How effective is the grand ATOM revival plan?

TechFlow Selected TechFlow Selected

How effective is the grand ATOM revival plan?

Cosmos's vision and many of its initiatives are quite forward-thinking, but it must be said, the progress is indeed slow.

By Tia, Techub News

Although Cosmos has recently been embroiled in governance scandals, dynamic developments from June to August show that several protocols have successively proposed to join the Cosmos Hub as consumer chains. Indeed, this policy, first introduced under Cosmos 2.0 back in 2022, is finally seeing some tangible progress.

Meanwhile, LSM (Liquid Staking Module), launched since September last year, has now been live long enough for us to analyze data and assess how much liquidity it has unlocked from staked ATOM.

The ATOM War has also attracted a wave of projects seeking funding, seemingly preparing to kick off its first phase.

With the three key drivers—ICS, LSM, and ATOM War—now in place, along with insights into staking rates, this article offers a brief examination of the actual impact of these initiatives.

Staking

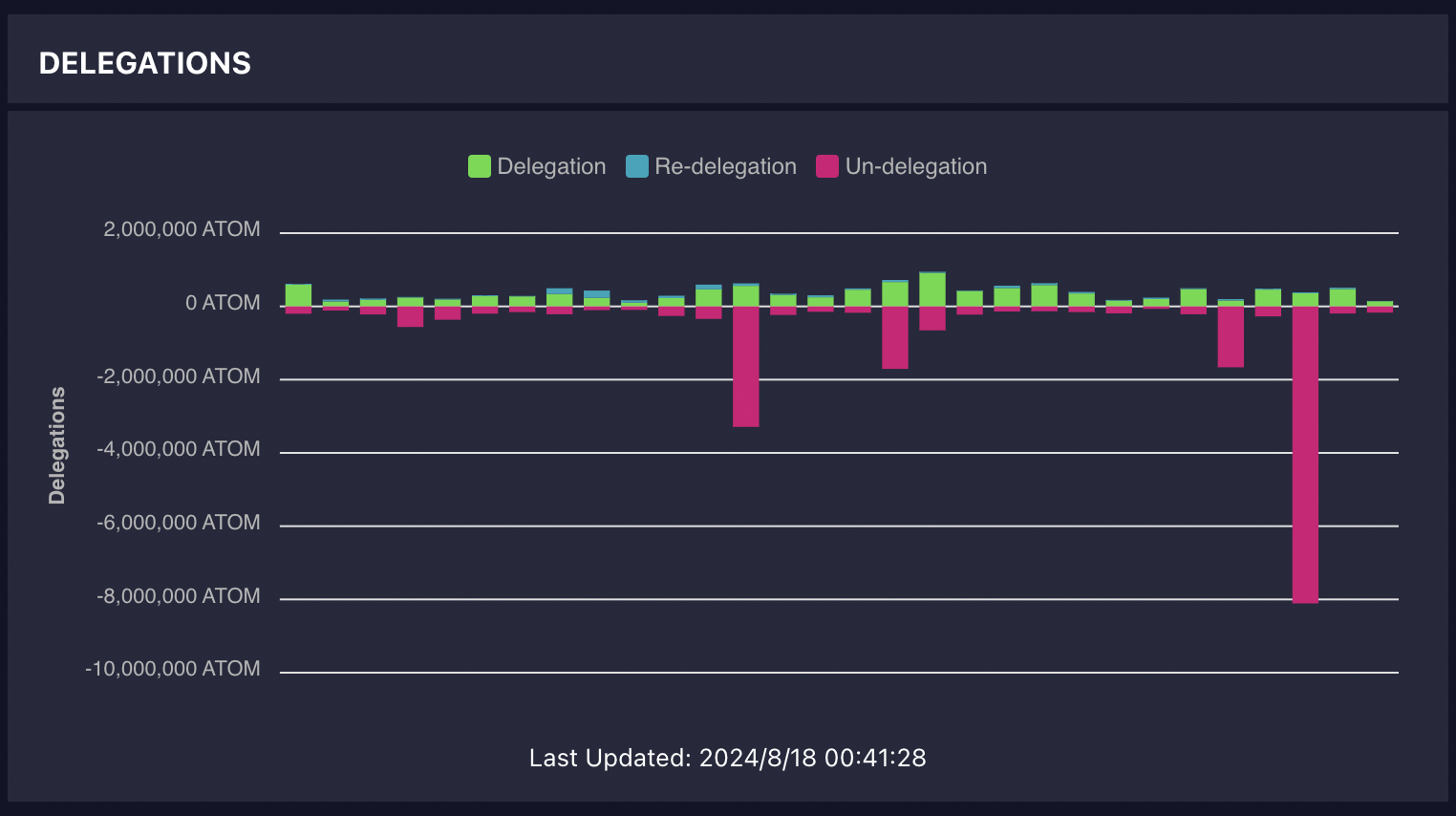

Data source: CosmosOutpost

Looking at staking data, the picture is bleak. Following the exposure of governance corruption within Cosmos on July 31, massive unstaking began. On July 31, approximately 3.3 million ATOM were unstaked; around 1.7 million ATOM on August 4; about 650,000 ATOM on August 5; roughly 1.66 million ATOM on August 13; and approximately 8.1 million ATOM on August 15. Over these days, a total of 12.11 million ATOM were unstaked—nearly 3% of the circulating supply. The ATOM price also dropped from $6.15 on July 31 to $4.62 on August 18, a decline of 33%.

ATOM token price

Replication Security (ICS)

The primary purpose of Replication Security is to allow other chains in the Cosmos ecosystem to leverage the Cosmos Hub’s validators for security, offering smaller chains—those unable to afford sufficient validator costs—a chance to share the Hub's security. These chains that share the Hub’s security are known as "consumer chains." To become a consumer chain, a project must submit a proposal outlining the cost it is willing to pay (such as transaction fees to the Hub). Only after ATOM holders approve the terms via governance can the chain officially become a consumer chain.

To date, two chains have successfully passed proposals: Neutron and Stride.

