Why Texas Appeals to Crypto Companies: A Perspective on Taxation and Regulation

TechFlow Selected TechFlow Selected

Why Texas Appeals to Crypto Companies: A Perspective on Taxation and Regulation

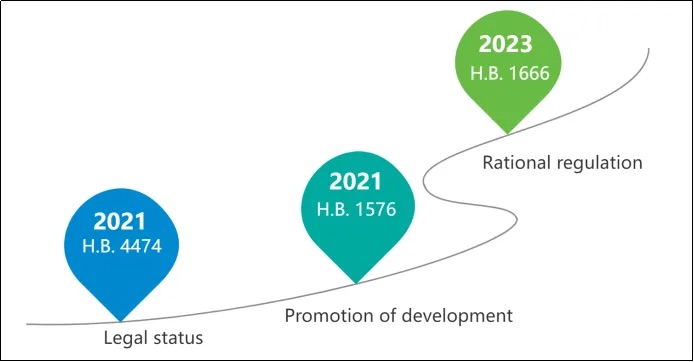

The status and regulation of crypto assets in Texas legislation have undergone phased changes, while new topics and perspectives continue to emerge.

Author: TaxDAO

1. Introduction to Texas

Texas, officially the State of Texas and commonly referred to as "the Lone Star State" due to its history as an independent republic, is the second-largest U.S. state by both land area and population. Covering approximately 690,000 square kilometers (second only to Alaska), it has a population of around 30 million people (second after California). Located in the south-central region of the United States, Texas boasts a diverse economy.

