In-Depth Analysis: The Two Major Licenses for Web3 Companies to Conduct Virtual Currency Business in New York State

TechFlow Selected TechFlow Selected

In-Depth Analysis: The Two Major Licenses for Web3 Companies to Conduct Virtual Currency Business in New York State

BitLicense and Limited Purpose Trust Company License.

By Aiying Aiying

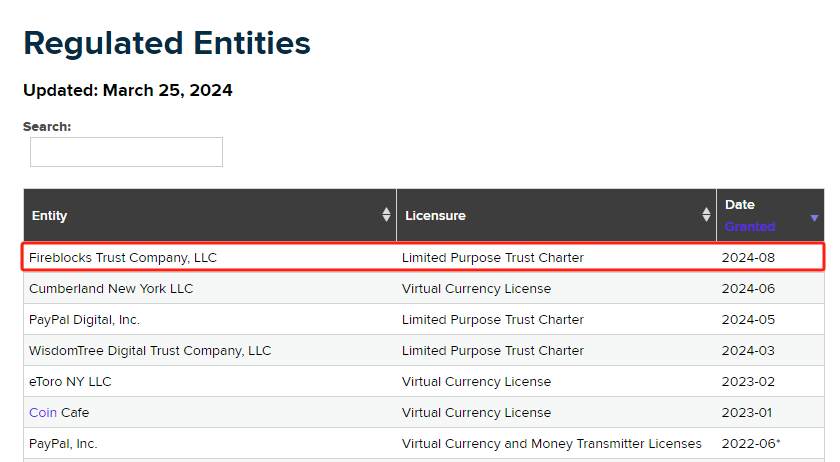

According to the latest official list checked by Aiying Aiying, Web3 infrastructure provider Fireblocks has obtained a Limited Purpose Trust Charter, allowing it to offer cryptocurrency custodial services to customers in the United States. The license permits the company to engage in virtual currency operations and is expected to soon launch cold storage custody solutions based on Fireblocks technology for U.S. clients.

(Source: New York State Department of Financial Services, NYDFS)

Fireblocks' trust company is part of its global initiative to build a regulated cryptocurrency custody network. In June, Fireblocks launched a global digital asset custody network, where custodians use Fireblocks' technology and connect with clients through the Fireblocks platform.

The Limited Purpose Trust Charter provides an alternative pathway for crypto firms to operate in New York State—offering additional benefits compared to the state's BitLicense. According to NYDFS regulations, "A limited purpose trust company may exercise fiduciary powers including custody services, and may conduct money transmission business in New York without holding a separate New York Money Transmitter License."

In the United States, federal and state laws create a nuanced "cooperative-competitive" relationship in cryptocurrency regulation. Federal oversight is primarily carried out by FinCEN, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC). FinCEN regulates cryptocurrency transactions under the Bank Secrecy Act (BSA), requiring businesses to register as Money Services Businesses (MSBs) and comply with strict anti-money laundering (AML) and know-your-customer (KYC) requirements. The SEC focuses on whether cryptocurrencies qualify as securities and oversees their issuance and trading. The CFTC regulates cryptocurrency futures and derivatives markets.

State-level regulation exhibits significant diversity. New York’s BitLicense remains the most stringent state-level regulatory framework for cryptocurrency, mandating that companies obtain a license before conducting any related business within the state. Obtaining a BitLicense is both complex and costly. Companies must pay high application fees and dedicate substantial resources to meet rigorous compliance standards. However, firms with a BitLicense often gain greater market trust and recognition. For example, Coinbase and Gemini have earned strong credibility among users and investors due to their BitLicense status, helping them attract more customers and capital. For a comprehensive overview of the U.S. virtual currency licensing system, see: [Payments] A Deep Dive into the Legal Foundations and Requirements of U.S. Cryptocurrency Payment Licenses.

Today, Aiying Aiying primarily aims to introduce two key licenses required for Web3 companies seeking to operate virtual currency businesses in New York State: the BitLicense and the Limited Purpose Trust Charter.

