Comparison of Four Mainstream Bitcoin Scaling Solutions: Who Will Unlock the Trillion-Dollar BTCFi Market Potential?

TechFlow Selected TechFlow Selected

Comparison of Four Mainstream Bitcoin Scaling Solutions: Who Will Unlock the Trillion-Dollar BTCFi Market Potential?

This article aims to explore Bitcoin scaling protocols, analyze the future trends of Bitcoin scaling by comparing the advantages and disadvantages of various solutions.

Author: TechFlow

Introduction

State channels (Lightning Network), sidechains (Stacks), Rollups (BitVM), UTXO + client-side validation (RGB++ Layer)... Which of these will stand out and truly unite the Bitcoin ecosystem, achieving scalability, interoperability, and programmability while introducing innovative narratives and significant growth?

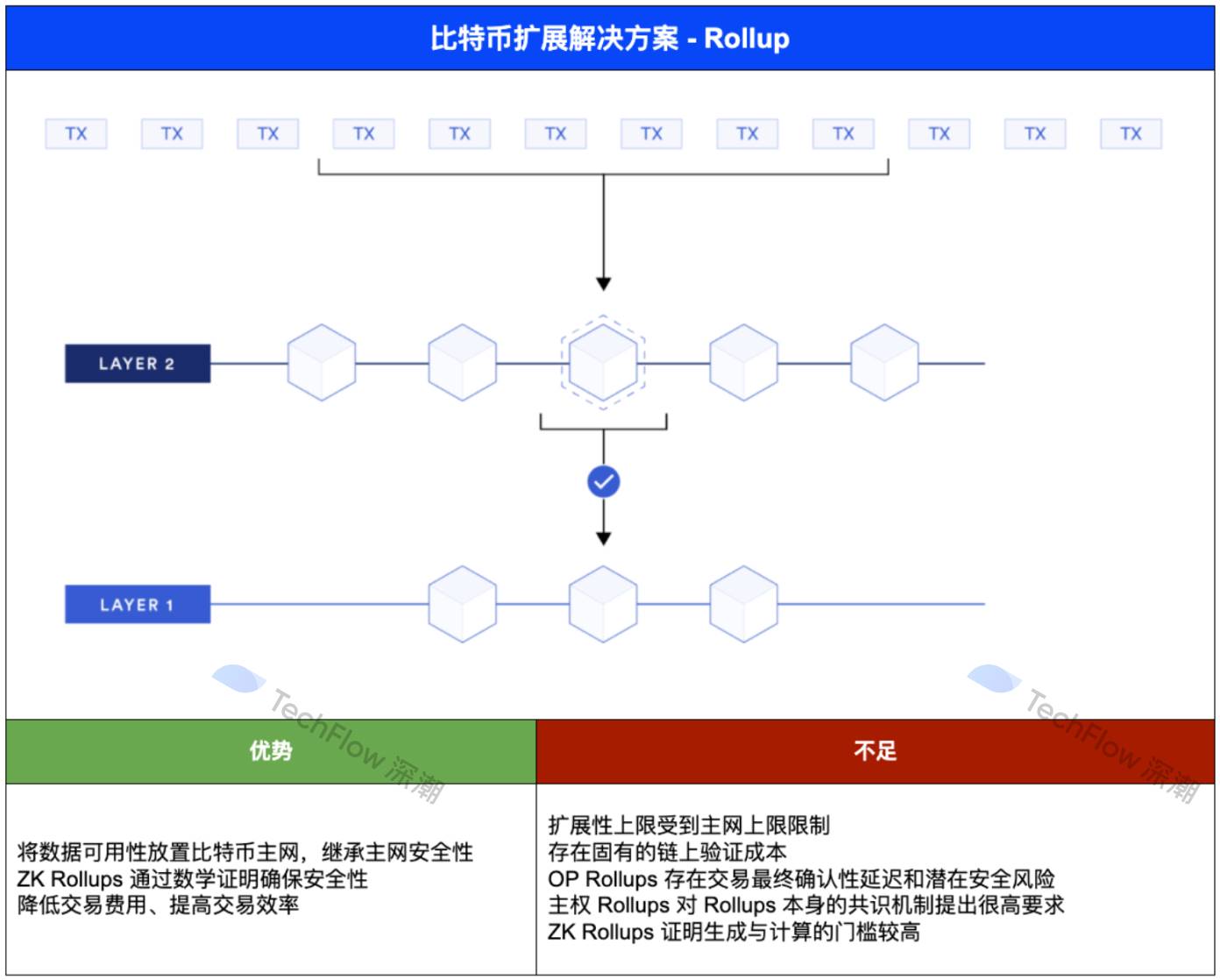

Infrastructure oversupply has been a prominent community sentiment in this market cycle. When supply exceeds demand, we see new public chains and L2s doing everything they can to avoid becoming ghost towns. However, within the Bitcoin ecosystem, we observe a completely different picture:

Since the "everyone minting inscriptions" craze, the market has witnessed strong community enthusiasm for participating in the Bitcoin ecosystem. However, due to Bitcoin's scalability limitations, a robust infrastructure buildout is urgently needed before the ecosystem can truly explode. Massive investments from institutions, often reaching millions of dollars, have turned this cycle into a period of intense construction—machines roaring, roads being paved, bridges built across the nascent Bitcoin city.

Suddenly, everyone wants a piece of Bitcoin’s growing momentum—but that piece isn’t easy to claim.

And for good reason:

Bitcoin's non-Turing completeness and other inherent characteristics make scaling extremely challenging. Projects have taken divergent paths, and Bitcoin's scaling journey is currently in a chaotic exploration phase.

In this process, we witness both veteran solutions like the Lightning Network—renowned for its “orthodoxy”—regaining vitality, and more radical innovations such as CKB’s RGB++, which extends RGB with bold new narratives. Meanwhile, various sidechains and L2s are racing forward—one group directly borrowing Ethereum-style approaches, another deeply researching Bitcoin’s own characteristics to develop tailored improvements.