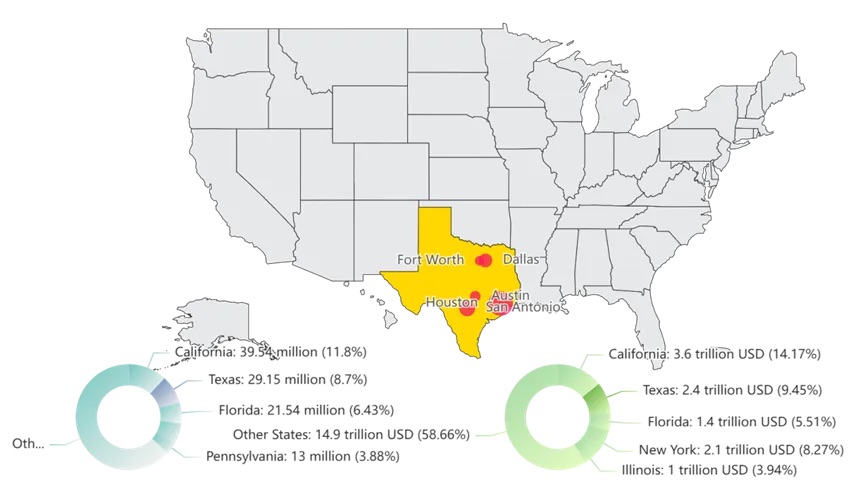

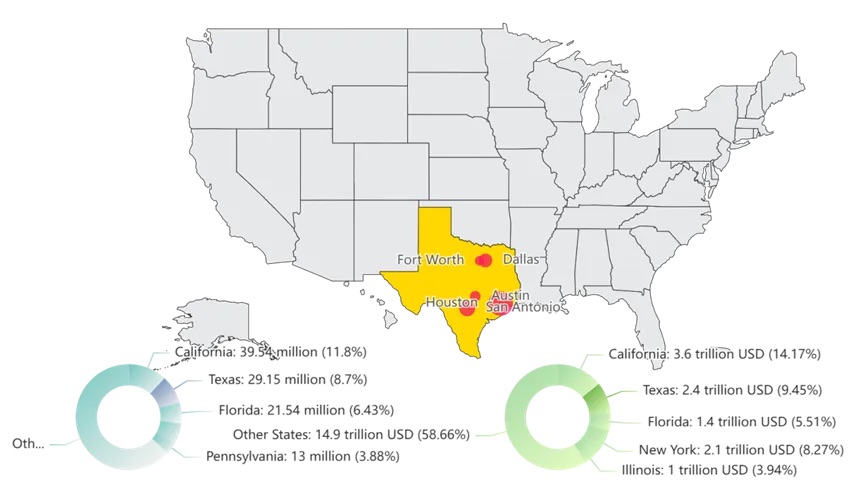

Self-created image. Data source: Wikipedia – U.S. GDP and Population

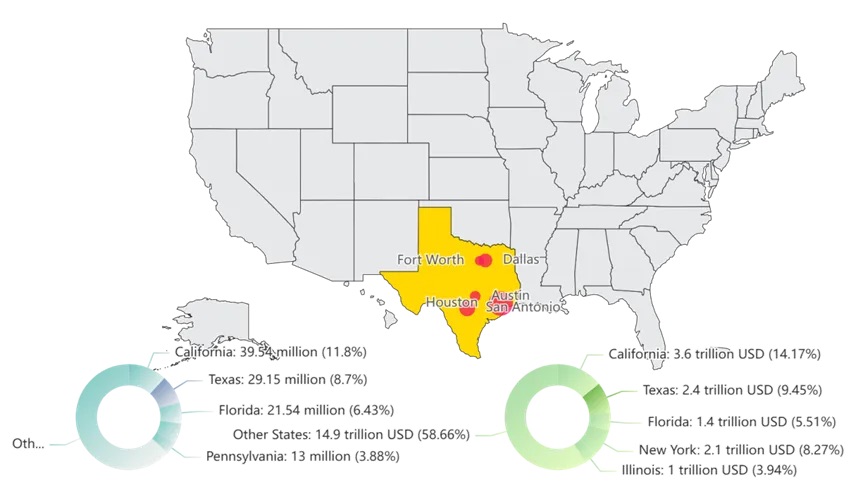

In 2022, Texas had an economic output of $2.4 trillion, accounting for 9.4% of the total U.S. GDP. Its key industries include energy, agriculture, high-tech manufacturing, and financial services. The state is rich in natural resources, with oil and natural gas being its primary minerals. Known oil reserves exceed 8 billion barrels, representing about one-third of the nation's known supply. Many major international oil companies are headquartered in Texas, including ExxonMobil and BP. Texas is also a leading hub for computer components, systems, and software development. Austin, Dallas, and Houston serve as central nodes for these sectors, with the Austin area often dubbed "Silicon Hills." With an average electricity price of about 10.50 cents per kilowatt-hour and generating 25.5% of the nation’s power capacity, Texas stands out as a haven for low-cost energy consumption.

Self-created image. Data source: EIA – Electricity Price and Share

2. Texas' Basic Tax System

When investors consider entering the U.S. market, they typically evaluate factors such as the business environment, market size, and operating costs. In January this year, Wall Street released a report on the best and worst states for startups in 2023, ranking all 50 states based on key entrepreneurial indicators like access to funding, affordability, and tax rates. According to the evaluation, Texas ranked third nationally for startup-friendliness due to its favorable employment climate, business-friendly regulations, and low state taxes.

The Texas government advocates for low taxation and minimal regulatory intervention. A study assessing small business friendliness across U.S. states found that Texas achieved an “A” grade in overall friendliness, talent benefits, government regulation, ease of starting businesses, labor recruitment, and taxation.

