Will Meme coins reach a trillion-dollar market cap? Discover the rise of Murad, the new king of meme coin pump calls

TechFlow Selected TechFlow Selected

Will Meme coins reach a trillion-dollar market cap? Discover the rise of Murad, the new king of meme coin pump calls

Super cycle, instant fame.

Author: TechFlow

You've probably seen this guy a lot lately — long hair, big beard, glasses, oozing rock-and-roll vibes.

His name is Murad Mahmudov. He wasn't previously considered a major crypto KOL, but thanks to a flurry of recent analysis and commentary overseas, he's suddenly become the meme coin hype king and top bull evangelist.

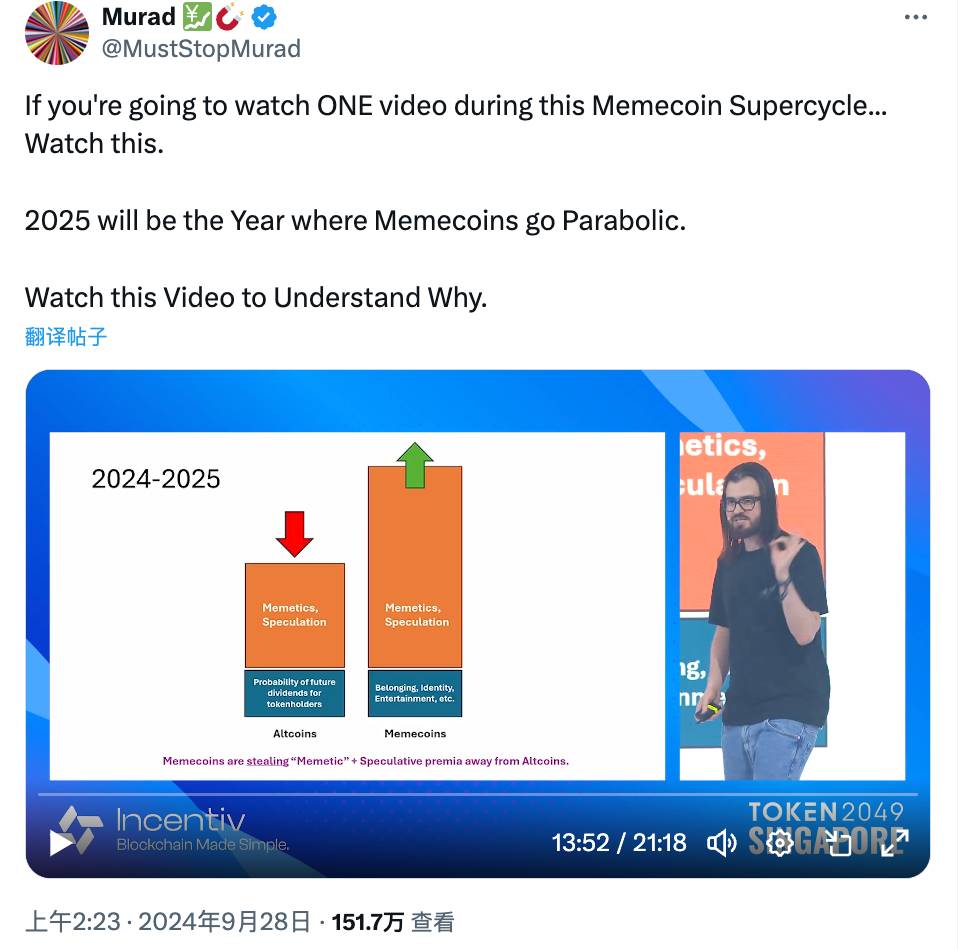

What catapulted him into the spotlight was his talk at the 2049 conference in Singapore titled "The Meme Coin Supercycle," which has already racked up 1.76 million views as of publication.

If you haven’t heard of him yet, watching that video will show you just how seriously — with formal theories, solid data, and unwavering conviction — he’s pushing meme coins. His key statements are packed with emotional appeal and dramatic flair:

For instance, the total market cap of meme coins will surpass one trillion dollars; Bitcoin will reach $200 trillion within 20 years; you need to completely overhaul your investment logic to embrace this new cycle and dive into memes...