Neutron, the first consumer chain on the Hub, launched in May 2023, shares revenue with the Hub as follows:

-

25% of transaction fees, payable in ATOM or NTRN

-

25% of MEV income, payable in NTRN

In addition, Neutron airdropped 70,000,000 NTRN tokens (7% of total supply) to Cosmos validators. However, more than half (42,727,950 NTRN) remained unclaimed and were subsequently transferred to the Cosmos Hub treasury—worth approximately $15.72 million (as of August 18), or 0.08% of ATOM’s market cap.

The other consumer chain is Stride, a liquid staking protocol with substantial revenue, which generously allocates part of its earnings to the Hub:

-

15% of liquid staking rewards

-

15% of STRD inflation staking rewards

-

15% of MEV income

-

15% of transaction fees

Partial Set Security

Since all validators are required to validate every consumer chain, the rewards received by consumer chains often fail to cover operational costs, leading to complaints that ICS imposes additional burdens on validators. This led to the proposal of Partial Set Security, which reduces the number of validators required to run each consumer chain, thereby lowering the cost burden. Under this model, validators can opt-in voluntarily, and those who choose to validate consumer chains receive a larger share of rewards when fewer validators participate. This proposal was approved on April 12 this year.

Permissionless ICS

Permissionless consumer chains represent another post-Partial Set Security proposal, allowing anyone to create optional consumer chains without submitting a governance proposal. This would enable faster chain deployment with less friction. Consumer chains could set basic parameters, such as requiring a minimum number of validators to opt-in before launching. Currently, fees paid by consumer chains go directly to the Hub, which may later propose redistributing portions to validators. This indirect mechanism delays subsidy distribution and could lead to inequities. In the future, permissionless ICS may allow consumer chains to directly specify commission rates for validators, potentially enabling direct payments.

The permissionless ICS proposal is currently under vote, ending on August 21. While theoretically feasible, fully permissionless chain creation requires codebase refactoring. Thus, the current version of ICS still relies on governance proposals to establish consumer chains.

