Numbers on ZK: L2 Spending on ZKP Exceeds $60 Million, zkRollup Gradually Rising

TechFlow Selected TechFlow Selected

Numbers on ZK: L2 Spending on ZKP Exceeds $60 Million, zkRollup Gradually Rising

This article will explore the growth of zero-knowledge, its adoption, network health, and competitive dynamics at both the application and infrastructure levels.

Author: OurNetwork

Translation: TechFlow

This issue focuses on zero-knowledge proofs (ZKPs)—one of the most important yet least understood technological breakthroughs in our industry. Here, we explore the growth, adoption, ecosystem health, and competitive dynamics at both the application and infrastructure layers.

Why This Matters:

For crypto applications to achieve true global mainstream adoption, the blockchains they rely on must become more scalable and efficient. For Ethereum—the world’s largest Layer 1 blockchain—and its community, this has led to a strategic embrace of Layer 2 scaling solutions. L2s like Optimism, Arbitrum, and Base represent the first wave of innovation in this space and have now become primary platforms for millions of users and applications, securing billions of dollars in value.

Meanwhile, zero-knowledge proofs (ZKPs) represent another critical breakthrough in scalability, with theoretical performance far surpassing existing infrastructure and enabling entirely new types of applications. Although still in early stages, the rapid progress made in such a short time warrants close attention.

While it's still early, on-chain data supports this narrative—crypto is undergoing a significant shift toward zero-knowledge proofs (ZKPs), starting with ZKP-powered applications and now extending to ZKP-based infrastructure such as rollups. Special thanks to the NEBRA and OurNetwork teams, along with core data contributors Jackie (Dune) and Brandyn (OurNetwork). Without their support, this analysis would not have been possible. Now, let’s examine the data behind this transformation.

