Interpreting Binance Meme Coin Report: Insights into the Global Market Environment and Understanding the Rise of Memes

TechFlow Selected TechFlow Selected

Interpreting Binance Meme Coin Report: Insights into the Global Market Environment and Understanding the Rise of Memes

Win the users, win the world.

Author: TechFlow

Even a powerhouse like Binance cannot ignore the rise of meme coins.

What fuels a meme phenomenon, and how has this supercycle been formed?

Recently, Binance Research released a report titled "Understanding the Rise of Meme Coins", offering a comprehensive analysis of the meme coin surge, its underlying macroeconomic drivers, value propositions, and potential impact on the cryptocurrency industry.

TechFlow has curated and interpreted the report to help you quickly grasp its key insights.

Key Takeaways

-

Macro Context: Global Money Supply Expansion and Investment Behavior

In the context of rapid global money supply expansion, high-risk investments have become more attractive. This trend can be broken down into several layers:

The majority of capital flows into traditional assets such as the S&P 500 index and real estate. A portion flows into major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

At the far end of the risk spectrum, meme coins have emerged as high-risk, high-return investment vehicles, attracting surplus capital.

-

Micro Environment: Retail Investors Seeking New Paths to Wealth Creation

Many retail investors are exploring new avenues for wealth creation, reflecting a shift in their perception of traditional finance.

Meme coins attempt to embody these principles by reducing internal advantages and increasing equal access for global investors.

-

Trend: The Financialization of Internet Culture

Since the early days of the internet, memes have demonstrated viral spread and community-driven appeal. This phenomenon is now extending into the financial realm through cryptography, enabling the financialization of memes.

-

Insight: Taking the Best Elements Forward

Key features such as fair launches and low circulating supply tokenomics have been successfully demonstrated by prominent meme coins—elements worth considering for any future token project.

Meme Coin Macro Data

Meme coins reflect another side of the industry—one focused more on financial gain than technological advancement.

-

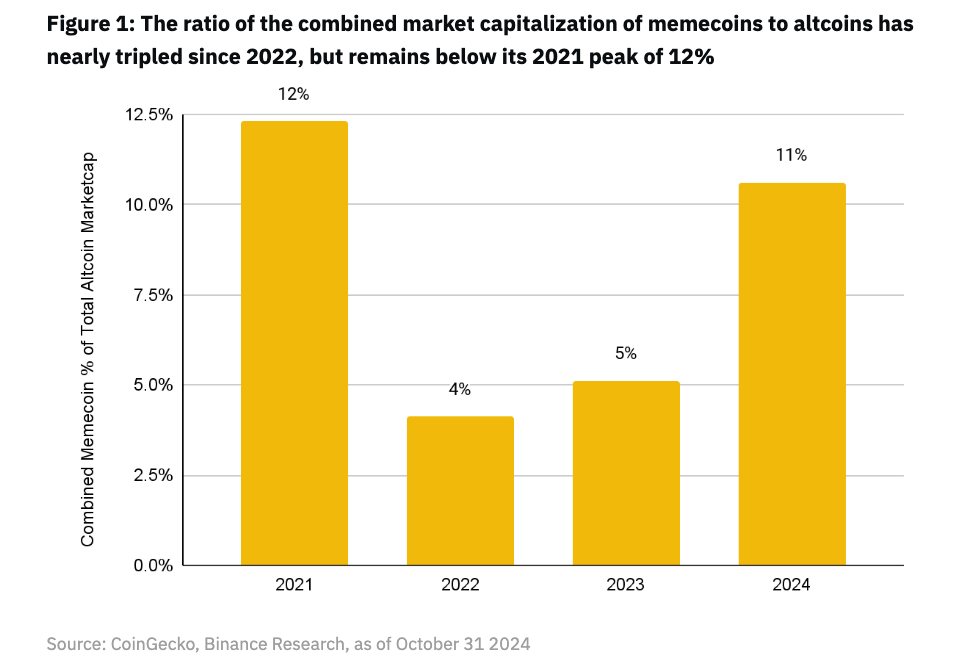

Since 2022, the total market cap share of meme coins (excluding BTC, ETH, and stablecoins) has increased from 4% to 11% in 2024.