Given the trillion-dollar potential of the Bitcoin ecosystem and the wide array of technical approaches, which scaling protocols will emerge victorious—truly uniting the ecosystem, enabling scalability, interoperability, and programmability, and bringing transformative innovation and substantial growth?

This article aims to dive deep into Bitcoin scaling protocols, comparing their strengths and weaknesses to analyze the future trajectory of Bitcoin scaling.

1. Bitcoin Scaling: The Inevitable Path to Ecosystem Explosion

Following the logic of first determining whether something is necessary, then explaining why, we begin by asking: Is Bitcoin scaling a fabricated need?

The answer is clearly no—in fact, Bitcoin needs scaling even more than any other blockchain.

This argument is strongly supported by multiple real-world observations.

From a market perspective, whether it’s the inscription frenzy or institutional investments routinely hitting tens of millions of dollars, we clearly see market enthusiasm for the Bitcoin ecosystem. This enthusiasm is understandable—over the years, many Bitcoin holders haven’t just wanted to “HODL,” but have been frustrated by the lack of meaningful ways to engage. Once exciting narratives emerge within the ecosystem, holders naturally jump in.

From Bitcoin’s own standpoint, as the pioneering blockchain, Bitcoin has evolved over more than a decade, with deeply entrenched and interconnected stakeholder interests. Achieving balance while maintaining long-term appeal remains a major challenge. Following the fourth halving in 2024, reduced block rewards will weaken miners’ profitability, further pushing Bitcoin toward exploring ecosystem prosperity and richer value flows. Bitcoin needs to empower all participants in its network and attract incremental users through ecosystem development.

More importantly, when it comes to ecosystem development, Bitcoin holds multiple advantages unmatched by any other public chain: driven by its community and battle-tested over more than a decade, Bitcoin now boasts a market cap of $1.2 trillion, enjoying unparalleled recognition and trust among global investors and the public. This grants Bitcoin unrivaled decentralization and a formidable security foundation. Notably, past ecosystem limitations have left vast amounts of Bitcoin capital dormant, underutilized—making the prospect of an explosive Bitcoin ecosystem even more compelling.

Unfortunately, Bitcoin’s inherent architectural constraints severely hinder ecosystem explosion: As widely known, Bitcoin handles only about 3–7 transactions per second. During peak times, network congestion occurs, forcing users to pay high fees for priority processing—resulting in slow speeds, high costs, and long confirmation times. More critically, Bitcoin’s non-Turing completeness prevents complex logic execution, discouraging developers from building sophisticated smart contract applications on Bitcoin.

Faced with such a powerful yet inherently limited Bitcoin—highly anticipated by the market but constrained by design—scaling becomes the inevitable path to ecosystem explosion. In today’s environment where less talk about technology and more focus on demand prevail, Bitcoin scaling protocols are increasingly guided by a principle of “change” and “consistency,” derived by reverse-engineering demands from Bitcoin’s own strengths and weaknesses.

Centered around Bitcoin’s limitations, Bitcoin scaling protocols aim to deliver key improvements:

One core goal of Bitcoin scaling protocols is enhancing user transaction experience—improving efficiency and reducing costs.

Additionally, Bitcoin scaling protocols aim to enable Turing-complete smart contracts on Bitcoin, allowing developers to build complex logic applications within the Bitcoin ecosystem. Realizing this functionality would allow Bitcoin to move beyond simple value transfers, supporting diverse financial products and services such as decentralized finance (DeFi) and automated contract execution. This would greatly expand Bitcoin’s use cases, attracting more developers and users.

Another critical improvement sought by Bitcoin scaling protocols is enhanced interoperability between Bitcoin and other blockchains and ecosystems. By breaking down current silos and enabling aggregation and collaboration across chains, users can seamlessly transfer assets and data across platforms. This interoperability strengthens the entire blockchain ecosystem, promotes resource sharing and cooperation, and drives innovation.

Meanwhile, regarding Bitcoin’s strengths, scaling protocols aim to preserve and amplify them:

Bitcoin scaling protocols strive to inherit and enhance Bitcoin’s decentralization and robust security. This not only ensures stronger security but also genuinely brings innovation to the Bitcoin ecosystem—not merely creating bridges that port Bitcoin assets to other ecosystems and enrich those instead.

Another important point: Bitcoin scaling protocols should extend functionality without altering the mainnet. Historically, Bitcoin has experimented with on-chain scaling solutions such as increasing block size and Segregated Witness (SegWit), laying solid groundwork. However, most on-chain scaling requires modifying mainnet code and often sacrifices some degree of decentralization and security. As a result, the community has grown cautious and now favors off-chain solutions built atop Bitcoin L1—solving performance issues without compromising the base layer.

Having understood the “change” and “consistency” principles of Bitcoin scaling protocols, we can now establish concrete evaluation criteria. Comparing mainstream Bitcoin scaling protocols using these dimensions may help readers gain clearer insights into the strengths and weaknesses of various technical approaches.

