Arthur Hayes' new article: Escalation of Middle East conflict and rising energy prices will drive up Bitcoin's value in the long term

TechFlow Selected TechFlow Selected

Arthur Hayes' new article: Escalation of Middle East conflict and rising energy prices will drive up Bitcoin's value in the long term

Although Bitcoin may rise in the long term, this does not mean its price won't experience sharp fluctuations, nor does it imply that all altcoins will benefit equally; the key lies in properly managing investment size.

Author: Arthur Hayes

Translation: TechFlow

(The views expressed in this article are solely those of the author and should not be taken as investment advice or a basis for making investment decisions.)

Want to learn more? Follow the author on Instagram and X.

For the first two weeks of October, I went skiing on New Zealand's South Island. My guide and I spent last season in Hokkaido, and he assured me that New Zealand is one of the best places in the world for backcountry skiing. I trusted him, so we set off from Wanaka and spent two weeks chasing powder snow and epic ski lines. The weather cooperated beautifully—I skied down majestic peaks and crossed vast glaciers. Plus, I deepened my knowledge of alpine mountaineering.

Storms on the South Island can be extremely intense. When bad weather hits, you're stuck indoors or in mountain huts. To pass the time, one day my guide gave a lecture on avalanche science. I’ve undergone avalanche training multiple times since my teenage years during backcountry trips in British Columbia, but I’ve never completed a formal certification course.

The material was both fascinating and sobering—because the more you learn, the more you realize there’s always risk when skiing in avalanche terrain. Therefore, our goal is to keep risks within an acceptable range.

The lesson covered different types of snowpack layers and how they contribute to avalanches. Among the most dangerous scenarios is the presence of a persistent weak layer (PWL), which can trigger persistent slab avalanches under stress.

In avalanche science, a persistent weak layer (PWL) refers to a specific stratum within the snowpack that remains structurally fragile over extended periods, significantly increasing avalanche risk. These layers are particularly hazardous because they may lie buried deep within the snowpack, remaining unstable for long durations until triggered by additional stress—such as a skier passing overhead or fresh snowfall. Understanding the existence of PWLs is critical for avalanche prediction, as they are often responsible for large-scale, deep, and deadly avalanches.

The post-WWII geopolitical situation in the Middle East resembles a PWL in today’s global order, with flashpoints frequently tied to Israel. From a financial market perspective, the “avalanche” we’re watching includes fluctuations in energy prices, disruptions to global supply chains, and whether hostilities between Israel and other Middle Eastern countries—especially Iran or its proxies—could escalate to nuclear weapon use.

As investors and traders, we find ourselves in a dangerous yet thrilling environment. On one hand, China has launched massive monetary easing and reflation efforts, prompting major economies to lower currency values and expand money supply. This seems like the ideal moment to take maximum long-term risk exposure—and clearly, I mean cryptocurrencies. However, if tensions between Israel and Iran continue escalating, leading to destruction of Persian Gulf oil fields, closure of the Strait of Hormuz, or even nuclear detonation, crypto markets could suffer severe damage. As the saying goes, war is not investable.

I face a choice: should I keep selling fiat to buy crypto, or reduce my crypto holdings and shift into cash or U.S. Treasuries? If this truly marks the beginning of a new bull run for crypto, I don’t want to miss out. But neither do I want to lose heavily if Bitcoin crashes 50% in a single day due to a financial avalanche sparked by conflict between Israel and Iran. Bitcoin will eventually recover—but what worries me more are some worthless parts of my portfolio… like meme coins.

I’d like to walk readers through my thought process regarding Maelstrom portfolio allocation using simple scenario analysis.

Scenario Analysis

Scenario One: The conflict between Israel and Iran evolves into limited military exchanges. Israel continues targeted assassinations, while Iran responds with predictable, non-threatening missile attacks. No critical infrastructure is destroyed, and no nuclear strikes occur.

Scenario Two: The conflict escalates, resulting in partial or total destruction of Middle Eastern oil infrastructure, closure of the Strait of Hormuz, or even nuclear attacks.

In Scenario One, the persistent weak layer remains stable. In Scenario Two, it fails—triggering a financial market collapse. We’ll focus on the second scenario, as it poses a direct threat to my portfolio.

