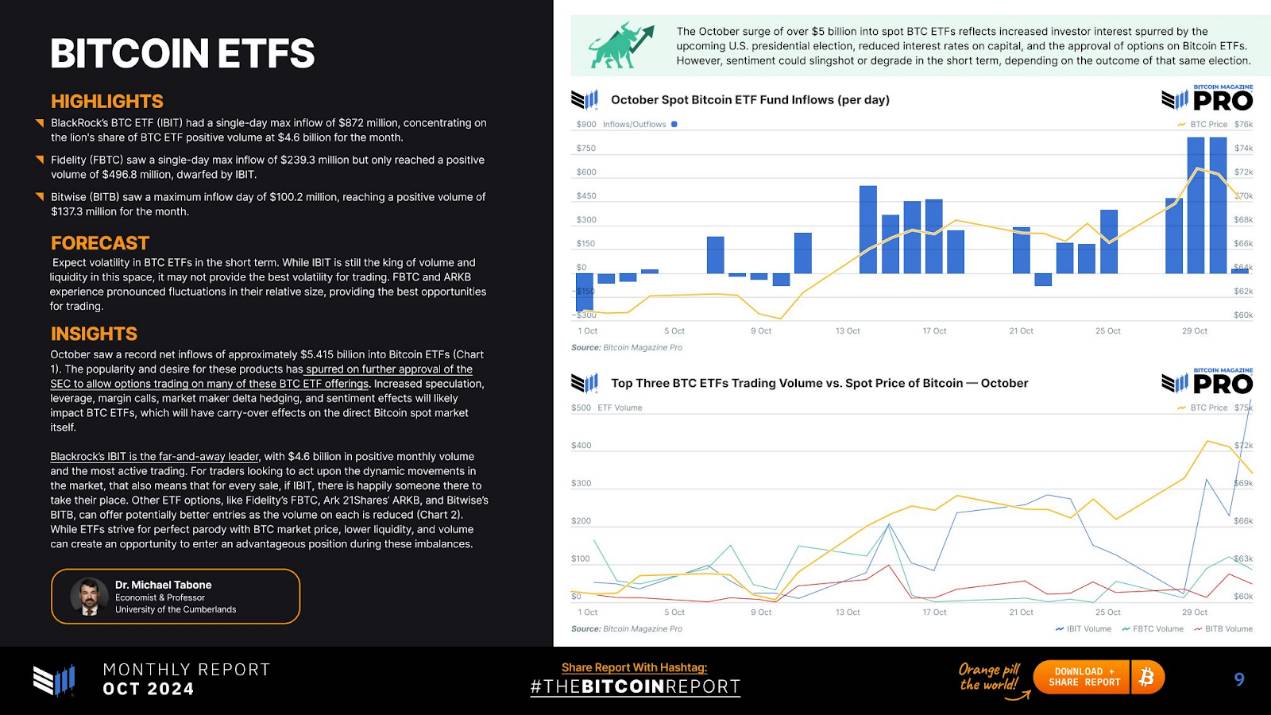

BlackRock’s BTC ETF (IBIT) recorded a single-day inflow high of $872 million, with a monthly net volume of $4.6 billion.

-

Fidelity saw a peak single-day inflow of $239 million, but only $496.8 million in net volume for the month—far behind IBIT.

-

Bitwise (BITB) achieved a single-day inflow high of $100.2 million, reaching $137.3 million in monthly net volume.

Outlook

Short-term volatility in BTC ETFs is expected. While IBIT remains the leader in trading volume and liquidity, it may not offer optimal trading volatility. FBTC and ARKB show noticeable fluctuations in relative size, creating favorable opportunities for traders.

Insight

In October, net inflows into Bitcoin ETFs reached a record $5.415 billion (Figure 1). The growing popularity and demand for these products prompted the U.S. SEC to further approve options trading on multiple BTC ETFs. Increased speculation, leverage, margin calls, market maker delta hedging, and sentiment effects could impact BTC ETFs, with ripple effects extending into the direct Bitcoin spot market.

BlackRock’s IBIT led by far, with $4.6 billion in monthly trading volume, making it the most active ETF. For traders acting on market movements, this means there is always counterparty liquidity available for IBIT trades. Other ETFs such as Fidelity’s FBTC, Ark 21Shares’ ARKB, and Bitwise’s BITB may offer better entry points due to lower trading volumes (Figure 2). Although ETFs aim to perfectly track BTC prices, periods of lower liquidity and volume imbalances can create opportunities to enter positions advantageously.

