TVL Surpasses $1 Billion, Market Cap Ranks 20th: What's Happening with Sui?

TechFlow Selected TechFlow Selected

TVL Surpasses $1 Billion, Market Cap Ranks 20th: What's Happening with Sui?

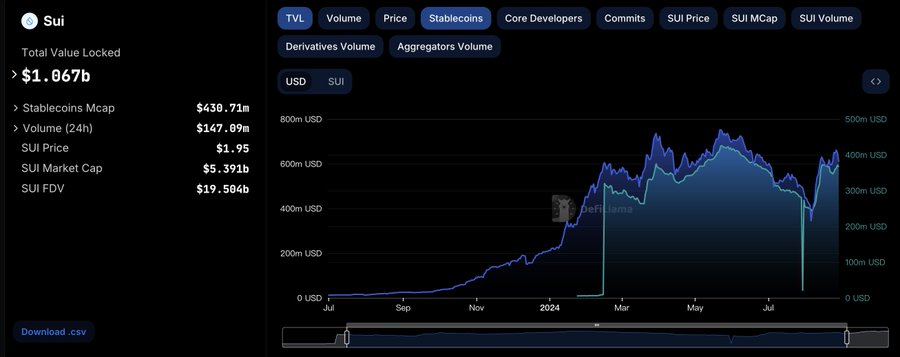

SUI has performed strongly since Q4 2023, with its market cap growing 120% quarter-on-quarter, followed by a further 176% increase in Q1 2024.

Author: Greythorn

This week, SUI led a new wave of gains driven by its token unlock, mainnet launch of the cross-chain bridge, and an unprecedented surge in meme activity, advancing its market capitalization to 20th place.

Overview

Sui is a permissionless, PoS-based Layer 1 blockchain developed by Mysten Labs, designed to deliver instant settlement and high throughput while supporting numerous next-generation latency-sensitive decentralized applications. The project was founded by former members of Facebook's Libra/Diem team after its dissolution and has attracted significant attention and funding from investors.

Market Performance

According to 2024 market data, SUI has performed exceptionally well:

-

Market Cap Growth: SUI demonstrated strong performance starting in Q4 2023, with a 120% quarter-on-quarter increase in market cap, followed by another 176% growth in Q1 2024.

-

Price Trend: SUI showed volatility throughout 2024 but maintained an overall upward trajectory. On March 27, 2024, SUI reached its all-time high of $2.18. As of October 3, 2024, the price further advanced, reaching approximately $1.92 at the time of writing.

-

Current Price: $1.92 (as of noon on October 3, 2024)

All-Time High: $2.18 (March 27, 2024)

Gain: Over 100% increase over the past three months

Sui Ecosystem Projects

Since its mainnet launch, Sui’s ecosystem has rapidly expanded, attracting numerous developers and enterprises.

Below is a brief overview of key projects already launched on the Sui blockchain:

DeFi Projects:

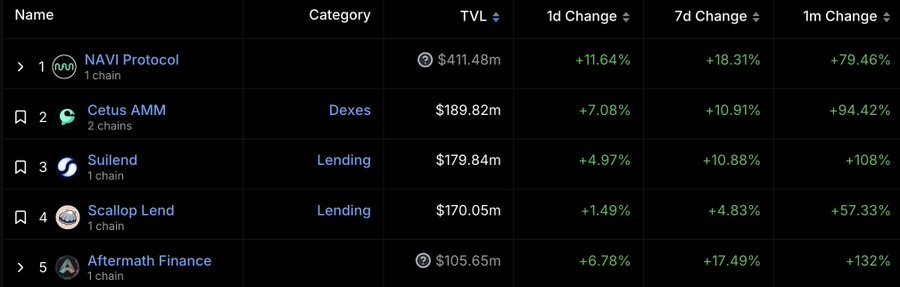

According to DefiLlama, five protocols currently have TVL exceeding $100 million:

Decentralized Exchanges (DEX)

-

Cetus: In the SUI ecosystem, Cetus holds a prominent market position with $180 million in TVL. As an efficient decentralized trading platform, Cetus offers a user-friendly experience, supports a wide range of token swaps, and allows users to participate in liquidity pools to potentially earn trading fees.

