Behind USDT's record-high supply: average transfer amount at $7,000, increasingly becoming the top choice for daily payments and remittances

TechFlow Selected TechFlow Selected

Behind USDT's record-high supply: average transfer amount at $7,000, increasingly becoming the top choice for daily payments and remittances

Despite valid concerns regarding centralization and transparency, the diverse benefits provided by Tether should not be overlooked.

Author: Tanay Ved

Translation: TechFlow

Introduction

Stablecoins are often seen as crypto’s “killer app,” playing a crucial role in bridging traditional finance with the digital asset ecosystem. In this space, dollar-backed stablecoins have seen remarkable adoption over the past few years. Stablecoins enable 24/7 value transfer, serve as both store of value and medium of exchange, and offer a compelling value proposition for dollar-scarce economies—especially in emerging markets where people face high inflation, currency depreciation, or limited access to basic financial services. With an ever-expanding landscape of new issuers, collateral types, and utilities, Tether (USDT) has emerged as a dominant force.

As the primary fiat-collateralized stablecoin, Tether accounts for over 75% of the more than $120 billion stablecoin market cap. However, this dominance comes with considerable skepticism, particularly around the transparency and nature of its reserves. Recent comments by Howard Lutnick, CEO of Cantor Fitzgerald—the firm managing Tether’s funds—regarding the legitimacy of its backing may have eased some concerns. Still, the sheer scale of USDT’s influence warrants closer examination.

In this article, we dive into the rise of Tether, exploring its key growth drivers, adoption trends, usage patterns, and reserve holdings—offering a comprehensive on-chain perspective on this stablecoin giant.

