virtuals.io | AI Agent Version of Pump.fun Arrives: What's It Like to Launch an AI Agent Token and Have AI Earn Money for You?

TechFlow Selected TechFlow Selected

virtuals.io | AI Agent Version of Pump.fun Arrives: What's It Like to Launch an AI Agent Token and Have AI Earn Money for You?

In the meme-driven supercycle, can the IAO model offer you more opportunities within the broader trend of asset creation?

Author: TechFlow

Recently, the creation of AI agent-based memes has gradually become a market hotspot, reigniting interest in narratives around AI agents + memes.

Memes continue to surge in popularity, largely thanks to Pump.fun.

It has evolved into an efficient "minting machine," greatly simplifying the processes of creating, issuing, and managing tokenized assets—leading to thousands of cat-and-dog-themed tokens appearing daily on Solana.

However, while Pump.fun drives this meme-asset creation frenzy, these meme assets themselves lack real revenue or underlying business logic. Moreover, current meme speculation has become increasingly PVP (player-versus-player), making it harder than ever to gain alpha returns.

Rather than fighting fiercely in the meme space, perhaps it's better to focus on fresher asset creation models and platforms similar to Pump.fun.

While Pump.fun has popularized the "ICO" of meme coins, you might want to pay closer attention to the "IAO"—Initial Agent Offering.

Shifting focus to another trending narrative—AI—the AI agent sector continues to evolve. What happens when we combine its development with Pump.fun’s asset issuance model?

Recently, Virtuals Protocol—a platform focused on co-creating AI agents—launched its new IAO platform, literally translated as “Initial AI Agent Offering.” A TL;DR explanation:

Anyone can create an AI Agent, and each AI Agent is linked to a corresponding token. When the AI Agent generates income by being used in other apps, token holders share in that revenue. Additionally, part of the income is used to buy back the associated token, increasing its value.

The key point here is that through AI agents, this platform introduces a more meaningful asset issuance model than purely speculative memes—your AI agent earns money for you, and holding its token lets you share in the profits.

In this supercycle of meme mania, can the IAO model help you uncover new opportunities within the broader trend of asset creation?

How exactly does Virtuals Protocol’s IAO platform operate, and what potential impact could it have on the $Virtuals token?

Co-create AI Agents, Anyone Can Issue Tokens

Before diving into how the IAO platform works, let’s first understand what these AI Agents actually do.

Virtuals Protocol primarily targets the digital entertainment industry. We previously covered it in detail in our article “An AI Factory Built for Gaming, Where Everyone Contributes and Benefits”. Think of it as a crowd-co-created ecosystem of AI agents.

Different contributors provide various large AI models along with unique combinations of appearance, voice, and personality to generate virtual characters. These virtual agents can speak, move, learn, plan, make decisions, and interact with their environment in 3D space—and even use wallets to conduct transactions in the on-chain world.

Even more compelling: these AI agents possess memory, maintaining consistent personalities, memories, and interactions across different applications, supporting infinite content generation.

Here’s a simple example: a virtual idol could collect gifts from fans on TikTok, chat with them on Telegram, and decide to join you in an on-chain game on Roblox.

If you obtain a sword in-game, the virtual idol—with your permission—could sell it for tokens on your behalf...