Quick Links: Dune Dashboard | Contribution Repo | Nebra

① ZKP: Ecosystem Health

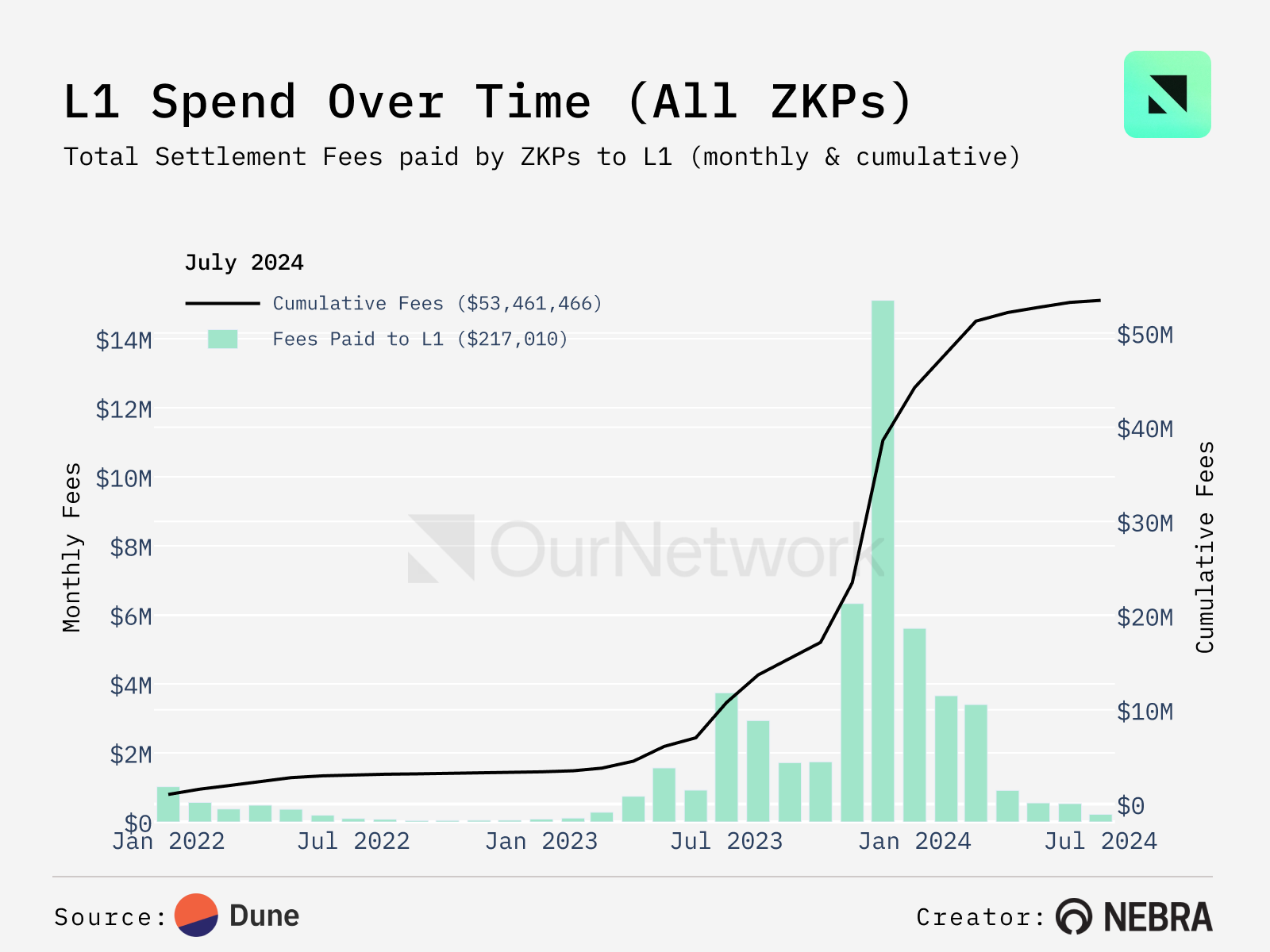

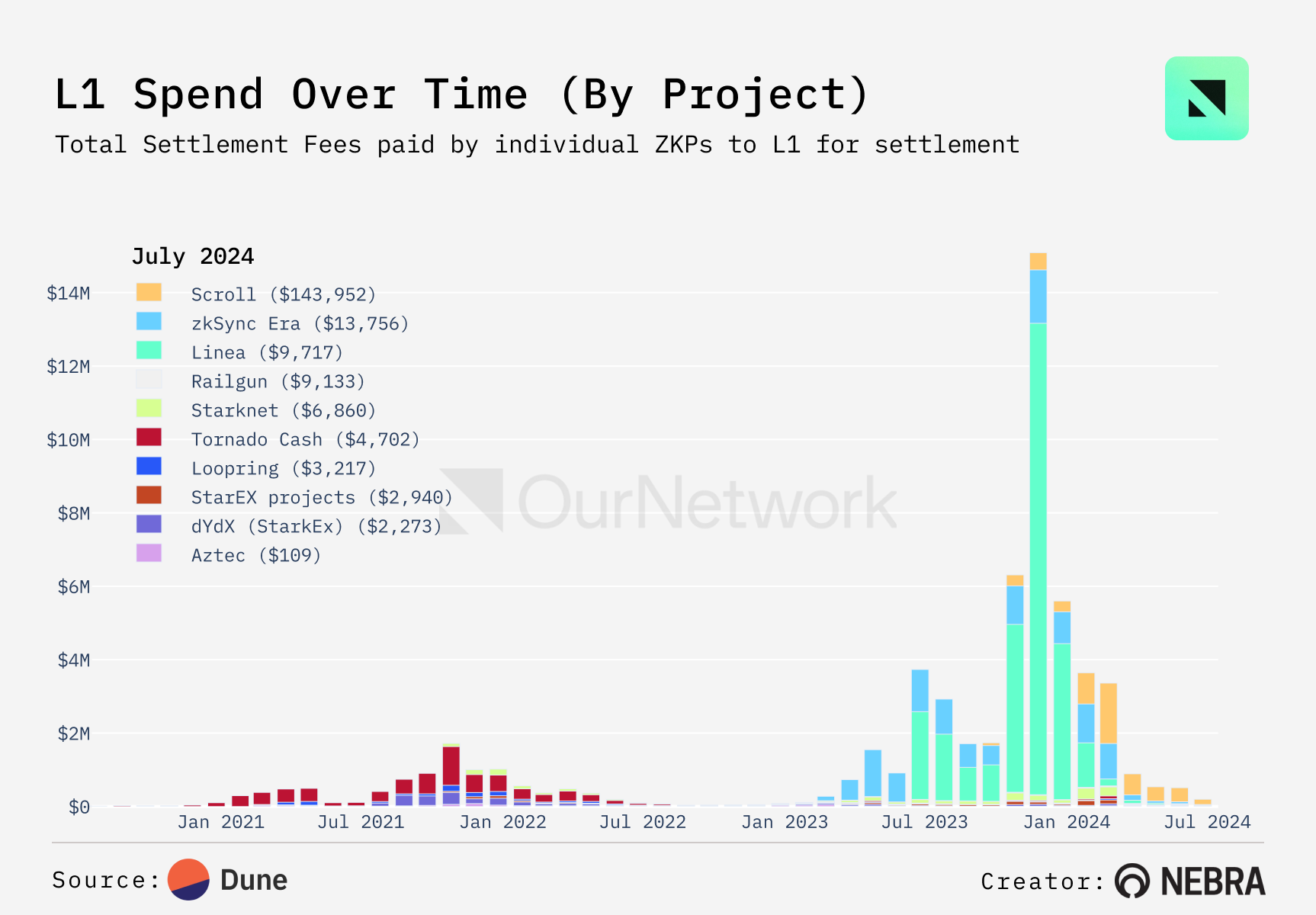

Total spending on zero-knowledge proofs (ZKPs) across Layer 2 solutions has exceeded $60 million.

-

Total settlement fees (TSF) paid by ZKP projects to Ethereum L1 have surpassed $60.4 million, reflecting significant adoption over time. TSF peaked at $15 million in December 2023. Over the past 30 days, TSF for ZKP verification on Ethereum L1 was only $150,000, highlighting cost-efficiency improvements driven by technical optimizations.

-

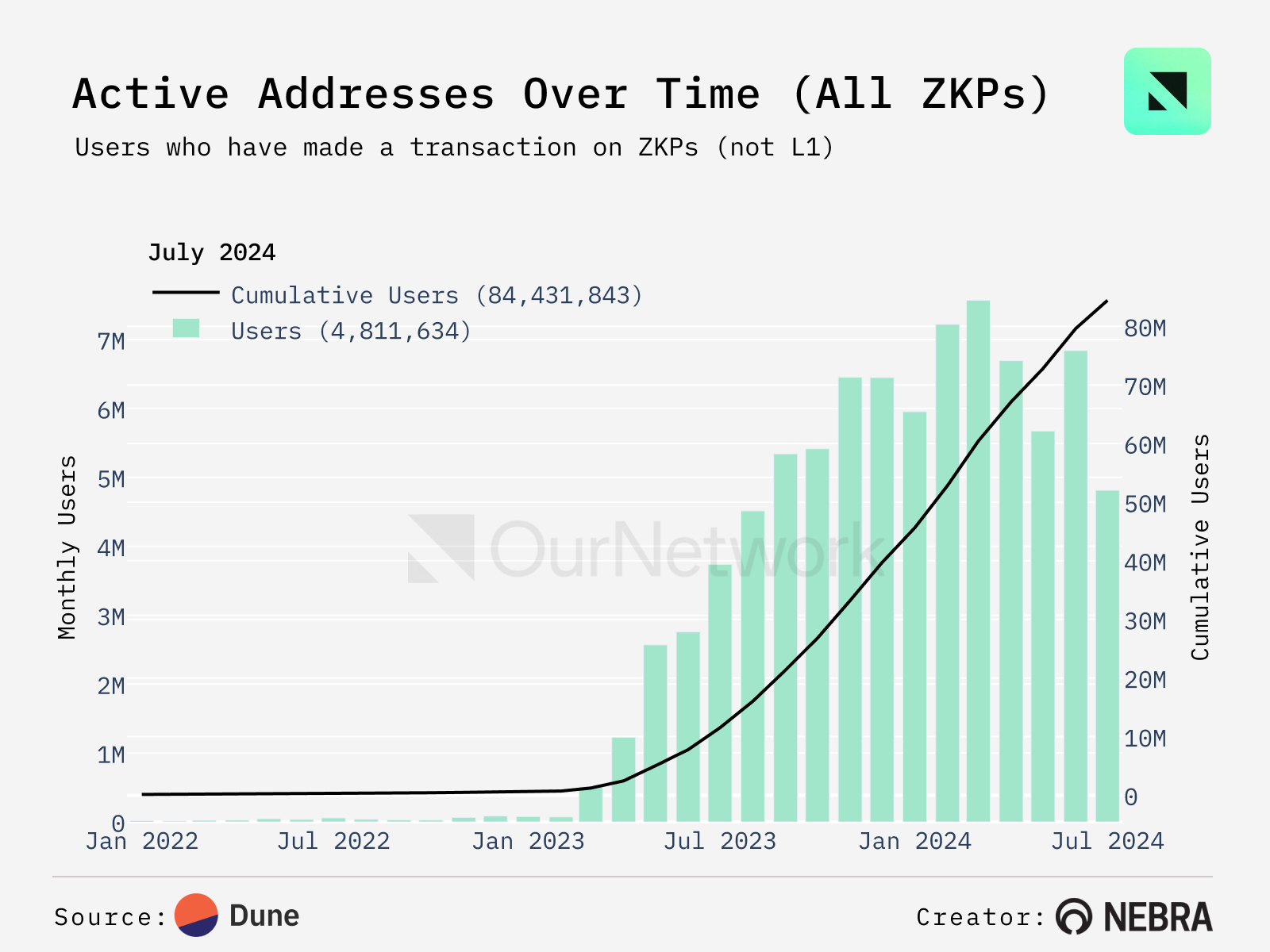

Active addresses using ZKPs have steadily increased in 2023 and 2024, peaking at 7.6 million in March. Although active addresses dropped to 4.8 million in July 2024—the annual low—the average monthly active address count reached 6.4 million in 2024, more than doubling the 2023 average of 3.2 million per month, despite an overall summer market slowdown.