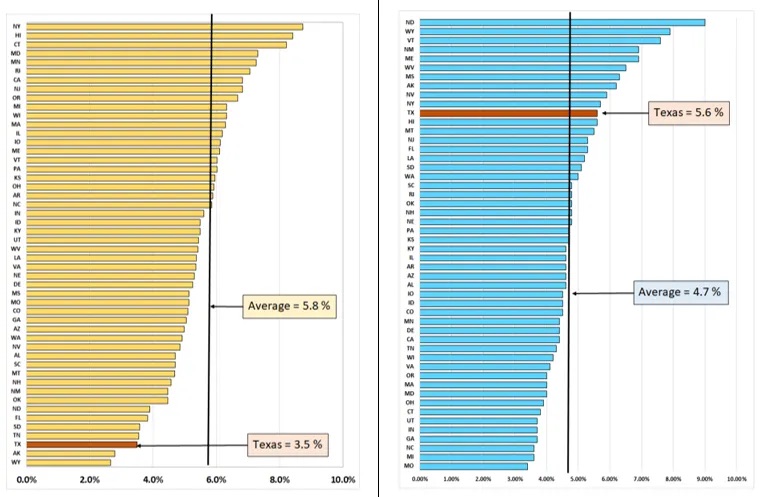

Texas is renowned for its low tax burden, but the reality is more nuanced. While the state does not impose a personal income tax (though federal income tax still applies to all residents), it compensates through other forms of taxation such as sales and property taxes. An Ernst & Young report from 2020 indicated that Texans pay state and local taxes amounting to 3.5% of their income—significantly below the national average of 5.8%. However, when measured against economic output, Texas’ effective business tax rate was 5.6%, higher than the national average of 4.7%, ranking 11th among all states.

Image source: TTARA Team Research Report June 20

2.1 Tax Types and Rates

According to official sources, Texas currently levies 29 categories of taxes, including sales tax, franchise tax, and property tax.

-

Sales and Use Tax: Texas imposes a 6.25% state-level sales and use tax on most retail sales, leases, rentals, and taxable services. Local taxing jurisdictions (cities, counties, special purpose districts, and transit authorities) may add up to 2%, resulting in a maximum combined rate of 8.25%. Most goods and services are subject to this tax, although certain grocery items (e.g., flour, sugar, milk, eggs) and prescription drugs are exempt. Additionally, digital goods such as online subscription services are also subject to sales tax.

-

Property Tax: Texas does not have a state-level property tax; instead, property taxes are collected by local governments. Rates vary by location, ranging between 1.5% and 3%, with an average of 1.65%. Property tax primarily applies to real estate, including residential homes, commercial buildings, and land owned by individuals or businesses.

-

Franchise Tax: Every entity conducting business in Texas must file and pay the franchise tax. This includes corporations, limited liability companies (LLCs), banks, national banking associations, savings and loan associations, and partnerships. Sole proprietorships (excluding single-member LLCs) and general partnerships are not required to file or pay this tax. The tax rate depends on the type of business: 0.375% for retail and wholesale businesses, and 0.75% for others.

-

Fuel Tax: Gasoline and diesel fuel are taxed at 20 cents per gallon, while liquefied natural gas is taxed at 15 cents per gallon.

Other taxes include hotel occupancy tax and tobacco tax.

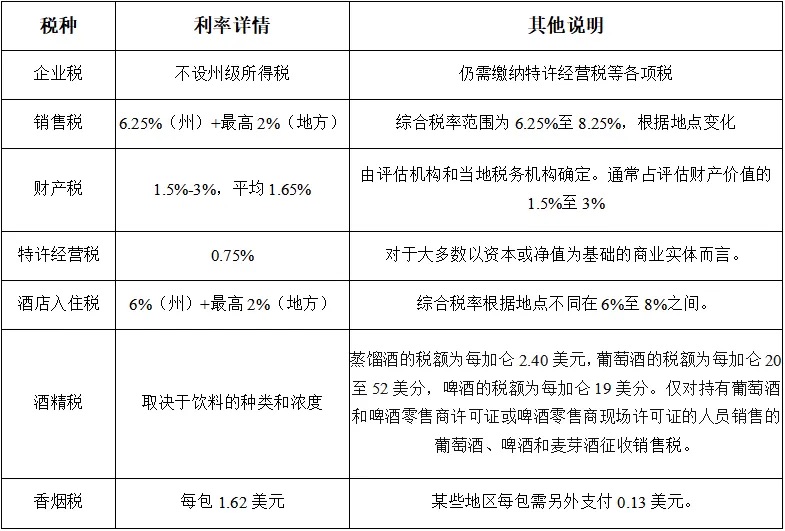

Self-created table. Content: Detailed Taxes in Texas

2.2 Taxpayers

Under Texas’ tax system, taxpayers include individuals, businesses, and other legal entities. The tax burden manifests differently depending on the category.