2. Overview and Comparison of Mainstream Bitcoin Scaling Solutions

Following different technical paths, current mainstream Bitcoin scaling solutions can be broadly categorized into the following types:

-

State Channels

-

Sidechains

-

Rollups

-

UTXO + Client-Side Validation

2.1 State Channels

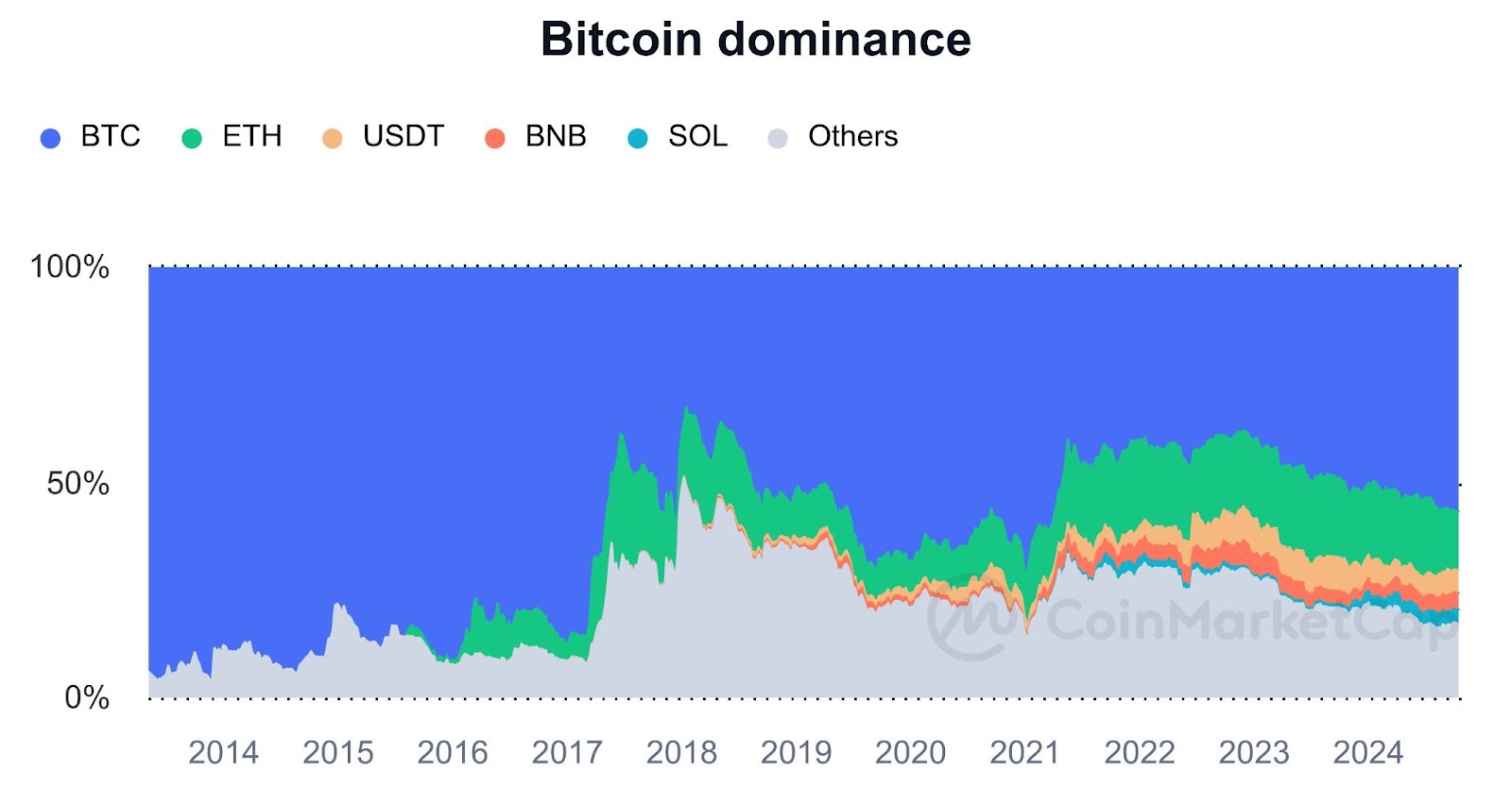

State channels are among the earliest and most orthodox Bitcoin scaling attempts. The most famous representative is the Lightning Network.

By definition, state channels establish private channels between two or more parties, enabling multiple off-chain transactions, with only the final state recorded on the Bitcoin mainchain—thus improving speed and reducing cost.

We can illustrate how state channels work with a vivid analogy:

A group of people deposit collateral to create a WeChat Pay group. Transactions within this group are fast and low-cost. When the group dissolves, all payment states are finalized and updated on the Bitcoin mainnet.

Understanding this mechanism reveals the clear pros and cons of state channels:

Advantages: First, state channels drastically reduce mainnet computation, lowering fees and improving efficiency. Second, since the mainnet validates the final state, security is well inherited from Bitcoin. Third, unlimited transactions can occur within a channel, theoretically enabling infinite TPS.

Disadvantages: High technical and financial barriers exist when opening a channel. Users can only transact with others in the same channel, limiting usability. Funds must be locked upfront, impacting liquidity. Most importantly, state channels do not support smart contracts—clearly falling short of Bitcoin’s ecosystem needs.