Equities

Highlights

-

MicroStrategy (MSTR) announced a three-year, $42 billion Bitcoin investment plan to add more BTC to its balance sheet.

-

Despite Bitcoin’s year-to-date (YTD) gain of 63.9%, six of the top ten Bitcoin-related stocks delivered negative returns.

-

Metaplanet INC (TYO: 3350) surged 838.82% YTD, primarily due to its announcement of adopting a Bitcoin balance sheet strategy.

Outlook

Driven by positive sentiment around Bitcoin at the start of Q4, Bitcoin-related equities may rise in the coming months. Stocks like Semler Scientific (SMLR), which are quietly adding Bitcoin to their balance sheets, could present opportunities and provide positive upward momentum for their valuations.

Insight

Intuitively, one might expect Bitcoin-related stocks to follow BTC’s bullish trend, yet most have not benefited from Bitcoin’s YTD increase of 63.9% (Figure 1). Marathon Digital (MARA), Riot Platforms (RIOT), and CleanSpark (CLSK) are down -31.42%, -38.98%, and -6.39% YTD respectively, reflecting operational challenges or sensitivity to crypto mining costs. Tesla (TSLA) rose only 0.2% since the beginning of 2024, while Block Inc. (SQ) declined by 6.72%. Although Coinbase (COIN) and Galaxy Digital Holdings (GLXY or BRPHF) performed positively, they still underperformed against spot Bitcoin price movements.

In contrast, MicroStrategy (MSTR) soared 263.68%, reflecting the impact of leveraged Bitcoin holdings and investor confidence in its Bitcoin-focused strategy. MicroStrategy Executive Chairman Michael Saylor announced a three-year, $42 billion Bitcoin investment plan, reinforcing the company’s buy-and-hold approach (Figure 2). In Japan, Metaplanet Inc. (TYO: 3350) has risen 838.82% YTD since announcing its Bitcoin reserve strategy earlier this year. As Bitcoin stands on the brink of the next bull cycle, more companies may consider adopting Bitcoin holding strategies.