BitLicense – New York Virtual Currency License

BitLicense, officially known as the "New York State Department of Financial Services Virtual Currency License", is a regulatory framework introduced in 2015 by the New York State Department of Financial Services (NYDFS). It specifically governs entities engaged in virtual currency activities within New York State. In simple terms, if you wish to buy, sell, store, or transfer Bitcoin or other virtual currencies in New York, you must first obtain this license. Below is a detailed breakdown:

1. Scope of Application

The BitLicense applies to all entities conducting virtual currency business in New York State, including:

-

Receiving, storing, and transferring virtual currency: such as providing virtual currency wallet services.

-

Virtual currency exchange: converting virtual currency to U.S. dollars or other fiat currencies, and vice versa.

-

Virtual currency trading: buying and selling Bitcoin and other virtual currencies.

-

Payment processing: offering payment services using virtual currency.

BitLicense is a broad term that actually encompasses different types of operational licenses, categorized based on the specific nature of the business activity:

-

Virtual Currency License: This covers basic virtual currency operations such as storage and transfer. It applies to businesses not involved in fiat money transmission. It can be understood as a virtual exchange license.

-

Virtual Currency and Money Transmitter License: More complex, this applies to companies that not only handle virtual currencies but also convert them into fiat currencies or conduct money transmission. It can be seen as a VAOTC (Virtual Asset Over-the-Counter) license.

2. Key Requirements

Companies applying for a BitLicense must meet a series of stringent requirements, including but not limited to:

-

Capital Requirements: Companies must maintain sufficient capital reserves to ensure financial soundness.

-

Compliance Programs: Firms must establish and implement anti-money laundering (AML) and know-your-customer (KYC) procedures to prevent illicit activities.

-

Cybersecurity: Companies must have a cybersecurity program in place to protect customer data and funds.

-

Consumer Protection: Measures must be taken to safeguard consumer rights, with full disclosure of associated risks prior to transactions.

-

Reporting and Recordkeeping: Companies must submit regular financial reports to NYDFS and retain all relevant business records for at least seven years.

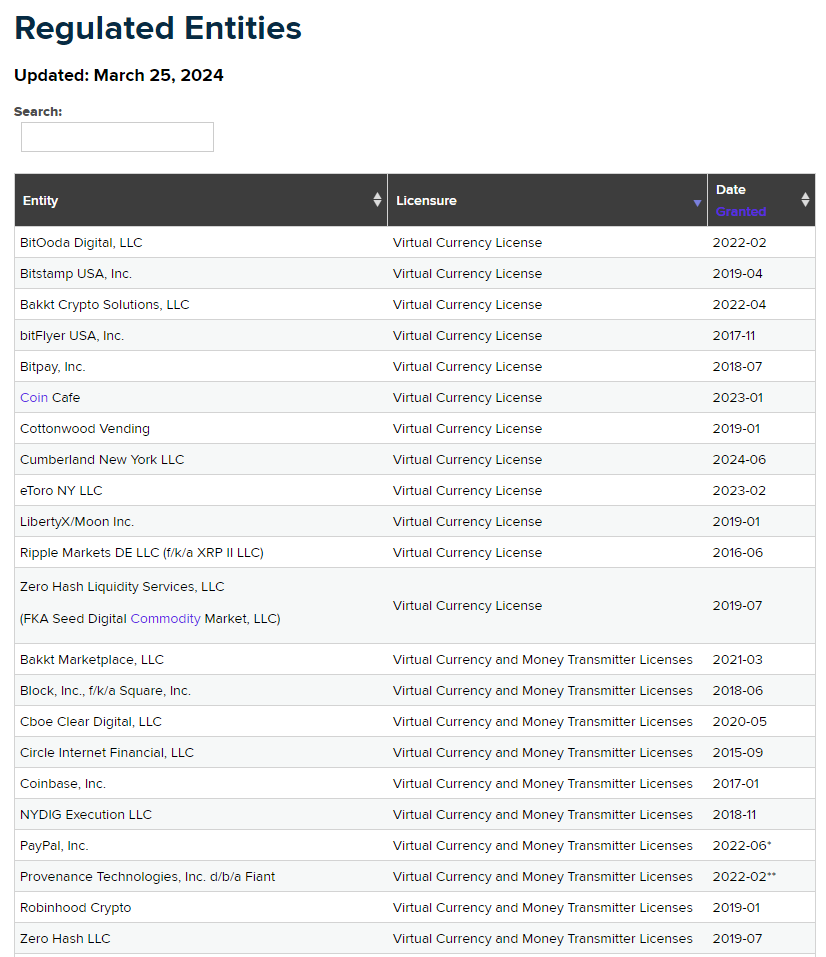

As per official data, 22 institutions have currently obtained the BitLicense, including well-known names such as PayPal, Robinhood, Bitstamp USA, Ripple, and Coinbase. Below is the full list of the 22 licensed entities:

