Digging into Airdrop Data: Should You Sell or Hold After Claiming? How Valuable Is Interaction with Top-Tier Unlaunched Projects?

TechFlow Selected TechFlow Selected

Digging into Airdrop Data: Should You Sell or Hold After Claiming? How Valuable Is Interaction with Top-Tier Unlaunched Projects?

Over the past two years, only AI, Meme, and modular airdrops have performed well; other tokens have had no holding value.

Author: On Chain Times

Translation: Nan Zhi

Introduction

Airdrop, airdrop, airdrop.

Since Friend.tech launched its points system in August last year, rewarding early users of protocols with off-chain points has become an industry standard. This arguably sparked the current wave of airdrops, prompting many projects to issue tokens over the past year. As is often the case with crypto trends, everyone rushed into this "gold rush," eventually inflating the sector to bubble-like levels and gradually draining its appeal.

Has the airdrop frenzy ended—or are we just catching our breath?

Key Takeaways

In this article, the author analyzes token performance from 47 of the most anticipated airdrop projects over the past two years and provides insights on several major upcoming launches. Key conclusions include:

-

Only 23% of projects increased in price post-airdrop; (Selling immediately is more profitable)

-

Among 47 airdropped tokens, only AI, Meme, and modular blockchain airdrops saw significant gains;

-

By network, only Solana-based airdrops posted positive returns from TGE to present; Ethereum-based airdrops performed worst;

-

12.7% of airdropped projects outperformed their respective ecosystem tokens this year; (Better off buying established tokens)

-

All Layer 2 airdrops showed declining metrics post-TGE except Starknet;

-

Linea’s expected per-address airdrop is $251—author believes it's underestimated; (After yesterday's co-founder departure, just launching a token would be a win)

-

Scroll’s general airdrop value is ~$27, with 16.9% of users expecting ~$1,350. Unless large capital participates across Scroll and other synergistic projects, engagement offers limited value;

-

Restaking has underperformed; author doubts any standout results;

-

For Berachain, consider collecting various (expensive) NFTs and regularly engaging testnets.

