Interpretation: The Story Behind the Ethereum Foundation's Large-Scale ETH Sell-Off

TechFlow Selected TechFlow Selected

Interpretation: The Story Behind the Ethereum Foundation's Large-Scale ETH Sell-Off

Is the Ethereum Foundation a "master at timing the market top"?

Author: Ebunker

Is the Ethereum Foundation a "Top-Timer"?

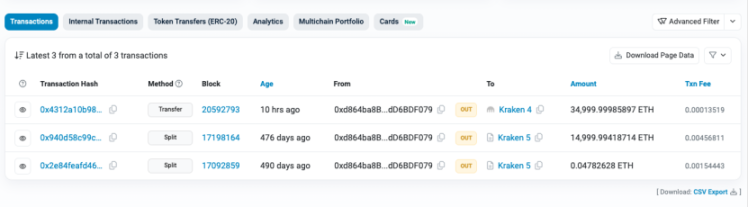

On August 23, the Federal Reserve signaled rate cut expectations, sparking a rally in the cryptocurrency market. However, shortly afterward came an on-chain move—the Ethereum Foundation transferred 35,000 ETH to the Kraken exchange in the early hours of August 24.

The last time the Ethereum Foundation moved a large amount of ETH to Kraken was on May 6 of last year, when it deposited 15,000 ETH. Within the following six days, ETH dropped from $2,006 to $1,740—a 13% decline.

Due to several past instances of selling large amounts near price peaks, the Ethereum Foundation has been humorously dubbed the "top-timer" by the market.

For example, during the 2021 bull run, the Foundation successfully executed two high-point sales:

(1) On May 17, 2021, it sold 35,053 ETH at an average price of $3,533. Shortly after, the crypto market experienced the "May 19 crash," with prices plunging to around $1,800—nearly halving.

(2) On November 11, 2021, the Foundation again sold 20,000 ETH, this time at an average of $4,677, just before the market began its prolonged downturn. Both moves were remarkably well-timed.

However, over longer timeframes, the Ethereum Foundation hasn't always sold at the peak.

Data compiled by Wu Blockchain shows that the Foundation also sold ETH ahead of major rallies—such as on December 17, 2020 (selling 100,000 ETH at $657 each) and March 12, 2021 (selling 28,000 ETH at $1,790)—missing out on substantial subsequent gains.

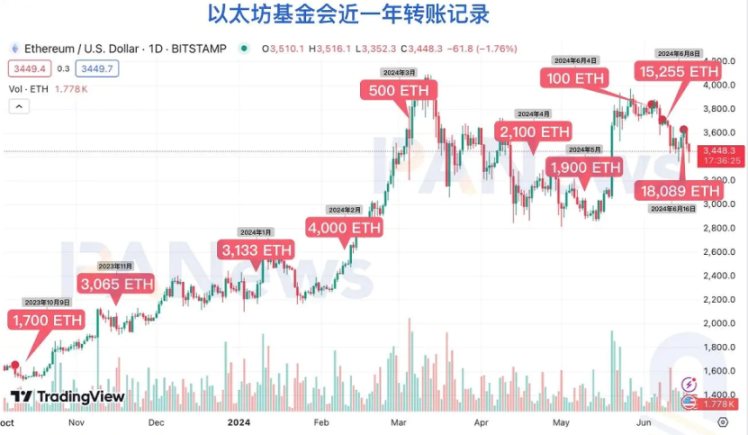

Looking at the Ethereum Foundation's transfer history over the past year, it’s clear these moves are largely part of regular fund management. Labeling it a "top-timer" based on a few high-price sales is therefore misleading.

Why Is the Ethereum Foundation Selling ETH?

Regarding the recent transfer of 35,000 ETH to an exchange, Aya Miyaguchi, Executive Director of the Ethereum Foundation, explained: "This is part of the Ethereum Foundation's treasury management activities. The Foundation's annual budget is approximately $100 million, primarily covering grants and salaries. Some recipients can only accept fiat currency. For much of this year, the Foundation was advised not to conduct any financial activities due to complex regulatory considerations, so we couldn’t share plans in advance. Importantly, this ETH transfer does not equate to immediate sales—it may be gradually sold according to future plans."

According to data from crypto analyst DefiIgnas, after transferring 35,000 ETH, the Foundation still holds about 273,000 ETH—approximately 0.25% of ETH's total supply. Per its latest report, the Foundation disbursed $30 million in grants in Q4 2023 and $8.9 million in Q3. Funds are primarily used for global conferences (such as the renowned Devcon and Devconnect), online courses, and innovative projects.