-

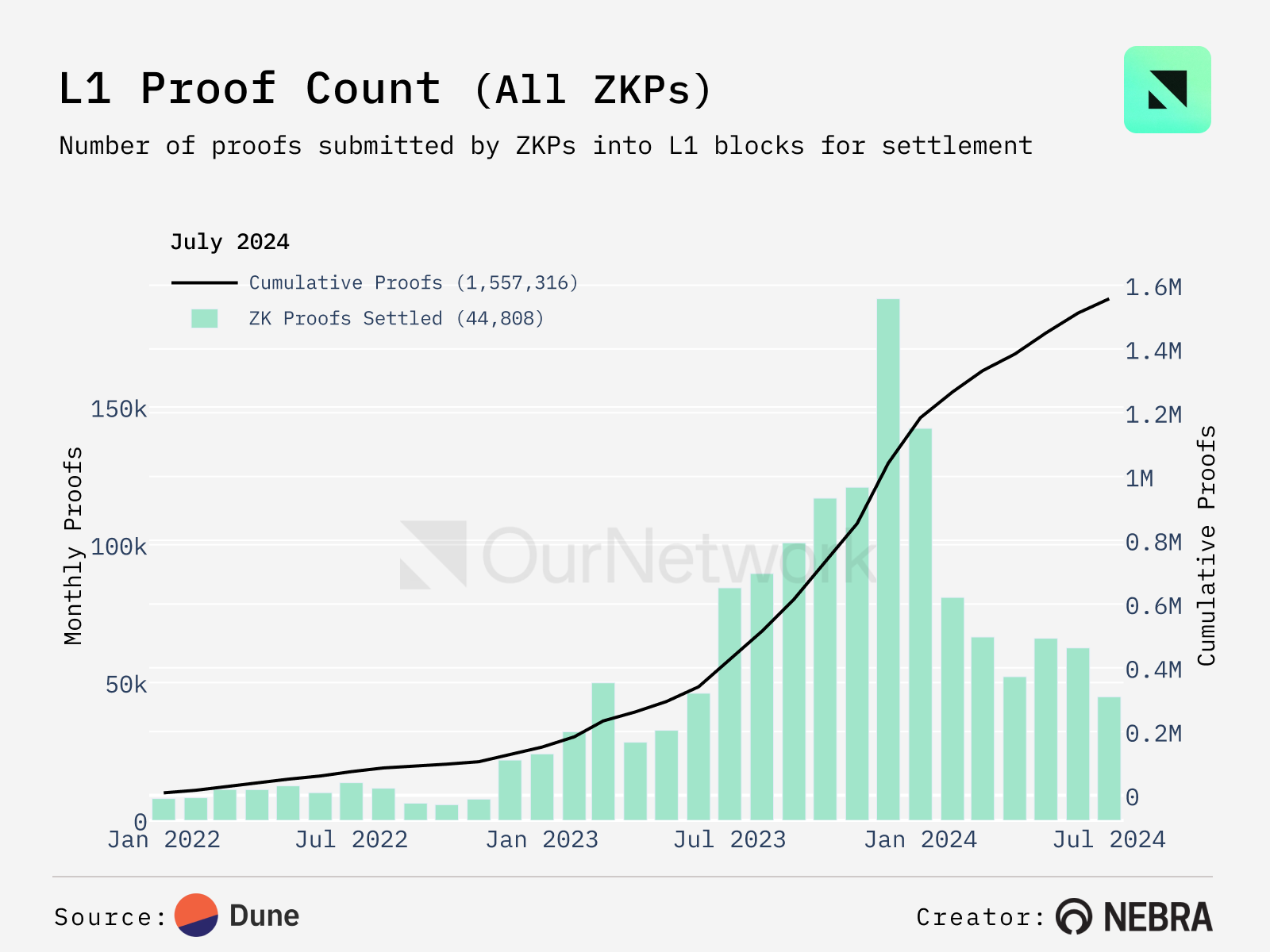

Last month saw over 1.5 million cumulative proofs generated, but the number of ZK proofs settled onto L1 blocks has declined since 2023, having peaked at 189,280 in December 2023.

-

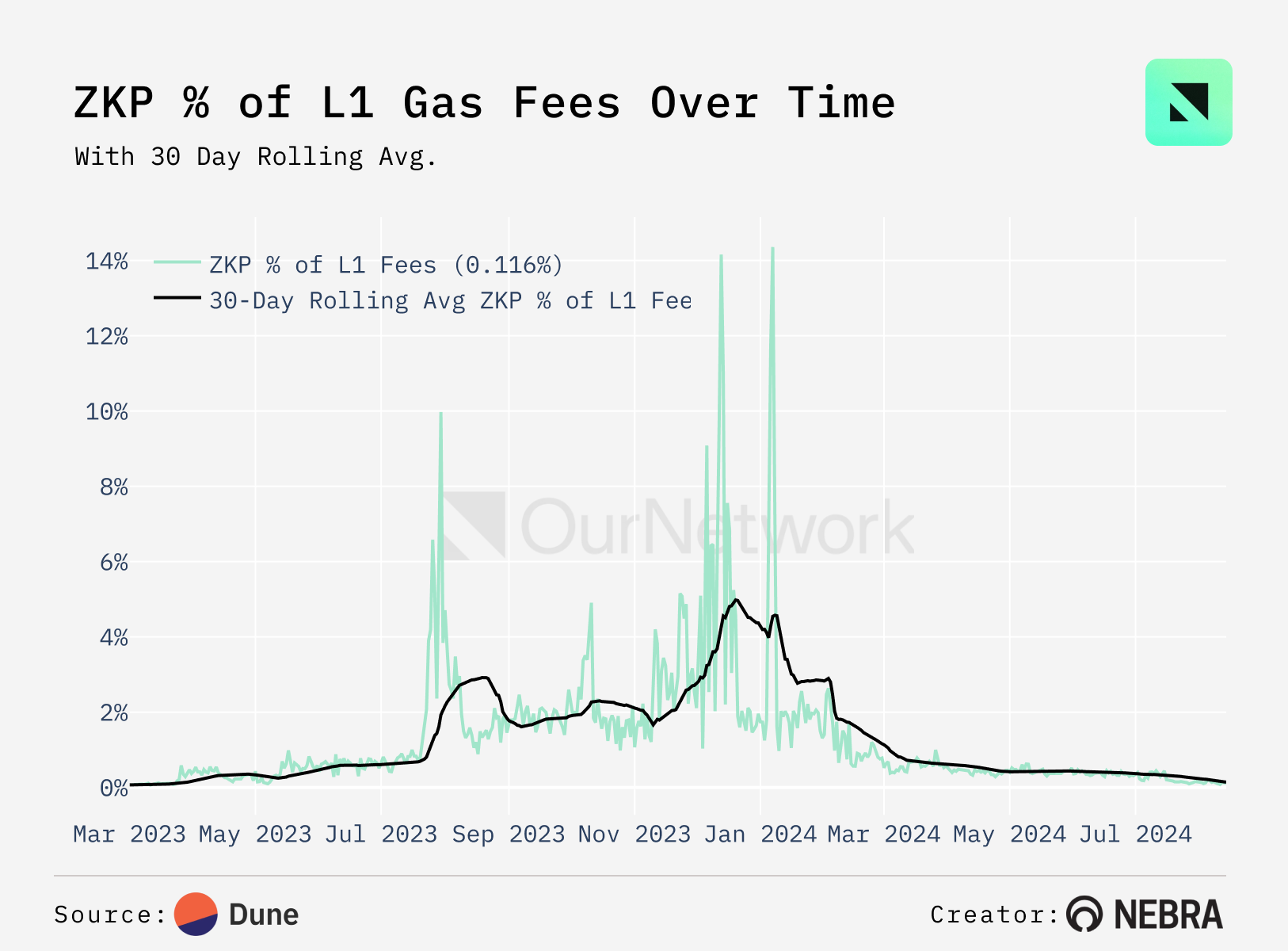

This trend is primarily due to a slight drop in demand (active users), but more importantly, technical advancements—zkRollups are adopting new techniques like proof aggregation to reduce both the number of proofs and TSF.