-

DeepBook: The first order-book DEX in the Sui ecosystem, DeepBook provides decentralized liquidity for Sui. Built collaboratively by MovEX and the Sui Foundation, it has been integrated into Sui’s official framework.

Lending Protocols

-

Navi: As the largest lending platform in the SUI ecosystem by TVL, Navi manages up to $410 million in assets. This protocol enables users to collateralize their assets to borrow others, offering flexible capital usage and supporting diverse investment and financial strategies.

-

Scallop: Another key lending protocol, Scallop holds a significant presence in the SUI ecosystem with $170 million in managed assets. It provides additional capital utilization options, contributing to financial diversity and robust growth within the Sui ecosystem.

-

Suilend: The Suilend lending protocol marks Solend’s first expansion beyond the Solana ecosystem. **By launching on Sui, Solend leverages the inherent security features built into the Move language, providing native protection for its smart contracts.

Wallet Solutions

-

OKX Wallet: A comprehensive digital asset management tool, OKX Wallet supports multi-chain functionality, including seamless integration with the SUI chain.

-

Sui Wallet: One of the most widely used wallets in the SUI ecosystem, known for its full-featured capabilities and user-friendly interface.

-

Suiet: Suiet (pronounced "sweet") is a self-custodial wallet built on the Sui blockchain, with fully open-source code.

Gaming Projects:

-

SuiPlay0x1: A lightweight handheld gaming device that has already entered pre-sales, selling over 2,000 units. Featuring native Web3 capabilities, it plans global release in 2025.

-

DARKTIMES: A battle royale game on Sui, developed by Blowfish Studios—an elite game studio under Animoca—and backed by Animoca Brands. DARKTIMES leverages the unique attributes of Web3 technology via Sui to host digital assets, including the $TIMES token, Genesis NFTs, and various decorative in-game character items integrated into the DARKTIMES ecosystem.

Meme Tokens

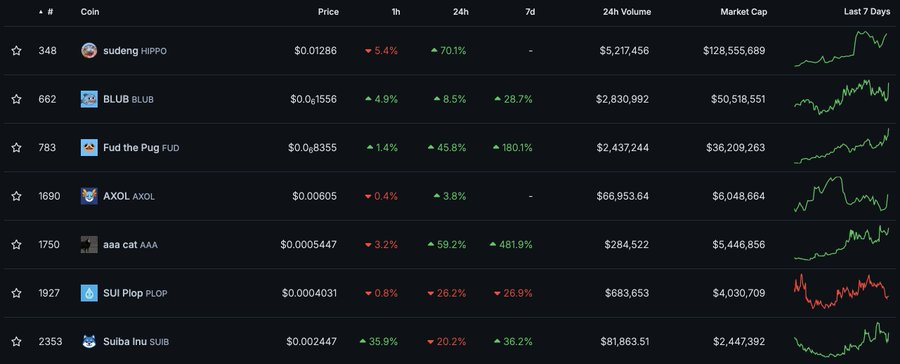

The current meme trend on Sui draws inspiration from successful memes on Solana, combined with Sui’s own aquatic theme, creating a familiar yet fresh appeal.

It should be noted that meme tokens on Sui are highly volatile and carry substantial risks. Users should exercise caution when participating to minimize exposure to scams and losses.

Below are some data provided by Coingecko for reference only.

Coingecko

$Hippo: The Hippo in the Water

Market Cap: $128,555,689

Twitter:https://x.com/blubsui

Telegram:https://t.me/HIPPO_SUI

Project Overview: Gained widespread attention after recently surpassing a $100 million market cap. According to the official website, this community will donate a portion of profits to wildlife conservation organizations worldwide.

$BLUB: The Pepe of the Water

Current Market Cap: $50,518,551

Twitter:https://x.com/blubsui

Telegram:https://t.me/blubsui

Project Overview: $BLUB originated in late June 2024. Its design resembles Pepe, earning it the nickname “Pepe of the water,” blending Pepe’s aesthetic with Sui’s droplet imagery. While not as strong in price momentum compared to Hippo, BLUB remains worth watching given the early stage of Sui’s meme cycle—potentially becoming the second meme project on Sui to exceed $100 million in market cap.

