USDC surpasses USDT: Compliance is the key for stablecoins to gain dominance

TechFlow Selected TechFlow Selected

USDC surpasses USDT: Compliance is the key for stablecoins to gain dominance

Upcoming regulatory frameworks in the United States and Europe could be factors attracting compliant users to use USDC instead of USDT.

Written by: Daniel Ramirez Escudero

Translated by: TaxDAO

As institutional investors enter the cryptocurrency market, Tether's dominance with USDT could be at risk. Tether has long dominated the stablecoin sector, largely due to USDT being the first fiat-backed stablecoin.

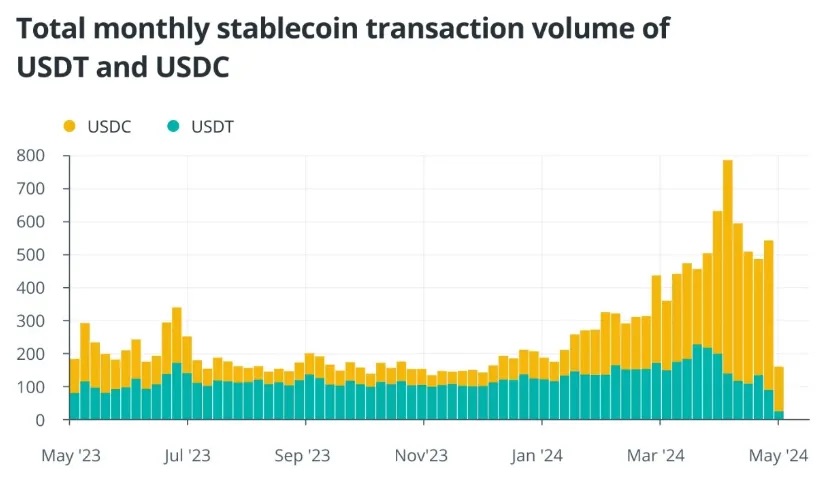

However, in recent years, powerful new competitors have entered the stablecoin market, challenging USDT’s position. Since 2024, Circle’s stablecoin USD Coin (USDC) has seen rising transaction volumes. According to data from payments giant Visa, USDC’s monthly transaction volume surpassed that of USDT for the first time in December 2023.

In March 2024, USDC transaction volume began a steady rise, maintaining dominance as USDT volume declined. On March 24, 2024, weekly trading volume for USDC closed nearly five times higher than USDT. By April 21, 2024, USDT’s weekly trading volume continued its downward trend, shrinking to $89 billion, while USDC surged to $455 billion.

Although launched in 2018, USDC now accounts for 20% of the total stablecoin market.

According to a January 2024 report from cryptocurrency exchange OKX, the battle for stablecoin leadership is clearly between USDT and USDC, which together control 90% of the entire stablecoin market. On-chain data shows USDC gaining traction among crypto institutions, and given the importance of institutional investors, this could threaten USDT’s dominance.

The cryptocurrency market has evolved significantly over the years—from an initial coin offering (ICO) era rife with fraudulent projects to a market on the verge of attracting major institutional investors following the approval of spot Bitcoin exchange-traded funds earlier this year.

On May 2, Changpeng Zhao, former CEO of Binance, posted on X that the crypto market has matured and may have entered a “new phase” where “compliance is extremely important.”

This emphasis on compliance is fueling competition among companies aiming to attract a new wave of investors into the crypto space—meaning compliant stablecoins are poised to stand out.

In this context, USDT faces challenges due to past reports questioning the authenticity of its reserves.

Ruslan Lienkha, marketing director at YouHodler, told Cointelegraph: “USDT is an offshore stablecoin lacking transparency and regulation, while USDC is closely monitored by U.S. authorities.”

Tether is headquartered in the British Virgin Islands, widely considered a tax haven for offshore banking. In contrast, Circle, issuer of USDC, operates under U.S. jurisdiction with its headquarters in Boston, Massachusetts. USDC’s strategy of positioning itself as a fully regulated and transparent stablecoin may pressure Tether to reshape its public image. On April 1, Tether completed an independent audit under the American Institute of Certified Public Accountants’ “gold standard.”

Upcoming regulatory frameworks in the United States and Europe could further incentivize compliant users to choose USDC over USDT.

On April 17, the U.S. Congress introduced the Lummis-Gillibrand Payment Stablecoin Act. If passed into law, it would affect all stablecoins operating in the U.S. market. For Tether to gain approval from U.S. regulators, it would need to change its offshore status—or risk missing out on one of the world’s largest markets.

In the European Union, the upcoming Markets in Crypto-Assets (MiCA) regulatory framework will require stablecoin issuers to register as electronic money institutions starting June 30.

These regulations are expected to take full effect later this year, placing Circle’s EURC—the euro-pegged sister version of USDC—in a favorable position.

On March 21, 2023, Circle applied to France’s financial regulator for a Digital Asset Service Provider license. This authorization would allow Circle to operate as a registered digital asset service provider, enabling it to “launch its flagship products in the European market” and “become a MiCA-compliant e-money token under the new regime.” Tether has not yet applied to become an e-money issuer in the EU.

The consolidation of USDC transaction volumes is an issue Tether cannot afford to ignore. If this trend becomes permanent, Tether could lose its crown as king of stablecoins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News