Airdrop Performance

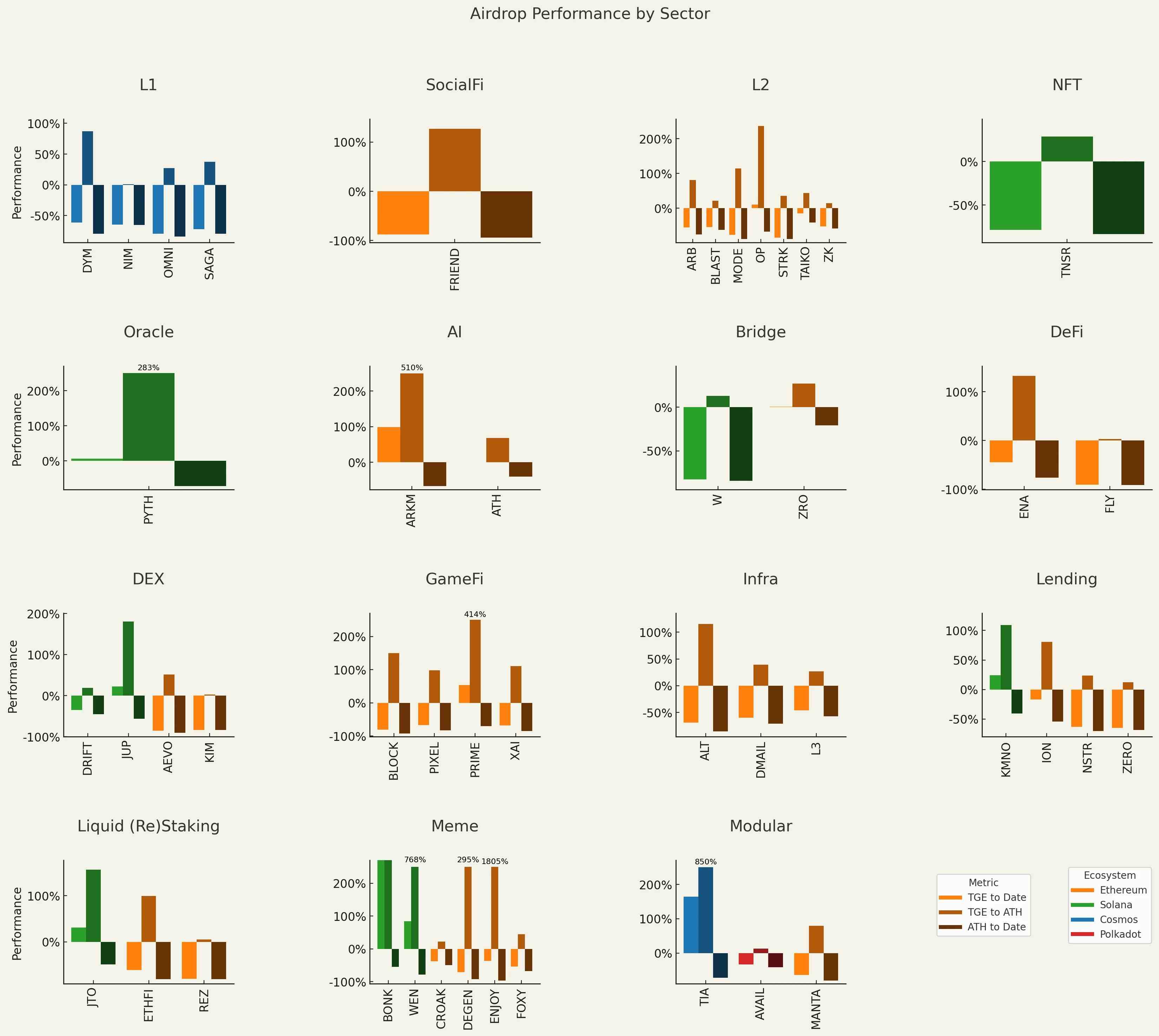

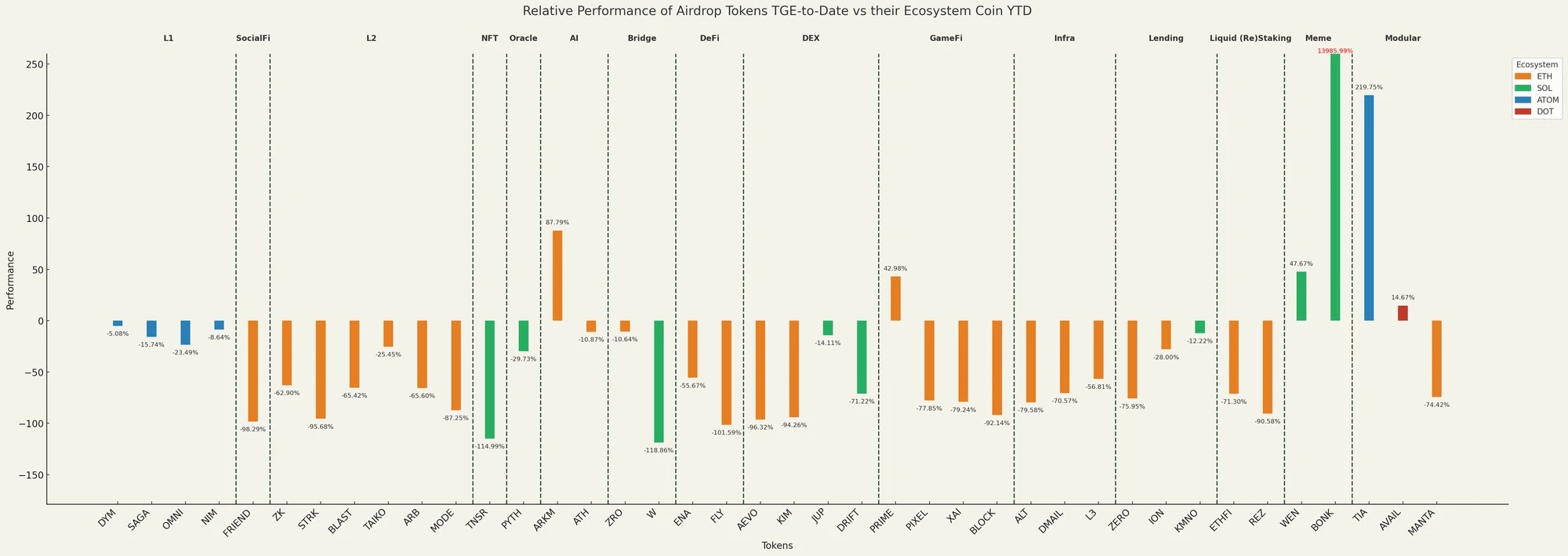

Airdropped tokens have drawn criticism for their “only down, never up” trajectory. The chart below includes 47 of the most watched airdrop projects. As of August 25, 2024, only 11 tokens rose in price after TGE, averaging a 49.56% return (excluding BONK). Meanwhile, the 36 tokens that declined averaged a loss of 62.15% since TGE.

Some tokens did rise post-TGE, averaging a 162.23% gain (excluding those that fell consistently and BONK). However, these tokens saw an average drawdown of -70.89% from their all-time highs (ATH).

(Odaily note: Each token in the chart has three bars—price change from TGE to present, historical peak gain post-TGE, and price change from ATH to present.)

Source: CoinMarketCap & CoinGecko

As of August 25, 2024

The trend is clear: aside from popular sectors in this cycle (like Meme and AI), airdrops since 2023 have mostly been in free fall (even if some rallied temporarily).