The speech itself has attracted massive viewership, but far less attention has been paid to Murad’s personal background:

From learning Chinese to entering the crypto world, from founding a hedge fund that later collapsed, to becoming a master of meme coin promotion — and now with his wallet addresses exposed, suspicions arise that he may be "talking his book."

We’ve compiled more information to help you quickly understand the past and present of this newly crowned “hype king.”

Learning Chinese, Origin Story at OKCoin

Initially, Murad wasn’t part of the crypto scene.

He grew up in Azerbaijan, moved to the U.S. at age 16 for school, and eventually attended Princeton University — a story similar to many young dreamers chasing the American Dream.

Interestingly, according to an interview with Blockworks, Murad revealed that during this time, he began studying both Chinese and French.

It was precisely because of learning Chinese that he got the chance to spend a year in China.

That year, Murad was 17 — and it was 2013, the year Bitcoin experienced its largest annual price surge ever, nearly 6000%.

Old-timers surely remember: in 2013, China was unquestionably the center of the crypto world. Mining and public awareness of Bitcoin were heating up rapidly. As Murad put it in his interview:

"I was in the right place at the right time."

In Beijing’s expat circles, Murad met employee No.5 of OKCoin — an American — through whom he first learned about cryptocurrency.

And OKCoin, of course, was the predecessor of today’s OKX.

Clearly, Murad got into crypto early. His mention of being in the “right time” carries another layer of meaning — he learned about crypto in China before the historic crash known as “94,” i.e., before the bubble burst — an experience that profoundly influenced his life, perspectives, and career afterward.

Later, Murad joined Goldman Sachs as an advisor, but those early experiences deepened his belief in Bitcoin as a store of value.

Don’t forget, back then memes weren’t flooding the space, and the old-school consensus of “Bitcoin is gold, Litecoin is silver” was unshakable.

So initially, Murad belonged to the Bitcoin cult, not the Meme cult (Meme Cults).

Fund Management, Blown Up During Pandemic

The turning point came in 2017.

