From DOGE to WIF: Analyzing the Tiered Evolution and Capital Rotation of Memes

TechFlow Selected TechFlow Selected

From DOGE to WIF: Analyzing the Tiered Evolution and Capital Rotation of Memes

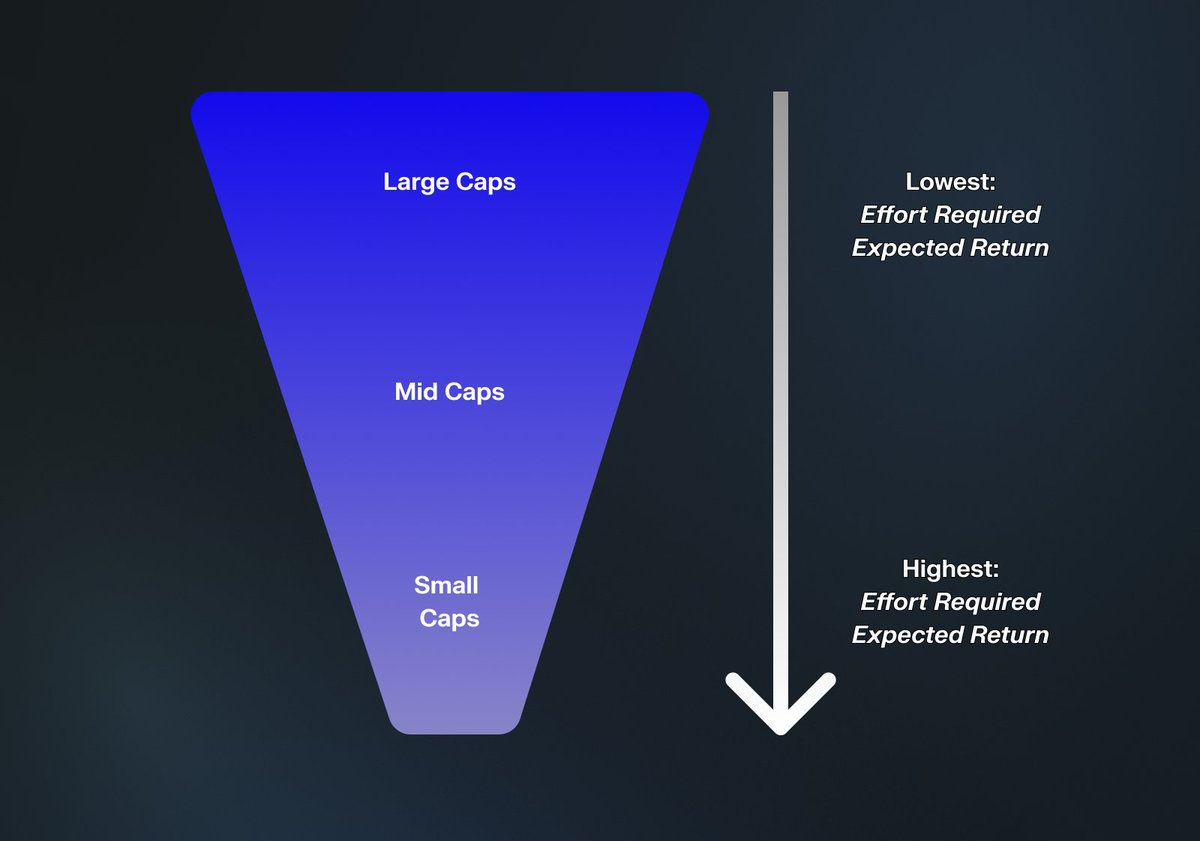

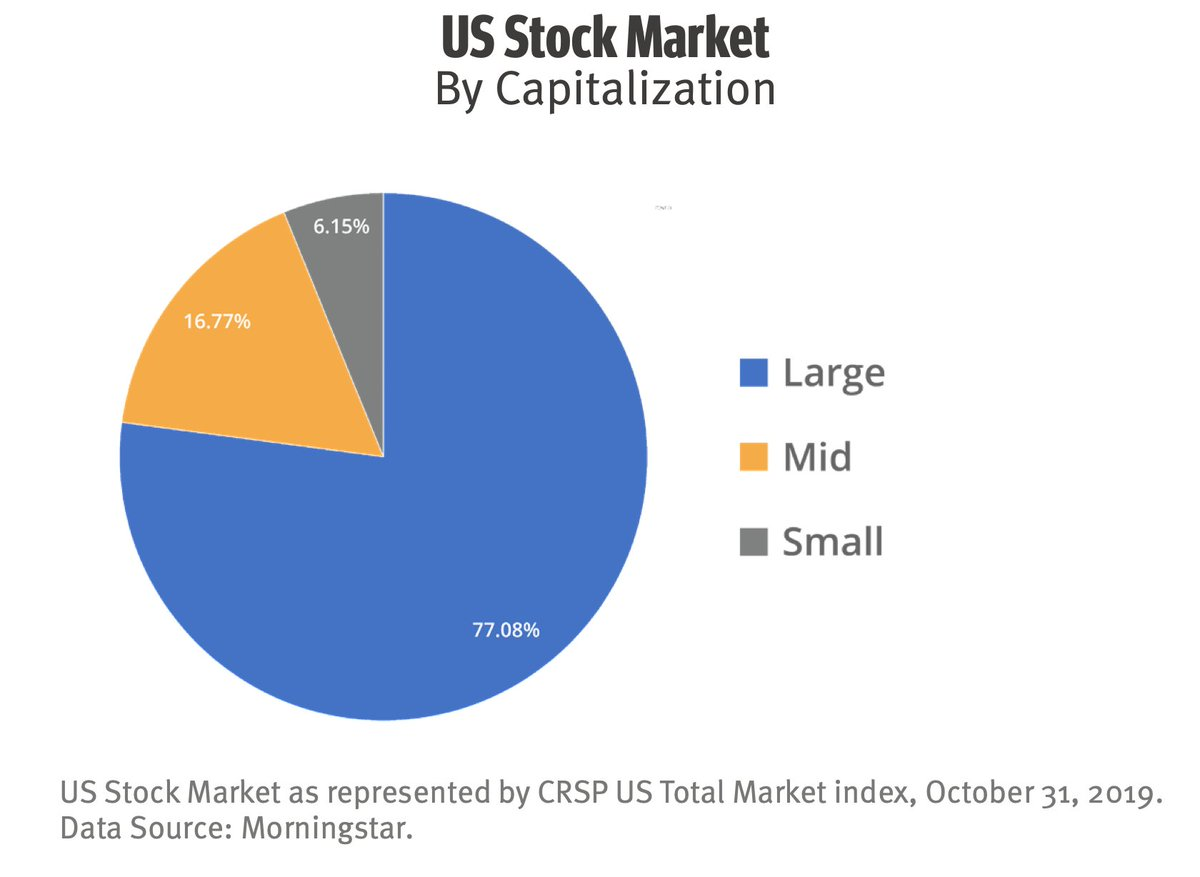

Capital will naturally become disproportionately concentrated in high-market-cap assets because most investors are lazy and prefer seeking confirmation bias.

Author: MONK

Translation: TechFlow

-

$DOGE -> Rotation into Mid-Cap Meme Coins

In my view, the performance of meme coins is inseparable from DOGE. With the election approaching, $DOGE is regaining attention, and I find it interesting to analyze how value is being distributed across the meme coin category. Here are my thoughts. Discussion below:

-

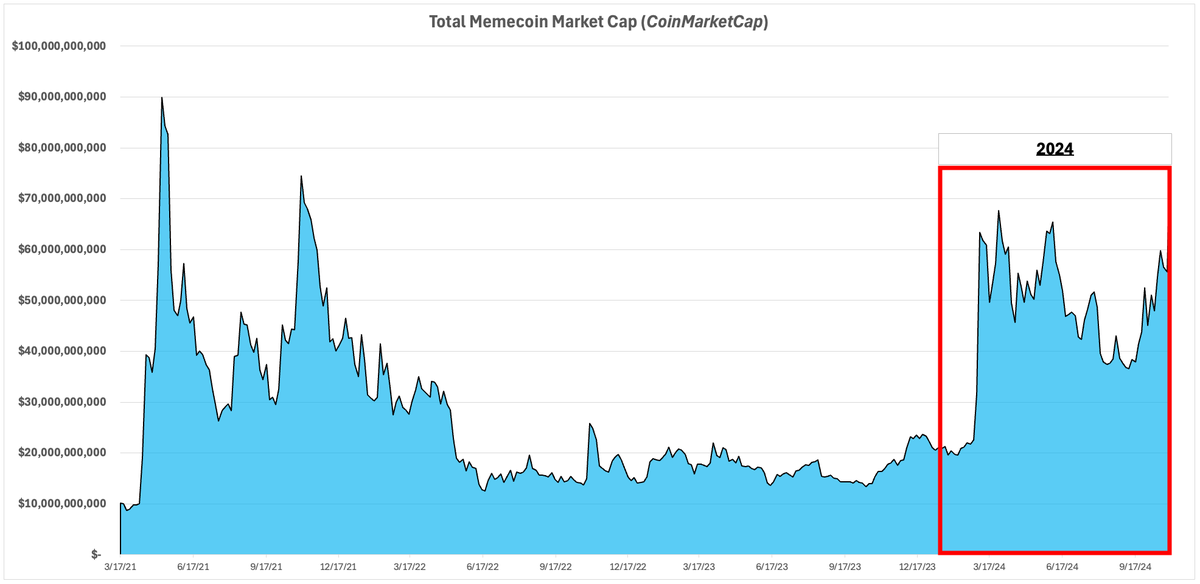

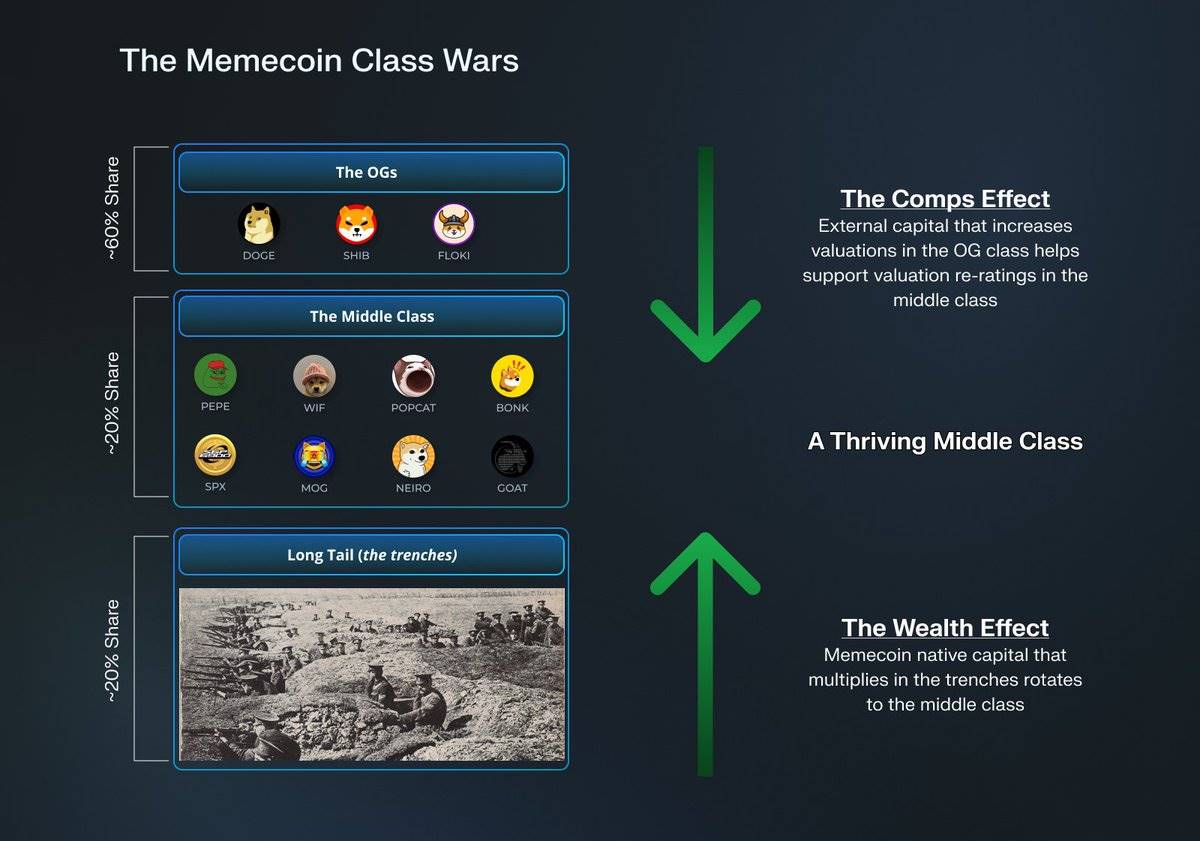

I believe it's becoming increasingly difficult to drive market share within the meme coin sector without significant rallies in $DOGE or $SHIB. In 2024, the overall market cap of meme coins