$FUD: The Dog in the Water

Current Market Cap: $36,209,263

Twitter:https://x.com/fudthepug

Telegram:https://t.me/fudthepug

Telegram Bot:https://t.me/FUDSuiBot

Project Overview: FUD was an airdrop distributed in December 2023 to the Sui NFT community. Notably, $FUD has no team or private sale allocations. Due to its early launch, $FUD boasts a mature community and ecosystem. On October 3, it launched a Telegram bot enabling fast trades. Additionally, FUD is widely integrated across multiple DeFi and GameFi projects on Sui.

Team Members

Mysten Labs is a research-driven company founded by former executives of Meta (Facebook)'s Novi Research and chief architects of the Diem blockchain and Move programming language.

-

Evan Cheng: Co-founder and CEO of SUI, formerly Director of Engineering at Facebook overseeing Novi Research.

-

Sam Blackshear: Head of Technology, primary designer of the Move programming language.

-

George Danezis: Chief Scientist, Cambridge PhD and USL professor, with extensive experience in blockchain and privacy-preserving technologies.

-

Avery Ching: Chief Technology Officer, former senior engineer at Facebook.

The team maintains close ties with Meta. After Meta’s 2019 stablecoin initiative Diem (formerly Libra) failed, the team seemingly disappeared from the crypto space. However, regulatory and compliance pressures remain high. Whether Meta might leverage former team members involved in Aptos and Sui to re-enter the crypto arena remains uncertain.

Token Economics

-

Total Supply: 10 billion SUI tokens

-

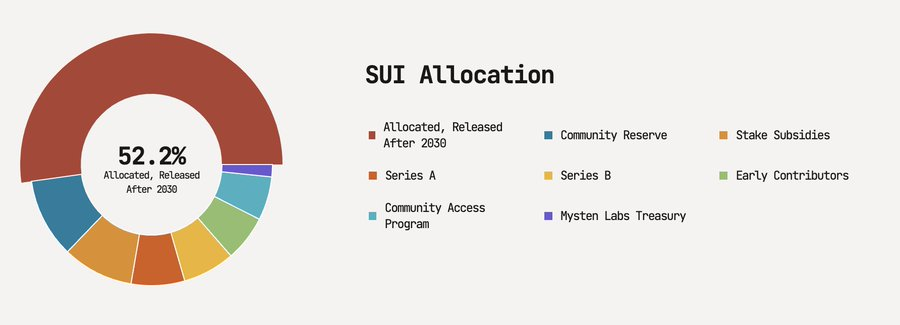

Allocation:

-

Allocations beyond 2030: 52.2% (5.22 billion tokens)

-

Community Reserve: 10.6% (1.06 billion tokens)

-

Staking Subsidies: 9.5% (949.41 million tokens)

-

Series A Investors: 7.1% (714.17 million tokens)

-

Series B Investors: 7% (695.56 million tokens)

-

Early Contributors: 6.1% (613.37 million tokens)

-

Community Access Program: 5.8% (582 million tokens)

-

Mysten Labs Treasury: 1.6% (163.48 million tokens)

Unlock Schedule

Approximately 52.2% of tokens will be unlocked after 2030 to ensure long-term project funding and development support. Regular token unlocks may cause market volatility, so investors should closely monitor related announcements and economic activities.

Economic Model

SUI’s economic model aims to maintain network activity and growth through generous staking rewards and community incentives, while driving real-world token utility via innovation in smart contracts and decentralized applications.

Inflation and Supply Dynamics: SUI employs a balanced supply model combining inflation and scarcity to support flexibility during early development and value preservation in later stages.

Staking Mechanism: By encouraging token holders to stake, SUI emphasizes decentralization and community participation.

