The current state of the liquid staking赛道: veteran Lido dominates over 60% of the market share, while several newcomers are entering the space with capital.

TechFlow Selected TechFlow Selected

The current state of the liquid staking赛道: veteran Lido dominates over 60% of the market share, while several newcomers are entering the space with capital.

Under PoS as the dominant consensus mechanism for public blockchains, liquid staking has become a significant theme in the crypto market.

Author: Nancy, PANews

With PoS becoming the dominant consensus mechanism for public blockchains, liquid staking has emerged as a key theme in the crypto market. At a time when first-mover advantages and network effects are especially pronounced, a wave of new entrants is now entering the liquid staking space with significant backing.

Ethereum and Solana Lead in Staking, Facing Centralization Risks

Liquidity serves as an endless driving force behind the sustained growth and innovation of the crypto market. The emergence of liquid staking has unlocked liquidity for re-staked assets, gaining increasing attention and recognition, leading to rising market penetration.

For PoS chains, higher participation in staking leads to higher staking rates, enhancing network security. Currently, driven by economic incentives, staking volumes across major PoS chains continue to grow substantially. According to StakingRewards, as of August 13, the total value locked (TVL) in staking projects exceeded $496.84 billion. The top ten mainstream projects have staking rates ranging from 25% to 80%. For example, Ethereum's staked value totals approximately $91.59 billion, with a staking rate of 28.06%; Solana’s staked market cap reaches $55.58 billion, with a staking rate of about 65.32%; and Sui’s staked market cap stands at $8.13 billion, achieving a staking rate of 80.45%. This indicates that as interest in and adoption of staking rapidly increases, the growth potential for liquid staking will be further unlocked.

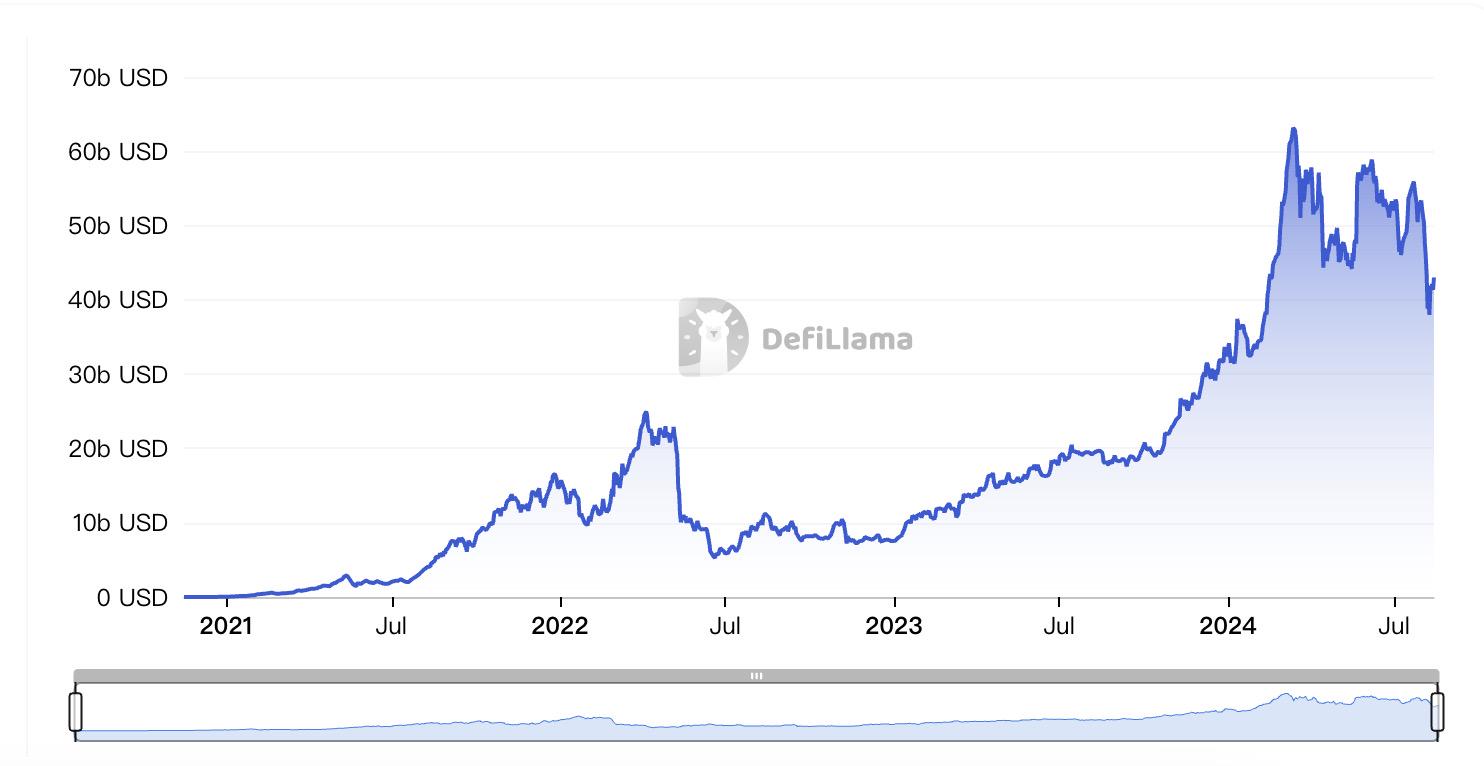

According to DeFiLlama, as of August 13, the liquid staking sector comprises 172 protocols with cumulative TVL exceeding $43.04 billion—an increase of 120.7% compared to a year ago.