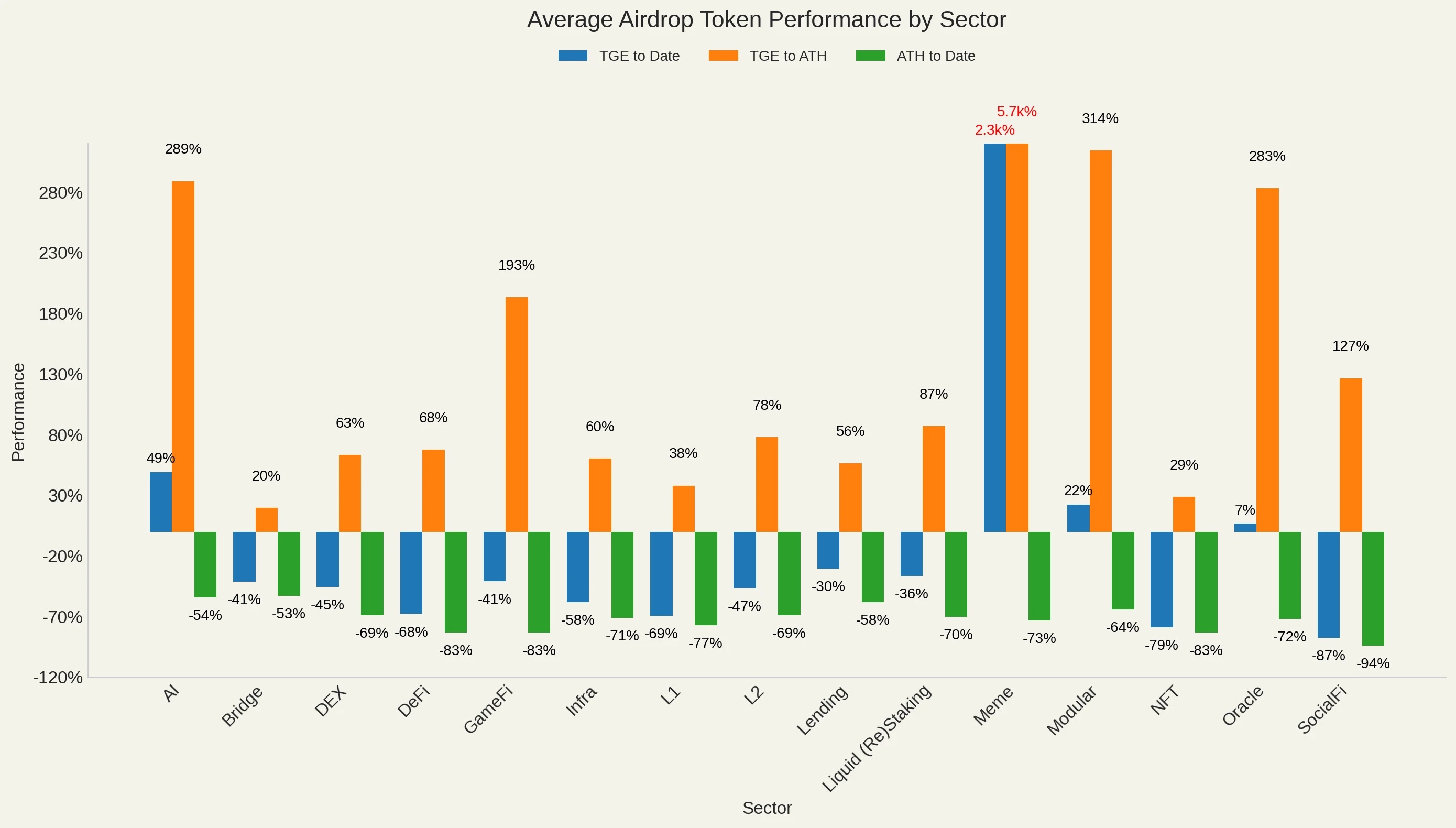

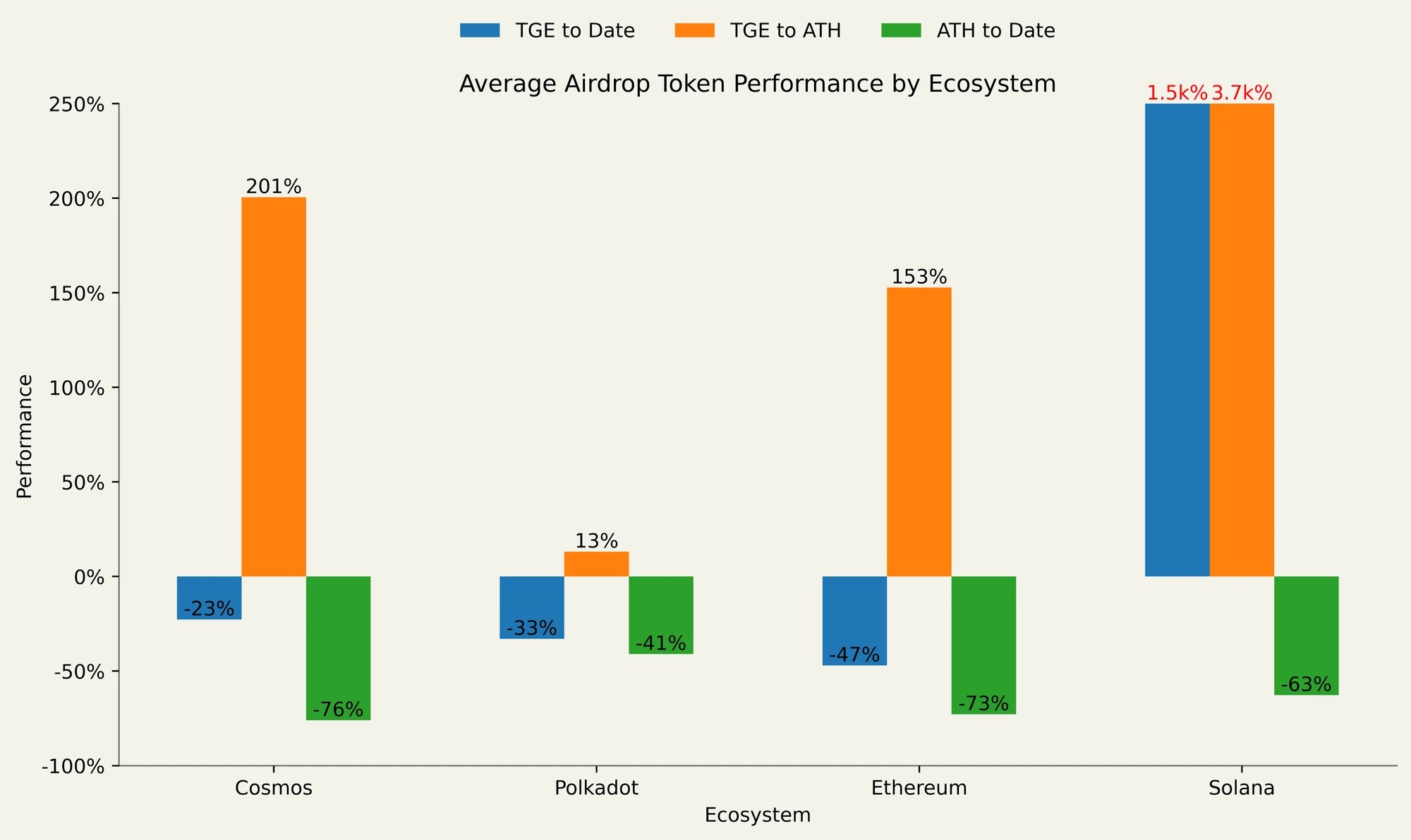

Average airdrop token performance from TGE to current, TGE to ATH, and ATH to current. Outliers are truncated and marked in red.

Source: CoinMarketCap & CoinGecko, as of August 25, 2024

On average, only AI, Meme, and modular blockchain airdrops delivered meaningful gains post-TGE. Meme tokens were the strongest performers, averaging a 2300% increase since TGE, largely driven by BONK.

In my view, BONK saved Solana—once dubbed “Soylana” two years ago—from the despair following FTX’s collapse. Many Pump.fun users should thank this cartoon dog.

Average airdrop token performance by ecosystem: TGE to current, TGE to ATH, and ATH to current. Outliers are truncated and marked in red.

Source: CoinMarketCap & CoinGecko, as of August 25, 2024

By ecosystem, only Solana-based airdrops are up since TGE—largely due to BONK. Ethereum-based airdrops performed worst, while Cosmos-based ones were the most volatile.

Cosmos’ average TGE-to-ATH gain was 201% (inflated by TIA’s 850% surge). Cosmos staking airdrops briefly gained popularity in Q4 2023, sparking a short-lived sub-trend of “staking to earn more airdrops,” which faded as quickly as it emerged. Beyond DYM (down 61.1% post-TGE), no significant staking rewards followed.

One might argue that poor performance and drawdowns reflect broader altcoin market conditions rather than being specific to airdrops. Yet when compared against their respective ecosystem tokens’ yearly performance, only 6 of the 47 airdropped tokens (half being Meme or AI) outperformed their ecosystems.

Relative performance of airdrop tokens vs. their ecosystem tokens from TGE to present. Outliers are truncated and marked in red.

Source: CoinMarketCap & CoinGecko, as of August 25, 2024

The crypto community (CT) attributes this phenomenon to low circulating supply and high FDV tokenomics, complaining these tokens are merely exit ramps for VCs—thus almost destined to “only go down.” While there’s truth to this, especially given most tokens offer only governance rights with unclear utility, a deeper and more troubling issue appears: projects relying on user activity and usage metrics—whether TVL, volume, or others—show alarming declines post-TGE.