I will assess the impact of Scenario Two on the cryptocurrency market, especially Bitcoin. As the reserve asset of crypto, Bitcoin dictates the movement of the entire sector.

What concerns me more is that, given the U.S. commitment to deploy THAAD missile defense systems in Israel, Israel might intensify its offensive operations. Israel may be planning a major strike, anticipating strong retaliation from Iran—and thus requesting reinforcements from President Biden. Moreover, the more publicly Israel declares it won’t attack Iran’s oil or nuclear facilities, the more suspicious I become that this is exactly their intention.

According to Reuters, on Sunday the U.S. announced it would send troops and advanced anti-missile systems to Israel—a rare deployment aimed at strengthening Israel’s air defenses following potential Iranian missile attacks.

Risk One: Physical Destruction of Bitcoin Mining Rigs

War is highly destructive. Bitcoin miners represent the most valuable and important physical assets in the cryptocurrency ecosystem. What kind of damage might they sustain in the event of war?

A key assumption in this analysis is where the conflict spreads. Although the war between Israel and Iran is essentially a proxy conflict between the U.S./EU and China/Russia, I assume neither side wants direct confrontation. Containing the conflict within these regional nations is preferable. Ultimately, the actual combatants are nuclear powers. The United States, as the most aggressive global military force, has never directly attacked another nuclear-armed country. That fact speaks volumes—especially considering the U.S. is the only nation to have used nuclear weapons (to force Japan’s surrender in WWII via atomic bombings). Thus, it’s reasonable to assume actual military engagements would remain confined to the Middle East.

The next question: Are any Middle Eastern countries conducting significant Bitcoin mining? According to some media reports, Iran is the only country in the region where Bitcoin mining thrives. Depending on sources, Iranian miners account for around 7% of global hash rate. What happens if Iran’s hash rate drops to zero due to internal energy shortages or missile strikes on facilities? Practically nothing.