USDT Supply: Reaching New Highs

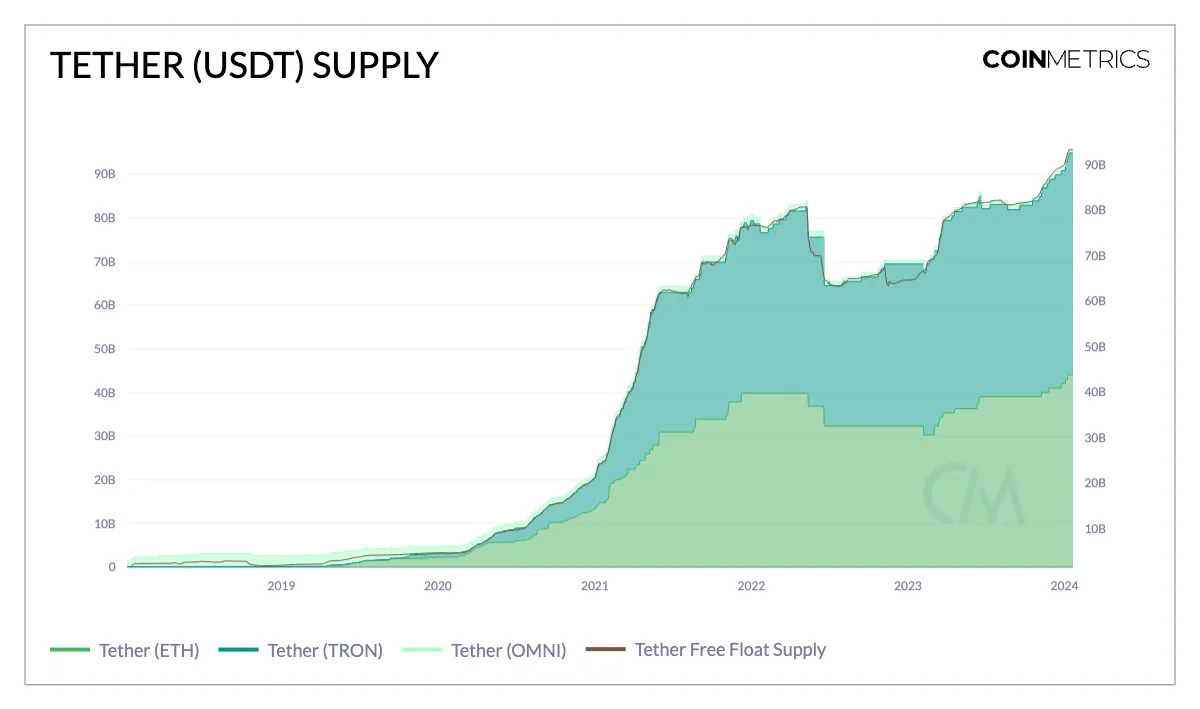

Recent interest in spot Bitcoin ETFs may have inadvertently overshadowed Tether’s significant growth. Tether recently hit a new milestone, surpassing its all-time high supply to exceed $95 billion—a 35% year-on-year increase. Examining the distribution of this total, 46% of the supply, or $44 billion, is issued on the Ethereum blockchain. In contrast, 53%, or $50.8 billion, is issued on Tron. Meanwhile, issuance on Omni—which once accounted for nearly 33% of total supply in January 2020—has dropped to just 1% as Tether decided to discontinue support for the network. As the digital asset ecosystem evolves, Tether’s issuance is expanding to alternative Layer 1 networks such as Solana and Avalanche. This diversification enhances USDT’s utility across various on-chain ecosystems.