Individuals do not pay state income tax. However, they are responsible for paying sales tax during daily purchases, with a base state rate of 6.25% and additional local surcharges of up to 2%, bringing some areas’ total sales tax rate to 8.25%. Individuals who own real estate (such as homes or land) must also pay locally assessed property taxes. In 2023, the average property tax rate in Texas was approximately 1.63%. Revenue from property taxes funds local public services, including education and infrastructure development.

For businesses, Texas does not levy a traditional corporate income tax. Instead, all businesses operating in the state must pay the franchise tax, which is based on gross revenue or margin. The rate varies by industry: 0.375% for retail and wholesale trade, and 0.75% for other industries. Even tax-exempt organizations must file annual returns. Businesses are also required to collect and remit sales tax on taxable goods and services sold, covering most tangible products and certain digital offerings such as software and media subscriptions.

2.3 Taxable Objects

Taxable objects refer to specific acts, properties, or transaction types defined under tax law, forming the foundation of government revenue collection. In Texas, various activities, assets, and transactions are subject to different tax treatments. Broadly speaking, these include goods, services, real estate, business revenues, and specific consumer products.

2.4 Key Tax Incentives and Preferential Policies

Texas has been rated the “Best State for Business” by CEOs for 20 consecutive years, thanks to its unique economic incentives and tax relief programs.

With no corporate or personal income tax, Texas ranks among the lowest-taxed states in the U.S. It offers numerous tax breaks to businesses, including exemptions from sales tax on machinery and equipment used in manufacturing, R&D-related materials, software, and equipment. Solar energy manufacturers, sellers, or installers are also exempt from franchise tax. Additional support includes property tax abatements, license fee waivers, local cash grants, and funding assistance to help companies relocate or expand within the state. The Texas Enterprise Zone Program (EZP) is a state-level sales and use tax refund initiative designed to encourage private investment and job creation in economically distressed regions.

Texas provides strong and extensive economic development incentives, continuously promoting industrial diversification to sustain business growth. For example, the Texas Enterprise Fund (TEF) is one of the largest performance-based “deal-closing” funds in the U.S., offering incentives tied to capital investment and job creation. Additional rewards target major events, university research initiatives, workforce training, new product development, and educational support for relocated employees and their families—aimed at attracting projects that bring significant capital and employment opportunities.

Companies relocating or expanding in Texas may qualify for asset-backed loans, leveraged financing, or tax-exempt bonds, including participation in the Texas Industrial Revenue Bond Program and the Texas Military Value Revolving Loan Fund. Grants are also available to communities, certain higher education institutions, and enterprises across Texas.

In recent years, Texas has attracted a growing number of cryptocurrency-related businesses and projects. Major crypto mining firms such as Riot Blockchain and Argo Blockchain have established mining operations in the state. Blockchain technology company Blockcap has relocated its headquarters to Austin, Texas. What makes Texas so appealing to cryptocurrency enterprises? We now examine this question from the perspectives of taxation and regulation.

3. Texas' Cryptocurrency Tax Regime

The legal status and regulation of digital assets in Texas have evolved gradually, with ongoing discussions introducing new topics and viewpoints. As of now, there is no dedicated legislation outlining how cryptocurrency should be taxed. Instead, crypto taxation follows existing frameworks, treating digital assets as property and applying different tax rules based on usage and context. This allows crypto businesses and individuals to benefit from Texas’ distinctive tax advantages.