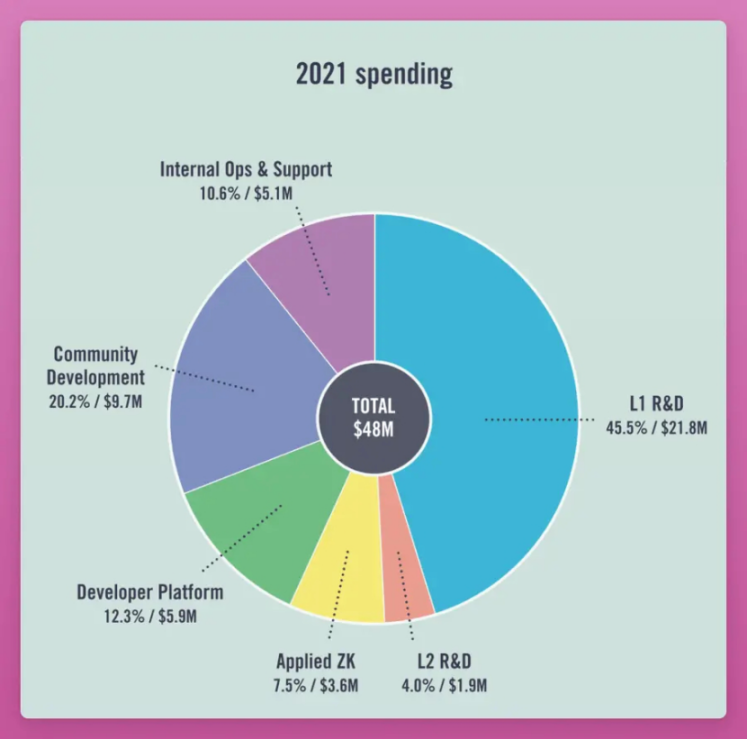

In addition, the 2021 report showed total expenditures of $48 million, including $21 million for Layer 1 R&D, $9.7 million for community development (grants and education), and $5.1 million for internal operations (salaries, legal fees, etc.).

It's worth noting that token sales by foundations aren't unique—Polkadot, for instance, faced controversy due to its aggressive spending.

Market Impact of Ethereum Foundation Sales and Potential Improvements

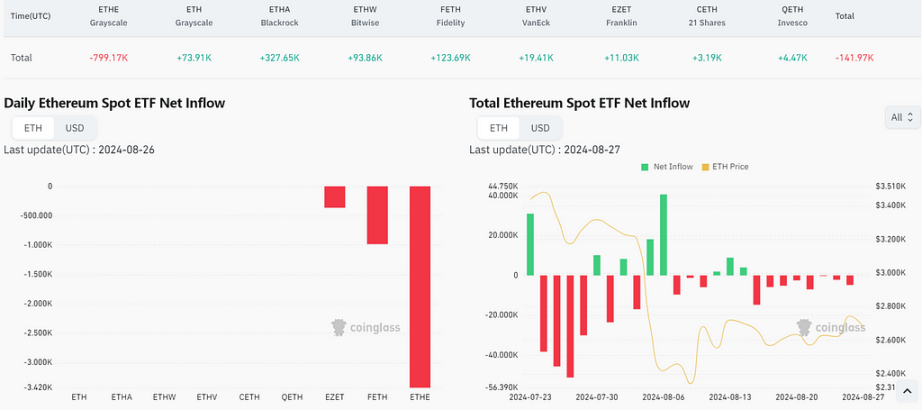

As shown in the chart above, since the launch of Ethereum ETFs on July 23 through August 26, Grayscale's ETHE has seen a cumulative net outflow of 799,000 ETH, averaging 32,000 ETH per day (other ETH products were net positive, resulting in a total net outflow of about 141,900 ETH). In comparison, the recent sale of 35,000 ETH by the Ethereum Foundation isn't particularly significant.

In reality, the Foundation's sale of ETH is understandable—development teams require funding to operate. Moreover, the 273,000 ETH held by the Foundation represents only 0.25% of total supply. In terms of market cap, the direct impact on liquidity is minimal. The negative effects are more psychological—potentially shaking holder confidence and triggering copycat selling.

Additionally, while the Foundation previously disclosed a $100 million budget, recent reactions highlight growing demand for regular, detailed financial disclosures. For example, publishing comprehensive reports periodically—including financial updates, team expenses, planned ETH sales (with careful consideration to minimize market impact), fund usage, team size, and allocations—would help stabilize community sentiment. Providing public dashboards or interfaces for announcements, activities, and financial movements would allow ETH holders to better understand and support the Foundation, ultimately supporting Ethereum's long-term growth.

We look forward to the Ethereum Foundation continuing its efforts in R&D outreach, community engagement, and market education to attract more developers and users to the world's most prominent smart contract blockchain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News