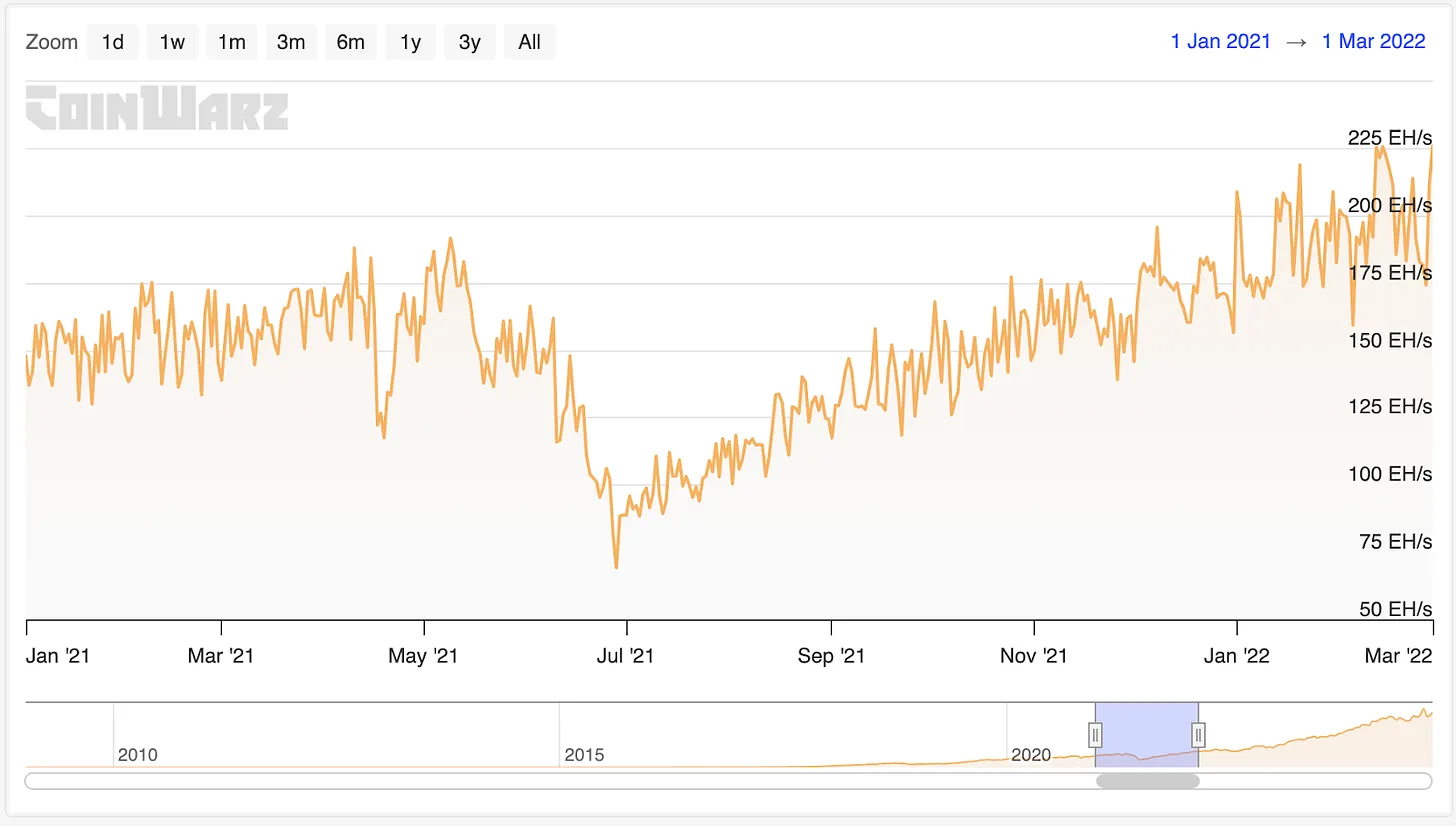

This chart shows Bitcoin network hash rate from January 2021 to March 2022.

Do you remember the 63% drop in hash rate after China banned Bitcoin mining in mid-2021? The network recovered to its May 2021 peak within just eight months. Miners either relocated out of China, or participants in other countries ramped up operations due to better economic conditions. Most importantly, Bitcoin reached an all-time high in November 2021. The sharp decline in network hash rate had no noticeable impact on price. Therefore, even if Iran were completely destroyed by Israel or the U.S., wiping out up to 7% of global hash rate, it would have negligible effect on Bitcoin.

Risk Two: Sharp Rise in Energy Prices

Next, consider what happens if Iran retaliates by destroying major oil and gas fields. The Achilles’ heel of the Western financial system is its dependence on cheap hydrocarbons. Even if Iran destroys Israel, the war wouldn’t end. Israel is merely a useful and expendable vassal of American hegemony. If Iran wants to strike the West, it must destroy hydrocarbon production and block oil tankers from passing through the Strait of Hormuz.

Oil prices would surge, driving up all other energy costs, as oil-deficient nations turn to alternative energy sources to sustain their economies. How would Bitcoin’s fiat-denominated price react? It would rise along with them.

Bitcoin can be viewed as digitally stored energy. Hence, when energy prices increase, so does Bitcoin’s value in fiat terms. Mining profitability wouldn’t fundamentally change, as all miners face synchronized increases in energy costs. Some large industrial miners might struggle to secure energy if governments invoke force majeure clauses to cancel utility contracts. But if hash rate declines, mining difficulty adjusts downward—allowing new entrants to profit even at higher energy prices. The elegance of Satoshi Nakamoto’s design would shine through.

