As Bitcoin Surpasses $70,000, Let's Discuss the Hidden Concerns of the Bitcoin Network

TechFlow Selected TechFlow Selected

As Bitcoin Surpasses $70,000, Let's Discuss the Hidden Concerns of the Bitcoin Network

BTC's "Cancer Cells": The Shift in Fee Structure and the Outflow of Value.

Author: Duo Nine

Translation: Azuma, Odaily Planet Daily

Editor's note: BTC price broke through the $70,000 mark again this morning, seemingly indicating positive momentum. However, Duo Nine, founder of YCC, has pointed out a hidden concern within the Bitcoin network. He argues that as Bitcoin transitions to a new fee structure, wrapped versions of BTC (xBTC) across various ecosystems and derivative investment products like ETFs are effectively siphoning value away from the Bitcoin network—what he describes as a "vampire attack" on Bitcoin.

Duo Nine acknowledges this issue may not appear severe at present, but it is showing signs of intensification. It could become a "cancer cell" growing alongside the Bitcoin network, one that must be addressed now before it escalates.

While Duo Nine’s stance on wrapped tokens from other ecosystems may lean toward extreme bitcoin maxis tendencies, the concerns he raises still hold meaningful implications worth considering.

Below is the original article by Duo Nine, translated by Odaily Planet Daily.

Bitcoin is in trouble.

If we don't make changes soon, things could go very wrong.

I'm not talking about halving events or block rewards—the problem runs much deeper.

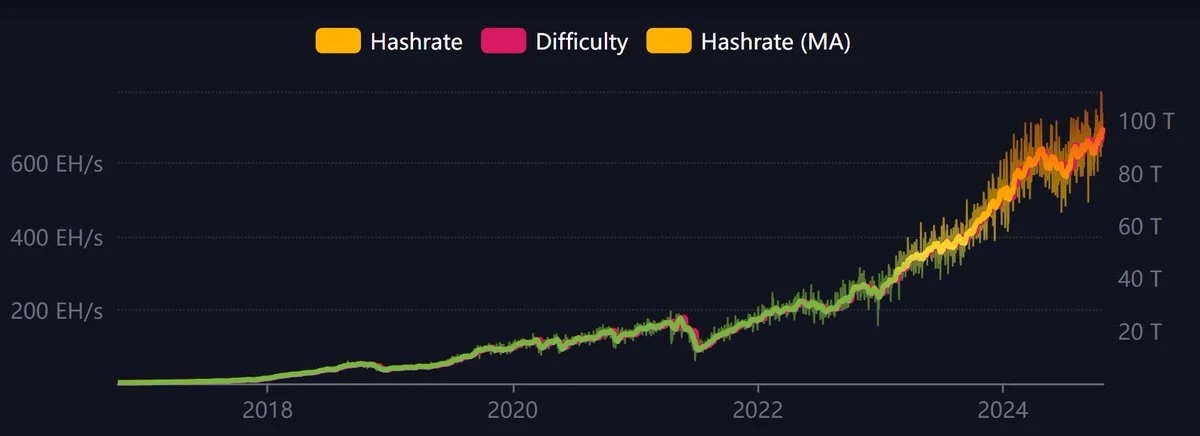

As the Bitcoin network evolves, transaction fees will gradually replace block rewards as the primary source of revenue for miners.

This transition will happen slowly over decades.

But a new problem is emerging—one difficult to predict, yet already showing early warning signs.

The issue lies in people no longer truly using Bitcoin.