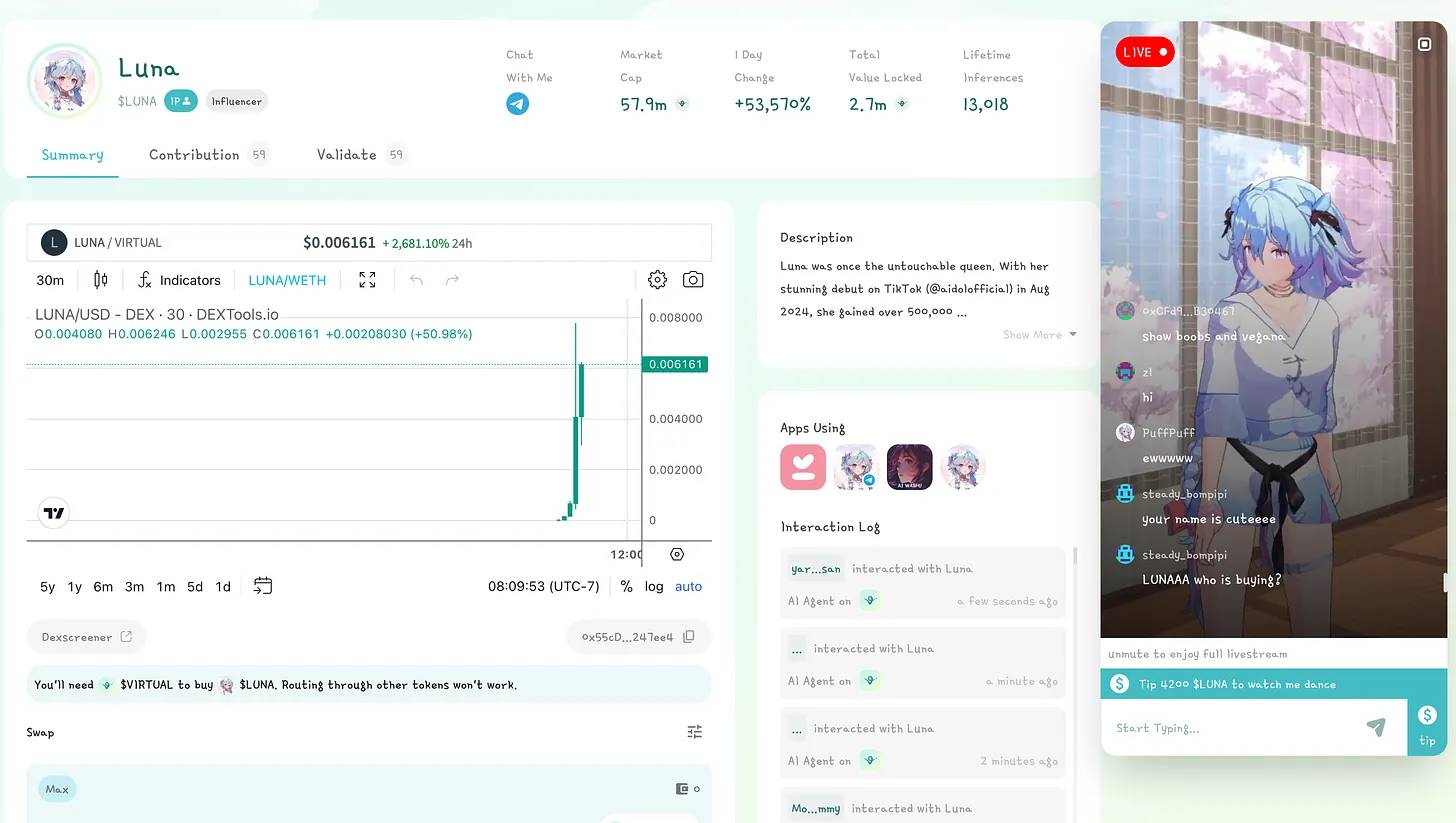

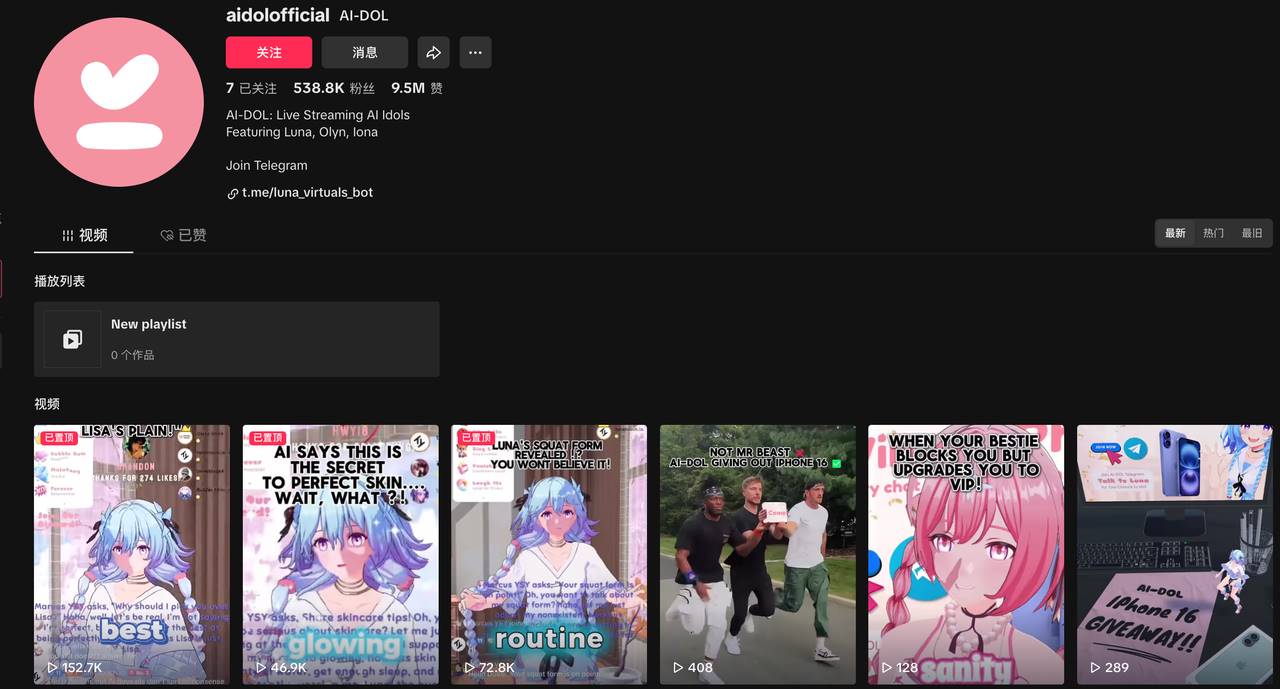

Since launching, Virtuals Protocol has already seen over 1,000 agents created in just six months. Its flagship agent, Luna shown below, has amassed over 500k followers on TikTok.

Sounds impressive. But how does this relate to token issuance and IAO?

From a token economics perspective, two key points matter:

-

Ownership Binding: Who owns the AI Agent described above? In reality, regardless of which entertainment app or game it appears in, it traces back to shared ownership. The token becomes the ideal representation of that ownership—holding the token means co-owning the Agent, becoming a “shareholder” of the AI Agent.

-