Image source: Internet

2.2 Sidechains

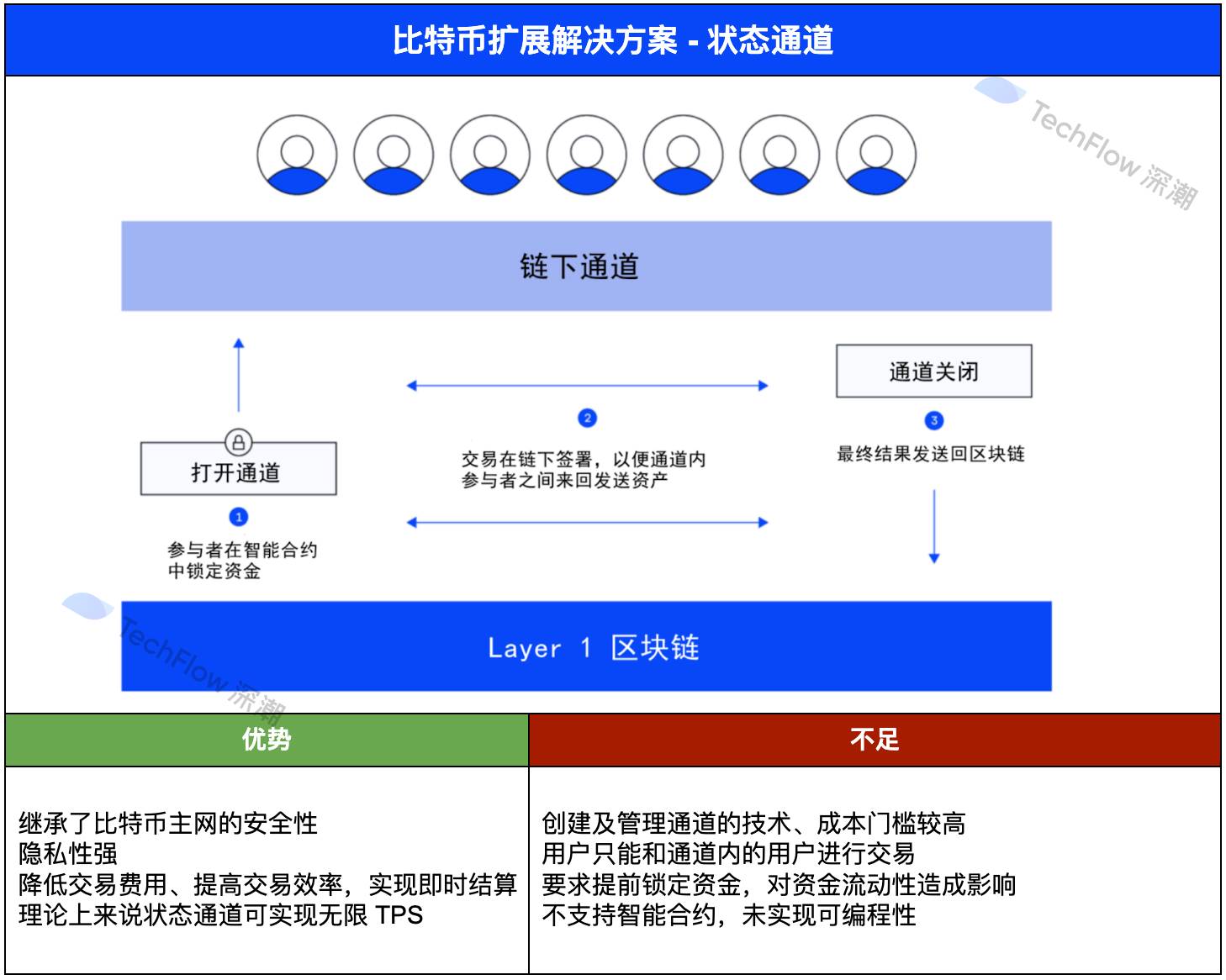

The concept of sidechains is not new. A sidechain is essentially an independent chain running parallel to the mainchain, allowing users to transfer assets between them via a two-way peg mechanism.

Several projects follow this path—notably the veteran Stacks and the rising star Fractal Bitcoin, both drawing community attention.

Because sidechains operate independently from Bitcoin, they can theoretically break free from Bitcoin’s technical constraints, adopting cutting-edge designs for better performance and user experience.

However, precisely because they’re independent, sidechains cannot fully inherit Bitcoin’s robust security. Their trust model relies on their own consensus mechanisms, which often suffer from centralization in early stages. That said, many sidechain projects are innovating here, strengthening their consensus to better tie into Bitcoin’s security foundation.