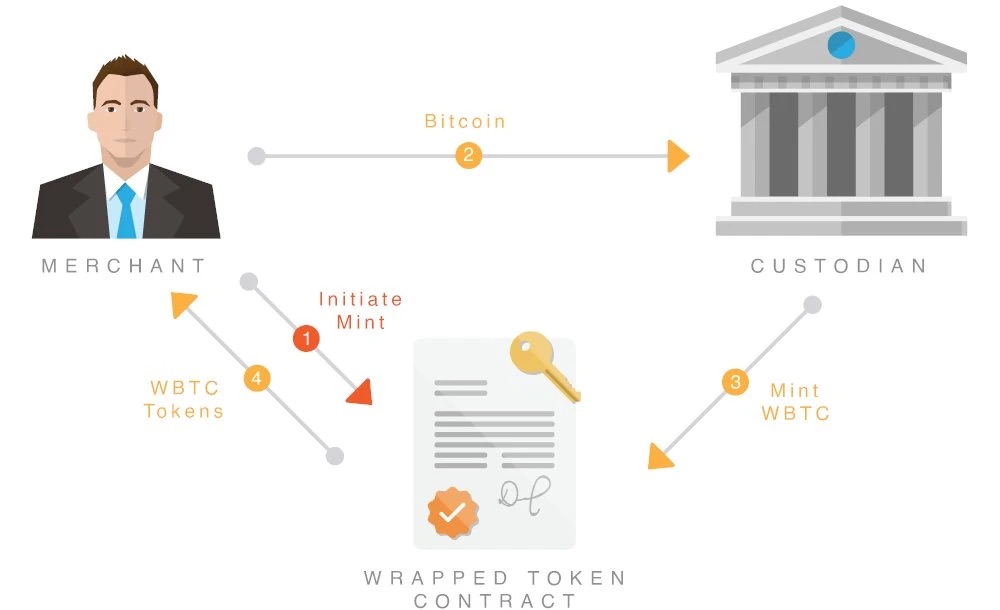

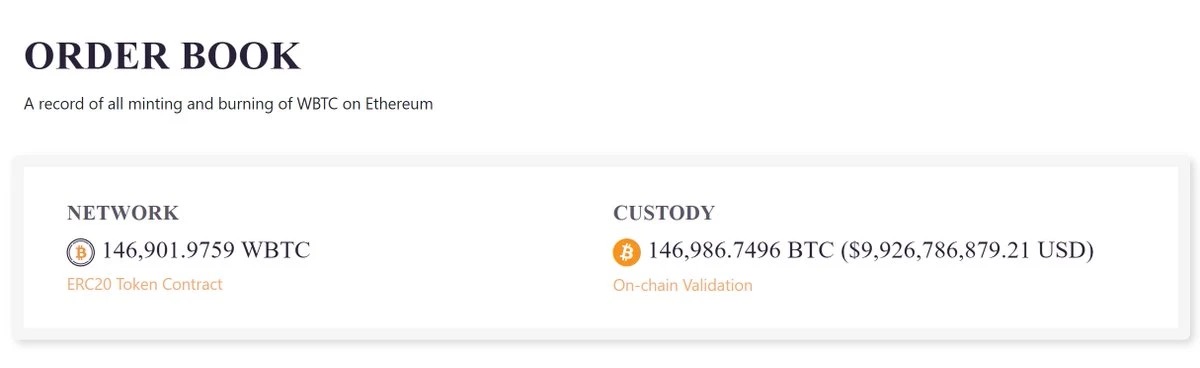

Every time BTC is wrapped into wBTC, cbBTC, tBTC, kBTC, or solvBTC, native BTC gets deposited into a wallet managed atop another network and then remains inactive.

When it stops moving, it generates no fees.

The value has been transferred to Ethereum or other networks. But this is just the tip of the iceberg.

With the growth of DeFi, more and more BTC will sit idle on its native chain, while their value flows out via wrapped tokens.

BitGo has wBTC, Coinbase has cbBTC, Kraken has kBTC, Threshold has tBTC… This trend clearly won’t stop anytime soon.

In ten years, there will only be more wrapped variants.