Layer 2

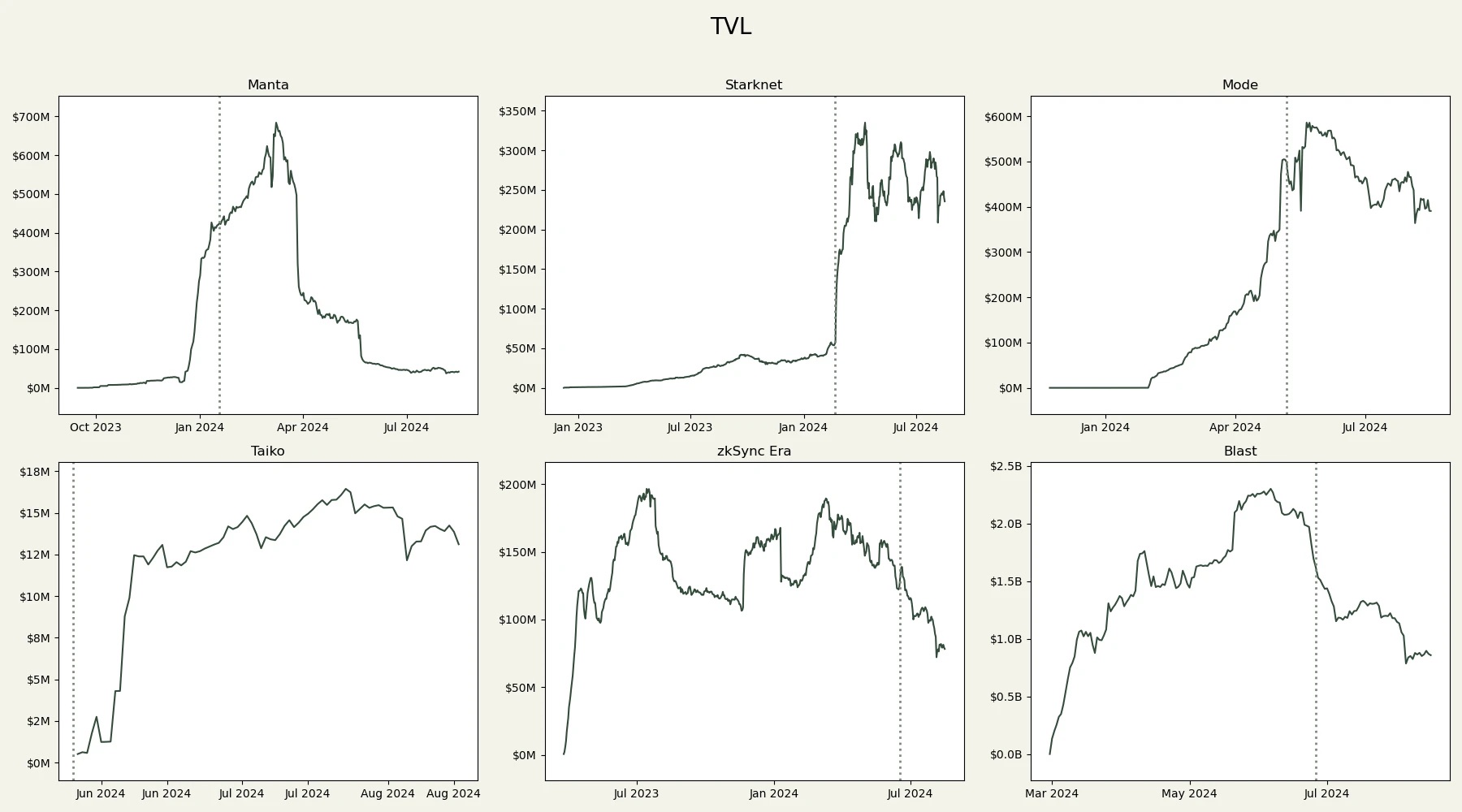

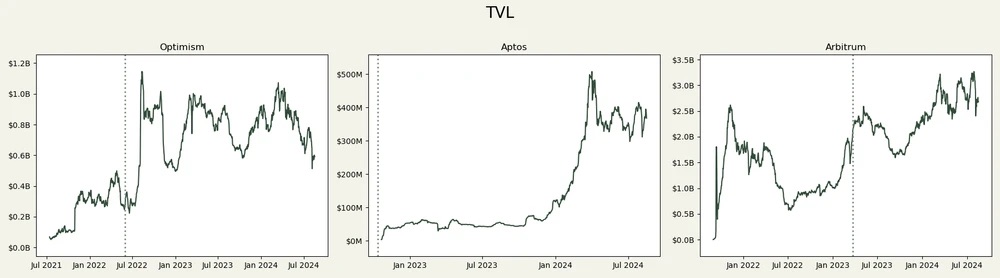

TVL over time for L2s that conducted airdrops in 2024, as of August 16, 2024

Dashed lines indicate TGE dates. Source: DefiLlama

Newly launched, highly anticipated L2s have struggled with TVL growth, often showing a “downward-only” trend.

-

Blast and zkSync Era are the clearest examples—both heavily farmed airdrops that seem to have lost market attention post-TGE.

-

Manta Pacific initially surged, likely due to its “new paradigm” marketing campaign. Funds couldn’t be bridged out until March 26, 2024, after which TVL collapsed by 94% from ATH. A similar situation may unfold on Mode, which delayed 50% of allocations to its first 2,000 wallets for three months, during which funds cannot be bridged out. That said, Mode’s relative strength could also stem from its Season 2 points program (which Manta lacks) and inclusion in Optimism’s Superfest.

-

Taiko chose to conduct TGE upon mainnet launch, creating a false impression of positive impact on TVL. Yet its TVL stands at just $14 million, indicating minimal market interest.

-

Notably, Starknet’s TVL clearly defies this trend, surging post-TGE. While impressive, this disconnect from broader market sentiment raises questions. Did Starknet’s last eight users revive it? Before Starknet supporters attack me—yes, that Dune dashboard is inaccurate; daily active users were actually 21,200 on June 4, 2024, down 94% from ATH two months earlier. Starknet raised $282.5 million at an $8 billion valuation, meaning its TVL remains 18% below funding amount. In contrast, Blast raised only $20 million but has a TVL 190% higher than its funding.