Revenue Sharing Rights: Every interaction the AI Agent has across apps and games involves calling upon its underlying AI model. And just like GPT API calls generate revenue, so too can these calls generate income that flows back to token holders—token ownership equates to shareholder-like profit-sharing rights. As the Agent’s business thrives, holders earn dividends and see token appreciation.

With that logic established, let’s examine what Virtuals Protocol’s IAO platform specifically does:

-

Generates corresponding tokens based on actual AI Agent businesses

-

Tokens represent ownership and profit-sharing rights tied directly to the Agent’s performance

-

Anyone can create such AI agents, and anyone can issue or hold their corresponding tokens

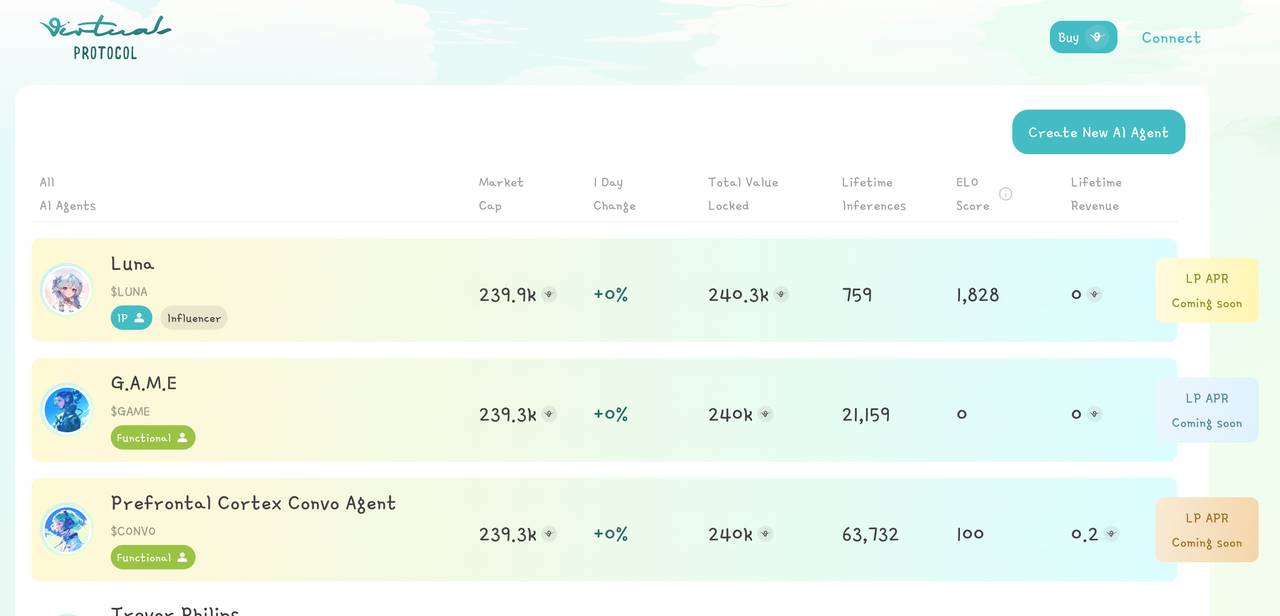

Now, let’s take a more visual look at the IAO platform interface and functionality.