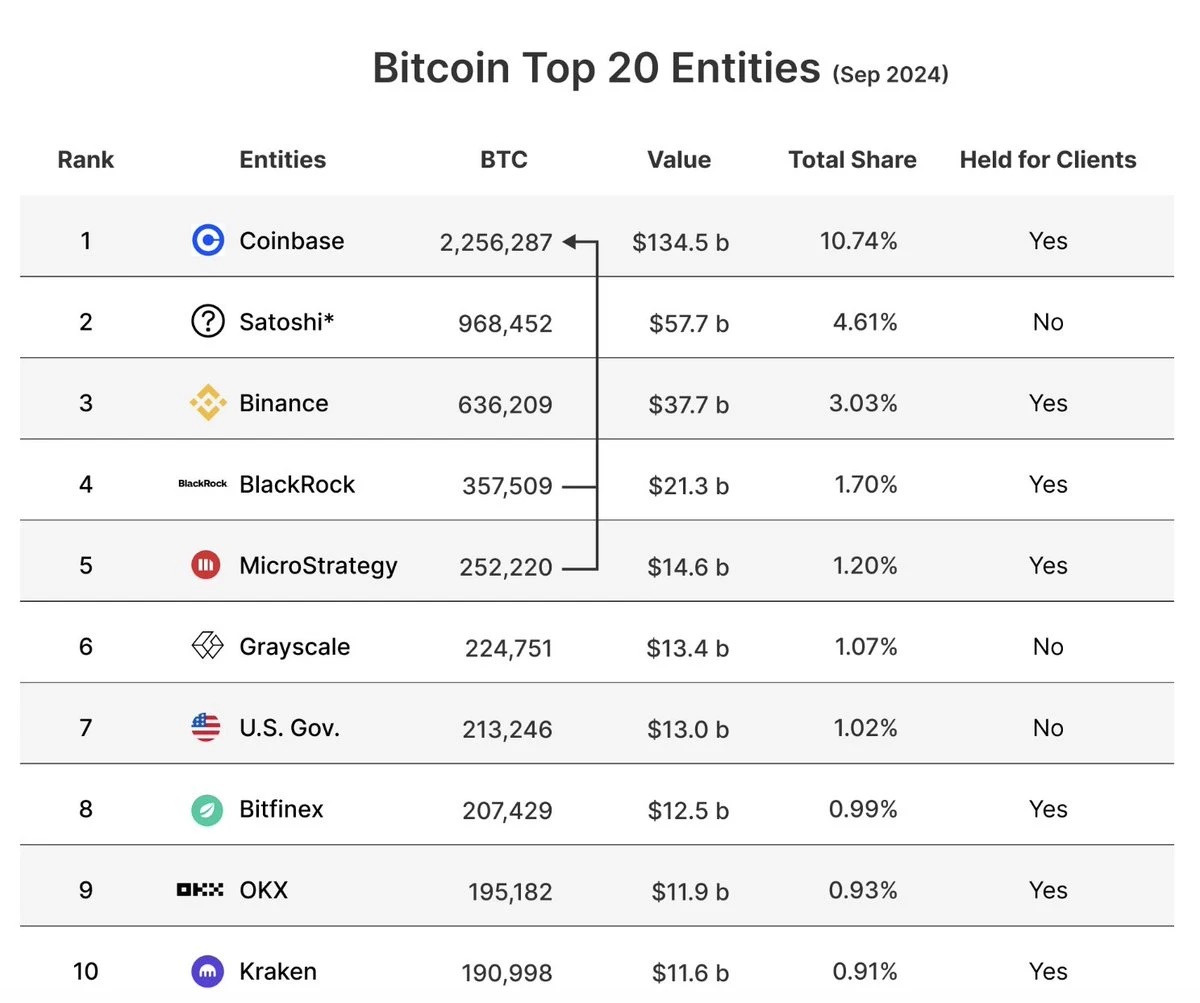

This year alone, 11 spot Bitcoin ETFs have been approved, collectively purchasing $20 billion worth of BTC so far.

Where is all this BTC? Sitting in custodial wallets—frozen, unused.

Investors actively trade Bitcoin investment products on Nasdaq, but they’re trading ETFs, not native BTC.

Much like wrapped tokens, the value of native BTC is being abstracted and moved elsewhere.

A critical question arises: if value keeps flowing out, who will pay for the security of the Bitcoin network?

Ethereum? Nasdaq? They certainly won’t.

Under normal assumptions, during the shift in fee structure, users would continue transacting on the native network, accumulating fees for miners.

But instead, Bitcoin is being “locked in vaults,” with its value migrating to other chains or being abstracted into ETFs and similar instruments.

In crypto, we call this kind of phenomenon a “vampire attack”!

A “vampire attack” occurs when liquidity and value—and often users—are drained from one chain or protocol and shifted to another.

Now, attackers on Bitcoin are stuffing these extracted values into their own pockets. Congratulations BlackRock, congratulations Coinbase—you're winning!

Custodians like Coinbase currently hold over 2 million BTC. A massive amount of BTC is locked up and gradually forgotten.

Worse, this trend risks placing Bitcoin under third-party control.