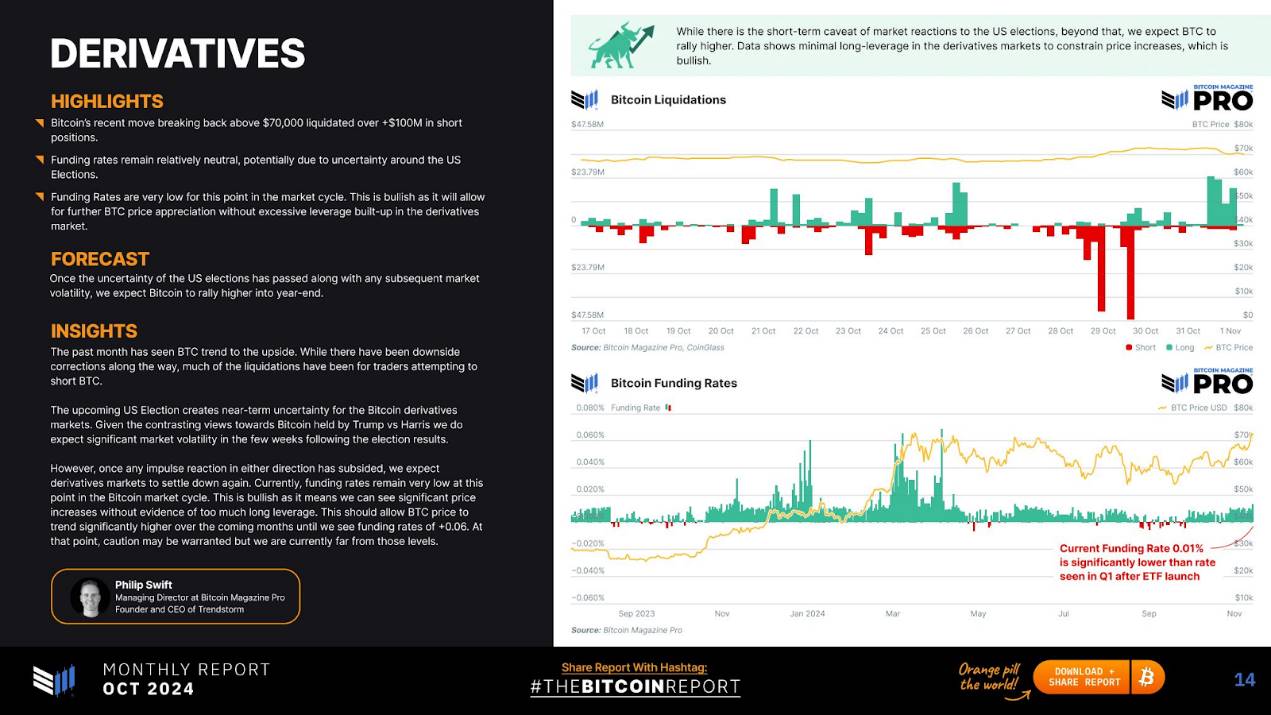

Derivatives

Highlights

-

Bitcoin recently broke above $70,000, triggering over $100 million in short liquidations.

-

Funding rates remain relatively neutral, likely due to uncertainty surrounding the U.S. election.

-

Funding rates are very low at this stage of the market cycle—an encouraging sign, as it allows BTC prices to rise further without excessive leverage building up in the derivatives market.

Outlook

Once uncertainty from the U.S. election and subsequent market volatility subsides, Bitcoin is expected to rally before year-end.

Insight

BTC has been on an upward trajectory over the past month. Although there were pullbacks along the way, most liquidations occurred among traders attempting to short BTC.

The U.S. election has introduced short-term uncertainty into the Bitcoin derivatives market, with sharp volatility expected in the coming weeks.

However, once initial directional reactions fade, the derivatives market is expected to stabilize again. Currently, funding rates remain very low at this point in the Bitcoin market cycle—a bullish signal that could allow BTC prices to climb significantly over the coming months until funding rates reach +0.06%. At that point, caution may be warranted, but we are still far from those levels.