Image source: Internet

2.3 Rollup

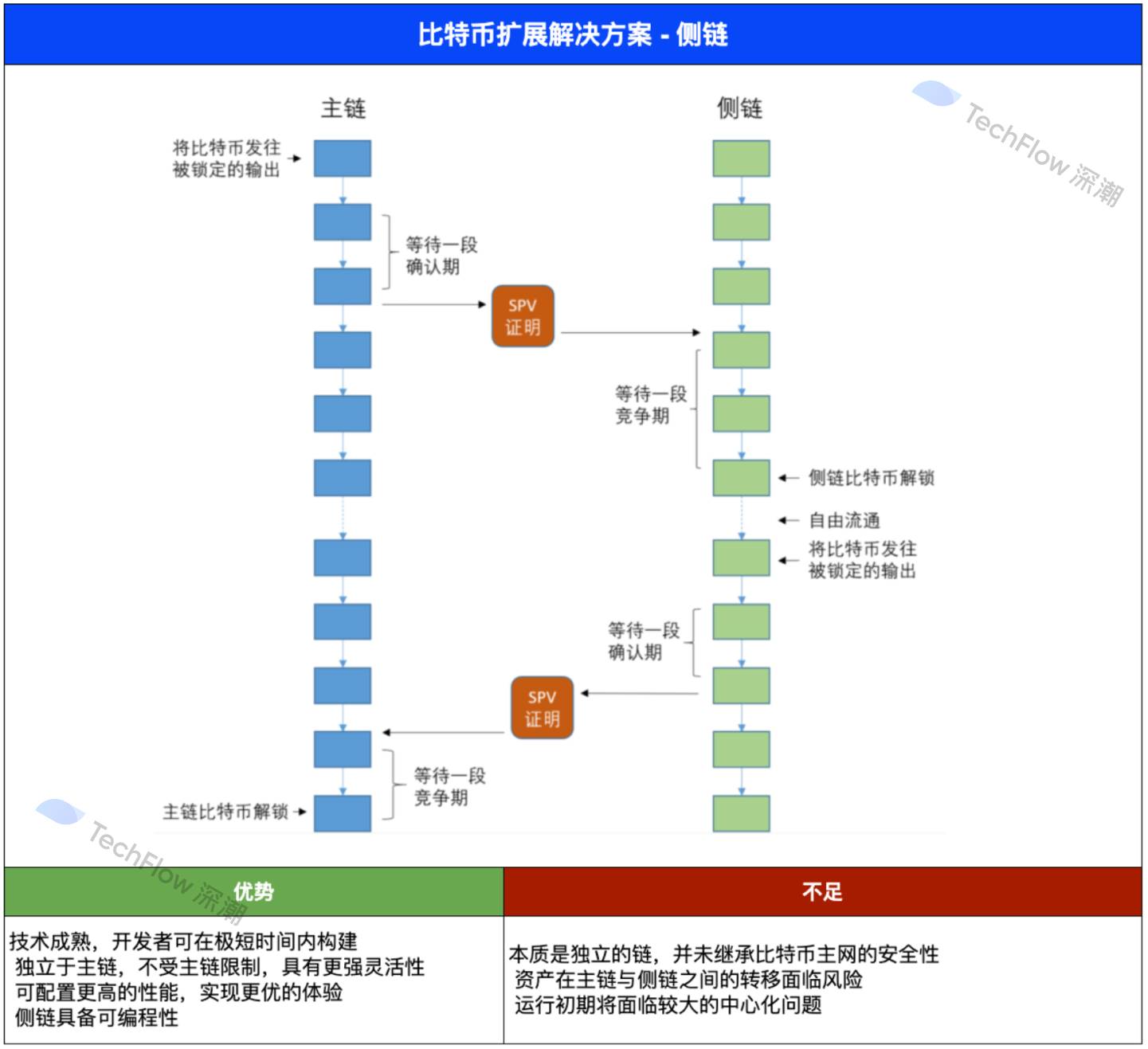

Many associate Rollups primarily with Ethereum L2s. In the crowded Ethereum L2 space, Rollup-based projects dominate. Now, during this wave of Bitcoin infrastructure development, Rollup techniques are also gaining traction in the Bitcoin ecosystem, with projects like B² Network and Bitlayer emerging as popular contenders.

Operationally, Rollups execute transactions off-chain, batch multiple transactions, and post the summary to the mainchain. This keeps data availability on the mainchain—preserving its security and decentralization—while significantly reducing on-chain data load, alleviating network congestion and lowering costs.

But unlike Ethereum Rollups: Ethereum has a virtual machine, so most Ethereum Rollups use Ethereum as both data availability and consensus layer. Bitcoin lacks a VM—so how can Bitcoin L1 verify Rollup proofs? This poses extra challenges for Bitcoin Rollup projects.

Currently, there are three main types of Bitcoin Rollups, none perfect:

Optimistic Rollups rely on trust assumptions—transactions are assumed valid unless challenged. Simpler to integrate and highly scalable, but finality is delayed due to challenge periods.

Sovereign Rollups take a more independent approach—data availability on mainchain, but transaction validation and execution via their own consensus. This shares Bitcoin’s security while bypassing script limits, but places high demands on the Rollup’s own consensus.

Validity Rollups (including ZK Rollups) use cryptographic proofs to verify batches of off-chain transactions without revealing underlying data. Efficient and secure, but generating ZK proofs remains computationally intensive and complex.

Image source: Internet

2.4 UTXO + Client-Side Validation

If Rollups are seen by many as Ethereum imports, UTXO + client-side validation feels more like a custom solution built for Bitcoin’s unique traits.

Introducing UTXO + client-side validation intuitively requires more explanation—due to both its technical complexity and years of iterative evolution.

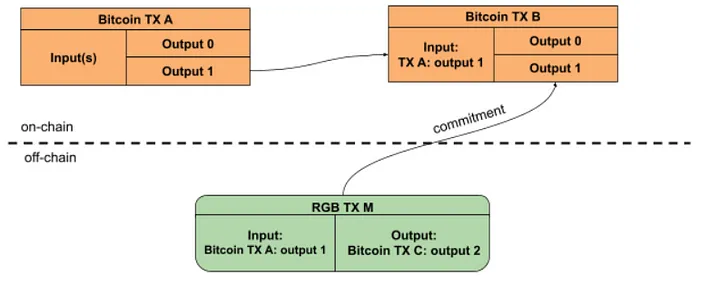

Bitcoin doesn’t use accounts; it uses the UTXO (Unspent Transaction Output) model—the core of Bitcoin transactions and the foundation of this scaling path. Specifically, this approach performs off-chain ledger computations based on Bitcoin UTXOs and uses client-side validation to ensure ledger authenticity.

This idea originated in 2016 with Peter Todd’s concepts of “single-use seals” and “client-side validation,” eventually leading to the creation of the RGB protocol.

As the name suggests, a single-use seal acts like a digital tamper-proof tag ensuring a message is used only once. Client-side validation moves token transfer verification off Bitcoin’s consensus layer—clients related to a transaction perform the verification themselves.

RGB’s core idea: Users must run a client and personally verify asset changes relevant to them. Simply put: recipients must confirm senders’ transfer statements are correct before the transfer takes effect—all occurring off-chain. Complex smart contract computations are handled off-chain, enabling efficiency and privacy.

How does it inherit Bitcoin’s strong security? RGB uses Bitcoin UTXOs as single-use seals, tying RGB state changes to UTXO ownership. As long as a Bitcoin UTXO isn’t double-spent, the associated RGB asset won’t be either—thus inheriting Bitcoin’s security.

Indeed, RGB’s emergence was significant for Bitcoin—but early-stage developments are always rough. RGB still has many flaws:

For example, average users using simple clients lack the capacity or resources to store full transaction histories, making it hard to provide proof to counterparties. Since each client stores only its own data, visibility into others’ assets is limited—creating data silos. This lack of global visibility and transparency severely hampers DeFi development.

Also, RGB transactions—being Bitcoin extensions—rely on a P2P network for propagation. Transfers require interactive operations between users, depending on a P2P network separate from Bitcoin’s.

More critically, RGB’s VM primarily uses AluVM, lacking mature developer tools and practical code. There’s also no robust solution for interacting with ownerless (public) contracts, making multi-party interactions difficult.

These very issues prompted Nervos Network—a technically advanced veteran blockchain project—to explore better solutions, giving rise to RGB++.