② ZKP: Project Trends

Linea has generated 23.2 million ZKP transactions from 5.5 million users

-

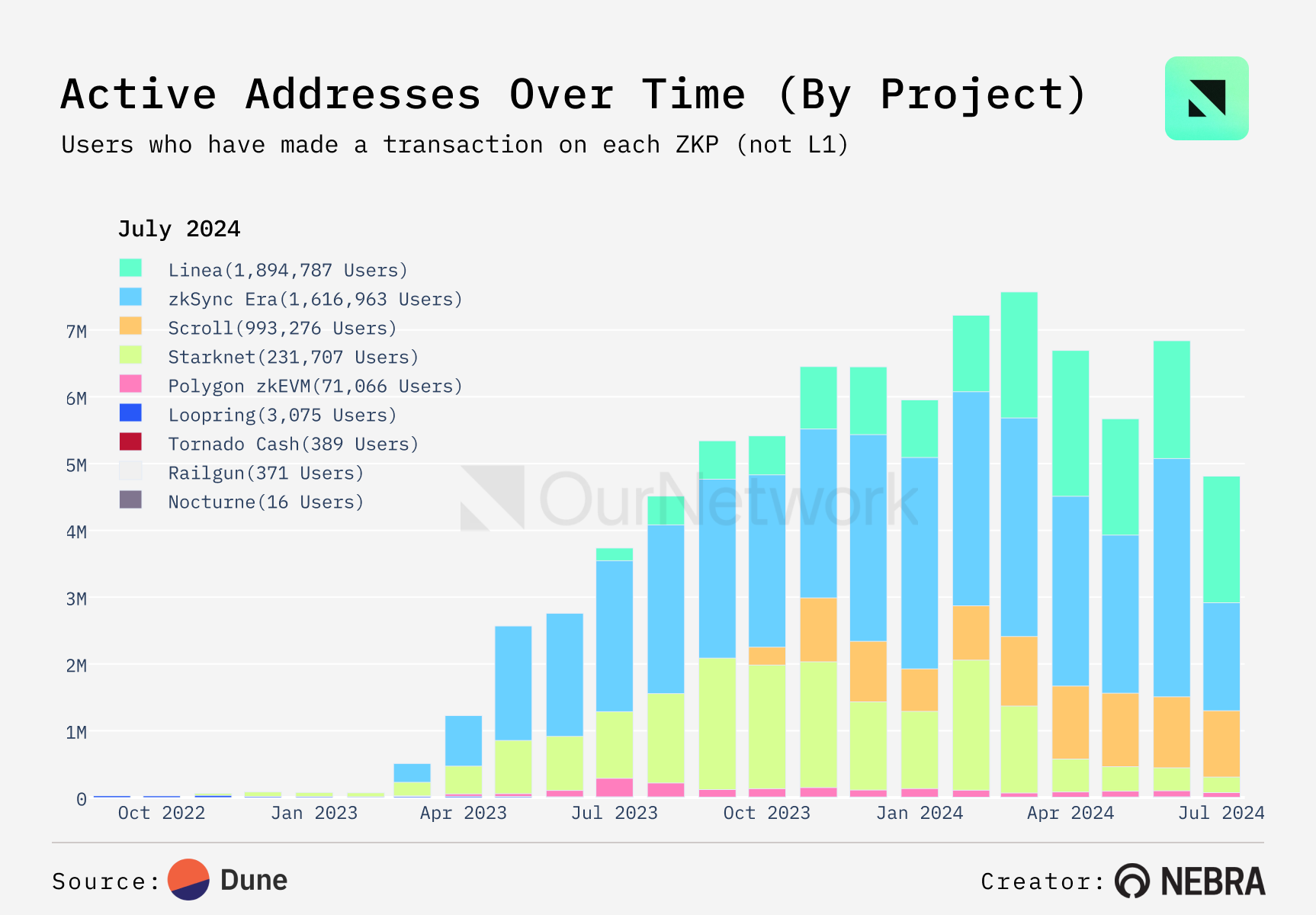

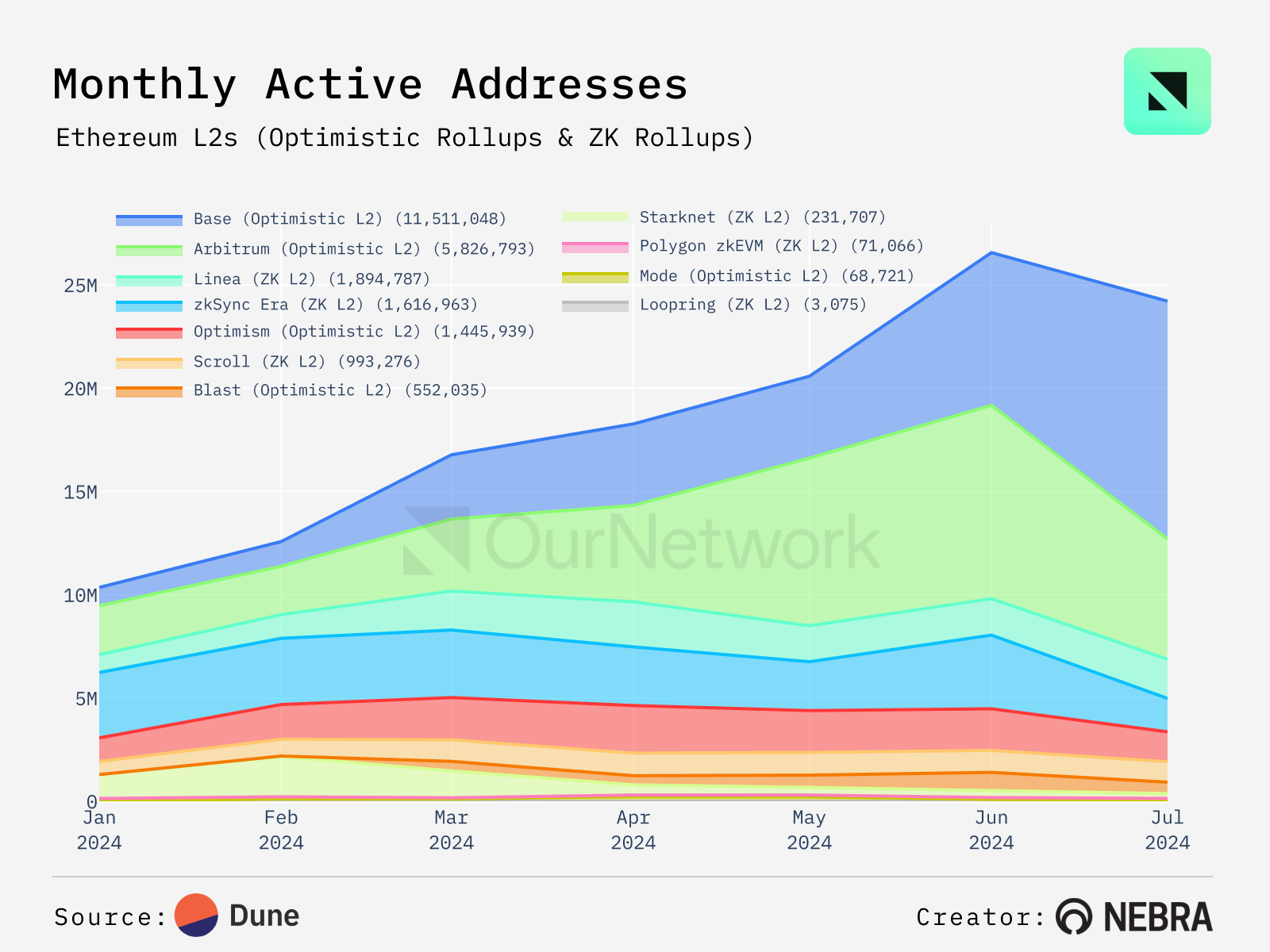

In terms of ZKP user adoption, Linea is emerging as a “successful” chain. In the past 30 days, it led all L2s with 1.77 million unique active addresses, followed by zkSync with 1.3 million and Scroll with 950,000.

-

In December 2023, Linea’s L1 spending on ZKPs surged to $12.8 million, accounting for nearly 85% of all project spending on ZKPs that month—a historical high driven largely by Linea’s Voyage XP program. More recently in 2024, Scroll has begun dominating TSF payments to L1 and is expected to further reduce costs with its upcoming upgrade scheduled for August 21.

