$120 billion, USDT market cap hits record high

TechFlow Selected TechFlow Selected

$120 billion, USDT market cap hits record high

Tether has minted $35 billion worth of USDT over the past year.

Source: BeInCrypto

Translation: Blockchain Knight

USDT, the largest stablecoin under Tether, is continuing to grow, further solidifying its dominant position in the market.

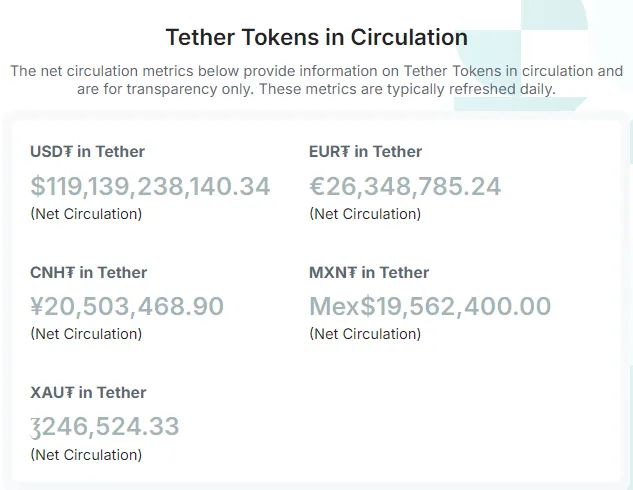

According to data from BeInCrypto, the market capitalization of USDT has approached $120 billion for the first time.

Last week, Tether minted $1 billion worth of USDT on the Ethereum blockchain, bringing its market cap to $119 billion.

Blockchain platform SpotOnChain revealed that Tether has minted $35 billion worth of USDT over the past year.

This growth reinforces USDT's status as the largest stablecoin.

Notably, Circle’s USDC, USDT’s closest competitor, remains significantly smaller, with less than one-third of Tether’s market share.

As of Q2 2024, Tether holds over $97 billion in U.S. Treasury bills and repurchase agreements. This positions the company as the world’s 18th-largest holder of U.S. Treasuries, surpassing countries such as Germany, the United Arab Emirates, and Australia.

Stablecoins are among the most practical real-world applications of crypto assets, offering a stable alternative to volatile digital assets.

These assets have seen significant adoption in emerging markets like Nigeria, where they are increasingly relied upon for savings, payments, and cross-border transactions.

Importantly, this has greatly boosted Tether’s adoption, with the USDT stablecoin now serving over 350 million users globally.

According to Token Terminal, the company generated over $400 million in net profit during the past 30 days.

In parallel, Tether is expanding into sectors such as agriculture and has restructured its operations into four divisions: finance, data, education, and energy.

This diversification supports the company’s efforts to promote USDT issuance and invest in ventures such as artificial intelligence and Bitcoin mining.

Despite its growth, Tether also faces criticism.

Consumer research organizations have expressed concerns about risks associated with Tether’s business model, warning of potentially significant user exposure. In addition, some market observers have raised red flags regarding the company’s reserves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News