Cross-Chain

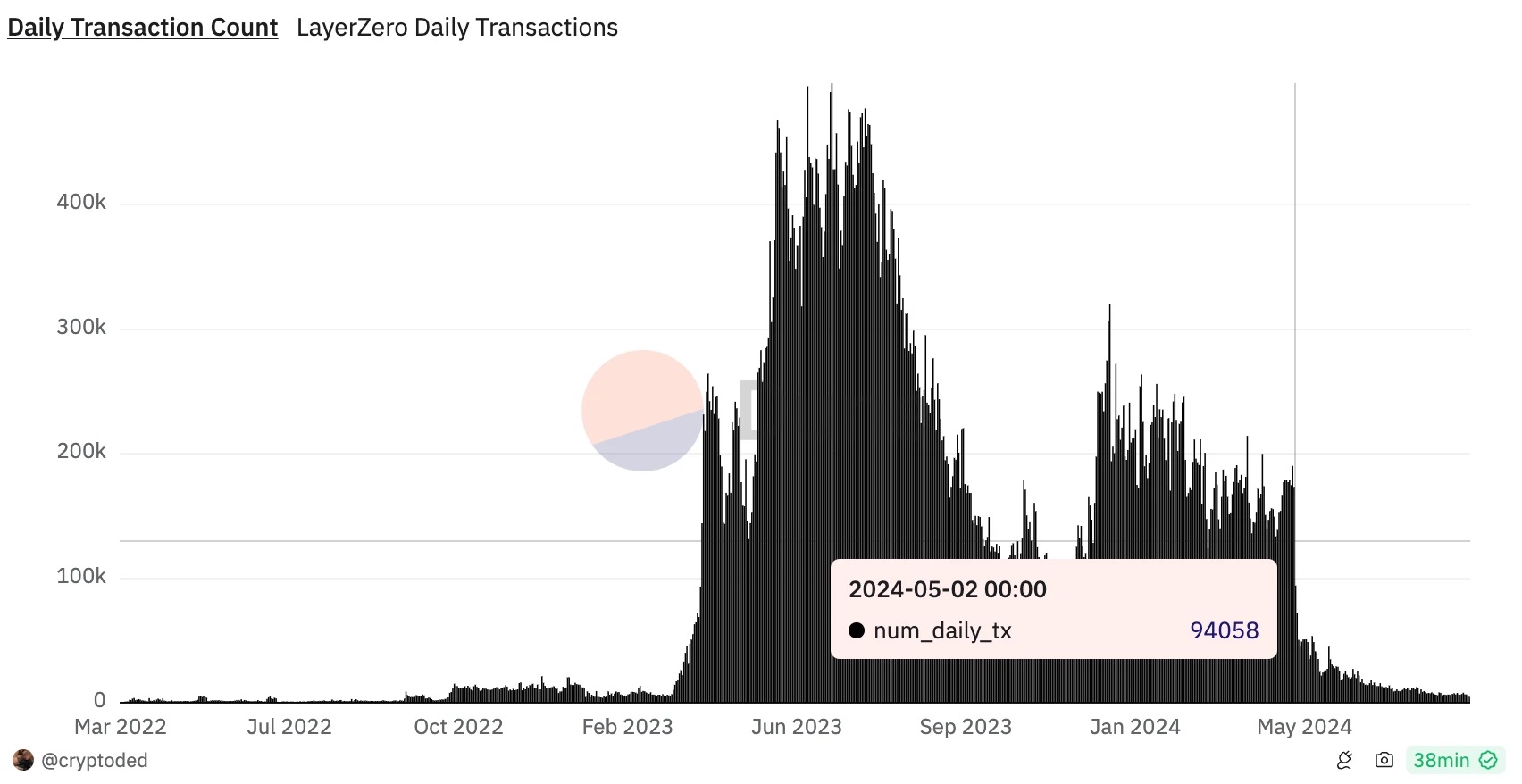

Looking at LayerZero’s daily transaction volume makes the picture clearer.

After announcing the first ZRO airdrop snapshot on May 1, 2024, daily transactions dropped 52% to about 45,000. They now stand below 7,000, down 92% from May 1 levels.

Farmers, sybil attackers (whatever you call them) have been driving crypto adoption this cycle—or at least creating the illusion of it. Although LayerZero belongs to the “old guard” without a formal points program, it long hinted at a token launch, so users acted accordingly, maximizing transactions to boost airdrop yields.

This inflated volume was what LayerZero showcased to VCs during its $12 million Series B round in April 2023. (Source: CryptoRank)

Contrast this with pre-August 2023 airdrops (arguably part of the previous cycle), and a very different picture emerges (here focusing on project fundamentals, not token performance). Aside from Aptos—which required APT as gas and thus had to launch TGE at mainnet release—Optimism and Arbitrum had operated on mainnet for over a year before releasing governance tokens, growing steadily.

This contrasts sharply with the opportunistic environment today, where many projects rush mainnet and TGE to monetize early. Back then, the L2 space was nascent—far from today’s reality where a new L2 seems to launch every month.

Points Should Step Aside

Looking back at some of the largest airdrops in history (by peak value), at least seven were unexpected windfalls for recipients—this positive sentiment likely helped push prices up quickly post-TGE.

Top 10 biggest airdrops in crypto history

Source: CoinGecko Research https://www.coingecko.com/research/publications/biggest-crypto-airdrops

In the previous cycle, most airdrops were widely welcomed as “free money.” Late-cycle airdrop farming grew more common, but nowhere near the mainstream obsession seen today. While Friend.tech’s points system initially sparked excitement, within months it became a tired cliché as every project waiting out the bear market introduced its own points program.

Season after season of points farming has increasingly demanded time and capital, eroding airdrop appeal. Airdrops are no longer “free money”—they now require real costs, leading to skepticism around nearly every recent TGE, trapping the model in a “death spiral.”

It’s time for the points economy to step aside. If projects stopped explicitly exploiting points and leaderboards to extract maximum value from farmers—and if overall market sentiment turned bullish—farmers might benefit again.

Are These Mega Projects Still Worth It?