③ ZKP: Infrastructure vs Applications

Infrastructure uses ZKPs over 250 times more than applications

-

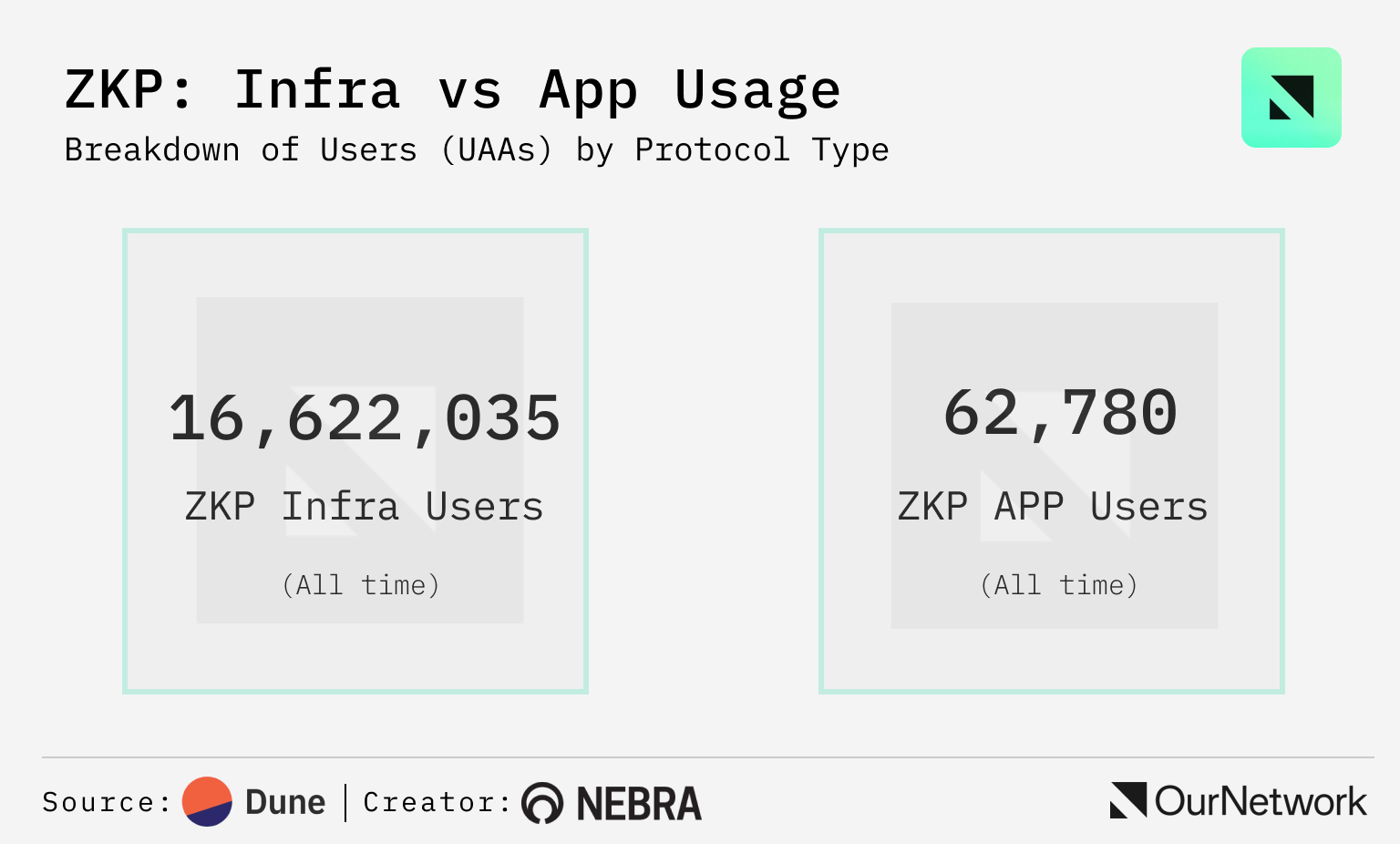

To date, 16.6 million addresses have triggered ZKP transactions via infrastructure—especially zkRollups—compared to just 62,780 addresses through applications.