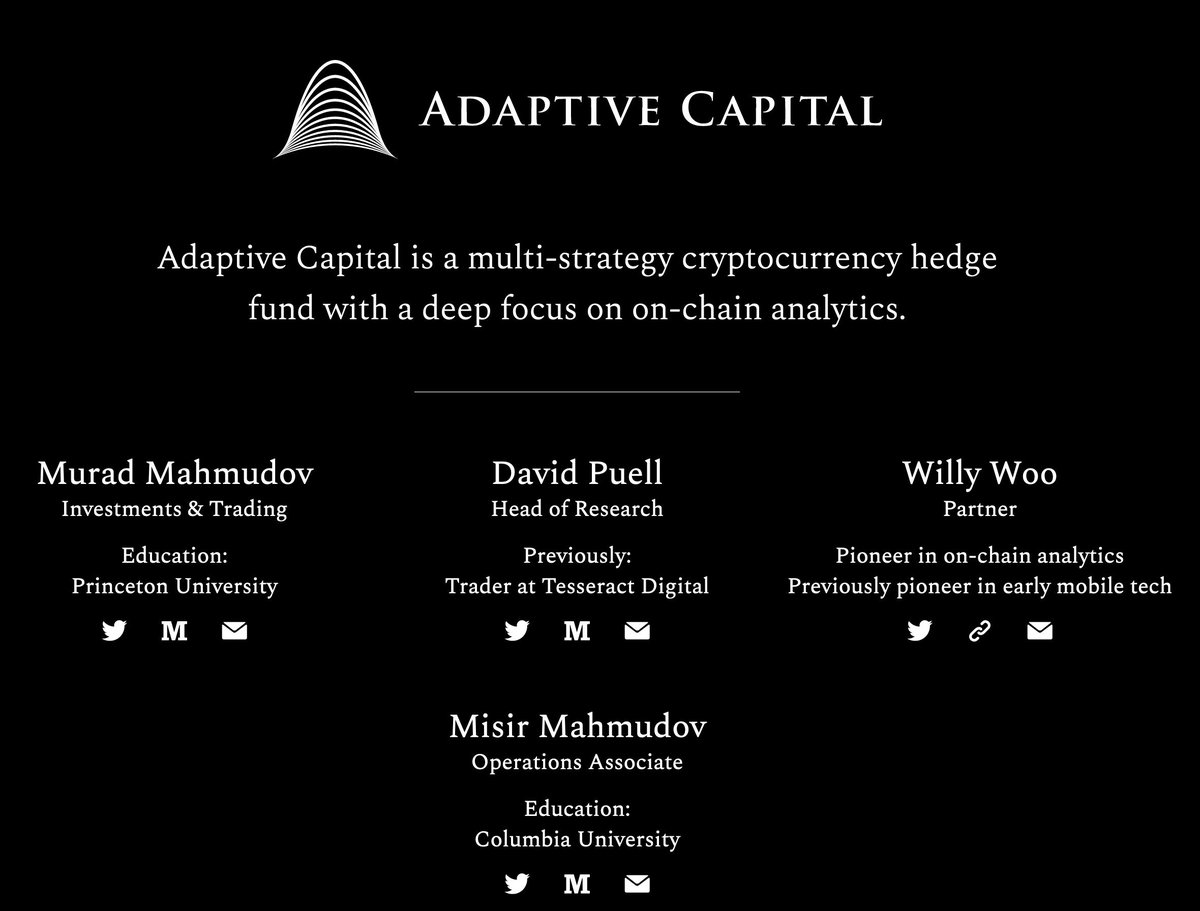

Although the entire crypto industry bled out due to the “94” incident that year, Murad founded Adaptive Capital — a small crypto hedge fund — around the same time.

If you dig through image search results, you can still find promotional pages for the company today. Murad handled investment and trading roles — loosely speaking, the so-called “trader” or “portfolio manager.”

Being on the front lines, Murad naturally accumulated significant trading and market observation experience.

But as the saying goes: if you walk by the river often enough, your shoes will get wet — especially beside the treacherous crypto river, where volatility shifts faster than the weather.

In 2020, the global pandemic hit, and international dynamics shifted dramatically.

At the same time, the crypto market swung wildly between highs and lows. On March 13th, after Bitcoin dropped over $1,000 in price, Murad’s Adaptive Capital suffered heavy losses. The firm sent an open letter to all investors announcing it would shut down and return remaining capital to limited partners.

Adaptive Capital blamed centralized exchanges (CEX) for halting services during the price crash, preventing them from adjusting positions in time and leading to liquidations:

"Some of the respected exchanges we use daily stopped operating during the sell-off, severely impairing our ability to respond accordingly."

In retail trader slang, this is the classic case of an exchange “pulling the plug.”

Right or wrong aside, as head of trading and investments at the fund, Murad clearly took a hit during the unplugged event — perhaps planting the seeds for his later pivot toward on-chain memes and seeking more opportunities directly on-chain.

Supercycle Speech, Overnight Fame

In 2022, Murad became increasingly active on social media, posting “I’m back.”

He firmly believed the industry would absorb even more capital, and that bear markets were the perfect time to plan for the next bull run.

And around that same time, various meme coins started emerging, catching Murad’s attention.

The rest is history: the long-haired guy took the stage at 2049 and delivered his passionate presentation titled “Memecoin Supercycle,” igniting massive viewing and discussion across CT (Crypto Twitter).

Prior to this, Murad’s story was largely unknown. But as the saying goes, “those who deliver emotional value get traffic.” Murad’s bold claims in the speech brought him extraordinary popularity — such as meme coins reaching a $1 trillion market cap, and Bitcoin hitting $200 trillion within 20 years.