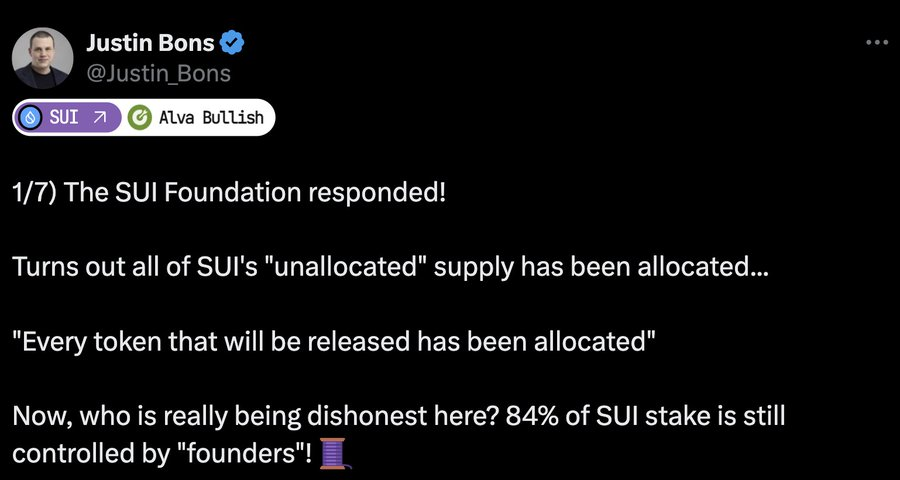

Notably, the founder of CyberCapital pointed out that although Sui claims its locked tokens are held by third-party custodians, the unlocking of these "unallocated" supplies post-2030 is merely an unsupported promise. We must trust the foundation, which has legally secured every exit option for itself—custodians typically do not enforce locking!

Key Events in 2024

In 2024, Sui has made active moves both technologically and commercially:

1. Network Iteration Updates:

The SUI network underwent two major updates in September. The mainnet has now been upgraded to version V1.34.2, with protocol version updated to 60.

2. New Platforms and Tools:

-

Hydropower Program: An eight-week virtual accelerator program providing hands-on workshops and expert guidance to technical teams, accelerating the development of the SUI ecosystem. Applications close on October 16.

-

Enoki Platform: An enterprise solution platform launched by Mysten Labs, allowing businesses to embed public ledger solutions into their apps, products, and services.

3. Native USDC from Circle Officially Launches on Sui

SuiCircle, the USDC issued by global fintech firm Circle, is set to launch on the Sui network. This integration will enhance Sui’s utility and interoperability, bringing higher liquidity and streamlined transaction experiences. Native USDC on Sui will strengthen its competitiveness in DeFi and enable cross-chain asset transfers via the Cross-Chain Transfer Protocol (CCTP), allowing users to more easily build cross-chain workflows from other chains such as Solana and Ethereum.

4. Sui Bridge Officially Launches on Mainnet

The Sui Bridge officially launched on mainnet in 2024, establishing a native connection between Ethereum and Sui. This marks a significant advancement in Sui’s interoperability, enabling seamless asset transfers between Ethereum and Sui. The bridge not only improves cross-chain transfer efficiency but also opens new opportunities for DeFi and other application areas. Secured by Sui’s validator nodes, the bridge ensures the security and reliability of cross-chain transactions.

5. Grayscale Fund

In August, Grayscale launched the SUI Trust—Grayscale Sui Trust—whose assets under management (AUM) quickly surpassed $1 million. The Grayscale SUI Trust ("the Trust") is one of the first securities fully invested in SUI and derives value from its price movements, enabling investors to gain exposure to SUI in the form of a security without needing to directly purchase, store, or custody SUI.

As of October 2, Grayscale’s official website shows AUM exceeding $2.5 million, with a net asset value per share (NAV) of $26.99.

6. Community Events:

For more Sui events, visit: https://sui.io/community-events-hub

Sui Builder House Singapore:

A community event showcasing major announcements and groundbreaking collaborations from SUI:

(1) Native USDC from Circle to launch on Sui

(2) Walrus releases whitepaper and token

(3) Decrypt partners with Walrus to store media content

(4) Electric vehicle brand DeLorean Labs collaborates with Sui to accelerate innovation

(5) Combat sports media ONE Championship leverages Sui to transform sports

Sui Connect New York:

A community gathering hosted by SUI, aiming to bring together the Web3 community to share ideas, learn about blockchain industry developments, and connect with other builders in the ecosystem.

Sui Technical Advantages

The Sui blockchain platform offers several unique technical advantages that drive innovation in the cryptocurrency space and deliver tangible benefits to developers and users alike. Below are the key technical strengths of Sui:

1. Object-Oriented Account Model

Sui adopts a revolutionary object-oriented account model, treating all assets and smart contracts as independent objects, each possessing its own properties and methods.

This model provides greater flexibility and scalability, making asset management more intuitive and efficient. Objects can operate independently, enabling parallel processing and updates, significantly improving network throughput and response speed.