-

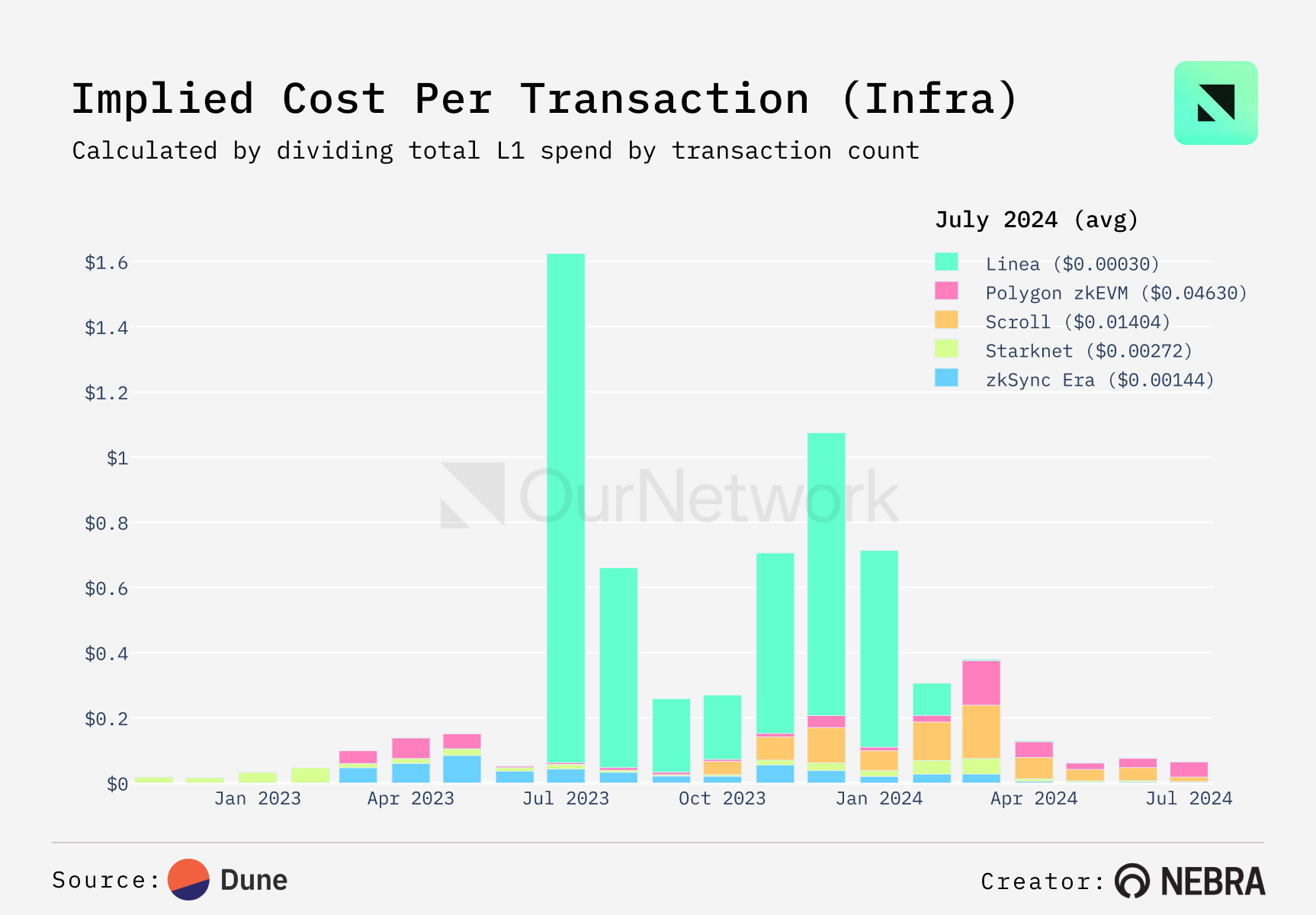

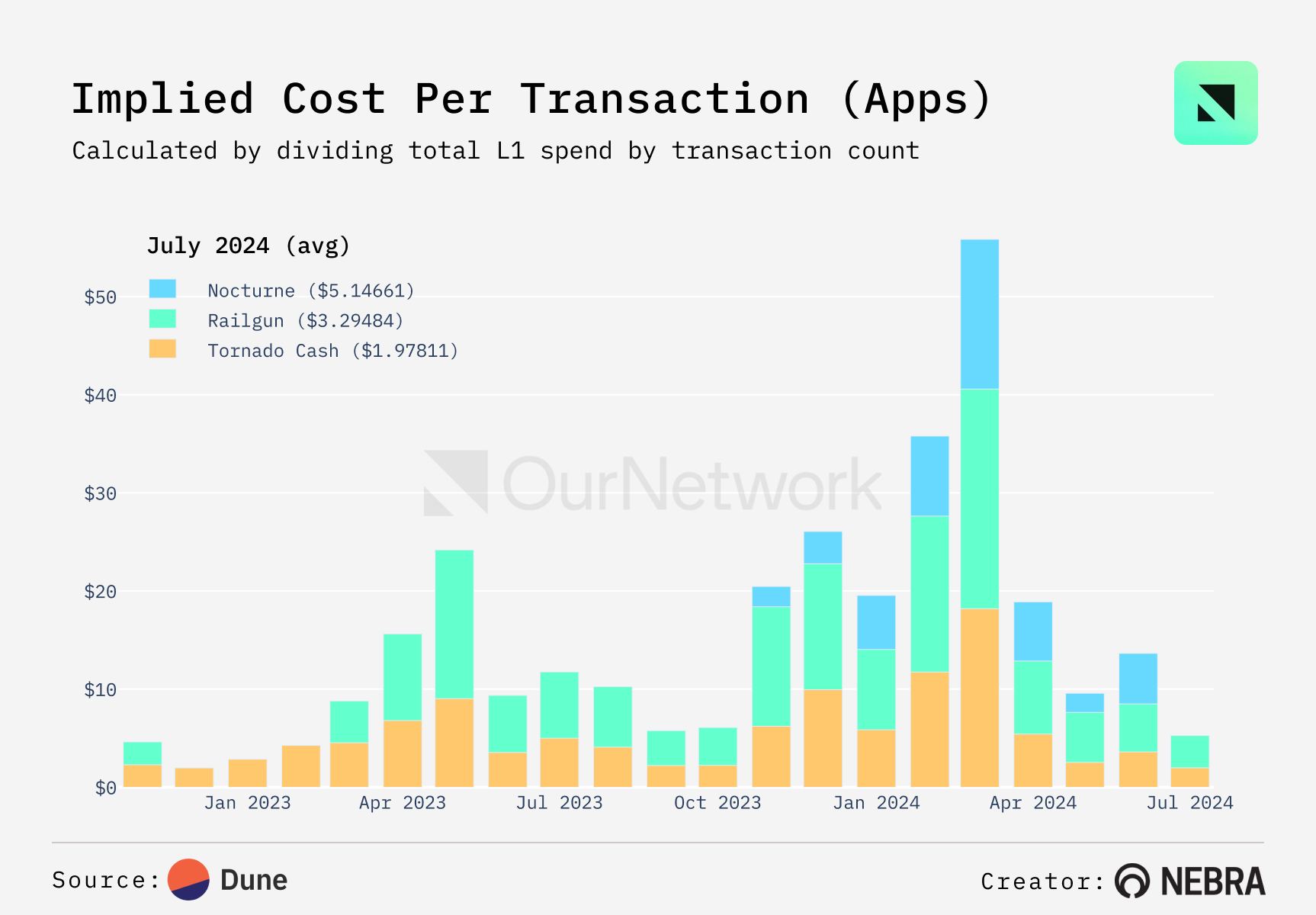

Several key factors explain this stark contrast. First, in August 2022, OFAC sanctioned Tornado Cash, a major privacy-focused application using ZKPs, making its use illegal for U.S. citizens and significantly reducing ZKP usage in applications. Second, the per-transaction cost of ZKPs at the infrastructure layer is dramatically lower than at the application layer—Linea averages $0.00034 per transaction over 30 days. Even Polygon zkEVM, the most expensive ZKP infrastructure, averages $0.03 per transaction, still far below top ZKP applications.

-

As the impact of OFAC sanctions subsides, ZKP application usage is recovering. Tornado Cash remains one of the relatively cheaper ZK applications, averaging $1.0 per transaction over 30 days. While not a fully comparable metric due to higher L1 fees, Tornado transaction costs are still about 33 times higher than Polygon zkEVM and roughly 3,300 times higher than Linea.

④ ZKP: Macro Trends

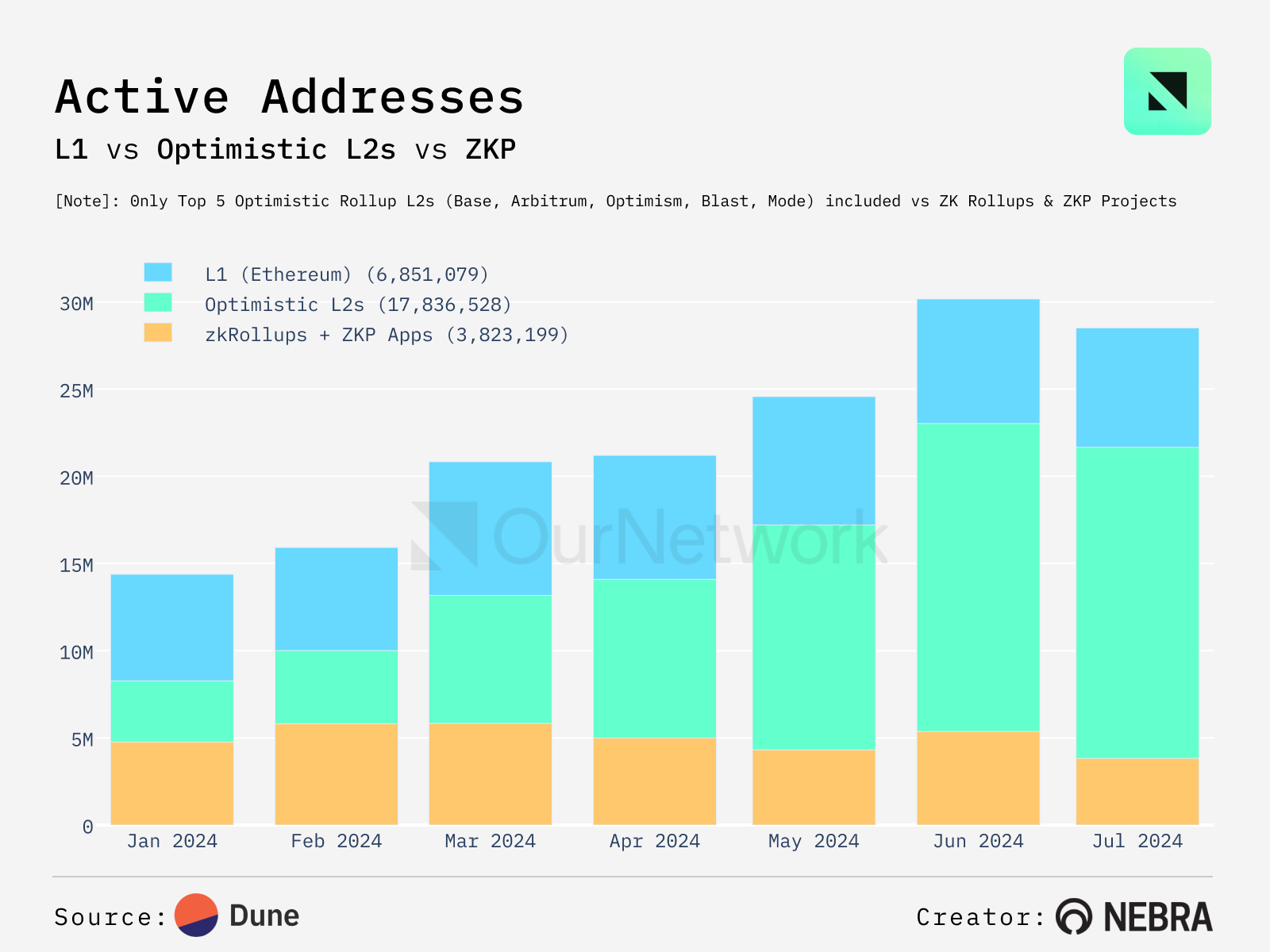

The top five Optimistic Rollups still lead zkRollups in active addresses by a ratio of 4:1; however, zkRollups have nearly matched Ethereum L1 in active address volume this year

-

The top five Optimistic Rollups have grown in active addresses this year, rising from 3.8 million in January 2024 (actually below zkRollups’ 4.8 million) to over 17.8 million. Despite many zkRollup chains still pending launch, these solutions have consistently attracted more than half the number of addresses compared to Ethereum L1 each full month—by July, zkRollups accounted for 13% of the combined active address market share of Ethereum L1 and the top five optimistic rollups.