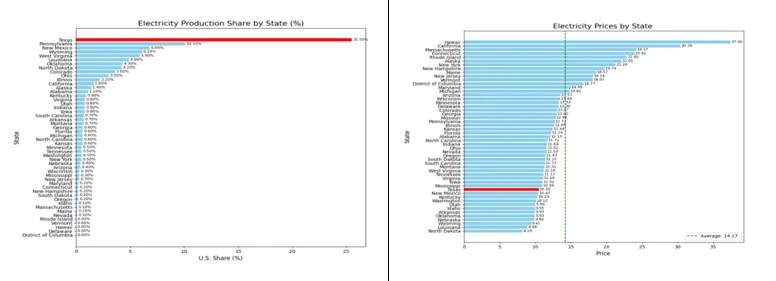

Self-created image. Content: Evolution of Crypto Legislation in Texas

3.1 Definition and Classification of Digital Assets

The legal definition of cryptocurrency in Texas was largely established through H.B. 4474 passed in 2021. This bill clarified the legal standing of cryptocurrencies, defining them as “electronic representations of value intended to function as a medium of exchange, unit of account, or store of value.” By amending the Texas Uniform Commercial Code (UCC), the law recognized crypto as a legitimate form of digital asset akin to other financial instruments. This ensures that cryptocurrencies can be used in lawful commercial transactions and provides a legal framework for protection and oversight.

Additionally, H.B. 4474 introduced the concept of “control” over cryptocurrency, granting holders exclusive rights to use, transfer, and possess their digital assets. This strengthens the legal position of asset owners in transactions. Through this framework, Texas has laid the groundwork for the legal application of blockchain technology in commerce and finance, providing security and confidence for both individuals and enterprises.

3.2 Taxes Applicable to Crypto Assets in Texas

The IRS classifies cryptocurrency and other “virtual currencies” as property. Any received cryptocurrency must be reported as “income,” and capital gains taxes apply upon sale. Residents engaging in crypto transactions must accurately report them using IRS Form 1040 (f1040) to reflect their annual tax obligations.

While federal taxes remain applicable, Texas residents enjoy exemption from state income tax—a major advantage. However, other taxes such as sales and property taxes still apply to crypto activities. If capital assets like cryptocurrency are sold at a profit (i.e., above acquisition cost), capital gains tax applies at the federal level (no state-level equivalent). Capital losses can offset gains under federal rules. Inheritors of crypto assets in Texas do not face state inheritance tax, though large estates may still incur federal estate tax. Sales tax applies when purchasing taxable goods or services with cryptocurrency, with the rate determined by the nature of the underlying product or service—not the payment method. Real estate purchased using cryptocurrency is also subject to county and municipal property taxes, even though Texas lacks a statewide property tax.

The absence of a state corporate income tax means businesses do not pay state-level income tax on profits from crypto transactions—an attractive feature for crypto firms and miners. However, Texas imposes a Margin Tax, which is based on gross revenue rather than net profit. Businesses with annual revenue exceeding approximately $1.2 million may be liable for this tax, with rates ranging from 0.375% to 0.75% depending on entity type and scale. This could pose a challenge for high-revenue, low-margin crypto operations, particularly mining ventures.

Crypto miners must pay particular attention to property taxes. Mining typically involves substantial hardware and power infrastructure, which are classified as “tangible personal property” (TPP) in Texas and thus subject to local property taxation. Texas property tax rates are relatively high, generally between 1.8% and 2.3%, varying by county and city. These costs must be factored into hardware investments. Moreover, mining activity itself is treated as income-generating at the federal level. Miners must report the fair market value of newly mined cryptocurrency as taxable income on federal returns. Thus, despite the lack of state income tax, miners are still obligated to pay federal income tax on mining rewards. If they later sell the coins at a higher price, the appreciation constitutes capital gain, subject to federal capital gains tax.

Businesses involved in crypto trading or related services must also consider sales tax implications. While the exchange of virtual currency itself is not subject to sales tax (as it is considered intangible), sales of physical mining equipment or provision of technical support services may trigger sales tax liabilities. For instance, companies selling ASIC miners or offering hosting services must charge the base sales tax rate of 6.25%, plus any local surcharge, potentially reaching a total rate of 8.25%.

Federal tax compliance remains critical. Despite Texas’ lenient state tax regime, federal law requires accurate reporting of income, capital gains, and losses. The IRS mandates strict disclosure of crypto transactions, mining income, and asset disposals. This means businesses must not only manage operational costs like electricity and hardware but also properly estimate the market value of earned crypto and report it correctly on federal tax forms.