Protocols with Pending Consumer Chain Proposals

From June to August, several protocols submitted proposals to join the Cosmos Hub as consumer chains. However, due to the operational costs involved, some projects—even after submitting Hub proposals—have not completed subsequent steps. Over the past two months, potential consumer chains highlighted by the official Hub Twitter include Elys Network, KiiChain, and Evmos. Aside from Evmos, which maintains relatively higher usage, the expected activity from the other two chains appears limited. In practice, therefore, the consumer chain initiative does not appear to be delivering strong results so far.

LSM Liquid Staking

For any decentralized network, consistent, available, and deep asset liquidity is crucial. The LSM (Liquid Staking Module) enables ATOM stakers to tokenize their staked ATOM into liquid staked assets via liquid staking protocols. Its main function is to unlock the value of staked ATOM, allowing it to participate in DeFi and boost activity across the Cosmos DeFi ecosystem—addressing the issue of low on-chain utility caused by ATOM’s extremely high staking rate.

The LSM module officially launched on September 13. Here we examine whether DeFi activity in the Cosmos ecosystem has increased since LSM activation, while also reviewing the price performance of associated liquid staking tokens.

Currently, the LSM module is primarily used by three liquid staking protocols: pSTAKE, Stride, and Quicksilver. Due to unavailability of historical data for pSTAKE and Quicksilver, this article focuses mainly on Stride’s data.