-

Last month, Linea ranked third among L2s with 1.8 million active addresses. Base led all L2s with 11.5 million active addresses, followed closely by Arbitrum with 5.8 million.

-

As L2s adopt more efficient ZKP-related technologies, the proportion of gas fees attributed to ZKP contract calls has actually dropped to a 30-day rolling average of 0.14%. This is about 1/100th of the recorded peak values, both of which occurred in December 2023 when ZKP transactions twice accounted for over 14% of total Ethereum gas fees.

ZK Proofs: NEBRA and the Future of the Proof Singularity

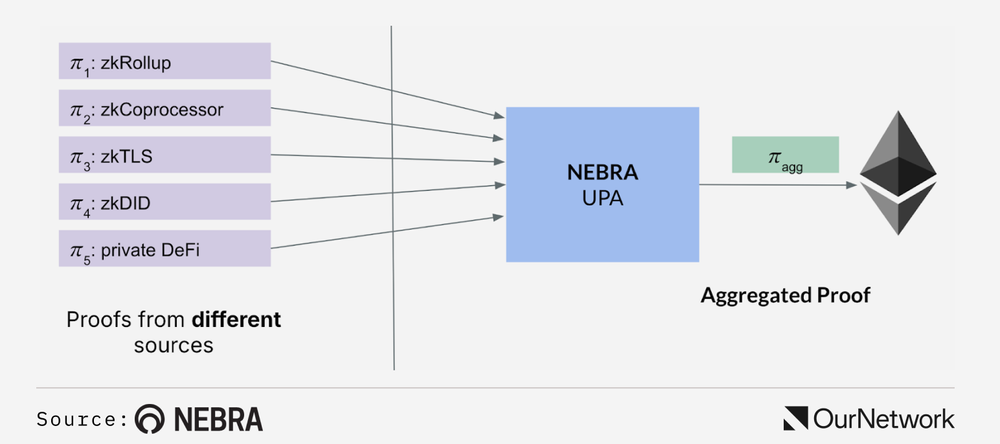

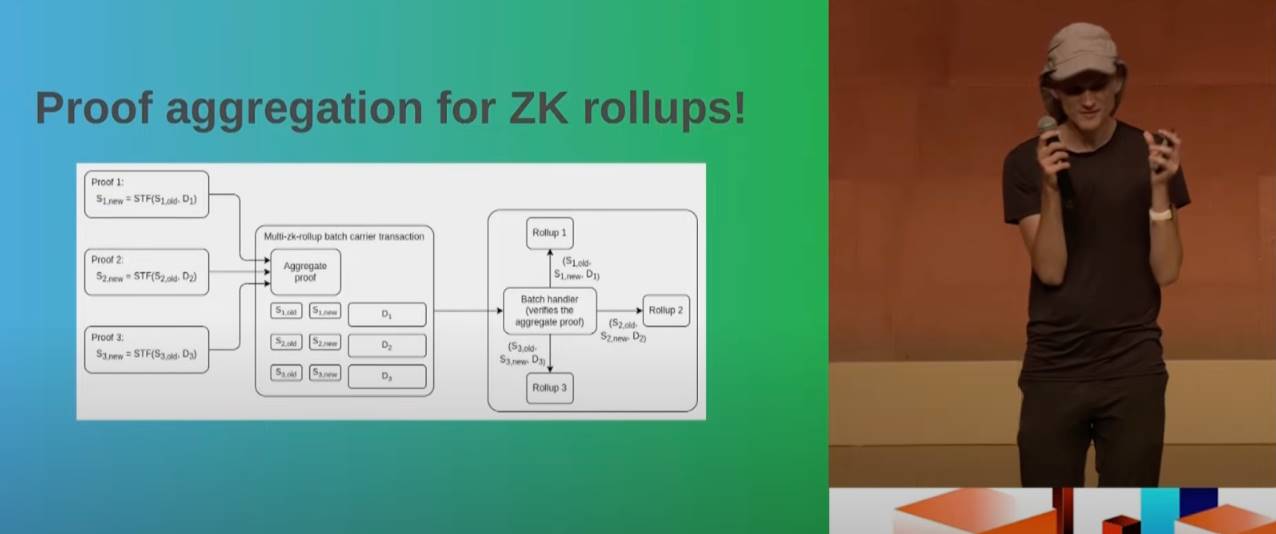

A key technology for scaling ZKP blockspace is proof aggregation, which combines multiple proofs from different sources into a single recursive proof verifying the validity of all original proofs (i.e., an aggregated proof).

Nebra

Proof aggregation protocols like NEBRA UPA significantly increase bandwidth and reduce the on-chain cost of zero-knowledge proofs. For example, in the current version of NEBRA UPA, Groth16 proof verification costs have decreased from 300,000 gas to 18,000 gas—a reduction of over 15x. This mirrors how data availability protocols (such as EIP-4844, Celestia, EigenDA, and Avail) reduce data availability costs.

Moreover, proof aggregation enables what Vitalik Buterin calls the "proof singularity"—where each block contains only one aggregated proof. Beyond reducing on-chain ZKP verification costs, proof aggregation also enables native interoperability and shared settlement between zkRollups.