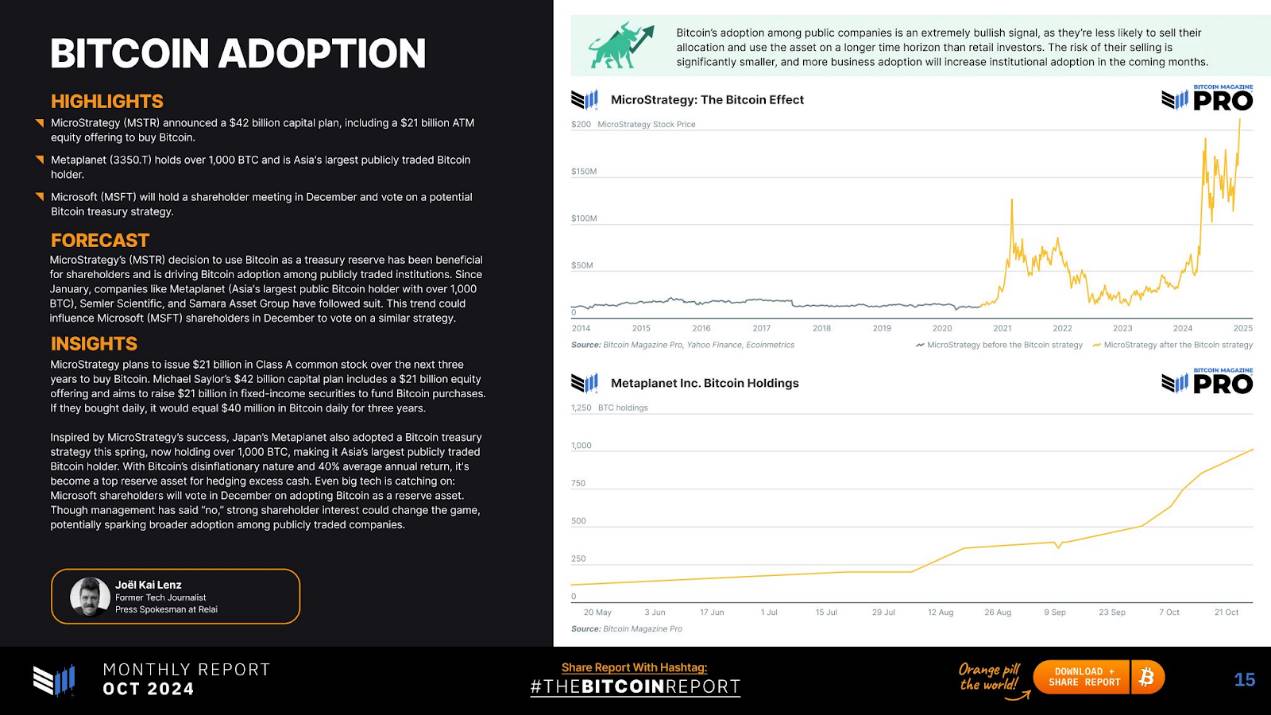

Adoption

Highlights

-

MicroStrategy (MSTR) announced a $42 billion capital plan, including $21 billion in ATM stock offerings to purchase Bitcoin.

-

Metaplanet (3350.T) holds over 1,000 BTC, making it Asia’s largest publicly traded Bitcoin holder.

-

Microsoft (MSFT) will hold a shareholder meeting in December to vote on a potential Bitcoin financial strategy.

Outlook

MicroStrategy’s decision to use Bitcoin as a treasury reserve asset has proven beneficial to shareholders and has accelerated institutional adoption of Bitcoin. Since January, companies such as Metaplanet (Asia’s largest public Bitcoin holder with over 1,000 BTC), Semler Scientific, and Samara Asset Group have followed suit. This trend may influence Microsoft (MSFT) shareholders’ upcoming vote in December on a similar strategy.

Insight

MicroStrategy plans to issue $21 billion in Class A common stock over the next three years to buy Bitcoin. Michael Saylor’s $42 billion capital plan includes $21 billion in equity issuance and aims to raise $21 billion in fixed-income securities to fund Bitcoin purchases.

Inspired by MicroStrategy’s success, Japan’s Metaplanet adopted a Bitcoin reserve strategy this spring and now holds over 1,000 BTC, becoming Asia’s largest publicly traded Bitcoin holder. Due to Bitcoin’s deflationary nature and average annual return of around 40%, it has become the preferred reserve asset for hedging excess cash. Even large tech firms are taking notice: Microsoft shareholders will vote in December on whether to adopt Bitcoin as a reserve asset. Although management has expressed opposition, strong shareholder interest could sway the outcome—potentially sparking broader adoption across public companies.