This TVL is primarily concentrated on Ethereum, Solana, BSC, TON, and Sui. Ethereum and Solana are the clear market leaders. Ethereum ranks first with $36.4 billion locked, capturing a dominant 84.5% market share. Solana accounts for 8.1%, while all other blockchains combined represent less than 1%.

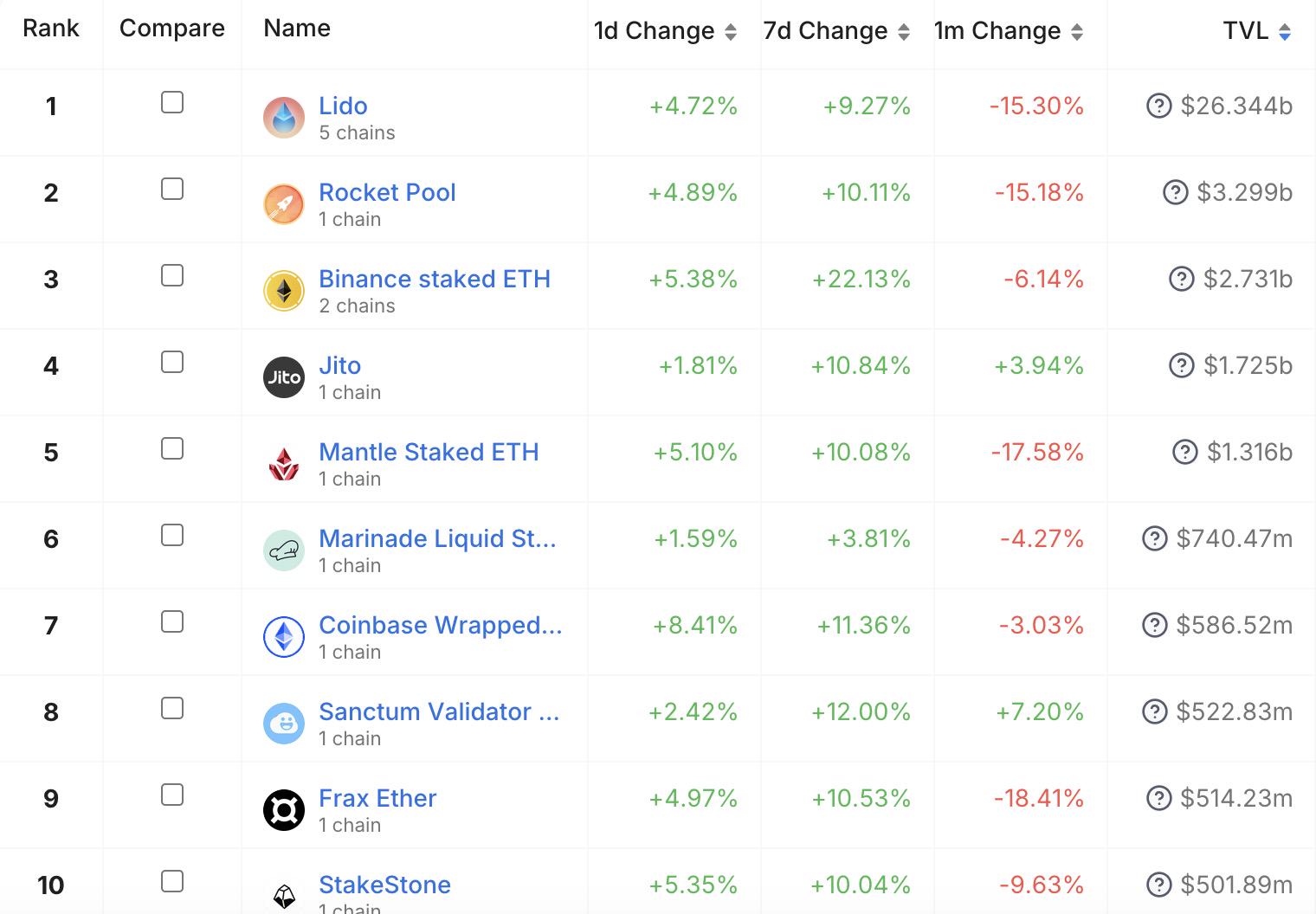

Beneath the rapid growth in liquid staking capital, industry concentration is becoming increasingly evident. Data from DeFiLlama shows that as of August 13, the top 10 protocols control nearly 82.5% of the total market TVL with $35.64 billion—mainly distributed between Ethereum (70%) and Solana (30%). This implies that the remaining 169 protocols collectively contribute only $7.57 billion, averaging just $45 million TVL per protocol. Moreover, the growth in liquid staking TVL heavily relies on leading projects. Lido, ranked first, holds a commanding lead with over $26.31 billion in TVL, capturing more than 60% of the market share alone.