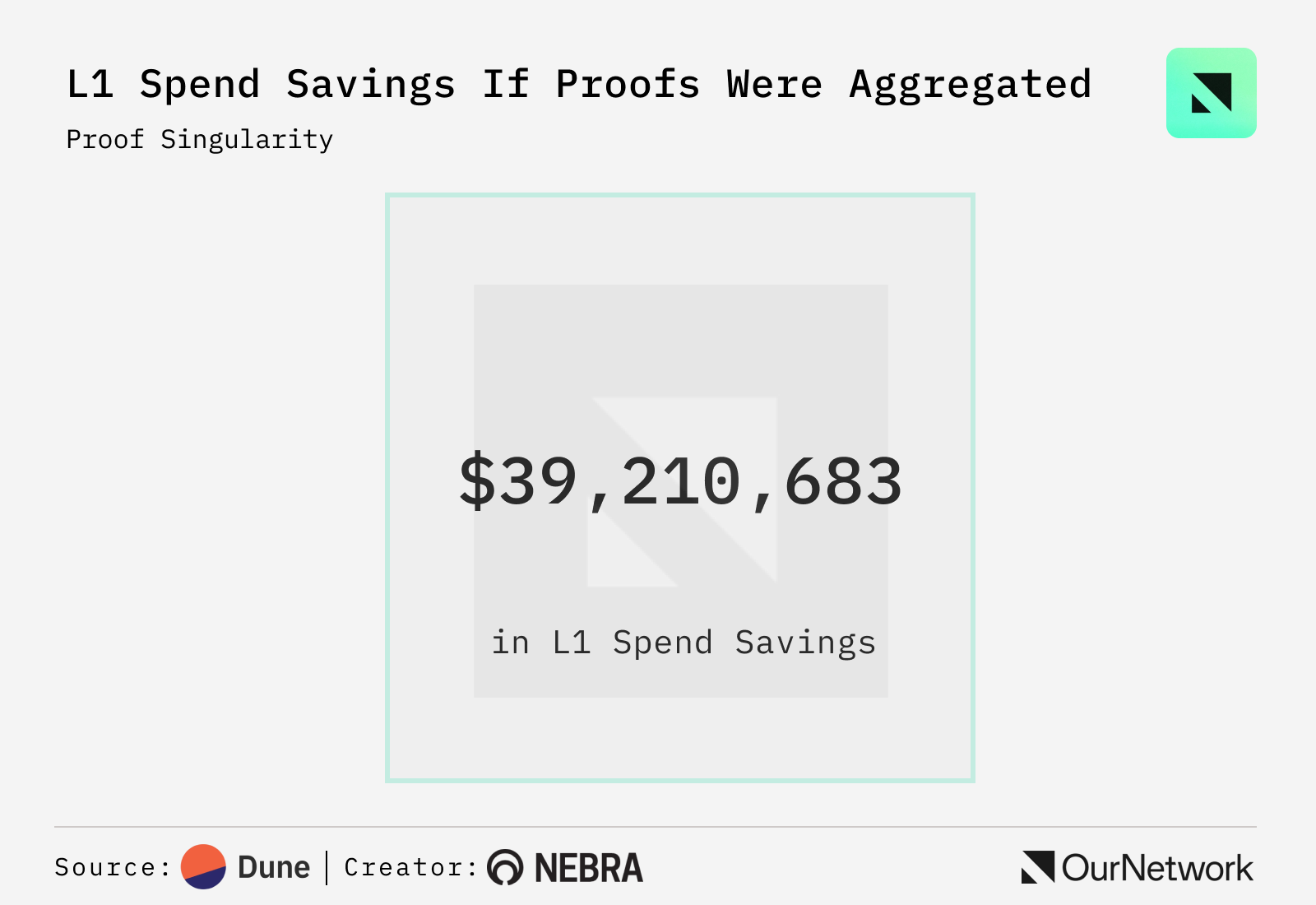

NEBRA’s launch of UPA and its future rollup operating system on Ethereum mainnet marks a significant milestone for the entire ZK field. As the proof singularity approaches, the future of ZK and blockchain looks brighter than ever. Imagine if every proof could be aggregated—Ethereum could save over $39 million in costs!

Concept:

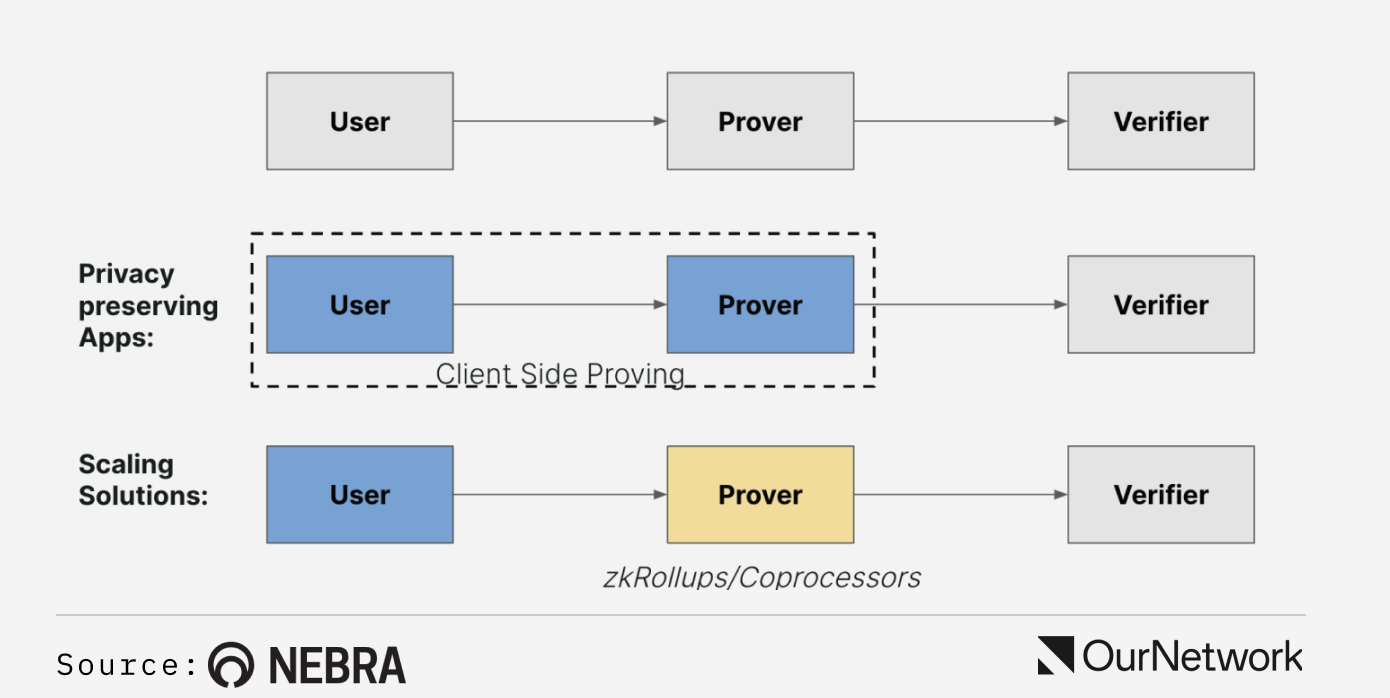

Zero-Knowledge Proofs (ZKPs) allow arbitrary computations to be verified using small cryptographic proofs while preserving privacy. Applications and infrastructure typically use ZKPs in two ways:

-

Privacy preservation

-

Verifiable computation and scalability

-

Nebra

Nebra

In these cases, zero-knowledge proofs are generated using a combination of user-specific data and public on-chain data. These proofs are then verified on-chain to execute subsequent business logic.

Privacy-Preserving Applications:

In terms of data flow, when ZKPs are used in privacy-preserving applications, proof generation must occur client-side to prevent exposure of sensitive user information (e.g., private keys). In these applications, user-controlled clients—whether browsers or mobile apps—submit proofs directly to the blockchain.

Examples:

-

ZK-based identity solutions, such as Worldcoin

-

Privacy-preserving financial applications, such as tornado.cash and railgun

Scaling Solutions:

When ZKPs are used for scaling, proof generation typically does not require access to users' sensitive data. Therefore, proof generation can be delegated to more powerful servers or public cloud infrastructure. Some scaling solutions leverage GPU acceleration to improve throughput and reduce latency in proof generation.

Examples:

-

zkRollups, such as zkSync, Polygon zkEVM, Scroll, Starkware, and Linea

-

zkCoprocessors, such as Succinct, RISC Zero, Axiom, Brevis, and Lagrange

Methodology:

Through this dashboard, we measure three key metrics:

-

Total Settlement Fees (TSF): The total amount of ETH paid by users or scaling solutions to verify zero-knowledge proofs on-chain. These fees are typically broken down into EVM precompile calls related to cryptography (explained in detail below).

-

Number of On-Chain Transactions: The number of transactions that verify ZK proofs.

-

Number of Active Users: The number of users utilizing ZK proofs.

How Do We Measure?

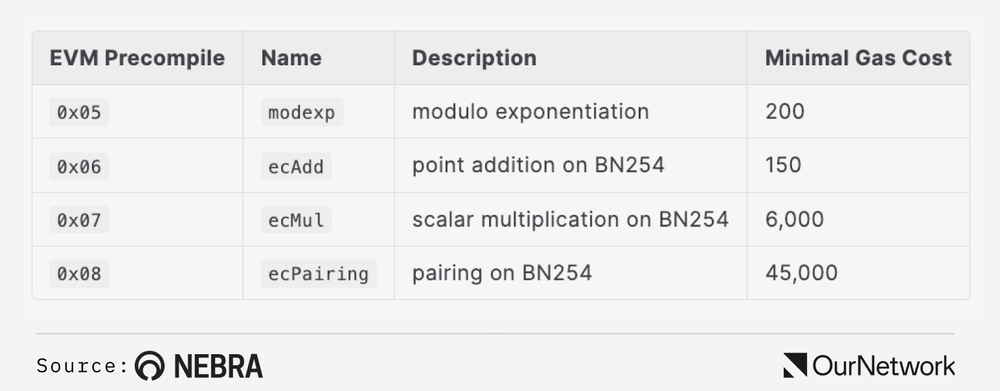

We implemented queries on Dune’s indexed Ethereum data to capture gas expenditures associated with ZKP verification. By identifying correct contracts and transaction call methods, we pinpointed relevant internal calls (see the annotated methodology in this section). These expenditures primarily stem from calling the following precompiles:

Nebra

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News