Bitget Research: The market is filled with negative sentiment, and the accelerated decline is paving the way for a new upward trend.

TechFlow Selected TechFlow Selected

Bitget Research: The market is filled with negative sentiment, and the accelerated decline is paving the way for a new upward trend.

In the past 24 hours, several new trending cryptocurrencies and topics have emerged in the market, and they could very well be the next wealth-generating opportunities.

Author: Bitget Research

Summary

Over the past 24 hours, Bitcoin dropped to $55,600, and U.S. spot Bitcoin ETFs saw net outflows exceeding $287 million. Key highlights:

-

The most promising wealth-generating sectors are: high-yield, low-risk USD-denominated yield pools; RWA sector (ONDO, Pendle)

-

Most-searched tokens & topics by users: Penpie, Flux, AAVE

-

Potential airdrop opportunities: Major, Soneium

Data cutoff time: September 4, 2024, 04:00 UTC

I. Market Environment

Over the past 24 hours, the cryptocurrency market plunged sharply, with fear sentiment reaching its lowest level since early August. Bitcoin fell to $55,600, and U.S. spot Bitcoin ETFs recorded over $287 million in net outflows. The main driver was the Bank of Japan governor reaffirming that interest rates would continue rising if economic and inflation data meet expectations. Recently, pre-launch projects in the primary market have drawn attention—for instance, Scroll, an Ethereum L2 network, posted a 12-second teaser video on social media ending with "Scroll.Soon.", hinting at a major upcoming announcement.

On the macro front, the August 2024 ISM Manufacturing PMI report indicates continued contraction in the U.S. economy. According to CME FedWatch data, due to weak economic figures, traders increased the odds of a 50-basis-point rate cut by the Federal Reserve in September from 30% one day earlier to 39%. The key macro event this week remains Friday’s August employment report, which could ultimately influence whether the Fed opts for a 25 or 50 basis point rate hike.

II. Wealth-Generating Sectors

1) Recommended Focus: High-Yield, Low-Risk USD-Denominated Yield Pools

Main reasons:

-

Market sentiment is fearful, and a strong rebound in the short term is unlikely. Ahead of a potential bull run, it's advisable to hold stablecoins and wait for market stabilization before entering on the right side of the trend.

Recommended projects:

-

Kamino: Currently the lending protocol with the highest TVL on Solana. Supplying USDC offers an APY of 13%, while supplying PYUSD yields 19%;

-

Aries Markets: The protocol with the highest TVL on Aptos. Supplying USDC offers an APY of 10%, and USDT yields 10.5%. Both borrowing and lending are subsidized with APT rewards, delivering relatively stable returns;

2) Sector to Monitor Going Forward: RWA (ONDO, Pendle)

Main reasons:

-

The RWA (Real World Assets) sector remains one of the most watched areas in crypto, widely seen as having significant growth potential. ONDO and Pendle lead in government bond tokenization and crypto interest rate swaps, respectively. These markets have extremely high asset ceilings, and protocol revenues grow proportionally with total assets under management—making them critical investments during every market recovery cycle.

Factors influencing future performance:

-

Total protocol asset size: Cash flow for such protocols primarily depends on their total asset scale. As more assets are onboarded, protocol revenue increases accordingly, leading to stronger token price performance.

-

Regulatory impact: As the crypto industry gains legislative approval and broader societal acceptance, favorable policies will become a key driver for token appreciation in this sector. With more traditional financial giants entering this space, steady growth is expected going forward.

III. User Trends & Searches

1) Popular Dapp

Penpie:

Penpie is a yield aggregator built on Pendle for interest-bearing assets. Its reward protocol suffered an attack resulting in approximately $27 million in losses. The project has announced a full suspension of deposits and withdrawals due to the security breach. The team is actively working to resolve the issue. Market data shows Penpie (PNP) has fallen below $1, currently trading at $0.96, down 35.4% in 24 hours.