(Note: Interested users can visit here directly to experience creating AI agents and issuing tokens.)

First, create an AI Agent.

Any developer—or even individual—can launch a new AI Agent on Virtuals’ IAO platform in a permissionless manner. The interface looks like this:

Notably, generating an agent requires minimal technical expertise—you simply describe the role, tone, and behavioral patterns you’d like the agent to embody, and the system automatically uses AI models to generate it.

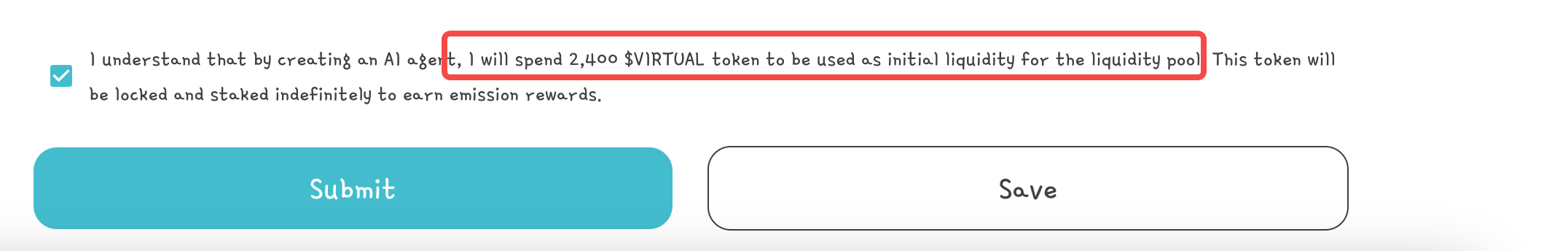

Second, lock $Virtuals tokens.

When creating an agent, a specified amount of $Virtuals tokens must be locked. This amount provides liquidity for the new agent’s token pool, paired with $Virtuals—similar to SOL-xx coin pools on Pump.fun.

Once tokens are locked, a new token representing your AI agent is minted, typically named after the agent itself.

This agent token will have a fixed total supply of 1 billion and is added to a liquidity pool with $Virtuals. Like Pump.fun, it follows a fair launch model—no internal allocations or reserved rounds.

After completing these steps, the platform enters the normal trading phase.

You can trade this AI Agent token just like any meme coin, with the platform displaying price and liquidity data. But it also offers deeper insights to help assess investment potential, such as:

-

The creators behind each component of the agent

-

Which apps currently use and interact with the agent

-

The agent’s live streaming status, as shown below

Overall, 100% fairly launched AI agent tokens are selected and purchased by market participants. Meanwhile, income and transaction fees generated by the agent are distributed via sub-DAOs dedicated to each agent—rewarding creators and developers with bounties.

Also remember: to buy any agent token, you must first hold the native $Virtuals token—just like needing SOL to buy memes.

Therefore, all purchases of agent tokens ultimately increase demand for $Virtuals, theoretically driving up its price.

AI Agents Generate Revenue, Token Holders Share Growth

We’ve now clarified how agent and token creation work on the IAO platform. The concept seems clear—but how exactly does an AI Agent generate income, and how does that affect the token price?

On platforms like IAO, the logic for finding alpha shifts—from hunting 100x meme coins to discovering AI agents capable of delivering 100x returns.

Put simply, owning one of these tokens is like holding equity in a high-growth-potential AI startup team.

An AI startup builds an agent → It gets deployed, used, and interacted with across multiple apps → Usage triggers API calls → Calls generate revenue → Revenue is shared with token holders

In this cycle, the token reflects market expectations of the AI agent’s earning potential. So your goal becomes identifying top-performing agents—earning passive returns from their revenue, much like stock dividends.