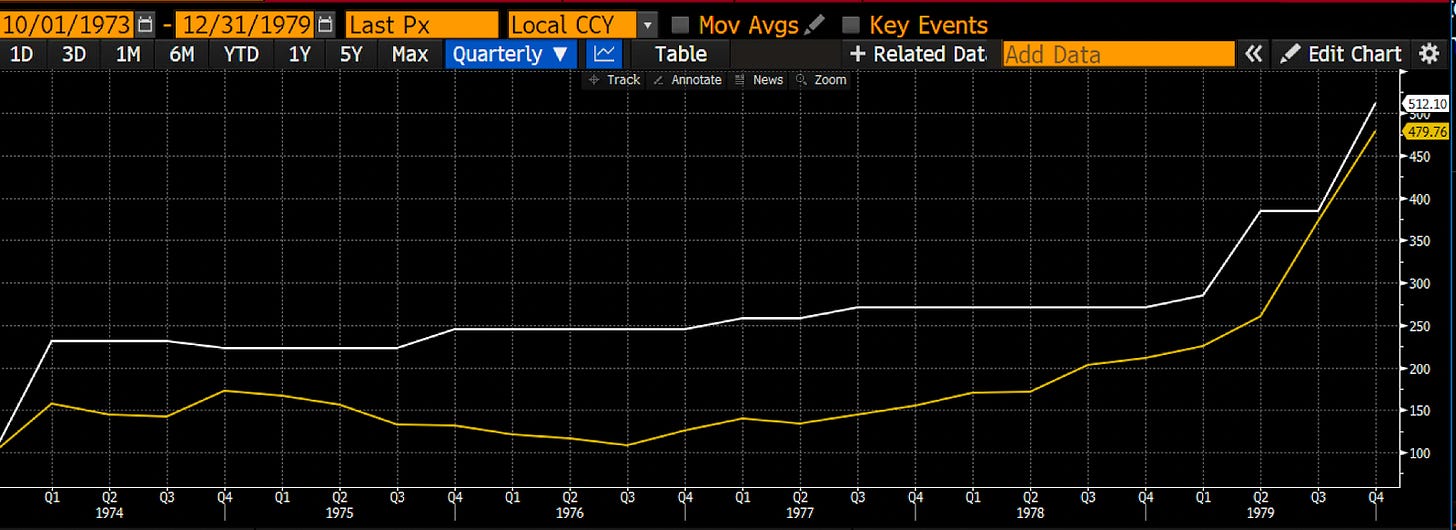

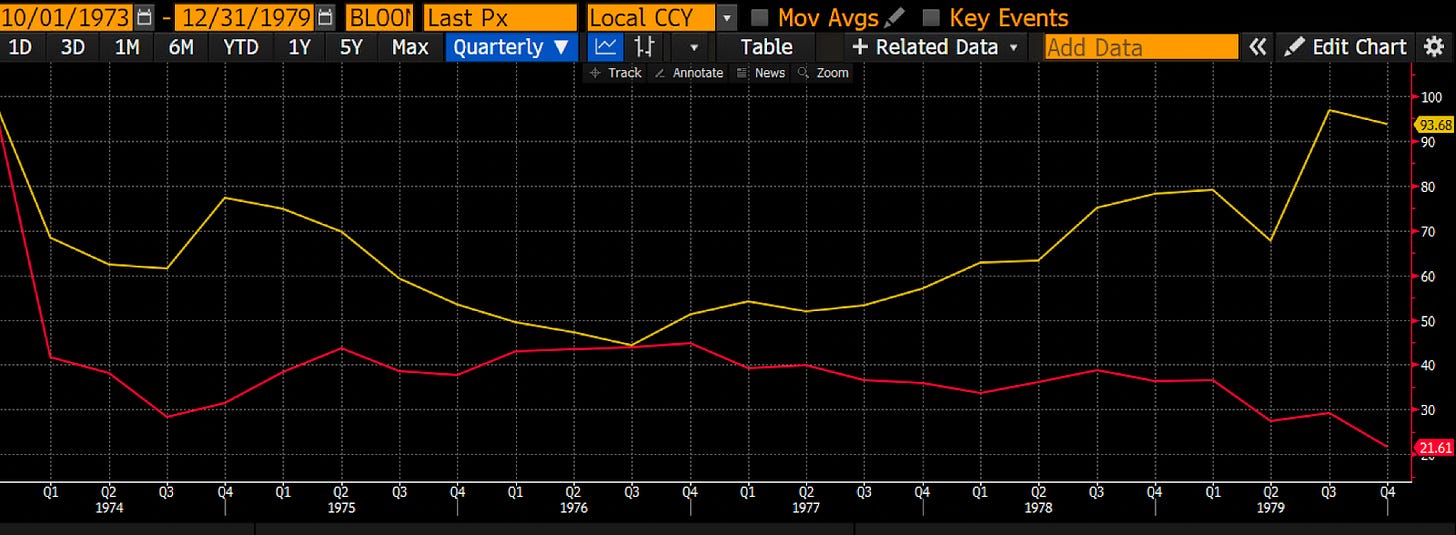

If you’re looking for a historical example of hard money resilience during energy shocks, look at gold’s performance between 1973 and 1982. In October 1973, Arab nations imposed an oil embargo on the U.S. in retaliation for American support of Israel during the Yom Kippur War. In 1979, Iran’s revolution overthrew the Western-backed Shah and established the current theocratic regime, removing Iranian oil from global markets.