Although RGB and RGB++ share similar names and originate from concepts like single-use seals and client-side validation, RGB++ is not an extension of RGB. In fact, RGB++ uses no RGB code. More accurately, RGB++ is a complete re-architecture of RGB’s concepts, designed for systematic optimization.

RGB++’s core idea: Offload data validation from users to achieve global verifiability. Of course, users can still run clients to validate RGB++ data and transactions themselves.

To whom? Public chains and platforms that support UTXO and extend its programmability—like CKB and Cardano.

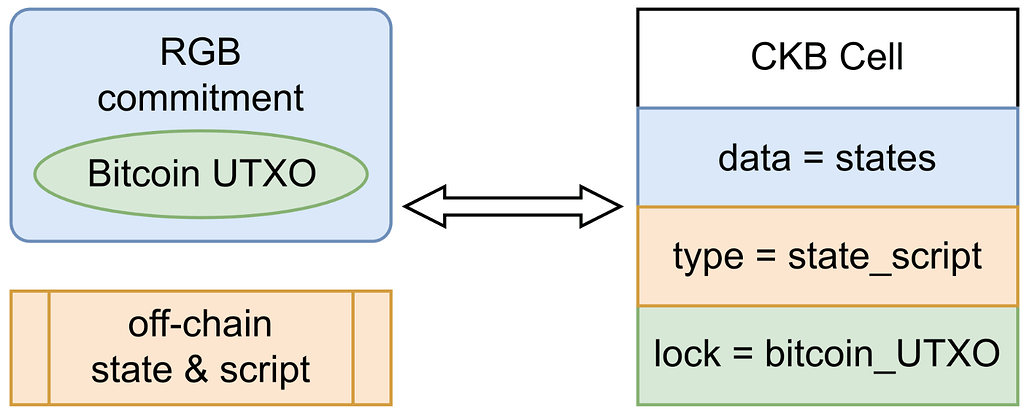

How? Through the crucial concept of “isomorphic binding”: Bitcoin is the mainchain; CKB and Cardano are like shadow chains. Extended UTXOs on CKB/Cardano serve as containers for RGB asset data—embedding RGB parameters into these containers to bind mainchain and shadow chain, displaying data directly on-chain.

Take CKB: Its Cell model—an extended UTXO—can map to Bitcoin UTXOs, allowing CKB to act as a public database and pre-settlement layer for RGB assets, replacing RGB clients and enabling more reliable data custody and contract interaction.

Thus, RGB++ inherits Bitcoin’s robust security while unlocking new use cases—non-interactive RGB transactions, commitment publishing for batched transactions, and direct BTC asset interaction with CKB assets without cross-chain steps—enabling advanced applications like DeFi.

Thanks to its standout advantages in security, efficiency, and programmability, RGB++—despite its high learning curve—has earned strong industry praise and become one of the mainstream favored Bitcoin scaling protocols. With the July 2024 upgrade to RGB++ Layer, Bitcoin scaling entered a new era of innovation.

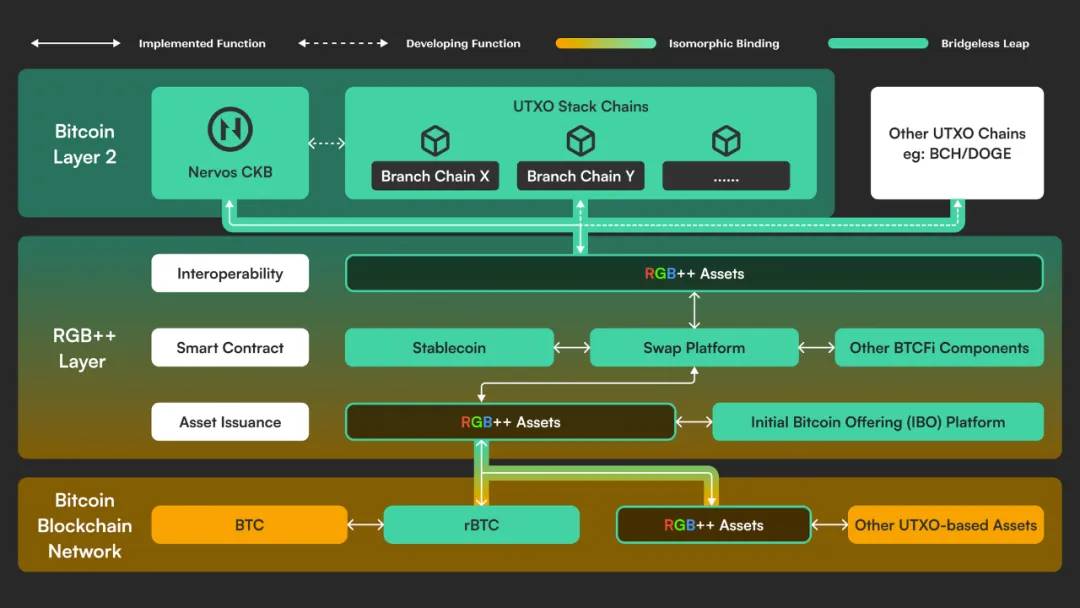

The name change alone signals much: from protocol to Layer, RGB++ is clearly moving toward broader service scope, deeper aggregation, and seamless interaction.

Like countries (blockchains) each having their own rules, RGB++ Layer aims to find a common ground (UTXO) and leverage it to connect key elements of ecosystem development—achieving a higher degree of “unified standards” to build a stronger expansion infrastructure for Bitcoin.

First, as infrastructure, RGB++ Layer must be intuitive and widely accepted: It features a native Account Abstraction (AA) scheme, compatible with account standards from other blockchains—smoothing UX and enabling key scenarios.