Shifting Adoption Trends

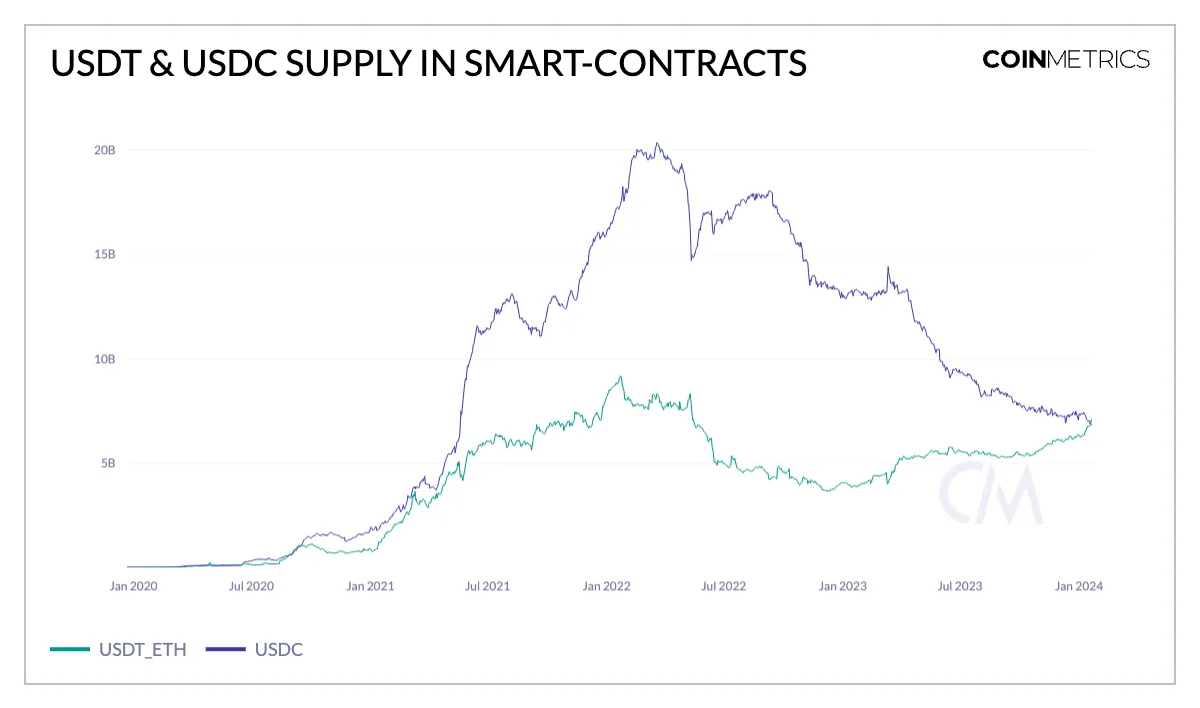

Recent turmoil—particularly the collapse of Silicon Valley Bank (SVB) and the fallout from Operation Choke Point 2.0—may have acted as catalysts for the surge in offshore stablecoins. Delving deeper into the composition of this growth reveals key drivers. A particularly notable trend is the rising importance of USDT (ETH) within smart contracts—a domain historically dominated by Circle’s USDC. The aftermath of the SVB crisis appears to have shaken market confidence in USDC, inadvertently boosting USDT’s engagement in smart contract activity. Since March 2023, USDT’s presence in this space has grown from $4 billion to nearly $6.9 billion. This shift underscores USDT’s growing popularity in decentralized finance (DeFi) applications—a trend highlighted in our other market reports. Notably, USDT has surpassed USDC on leading platforms like Aave v2 and Compound, further cementing its position in DeFi.

The increasing influence of USDT in DeFi, evident across lending platforms and exchanges, highlights its critical role in trustless, dollar-denominated transactions—ultimately enabling broader and more efficient access to financial services.

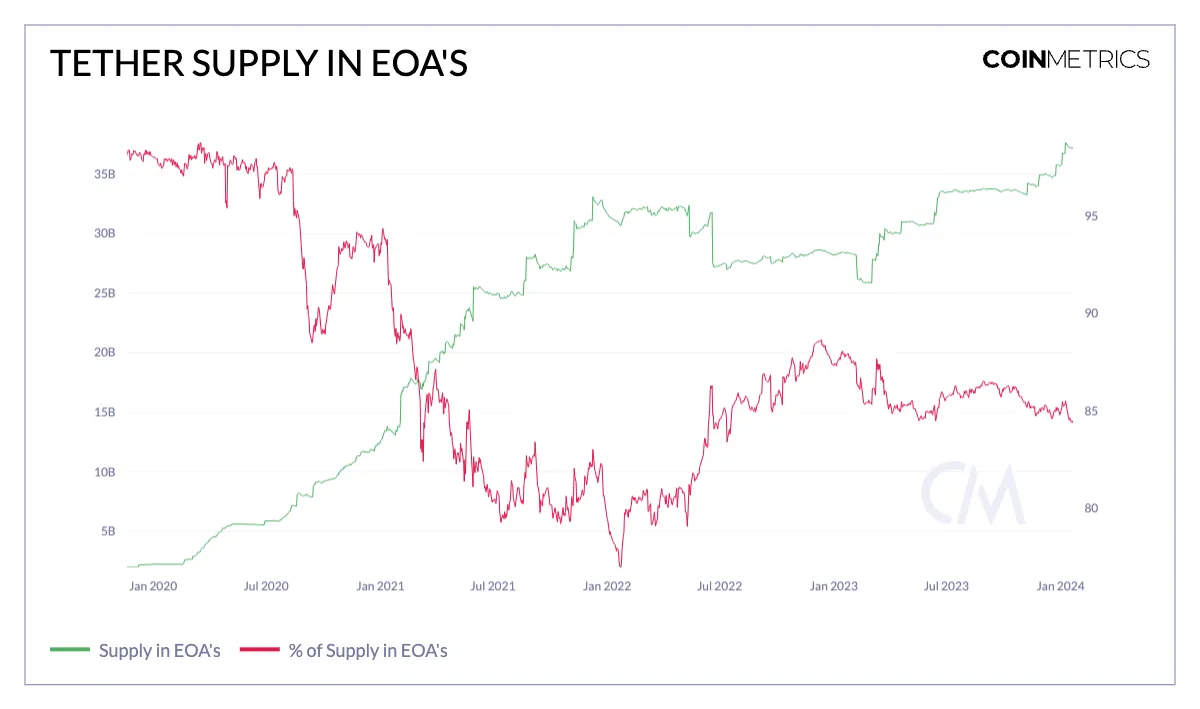

Although Tether’s use in smart contracts has expanded, it remains predominantly held in externally owned accounts (EOAs)—accounts controlled by private keys, similar to those owned by individual users. On Ethereum, Tether (ETH) supply has risen to $37 billion, representing 84% of its total supply on the network. These trends reflect the growing role of digital dollars—not only as a store of value or hedge against volatility, but also as tools for transactional activity such as trading or payments.