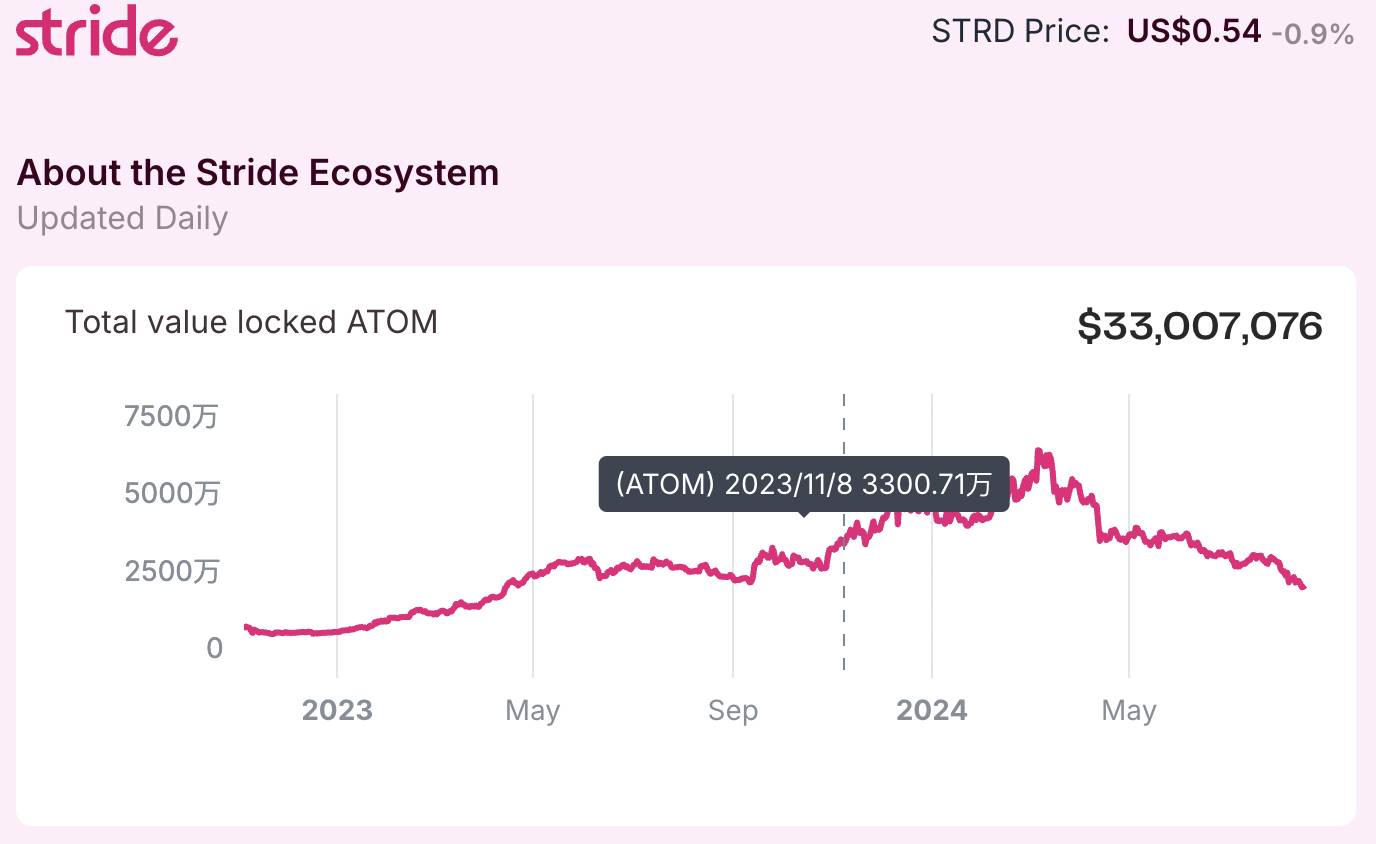

The chart below shows the TVL (total value locked) of stATOM minted on Stride. Since September 13, the TVL of minted stATOM has significantly increased, peaking around April 8 before declining. Although the trend is downward, compared to the concurrent drop in ATOM price during this period, the actual amount of staked ATOM likely hasn’t decreased significantly—though growth rates have slowed.