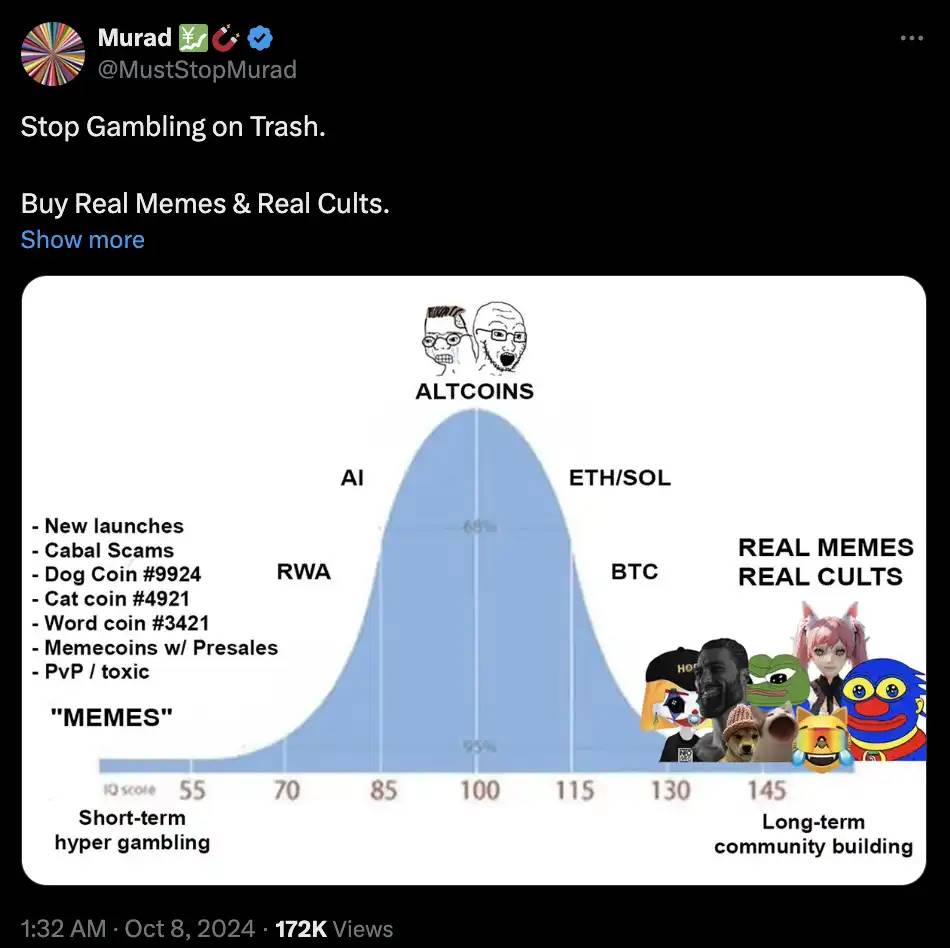

With memes running rampant and meme coins constantly breaking into the top 50 market caps, Murad’s “supercycle” narrative gave every meme investor confidence and legitimacy in their holdings — and he wasn’t just blindly shilling.

For example, he offered a semi-academic yet accessible classification of most crypto tokens: if a token isn’t a store of value nor generates income distribution, then it’s a memecoin.

As Twitter user @0xWendy99 put it:

"The difference with this Princeton guy is his 'legitimacy' is way stronger than Ansem’s. He speaks like proper military-grade finance. 'Tokenized communities,' 'tokens as products' — memes are no longer side jokes or low-tier assets. He uses theory to guide meme investing, systems to drive speculation. Retailers feel sophisticated hearing him, institutions feel justified."

With early trading experience combined with strong theoretical pitching skills, Murad rose to fame overnight with one single speech during the supercycle.

High Status Brings Scrutiny: Is It Just Talking Your Book?

With fame comes controversy — Murad is no exception.

After skyrocketing to prominence, Murad frequently promoted specific coins, analyzing the quality and investment potential of various memes.

This inevitably raised suspicion: is his staunch bullishness on memes driven by financial interest? Could he be pumping to dump?