has risen sharply, nearing the all-time high (ATH) levels seen in 2021:

-

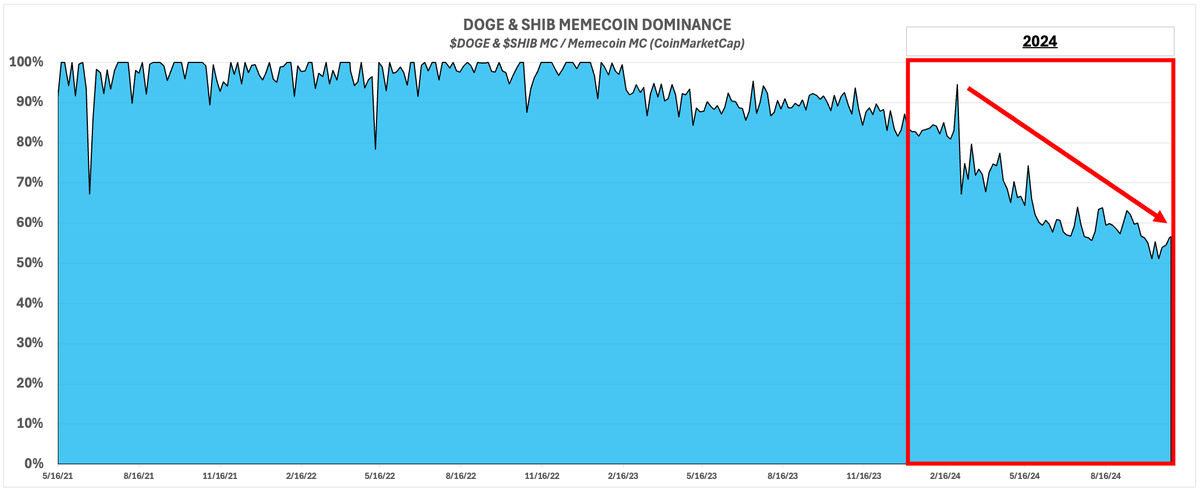

Most of this year’s value growth has come from explosive gains in non-$DOGE / $SHIB meme coins. DOGE and SHIB’s market dominance has now dropped to around 57%:

-

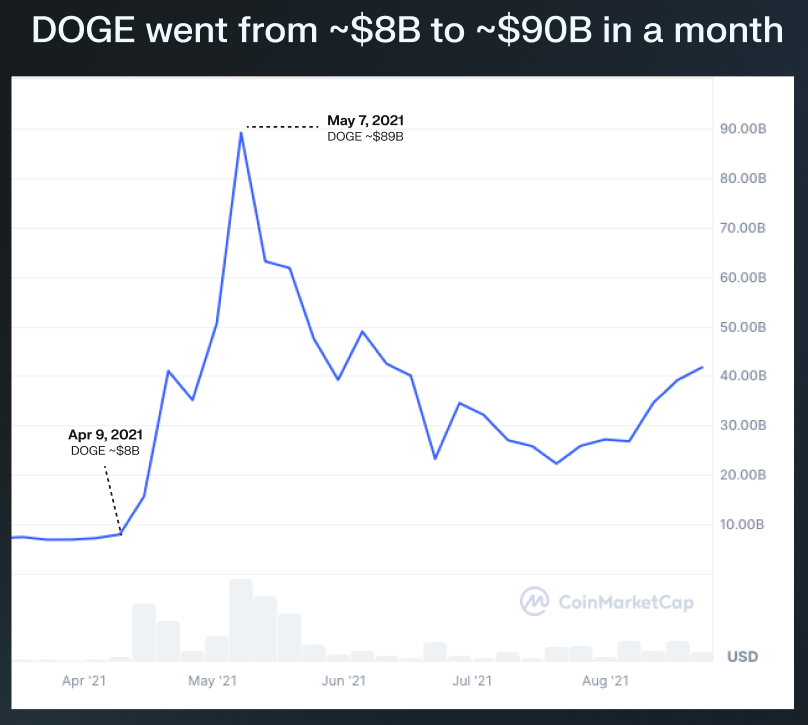

Nonetheless, meme coins’ share of the broader cryptocurrency market remains below the level reached in 2021 when $DOGE hit its ATH. DOGE's influence cannot be ignored—this week alone, the asset gained $7 billion in market cap, roughly equivalent to a full $PEPE + $WIF.

-

I find $DOGE’s outlook intriguing, even absent new retail interest. I expect $DOGE / $SHIB dominance to gradually recover. Right now, during this meme coin rebound, there's a large amount of capital standing on the sidelines...

-

...these are intermediate investors who remain skeptical about the legitimacy, sustainability, and impact of this category. Or perhaps they simply don’t want to engage in low-liquidity, high-turnover trades. As a result, many have missed out on opportunities in $WIF, $PEPE, and $BONK.

-

However, sentiment toward meme coins has shifted significantly. Interest in this category now far exceeds levels seen just months ago, with coverage around $GOAT serving as a prime example. Even self-proclaimed intermediate investors are beginning to change their stance:

-

I believe these participants may soon bid up a fresh rally in $DOGE. This is the trend I see driving both meme coins and crypto’s overall market share to new highs. Any news could act as a catalyst—whether it’s a new government agency, Elon Musk, Trump, or something else entirely.

-

Much of the capital will likely come from other areas of crypto. Retail participation could help too—I think $DOGE has higher public recognition than $SOL—but today’s liquidity environment is markedly different from 2021.