Examining Usage Patterns

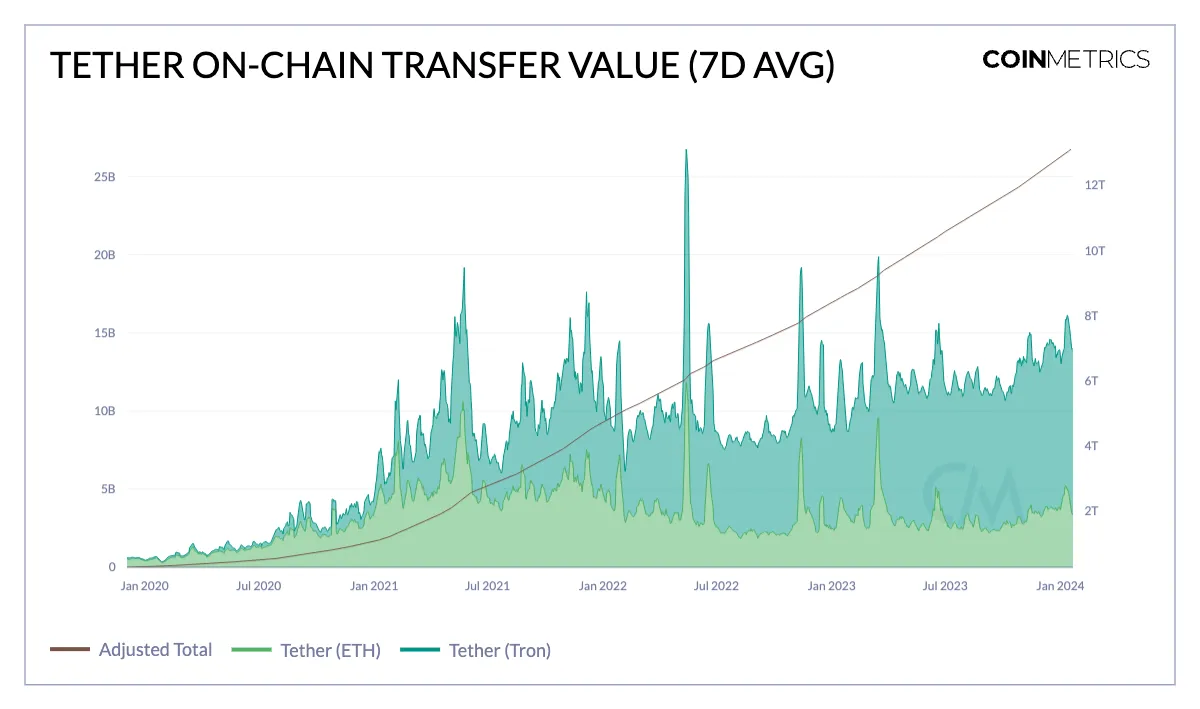

As the largest and most widely adopted stablecoin, Tether sees extensive use. This month alone, adjusted on-chain transfer value involving different USDT addresses exceeded $5 billion on the Ethereum network. Meanwhile, transfer value on the Tron network surpassed $11 billion. Since its launch in 2014, Tether has facilitated over $13 trillion in transfers, underscoring its growing utility. This widespread adoption is especially pronounced in emerging markets across Africa, Latin America, South Asia, and other regions. In these areas, Tether often serves as a substitute for the U.S. dollar—providing a means to protect savings, pursue economic stability, gain access to banking infrastructure, and enable peer-to-peer transactions for various purposes.