-

This ratio remains below the peak seen in 2021, when $DOGE and $SHIB reached market caps of $80 billion and $39 billion respectively.

-

From 2022 to 2024, the market cap share of meme coins nearly tripled.

Global Economic Context Behind Meme Coins: Excessive Liquidity and Financial Nihilism Among Youth

Fiat Printing: Rising Global Money Supply

-

During the 2020 pandemic crisis, central banks worldwide expanded fiat money supply at an unprecedented pace.

-

Figure 2 shows: From 2020 to 2022, global money supply rose from $81 trillion to $102 trillion—an increase of over 25%.

Inflation and Rising Prices

-

U.S. inflation hit 7% in 2021 and 6.5% in 2022.

-

In response to currency devaluation, rational actors allocate funds toward assets perceived as having long-term value.

-

Wage growth fails to keep up with rising home prices. Figure 4 shows: The number of average annual salaries needed to buy a house increased from 4.4 years in 1963 to 8.1 years in 2021—nearly doubling.

Youth Sentiment: Financial Nihilism

-

Macroeconomic conditions place pressure on younger generations. Young people are losing faith in the traditional financial system, particularly evident in the crypto market.

-

94% of cryptocurrency buyers are Millennials and Gen Z, aged between 18 and 40.

-

Key event: The 2021 GameStop short squeeze reflected young investors’ skepticism toward traditional financial structures.

Value Proposition of Meme Coins: No Utility, But Strong Appeal

Defining Meme Coin Nihilism: Based on internet culture, memes, or popular trends; typically lacking clear utility or intrinsic value.

-

Since 2020, the number of meme coins has surged. 75% of all meme coins were created within the past year.

Alternative Appeal: Representing a newer, fairer, and more accessible path to wealth creation.

-

No pre-mine, team allocations, or VC allocations.

-

All tokens are equally available to all participants upon launch.

-

Often feature simple, easy-to-understand narratives, making them more accessible and easier for ordinary investors to engage with.

-

Largely driven by investor sentiment and herd psychology.

Risk Considerations

Nine Out of Ten Fail, Manipulation Remains Rampant

-

97% of meme coins have failed. Only a small number of meme coin projects survive long-term and maintain relevance.

-

Scams and rug pulls are widespread—you might just be the one providing "exit liquidity."

-

Low liquidity can lead to extreme price volatility and difficulty exiting positions.

Market Saturation and Innovation Stagnation

-

New projects may struggle to gain attention or funding, or may only attract fleeting interest.

-

The meme coin market may already be saturated. Its popularity could divert attention and resources away from genuinely innovative projects, potentially hindering long-term development and innovation across the cryptocurrency industry.

Outlook: Tokenized Software Businesses vs. Tokenized Ideas

Altcoins vs. Meme Coins

-

We can describe technology-driven altcoins as tokenized on-chain software businesses, while meme coins represent tokenized ideas and narratives.

-

In the long run, the most successful altcoins will need to create and sustain useful, well-differentiated software products with genuine product-market fit.

-

The most successful meme coins may instead need to create and sustain differentiated, unique narratives and ideas.

Winning Users Wins the Game

-

Meme coins demonstrate significant retail demand for fairly launched tokens that are openly accessible to all blockchain participants from day one.

-

While brand recognition and network access provided by established venture capital firms (via private token sales) may be appealing to new projects, the ultimate user base for any product will consist of retail participants.

-

Providing retail investors with the opportunity to invest early and grow alongside the team is crucial for building a strong, loyal community around any crypto asset.

Global Price Discovery Mechanisms

-

The rise of meme coins shows that tokens issued in this manner can reach million- or even billion-dollar valuations through organic price discovery, powered by the borderless, permissionless nature of decentralized markets.

-

The emergence of meme coins is an exciting new trend that strongly demonstrates blockchain technology’s ability to unite individuals globally and organically build communities around tokenized assets—a capability that appears stronger than ever before.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News