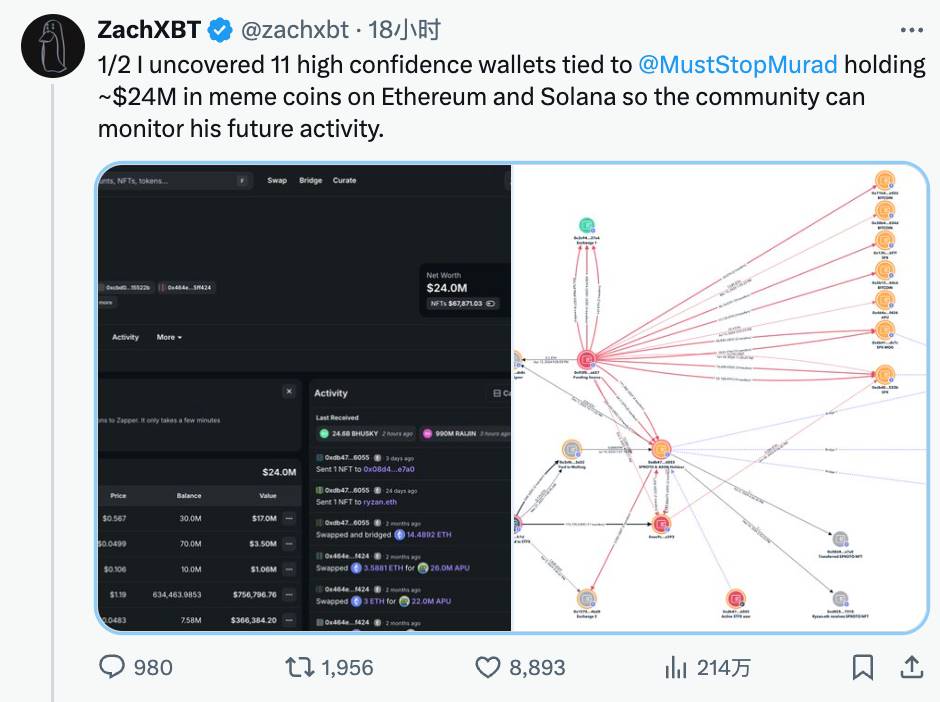

Enter famed on-chain investigator ZachXBT, who recently uncovered 11 wallet addresses疑似 highly linked to Murad, holding approximately $24 million worth of meme coins across Ethereum and Solana.