Limited Purpose Trust Charter

The Limited Purpose Trust Charter is a license issued by the New York State Department of Financial Services (NYDFS) specifically fortrust and asset custody operations. This license allows companies to act as trustees managing and safeguarding client assets within New York State, which may include traditional financial assets (such as cash and securities) as well as virtual currencies. Below is a detailed introduction:

1. Definition and Use Cases

-

Definition: The Limited Purpose Trust Charter enables a company to serve as a trustee, offering asset custody and management services to clients. This license is typically granted to institutions focused on trust services, asset management, and custodial functions.

-

Use Cases: License holders can manage various types of assets, including cash, securities, precious metals, and virtual currencies. This enables them to provide specialized services such as asset management, financial planning, and estate administration.

2. Application Requirements

Applicants for the Limited Purpose Trust Charter must meet a series of strict criteria, generally including:

-

Capital Requirements: Companies must maintain adequate capital to ensure financial stability and service capability. Capital thresholds are typically adjusted based on the scale and risk profile of the assets the company intends to manage.

-

Management Background Checks: NYDFS requires thorough background checks on executives and board members, assessing their legal compliance, financial standing, and professional qualifications.

-

Business Plan: Applicants must submit a detailed business plan outlining the scope of trust and custody services, target markets, and operational models.

-

Compliance Program: A comprehensive compliance framework must be established to ensure adherence to applicable laws and regulations, particularly AML and KYC requirements.

-

Cybersecurity Measures: Companies must demonstrate robust cybersecurity capabilities to protect client data and custodied assets.

3. Ongoing Regulation and Compliance

After obtaining the Limited Purpose Trust Charter, licensees must continuously comply with NYDFS regulations, including but not limited to:

-

Periodic Audits: Companies are subject to regular audits covering financial reporting, compliance procedures, and risk management practices.

-

Reporting Obligations: Licensees must regularly submit financial statements and other relevant reports to NYDFS to ensure transparency and regulatory compliance.

-

Consumer Protection: Strict consumer protection measures must be implemented to safeguard client assets and provide full risk disclosures during service delivery.

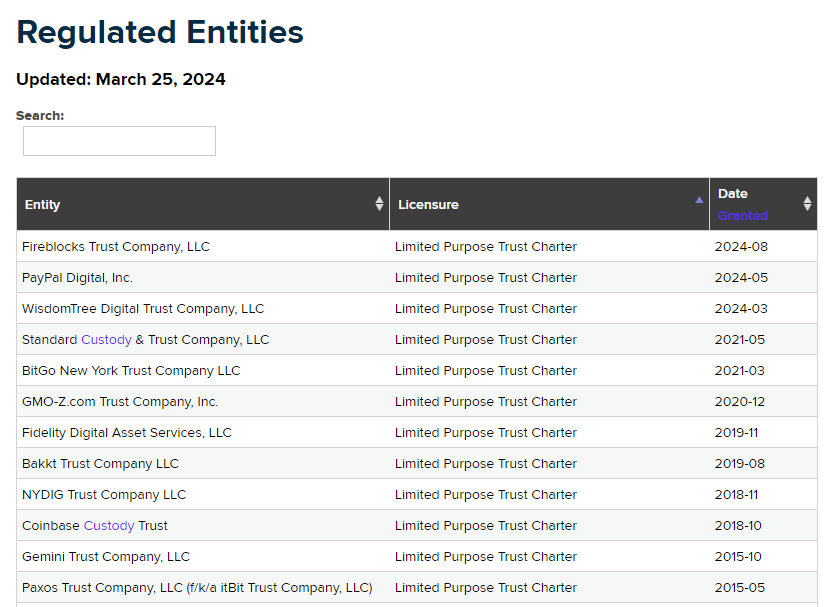

To date, only 12 institutions have received this charter, including Coinbase Custody Trust, a subsidiary of Coinbase that already provides custodial services for eight Bitcoin ETFs in the U.S. Below is the list of licensed institutions:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News