RGB++ Layer also focuses on unifying asset issuance: It supports issuing various RGB++ assets—user-defined tokens (UDT) like ERC20 and digital objects (DOB) like ERC721. Leveraging UTXO advantages, RGB++ enables a new paradigm: the same asset can be issued simultaneously across multiple chains, with different ratios per chain—ensuring cross-chain coordination while offering issuers maximum flexibility.

If asset issuance is unified, asset interaction becomes seamless: Through RGB++ Layer’s bridgeless cross-chain (Leap), assets on UTXO chains can move to other UTXO chains without bridges—enhancing security and interoperability. Assets from Cardano, Dogecoin, BSV, and BCH can seamlessly integrate into the Bitcoin ecosystem.

After unifying issuance and interaction, RGB++ Layer aims to bring a unified smart contract framework and execution environment to Bitcoin via CKB-VM, enhancing Bitcoin’s programmability. Any RISC-V-compatible programming language can be used to develop contracts and complex applications on RGB++ Layer—unlocking BTCFi and enabling countless new innovations.

At this point, we’ve covered the fundamental mechanics, representative projects, and pros and cons of the four main Bitcoin scaling protocols. Readers can review the summary chart below for a clearer, more visual comparison.

Of course, the above analysis draws from past performance of these solutions. But in this cycle, with the Bitcoin ecosystem poised for takeoff, leading projects aren’t standing still—they’re innovating aggressively to secure better ecosystem positions.

Therefore, after reviewing the past, we must now look to the future—by examining how top projects are evolving, we can glimpse the competitive landscape of Bitcoin scaling solutions ahead.

3. Ecosystem Status and Future Potential of Leading Protocols

3.1 Lightning Network: Synonymous with “Orthodoxy,” Moving Toward a Multi-Asset Network

The Lightning Network’s orthodoxy traces back to 2009, when Bitcoin’s creator Satoshi Nakamoto included draft code for payment channels in Bitcoin 1.0—the prototype of Lightning.

After more than a decade of development, the Lightning Network is now highly mature. According to 1ML statistics, the network currently has 12,700 nodes, 48,300 payment channels, and ~5,212 BTC in channel capacity, partnering with multiple social and payment platforms.

Compared to May’s figures—13,600 nodes, 51,700 channels, and 4,856 BTC—we see funding growth slowing and channel count declining. Community sentiment has also turned somewhat negative in recent years.

On one hand, early developers recognized the technical limitations and challenges of the protocol. Its complexity has made development slow, difficult, and time-consuming.

On the other hand, after years of development, public perception remains largely confined to payments. As Lightning core developer Anton Kumaigorodski noted on social media: “Beyond payments, people should look elsewhere.” This has pushed Lightning to a pivotal turning point.

Adding to the difficulty, team disagreements have accompanied Lightning’s growth. Over the past year, several key developers have left—further hampering progress.

Yet, Lightning hasn’t remained passive. Beyond continuing to strengthen micro-payments, leveraging years of experience, it has realized that the narrative of a Bitcoin monetary network is more compelling than just Bitcoin-as-asset—and is now moving toward becoming a multi-asset network.

On July 23, 2024, Lightning Labs launched the first mainnet version of the multi-asset Lightning Network, officially integrating Taproot Assets.

Before Taproot Assets, Lightning only supported Bitcoin as a payment currency—severely limiting use cases.

Now, with the mainnet launch, individuals and institutions can issue their own tokens via Taproot Assets—including fiat-backed stablecoins. Full compatibility with Lightning makes instant global FX settlement and stablecoin purchases feasible, paving the way for Lightning to become foundational infrastructure for a global payment network.

3.2 Stacks: Veteran Sidechain Project, Nakamoto Upgrade Complete

Within the Bitcoin ecosystem, Stacks stands out as a unique player. Launched in 2017 as an OG project, it became the first token sale approved by the U.S. SEC under Regulation A+ in 2019.

According to DeFi Llama, fueled by the inscription trend, Stacks TVL grew steadily from the start of 2024, peaking at $183 million in April. After the hype faded, TVL settled around $100 million. Still, after years of development, Stacks’ DeFi activity is impressive—e.g., StackingDao, the top TVL liquid staking project, has over 30,000 real stakers, and total unique wallets exceed 1.21 million.

However, Stacks faces significant challenges as a sidechain:

First, chain security heavily depends on miner budgets. While the proof-of-transfer mechanism linking Stacks to Bitcoin enhances decentralization and security, it limits performance and scalability.

Second, although sidechains offer flexibility, building a new chain outside Bitcoin—with independent governance and transaction models—leads some to question Stacks’ orthodoxy, resulting in weak community认同.

Recently, a landmark moment for Stacks was the completion of the Nakamoto upgrade: This not only improves security but also reduces block confirmation time to ~5–10 seconds—about 100x faster than before.

Simultaneously, the Stacks core team is developing sBTC—a trustless solution bridging BTC from Bitcoin to Stacks. With permissionless, open participation, sBTC could unlock massive DeFi innovation on Stacks, potentially driving $10 billion in TVL.

3.3 BitVM: Bringing Expressive Logic Directly to Bitcoin

Earlier, we mentioned that Bitcoin lacks a VM, making Rollup proof validation difficult. BitVM aims to introduce expressive logic directly into Bitcoin—enabling off-chain computation and on-chain verification of any computation—without changing Bitcoin itself. This breakthrough emphasizes both security and efficiency, opening the door to Bitcoin programmability, including Turing-complete smart contracts.

Though still early, BitVM has drawn attention from projects and the community. Multiple projects—including Bitlayer, Citrea, Yona, and Bob—are already building on BitVM.

BitVM continues refining its mechanism—upcoming upgrades like BitVM2 and BitVM Bridge exemplify this:

BitVM2 enables complex off-chain computation with on-chain fraud proofs—cleverly achieving Turing-complete verification despite Bitcoin’s limited scripting.