The data suggests that while expanded yield opportunities and unlocked asset liquidity have created scale effects in liquid staking, excessive market concentration may introduce centralization risks. For instance, Ethereum co-founder Vitalik Buterin highlighted concerns about centralization in Ethereum staking several months ago, introducing the concept of "rainbow staking." In follow-up writings, he further outlined short- and medium-term plans to improve Ethereum’s permissionlessness and decentralization.

Liquid Staking Sees Renewed Funding Surge

To mitigate centralization risks, the liquid staking landscape is unlikely to remain dominated by a single player long-term; the market requires more diverse participants. Over the past two months, fresh players have entered the space, with multiple projects securing tens of millions in funding, primarily focused on Ethereum, Monad, Solana, and BSC.

Lido Institutional

In early August, Lido announced the launch of "Lido Institutional," a liquid staking solution tailored for institutional clients. The Lido Institutional middleware combines enterprise-grade reliability and security with the liquidity and usability needed for diverse institutional strategies.

aPriori

aPriori is a MEV-driven liquid staking solution built on the Monad network. Its innovative probabilistic validator design significantly reduces latency, maximizing compatibility with Monad’s high performance to enhance user experience.

At the end of July, Binance Labs announced investment in aPriori through its incubation program to advance MEV-driven liquid staking. Prior to this, aPriori had already raised $10 million in funding from investors including Pantera Capital, Consensys, OKX Ventures, and CMS Holdings.

Kintsu

Kintsu is another liquid staking protocol based on the Monad blockchain, founded last year by Stephen Novenstern, who previously served as Head of Strategy at Pangolin, a decentralized exchange on the Avalanche blockchain.

In July, Kintsu announced a $4 million seed round led by Castle Island Ventures, with participation from Brevan Howard Digital, CMT Digital, Spartan Group, Breed VC, CMS Holdings, Animoca Ventures, and angel investors including Alex Matthews and Ross Trachtman from Brevan Howard Digital, and Marin Tvrdic from Lido.

Ion Protocol

Ion Protocol is a protocol that unlocks liquidity for stakers by enabling loans against staked and re-staked assets. Users can deposit any validator-backed asset—including liquid staking tokens (LSTs) and re-staking positions—into collateral vaults and mint allETH against their deposits.

Recently, Ion Protocol announced a $4.8 million funding round, with investors including Gumi Capital Cryptos, Robot Ventures, BanklessVC, NGC Ventures, Finality Capital, and SevenX Ventures, bringing its total funding to approximately $7 million.

Save

Last month, Solana lending protocol Solend announced its rebranding to Save and unveiled three new products, including the SOL liquid staking token saveSOL.

Bima Labs

Bima Labs developed USBD, a Bitcoin-backed stablecoin that can be minted by providing Bitcoin liquid staking and re-staking tokens as collateral. It will accept collateral from multiple blockchains, including Bitcoin, Bitcoin scaling networks, EVM-compatible chains, and Solana.

In July, Bima Labs announced a $2.25 million seed round led by Portal Ventures, with participation from Draper Goren Blockchain, Sats Ventures, Luxor Technology, CoreDAO, Halo Capital, and angel investors such as Ryan Fang from Ankr, Brian Crain from Chorus One, Jeffrey Feng from Sei Labs, and Smokey from Berachain.

Infrared Finance

Infrared Finance is a liquid staking protocol on Berachain, aiming to maximize value accrual by offering liquid staking solutions for Berachain’s governance token BGT and gas token BERA, along with essential node infrastructure and Proof-of-Liquidity (PoL) vaults.

In July, Infrared announced a strategic fundraising round from Binance Labs, terms undisclosed. Previously, Infrared Finance secured a $2.5 million seed round led by Synergis, with additional participation from NGC Ventures, Tribe Capital, CitizenX, Shima Capital, Dao5, Signum Capital, Ouroboros Capital, Decima, and Oak Grove Ventures.

Astherus

Astherus is a liquidity protocol for staked assets and a Season 7 incubation project of Binance Labs. It supports Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs). Its distinguishing features include a multi-asset staking system, an LST foundation, and an LST-powered DApp ecosystem, including AstherEX—a DEX supporting re-staked asset trading; AstherEarn—a yield aggregator across multiple blockchains; and AstherLayer—a Proof-of-Stake Layer 1 blockchain designed to expand the utility of LSTs from other chains.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News