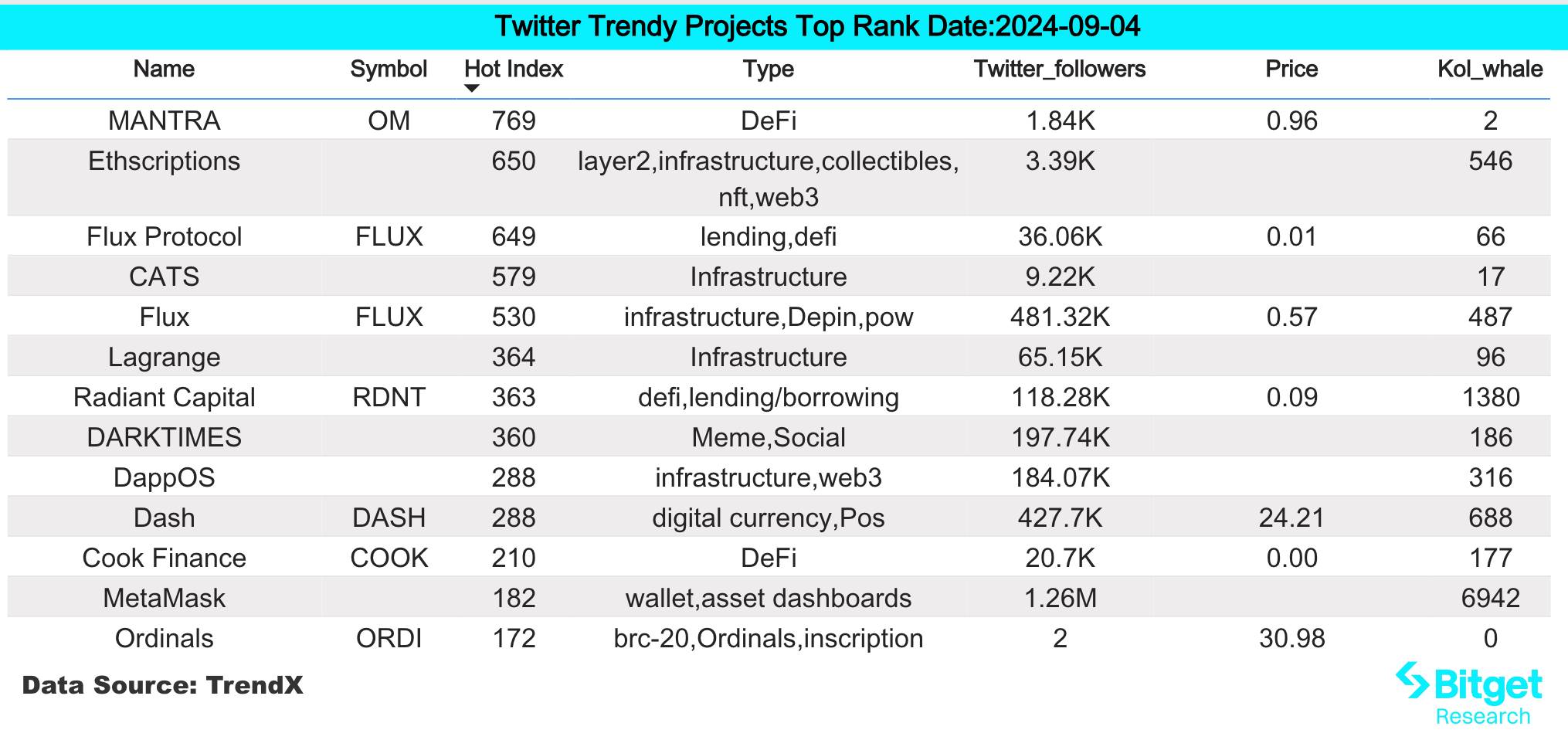

2) Twitter

Flux:

Flux provides decentralized cloud computing services and Web3 solutions, offering Dapps a fast, manageable, decentralized alternative to AWS or Google Cloud. Binance Futures launched the FLUXUSDT perpetual contract on September 3, 2024, at 15:00 (UTC+8). Following the listing, FLUX surged over 40%, but prices have since pulled back. Participation is advised with caution.