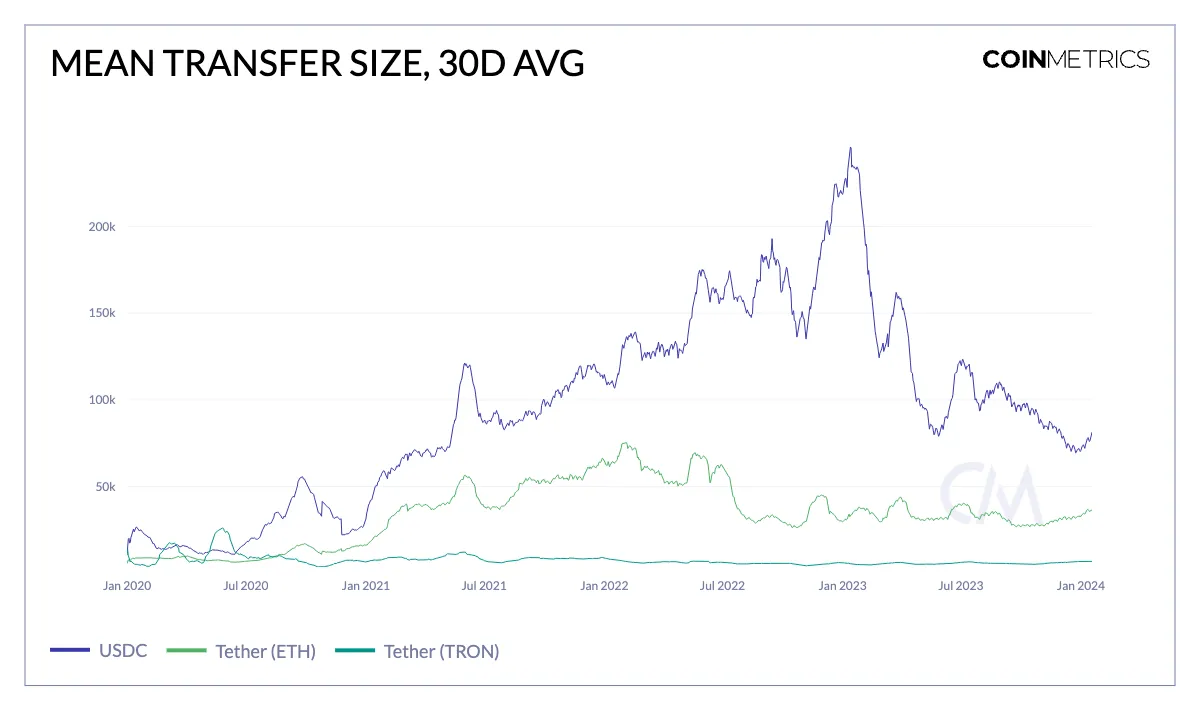

To better understand usage patterns and who benefits from Tether, examining the nature of a “typical” Tether transaction offers valuable insights. Data shows that the average USDT transfer amount is typically smaller than that of USDC, which currently averages around $75,000 per transaction. This higher average suggests USDC is often used for larger-scale transactions, consistent with its status as the primary domestic (U.S.-based) stablecoin and its broad use in DeFi applications.

In contrast, USDT on Ethereum shows an average transfer size of $35,000, indicating participation in large-scale financial activities within the DeFi ecosystem—possibly influenced by Ethereum’s higher transaction fees. On the Tron network, however, USDT presents a different picture. Due to Tron’s lower transaction costs, the average USDT transfer is around $7,000, facilitating more frequent, low-value transactions. This makes it a practical choice for everyday payments and remittances.

More broadly, these patterns not only reflect differing user demographics and preferences but also highlight the impact of the underlying networks on which these stablecoins operate.

