Another U.S. listed company goes all-in on Bitcoin, now holding 1,000 BTC

TechFlow Selected TechFlow Selected

Another U.S. listed company goes all-in on Bitcoin, now holding 1,000 BTC

Medical technology company Semler Scientific spent $5 million to repurchase 83 BTC.

Source: cryptoslate

Translation: Blockchain Knight

According to a statement on August 26, Semler Scientific, a Nasdaq-listed medical technology company, has purchased an additional 83 BTC for $5 million, aiming to expand its Bitcoin holdings.

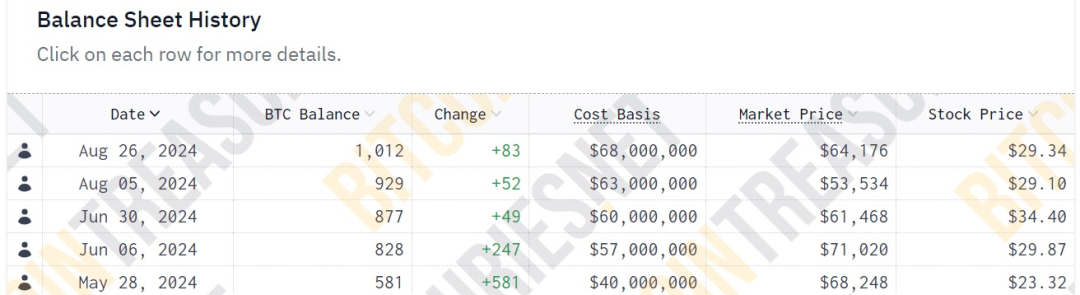

This acquisition brings the company's total BTC holdings to 1,012, with cumulative costs including fees and expenses amounting to $68 million.

The company's chairman, Eric Semler, explained that funding for this purchase came primarily from cash generated by company operations, supplemented by funds from its at-the-market equity program.

Semler added, "We are encouraged by the increasing institutional adoption of BTC. Recent reports indicate that over 20% of assets in BTC ETFs are now managed by institutions. We believe this institutional accumulation will drive BTC price growth."

Semler Scientific began investing in BTC in May this year, acquiring 581 BTC for $40 million at that time.

Since then, the company has continued aggressive purchases—buying 247 BTC for $17 million on June 6, 49 BTC for $3 million on June 28, and another 52 BTC for $3 million on August 5.

According to BTC Treasury data, following its latest purchase, Semler Scientific now ranks among the top 20 corporate holders of Bitcoin.

In its second-quarter report, CEO Doug Murphy-Chutorian reaffirmed the company’s commitment to BTC, emphasizing that Bitcoin complements the company’s healthcare business strategy.

Semler Scientific’s growing BTC reserves highlight rising corporate confidence in using the flagship digital asset as a treasury reserve instrument.

This trend was first initiated in 2020 by MicroStrategy, and this year other companies—including Japanese investment firm Metaplanet and publicly traded DeFi Technologies—have made significant BTC acquisitions.

Furthermore, the launch of BTC ETF products has significantly increased institutional investment into this emerging sector. Matt Hougan, CIO of Bitwise, predicts that as the BTC industry continues maturing, this trend will intensify in the coming years.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News