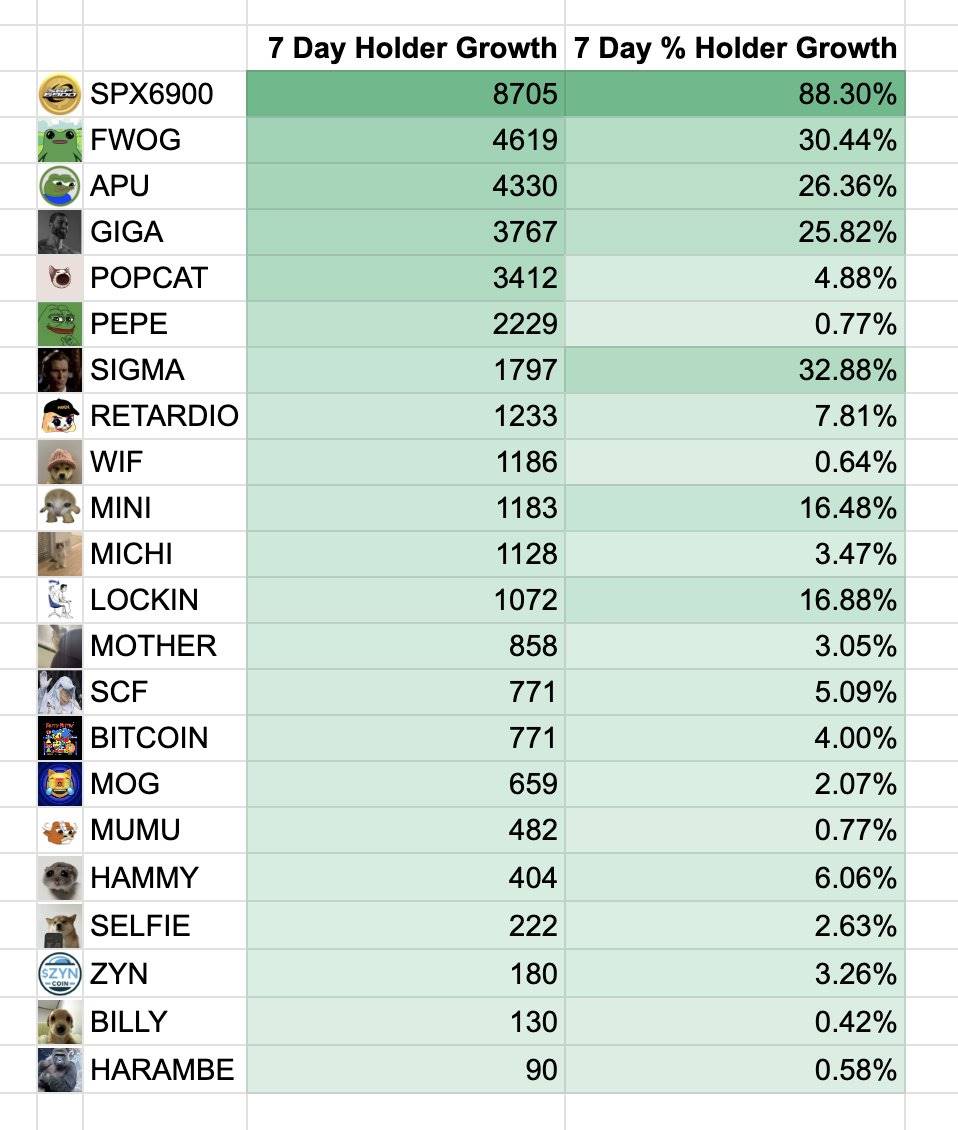

Data shows some of these addresses bought large amounts of the meme coin SPX between June and August, achieving over 60x returns within four months — perfectly aligning with Murad’s publicly recommended meme rankings:

Still, there's a classic truth circulating in crypto circles:

Not promoting a coin you bought is downright stupid.

Murad bought and promoted — in a sense, practicing what he preaches. Whether this is a calculated scheme to buy first, then pump so others push the price up for him, or pure faith in the Meme cult so strong he wants everyone else to believe too — well, that’s open to interpretation.

Currently, the community is fiercely debating the ethics of exposing Murad’s wallet holdings.

Some Twitter users argue ZachXBT’s actions help protect followers from getting dumped on; Slorg, project lead of Solana tool Sol Incinerator, questioned: "Do you really think this stuff was hidden?" implying such info is public anyway, so exposure isn’t unjustified.

But voices opposing full exposure are also loud:

Udi Wertheimer, co-founder of Taproot Wizards, said publicly seizing someone’s wallet to prevent potential wrongdoing is crazy; others disagree with painting a target on Murad prematurely, especially when he hasn’t done anything wrong.

Buying and trading tokens isn’t inherently criminal;

Yet, as the saying goes, “it’s cold at the top.” When a hype-driven maximalist suddenly gains massive visibility and influence, people will inevitably scrutinize him under a microscope, digging for any clues.

Whether it’s for clout, or moral duty to expose insider manipulation, fame always brings drama — and the higher you climb, the colder it gets.

We can’t definitively say whether Murad is simply a true believer or a master manipulator of retail investors. But in an interview, he did say: “For certain tokens, I’ll definitely sell some by the end of 2025 or early 2026… but for others, I plan to hold long-term and ride through cycles.”

Yet there’s a good saying: Peak popularity brings false loyalty; only twilight reveals the truly faithful.

After this supercycle ends, whether newcomer hype king Murad is still holding memes or has switched back to BTC — time will tell.

Appendix: Wallet addresses strongly associated with Murad, identified by on-chain investigator

ETH

0x6b411100c72ba2445e50ffd20839c28b3546de7c

0xcbd0dee0c3eed152c3398b062361becc4a15522b

0x13fc38ec99a8217a06d1dc6db8c0bf0ee97ebf7f

0x71b4fd11eef705ba60176e7c034cd1a4f97ae02d

0x30b46a659761b576a00028b44d1e37fdc64b034d

0x5b1569db234a0f2884814a3f7184f01cf641b0c6

0x464e0a666734ba93e231d929ace538eaf05ff424

0xdb47714727cba70f0408ba30dc4ea0b5ac436055

SOL

7QZGS7MQ4S6hRmE8iXoFTXgQ2hXVUCho2ZhgeWvLNPZT

GyBkVYkHBPMapyQeueQ6d44YthwqYiX4ajgnGLqq9P7r

2xn57hPD2v6ighJFPXNPSoiGUXkW4KKo8Hb3NpXmHZvZ

Dashboard:

https://dune.com/0xtoolman/murad-buys-and-sells

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News