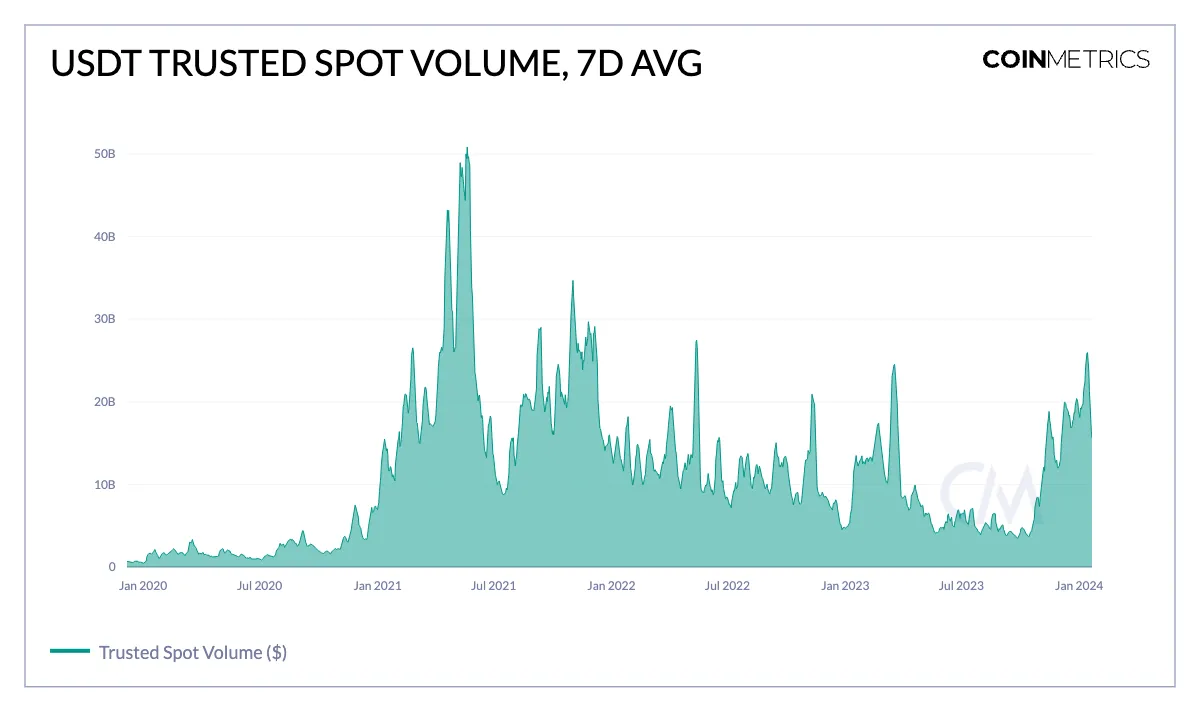

Like other stablecoins, USDT plays a vital role as a quote asset, facilitating liquid trading of digital assets on exchanges. Amid the recent rally in digital asset markets and the launch of spot Bitcoin ETFs, USDT has enabled over $25 billion in trusted spot trading volume, exceeding peaks seen in November 2022 and March 2023. Tether also dominates this space, accounting for over 85% of stablecoin-denominated trading volume.

Nature of Tether Reserves

The composition and transparency of Tether’s reserves have long been contentious topics, often fueling speculation about whether its backing is sufficient. However, Howard Lutnick’s confident remarks at the World Economic Forum in Davos—confirming “they have the money”—helped alleviate some of these concerns, adding credibility to discussions around Tether’s reserves. Currently, the only way to verify this is through independent auditor reports, which provide a detailed breakdown of the assets held in reserves on a quarterly basis.