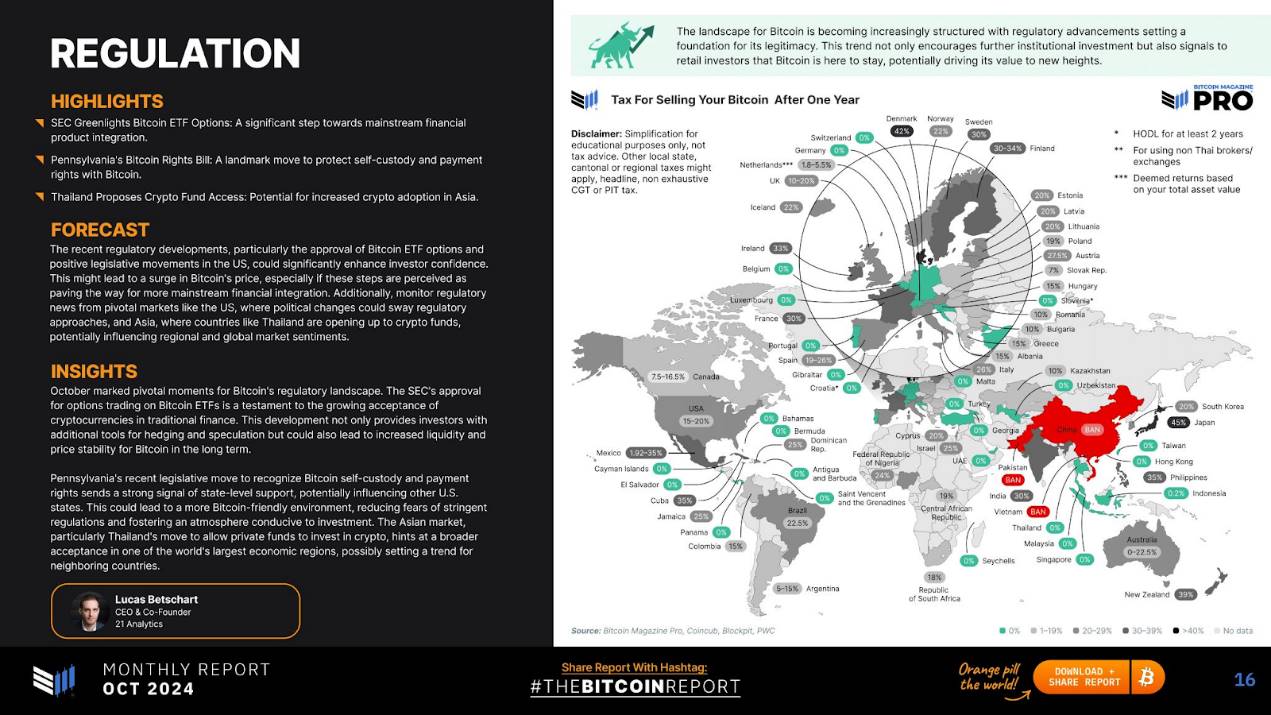

Regulation

Highlights

-

SEC approval of Bitcoin ETF options: a major step toward integration into mainstream finance.

-

Pennsylvania’s Bitcoin Bill of Rights: a milestone protecting rights to self-custody and pay with Bitcoin.

-

Thailand proposes crypto fund access: could boost crypto adoption across Asia.

Outlook

Recent regulatory developments—especially the approval of Bitcoin ETF options and positive legislative momentum in the U.S.—could significantly boost investor confidence. This may lead to a surge in Bitcoin prices, particularly if these moves are seen as paving the way for deeper integration into traditional finance. Additionally, regulatory shifts in key markets like the U.S. should be monitored closely, as political changes could affect regulatory approaches. Meanwhile, countries like Thailand opening up to crypto funds may influence regional and global market sentiment.

Insight

October marked a pivotal moment in Bitcoin’s regulatory landscape. The SEC’s approval of options trading on Bitcoin ETFs underscores growing acceptance of cryptocurrencies within traditional finance. This development not only provides investors with additional hedging and speculative tools but could also enhance Bitcoin’s liquidity and long-term price stability.

Pennsylvania’s recent legislation recognizing the right to self-custody and transact in Bitcoin could set a precedent for other U.S. states. This may foster a more Bitcoin-friendly environment, reduce fears of stringent regulation, and create a more favorable climate for investment. In Asia, Thailand’s move to allow private funds to invest in crypto signals broader acceptance in one of the world’s largest economic regions, potentially influencing neighboring countries’ policies.