The spot oil price (white) and gold price (yellow), indexed to 100 against the dollar. Oil rose 412%, while gold nearly kept pace with a 380% gain.

This chart compares gold prices (gold) and S&P 500 index (red), adjusted for oil prices and indexed to 100. Gold’s purchasing power declined only 7%, while equities lost 80%.

Assuming either side removes Middle Eastern hydrocarbons from the market, the Bitcoin blockchain will continue operating, maintaining at least parity with energy value and almost certainly rising in fiat terms.

I’ve discussed physical and energy risks—now let’s examine the final monetary risk.

Risk Three: Monetary Policy

The crucial question is how the U.S. will respond to the conflict. Both Democrats and Republicans firmly support Israel. Even as Israeli forces inflict civilian casualties while attempting to destroy Iran and its proxies, America’s political elite will continue backing Israel. The U.S. supports Israel militarily by supplying weapons. Since Israel cannot afford the weapons needed to fight Iran and its proxies, the U.S. government borrows money to pay American defense contractors like Lockheed Martin for ammunition provided to Israel. Since October 7, 2023, Israel has received $17.9 billion in military aid.

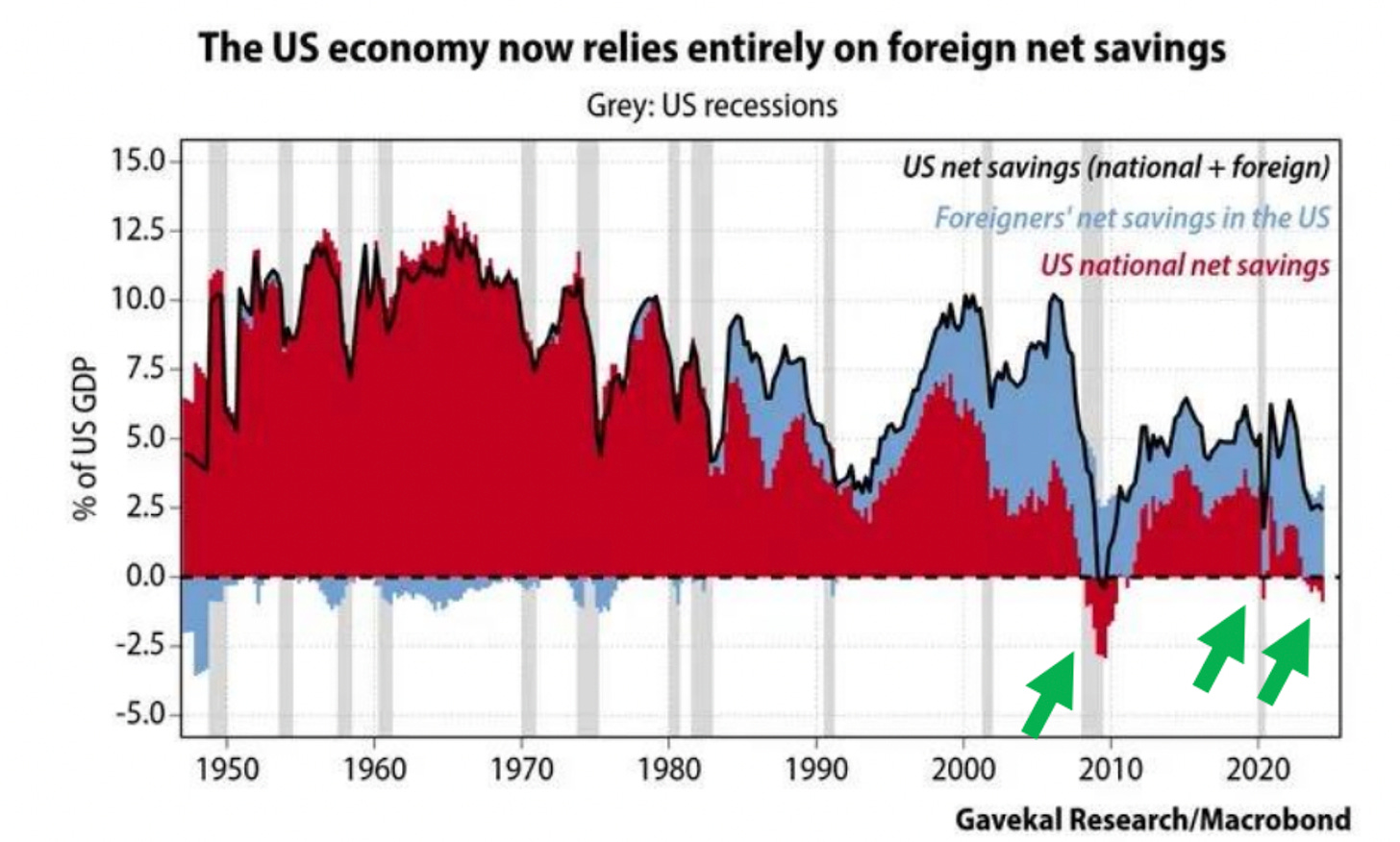

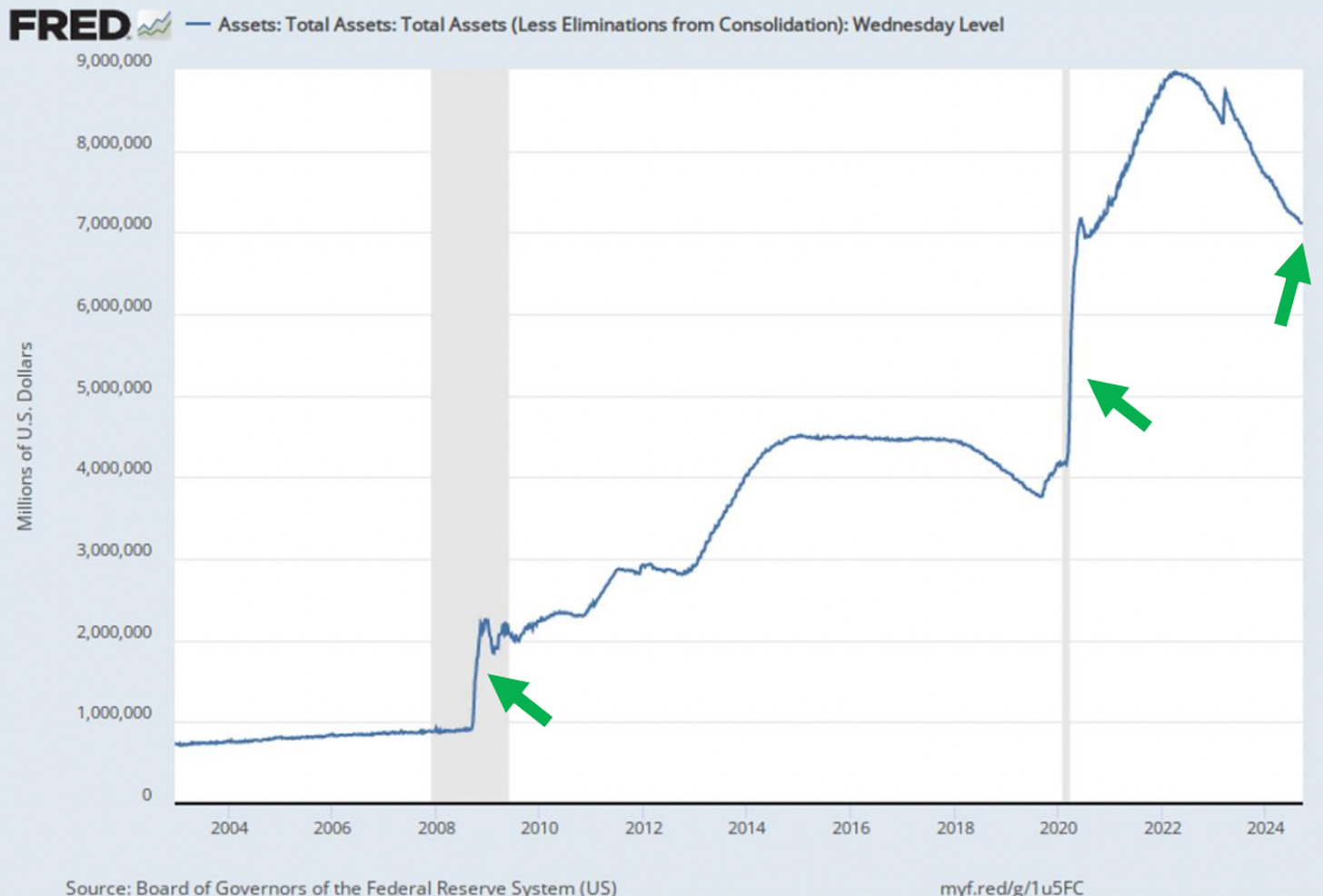

The U.S. government purchases through borrowing, not savings—this is what the chart illustrates. To provide free weapons to Israel, the already deeply indebted U.S. government must borrow further. The problem arises: who buys this debt when national savings are negative? The green arrows indicate periods when U.S. net national savings turned negative. Luke Gromen points out these periods correspond to sharp expansions of the Federal Reserve’s balance sheet.