-

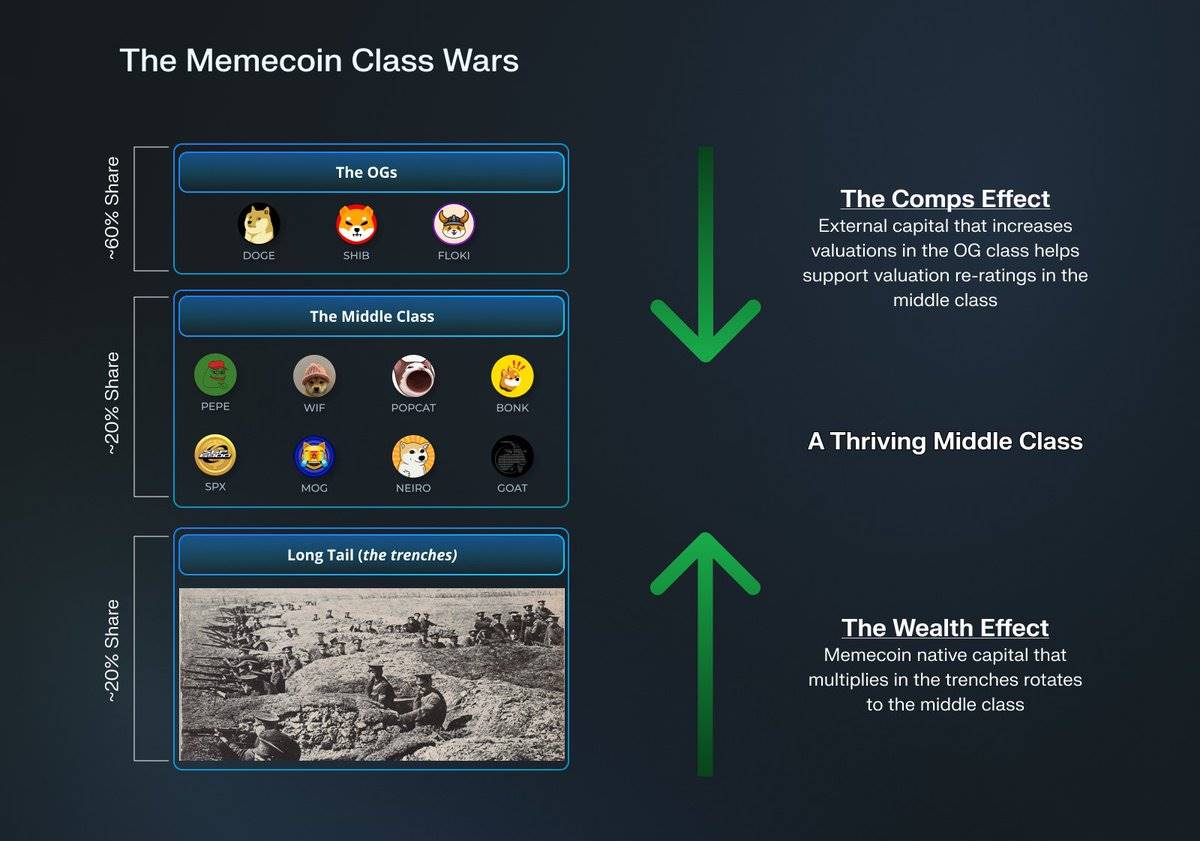

So what happens after a $DOGE rally? I believe any strong move in $DOGE / $SHIB would bring additional value to the emerging "meme coin middle class," unlocking potential for assets like $WIF, $PEPE, and $POPCAT.

-

The relative appeal for intermediate investors increases. When $DOGE reaches a $100 billion market cap, $WIF becomes more attractive than when $DOGE was at $30 billion. As the number of investable meme coins with over $1 billion market cap grows, the risk-reward profile of stablecoins starts looking less appealing in this post-$DOGE landscape.

-

As meme coins gain greater recognition as an asset class, the re-rating theory for the middle tier will attract new potential buyers. These assets ($PEPE, $WIF, etc.) offer better liquidity, lower volatility, and easier manageability compared to small-cap tokens.

-

They also have greater upside potential following a $DOGE rally, and I believe intermediate investors will eventually step in to push prices higher—a necessary development under current conditions. I don’t believe $PEPE can reach a $10 billion market cap in a stagnant $DOGE environment.

-

Therefore, treat $DOGE as the $BTC of meme coins: further rallies in $PEPE, $WIF, $POPCAT, etc., must precede a $DOGE breakout. I see no clear advantage for stablecoin investors, and due to persistently high entry barriers, small-cap coins remain in rotation mode.

-

I also see potential for some middle-tier coins to graduate into large-cap status ($PEPE has essentially already reached that level). Capital will naturally concentrate disproportionately in high-market-cap assets, as most investors are lazy and seek confirmation bias.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News