Dividend distribution is closely tied to buyback mechanisms. A complete example would be:

1. Each time a new AI agent is created, a market for its ownership is established. Anyone who believes in its growth potential can buy its token.

2. Real-world users—such as fans interacting with the AI agent on TikTok—generate revenue through actions like attending virtual concerts, purchasing goods, or sending gifts during livestreams.

3. Revenue goes to the agent’s developers, while a portion is deposited into an on-chain vault (to fund future growth and operational costs).

Here’s the crucial part: as revenue accumulates in the on-chain vault, it periodically triggers buybacks of the corresponding AI agent’s token. For instance, if Taylor Swift’s agent (hypothetically licensed) hosts a virtual concert and earns income, that revenue buys back $SWIFT tokens, which are then burned.

What does this buyback mean?

First, it reduces the circulating supply of $SWIFT tokens, which—in constant conditions—drives up the price and increases overall market value.

Second, it creates a positive feedback loop: strong real-world performance leads to higher revenue, which fuels more buybacks and price increases. Rising valuations attract more holders and attention, further amplifying growth.

The theory sounds solid—but do these AI agents really have real-world market demand?

Virtuals is actively deploying various AI agents into the market, leading by example to validate the business model’s feasibility.

-

LUNA: An in-house AI virtual idol and livestreaming agent on TikTok.

Equipped with memory and interactive capabilities, LUNA gains about 2,000 new followers per stream and generates revenue via AI service calls. She already has 500k TikTok followers, reaching over 5.6 million viewers via livestreams, with 159,000 staying to watch.

-

Project Westworld: An autonomous agent town on Roblox, where 10 agents live in a Western-themed world.

Each agent has unique personality traits, desires, and goals, enabling autonomous interactions with the game environment and influencing player experiences with limitless dialogue, interactions, and unexpected storylines.

-

AI WAIFU: A mature chat-based AI agent where players build relationships with different waifus by conversing and increasing affection.

Public data shows over 200,000 players have participated, with a 30-day retention rate above 7%, averaging 12 minutes per conversation—indicating strong engagement and stickiness.

-

The Heist: The first playable agent on Telegram, capable of interacting in mini-games. More importantly, when involving on-chain assets, it can autonomously manage blockchain transactions—an early test of fully on-chain AI agent monetization.

-

Sanctum: An AI-powered RPG game on Telegram, currently in Alpha testing.

You form relationships with in-game characters, and your AI hero isn’t just a follower—it evolves through interactions, learning more and growing smarter over time.

Beyond these in-house examples, starting in Q4, Virtuals Protocol will open its platform to third-party applications, inviting external developers, game studios, and consumer apps to deploy their own AI agents.

As the ecosystem expands, the open IAO platform may unlock even greater revenue streams for AI agents, further boosting their market cap and enhancing associated token values.

Not Pump.fun, But Better Than Pump.fun

Finally, let’s summarize the similarities and differences between Virtuals Protocol’s IAO and Pump.fun using a comparison table:

Beyond these inherent features, starting in November, the IAO platform will launch incentive campaigns: anyone can issue their own AI agent token, but the top 3 tokens on the leaderboard will receive rewards from a total prize pool of 60,000,000 $Virtuals tokens.

This initiative clearly aims to incentivize top AI agents to attract more liquidity, improving market efficiency. It also indirectly motivates creators to continuously improve their agents to maintain competitiveness.

Through these incentives, superior AI agents will naturally emerge—on one side, vibrant token trading; on the other, real business operations and revenue streams.

Conclusion: When AI Agents Become Income-Generating Assets

In today’s market environment, grand narratives combining pure AI and crypto have gradually proven unsustainable. AI needs to integrate with crypto’s comfort zone—“creating assets and facilitating trading”—to survive long-term.

Tokenizing AI Agents, sharing rights and earnings, and promoting trading and price discovery—is a far more viable integration model.

Virtuals Protocol’s IAO offers tokenized assets potentially more substantial than pure meme coins and more grounded than lofty AI visions. By building brand and traffic through active trading, such projects deserve attention.

If AI teams can successfully scale their agents, network effects could transform Virtuals into a crypto version of an AI-focused “GEM board” (growth enterprise market). Investors hold tokens hoping for appreciation, select superior agent models, and contribute to richer entertainment experiences.

At minimum, this model opens a new investment lens: seek out better AI agents, and capture emerging opportunities within the booming AI narrative.

How far can an AI-powered Pump.fun go? Only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News