Many projects are still heading toward TGE, so we’ll focus on a few (the heavyweights).

Linea and Scroll

Linea and Scroll are the last two major L2s without tokens (assuming Base doesn’t launch one). Scroll raised $80 million at an $1.8 billion valuation, while Linea’s parent company Consensys has raised $725 million at a $7 billion valuation.

While Consensys runs many other ventures (including MetaMask), Linea clearly enjoys strong financial backing. Compared to zkSync and Starknet—raising $458 million and $282.5 million respectively, both at $8 billion valuations—Linea has room for solid performance. STRK briefly hit a $50 billion FDV minutes post-TGE—over six times its valuation—while ZK debuted at ~$4.7 billion FDV, delivering generous payouts to zkSync farmers and even casual Starknet hackathon participants.

Thus, I believe users who participated in Linea’s Surge events or engaged early on Scroll Mark can expect a Christmas gift in Q4. Latecomers need substantial capital to catch up—but if multi-farming across protocols (e.g., providing WRSETH/ETH liquidity on Ambient to farm Kelp, Scroll, and Ambient simultaneously), it may be worthwhile.

(Odaily note: Scroll Mark is its points system.)

Linea Math

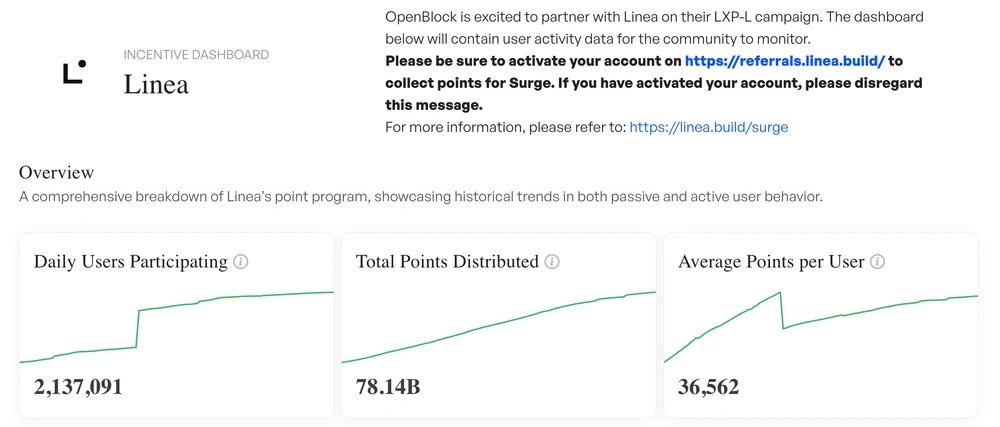

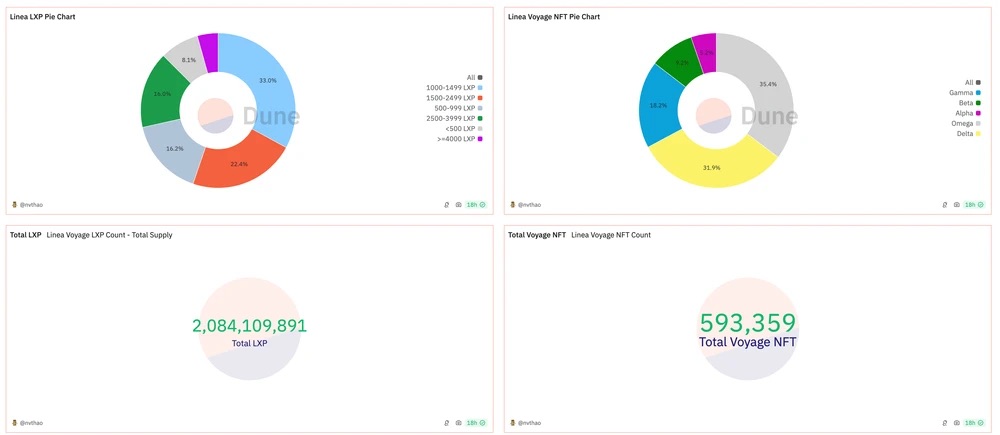

Whales Market data shows LXP and LXP-L currently valued at $0.11 and $0.003 respectively, implying an average airdrop tied to LXP-L of just $109, with total LXP-L distribution around $234 million.

OpenBlock Linea Surge Dashboard as of September 2, 2024

According to @nvthao’s Dune dashboard, most users hold 1000–1499 LXP, meaning most will receive only ~$137 in value.

Additionally, there’s the Linea Voyage testnet NFT; its Delta version currently trades at 0.00187 ETH (~$5) on Element.

If these estimates hold, the average Linea farmer can expect ~$251 from testnet Voyage, several mainnet Voyages, and six Surges—closer to $150 after gas fees. Personally, I find this expectation too pessimistic, likely influenced by trauma from past L2 airdrops. If market sentiment improves, LXP should be worth at least $0.50.

Still, I expect most regular users to be disappointed with Linea, as trading incentives are no longer as lucrative—projects now prioritize TVL.