Data source: Stride

Data source: Stride

ATOM token price

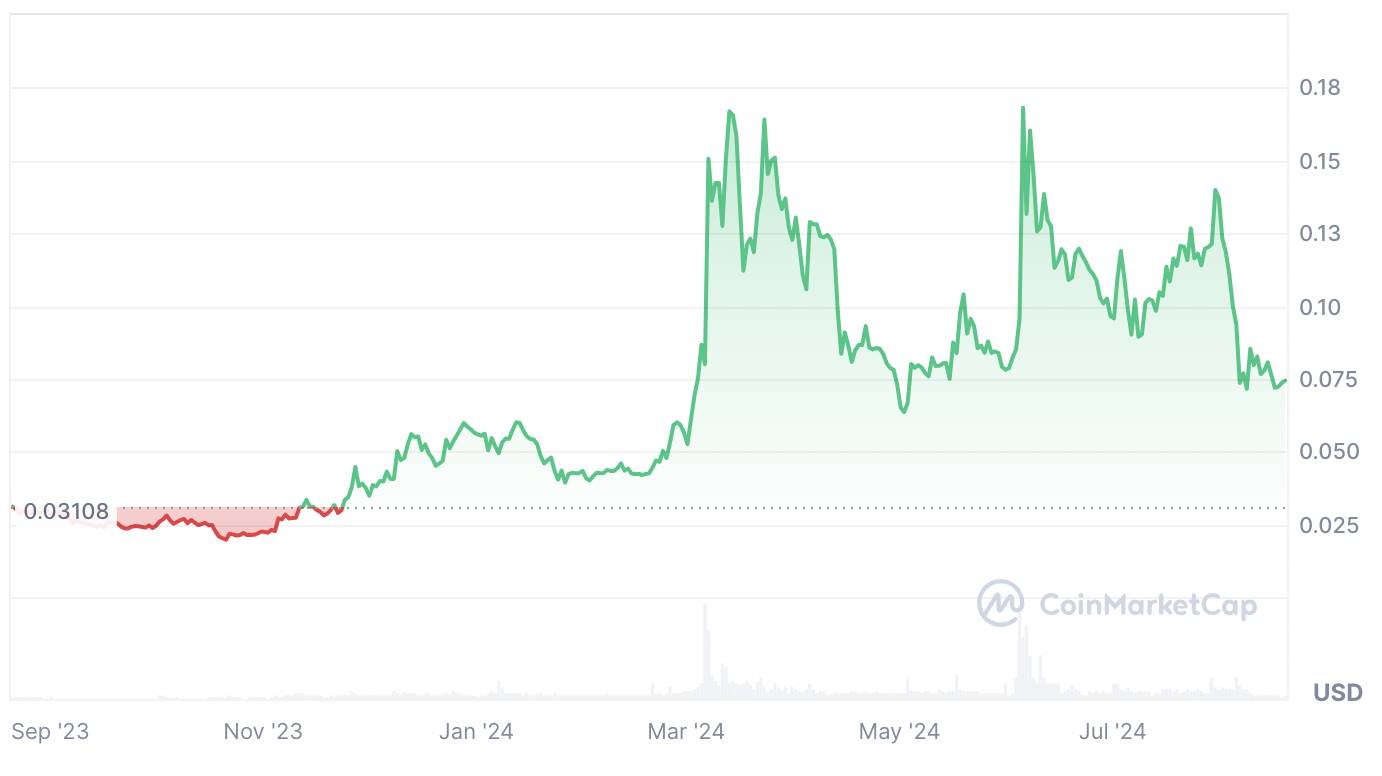

Stride, as a liquid staking chain, saw its token price rise significantly starting in October but began to retreat from its peak in mid-February—about a month earlier than the broader crypto market downturn in mid-March.

Stride token price

pSTAKE token price

pSTAKE performed well too, showing impressive gains.

Quicksilver token price

Quicksilver token price

Quicksilver showed promising early performance, but due to stagnant TVL growth, its token price later performed extremely poorly.

Overall, LSM has had a noticeable positive effect on consumer chains.

In terms of staking volume, Stride currently holds about 4,223,479 ATOM, and pSTAKE about 661,066 ATOM—totaling approximately 4,884,545 ATOM. Given that LSM’s cap is 25% of total staked ATOM (around 60 million), although this is incomplete data, tokenized staked ATOM currently accounts for less than 10%. Compared to Ethereum, where liquid staking represents 32.34% of total staked ETH (11,043,280 ETH out of 34,140,035 ETH), there remains significant room for growth. Future observation should focus on related metrics and potential incentives to promote LSM adoption.

Atom War

Atom War is analogous to Curve War. Given that some projects in Cosmos request ATOM funding (similar to loans) from the Hub, Atom War introduces a competitive mechanism: projects vying for ATOM funding compete against each other, and holders of LSM-derived “shares” can lock their shares to gain voting power directing funding allocations. This mechanism is primarily implemented through Hydro.

Demex, Electron Protocol, Nolus, and Shade Protocol are the first batch of projects competing for funding. As the auction has not yet started, no observable data is available.

Summary

In summary, these revitalization efforts do not appear particularly optimistic, with ongoing unstaking reflecting this reality. While Cosmos’ vision and many of its measures are forward-thinking—for example, introducing shared security concepts early on—the actual benefits have been minimal. (Of course, this also relates to individual project conditions; implementing Cosmos’ shared security is indeed more complex.) But undeniably, progress has been slow.

Moreover, Cosmos now faces challenges common to ecosystems at its stage—governance centralization. The community expresses dissatisfaction with perceived exclusivity, factionalism, and wasteful spending within Cosmos. Whether due to prolonged waiting or genuine disappointment, even some genesis wallet addresses have begun unstaking ATOM.

I recall when Cosmos 2.0 was first unveiled, teams gave interviews full of enthusiasm and hope. Watching those podcast episodes, I myself was inspired by their passion. Yet sometimes reality is harsh—in any case, the outcomes so far have fallen short of expectations. Despite widespread criticism of Cosmos, especially directed at Ethan, the figure behind it all, I still believe that Ethan—the man who likes wearing skirts, hair clips, never shaves, is fascinated by money, and dreams of applying biological ecosystem principles to blockchain design—is not as bad as the community portrays him to be.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News