3.3 Crypto Tax Incentives

Currently, there are no explicit tax exemptions or incentives targeting cryptocurrency trading, investing, or mining in Texas. Most preferential policies focus on traditional industries, renewable energy, and manufacturing. However, certain strategies allow crypto participants to reduce their tax burden:

-

Hold assets for over one year before selling. Long-term capital gains are taxed at 25%, compared to 32% for short-term gains.

-

Harvest tax losses. Selling losing positions allows realization of losses, which can offset capital gains or up to $3,000 of ordinary income annually. Unused losses can be carried forward indefinitely.

-

Sell during low-income years. Lower income typically corresponds to lower tax brackets.

Furthermore, certain actions taken by crypto miners and related businesses may qualify them for existing state-level tax incentives—even if not specifically designed for the crypto sector:

-

Building large data centers or mining facilities: Miners often construct or expand capital-intensive data centers. Under Chapter 312 of the Texas Local Government Code, companies can negotiate agreements with local governments to receive property tax abatements for up to 10 years, significantly reducing long-term operating expenses.

-

Engaging in energy-intensive mining operations: Crypto mining demands vast amounts of electricity. ERCOT’s deregulated electricity market enables miners to negotiate long-term power contracts at favorable rates. Furthermore, those utilizing renewable energy sources like solar or wind may qualify for additional energy incentives.

-

Conducting R&D on mining technologies or blockchain applications: Enterprises investing in research and development may claim federal and state R&D tax credits. These credits directly reduce tax liability based on qualified expenditures.

-

Purchasing or leasing commercial real estate for mining: Miners often acquire or lease industrial spaces for mining operations. Under Chapter 312, they may negotiate property tax reductions, especially when expanding commercial activity. Additionally, imported or stored mining equipment may qualify for the Freeport Tax Exemption, waiving property tax on inventory held for resale or use in production.

4. Regulatory Framework for Crypto Assets in Texas

As laws emerge and public interest grows, Texas continues to refine its legal approach to digital assets. Like its tax system, however, there is currently no comprehensive, standalone regulatory framework exclusively for crypto. Existing regulations cover certain aspects but leave notable gaps. Nonetheless, Texas’ regulatory thinking and innovation place it at the forefront nationwide.

4.1 Regulatory Authorities

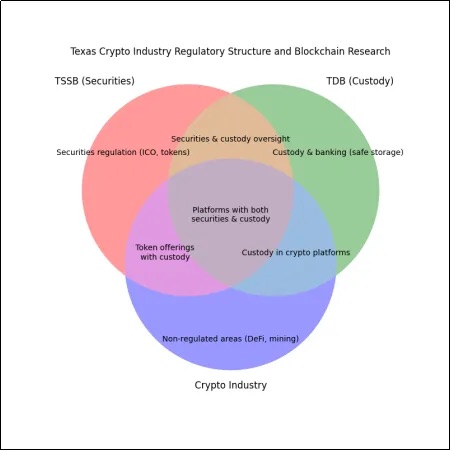

Although Texas is progressively enacting laws to strengthen oversight of digital assets, the overall regulatory structure remains fragmented. Currently, key agencies involved in crypto regulation include the Texas State Securities Board (TSSB), the Texas Department of Banking (TDB), and the Blockchain Working Group. Each plays a distinct role, yet no unified regulatory body exists.

The TSSB oversees securities-related crypto activities. If a cryptocurrency or token offering exhibits characteristics of a security, the TSSB ensures compliance with Texas’ Securities Act, preventing fraud and unregistered fundraising. Its focus lies primarily on investment-oriented tokens and ICOs.

The TDB regulates crypto custodial services. Texas permits state-chartered banks to offer crypto custody, and the TDB ensures these institutions implement robust risk management practices to safeguard customer assets.

Self-created image. Source: Regulatory Framework for Crypto in Texas

In addition, under H.B. 1666, the TDB will require digital asset service providers to prove reserve adequacy, ensuring customer funds are segregated from operational accounts.