Scroll Math

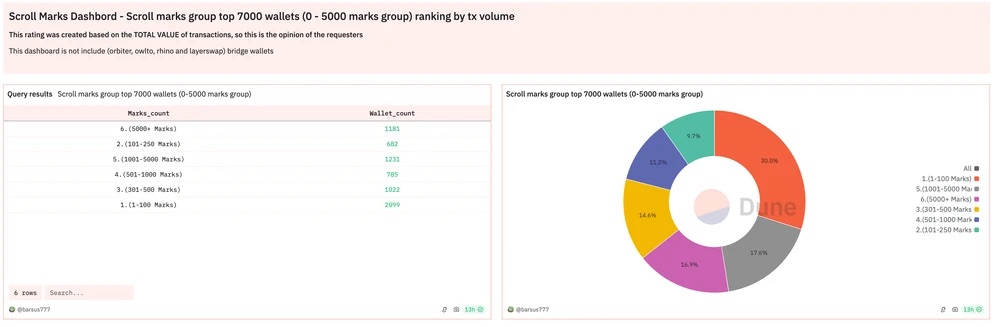

Scroll’s math is simpler. Based on Whales Market (though trading volume is very low), Scroll Mark is currently worth ~$0.27. Thus, most wallets with 0–100 Marks are valued at ~$27. But we’re only in Phase 1—the number will grow. Notably, 16.9% of wallets have over 5,000 Marks, implying potential earnings of ~$1,350.

@barsus777’s Scroll Marks Dune Dashboard as of September 2, 2024

There’s also Scroll Canvas—NFT badges based on transaction activity. Though projects have moved away from allocating large token amounts based purely on transaction volume, I find it hard to believe these badges won’t factor into airdrops. Since they’re separate from the points system, they may act as multipliers.

Overall, unless you’ve interacted before Mark went live, I think there are better places to allocate capital. If you can accumulate tens of thousands in Marks, it might be worth a shot.

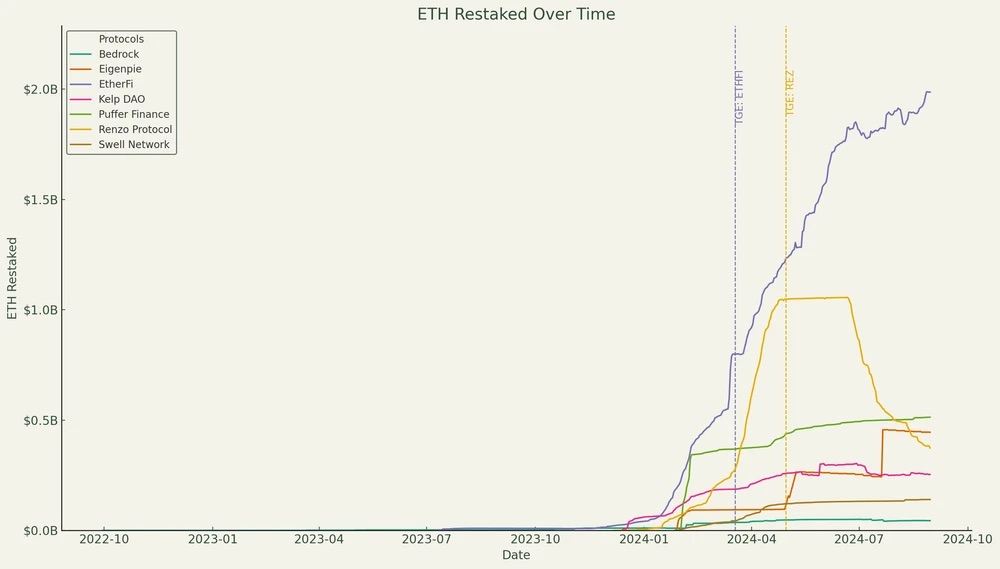

Restaking

Among the 7 largest ETH liquid restaking protocols, only EtherFi and Renzo have conducted airdrops. Despite disappointing token performance—down 60.4% and 79.7% from TGE respectively—EtherFi has shown notable strength, cementing its position as the preferred LRT. Meanwhile, Renzo’s TVL stagnated post-TGE and began a sharp decline months later—likely because withdrawals weren’t enabled until June, trapping many farmers when ezETH depegged in open markets.

Other major LRTs haven’t grown much since the airdrop hype faded, so I doubt they’ll deliver strong outcomes.

We’re still awaiting EIGEN’s TGE, though its pre-market price on Whales Market is $3.62. Even with an extra 100 EIGEN, most farmers wouldn’t earn more than $400. Karak and Symbiotic might beat EIGEN to TGE, but interacting requires significant capital.

Berachain and Monad

Finally, two of the most mysterious and anticipated projects we’ve seen: Berachain and Monad. Over the past six months, CT has shown immense interest in both, yet it remains unclear how to engage precisely, and no mainnet launch dates are visible. Given they’ve raised $142 million and $244 million respectively—with Berachain’s valuation humorously noted as $420.69 million (lol)—this could be a feast for eligible airdrop recipients.

Starting with the relatively less mysterious Berachain, collecting various (expensive) Bera NFTs and securing exclusive Discord roles may yield the highest returns. If you dislike NFT trading, best practice is consistent interaction with key testnet dApps (BEX, BEND, BERPS, etc.). Completing tasks via TheHoneyJar to earn badges is helpful, though they’re not officially affiliated with Berachain. That said, testnet participation may ultimately lead nowhere (always remember the Sui lesson).

Monad is essentially a “cult,” with the only known way to build reputation currently being engagement on its social platforms—since there’s still no testnet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News