BitVM Bridge introduces a novel 1-of-n security model—where a single honest participant can prevent theft—potentially boosting Bitcoin’s cross-chain security and decentralization, catalyzing BTCFi growth.

Notably, while BitVM2 simplifies verification, on-chain gas costs remain high. Moreover, BitVM is essentially an unrealized virtual computer concept, and its logic doesn’t fundamentally overcome the limitations of ZK or Optimistic Rollups. Thus, many remain cautiously观望.

3.4 RGB++ Layer: Bitcoin’s Asset Issuance Layer, Smart Contract Layer, and UTXO Interoperability Layer

After upgrading to RGB++ Layer, the project shifted focus from brand storytelling to refined technical execution, prioritizing BTCFi with a series of tech iterations and ecosystem initiatives. It announced upcoming product launches aimed at integrating Bitcoin’s asset issuance, smart contract, and interoperability layers into a unified, secure, seamless, and efficient infrastructure.

On asset issuance, RGB++ Layer is introducing Initial Bitcoin Offering (IBO)—a new issuance model enabling direct liquidity pool creation on UTXOSwap. This allows newly issued assets to trade with high liquidity—fair, community-driven, and setting a new standard for RGB++ and Bitcoin ecosystem asset launches.

As a DEX built on RGB++ Layer, UTXOSwap uses intent-based trading, with off-chain matching and on-chain validation. Leveraging UTXO parallelism, it boosts efficiency and aims to become the central hub of RGB++ Layer—aggregating liquidity across UTXO chains and laying a solid foundation for DeFi.

Stablecoins are one of DeFi’s three pillars—RGB++ Layer has strategic plans here too: Stable++ is a decentralized over-collateralized stablecoin protocol leveraging RGB++ Layer’s Turing-complete programmability to efficiently build vaults and liquidation modules. Users can mint USD-pegged RUSD using BTC and CKB as collateral. Thanks to RGB++ Layer’s strong interoperability, RUSD is compatible with all UTXO chains and freely circulates within the Bitcoin ecosystem—becoming a core liquidity component of BTCFi.

Beyond innovating, RGB++ Layer aims to empower the broader Bitcoin ecosystem—through strategic partnerships to integrate liquidity and use cases, fueling further ecosystem explosion. UTXO Stack and Fiber Network are prime examples.

Last September, UTXO Stack announced a pivot to become a staking layer for the Lightning Network, launching token incentives for users who stake CKB and BTC to boost state channel liquidity—aiming to improve Lightning’s yield model and pave the way for mass adoption.

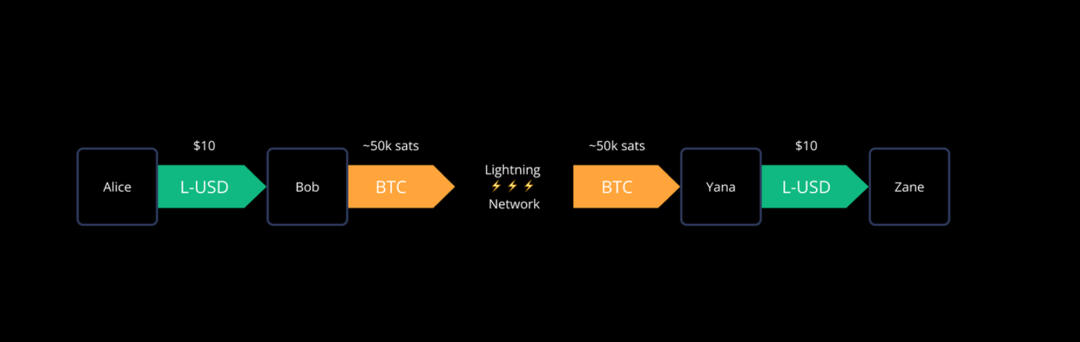

Fiber Network is a CKB-based L2. Initially similar to Lightning, it aims to be a high-performance, low-cost micropayment network. But thanks to CKB’s Turing-completeness, Fiber offers greater flexibility in liquidity management, higher efficiency, lower cost, and better UX. Crucially, unlike Lightning’s focus on BTC, Fiber supports multiple assets—BTC, CKB, and native Bitcoin stablecoin RUSD—enabling complex cross-chain financial applications.

But Fiber isn’t meant to replace Lightning. Its ultimate goal is to become a programmable scaling solution for Bitcoin—and in this journey, it collaborates closely with Lightning. Fiber’s stack includes CKB Cells, RGB++ Layer, Bitcoin’s HTLC scripts, and Lightning’s state channels. Its first testnet has already proven the feasibility of decentralizing BTC transfers from Lightning to CKB—enabling more BTC assets to flow on CKB.

Due to technical isomorphism, Fiber and Lightning naturally support atomic cross-chain swaps. This fusion of “Bitcoin-level security + Ethereum-level functionality + Lightning-level speed” won’t just shine in payments—it will enable native stablecoins, native lending, native DEXs, and more DeFi apps on Bitcoin, accelerating BTCFi’s breakout.

Conclusion

Through this article, we’ve explored the flourishing landscape of Bitcoin scaling solutions:

State channels theoretically enable infinite TPS;

Sidechains offer exceptional flexibility;

Rollups’ success in Ethereum has raised hopes for their role in Bitcoin;

And UTXO + client-side validation, after multiple iterations, culminates in RGB++ Layer—an integrative solution inheriting Bitcoin’s security while excelling in UX, programmability, and interoperability. From a technical standpoint, it represents one of the most mature and comprehensive Bitcoin scaling frameworks.

That said, while RGB++ Layer continues iterating with a clear roadmap, its real-world effectiveness must still be validated through ecosystem development. As multiple projects roll out roadmaps and launch products, will RGB++ Layer become the catalyst that unlocks BTCFi’s full potential?

The battle for Bitcoin scaling supremacy remains undecided. Each solution is fighting hard—only time will tell which rises above. The community watches closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News