The U.S. plays kingmaker in Israel’s military campaign, requiring more borrowing. Just as after the 2008 Global Financial Crisis and the COVID-19 lockdowns, either the Fed or the commercial banking system will rapidly expand its balance sheet to absorb newly issued debt.

How will Bitcoin react to another massive expansion of the Fed’s balance sheet?

This chart shows Bitcoin price divided by the Fed’s balance sheet, indexed to 100. Since its inception, Bitcoin has outperformed the growth of the Fed’s balance sheet by over 25,000%.

We know war causes inflation. We understand the U.S. government needs to borrow to sell weapons to Israel. We also know the Federal Reserve and U.S. banking system will monetize this debt through money printing and balance sheet expansion. Therefore, it’s foreseeable that as conflict intensifies, Bitcoin’s fiat-denominated price will surge dramatically.

Regarding Iran’s war financing, will China and Russia somehow support Iran’s war effort? China is willing to buy Iranian hydrocarbons, and both China and Russia sell goods to Iran—but none of these transactions involve credit. More realistically, I believe China and Russia may play cleanup roles. They’ll publicly condemn the war but take no effective action to prevent Iran’s downfall.

Israel isn’t interested in nation-building. Instead, it may hope that attacks spark domestic unrest leading to regime collapse in Iran. In that case, China could step in with its usual diplomatic playbook—offering loans to a newly formed, weak Iranian government to rebuild using Chinese state-owned enterprises. This mirrors President Xi Jinping’s “Belt and Road Initiative” pursued throughout his tenure. Resource-rich Iran—with abundant minerals and hydrocarbons—would then fully integrate into China’s economic sphere. China could find a new market in the Global South to offload its surplus of high-quality, low-cost manufactured goods. In exchange, Iran would supply China with cheap energy and industrial raw materials.