The Blockchain Working Group, established via H.B. 1576, focuses on advancing blockchain technology adoption, studying potential applications in finance, supply chain management, and other fields, and advising the state legislature. It does not engage in direct regulation but supports technological and industrial advancement.

Despite progress, current regulations fail to fully address emerging areas such as decentralized finance (DeFi), crypto mining, and digital payments, leaving significant regulatory voids. Nevertheless, Texas demonstrates a clear trend toward progressive regulation and structural refinement. With continued legislative innovation, Texas is poised to close existing gaps and provide a more stable and secure operating environment for the crypto industry.

4.2 Regulated Entities

Texas’ crypto regulatory framework remains loosely structured but leads the nation in forward-thinking policy. Key regulated entities include cryptocurrency exchanges and mining companies.

Exchanges face broad regulatory scrutiny, encompassing reserve management, customer fund transparency, trading compliance, cybersecurity, and user protection.

Following the passage of H.B. 1666, Texas now requires exchanges to submit regular proof-of-reserves audits, ensuring strict separation between customer assets and platform funds. This prevents misuse of client deposits and enhances investor protection. The requirement mirrors traditional banking reserve rules, guaranteeing users can redeem their digital assets at any time.

Exchanges must also comply with federal and state anti-money laundering (AML) and know-your-customer (KYC) requirements, particularly for cross-border transactions, to prevent illicit financial flows. Major platforms like Coinbase have implemented advanced identity verification and anti-fraud systems to ensure full regulatory compliance.

Additionally, exchanges must avoid violations of U.S. securities laws. The TSSB conducts rigorous compliance reviews of token offerings (ICOs) and securities-like crypto projects. In 2018, Texas shut down several unregistered ICOs for failing to disclose adequate information and posing fraud risks. Such oversight protects investors and sets strict standards for compliant digital asset issuance.

Mining companies are subject to more dispersed regulation, touching on energy usage and environmental responsibility.

In 2018, the Texas Securities Commissioner halted an Australian mining firm from selling unregistered securities due to fraudulent and misleading practices.

Texas’ low electricity prices and flexible energy markets have drawn numerous mining firms, making it one of the world’s largest Bitcoin mining hubs—especially given policy support for renewables. Energy regulation is a core issue for miners. Due to their massive power consumption, high-energy users face strict monitoring and load management requirements. Miners must adjust operations according to grid conditions, curtailing or halting mining during peak demand to maintain grid stability. During the severe winter storm in February 2021, which caused widespread blackouts, several mining firms voluntarily reduced power usage to prioritize electricity for households and hospitals. ERCOT manages dispatch for such energy-intensive industries.

Environmental regulations also govern mining operations. Large-scale mining can impact the environment, especially when relying on fossil fuels. To mitigate this, Texas encourages a shift toward renewable energy, offering tax incentives and policy support for wind and solar-powered mining.

Other crypto-related intermediaries are also regulated, albeit without a cohesive framework.

Wallet providers, investment funds, and crypto ATM operators fall under supervision. Wallet services must secure stored assets against hacking and adhere to KYC and AML standards. Crypto funds and investment vehicles must follow securities laws, particularly regarding tokenized assets or DeFi investments, with the TSSB enforcing disclosure requirements. ATM operators must strictly comply with AML and KYC rules to prevent money laundering through anonymous machines.

5. Conclusion and Outlook

Considering its state-level policies, market environment, and operational capabilities, an increasing number of crypto enterprises—not limited to mining—are choosing Texas as their base. The state offers abundant economic and natural resources, a unique tax environment, and pioneering regulatory frameworks. Its rich energy reserves, high power generation capacity, and low electricity costs create ideal conditions for cryptocurrency mining. Combined with the absence of state income tax, these factors enhance corporate profitability. Moreover, Texas leads the nation in legislative and regulatory innovation, balancing asset protection with space for technological experimentation.

Looking ahead, as blockchain and digital asset technologies continue to evolve, Texas is well-positioned to solidify its global leadership. It may introduce further innovative regulations to promote standardized and sustainable industry growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News