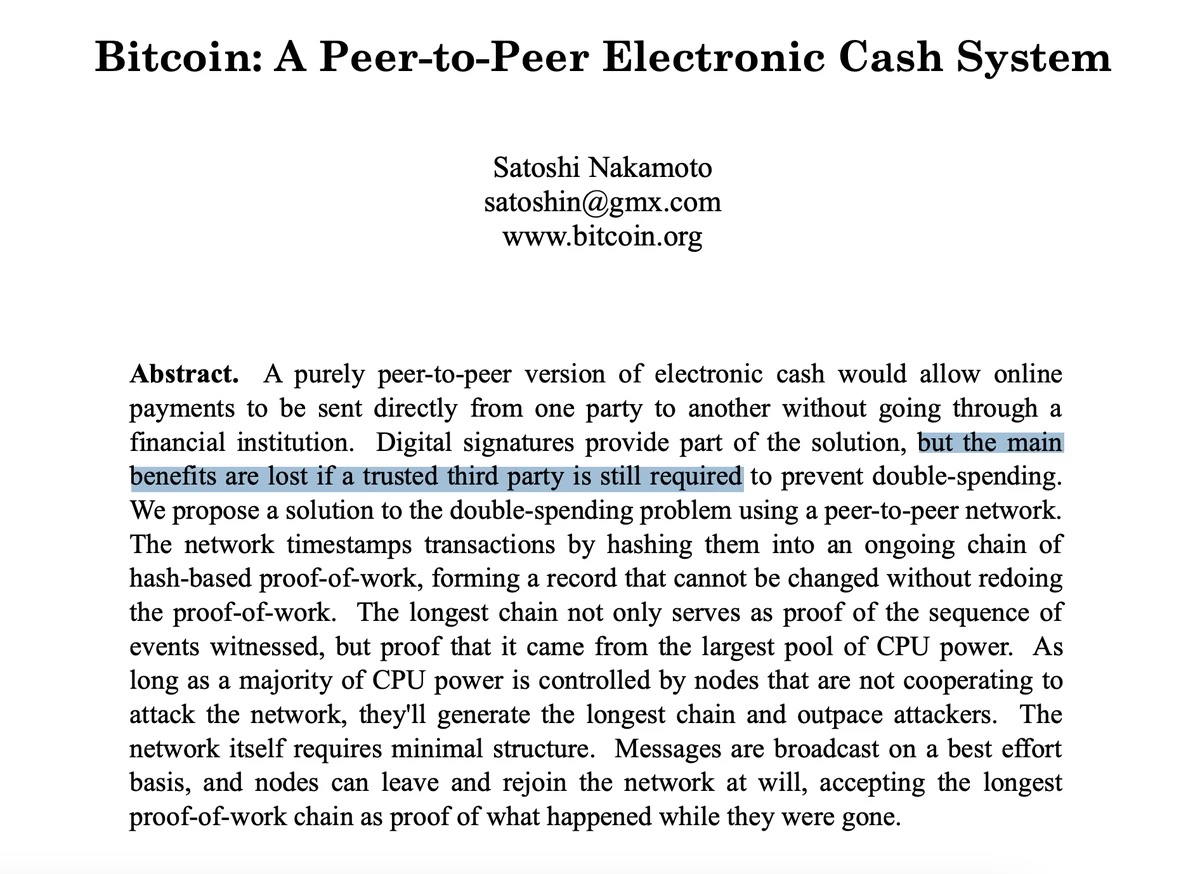

Satoshi warned us about this in the whitepaper: “Whenever there's a third party between you and your BTC, value is lost.”

BlackRock, Coinbase, wBTC, cbBTC—they only provide an IOU.

They keep the real BTC and give you a worthless piece of paper in return—if they decide to renege.

This poses a real danger—to you and to the entire Bitcoin network. Third parties might break their promises, or steal value from Bitcoin’s native chain, weakening the network’s security.

The good news? This isn’t an immediate crisis. For the next two decades, block rewards on the Bitcoin network will remain substantial.

At the same time, demand for Bitcoin will continue rising—especially from third parties eager to exploit it for their own gain.

So what should you do?

First, avoid letting third parties hold your Bitcoin. Relying on them contradicts the very purpose of Bitcoin—and your reason for owning it.

The best custodian is always yourself. Hold your Bitcoin natively on the Bitcoin network, not through third-party intermediaries.

Second, actually use the Bitcoin network. With the rise of ordinals and other emerging use cases, many are capturing and preserving value directly on Bitcoin’s native layer. In this model, Bitcoin’s value can never be abstracted away.

Keep using the Bitcoin network—it’s the greatest investment you can make in Bitcoin’s future. By using the native chain, you help secure the network; the fees you pay incentivize miners to protect it. If enough people transact, the transition to a fee-based economy can happen seamlessly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News