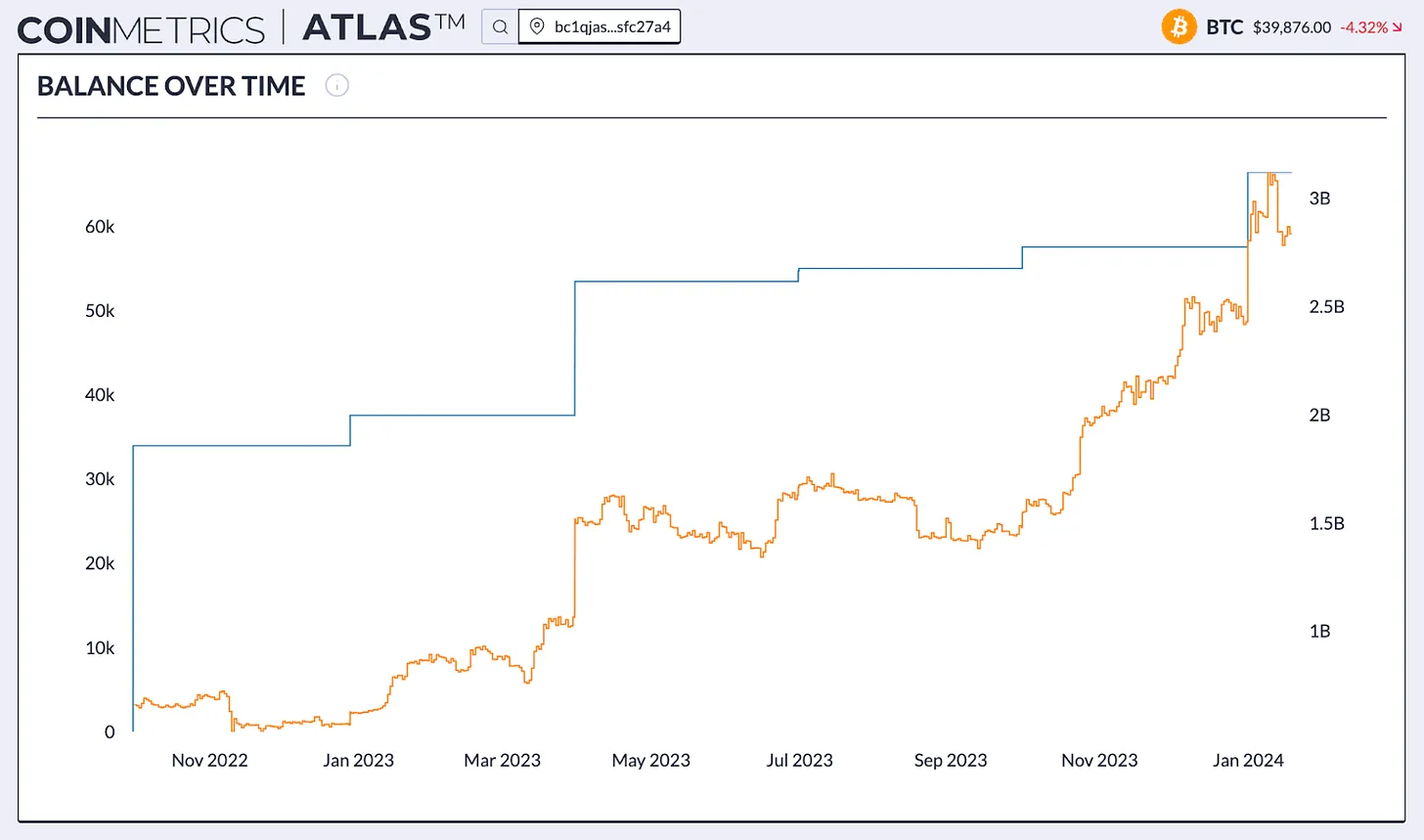

Over the years, the composition of Tether’s reserves has undergone several shifts. While debt instruments like commercial paper made up the bulk of reserves in 2021, their latest attestation shows reserves are now primarily composed of U.S. Treasuries, reflecting the rising interest rate environment. In May 2023, Tether announced it would allocate up to 15% of realized profits toward purchasing Bitcoin to bolster USDT’s excess reserves. This has materialized in the form of 57.5K BTC—equivalent to $1.6 billion in Bitcoin holdings—consistent with their latest attestation in Q3 2023. However, if this Bitcoin wallet can be definitively linked to Tether, it implies they have recently acquired an additional 8.9K BTC, bringing their current total to 66.4K BTC. This inference is strengthened by evidence suggesting credits to this wallet are associated with Bitfinex, an exchange closely tied to Tether.

While quarterly attestations offer insight into Tether’s holdings, official, more frequent audits providing detailed transparency would be a welcome development for users and skeptics alike.

Conclusion

Tether’s impressive rise stands as a testament to its tangible utility—especially in developing economies, where economic instability and lack of reliable monetary systems underscore its real-world value.

Despite valid concerns around centralization and transparency, the diverse benefits Tether provides should not be overlooked. As one of the gateways to broader digital asset adoption, Tether has propelled the entire stablecoin market forward. While it is today’s largest stablecoin, it will be fascinating to see whether it continues to dominate in an evolving landscape. Circle’s plans for going public, along with the rise of crypto staking and interest-bearing stablecoins, make the stablecoin market increasingly dynamic.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News