Sui’s object-oriented approach delivers a more intuitive user experience, analogous to owning physical items like houses or cars. On the Sui platform, users can freely lend, transfer, or modify the state of these objects without the complex accounting or UTXO-style tracking required in traditional models. Moreover, each object in Sui maintains self-integrity and can be managed independently, allowing users and developers to interact with them as if handling real-world objects rather than abstract ledger entries.

In my view, #sui’s object-based account abstraction combines the strengths of Ethereum’s account model and Bitcoin’s UTXO model, representing a new generation of blockchain account abstraction that balances concurrency and decentralization.

2. Native Randomness

Sui provides native on-chain randomness, achieved through secure random number generation by its network of validator nodes. This native randomness serves as a solid foundation for developing various applications, especially those requiring probabilistic outcomes such as gaming, random NFT distributions, or any scenario demanding fairness and unpredictability. Compared to external randomness sources (e.g., oracles), Sui’s native randomness eliminates reliance on third parties, reduces manipulation risks, and enhances overall system security and transparency.

3. Native zk (Zero-Knowledge Proofs)

Sui supports native zero-knowledge proofs (ZKP), a technology that enables verification of transaction validity without revealing any underlying information. ZKP plays a crucial role in protecting user privacy, allowing users to validate transactions while keeping personal data confidential.

Sui’s zkLogin is a native feature and a world-first truly trustless, reliable, and user-friendly authentication mechanism in Web3. With zkLogin, developers can create seamless sign-up and login flows, allowing users to easily create and manage Sui addresses using familiar Web2 credentials such as Google or Facebook accounts.

Outlook and Challenges

Advantages:

-

Superior Technology: SUI leverages the Move programming language to deliver enhanced security and scalability, addressing limitations of existing smart contract platforms.

-

Strong Team: Comprised of top talent from Facebook and Novi Research, SUI benefits from high-level R&D expertise.

-

Market Momentum: SUI has garnered broad market attention and capital backing, including strategic partnerships with gaming companies and a notable collaboration with Red Bull Racing.

Challenges:

-

Market Competition: Faces intense competition from other L1 projects such as Solana and Aptos.

-

Sustainability of Meme Momentum: While current meme projects on Sui have drawn new attention through price pumps, the overall ecosystem remains relatively small.

-

Lack of Breakout Applications: Unlike Solana’s previous bull run, which featured breakout dApps like Pumpfun and MagicEden that generated massive wealth effects and mainstream traction, Sui has yet to see similar flagship applications.

-

Transparency Concerns: The community has raised questions regarding tokenomics and project transparency, requiring proactive responses from the team.

Conclusion

The SUI project, supported by its innovative technical architecture and a strong founding team, possesses significant long-term growth potential. Its distinctive technical advantages—such as the object-oriented account model, native randomness, and zero-knowledge proofs—set it apart in the blockchain landscape. Nevertheless, despite its notable technological breakthroughs, SUI still faces important challenges ahead.

Therefore, while SUI’s technological outlook is promising, potential investors should closely monitor the progress of its ecosystem—particularly the emergence of new applications and innovations—and conduct thorough risk assessments before making investment decisions.

Disclaimer

This presentation has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be regarded as general information only rather than investment advice and financial advice. It is not an advertisement nor is it a solicitation or an offer to buy or sell any financial instruments or to participate in any particular trading strategy. In preparing this document Greythorn did not take into account the investment objectives, financial circumstance or particular needs of any recipient who receives or reads it. Before making any investment decisions, recipients of this presentation should consider their own personal circumstances and seek professional advice from their accountant, lawyer or other professional adviser. This presentation contains statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Greythorn is not obliged to update the information. Those assumptions may or may not prove to be correct. None of Greythorn, its officers, employees, agents, advisers or any other person named in this presentation makes any representation as to the accuracy or likelihood of fulfilment of any forward looking statements or any of the assumptions upon which they are based. Greythorn and its officers, employees, agents and advisers give no warranty, representation or guarantee as to the accuracy, completeness or reliability of the information contained in this presentation. None of Greythorn and its officers, employees, agents and advisers accept, to the extent permitted by law, responsibility for any loss, claim, damages, costs or expenses arising out of, or in connection with, the information contained in this presentation. This presentation is the property of Greythorn. By receiving this presentation, the recipient agrees to keep its content confidential and agrees not to copy, supply, disseminate or disclose any information in relation to its content without written consent.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News