From this perspective, Chinese and Russian support won’t increase the global supply of fiat currency. Therefore, it won’t meaningfully affect Bitcoin’s fiat price.

Escalating Middle East conflict won’t destroy any critical physical infrastructure supporting cryptocurrencies. With soaring energy prices, Bitcoin and crypto values will rise. Hundreds of billions—or even trillions—of newly printed U.S. dollars will fuel another Bitcoin bull market.

Trade Cautiously

While Bitcoin may rise over the long term, that doesn’t mean its price won’t experience extreme volatility, nor does it imply all altcoins will benefit equally. Proper position sizing is key.

I prepare every investment in my portfolio for sharp valuation swings. As some readers know, I’ve invested in several meme coins. When Iran launched missiles at Israel, I promptly reduced these positions—because in the short term, crypto assets’ reactions to escalating conflict are unpredictable. I realized my exposure was too large; losing all my capital on joke cryptocurrencies would leave me deeply regretful. Currently, the only meme coin I hold is Church of Smoking Chicken Fish (ticker: SCF). R’amen.

I haven’t instructed Maelstrom’s investment head Akshat to slow down or halt investments in pre-sale tokens. For Maelstrom’s idle cash, I plan to stake it on Ethena to earn solid returns while waiting for optimal entry points into various liquid altcoins.

As a trader, the worst mistake is trading based on who you think stands on the “right” side of a war. That path leads to losses, because both sides face financial suppression, asset seizures, and destruction. The wisest approach is to ensure your own and your family’s safety first, then allocate capital to investments that can withstand fiat devaluation and preserve their energy purchasing power.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News