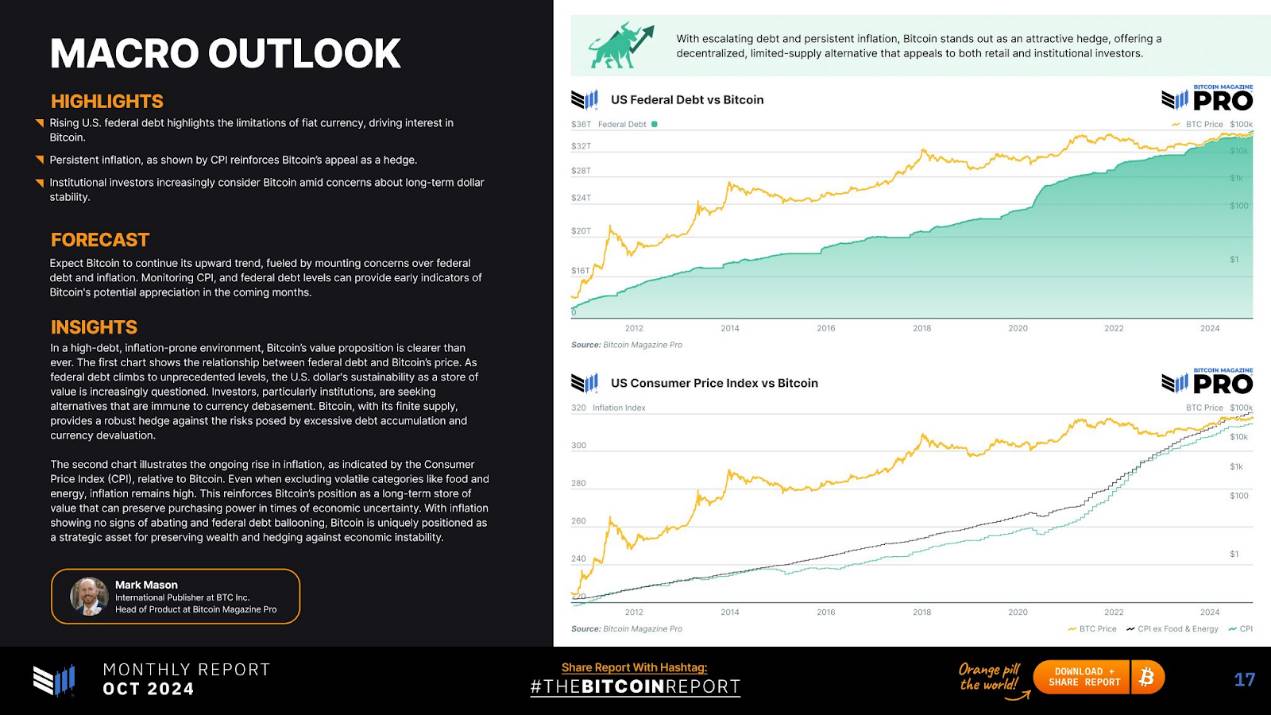

Macro Outlook

Highlights

-

Rising U.S. federal debt highlights the limitations of fiat currency, fueling interest in Bitcoin.

-

Persistent inflation, as reflected in CPI data, enhances Bitcoin’s appeal as a hedge. Amid concerns over the long-term stability of the U.S. dollar, institutional investors are increasingly considering Bitcoin.

Outlook

Bitcoin is expected to continue its upward trajectory, driven by growing concerns over federal debt and inflation. Monitoring CPI and federal debt levels could provide early signals for Bitcoin’s potential appreciation in the coming months.

Insight

In today’s high-debt, inflation-prone environment, Bitcoin’s value proposition has never been clearer. The first chart below illustrates the relationship between federal debt and Bitcoin’s price. As federal debt climbs to unprecedented levels, the sustainability of the U.S. dollar as a store of value is increasingly questioned. Investors, especially institutions, are seeking alternatives immune to monetary devaluation. Bitcoin’s fixed supply makes it an effective hedge against excessive debt accumulation and currency depreciation.

The second chart shows persistent inflation measured by the Consumer Price Index (CPI), even when excluding volatile categories like food and energy. This reinforces Bitcoin’s role as a long-term store of value capable of preserving purchasing power during times of economic uncertainty. With no signs of inflation easing and federal debt continuing to balloon, Bitcoin occupies a unique position as a strategic asset for wealth preservation and protection against economic instability.

Price Forecast

Highlights

-

Price action is poised to close at all-time highs on daily, weekly, and monthly charts—an extremely bullish signal across all timeframes.

-

Tone Vays' MRL indicator has only closed two consecutive green bars seven times in Bitcoin’s history. All prior six instances were followed by price gains exceeding 100% over the next 12 months.

-

Cup-and-handle patterns and Fibonacci extensions provide additional bullish targets in the $100,000–$105,000 range.

Outlook

The biggest current concern is “herd mentality”—everyone expects prices to surpass $100,000. Personally, I do not see any red flags in TA charts, on-chain data, four-year halving cycle analysis, mining trends, or regulatory setbacks. Many are buying Bitcoin anticipating greater regulatory clarity under a potential Trump administration.

Insight

Bitcoin appears well-positioned for a potential bull run, with technical indicators pointing to three key price targets. Tone Vays’ MRL indicator on the two-month chart suggests at least a 100% gain over the past six months, implying a peak of approximately $140,000 or higher by Q2 2025. This pattern aligns with major rallies seen in 2017 and 2021.

Additionally, cup-and-handle formations on the weekly and monthly charts point to a target of $105,000, typically achieved within 4–6 months based on historical trends. Finally, Fibonacci extensions indicate an initial target of $102,000, with potential to reach higher levels of $155,000 and $210,000 if previous cycles repeat.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News