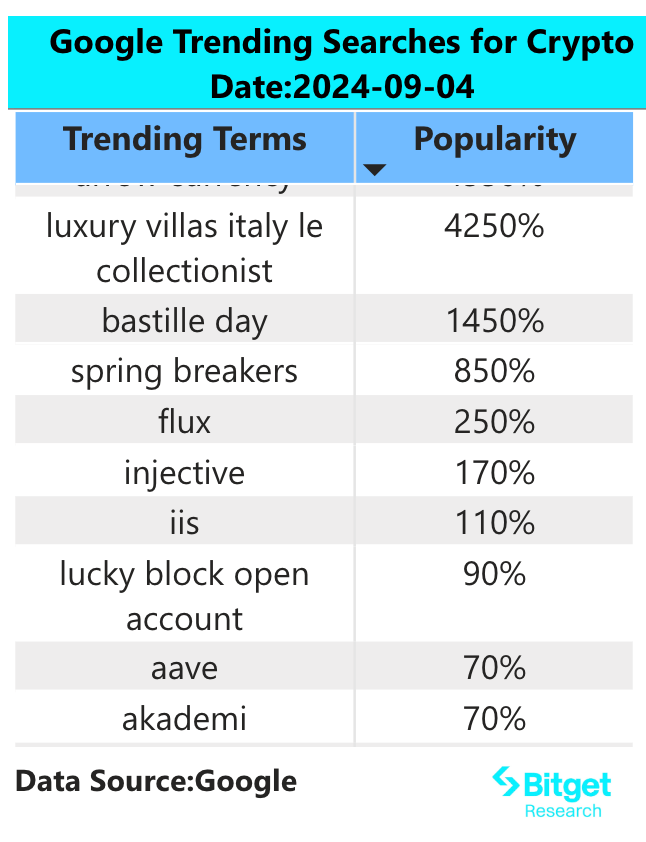

3) Google Search & Regional Trends

Global trends:

AAVE:

Aave Labs announced the launch of Sky Aave Force—an initiative co-founded by MakerDAO’s Rune Christensen and Aave’s Stani Kulechov aimed at driving mass adoption and bridging DeFi with TradFi. Sky Aave Force proposes integrating USDS and savings USDS (sUSDS) into Aave V3 with native token incentives, and creating a new Spark/Aave market enabling seamless interaction and exclusive rewards. AAVE’s transaction volume and key metrics are steadily improving, showing positive price momentum—moderate participation is recommended.

Regional search trends:

(1) Enthusiasm for TON mini-apps has clearly risen in Western and English-speaking regions: “Ton” blockchain appears in trending terms in Canada, Australia, the Netherlands, and Poland; “hamster kombat” appeared in the UK’s trending searches;

(2) No clear hotspots in Asia and Latin America, with scattered search terms; a few countries mentioned the Tron blockchain.

IV. Potential Airdrop Opportunities

Major

Major is a minimalist Telegram-based game where the sole objective is collecting stars—the more stars a player accumulates, the higher their rank and the greater their rewards. Stars can be earned through daily tasks, referrals, and profile completion. Bitget has launched a pre-market trading venue, allowing users to place limit sell orders ahead of time to lock in profits.

In the game, players aim solely to collect more stars. Currently, Major rewards top 100 weekly leaderboard participants with TON tokens: 1st place receives 150 TON, 2nd gets 100 TON, 3rd gets 70 TON, 4th–5th receive 50 TON each, 6th–10th get 20 TON each, and 11th–100th receive 5 TON each.

How to participate: 1) Enter the game to receive initial stars; 2) Complete daily tasks, invite friends, and complete your profile via the task menu to earn additional stars.

Soneium

Soneium is an Ethereum Layer 2 network developed by Sony designed to bridge blockchain technology (Web3) with everyday internet services (Web2). Built using Optimism’s OP Stack and leveraging Optimism Rollup technology, it aims to integrate seamlessly with the existing OP ecosystem.

How to participate: Soneium launched its testnet on August 28, 2024. Users can engage via testnet interactions. For now, the best steps are learning about the project and securing a role on Discord: https://discord.com/invite/soneium.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News